🧬 Deep Dive Novo Nordisk

Investment Case Novo Nordisk

Novo Nordisk is a global market leader in diabetic and obesity care.

This market is growing at tremendous rates. But Novo Nordisk struggled last year.

Is it still an attractive company?

Novo Nordisk - General Information

🧬 Company name: Novo Nordisk

✍️ ISIN: DK0062498333

🔎 Ticker: $NVO.B

📚 Type: Duopoly

📈 Stock Price: DKK 378

💵 Market cap: DKK 1.3 trillion

📊 Average daily volume: DKK 1.98 billion

📅 Last update: July 29th, 2025

Steven Van Der Burg wrote a Deep Dive of 78 (!) pages on the company.

Let’s dive into the conclusion and share the full investment case.

Conclusion Investment Case

Novo Nordisk is a quality stock facing problems right now.

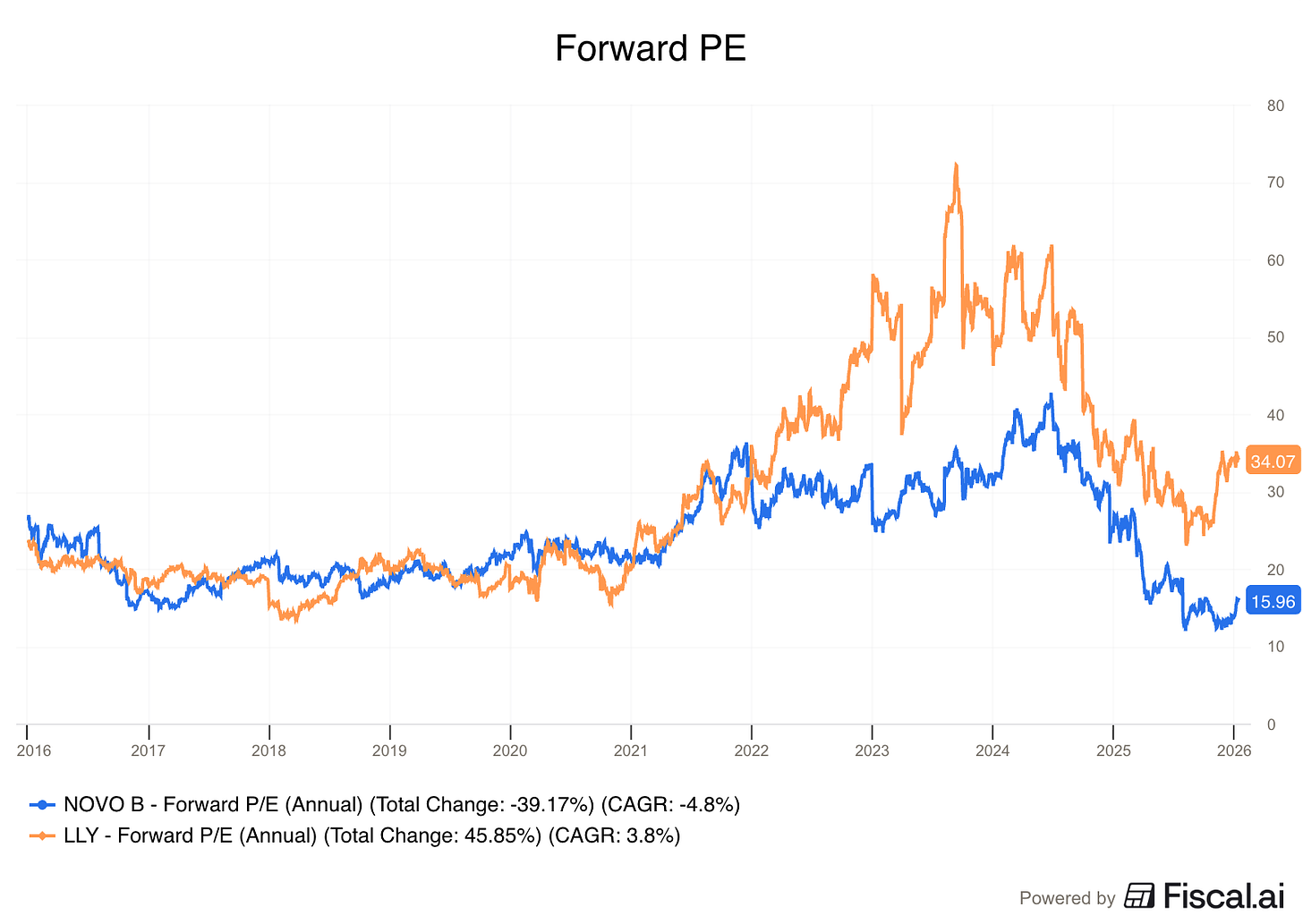

Today, Novo Nordisk is 3x as cheap as Eli Lilly.

I don’t believe this large valuation difference is justified.

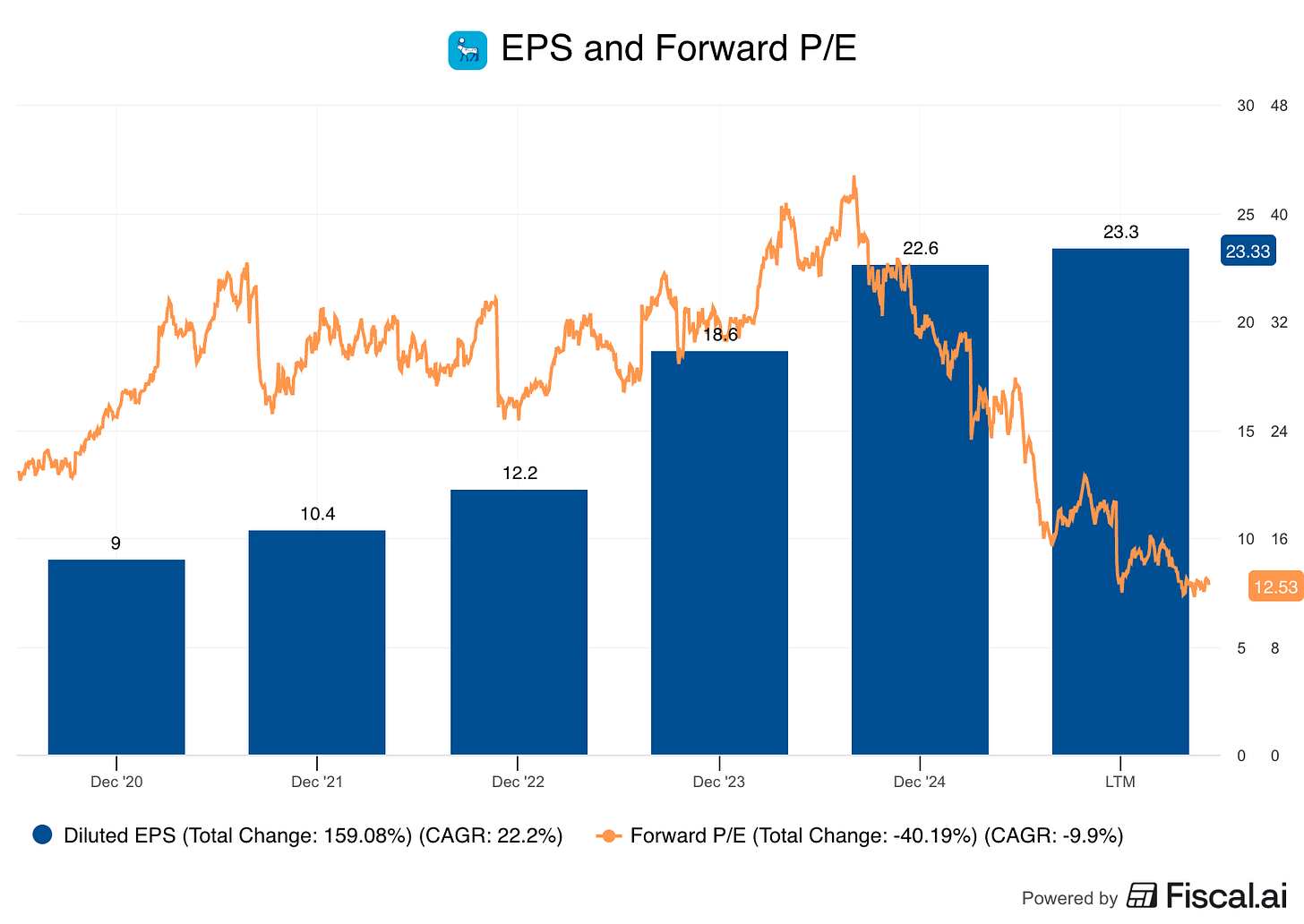

If you want to see the entire investment case in one image, look at this one.

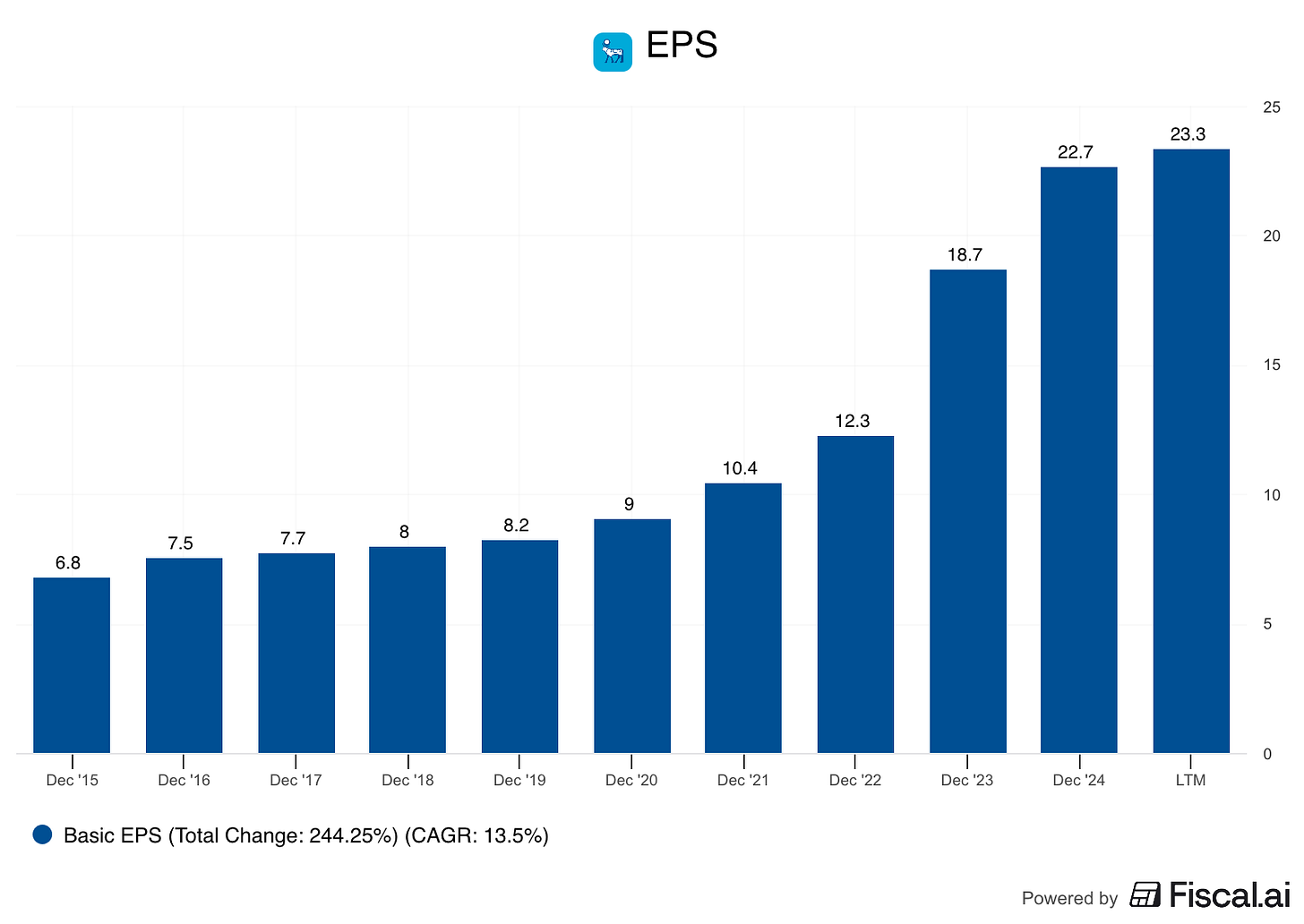

It compares the forward PE (orange) with the EPS (blue):

Since 2020:

The Forward PE declined from 20.9x to 12.9x (-38%)

EPS rose from 9 DKK to 23.5 DKK (+161%)

Novo Nordisk is really cheap.

This gives (a lot of) room for multiple expansion in the future.

What is Novo Nordisk?

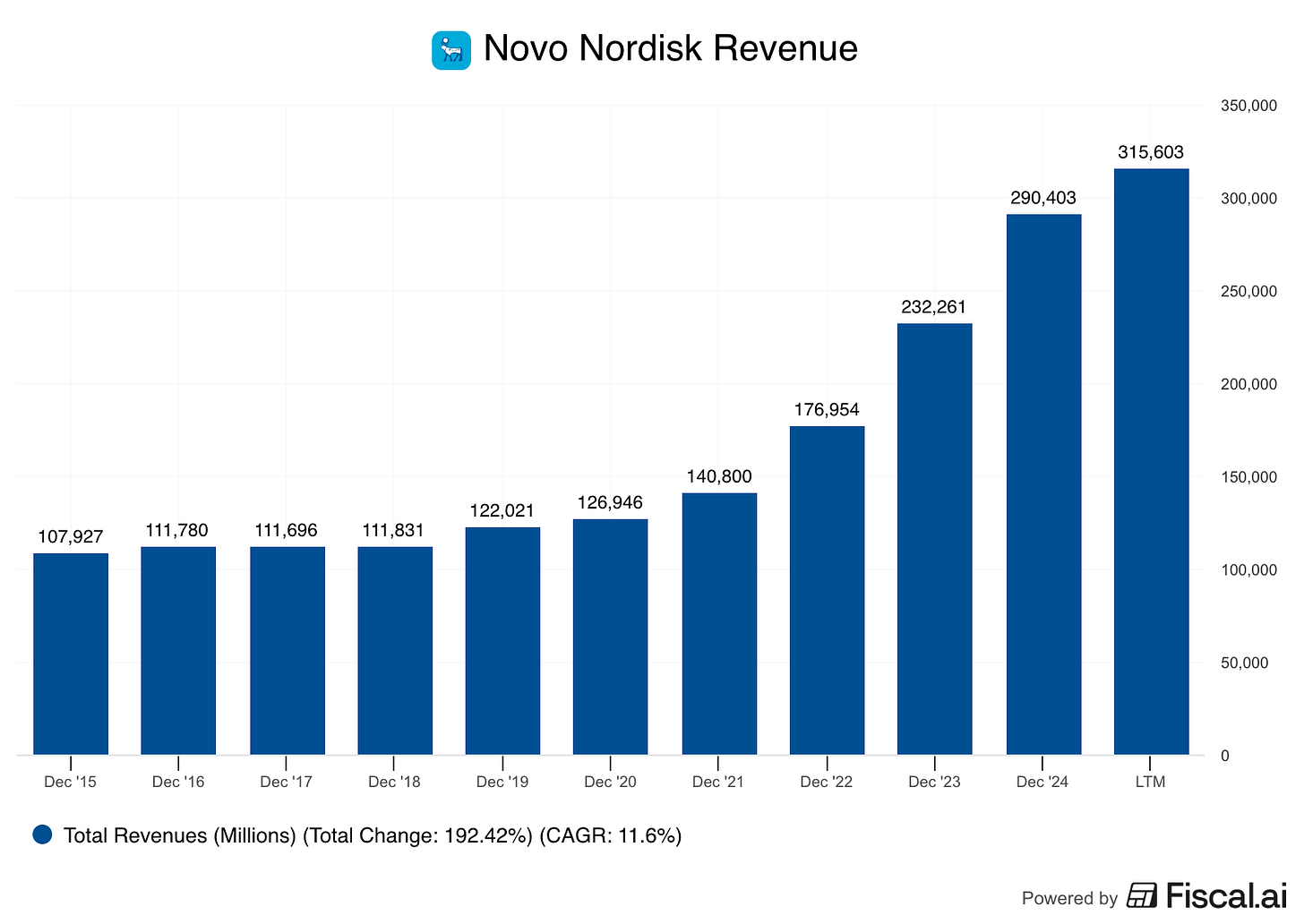

Novo Nordisk is a Danish healthcare giant focused on serious chronic diseases.

They are the world leader in diabetes care, producing over 50% of the world’s insulin supply.

But the real story today is GLP-1 drugs for obesity.

The Obesity Market

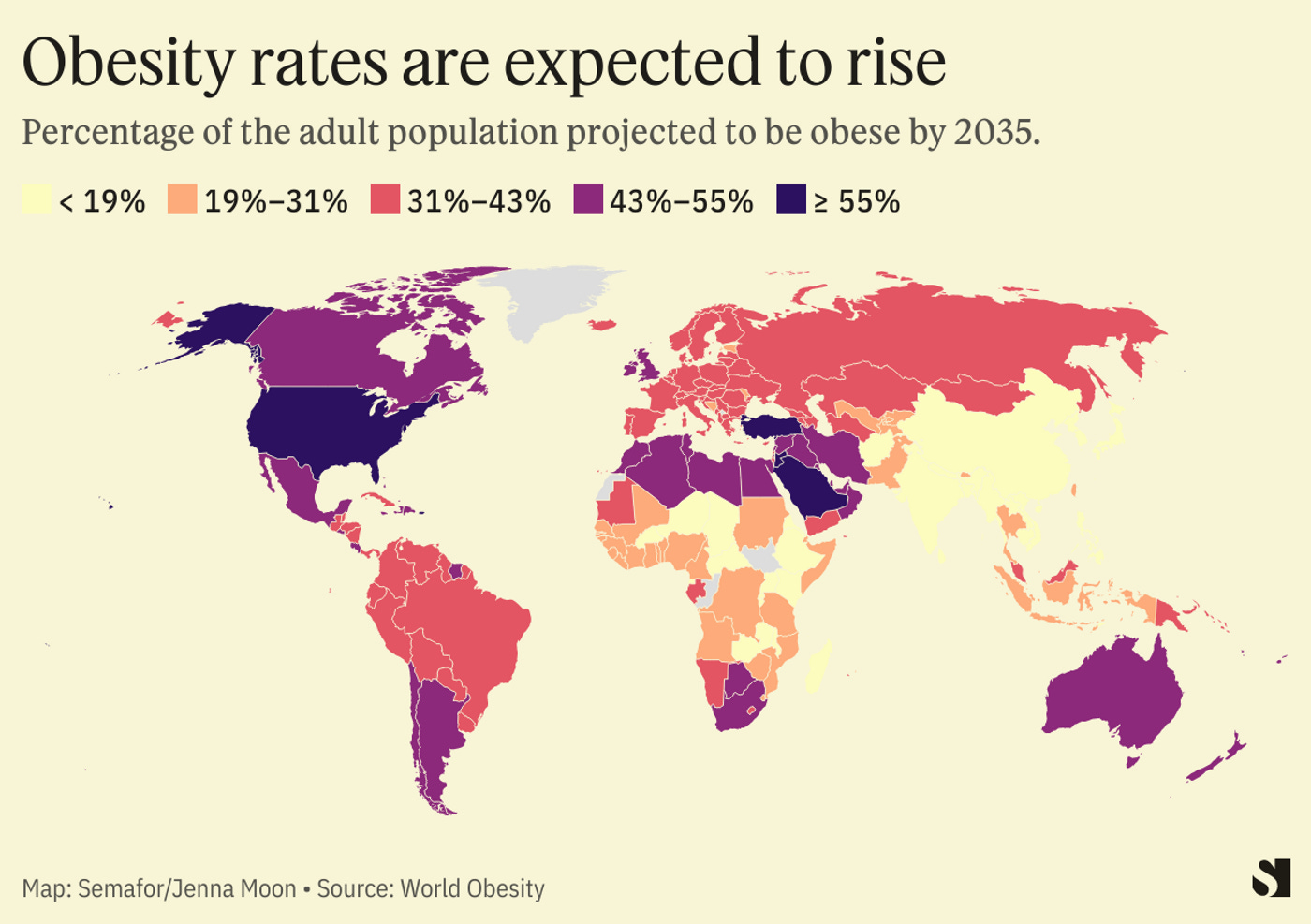

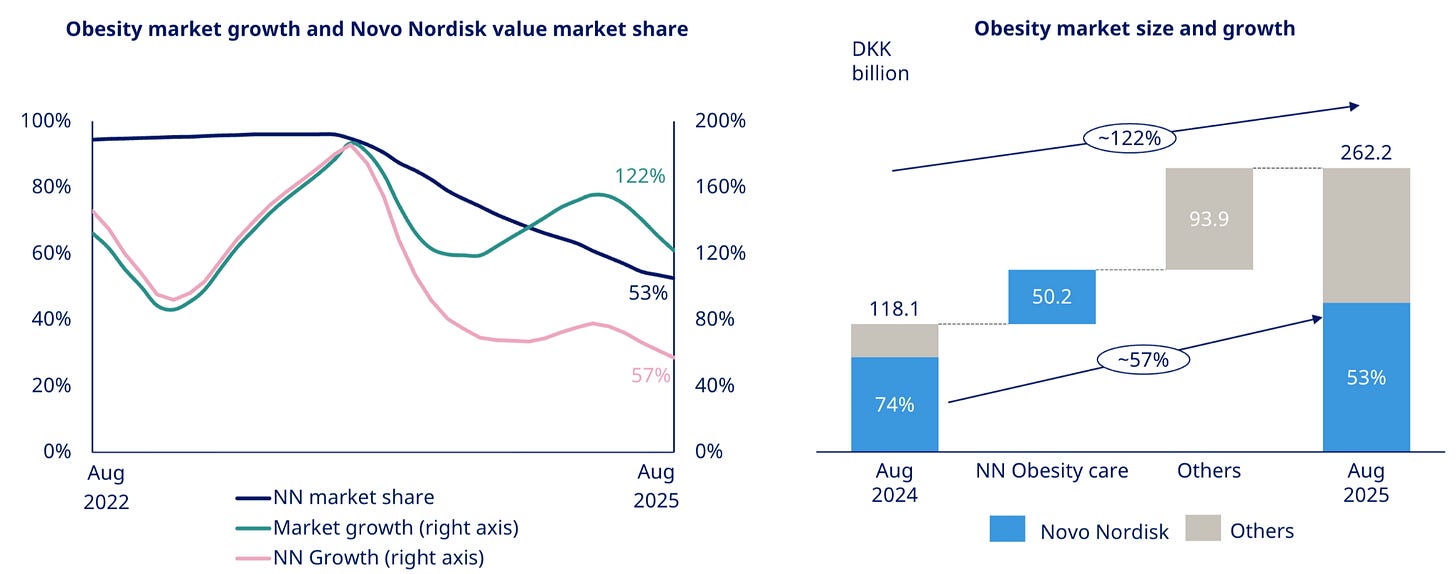

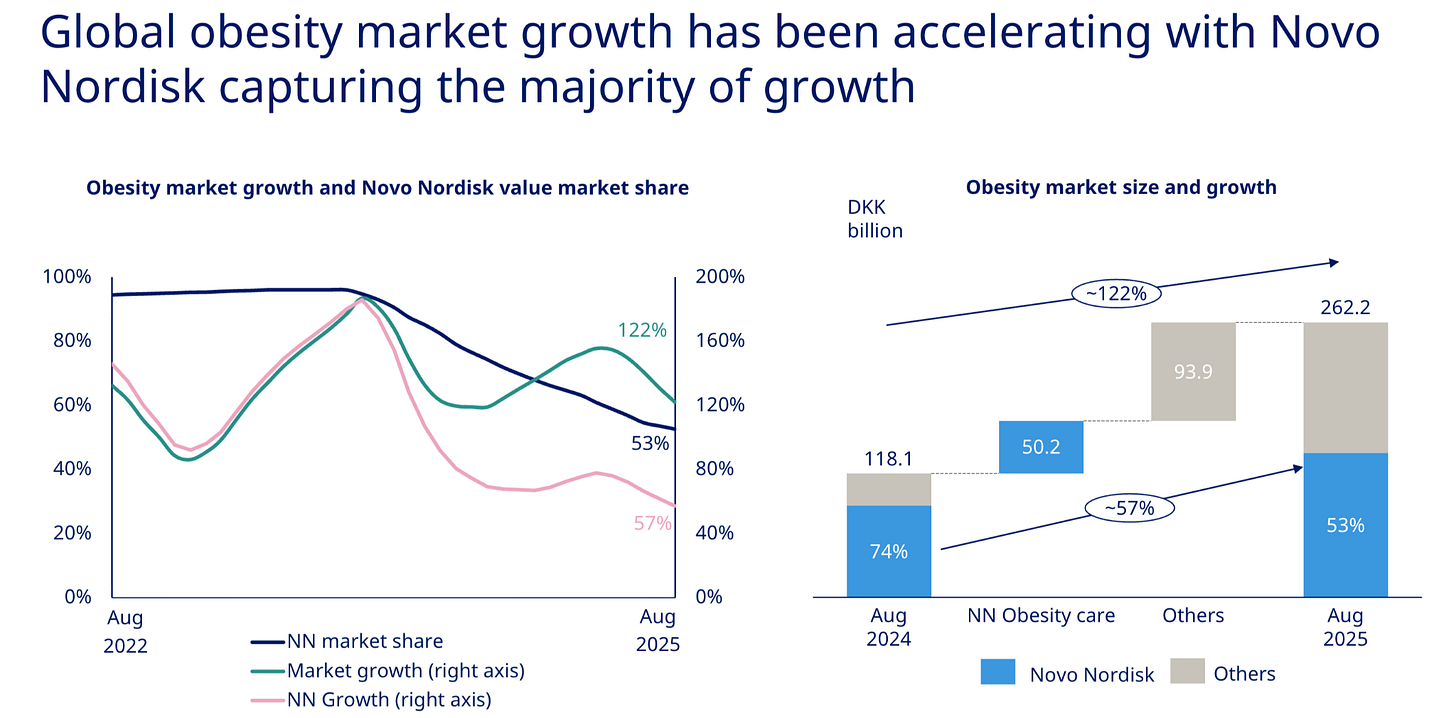

The market for obesity treatments is growing tremendously.

934 million people worldwide have obesity.

Only 2.2 million are currently treated with branded medication.

This means over 97% of the market is still untapped.

Demand for obesity drugs is growing at more than 100% (!) per year.

For a while, Novo Nordisk was the only company with GLP-1 medication.

But Novo Nordisk was in a ‘perfect storm’ recently.

Let’s go over everything you need to know.

The Problems Novo Nordisk Faces

1. Production Constraints

In 2024, demand for Wegovy was so high that Novo Nordisk simply couldn’t produce enough:

This left the door open for competitors.

Novo Nordisk spent a lot of money to solve this problem.

Invested DKK 47.2 billion in 2024 to expand factories.

Acquired three manufacturing sites from Catalent for $11 billion.

As of early 2025, the FDA declared the shortage resolved.

2. Compounding Pharmacies

When Novo Nordisk couldn’t supply drugs, US law allowed pharmacies to make their own ‘compounded’ versions.

What is compounding?

Compounding is when pharmacies mix their own drugs from raw ingredients instead of selling the factory-made version.This created a massive grey market of unapproved, cheaper drugs.

Once the shortage officially ended, Novo filed over 130 lawsuits to ban these copycats.

The FDA has also ruled that most compounding is illegal again.

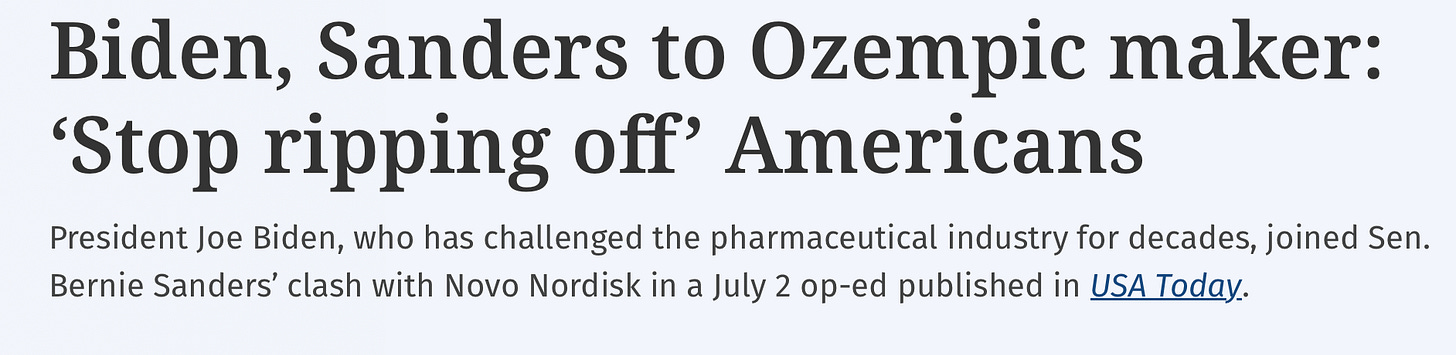

3. U.S. Pricing & Access

US politicians (like Senator Bernie Sanders) attacked Novo for charging $1,300+ for Wegovy while selling it for < $200 in Europe.

Insurers were also reluctant to pay for it.

As a result, Novo Nordisk has lowered the price of GLP-1 drugs.

CVS: In May 2025, CVS Caremark (a large pharmacy benefit manager) made Wegovy its preferred drug over Lilly’s Zepbound

Direct-to-Consumer: You can now get Wegovy for as low as $349 per month when you pay in cash

Government Deal: Novo struck a deal with the White House to lower prices in exchange for broader access to Medicare and Medicaid starting in 2026.

Competition From Eli Lilly

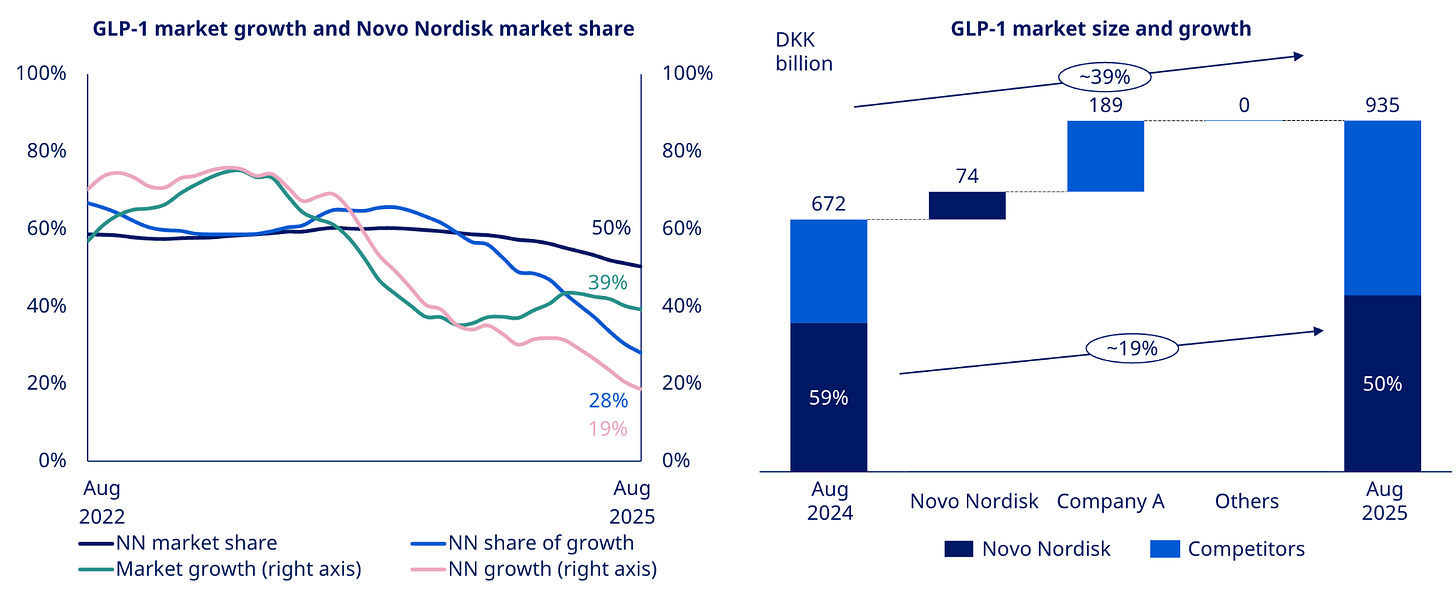

The biggest competitor of Novo Nordisk? Eli Lilly.

Eli Lilly has launched a competitor drug called Zepbound (tirzepatide).

Studies show Zepbound is slightly more effective for weight loss than Wegovy.

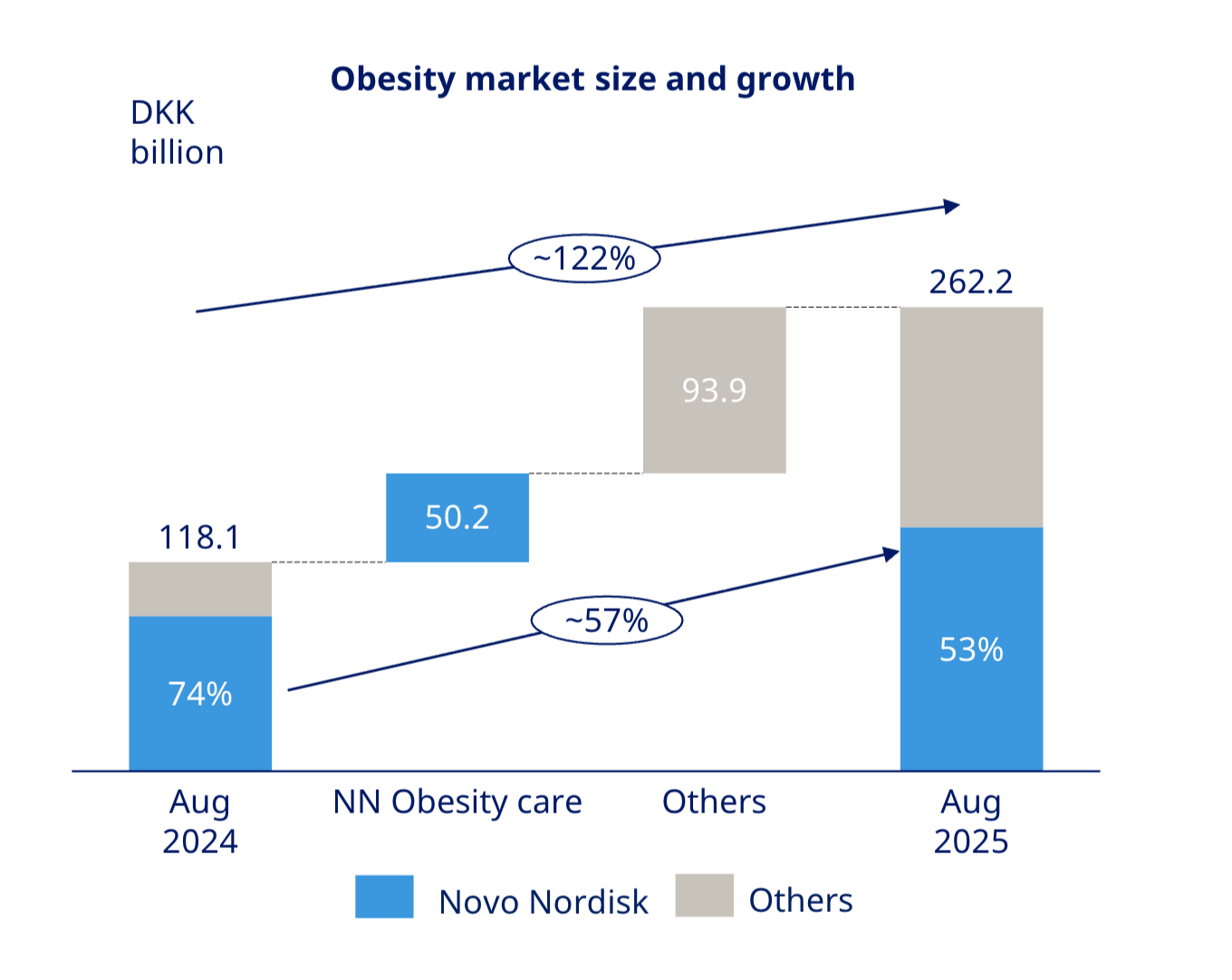

As a result, Novo’s GLP-1 market share has dropped from 59% to 50%.

It’s obesity market share dropped from 74% to 53% in one year.

Eli Lilly has captured significant territory in a very short time.

Why Did This Happen?

There were 3 major reasons.

1. A Better Drug

Patients and doctors follow the data, and Lilly’s drug (Zepbound) simply works better.

Studies show a 20% weight loss with Zepbound compared to 14% for Novo’s Wegovy.

When given the choice, many new patients chose the more effective option.

2. Empty Shelves

The shortage of Wegovy meant that for a long time, doctors couldn’t prescribe it because it wasn’t in stock.

Lilly capitalized on this by ramping up their own supply faster, taking market share.

3. Compounding

In the US, up to 30% of patients turned to compounded (unapproved) versions of the drug.

These were cheaper and easier to get than the brand-name version.

Because Novo’s drug was easier to copy than Lilly’s, this hurt Novo Nordisk much more than Eli Lilly.

The Good News?

None of this matters as much as you might think.

The market is growing so fast that even with less market share, Novo’s revenue is still hitting record highs.

The company is still a money-printing machine.

Products: Novo Nordisk versus Eli Lilly

This is a two-horse race.

Here is how their main products stack up.

1. Current Injectables

Eli Lilly’s product hits 2 hormones instead of one, and has higher weight loss.

But Novo has the stronger brand and huge supply capacity after their investments.

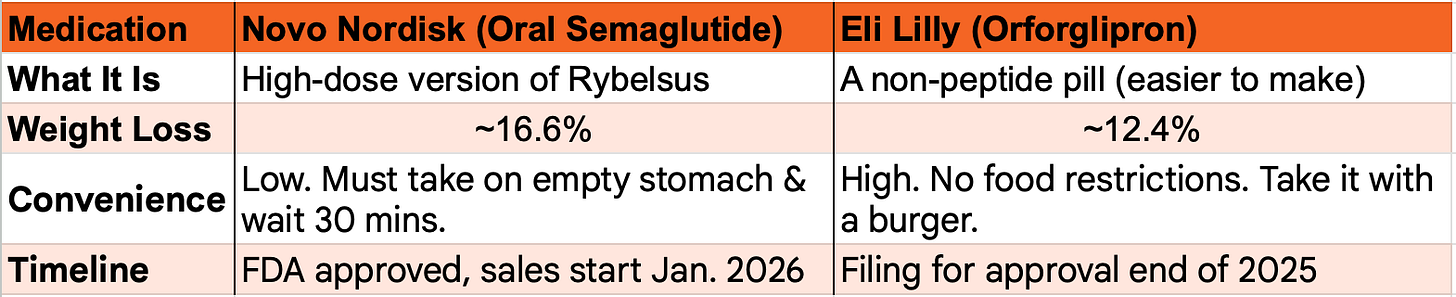

2. Oral Pills

Not everyone likes needles. The next market for GLP-1 drugs is a daily pill.

Novo Nordisk has higher weight loss and is the first to market.

Eli Lilly’s drug is more convenient to take, and easier to make.

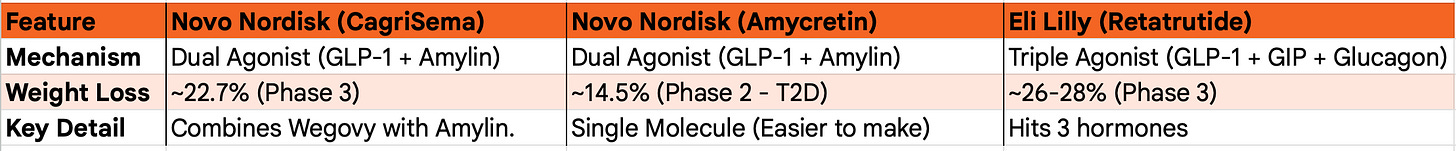

3. Future Pipeline

The goal is to reach 25% weight loss which is similar to bariatric surgery.

Here’s how the future drugs of Novo Nordisk and Eli Lilly compare.

Lilly currently has the strongest drugs (Retatrutide & Zepbound).

Novo is building a “broad” portfolio with different options (CagriSema, pills, and Amylin-based drugs).

Novo has also licensed its own triple agonist drug targeting GLP-1/GIP/glucagon.

In a mid-stage study, it achieved 24% weight loss after 48 weeks, comparable to Lilly’s Retatrutide.

The growth runway is still enormous and the market is big enough for both to win.

Remember, 97% of people with obesity are still untreated.

It’s also not just about weight anymore.

Semaglutide is showing promise for heart failure, kidney disease, and even alcohol addiction.

Each of these is a multi-billion dollar opportunity on its own.

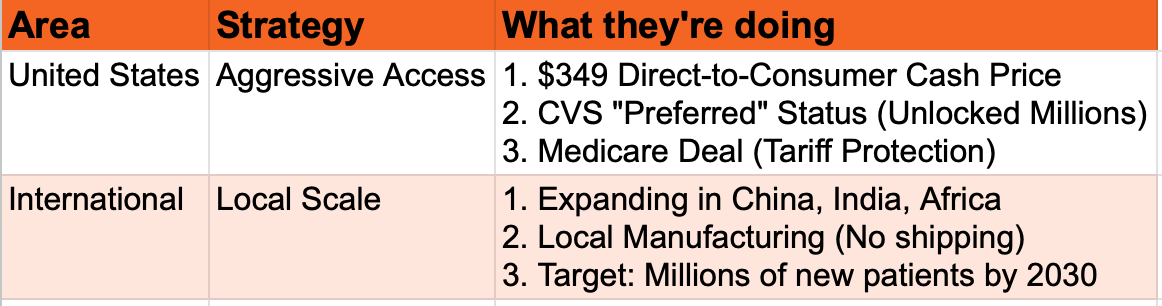

Can Novo Nordisk retake market share?

Novo Nordisk is not just letting Eli Lilly make headlines and take market share.

They are actively working on regaining market share again.

Here’s how they’re competing.

The United States

The U.S. is the most important market.

Novo has lowered prices and made deals to sell more drugs.

Global markets

Novo is also expanding heavily in China, India, and Africa with local production.

By 2030, they could serve millions of patients in these regions.

Even at lower prices, the volume creates a massive advantage (and source of revenue) for Novo Nordisk.

Valuation

This is where it gets interesting.

The market is currently very negative on Novo Nordisk.

Why? Because it is worried about competition from Eli Lilly and lower market share.

But let’s look at the numbers.

Eli Lilly trades at 34.1x next year’s earnings.

Novo Nordisk trades at 16.9x next year’s earnings.

You can buy more than two shares of Novo Nordisk for 1 Eli Lilly.

I don’t think this huge valuation difference is justified.

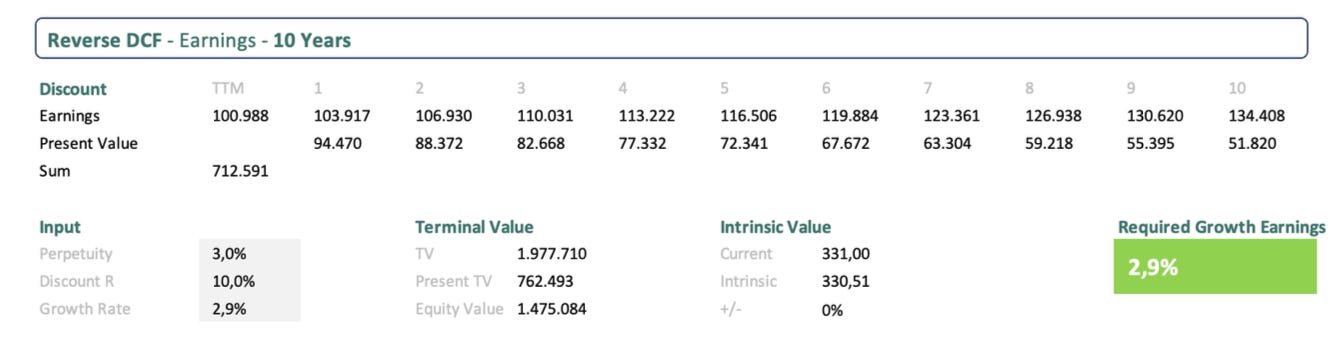

Reverse DCF

Charlie Munger once said that if you want to find the solution to a complex problem, you should invert. Always invert. Turn the problem upside down.

A reverse DCF shows you the expectations implied in the current stock price.

You try to determine for yourself whether these expectations are realistic or not.

You can learn more about a reverse DCF here: Reverse DCF 101.

We use EPS instead of FCF because Novo Nordisk is investing heavily in future growth (high CAPEX).

Our Reverse DCF shows Novo Nordisk only needs to grow its EPS by 2.9% per year to return 10% per year to shareholders.

This looks very reasonable to me.

The market doesn’t seem to have a lot of expectations from Novo Nordisk right now.

Bringing everything together

Summarizing the investment case in one image?