👑 How to value stocks like a professional

Everything you need to know about a reverse DCF

As a professional investor, I always use a reverse DCF to value companies.

It’s the best way to think about valuation.

I’ll teach you everything you need to know in this article.

Never use complex formulas

Many investment professionals try to determine the fair value of a company to two decimal places.

This is complete nonsense as there are so much assumptions you must make to determine the intrinsic value of a company.

You don’t believe me? Don’t take my word for it:

“It is better to be roughly right than precisely wrong.” - John Maynard Keynes

“Some of the worst business decisions I’ve seen came with detailed analysis. The higher math was false precision. They do that in business schools, because they’ve got to do something.” - Charlie Munger.

Here’s what Charlie Munger has to say about valuing companies:

So now you know that you shouldn’t use complex formulas to determine the fair value of a company.

But how can you know whether a stock is cheap or expensive?

The fair value of a company

Let’s start with a very simple example.

When a company would be able to grow at the same rate forever, the value of the company can be calculated as follows:

Value of the company = Free cash flow per share in year 0 / (expected return - yearly growth rate FCF)

An example will make everything more clear.

Let’s say that a company called Quality Inc. has the following characteristics:

Free cash flow per share: $10

Yearly FCF per share growth: 8%

Expected return: 10%

This is the return you want to achieve as an investor

In this example, the fair value of Quality Inc. is equal to:

Value of the company = FCF per share in year 0 / (expected return - yearly growth rate FCF)

Value of the company = $10/ (10% - 8%) = $500

So now you know that the fair value of Quality Inc. is equal to $500.

This means that you will generate a yearly return of 10% as an investor when you buy Quality Inc. for $500.

As a reminder: we used 10% as our expected return in this example.

Always revert

Charlie Munger says that if you want to solve a complex problem, you should always revert.

Instead of calculating the intrinsic value of a company yourself, you can also look at the expectations which are implied in the stock price.

After that, you can determine whether these expectations are realistic.

Yearly growth rate implied in the stock price

Let’s say that Quality Inc. is trading at a stock price of $400 today.

The company’s FCF per share is still equal to $10 and you still want to achieve a return of 10% per year as an investor.

As a reminder, this was the formula to calculate the fair value of a company:

Value of the company = FCF per share in year 0 / (expected return - yearly growth rate FCF)

From this formula, you can also calculate which growth rate of the FCF per share is implied in the current stock price:

Yearly growth rate FCF = Expected return - (FCF per share in year 0 / Value of the company)

Yearly growth rate FCF = 10% - ($10/$400) = 7.5%

At a stock price of $400, the market expects that Quality Inc. should be able to grow its FCF per share with 7.5%.

This means that when you think Quality Inc. can grow its FCF per share with more than 7.5% per year, the stock is undervalued.

Yearly return for shareholders implied in the stock price

You can use the same formula to calculate your expected return as a shareholder.

Let’s say that Quality Inc. still trades at $400, has a FCF per share of $10 and can grow its FCF per share with 8% per year into perpetuity:

Expected return = Yearly growth rate FCF + (FCF per share in year 0 / Value of the company)

Expected return = 8% + ($10/$400) = 10.5%

This means that you would generate a return of 10.5% per year if you would buy Quality Inc. for $400.

Would you be happy with a yearly return of 10.5%? In that case you should consider buying Quality Inc.

Reverse DCF

In practice, there is no company that can grow its FCF per share at the same rate forever.

That’s why the examples used above are good to get a first grasp about a company, but shouldn’t be used to base your investment decisions on.

Please note that this section will be a bit more complex. Don’t worry if you don’t understand everything completely after you’ve read it for the first time.

How to calculate the intrinsic value of a company

Do you know how to calculate the intrinsic value of a company?

The intrinsic value of EVERY company is equal to the present value of all cash the company will generate over its remaining lifetime.

Let’s say that Quality Inc. will still exist for 10 years and will shut down its operations after that. Over these 10 years, Quality Inc. will generate $15 in free cash flow per year.

In this example, the intrinsic value of the company is equal to the discounted value of $150 ($15*10).

It’s important to take the discounted value because $15 in 10 years from now is worth less than $15 today. Why? Because inflation reduces your purchasing power.

If we use a discount rate of 10% (the yearly return we want to generate as an investor), the calculation of the intrinsic value of Quality Inc. looks as follows:

In this example, the intrinsic value of Quality Inc is equal to $92.2.

This means that when you can buy Quality Inc. for $92.2 or less, you will generate a return of at least 10% per year.

* To look at the calculations of the intrinsic value per share, please look at the Excel attached to this article. You need to discount the free cash flow of every year at the discount rate.

Present value of free cash flow = free cash flow / (1+discount rate)^number of years. In our example we used a discount rate of 10%. This means that in year 8 the present value of the free cash flow is equal to: $15/(1+10%)^8 = $7.00

How to execute a reverse DCF

A reverse DCF is one of the best ways to value a company.

With a reverse DCF, you calculate how much growth the stock price has priced in. You compare this growth rate with your own expectations to determine whether the company is undervalued.

In this section we’ll use 2 examples to make this concept more clear.

I would recommend you to open the Excel right away and make the calculations yourself. The best way to learn something new is by doing it yourself.

You can also use this Excel to make your own calculations for other companies.

To execute a reverse DCF, you need the following data:

The current stock price

Total shares outstanding

Perpetuity growth rate

This is the growth rate of the free cash flow after year 10. This number should be in line with GDP growth. We use 3,5%

Discount rate

The discount rate can be used as a proxy for your expected return

Free cash flow in year 1

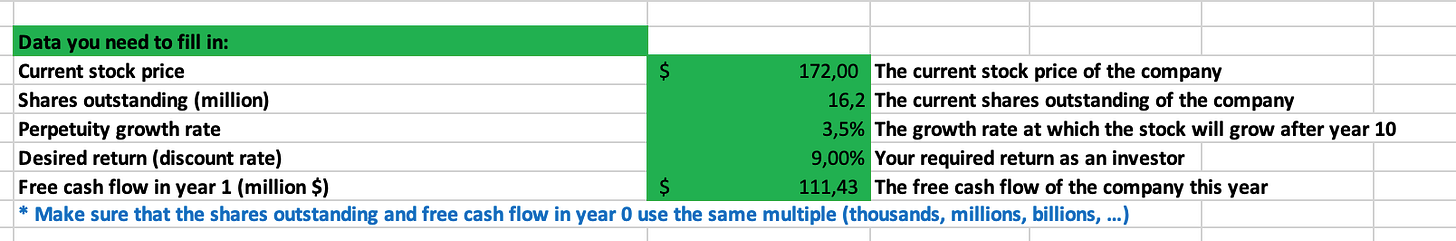

We will use Apple as an example to make everything more clear. Via the Excel, you can do all the calculations yourself:

Current stock price: $172

Total shares outstanding: 16.2 billion

You can find the total shares outstanding on free websites like Stratosphere

Perpetuity growth rate: 3.5%

Discount rate: 9% (your expected return as an investor)

Free cash flow in year 1: $111.43 billion

You can find the total shares outstanding on free websites like Stratosphere

Here’s how the input looks like in the Excel sheet:

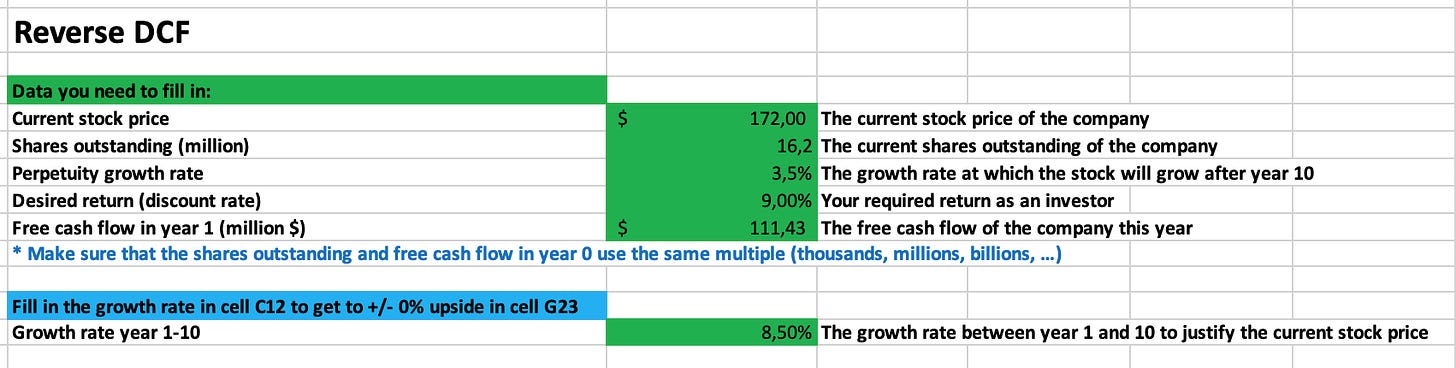

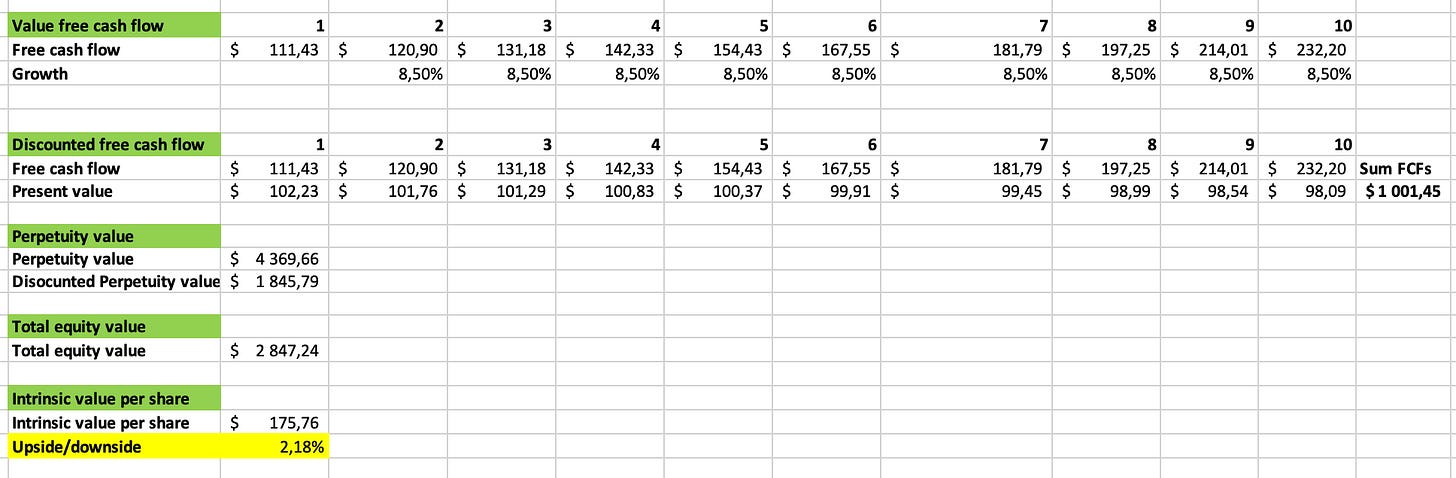

Now there is only one more data point you need: the implied growth rate of the free cash flow between year 1-10.

But how can you know this growth rate? Well… It’s pretty easy.

You just need to play with this number a bit until the intrinsic value per share (cell C34) is more or less equal to the current stock price (cell C5):

Free cash flow per share growth between year 1 and 10 is 5%

Intrinsic value = $138.5 (Upside/Downside = -19.5%)

Free cash flow per share growth between year 1 and 10 is 10%

Intrinsic value = $194.7 (Upside/Downside = 13.2%)

Now you know that the market is expecting that Apple’s free cash flow will grow more than 5% per year and less than 10% per year over the next 10 years.

After playing around a bit, we find that when Apple’s free cash flow will grow with 8.5% per year over the next 10 years, the intrinsic value per share is equal to $175.8. This is more or less equal to the current stock price of $172.

This means that Apple should be able to grow its free cash flow per share with 8,5% per year over the next 10 years to generate a return of 9% per year for you as an investor.

Do you believe that Apple can grow its FCF with at least 8.5% per year over the next 10 years and are you happy with a return of 9% per year?

In that case, Apple might be an interesting investment for you. If not, you should look for other investment opportunities.

One final example

Did the above sound a bit complex? No worries. Let’s do one more example together.

Now we’ll use Alphabet as an example:

Current stock price: $120

Total shares outstanding: 13.06 billion

Found via Stratosphere

Perpetuity growth rate: 3.5%

Discount rate: 9% (our expected return)

Free cash flow in year 1: $60.01 billion

Found via Stratosphere

Our input in Excel now looks like this:

The only thing you still need to do is find the growth rate of the free cash flow for the next 10 years (cell C12 in Excel) to get to an upside/downside potential of more or less 0% (cell C35 in Excel).

After playing around with the numbers a bit (try 1%, 3%, 5%, …) we find that Alphabet should grow its FCF with 9% per year over the next 10 years in order to generate a return of 9% for you as a shareholder:

If you think these assumptions are realistic and you are happy with a yearly return of 9%, you can consider buying Alphabet. If not, you should look for other investment opportunities.

Conclusion

That’s it for today. If you still have questions after reading this article, just send me an email.

A reverse DCF is the best way to value a company

You shouldn’t use complex formulas to determine the fair value of a company

A reverse DCF shows you how much growth the stock price has priced in. You compare this growth rate with your own expectations to determine whether the company is undervalued

You can open and download the Excel attached in this article to calculate the implied growth in the stock prices of the companies you own

That’s it for today.

As these articles take a lot of time to write and I’ve already written more than 100 articles completely for free. It would be lovely to get your support.

You can support us by liking and/or reacting on this article, send us an email or share this article with friends and family. You guys are the best!

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter and Linkedin.

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Hey CQ,

I just wanted to take a moment to express my gratitude for your latest article on valuing companies using a reverse DCF analysis. Without a doubt, it’s one of your best in my opinion! As always, the quality and depth of your content are unmatched, and I can't thank you enough for sharing your expertise with us.

I know I’ve said this before but it’s worth repeating that you have a true gift for teaching, my friend. The way you break down complex concepts into easily digestible pieces is simply remarkable. Your ability to make even the most daunting topics approachable and understandable is something I truly admire.

But it's not just the knowledge you impart that makes your articles stand out. Your writing style is engaging, relatable, and very enjoyable. You have a knack for making even the driest subject matter entertaining, and I find myself eagerly devouring each word you write.

So, thank you, CQ, for your exceptional work. I appreciate the time and effort you put into crafting such informative and engaging articles. You've made a genuine impact on me and countless others who have had the privilege of reading your work.

Keep up the fantastic work, and I'm eagerly looking forward to your next article!

Warmest regards,

Hello

Thank you for posting this article - it’s excellent. I’m still trying to wrap my head around it but a few of beginner’s questions for you:

1. Why do you use the gdp growth as the long term in perpetuity growth rate?

2. With respect to the targeted expected return e.g of 9% - just checking this means the expected growth in share price based on number of current shares outstanding? (Ie it doesn’t take into account dividends etc).

3. Finally - in the final apple example - just want to confirm we are looking at the fcf growth rate the market is pricing in for the 9% return (share price growth) we are hoping to achieve as an investor.

That’s it. Thank you for your help