📚 Deep Dive UnitedHealth Group

Investment case $UNH

Hi friend 👋

Over the past few months, Warren Buffett has been buying a mysterious stock.

Last weekend, the name of the stock was revealed.

The company Buffett was buying? UnitedHealth Group.

I think this is quite funny.

In May, TJ and I were in Omaha to attend the annual shareholder meeting of Berkshire Hathaway.

A stock TJ pitched me at the bar?

UnitedHealth Group.

He said the company was providing a great opportunity for investors for two main reasons:

It’s an amazing dividend growth company

The stock is very cheap

And guess what?

Warren Buffett bought UnitedHealth for exactly the two reasons TJ mentioned to me at the bar.

As TJ works on the dividend newsletter, UnitedHealth could already be found in the Compounding Dividends portfolio.

The fact that the stock is up +22% over the past 5 days is great.

It means Our Portfolio made a profit of $10.595,3 just from UnitedHealth Group in 5 days.

You are not a Partner of Compounding Dividends yet? Find out here whether it’s something for you.

📚 Deep Dive UnitedHealth Group

1. Do I understand the business model?

UnitedHealth Group’s Business Overview

Company Scale:

UnitedHealth Group is a massive and vertically integrated healthcare system.

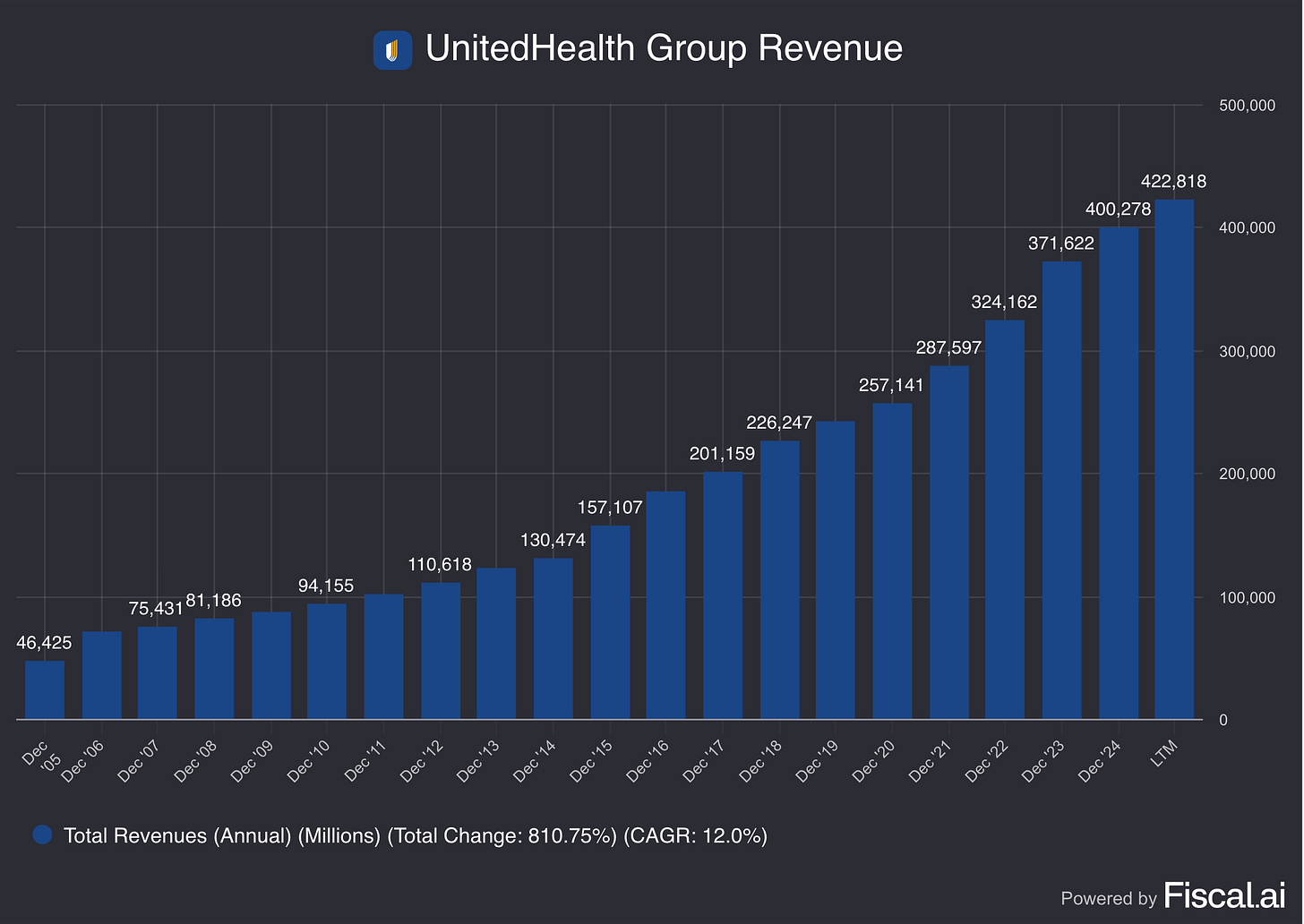

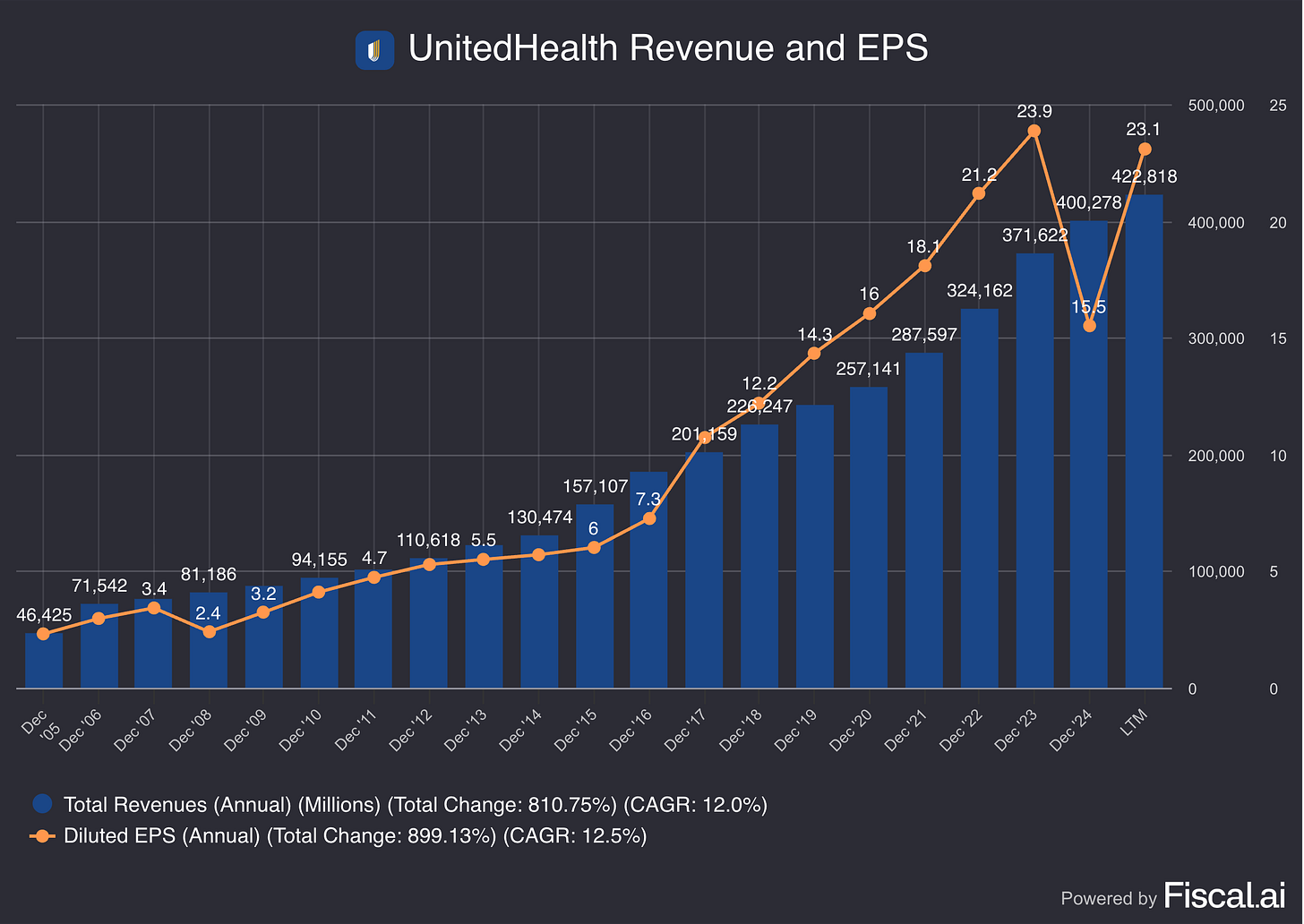

It touches every aspect of the U.S. healthcare system, serving over 150 million people and generating $400 billion in annual revenue.

Source: Fiscal.ai

Business Structure:

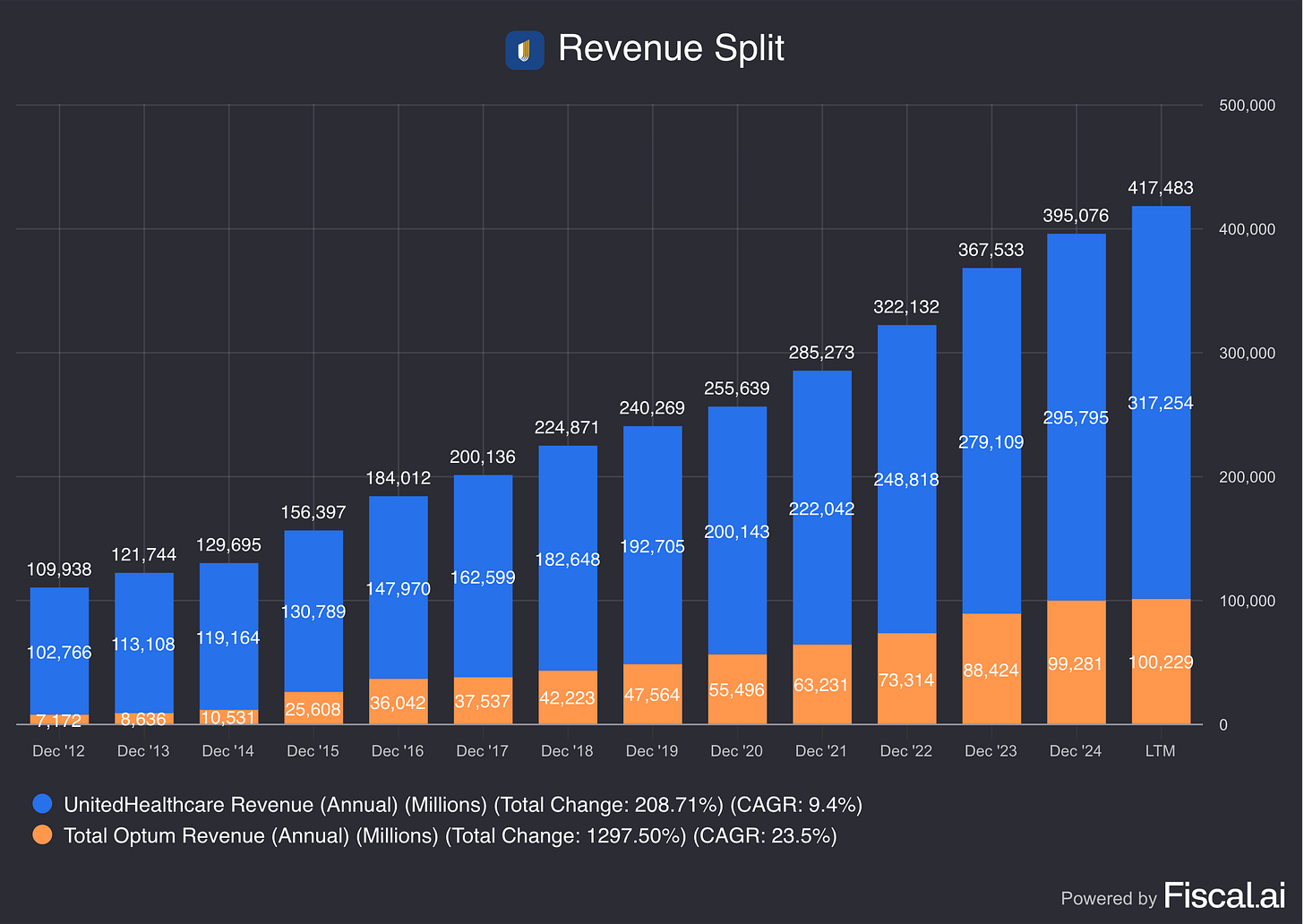

UnitedHealth Group is divided into 2 segments:

UnitedHealthcare (UHC): The insurance arm, which underwrites risk, pays for care, and collects premiums

Optum: The services and tech platform

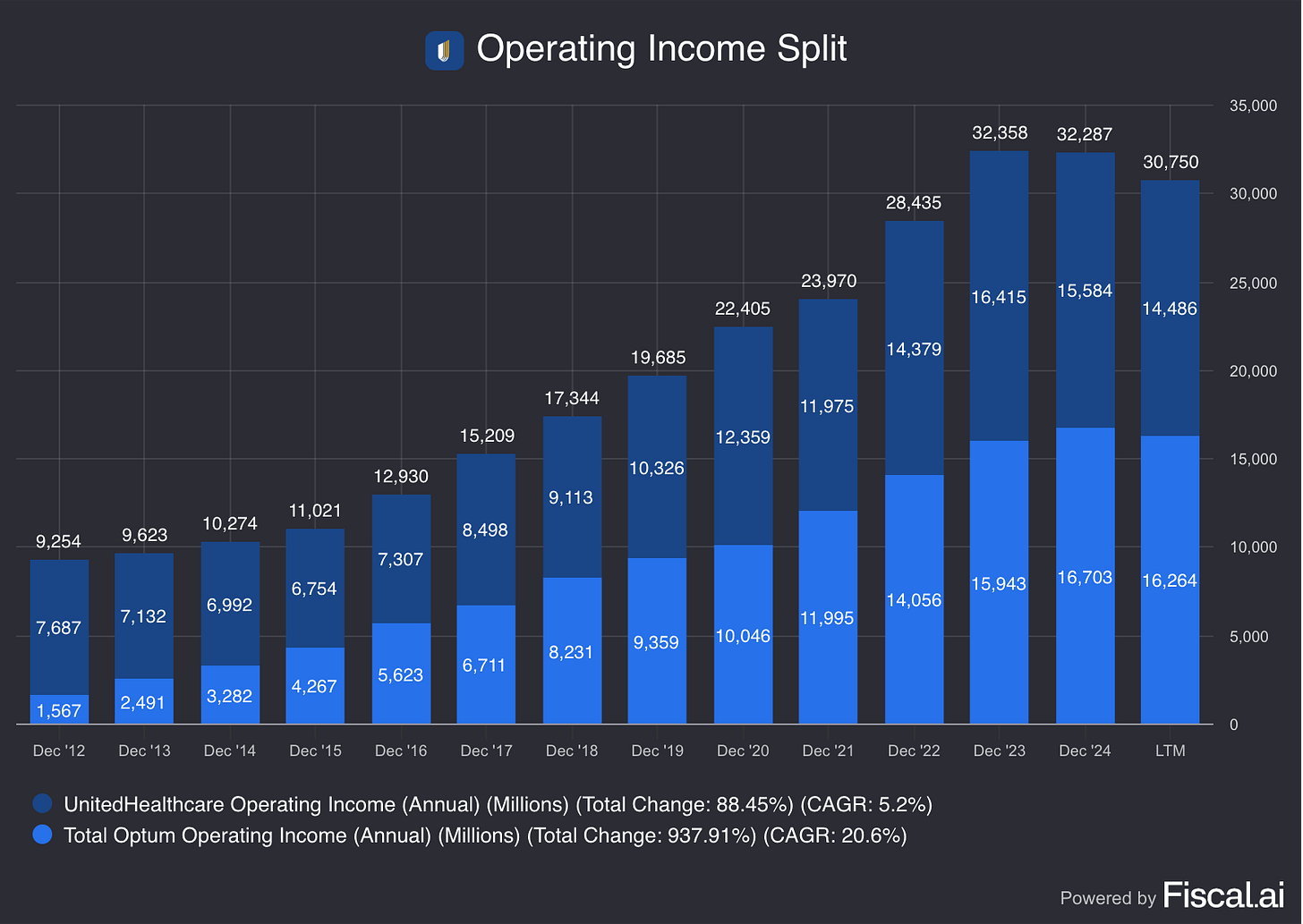

UHC drives the majority of revenue.

But when we look at the Operating Income, it’s split nearly 50/50. That’s because Optum has much higher margins than UnitedHealthcare.

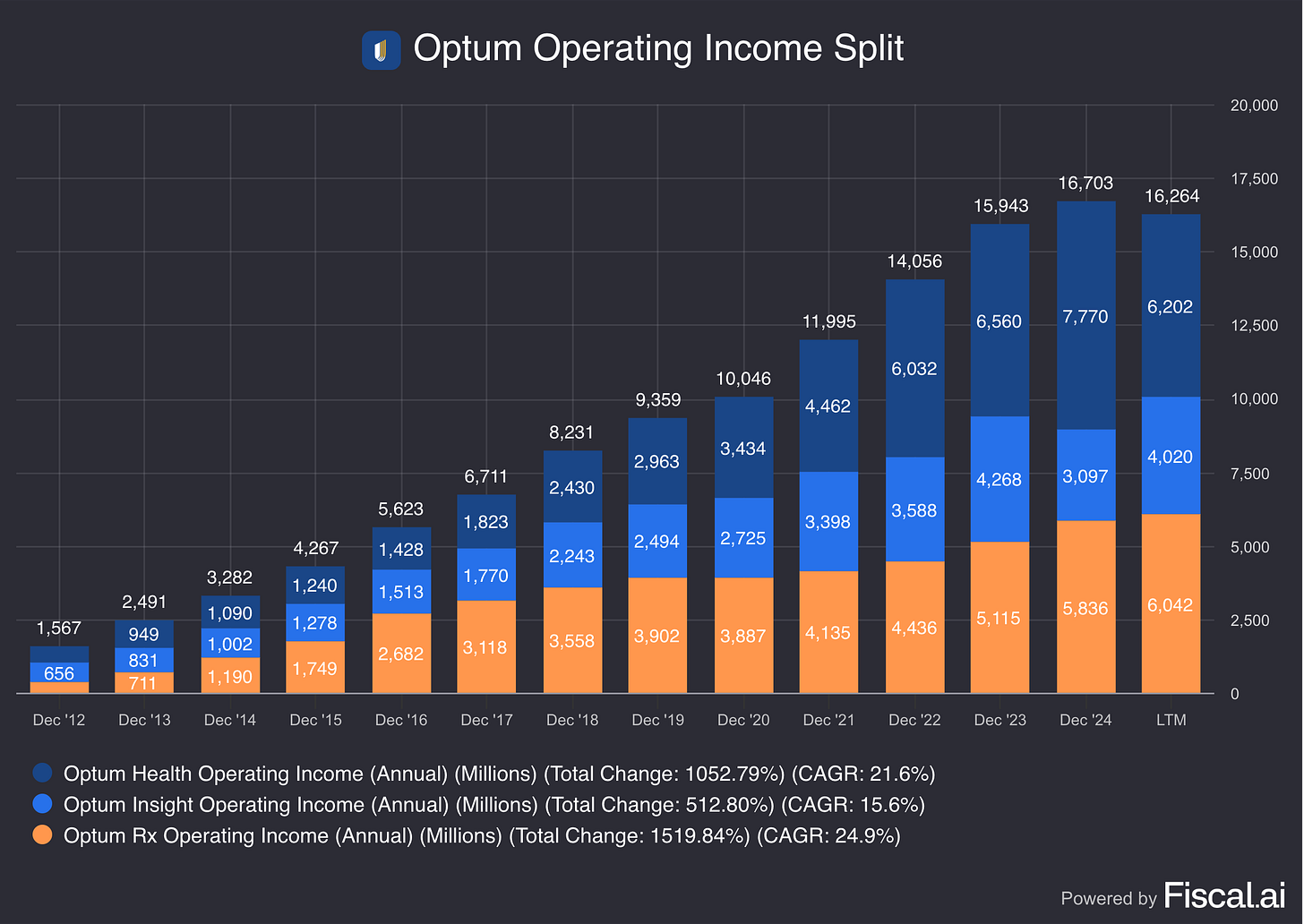

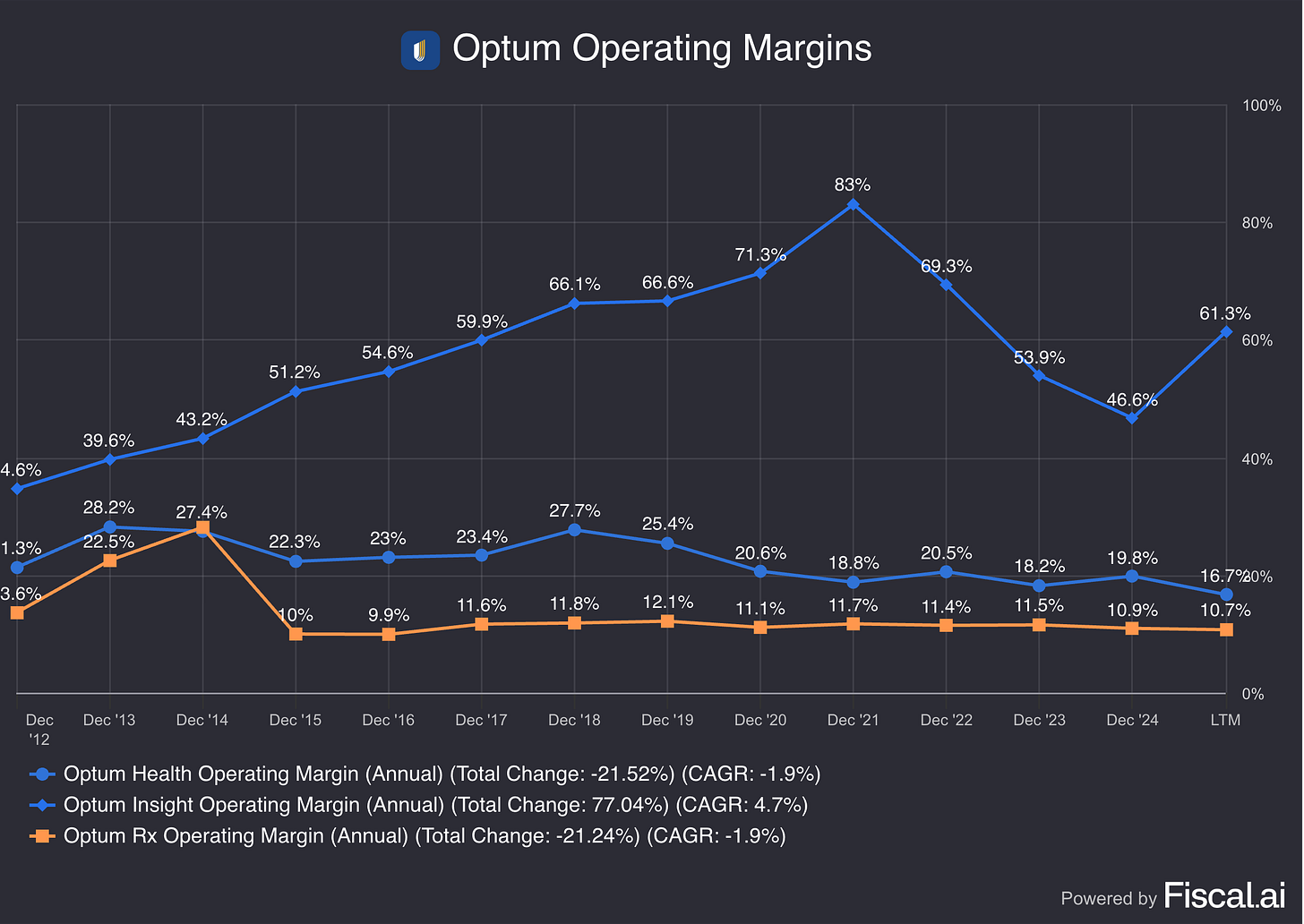

Optum is further divided into three segments:

Optum Health: Delivers care (clinics, surgical centers, home visits)

Optum Insight: Handles data analytics, revenue-cycle management, and technology.

OptumRx: A pharmacy benefits manager (PBM) optimizing drug pricing and formulary management

Optum Health and OptumRx drive the majority of Operating Income for the Optum segment:

However, Optum Insight is the highest margin business of the three:

Flywheel Model:

UnitedHealth Group has put these business segments together to build a flywheel.

It works like this:

UHC enrolls members and collects premiums

Optum provides services, manages costs, analyzes data, and delivers care

This integration creates a feedback loop: better data, more precise pricing, improved outcomes, and margin expansion

Competitive Advantages

Scale: UHC has over 50 million medical members, enabling better rates and risk control

Integration: Combining insurance, care delivery, and analytics offers unique efficiencies

Data: One of the largest healthcare datasets in the U.S. enables predictive analytics and cost control

Technological Sophistication: Early investment in AI and machine learning improves risk prediction and operational efficiency

There isn’t another health company built like UnitedHealth Group.

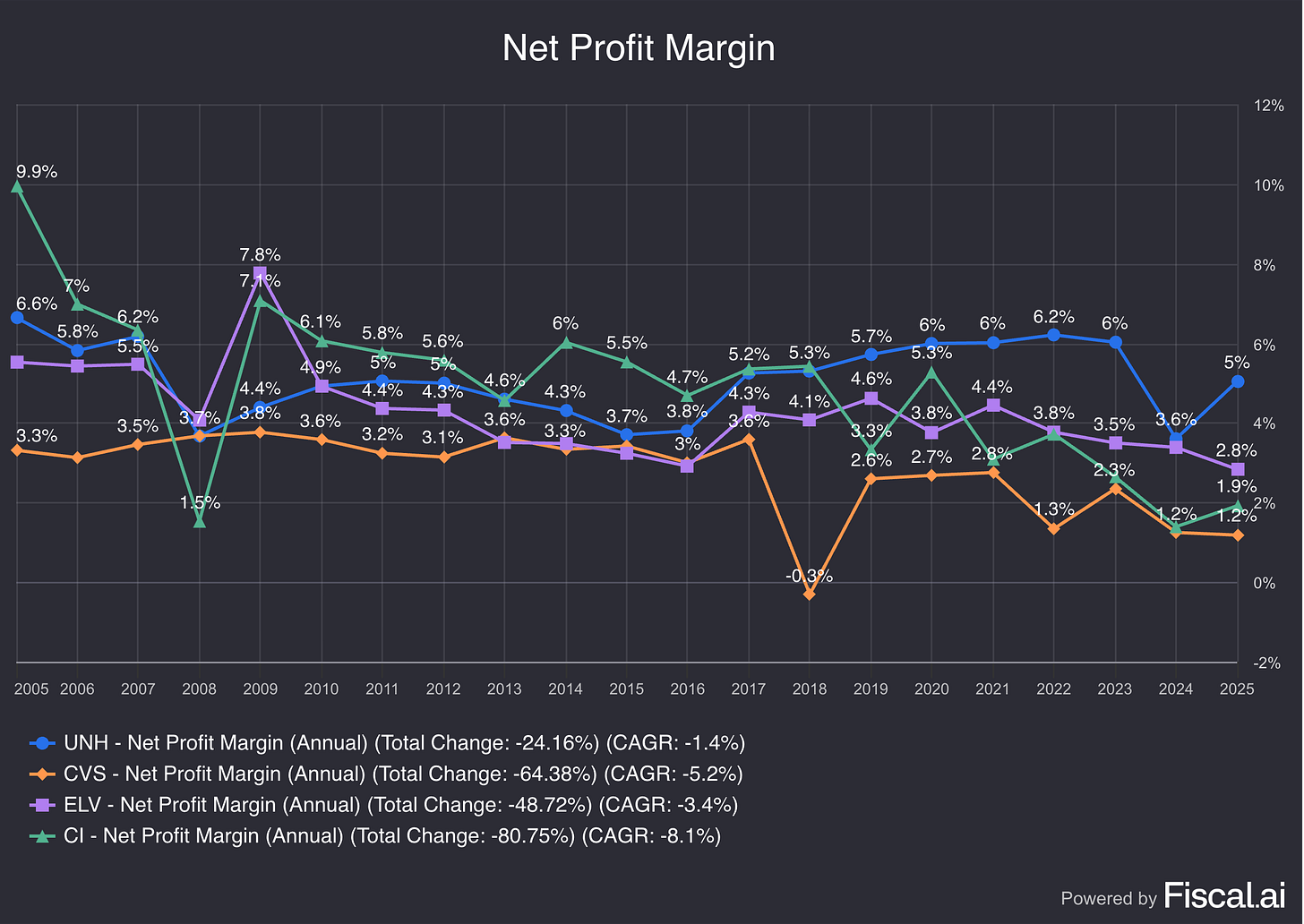

CVS: is primarily a retail business - they bought Aetna to get into insurance and care delivery

Cigna: has a larger PBM business via its acquisition of Express Scripts, but has a smaller insurance business

Elevance Health: is now trying to integrate similar to UnitedHealth, but previously focused on horizontal M&A to expand rather than vertical like United.

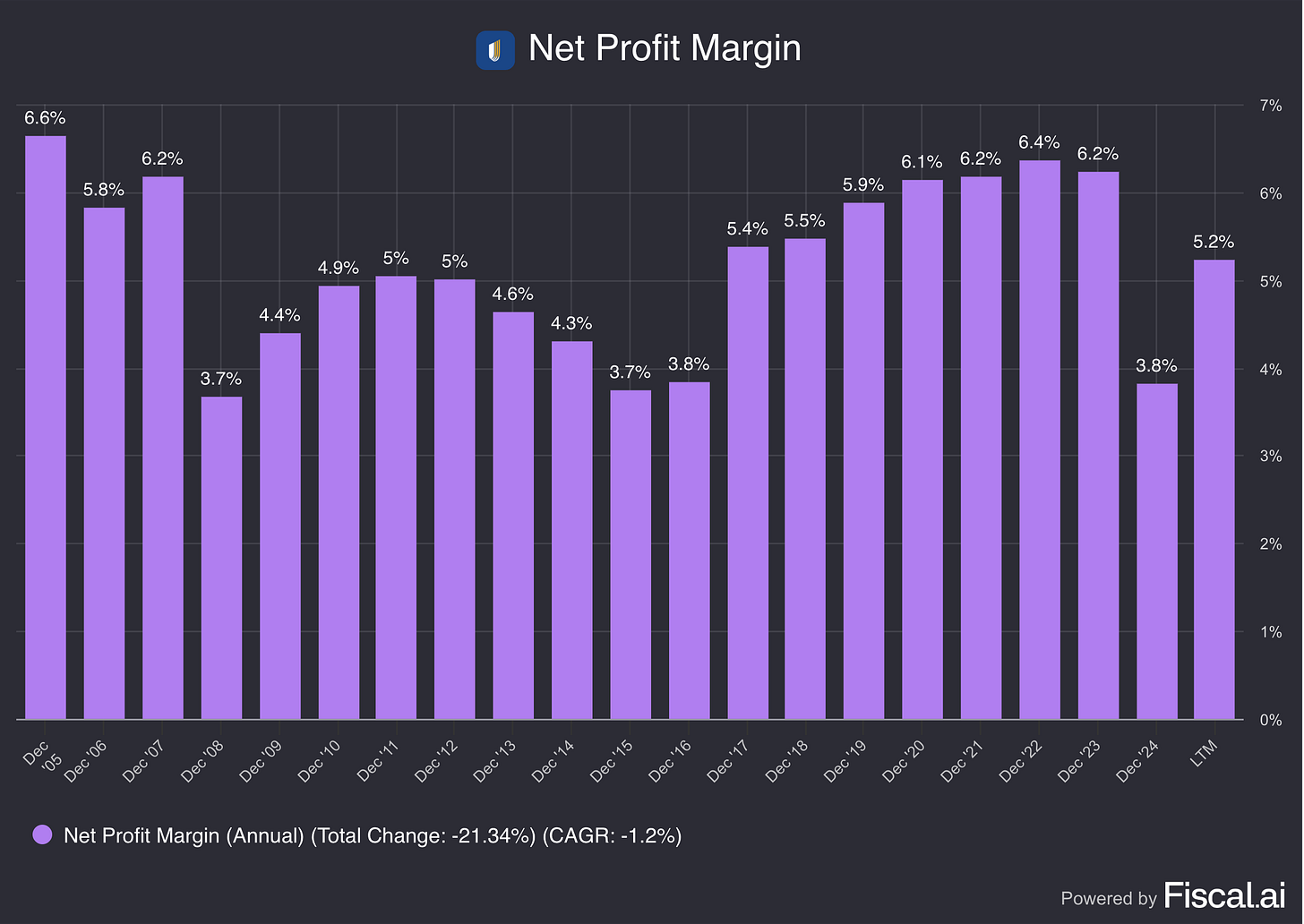

You can see the benefits of United’s business model by looking at its margins compared to peers:

2. Is management capable?

Management is one of the reasons for the drop in stock price at UnitedHealth.

Andrew Witty

Andrew Witty was the CEO of UnitedHealth from 2021 until he stepped down for ‘personal reasons’ on May 13.

There were several potential issues during his time leading the company.

Remote Leadership and Limited Presence: Witty was based in Buckinghamshire, UK, and rarely used the Minnesota headquarters. He typically worked from Washington, D.C., or virtually. He relied on corporate jets for transatlantic travel and delegated intense executive oversight to operating chief Dirk McMahon.

Unconventional Leadership Style: Witty’s casual style (e.g., wearing tracksuits and sneakers) and focus on benefits like education and childcare were very different from UnitedHealth’s traditional accountant-led culture.

Lack of U.S. healthcare experience: Witty was previously the CEO of drugmaker GlaxoSmithKline. His key hires, such as Roger Connor and Rupert Bondy, also from GSK, lacked deep U.S. healthcare experience.

Medicare Advantage Growth and Risks: Witty aggressively expanded UnitedHealth’s Medicare Advantage business. This did create high profits, but it also created risks - like when Medicare payment rules changed in 2023, impacting 2024 payments.

A 2023 Optum analysis had warned of the impact of new Medicare billing rules, yet Witty’s optimistic growth strategy for 2025, targeting high-risk patients, was misaligned with industry trends as competitors scaled back due to rising costs.

Operational and External Challenges: Witty’s tenure saw a major hack of a technology unit and the tragic killing of UnitedHealthcare’s leader in 2024, compounding difficulties. The company’s heavy reliance on Medicare diagnoses for revenue also drew scrutiny, as did its prior authorization practices, which frustrated doctors and patients.

Witty’s time leading the company did lead to ambitious growth, particularly in Medicare Advantage, but his remote leadership, reliance on non-U.S. healthcare executives, and failure to adapt to regulatory changes likely led to the current issues at the company.

Stephen Hemsley

Stephen Hemsley, led the company from 2006 to 2017 and is now stepping back in as CEO following Mr. Witty’s exit.

We’ll start by looking at his background:

Hemsley has an accounting background and is credited with building the integrated company UnitedHealth is today by expanding Optum

He was much more hands-on than Witty, having monthly executive meetings at the Minnesota headquarters. Participants called them ‘colonoscopies’.

Led UNH through dramatic changes in the past - Hemsley was in charge when the Affordable Care Act (ACA) dramatically changed regulations and the insurance landscape in 2010

What about now?

Hemsley has said that he believes many of the issues UnitedHealth is facing are within their control to resolve

His compensation package is very interesting - he’s getting $1 million per year as a salary, but he also got $60 million in equity as a one-time award that vest in 3 years with no additional stock grants or other bonuses during that time - if he leaves or is fired in the 3 years, he doesn’t get the stock award

This means that the vast majority of his compensation for the next 3 years is tied to the stock price of UnitedHealth Group

He also bought $25 million in UNH shares on May 16 on the open market

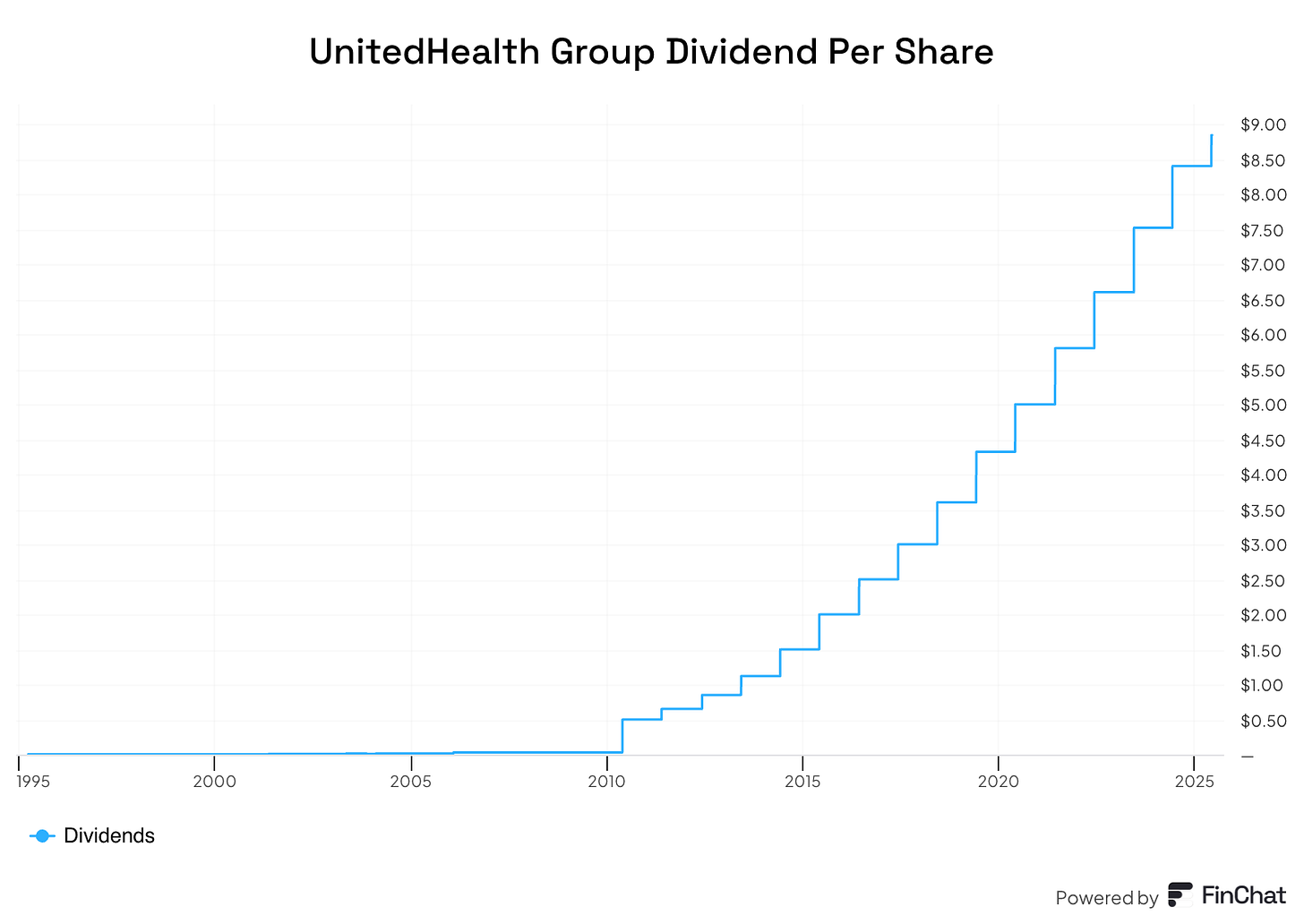

3. Has the company grown the dividend attractively?

We look for:

At least 10 years of dividend growth

5-year dividend growth CAGR >5%

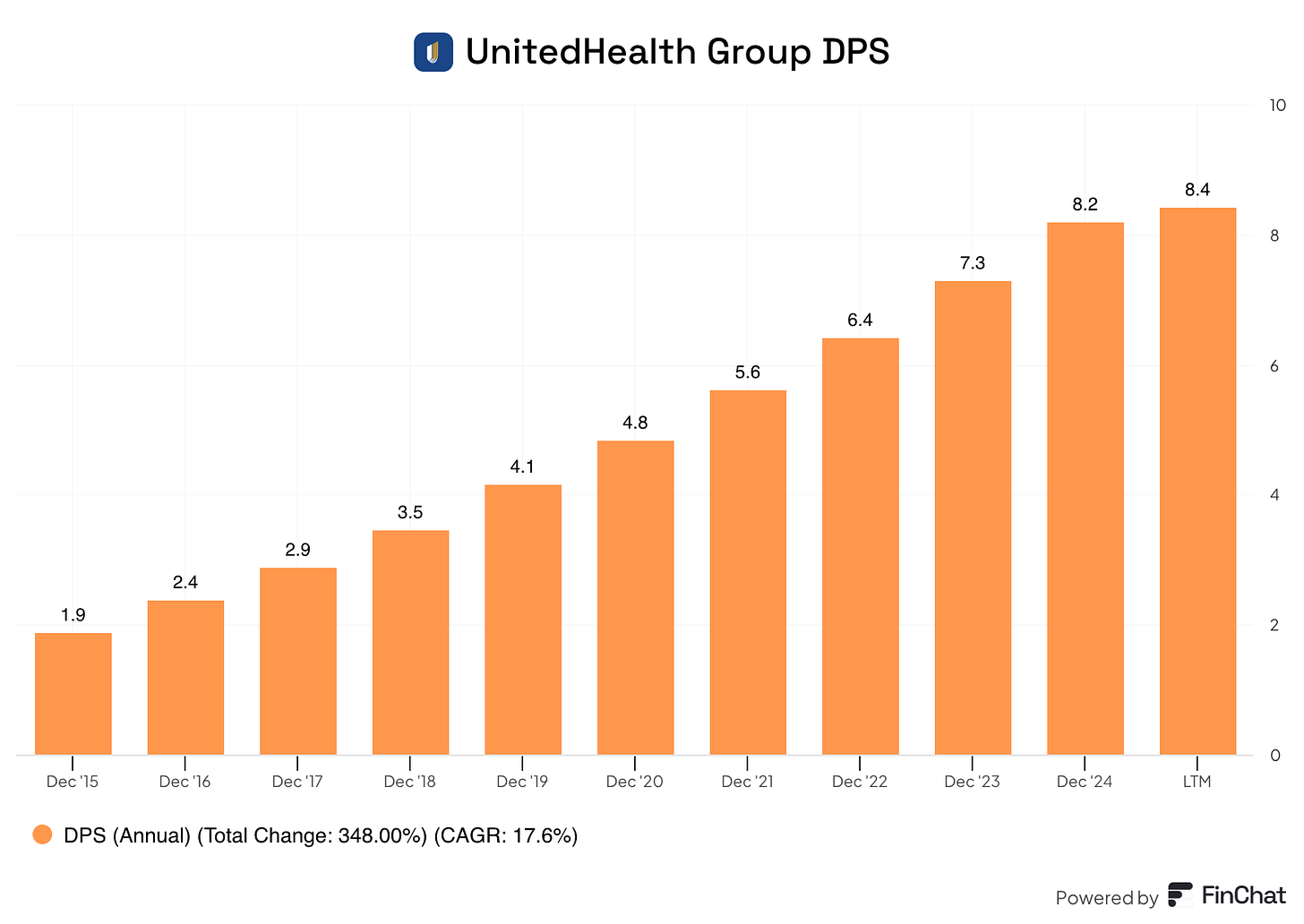

UnitedHealth Group has a great history of dividend growth

5-year dividend growth rate: 14.2% annually

10-year dividend growth rate: 18.8% annually

4. Is the company active in an attractive end market?

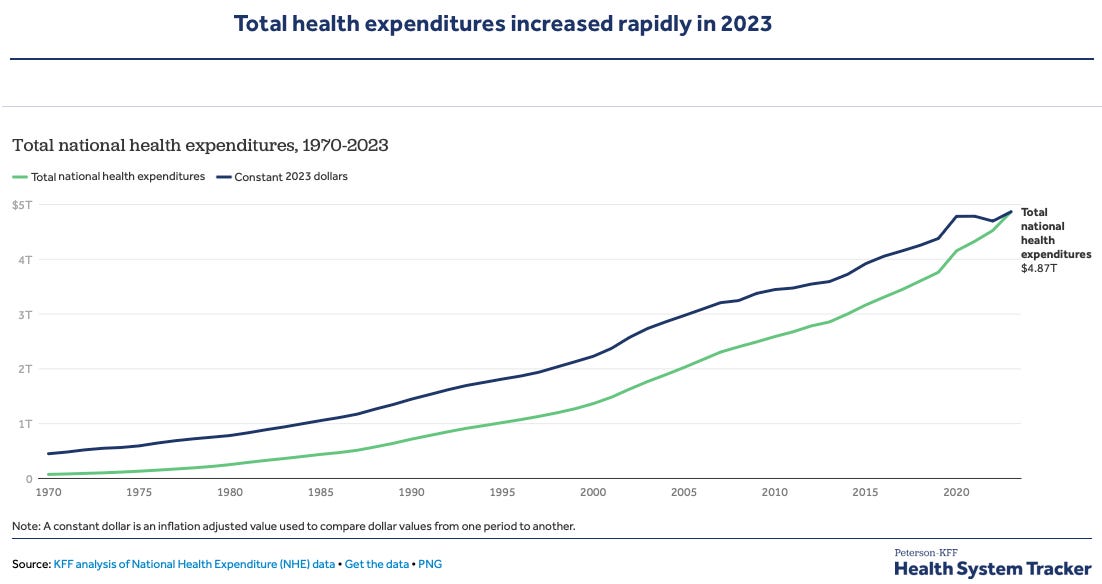

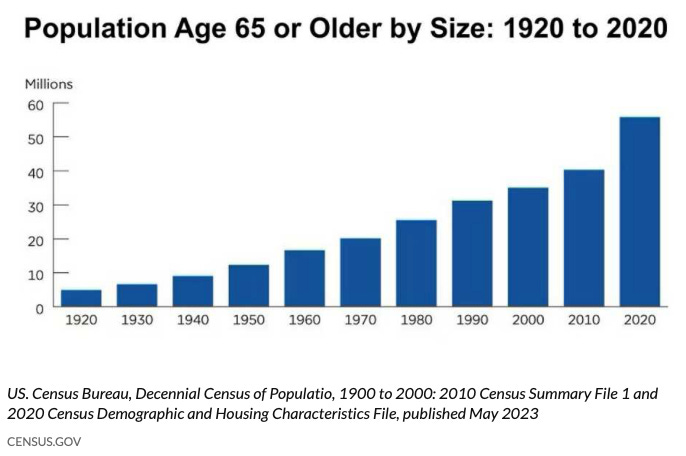

U.S. Healthcare spending has been on an upward trend for decades, and that’s not expected to change.

The U.S. population is aging, which will drive more need for medical services and health insurance.

UnitedHealth will have secular tailwinds driving the need for its services for a long time.

5. What are the main risks for the company?

Here’s an overview of the most important risks:

Regulatory Scrutiny:

Medicare Advantage Risk Adjustment: Increased focus on coding practices and potential accusations of overcoding or fraud

Mitigation: There’s a lot of room for interpretation in medical coding - the most likely outcome here (assuming there is another investigation) is that UnitedHealth settles and pays a fine. A finding that nothing wrong was done is also possible.

Also consider that Medicare Advantage is one of the most closely monitored and most frequently audited programs in U.S. healthcare - to date, no fraud has been uncovered in the regular audits that UnitedHealth plans have faced.

Political Pressures: Both parties are scrutinizing healthcare costs, with PBMs and MA plans frequently in the crosshairs

Mitigation: Hemsley has led UnitedHealth through challenges like this before. Also, there has been scrutiny on large healthcare players like UnitedHealth for years - none of this is new - and profits keep growing. UnitedHealth’s integrated model means they’ll be able to navigate any changes better than competitors, and large-scale change to the U.S. healthcare system is very unlikely.

Potential changes to CMS reimbursement models could impact margins

Mitigation: UnitedHealth gets to re-price premiums every year. Any impact will be short term.

Utilization Spikes:

Post-COVID, higher-than-expected medical utilization (e.g., more procedures and appointments) has pressured margins, especially in capitated contracts under Optum Health

Mitigation: Again, UnitedHealth re-prices premiums annually. This is a temporary issue that is easily solved

Complexity of the U.S. Healthcare System:

Fragmentation and high costs (admin costs alone represent 30% of excess spending vs. peer countries) make the environment difficult to navigate

Mitigation: UnitedHealth’s integrated model gives it better data and lower costs than competitors

Rising patient acuity (severity of illnesses) adds to the unpredictability

Mitigation: Optum’s data helps UnitedHealth make better decisions and the annual re-pricing helps mitigate this risk as well

Leadership Changes:

CEO Andrew Witty’s recent departure has added uncertainty, especially given his alignment with Optum’s growth strategy

Mitigation: Uncertainty is not risk, as UnitedHealth has brought back a previously successful CEO with his incentives aligned to shareholders

Reputational Risk:

Accusations of claim denials or aggressive billing practices could harm public perception and regulatory relationships

Mitigation: I don’t know of an insurance company that’s popular. People need health insurance and healthcare. The industry is so consolidated in the U.S. that consumers often don't have much choice.

Medicare Advantage plans receive a star rating from the Centers for Medicare & Medicaid services. These are based on quality of care and measurements of customer satisfaction. They range from 1 star (worst) to 5 stars (best). For 2025, 73% of UHC members enrolled in a Medicare Advantage plan have a 4 star or higher rating.

6. Does the company have a healthy balance sheet?

We like a Debt/Equity ratio < 50%.

UnitedHealth’s Debt/Equity ratio is 80%.

But UNH’s balance sheet is a bit complicated. Why?

Float.

UnitedHealth gets to collect money up front in exchange for maybe paying it out later as health services.

For accounting purposes, the portion of premiums collected up front that match the period of coverage that hasn’t happened yet has to be recorded as liabilities on the balance sheet. Those are listed as ‘Unearned Premiums’

There’s also ‘Unpaid Claims’, which are estimates of what UnitedHealth is going to have to pay out.

What really matters is whether UNH’s debt is a risk to the survival of the business.

Let’s simplify things.

UnitedHealth Group has $71.2 billion in long-term debt. They have $30 billion in cash, and $55 billion in investments. That’s enough to pay off the long-term debt.

UnitedHealth’s balance sheet isn’t concerning to me.

7. Is the company a great capital allocator?

Here’s what we look for:

Payout Ratio <60%

Effective investments or buybacks

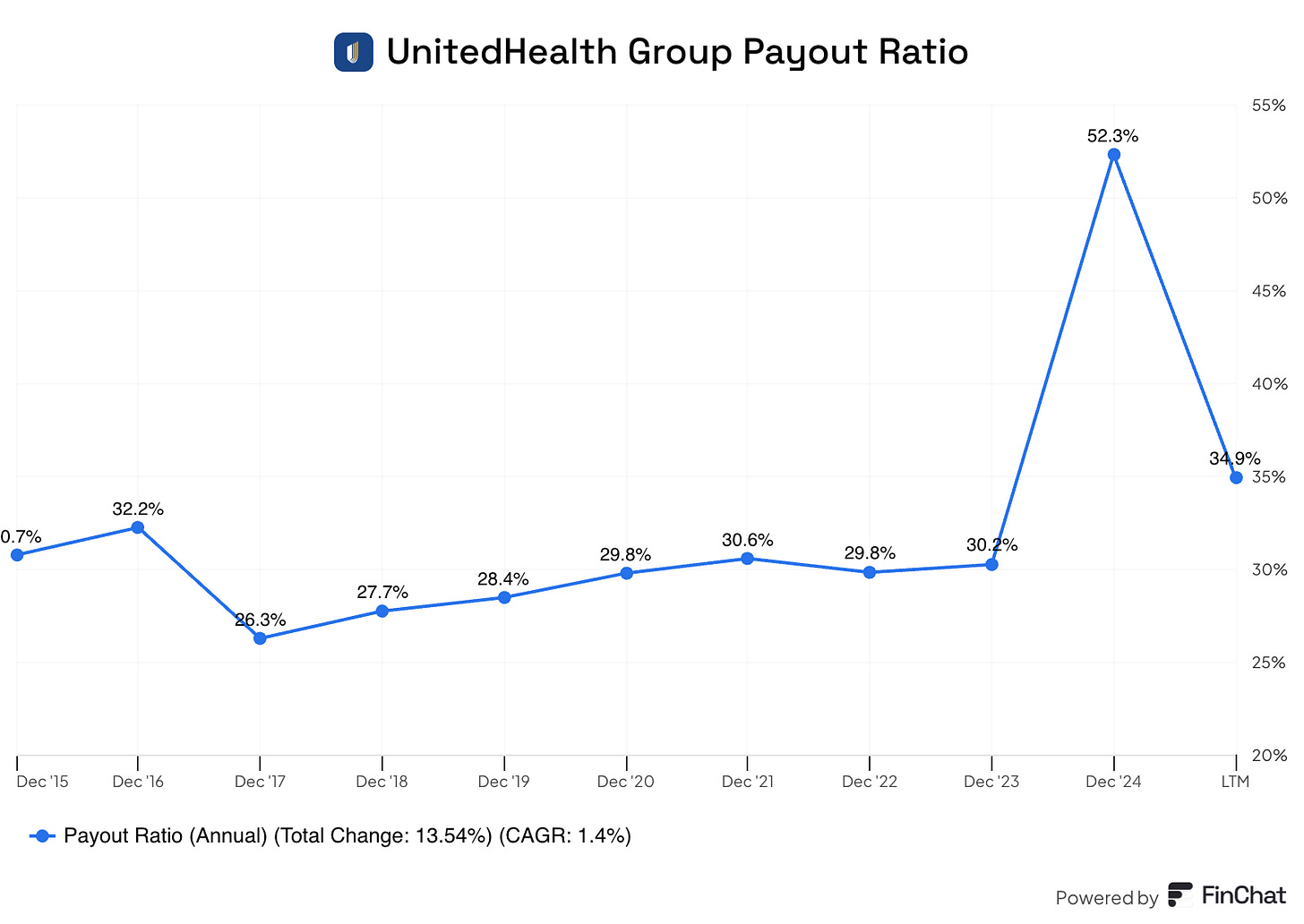

UnitedHealth typically maintains a low payout ratio of around 30%.

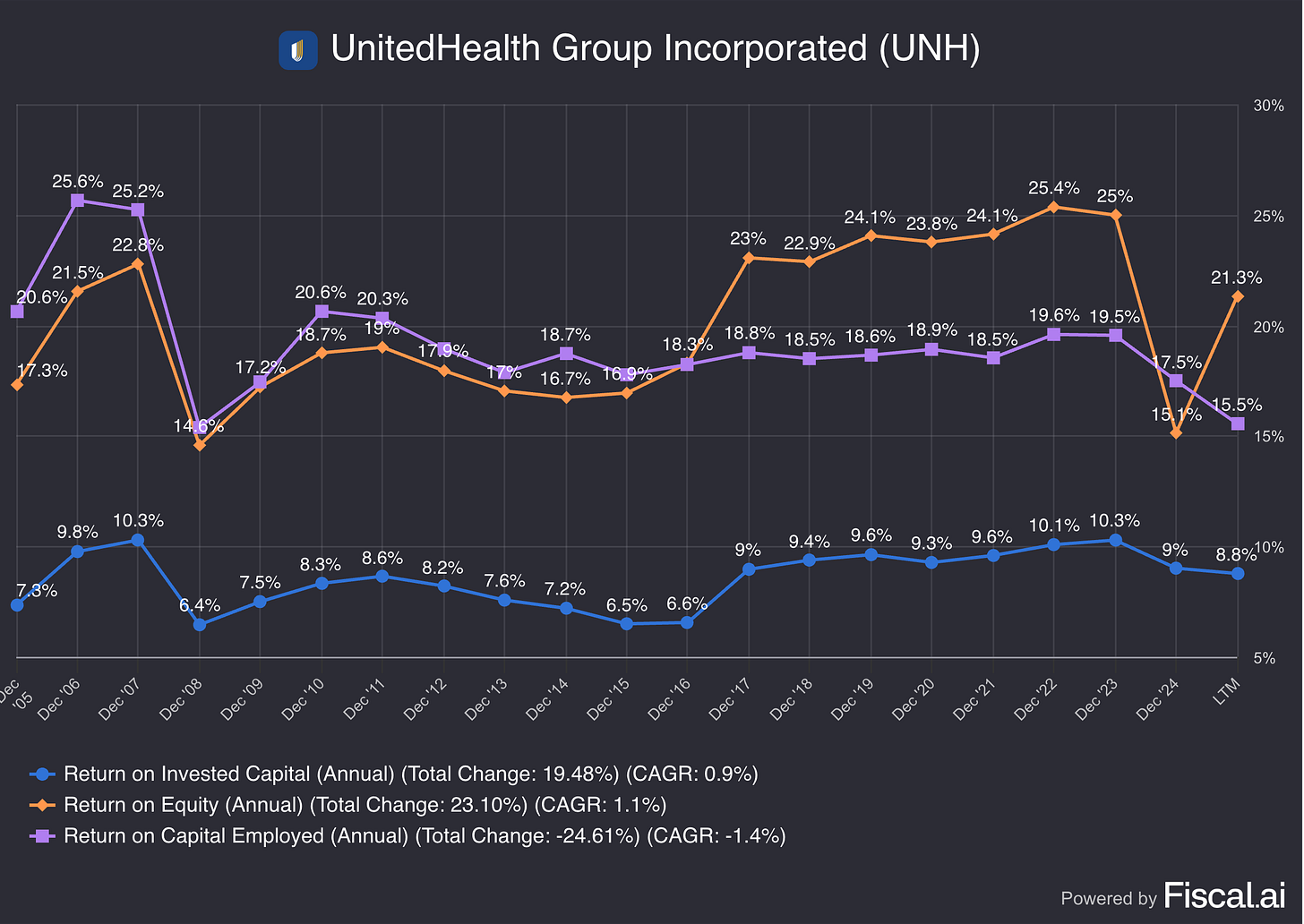

The company also has a history of attractive returns on investments made in the business:

8. How does the past and future growth of the company look?

UnitedHealth has a strong track record of growth:

5-year revenue growth: 11.3% per year

5-year EPS growth: 5.4% per year

Long-term EPS growth rate: -0.1%

I believe the Expected EPS Growth Rate is too conservative.

UnitedHealth will likely grow its profits by about 6% per year over the long term, thanks to the attractive market it operates in.

UnitedHealth has plenty of areas to invest in and grow into the future as well.

Value-Based Care:

Shifting from fee-for-service to value-based care, where providers are paid for patient outcomes rather than procedures

UHC’s integrated model enables early interventions, reduces unnecessary care, and aligns incentives to manage costs and improve outcomes

Growth in Medicare Advantage (MA):

MA is a high-growth area, driven by the aging U.S. population

UHC consistently outperforms peers in CMS star ratings for quality and patient satisfaction, which gives them higher reimbursements

Optum’s Expansion:

Optum is a $100 billion revenue business on its own. Its capabilities in data, analytics, and care delivery provide a significant (and highly profitable) growth engine

Optum Health is the largest employer of physicians in the U.S. (>70,000)

Resilience and Adaptability:

Unlike traditional health insurers, UHC can reprice its entire book annually, making it less sensitive to long-term shocks

The company’s ability to integrate technology and adapt to regulatory changes has historically driven consistent earnings growth

Based on these and the secular tailwinds of the aging U.S. population, I’d expect UNH to continue growing into the future.

9. Can the company grow its dividends into the future?

Let's check:

Current yield: 3.3%

Payout ratio: 36.6%

UnitedHealth is a dominant player in a growing market.

They have a long history of dividend growth, and the current dividend is well covered by earnings.

Assuming the company returns to growth in 2026, the dividends can likely keep compounding at attractive rates for a long time.

10. Does the company trade at a fair valuation level?

We value every company in 3 different ways:

1. Dividend Yield vs History

Historical average dividend yield: 1.4%

Current yield: 3.3%

This valuation method suggests UnitedHealth Group is undervalued.

2. Earnings Growth Model

This shows us the yearly return we can expect from a company.

It takes into account Earnings Per Share growth, the dividend yield, and multiple contraction or expansion.

The formula looks like this:

Expected return = EPS Growth + Dividend Yield + Multiple Expansion (or contraction).Here are the numbers for UNH:

EPS Growth: 6%

Dividend Yield: 3.3%

Change in PE: from 13.5x to 16x in 10 years (conservative considering UNH has traded at a PE of 20x or higher for most of the last 10 years)

Expected return = 6% + 3.3% + 1.9% = 11.2% return per year3. Reverse Dividend Discount Model

As Charlie Munger says, “Invert, always invert!”

Solving complex problems is often easier backward. That’s exactly what we do with the Reverse DDM.

Solving the DDM for growth tells us how much dividend growth is priced in by the market.

Here’s the formula:

Expected growth = Required return – (DPS next year / Current share price)Let’s put some numbers in for UnitedHealth Group:

Required return: 10%

DPS next year: $9.28 (5% growth from current DPS)

Current share price: $309

Expected growth = 10% - (9.28 / 309) = 7.0%This tells us that the market is pricing in a 7.0% growth in UnitedHealth’s dividend.

It’s way more conservative than the DPS CAGR of 14.2% over the past 5 years.

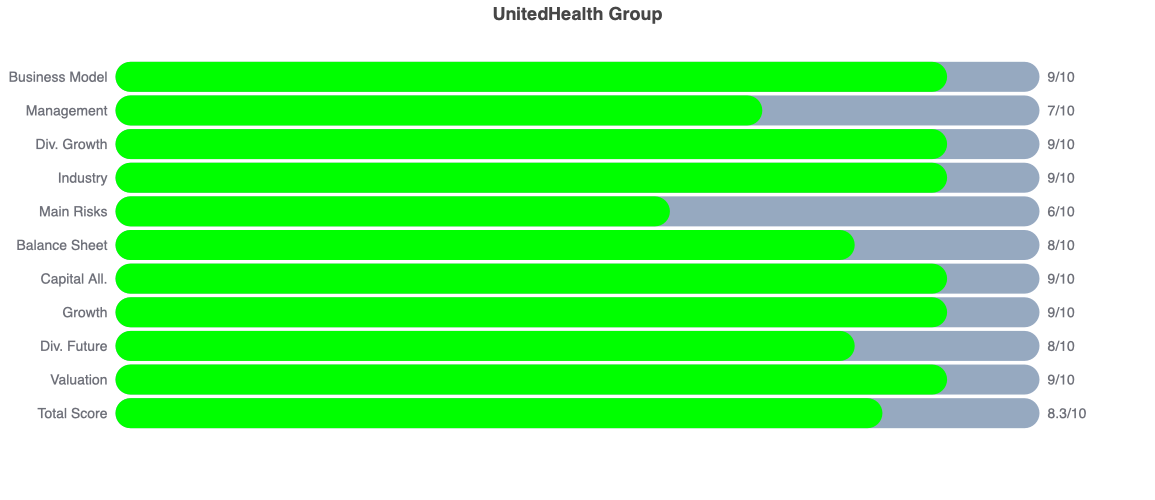

Dividend Score

UnitedHealth receives a Dividend Score of 8.3/10.

The main categories that hurt the score?

Management - I feel confident with Mr. Hemsley running the company, but we don’t know who will step in next

Main Risks - There is a lot of uncertainty around the company right now. I think these risks are manageable and that we’ll have a lot more clarity in the next year or two, but for now, this score has to be lower.

Conclusion

UnitedHealth Group is a complex but highly efficient healthcare giant with a unique integrated model that combines insurance, care delivery, and data analytics.

Its scale and use of technology give it a competitive edge in an inefficient U.S. healthcare system.

While regulatory scrutiny, utilization pressures, and leadership changes pose challenges, I think its structural advantages and adaptability make it a good long-term investment opportunity.

UnitedHealth currently offers a starting yield that’s double its historical yield

The market is pricing in a dividend growth rate that’s half of UnitedHealth’s historical rate

Very modest growth and valuation re-rating will result in a 10% return per year.

Here are the main points you should remember:

Misunderstood Business Model:

The market often has a hard time pricing complex companies like UNH due to its complexity and integration across insurance, care delivery, and analytics

Recent share price declines (a three-standard-deviation sell-off) likely reflect behavioral overreactions rather than fundamental issues.

Structural Resilience:

UNH’s ability to adapt to regulatory changes and reprice annually makes it more resilient than its competitors

Its integrated model creates a competitive moat, allowing it to manage costs and risks more effectively than traditional insurers

Long-Term Growth Drivers:

Continued expansion of value-based care and Optum’s platform

Increasing market share in Medicare Advantage, particularly as rivals struggle with star ratings

Regulatory Risk Mitigation:

UHC has consistently navigated major policy shifts (e.g., Obamacare, Medicare adjustments), using its scale and agility to adapt.

Compounding Dividends

Did you like this?

A subscription to the Founding Tier of Compounding Dividends costs $1,200 per year.

But to celebrate that TJ had an amazing investment idea before Warren Buffett had exactly the same idea, I want to do something special for you.

Keep reading as it consists of three amazing things.

1. Free upgrade to the Founding Tier

If you subscribe today, you will get a free upgrade to the Founding Tier.

This means you only pay $499 per year instead of $1,200 per year.

2. An extra discount of $150

But that’s not everything.

On top of that, I’m willing to give you an extra discount of $150.

This means you pay just $350 per year. A discount of $850!

3. Test it out risk-free

But it gets even better.

Today, I am offering you a 90-day money-back guarantee.

If you subscribe today and you’re not 100% happy, just send me an email at pieter@compoundingquality.net. I’ll give you a full refund. No questions asked.

This means subscribing today is a risk-free investment you can make in yourself.

I’m 100% sure that you’ll never regret it.

Here’s everything you get:

📈 My Personal Compounding Dividends Portfolio full of Dividend Growth Stocks

✍️ Three articles per week (Tuesdays, Thursdays & Sundays )

📚 Full access to our entire library of data-driven articles

🔎 Full investment cases about exciting companies

📊 Access to the Private Community

🚀 An exclusive report with the investment case of UnitedHealth Group

You can grab the $800 discount, including a 90-day money-back guarantee here:

Everything In Life Compounds

Pieter

PS Don’t miss out on stocks like UnitedHealth Group. Become a Partner of Compounding Dividends and get access to the Portfolio right away.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Thank you.

Hi Pieter - I thought you had bought UNH based off of this article and another, however when I log into the portfolio I can’t see it, nor can I in your most recent round up of the portfolio performance. I just wanted to check whether you have invested in UNH, and whether the portfolio is yet to be updated, or have I missed something?

Apologies if this is a silly question!