Dino Polska Deep Dive Part 3

Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

Dino Polska might be the highest-quality growth stock I’ve ever seen:

✅ Reinvesting EVERYTHING back in the business

✅ Yearly revenue growth past 10 years: 32.4% (!)

✅ Number of stores expected to grow from 2,340 to 5,300

Let’s dive into Dino’s fundamentals today.

Does Dino Polska have a healthy balance sheet?

In general, it can be concluded that Dino Polska has a healthy balance sheet:

Interest Coverage: 12.2x

Net Debt/EBITDA: 0.4x

Goodwill/Assets: 0.7%

What’s also great to see? Dino Polska has negative working capital.

Their average cash conversion cycle since 2014 has been -25 days. This means that customers of Dino Polska pay them 25 days earlier than Dino needs to pay its suppliers.

Cash Conversion Cycle = Days Inventory Outstanding + Days Sales Outstanding - Days Payable Outstanding

How much capital does the company need to operate?

The less capital a company needs to operate, the better.

Here’s what things look like for Dino Polska:

CAPEX/Sales: 4.7%

CAPEX/Cash From Operations: 115.4%

Wait… CAPEX is higher than Cash From Operations?

This doesn’t look good at first sight. Does it?

But actually, it’s a very good thing!

Do you know why? Dino is reinvesting everything in organic growth.

Dino’s CAPEX is equal to 1,167 billion Polish zloty while its Deprecation & Amortization is equal to 337.5 million Polish zloty.

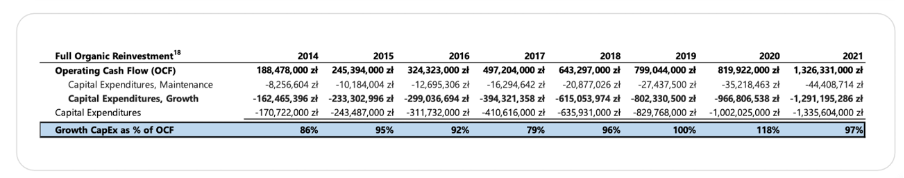

CAPEX = Maintenance CAPEX + Growth CAPEX

As a rule of thumb, we state that Maintenance CAPEX is equal to Depreciation & Amortization.

For Dino Polska, this means that maintenance CAPEX is equal to 337.5 million zloty while growth CAPEX is equal to 829,5 million zloty.

When we only take maintenance CAPEX into account, Dino Polska’s capital intensity looks as follows:

CAPEX/Sales: 1.4%

CAPEX/Operating Cash Flow: 18.7%

These numbers DO look attractive.

We love the fact that Dino is investing heavily in future growth.

Is Dino Polska a great capital allocator?

You might know this beautiful quote from Charlie Munger:

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much difference than a 6% return—even if you originally bought it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive-looking price, you'll end up with a fine result."

The above is only true when a company can reinvest everything in the business.

And that’s exactly what Dino Polska does.

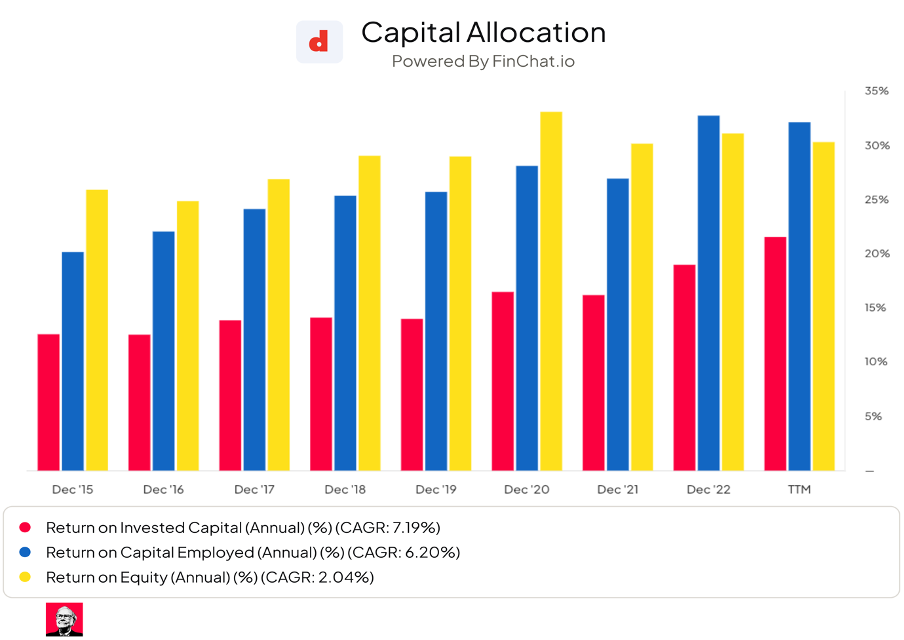

They reinvest 100% of their operating cash flow back into the business for organic growth. And they do this while their ROIC is high (ROIC: 21.6%). That’s how you create a compounding machine!

Dino Polska reinvests EVERYTHING back in the company. They have never paid out dividends or repurchased shares. They also rarely do M&A.

The company keeps focusing relentlessly on organic growth. This is also by far the most preferred capital allocation choice. The company should keep doing this until the market is saturated.

As you can see in the table hereunder, Dino Polska reinvests everything in organic growth:

Here’s an overview of Dino Polska’s ROIC, ROCE and ROE:

Over the past 5 years, Dino’s ROIC and ROE have averaged 22.6% and 29.3% respectively. These numbers are attractive.

How profitable is Dino?

Here’s what the profitability numbers for Dino Polska look like:

Gross Margin: 26.1%

Net Profit Margin: 5.6%

The profitability isn’t sky-high, but this is no problem as Dino is active in the grocery business. They have a negative cash conversion cycle and their asset turnover ratio is high.

It’s also great to see that Dino’s profitability has been improving gradually over the years:

The great thing about Dino’s profitability? The company’s margins will increase in the years to come.

Dino’s current profitability is optically low because the newly opened stores still earn lower margins.

As the company is expanding aggressively, this impact is significant. 25% of Dino stores were opened within the last 2 years (!). The margins of these new stores will expand thanks to operating leverage.

And when you take this into account, Dino’s profitability will increase and its valuation will come down. I think the impact of this is overlooked by the market right now.

The profitability of Dino’s stores:

1-year-old store: EBIT Margin = -5.8%

2-year-old store: EBIT Margin = 4.4%

Mature store: EBIT Margin = 10.4%

Today, 942 stores are less than 3 years old. As Dino has 2,340 stores, this means 40% of their stores haven’t reached full maturity and profitability yet!

This gives the company plenty of room for margin expansion and operating leverage.

Does Dino use a lot of stock-based compensation?

Stock-based compensation is a cost for shareholders and it should be treated accordingly.

“If options aren't a form of compensation, what are they? If compensation isn't an expense, what is it? And, if expenses shouldn't go into the calculation of earnings, where in the world should they go?” – Warren Buffett

There is no shareholder incentive program at Dino Polska. It underlines once again the great company culture of the business.

Now let’s dive into the most important questions: does Dino grow at attractive rates and do they trade at reasonable valuation levels?