Earnings Growth Model

Your expected return

Investing is an art.

But it’s also a craft and a science at the same time.

In this article, I’ll teach you how to value a stock.

Many of you have asked about this, so I’m considering launching an investment fund based on the principles I’ve shared with you over the years.

To gauge interest and understand potential investments from my readers and followers, I’ve created a short survey.

Might you be interested? Fill in this survey to be kept up to date.

Keep Things Simple

Great investors use common sense.

If you need an Excel sheet to determine whether a stock is interesting, it’s probably not.

The easier you keep things, the better.

Simplicity and patience are key to success.

"You don’t have to be a genius to invest well. Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ." - Warren Buffett

"Take a simple idea and take it seriously." - Charlie MungerDouble your investment

A simple rule to use? The rule of 72.

Divide 72 by your yearly return and you know how long it takes to double your money.

If your return is 9% per year, it takes 8 years to double your money (72/9%).

It would only take 4.8 years (72/15%) to achieve a yearly return of 15%.

Doubling your investment every 5 years sounds like a great objective.

As an investor, you try to determine two things:

How much the company will earn (EPS) in 5 years from now

The fair P/E multiple at which I think this company should trade over time

Stock Price = Earnings Per Share * P/E RatioLet’s say Company X earns $1 per share today and trades at 20x earnings.

Stock Price = Earnings Per Share * P/E Ratio

Stock Price = $1 * 20x = $20I now make the following assumptions:

Company X will earn $2.5 per share in 5 years from now

A fair P/E multiple would be 16x

In that case, your expected return looks like this:

Stock Price = Earnings Per Share * P/E Ratio

Stock Price today = $1 * 20x = $20

Stock Price in 5 years from now = $2.5 * 16x = $40In this case, the stock price of Company X should be equal to $40 in 5 years from now versus $20 today.

This means we doubled our money in 5 years from now.

Easily formulas like this are exactly what we want to use as an investor.

Earnings Growth Model

And this brings us to the Earnings Growth Model.

We use this model every single time to value a company.

What is an Earnings Growth Model?

An Earnings Growth Model (EEG) is an interesting valuation method.

It shows you the yearly return you can expect as an investor.

You need three components:

Expected Earnings Per Share (EPS) Growth

Dividend Yield

Change in Valuation

Expected EPS Growth

At which rate will the company grow its earnings in the years to come?

To make an educated guess about the expected EPS Growth Rate:

Look at the historical growth rate

Look at the outlook of management

Look at analyst expectations

Dividend Yield

You can calculate the Dividend Yield by dividing the Dividend Per Share of the company by its Stock Price.

Change In Valuation

Will the company’s valuation go up or down in the years ahead?

Multiple expansion: You expect the valuation to go up in the years ahead

Multiple contraction: You expect the valuation to come down in the years ahead

How to calculate your expected return?

Your expected return can be calculated as follows:

Expected Return = EPS Growth + Dividend Yield +/- Change in ValuationYou can perform these calculations over either 5 years or 10 years.

The concept isn’t clear yet?

Don’t worry. An example will guide you.

Example: Microsoft

Let’s determine which return we can expect from Microsoft based on our Earnings Growth Model.

EPS Growth

To determine the EPS Growth for the future, we look at the Long-Term Expected Growth Rate on Finchat.

This figure shows us the growth rate analysts expect in the future.

According to analysts, Microsoft should be able to grow its EPS by 13.3% per year.

Is this realistic? It might be, considering Microsoft increased its EPS by 16.9% annually over the last 10 years.

But as we know, analysts are often too optimistic.

That's why we apply a 30% margin of safety.

In our Earnings Growth Model, we assume that Microsoft will grow its EPS by 10% annually.

Dividend Yield

It’s easy to look at the dividend yield of a company.

Microsoft’s Dividend Yield equals 0.8%.

Change In Valuation

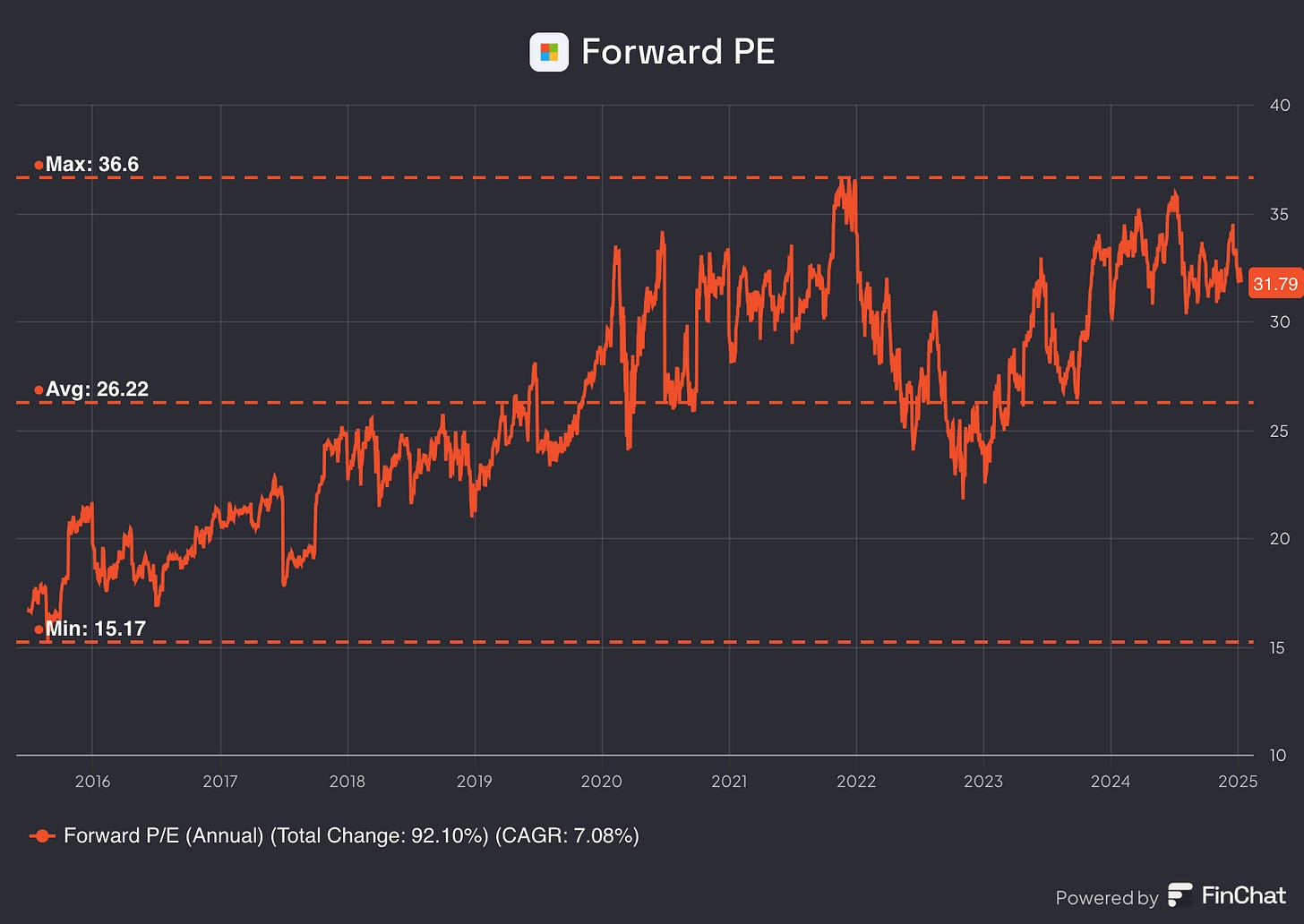

Microsoft currently trades at a forward PE of 31.8x.

When we look at the evolution of the Forward PE, we get the following:

Microsoft seems to be trading at rich valuation levels compared to its historical average.

Microsoft trades at a forward PE of 31.8x today versus an historical average of 26.2x.

We now want to determine a fair exit PE for Microsoft.

Let’s say that we consider the average forward PE of the past 10 years (26.2x) as fair.

We expect Microsoft’s valuation to evolve from 31.8x (current forward PE) to 26.2x (the average of the past 10 years).

Earnings Growth Model

Now we have all the numbers, we can calculate our expected return.

Expected Return = EPS Growth + Dividend Yield +/- Change in ValuationHere are the assumptions we use:

Expected EPS Growth: 10% per year

Dividend Yield: 0.8%

Forward PE to decline from 31.8x to 26.2x over the next 10 years

When we do the calculations, we get the following:

Expected Return = EPS Growth + Dividend Yield +/- Change in Valuation

Expected Return = EPS Growth + Dividend Yield + 0.1*(Ending PE - Beginning PE)/Beginning PE

Expected Return = 10% + 0.8% + 0.1 * ((26.2x- 31.8x)/ 31.8x)

Expected Return = 10% + 0.8% - 1.7% = 9.0%

Based on our Earnings Growth Model, an investment in Microsoft is expected to yield an annual return of 9.0% over the next 10 years.

This means your money would double every 8 years (72/9% return).

Would you be satisfied with that return? If so, investing in Microsoft could make sense.

However, if you're seeking a higher return, you may want to explore other, more promising opportunities.

Conclusion

Here are the key takeaways from today:

An Earnings Growth Model helps you to calculate your expected return

You need to know 3 things:

Expected EPS Growth

Dividend Yield

Current Forward PE and a fair Exit PE

Your Expected Return = EPS Growth + Dividend Yield +/- Change In Valuation

This visual summarizes the essentials.

Everything In Life Compounds

Pieter

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

thanks a lot for this - really interesting to explore and Im trying to get as much as possible into a google colab notebook. It will be interesting to see how nicely it matches up with the buy-hold-sell sheet

Out of interest, you always use 30% margin of safety? I've just been rounding down the lowest number out of the 10 year average and the LT growth estimate

A mathematical question: how do you get to the -1.7% contraction? I know it’s (new-old/old), but i don’t understand the 0.1.

Thanks you!