Hi Friend 👋

✨ First of all: my best wishes for 2025 ✨

I wish you a year full of love, health & wealth.

Results 2024

In 2024, the S&P 500 returned 24%.

The three best performers:

Palantir: +340.5%

Vistra: +257.9%

Nvidia: +171.2%

The three worst performers:

Walgreens Boots Alliance: -65.0%

Moderna: -63.0%

Estée Lauder: -48.5%

Big Tech accounted for over 50% of all the capital gains within the S&P 500.

Expectations for 2025

When the legendary banker J.P. Morgan was asked on the street what the stock market would do the next day he replied: “It will fluctuate.”

Around this time every year, big banks come up with their price targets for the S&P 500.

These price targets don’t make any sense if you ask me.

Nobody knows what the stock market will do in the short term.

As Warren Buffett once said: “We've long felt that the only value of stock forecasters is to make fortune tellers look good.”

The only thing we can do is to prepare.

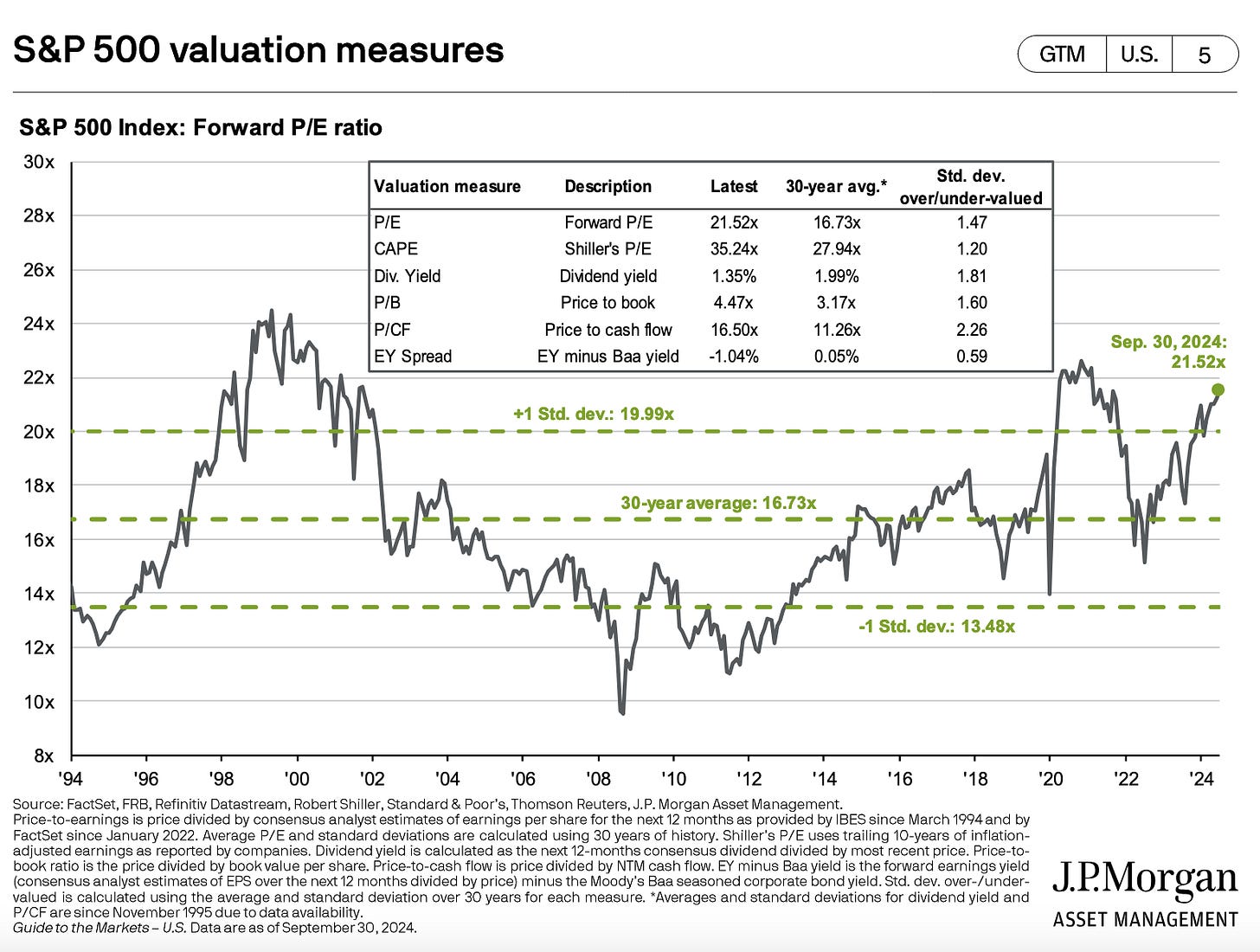

As you can see here, the S&P 500 is trading at rich valuation levels:

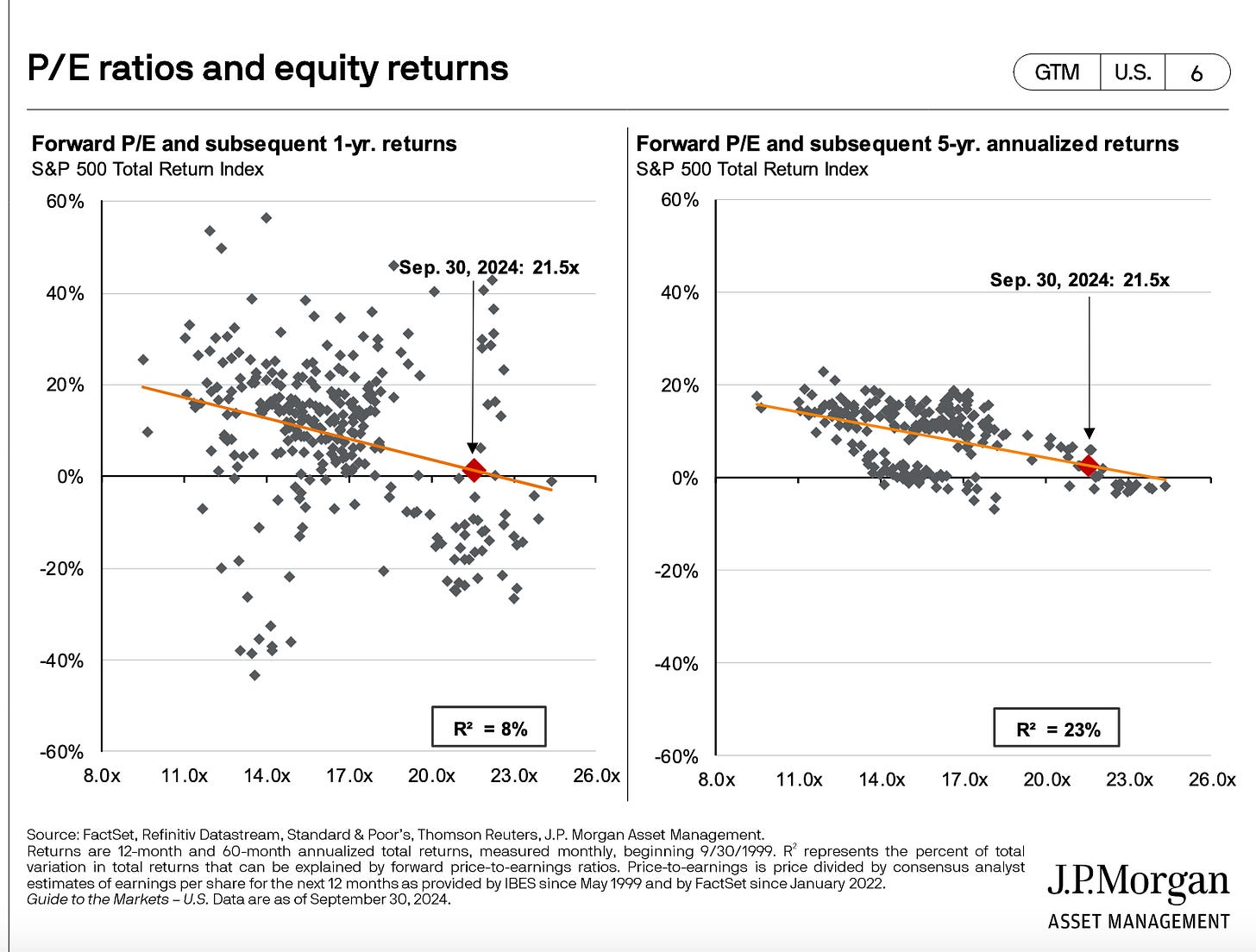

If we may believe J.P. Morgan, the expected return for the next twelve months and 5-year period are low as a result of these rich valuation levels:

Today, it’s more than ever important to do your homework.

Why? Everyone is a genius in a bull market.

It’s during bear markets that the big differences are made.

The good news?

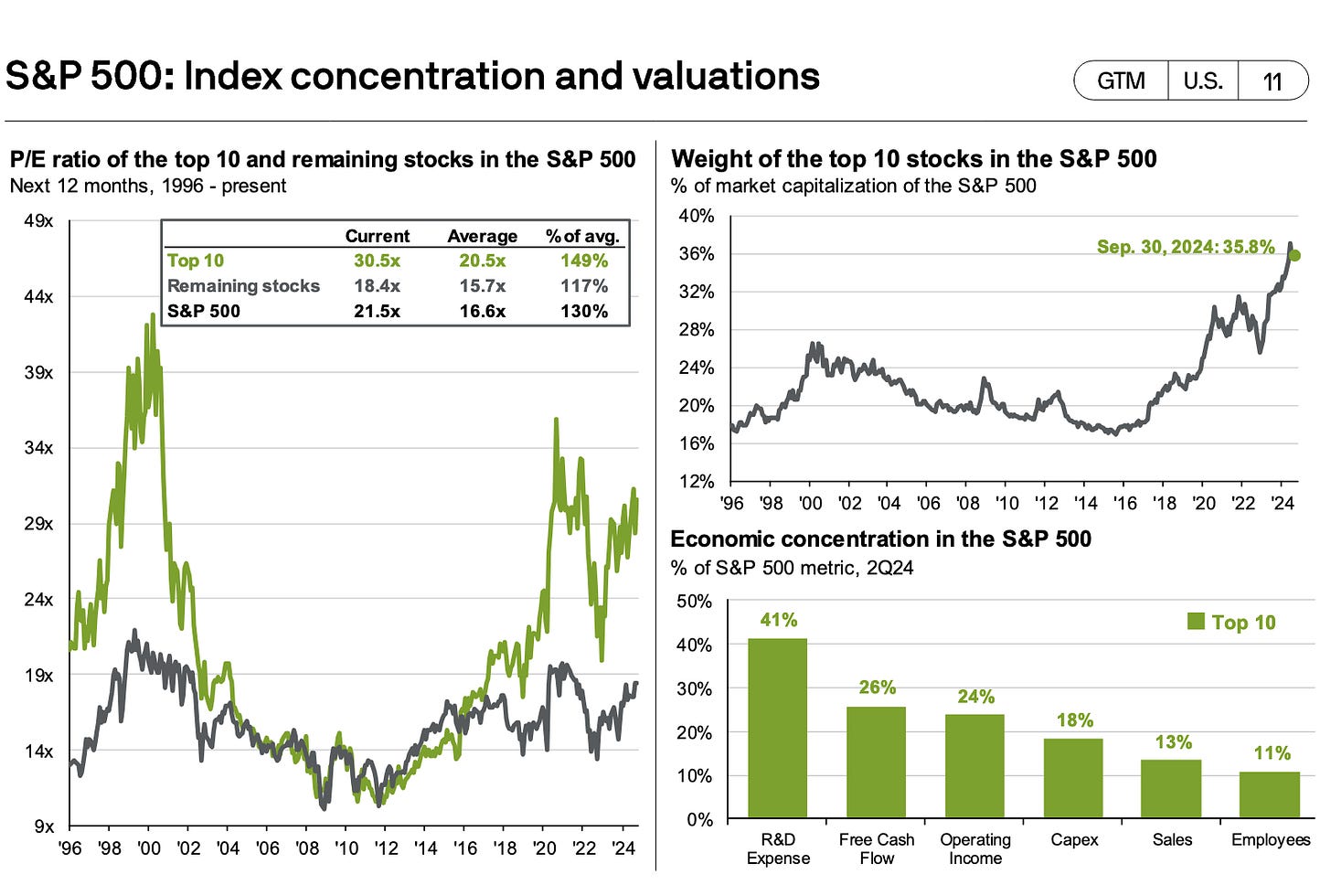

When you exclude the Top 10 stocks from the S&P 500, the valuation already looks more reasonable.

Since 1996, the percentage weight of the top 10 stocks in the S&P 500 has never been higher than today:

Since 2004, non-US stocks have never been as cheap compared to US stocks as today.

We own 6 non-US stocks in Our Portfolio.

Flavor of the Day

Bitcoin is hot, once again.

Currently, a Bitcoin costs over $96,000. The price increased by +113% in 2024. Trump’s election caused Bitcoin to gain momentum.

While Blockchain technology is fascinating, I have no clue what a Bitcoin is worth.

Cryptocurrencies don’t generate cash flows like companies do, and their value is solely determined by what the next person is willing to pay for them.

As a result, I see no margin of safety (at all) when investing in cryptocurrencies.

I would encourage investors to avoid cryptocurrencies (or only invest a small percentage that you can afford to lose).

"The value of every business is equal to the future cash flows generated over its lifetime discounted to today." - Warren BuffettMistakes of 2024

The most costly investment mistakes?

Mistakes of omission (not doing what you should have done).

Here are the three biggest mistakes I made in 2024.

🥉 MSCI

How does the company make money?

MSCI provides investment decision support tools, including indices, data, and analytics, to help investors manage risk and performance in global markets.MSCI is a great business I would love to own at the right price. 97% (!) of its revenue is recurring in nature.

The company earns money on all the assets invested in an ETF that has the name ‘MSCI’ in it.

Think about the iShares MSCI World ETF for example.

In April, the stock plummeted by over 10% (down 25% from its peak) on less-than-expected results.

I knew the company wasn’t expensive but I wanted to buy them at even cheaper valuation levels.

Since then the stock has been up by almost 40%.

🥈 Fortinet

How does the company make money?

Fortinet provides cybersecurity solutions to protect businesses from digital threats, offering products like firewalls, VPNs, and intrusion prevention systems.I consider Fortinet the highest-quality cybersecurity player. They are active in a clear secular trend. In November 2023, I already wrote a Not So Deep Dive about the company.

In August this year, Fortinet was down 25% from its peak and the company wasn’t trading at a rich valuation.

The Forward PE of 26.5x was very reasonable given the attractive growth.

While I knew the valuation level might have provided opportunities, Once again, I was too frugal and decided to wait for even lower valuation levels.

Since then, Fortinet is up +70%.

Key lesson? When you’ve found a great quality company that is trading at reasonable valuation levels, you don’t need to be too frugal.

🥇 KKR

How does the company make money?

KKR is a global investment firm that manages assets across private equity, credit, and real estate to generate returns for its investors.At the beginning of the year, I seriously considered buying KKR.

Why? Private Equity is a very interesting niche for two main reasons:

It’s hard to get access to Private Equity as a private investor. Via a listed private equity firm, you can get access to smaller amounts of money

In the very long term, Private Equity performs even better than stocks

We didn’t buy KKR and bought Text SA instead.

Text SA is the company we only owned for a few months. We made a huge mistake.

The moat of Text SA was way smaller than we initially thought. You can read more about it here.

After a few months, we sold Text SA at a loss of 20% while KKR’s stock price doubled in 2024.

Our Performance

The Performance of Our Portfolio since inception looks like this:

The screenshot above is the official track record from Interactive Brokers.

I use Interactive Brokers for every transaction. You can explore Interactive Brokers here.

It’s lovely to see that we did better than the S&P 500 as it was very hard to beat the index when you didn’t own Big Tech (we don’t).

It’s exactly the reason why many super investors didn’t beat the index over the past few years.

Since October 2023, we outperformed the market by 8%.

Do you want to get access to My Personal Portfolio?

Head over to this page, subscribe to the Annual Plan, and you’ll be automatically upgraded to Founding Partner status."

Everything In Life Compounds

Pieter