Foolish Wall Street

Do you know how many Fund Managers perform better than the S&P 500?

The correct answer is less than 10%.

In today’s article we’ll talk about what’s wrong with Wall Street and the big advantage you have.

If you didn’t become a Premium Partner yet, please note that this is the last week we’ll give a discount.

People who subscribe this week get a discount of $100 + $300 worth of investing tools.

Partners get access to the Compounding Portfolio, receive full investment cases, courses, onepagers of Quality Companies and much more.

What’s wrong with Wall Street

Do you invest in Mutual Funds via your (local) bank?

Know that almost no Professional Investor beats the S&P500 over time.

More than 90% of all Professional Investors underperform the market.

There is a lot wrong with Wall Street.

It’s the main reason why I left my job as a Professional Investor. I want to help investors like you and genuinely do the right thing.

In general, most investors would do way better with an ETF Portfolio or by managing their own investments.

Your big advantage

Peter Lynch wrote in his book ‘One Up on Wall Street’ that individual investors have big advantages over investment professionals.

And he was completely right.

Why?

You have the ability to spot plenty of investment opportunities in your day-to-day life.

Do you notice that the parking lot at a local factory is very well filled recently? Or that your daughter and all her friends want a certain toy?

Take a look at these companies and find out whether they might be good investments.

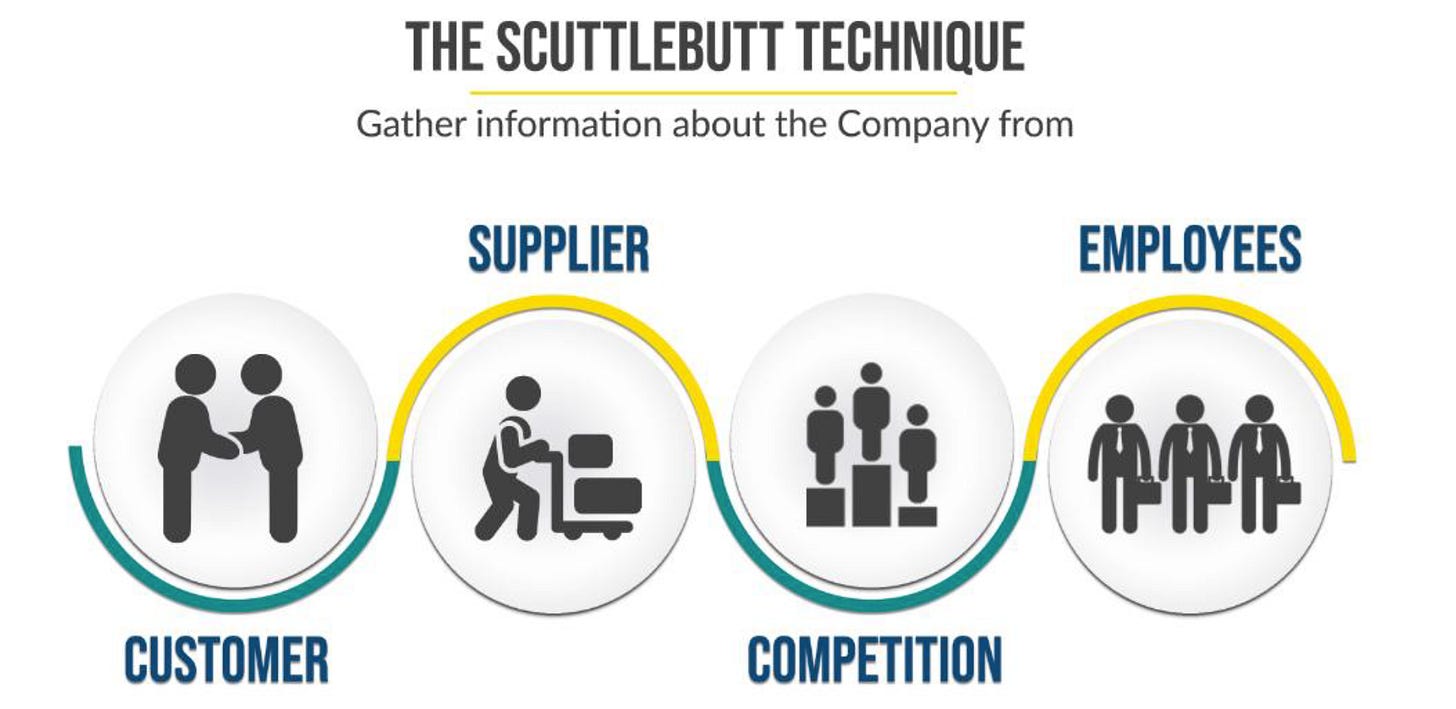

Philip Fisher called this the scuttlebutt technique.

It’s an investment technique where you gather information about a company by talking with different stakeholders (employees, customers, suppliers, competitors, …).

Foolish Wall Street

Now let’s dive into what Professional Investors are doing wrong and what you can learn from this.

1. Index hugging

Most Fund Managers just copy an index.

This means that the result you are getting as an investor is the return of the index less management fees.

In other words: when your Fund Manager copies an index, you are mathematically certain to underperform.

✅ Takeaway for you: If you want to outperform, you have to do something different. If you want to hug an index, just buy a low-cost index fund.

“The greatest risk to most fund managers’ careers is not losing money for you or underperforming the index. It is in doing something different to their peers.” - Warren Buffett

2. Short-term mindset

Professional Investors focus on quarterly results.

Many Professionals know exactly by how many cents a company missed analyst expectations, but they don’t even fully understand the business model of the companies they cover.

✅ Takeaway for you: Think in quarter decades instead of quarters and always stay within your circle of competence.

“If you are a long-term investor, you should own high-quality stocks and close your ears to those who say a rate rise will cause you problems. If you are not a long-term investor, I wonder what you are doing in the stock market at all, and so will you one day.” – Terry Smith

3. Sound interesting > be interesting

When I worked in the industry myself, I often had the feeling that it was way more important to sound interesting than to be interesting.

In other words: buy hot stocks which look fundamentally very unhealthy but which allow you to tell an interesting story during roadshows and important client meetings.

✅ Takeaway for you: The best investors are willing to look like a fool from time to time. Focus on being interesting instead of to sound interesting.

Subscribe today and get $100 discount + $300 worth of Investment Tools.

4. Trading too much

At the company I worked for, there was a Fund Manager who traded equities for roughly $400 million per year.

The size of his fund? $100 million.

This means he bought and sold all position within his fund 4 times per year or once every 3 months.

“Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic.” - Warren Buffett

✅ Takeaway for you: Don’t trade too much. Fees and expenses harm your investment results.

5. Focusing on the news

For Fund Managers, it’s way better for their reputation to fail conventionally than to succeed unconventionally.

That’s why most Professional Investors suffer from herd behavior.

✅ Takeaway for you: Think contrarian. When the media is talking about market crashes, it’s usually a great time to invest and the other way around.

6. Looking at macroeconomics

A lot of Professional Investors make investment decisions based on macroeconomics.

They switch from value to growth, increase and decrease their exposure to foreign currencies, … based on certain economic predictions.

That’s almost never a good idea. As Peter Lynch used to say: If you spend 13 minutes a year on economics, you've wasted 10 minutes.

✅ Takeaway for you: Be a bottom-up stock picker. Focus on the evolution of the intrinsic value of the companies you own.

"I am constantly amazed at the number of people who talk about investment and spend most or all of their time talking about asset allocation, regional allocation, sector weightings, economic forecasts, bonds vs equities, interest rates, currencies, risk controls and never mention any need to invest in something good." - Terry Smith

7. Only investing in large caps

Due to their size, Professional Investors can almost solely invest in large caps.

The law of large numbers is the main reason why Berkshire Hathaway didn’t outperform over the past years.

✅ Takeaway for you: The smaller the stock, the less efficient the market. That’s why there are huge opportunities in small cap stocks for investors like you.

Subscribe today and get $100 discount + $300 worth of Investment Tools.

8. Lack of accountability

A study of Morningstar found that two thirds (!) of all Fund Managers didn’t invest a single dollar in their own fund.

Can you believe this?

These guys are often managing hundreds of millions of dollars for other people but don’t consider it a good idea to invest a single dollar of their own money in their fund.

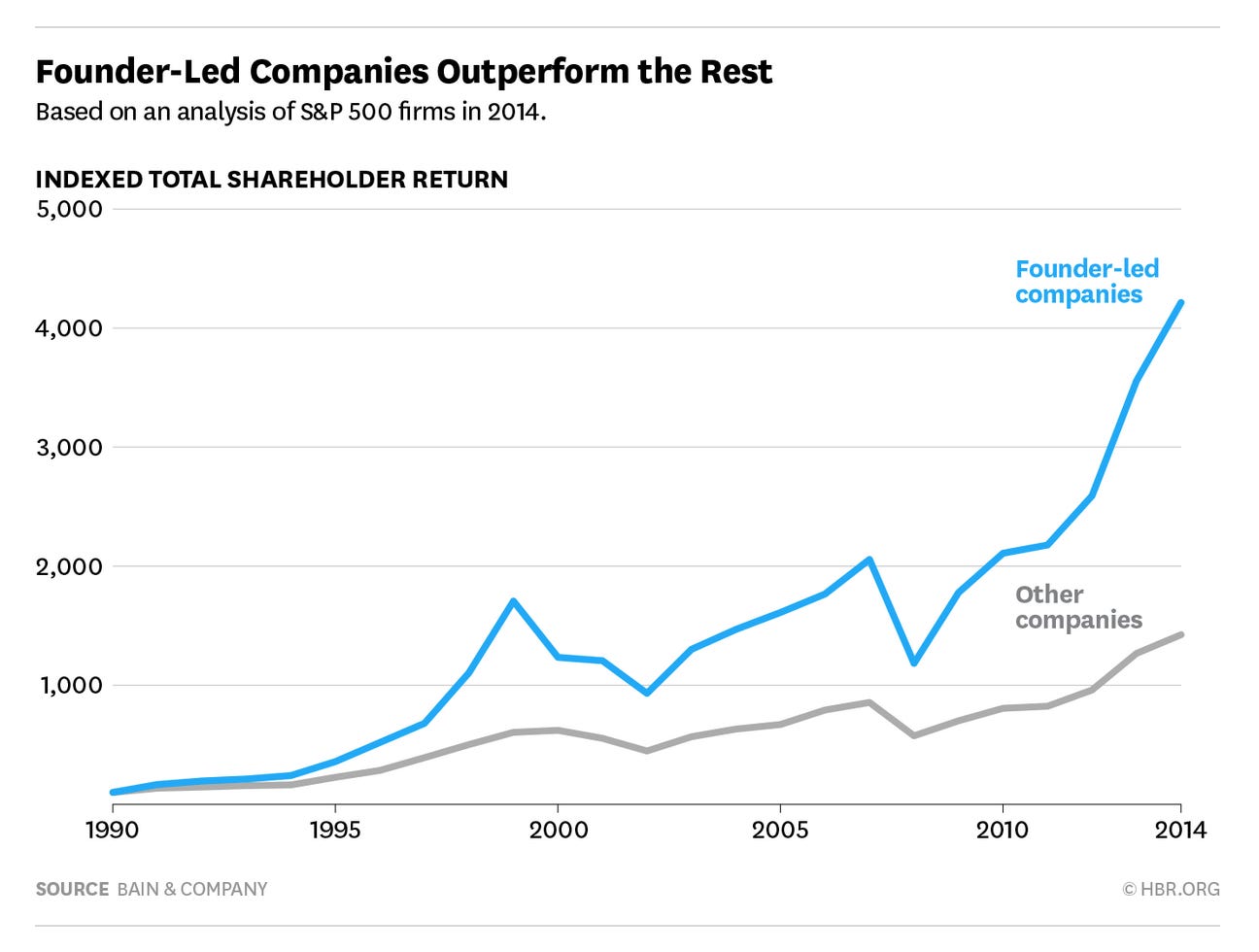

✅ Takeaway for you: Skin in the game matters. Focus on great owner-operator stocks or family companies.

9. Complex investment strategies

Using complex strategies often sounds intelligent, but it’s seldomly a good idea.

Just look at what happened with LTCM for example.

You need another example? CDOs during the Financial Crisis.

✅ Takeaway for you: Use common sense and try to make things as simple as possible, but not simpler.

“It is better to be roughly right than precisely wrong.” - John Maynard Keynes

10. Trying to time the market

A lot of (professional) investors try to time the market.

Know that trying to time the market is a fools game.

There are only 2 kinds of people who can successfully do it:

Cheaters

Liars

✅ Takeaway for you: Time in the market beats timing the market. Invest periodically and don’t worry too much about stock market volatility.

Launch of the Portfolio

The portfolio and all other services will gradually roll out starting from the first of October.

This section will only be available for partners.

As I am very thankful for all 112,000 (!) loyal readers of Compounding Quality, I want to give you one last chance.

That’s why people who subscribe today will get a discount of $100 + 3 months access to Koyfin Pro (value: $300).

The discount expires on Sunday the 17th.

About the author

Compounding Quality has a true passion for investing and helping other investors. He aims to invest in the best companies in the world as it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Compounding Quality used to work as a Professional Investor but left his job to help investors like you. The main reason for this? He was sick of the short-term mindset of Wall Street and wanted to genuinely do the right thing.

All readers of Compounding Quality are treated as PARTNERS. We ride our investment journeys together.

“We have an attitude of partnership. Charlie Munger and I think of our shareholders as owner-operators.” – Warren Buffett

This was a fascinating read (just like all the previous ones). 😊

Have a great weekend, my friend!

wow, love it 🙏