💰 Growth Investing with Philip Fisher

Philip Fisher is the father of growth investing.

He always used the same 15-step approach to select the best growth companies.

I’ll teach you everything you need to know in this article.

What you can learn from Philip Fisher

Philiper Fisher’s most famouns investment? He bought Motorola in 1955 and held it until he passed away in 2004. It’s a beautiful example of letting your winners run.

He’s also the inventor of the ‘scuttlebutt’ method, an investment method that Peter Lynch used a lot.

Scuttlebutt refers to the idea that if you’re interested in a certain company, you should go talk with their customers, competitors, (former) employees, and so on.

Warren Buffett once called Philip Fisher's book Common Stocks and Uncommon Profits one of the best books on investing that has ever been written.

“I am an eager reader of whatever Philip Fisher has to say. And I recommend him to you.” - Warren Buffett

If even Warren Buffett admires Philip Fisher, shouldn’t you?

15-Step approach

Now let’s dive into Philip Fisher’s investment approach.

He used the same 15-step approach over and over again to select the best growth companies.

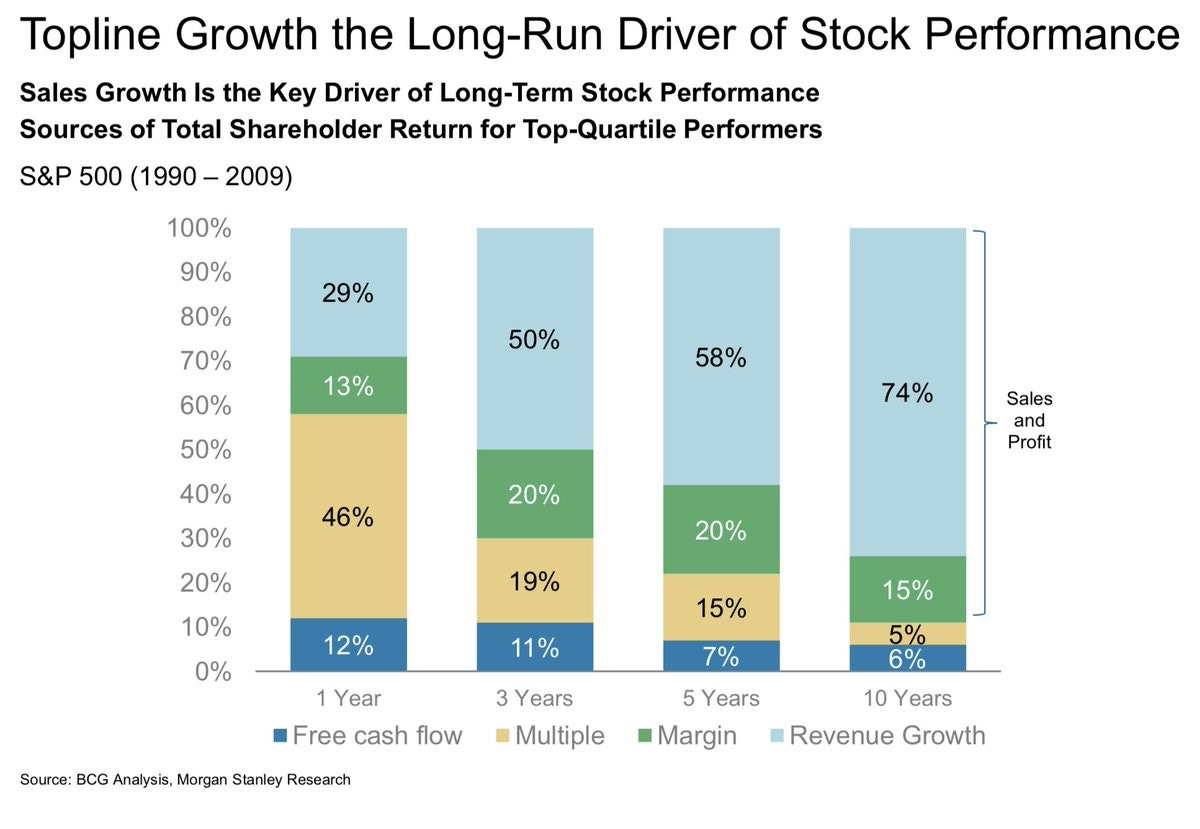

1. Can the company grow its sales at attractive rates?

In the long term, stock prices follow the evolution of the intrinsic value of a company.

That’s why you look for companies which can grow their revenue at attractive rates (at least 5%) for years and preferably even decades.

2. Does the company keep developing new products to increase its sales potential?

Innovation is the worst enemy of every (quality) stock.

To stand still is to go backwards. That’s why investing in R&D is essential. It allows companies to stay ahead of competition and keep growing at attractive rates.

Just look at Amazon for example that initially started as an online book store or Netflix that started as a DVD-by-mail service.

3. How effective is the company’s R&D?

Is the company overspending or underspending in R&D compared to peers?

A great way to look at this is via ratios such as R&D/Sales and R&D/Operating Cash Flow.

You want to invest in companies which have integrated innovation within their corporate culture.

4. Does the company have an above-average sales organization?

Selling a product or service is the essence of every business.

Without sales, every company would go bankrupt.

Ideally, you want to invest in companies that are making repeat sales to satisfied customers.

The best companies offer products so good that they don’t need to be marketed to reach maximal potential.

5. Has the company a high profit margin?

You want to invest in companies which are very profitable.

Look for companies with a profit margin of at least 10%. This means that for every dollar in sales, the company makes $0.10 in net income.

Invest in companies that consistently report higher profit margins than their peers. It often means that they are operating more efficiently.

6. What is the company doing to maintain or improve profit margins?

Investors should always be cautious for reversion to the mean.

A sustainable competitive advantage is one of the only ways a company can maintain or improve its profit margins over time.

7. Does the company have outstanding labor and employee relations?

Having a great company culture is essential for creating shareholder value in the long term.

If employees feel that they are fairly treated by their employer, they will perform better.

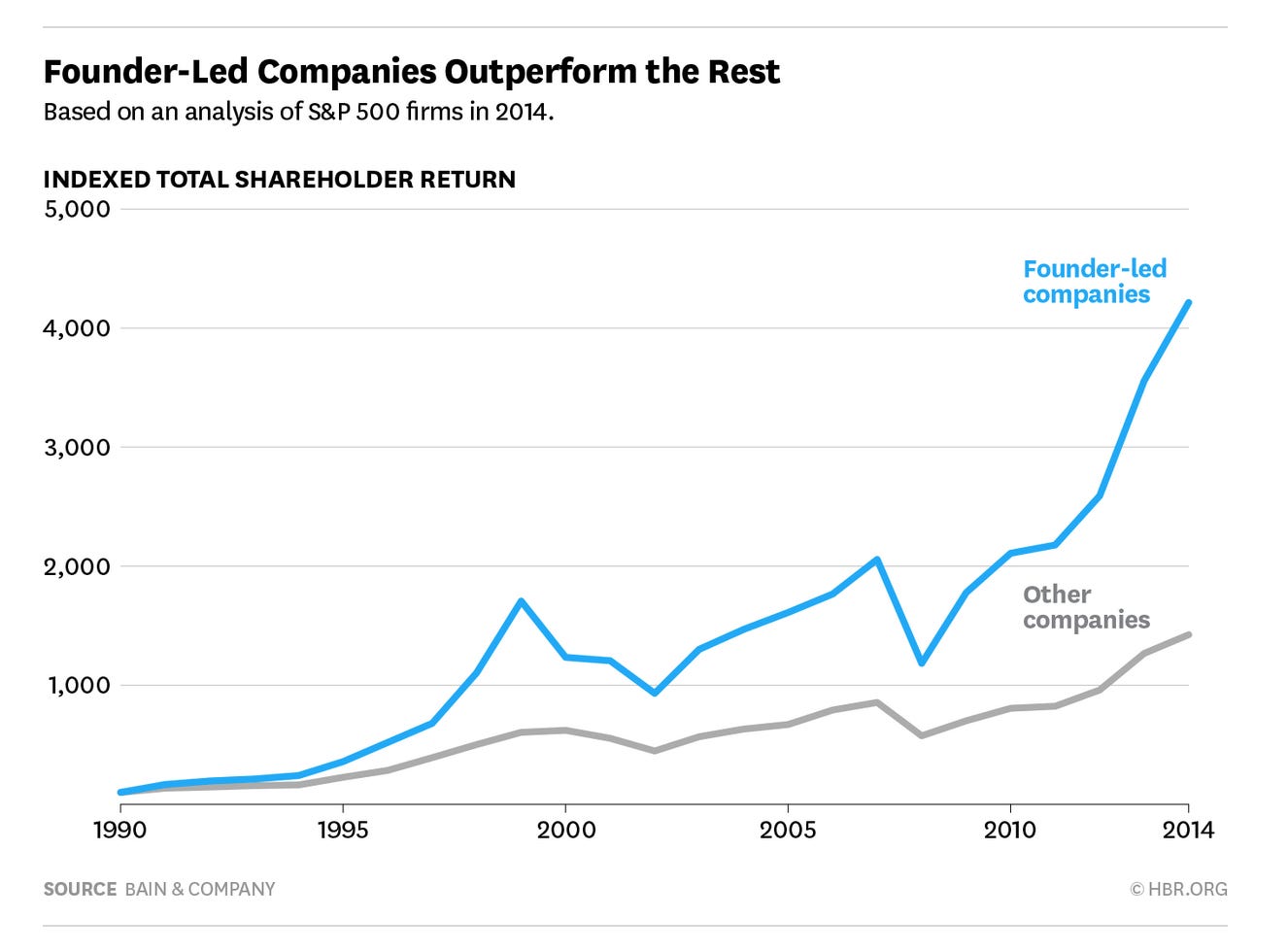

8. Has the company outstanding executive relations?

Skin in the game matters.

Studies have found that founder-led companies as well as family companies outperform the market on average with more than 3% (!) per year.

There are almost no investors who manage to outperform the market with 3% per year. Just buying a bucket of founder-led companies would allow you to do this.

9. Does the company have depth to its management?

All humans are finite.

This also means that when you invest in a company because it’s run by a great founder, one day this excellent owner-operator will be gone.

That’s why companies should always have a plan about what can be done to prevent corporate disaster if the key man should no longer be available.

10. How good are the company's cost analysis/accounting controls?

Companies should break down unit economics in minute detail so that they know where to focus its attention.

To measure is to know.

You want to invest in companies run by managers who know the company inside and out.

11. Look at patents

Philip Fisher highlights that it’s very important to look at patents.

Strong patent positions can allow a company to operate at high sustained profit margins. However, as soon as a patent’s tenure ends, a company’s profit may suffer badly.

Characteristics such as skilled labors, a high reputation, existing market share or patents can help a company to gain or maintain its competitive advantage.

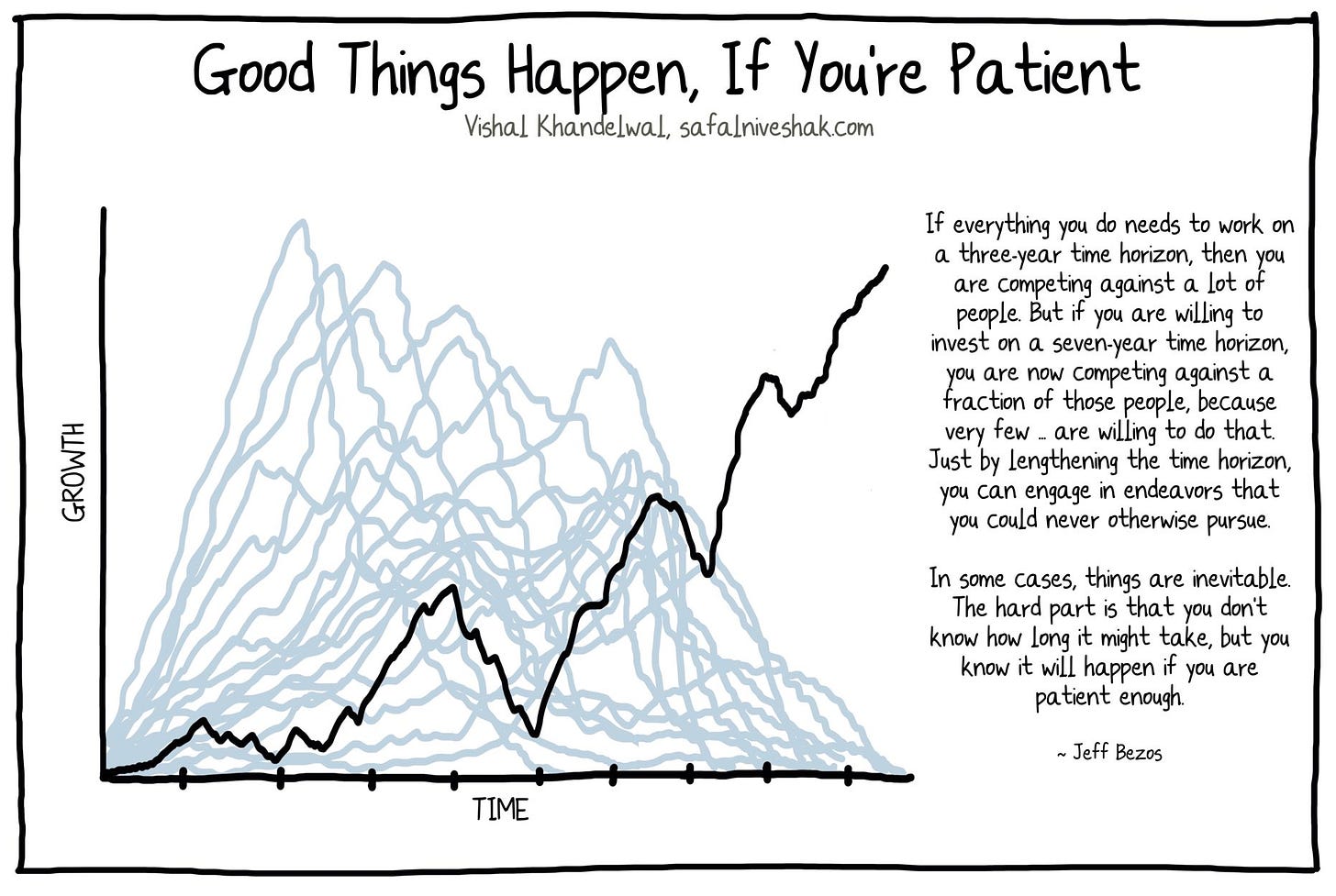

12. Does the company think on the long term?

Investing is all about delayed gratification.

You try to optimize the risk-return characteristics of your portfolio.

Just like investors, companies should always use a long-term mindset in order to maximize the creation of shareholder value.

13. Is the company diluting shareholders?

Capital increases or stock-based compensation (SBCs) are costs for investors as it dilutes your stake in the company.

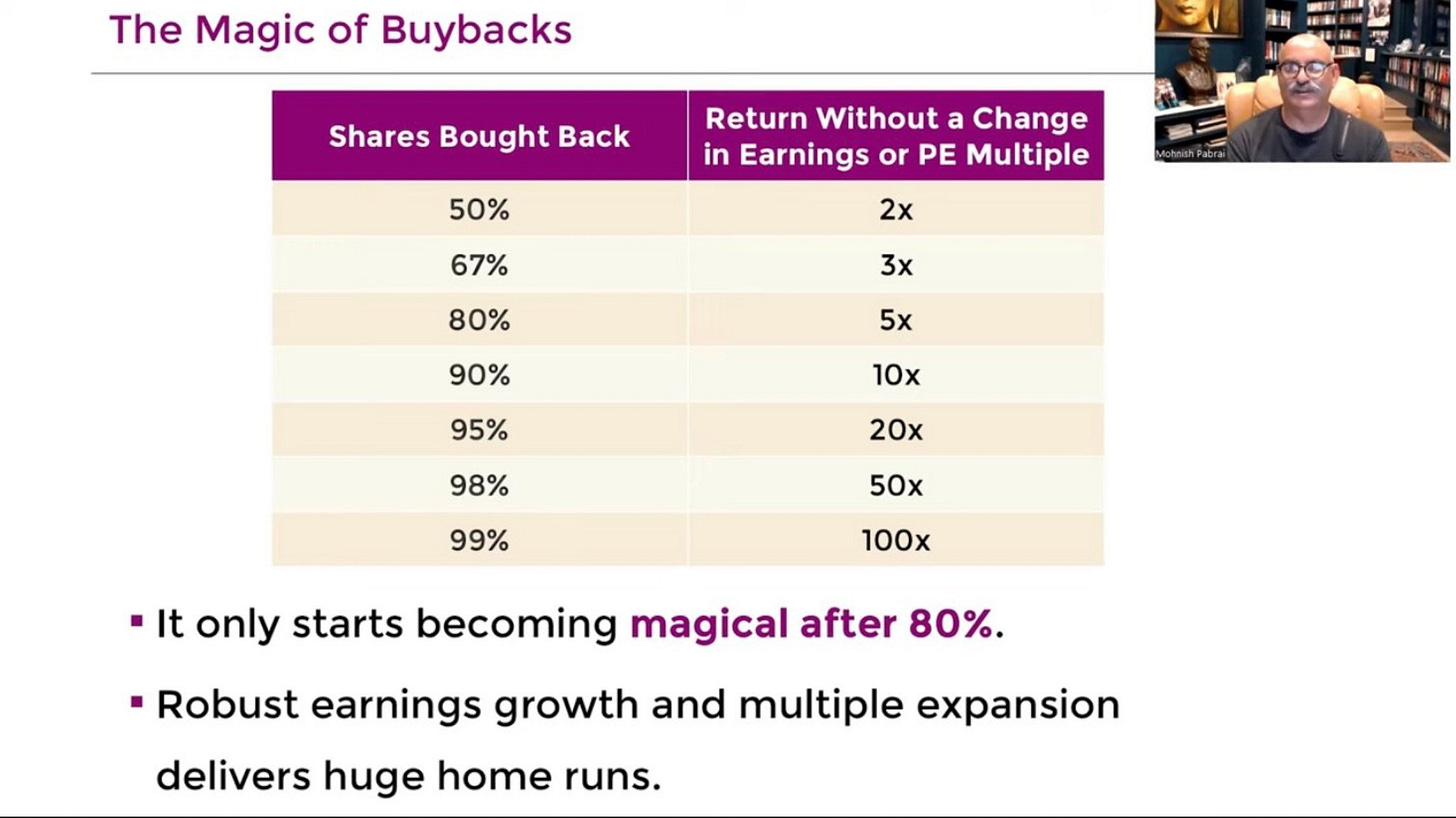

You want to invest in companies where shares outstanding remain constant or decrease via share buybacks.

Just take Autozone for example which bought back more than 50% (!) of its shares outstanding since 2015.

14. Does management admit its mistakes?

Charlie Munger once said that there's no way that you can live an adequate life without making many mistakes.

That’s indeed true. The most important thing is how a company handles these mistakes when they occur and how they communicate about them.

Avoid companies which try to hide bad news at all costs.

15. Has the company a management of unquestionable integrity?

Only invest in companies run by people who you want to be around with.

Ask yourself: if your daughter would want to marry the CEO, would you let her?

If the answer is yes, you know that you’ve found a great manager with high integrity.

Some great Philip Fisher quotes

The stock market is filled with individuals who know the price of everything, but the value of nothing

The stock investor is neither right nor wrong because others agreed or disagreed with him, he is right because his facts and analysis are right

Never promote someone who hasn’t made some bad mistakes, because if you do, you are promoting someone who has never done anything

The greatest investment risks are the ones you take without knowing what you're doing

The stock market is a device for transferring money from the impatient to the patient

Fisher Masterclass

You want to learn even more about Philip Fisher?

Here’s a masterclass which talks extensively about his investment philosophy:

Big announcement

On the 31st of August, Compounding Quality has a big announcement to make.

I would advise you to mark this date in your agenda and make sure to handle fast once the announcement has been made.

All information will be emailed to you around 9 AM Eastern Time (ET) / 3 PM Central European Time (CET).

The end

That’s it for today.

Do you want to read more from Compounding Quality? Please subscribe to my newsletter where I provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. I’ve read over 500 investment books and spend more than 50 hours per week researching stocks.

I personally love this kind of content( it’s all too notch educational)but anything about investors is very interesting to me. I love reading about people who are successful and what I mean by that is that it’s possible. That regardless of where someone started or their journey success is always within reach! Great stuff CQ!!!

Another Thursday and another awesome post from CQ!

How do you get the time, the energy, the discipline, the inspiration...? Whatever it is that you're doing, please don't stop. We are all getting irreversible addicted to your quality lessons on investing.

I, and I am sure many of your readers, have to keep the pedal to the metal reading and digesting all the knowledge you are sending our way! 😊

Rest assured, I got August 31st circled in red on my calendar!

Regardless of how many times I write "thank you", it won't be enough. But when the time comes, you'll have my full support! 🙏