🧑🏫 How to analyze a stock

Course: Stock Analysis

Knowing how to analyze a stock is crucial to make good investment decisions.

The best investors in the world use a strict and rational framework to analyze stocks.

In this article, I’ll teach you how to analyze stocks like a professional.

🧑🏫 Course: How to Analyze a Stock

This is the fourth article in the series How to Analyze a Stock.

Did you miss the start of this series? Take a look here:

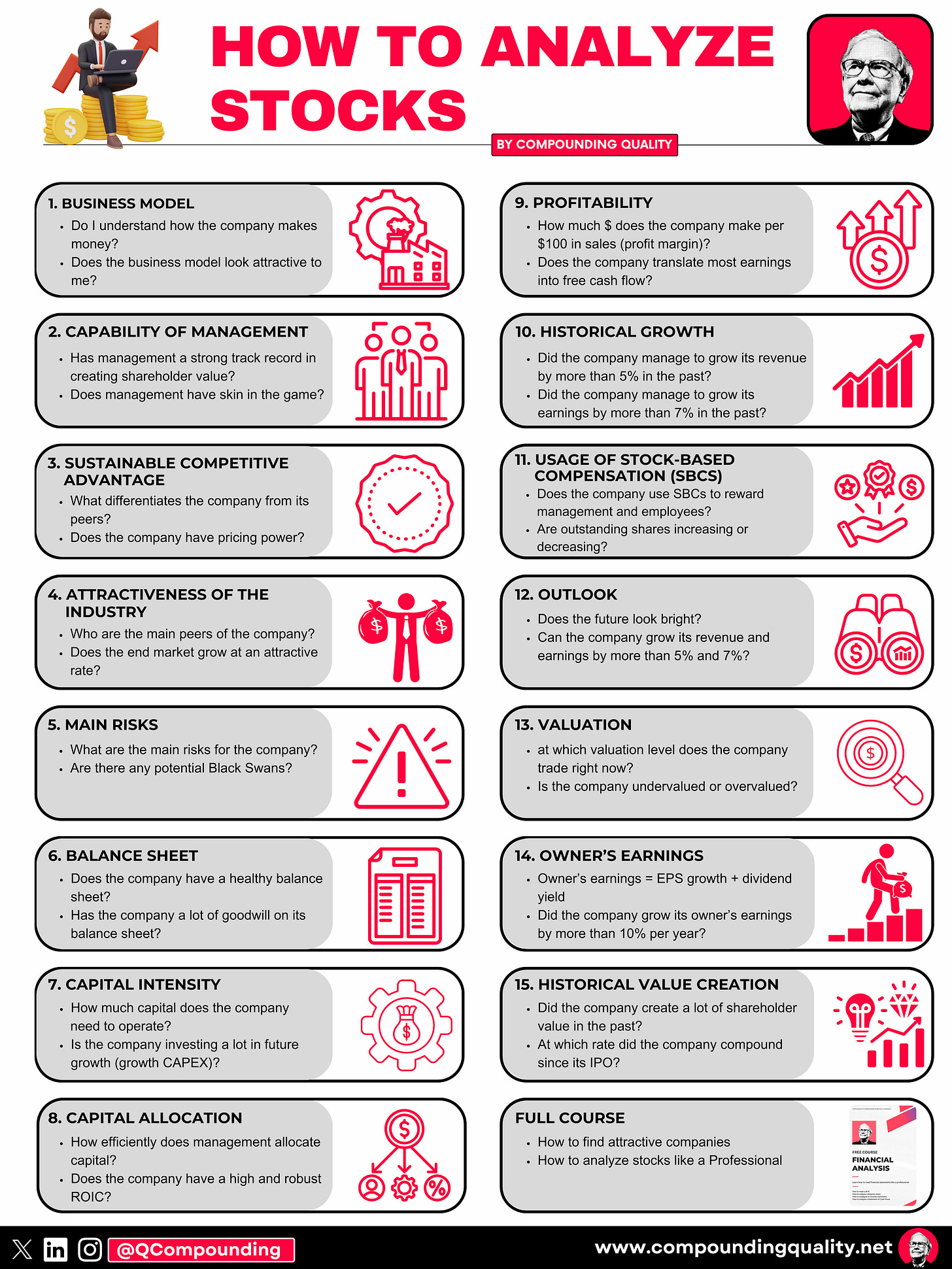

15-Step Approach

We will always use the same 15-step approach to analyze a stock.

When you go over every step, you’ll have a good idea about whether the company is an interesting investment or not.

For every step, we give the company a final score on 10.

In the end, the company gets a Total Quality Score based on all 15 metrics.

The ‘Total Quality Score’ is simply calculated by taking the sum of the score of all 15 metrics and dividing it by 15.

1. Business model

How does the company make money?

Do I understand the products/services the company sells?

If the business profile doesn’t look attractive to you or you don’t understand it properly, you can stop looking into the company right away.

The more simple and attractive the business model, the better.

"Know your circle of competence, and stick with it. The size of that circle is not very important; knowing its boundaries, however, is vital." - Warren Buffett

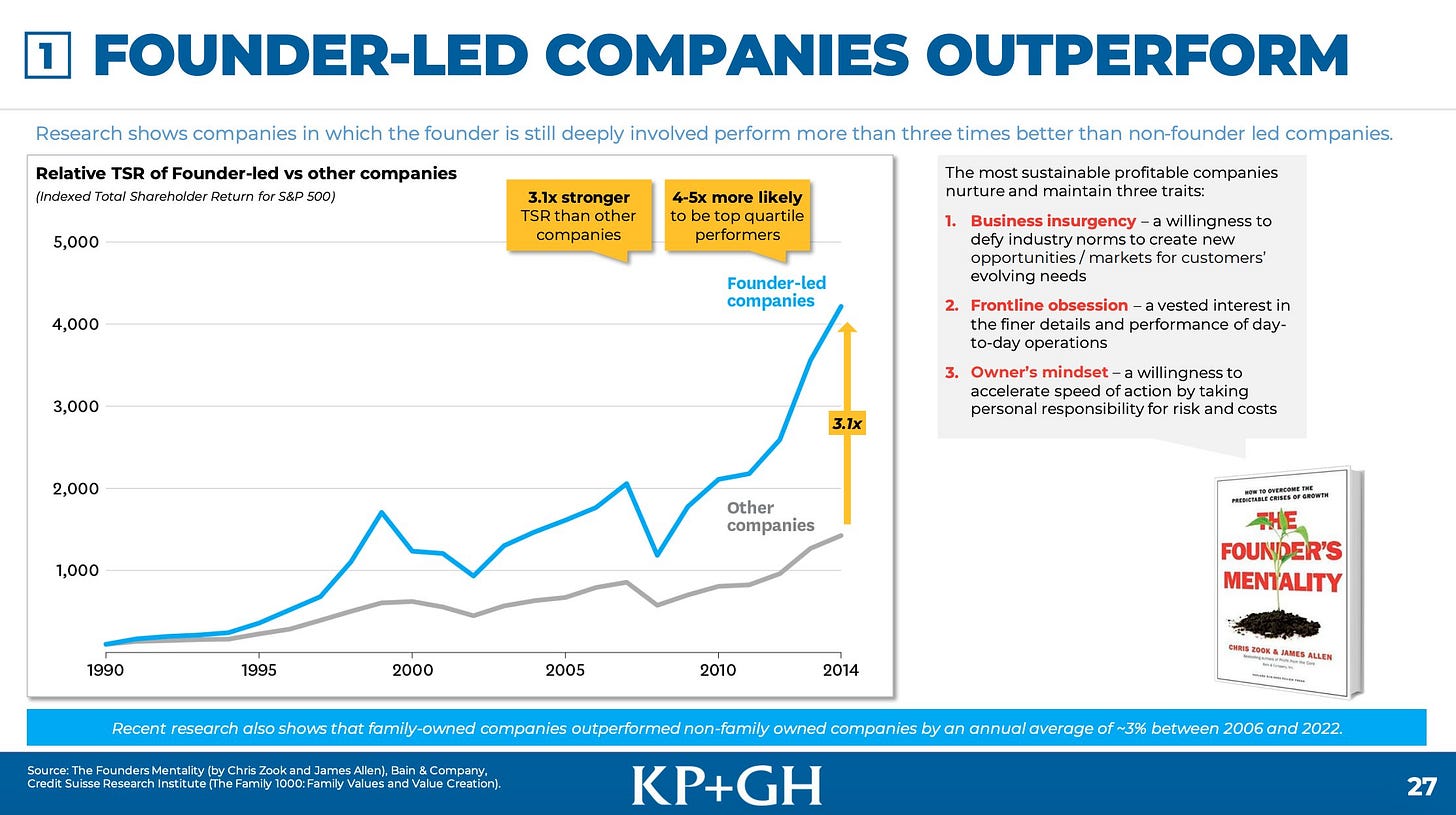

2. Is management capable?

You want to invest in companies that are led by great managers.

Preferably, the founder or his/her family is still active within the business.

Look at the track record of management and visit websites like Glassdoor to determine whether employees are happy to work for the company.

As you can see here, founder-led companies tend to outperform:

3. Does the company have a sustainable competitive advantage?

A moat or sustainable competitive advantage is essential.

Companies with a moat are usually characterized by the following:

A high and consistent Gross Margin

A high and consistent ROIC

This study of Morningstar concludes that companies with a sustainable competitive advantage outperform:

4. Is the company active in an attractive end market?

Ideally, we want to invest in companies that only have a few competitors and high barriers to entry.

The less competition, the better.

“Over the years, Buffett followed his philosophy of buying into industries with little competition. If he can’t buy a monopoly, he’ll buy a duopoly. And if he can’t buy a duopoly, he’ll settle for an oligopoly.” - The Myth of Capitalism (Book)

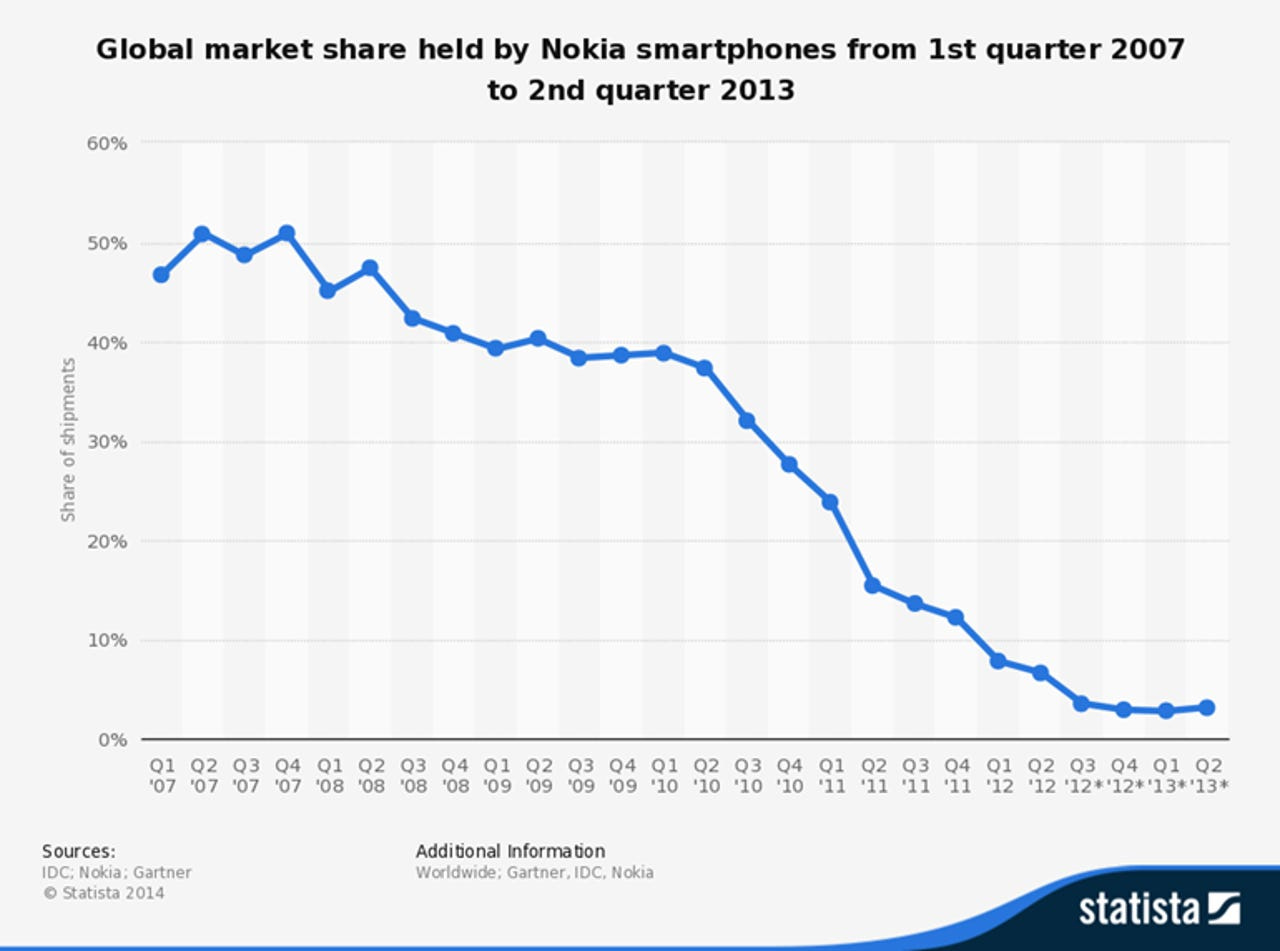

5. What are the main risks for the company?

Disruption is the worst enemy of every quality investor.

When you invest in a quality stock that is losing its moat, you’ll end up with horrible investment results.

Just take Nokia for example:

That’s why you should always identify the main risks a company faces before investing in it.

Now let’s dive into the most important part: the Fundamentals.