Terry Smith is one of the greatest Quality Investors in the world. Since his fund launched in 2010, Fundsmith achieved an astonishing CAGR of 15.46% (!) after fees. In this article you will find 10 great investment tips from the Quality Maestro himself. Furthermore, you can find a PDF with all his annual shareholders letters at the bottom of this article.

1. Invest in companies with wide economic moats

When a company earns a lot of cash, it will attract rivals and reversion to the mean takes place. However, this is not the case for wide moat stocks as they have a superior service or product which rivals can’t replicate. That’s why a moat is truly essential for quality investors.

Coca-Cola is a great example:

“If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done.” – Warren Buffett

2. Strong organic growth is a must

Organic growth is the most preferred source of growth. Looking at the past is already a great indication. Seek for companies who managed to grow organically over the past years and preferably even decades.

When these companies are still active in a strongly growing end market today, this a great indication you have found a Quality Company.

3. Invest in companies with a high Return on Invested Capital (ROIC)

The higher the Return on Invested Capital (ROIC) of a company, the better.

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result." – Charlie Munger

4. Revenue growth is the main driver for value creation

Eventually, the stock price will follow the revenue and free cash flow growth of a company.

"If you bought the S&P 500 at a P/E of 5.3x in 1917, and sold it in 1999 at a P/E of 34x, your annual return would have been 11.6%. Only 2.3% p.a. came from the massive increase in P/E. The rest of your return came from the companies’ earnings and reinvestments." - Terry Smith

5. Buy companies who translate most earnings into free cash flow

Earnings are an opinion, cash is a fact.

A study found that between 1962 and 2001, companies that translated most earnings into free cash flow outperformed companies that translated the least earnings into free cash flow by 18% (!) per year.

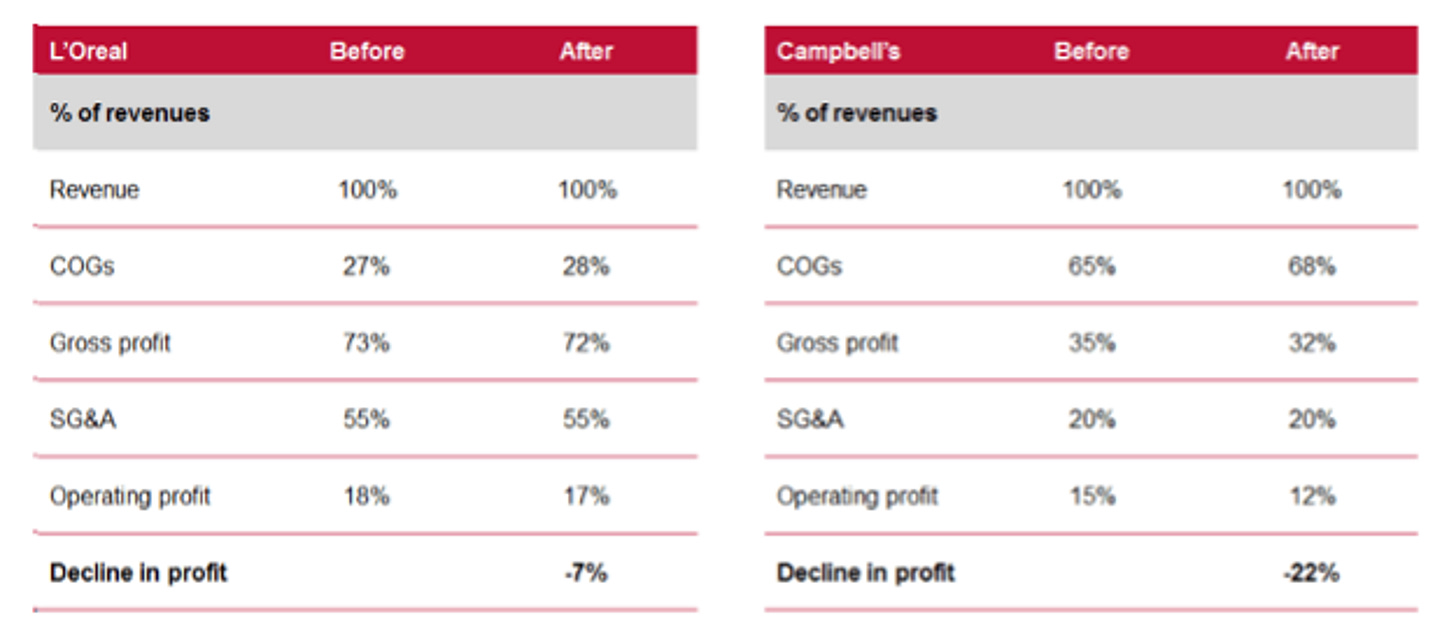

6. A high gross margin is a good protection against inflation

The higher the gross margin of a company, the better the company is protected against inflation. An increasing cost of goods sold (COGS) does not hurt high margin companies as much as low margin companies.

When a company has high, consistent gross margins, it is a great indication that the company has a wide moat too.

7. Be disciplined

When you invest in stocks, one thing is for sure: you will underperform the market from time to time. No rider has ever won all stages of the Tour De France. The same principle is valid on the stock market.

Always stick to your investment philosophy and strategy. Investing is a marathon, not a sprint.

8. Look at ROCE instead of ROE

The Return on Capital Employed (ROCE) is a better metric than the Return on Equity (ROE) because it considers all capital employed (equity, debt and other liabilities).

The ROE only looks at the equity part and can be manipulated as this ratio increases when a company uses more debt (and/or less equity) to finance its operations.

9. Don’t overpay

Even the best companies in the world can sometimes be so overvalued that you will end up with bad investment results. Pay a fair price for a wonderful company, and you’ll end up with wonderful investment returns.

10. Do nothing

The best investor is a dead investor.

Trading too much harms your investment results. Be disciplined and don’t trade too much.

Download all shareholder letters of Terry Smith

Finally, we mapped all shareholder letters of Terry Smith in one document. You can download it for free here:

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter and Linkedin.

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

The end. If you liked this thread and want to learn more, you can read all shareholder letters of Terry Smith via this link

Do you think you could update this to 2022? As this goes to march 2020 and stops?

Thanks!

What different between roic and roe? Thanks