Is Advanced Drainage Systems interesting?

Not So Deep Dive Advanced Drainage Systems

Advanced Drainage Systems makes pipes to manage rain and wastewater.

It sounds boring… because it is. But boring businesses often build a lot of wealth.

Let’s see if this boring stock deserves a place in your portfolio.

WMS - General Information

👔 Company name: Advanced Drainage Systems, Inc.

✍️ ISIN: US00766N1046

🔎 Ticker: WMS

📚 Type: Market Leader

📈 Stock Price: $147.9

💵 Market cap: $11.5 billion

📊 Average daily volume: $117.7 million

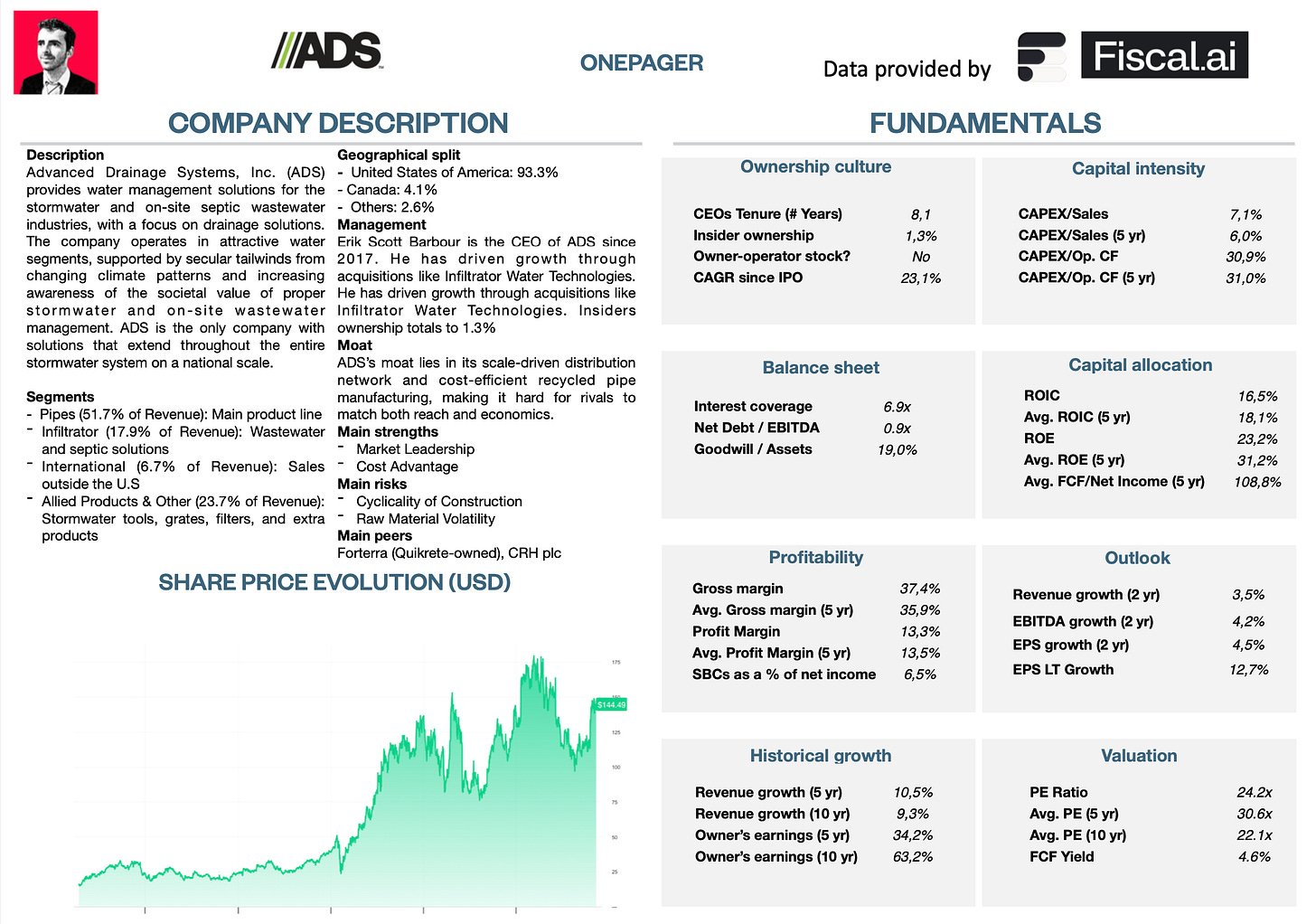

Onepager

Here’s a onepager with the essentials of Advanced Drainage Systems:

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give Advanced Drainage Systems a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

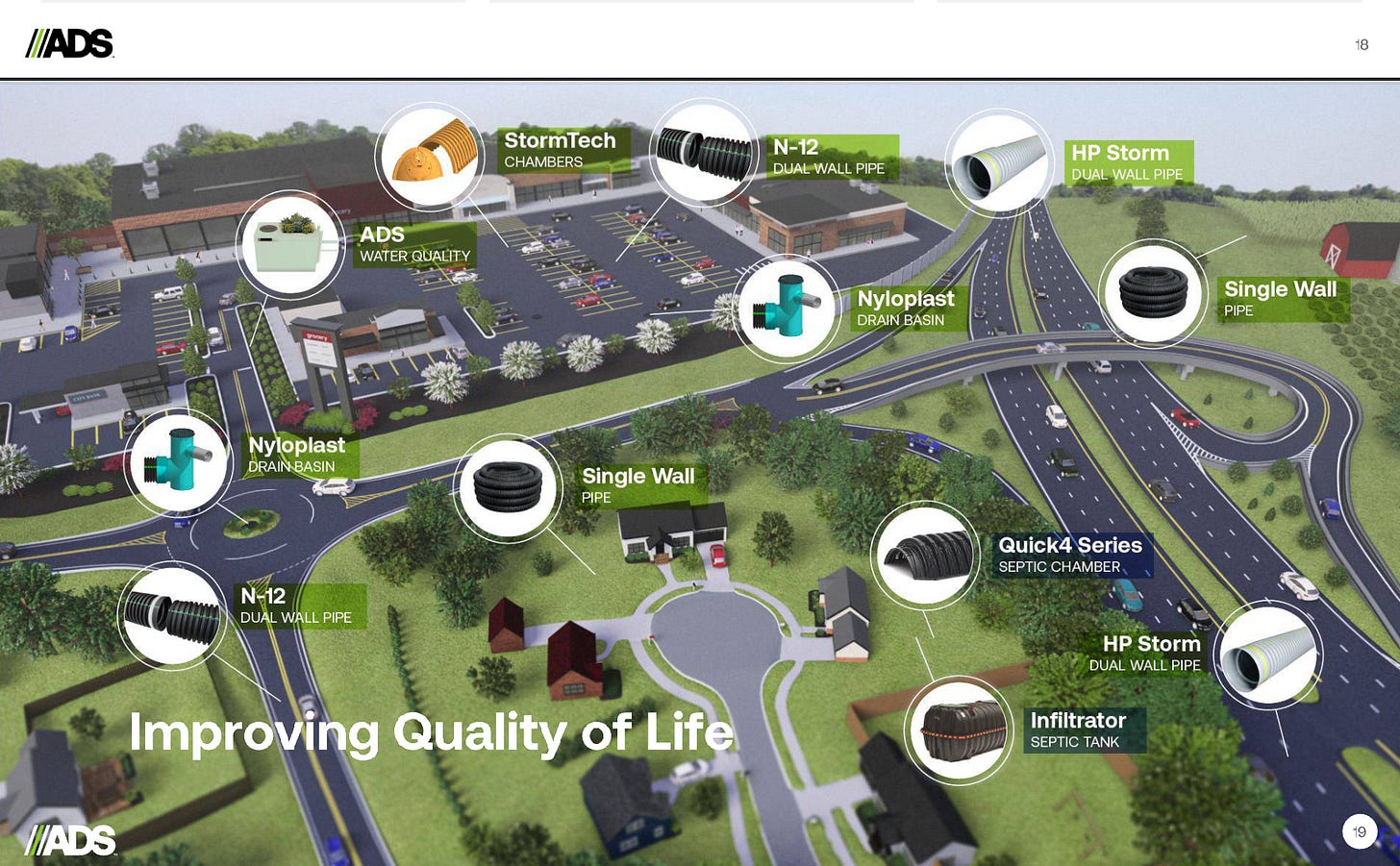

Advanced Drainage Systems (ADS) makes the pipes and drainage systems that manage rainwater and runoff.

Every time a new road, parking lot, or housing community is built, the natural ground that soaks up rainwater is replaced with hard surfaces.

The water that can’t soak into the ground anymore needs somewhere to go.

The products of ADS manage that water runoff safely.

Their solutions are a critical, non-negotiable part of modern construction.

This makes builders, farmers and governments their most loyal customers.

ADS makes money from the following products:

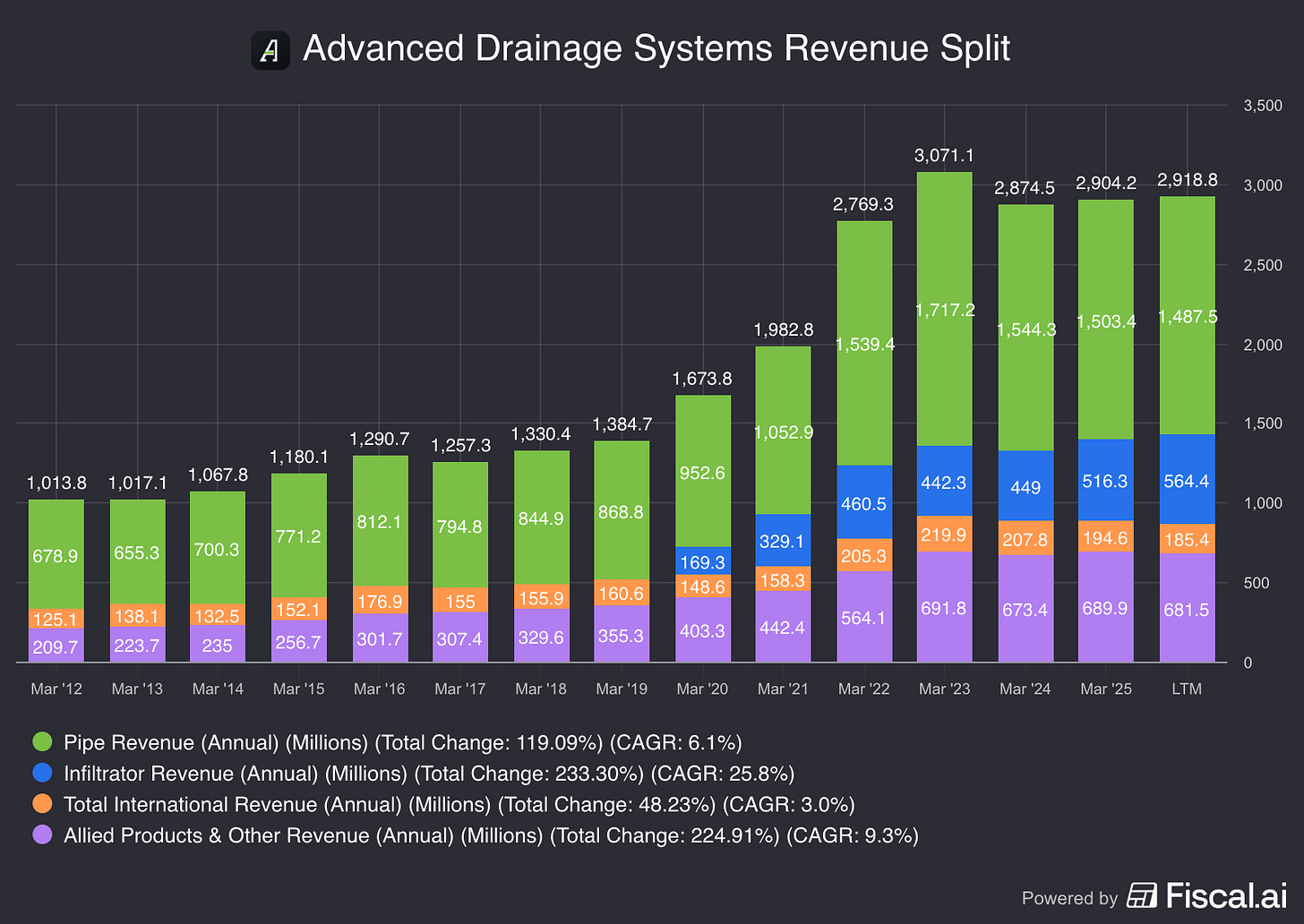

Pipes (51.7% of revenue): pipes that carry water away so land, roads, and buildings don’t flood

Infiltrator (17.9% of revenue): Wastewater and septic solutions

International (6.7% of revenue): All sales outside the U.S

Allied Products & Other (23.7.% of revenue): Stormwater tools, grates, filters, and extra products

ADS is a serial acquirer in the water management industry. You can learn more about serial acquirers here.

Their most recent acquisition? Norma Group.

ADS paid $1.0 billion in cash for the company.

Norma is a leading supplier in the stormwater management segment.

Acquisitions like this one help ADS add new products, reach more customers, and keep their lead in the industry.

2. Is management capable?

Scott Barbour is the CEO of ADS since 2017.

Barbour previously held executive positions at Emerson Electric Co., including President and CEO of its Network Power business.

He has helped ADS grow and move into new products, like when they bought Infiltrator Water Technologies, which significantly increased their revenue.

ADS insiders own 1.3% of the company.

3. Does the company have a sustainable competitive advantage?

ADS has a moat based on three strong pillars:

Massive Economies of Scale: ADS is a market leader with scale that competitors can’t match

Regulatory Moat: ADS has secured over 200 national and state approvals and more than 1,100 local approvals

Intangible: ADS has spent 6 decades building trust and reputation with engineers and distributors all over North America, these strong relationships help them win repeat business and new contracts

Companies with a sustainable advantage have these qualities:

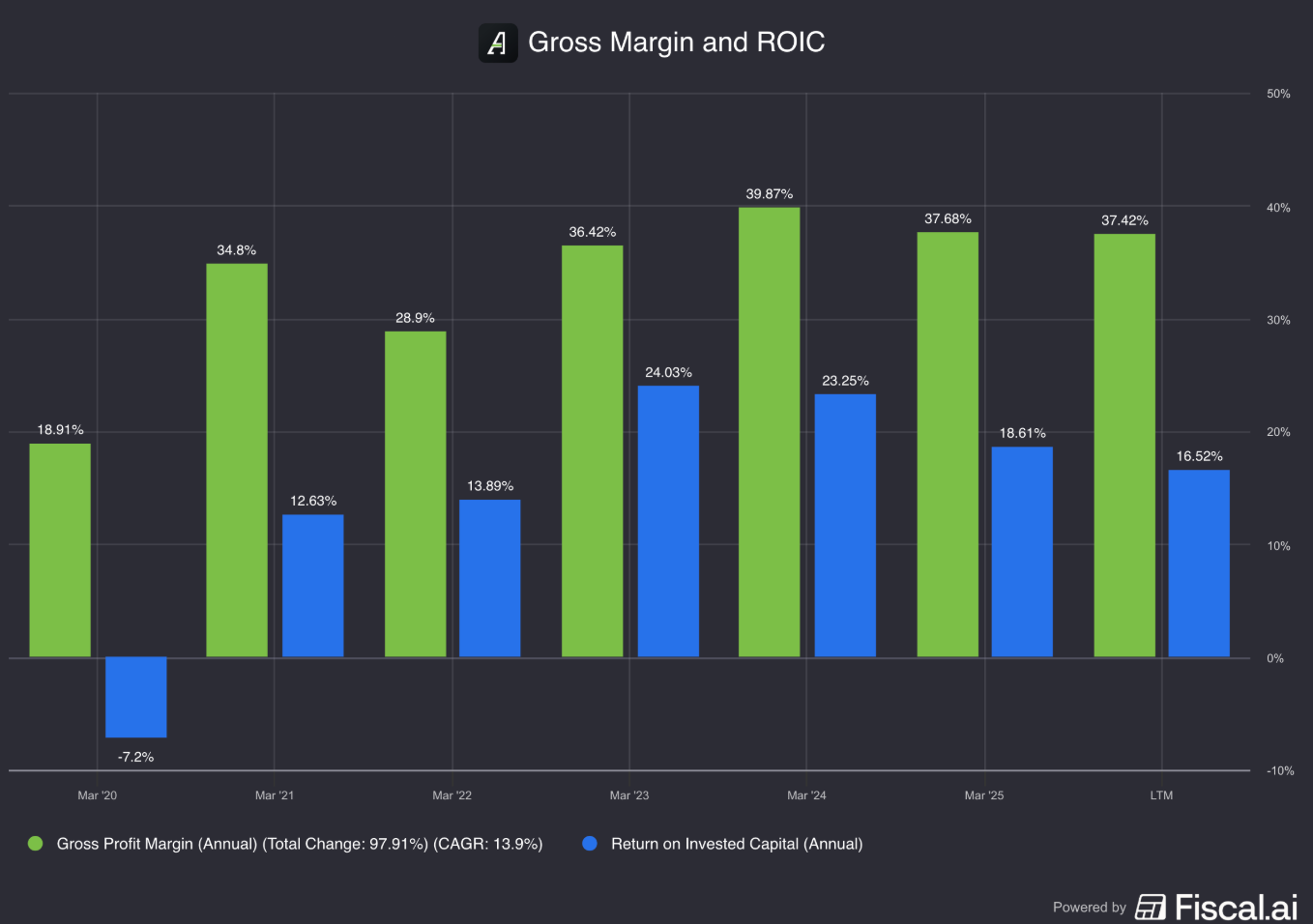

Gross Margin: 37.4% (Gross Margin > 40%? ❌)

Return On Invested Capital (ROIC): 16.5% (ROIC > 15% ✅)

The negative ROIC in 2020 was due to a one-time cost from acquiring Infiltrator.

Gross margins do fluctuate, mainly due to changes in the cost of raw materials.

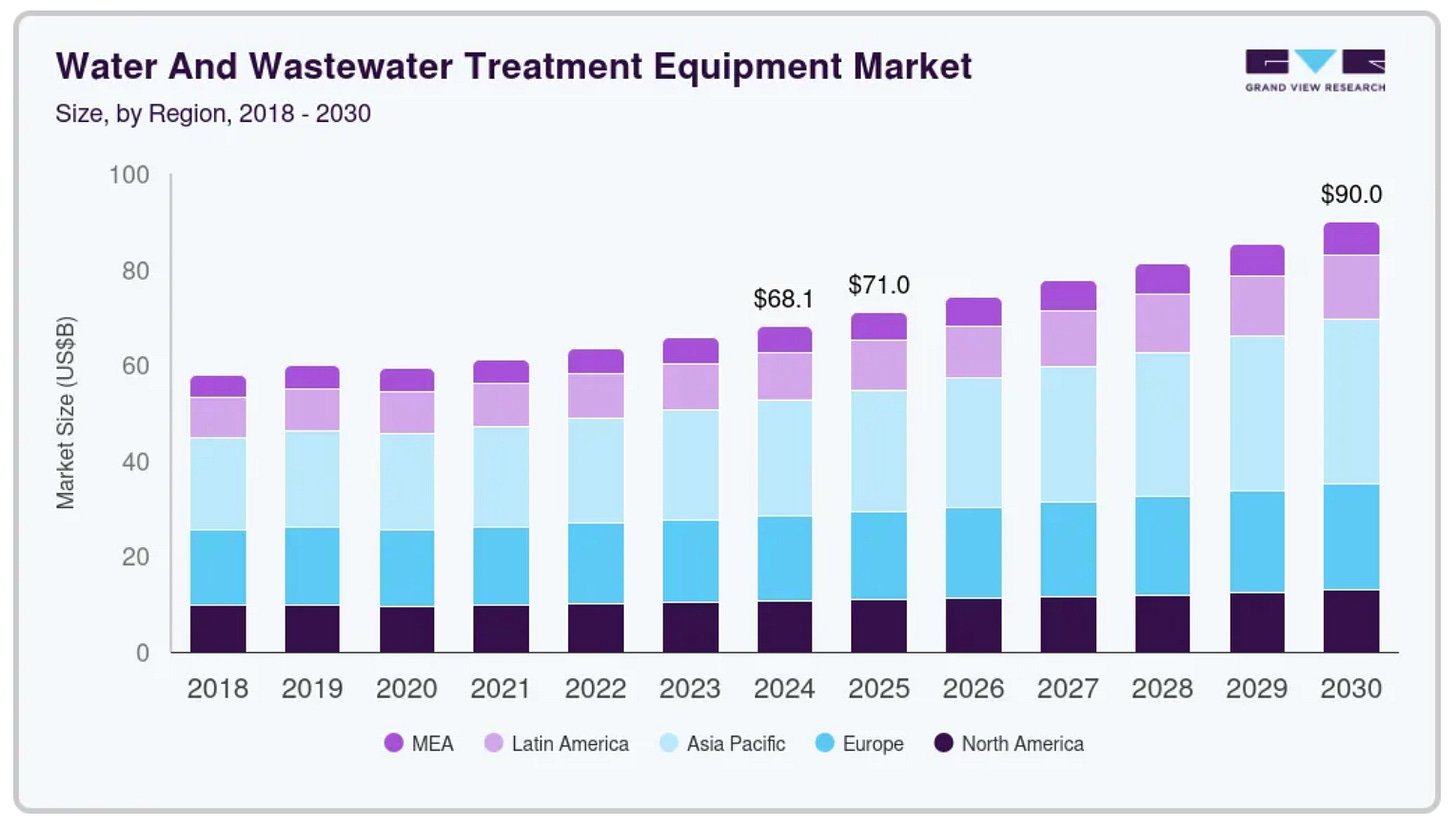

4. Is the company active in an interesting end market?

ADS is active in an attractive end market.

The water and wastewater treatment equipment market is expected to reach $90 billion by 2030, growing by 4.9% per year.

Climate change, aging pipes, and stricter regulations are driving this growth.

In the US alone, ADS’s market is worth $15 billion.

In short: the future is still full of opportunities.

5. What are the main risks for the company?

Here are the main risks for ADS:

Economic Sensitivity: ADS depends heavily on government and infrastructure spending. If this slows, sales could drop

Mitigation: Even if government spending slows, ADS sells necessary products, as long as there is construction, ADS will have sales

Commodity Price Volatility: Raw material costs, like plastic resins, have been rising and could hurt profit margins

Mitigation: Economies of scale should protect ADS and help them fair better than the competition

Operational Risks: Bad weather or supply chain disruptions can delay projects

Mitigation: Economies of scale should help protect ADS from supply chain disruption

Acquisition & Goodwill Risk: ADS acquires a lot of businesses, bad acquisitions could hurt the business

Mitigation: ADS is run by good management who have shown excellent capital allocation skills in the past

6. Does the company have a healthy balance sheet?

We look at three ratios to determine the healthiness of ADS’ balance sheet:

Interest Coverage: 6.9x (Interest Coverage > 15x? ❌)

Net Debt/FCF: 1.6x (Net Debt/FCF < 4x? ✅)

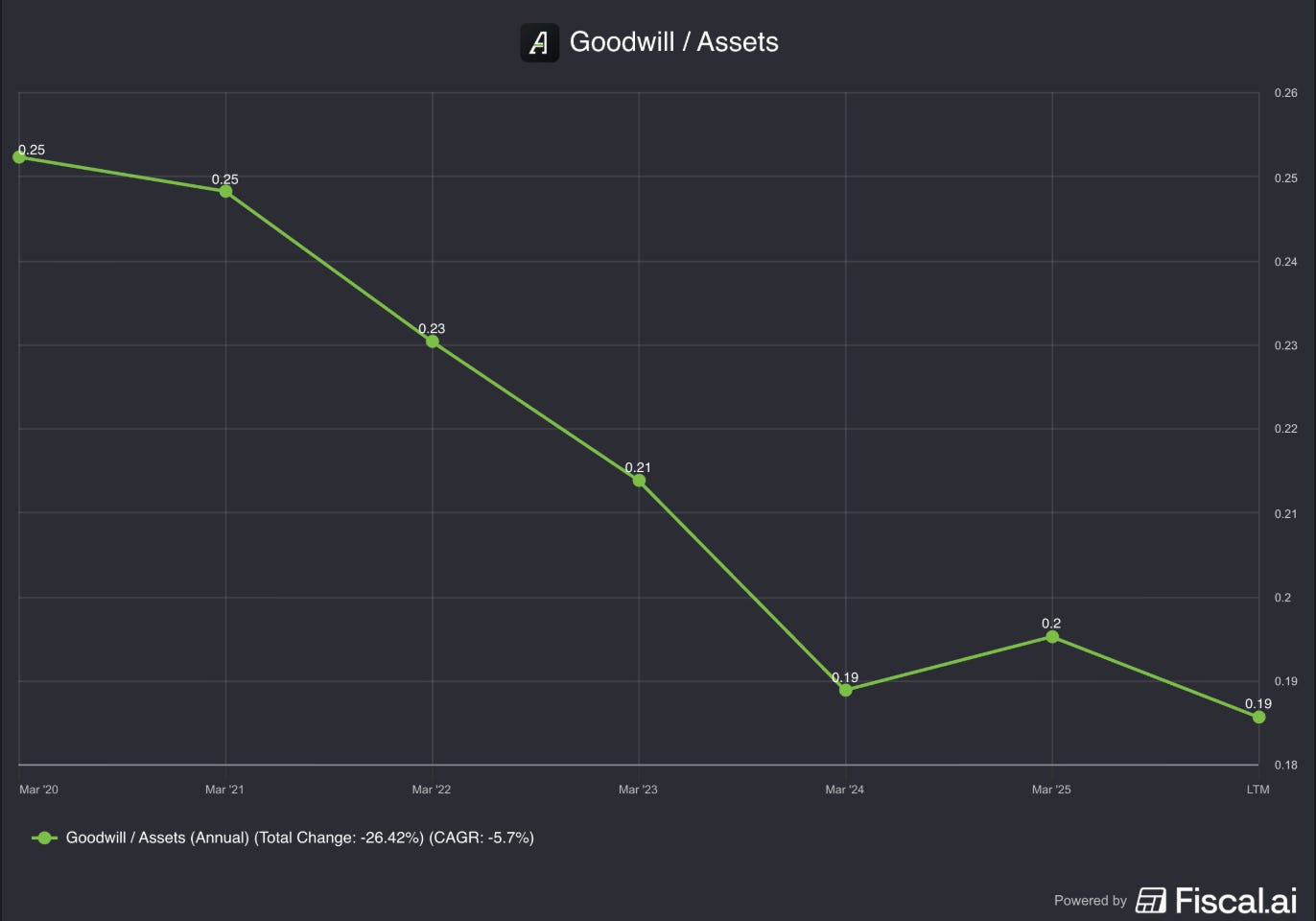

Goodwill/Assets: 19.0% (Goodwill/assets not too large? < 20% ✅)

Goodwill/Assets of ADS has been decreasing which shows management’s prudent capital allocation skills.

7. Does the company need a lot of capital to operate?

We prefer companies that require little capital to operate.

Advanced Drainage Systems:

CAPEX/Sales: 7.1% (CAPEX/Sales < 5%? ❌)

CAPEX/Operating Cash Flow: 30.9% (CAPEX/Operating CF? < 25% ❌)

ADS seems to need quite some capital to operate.

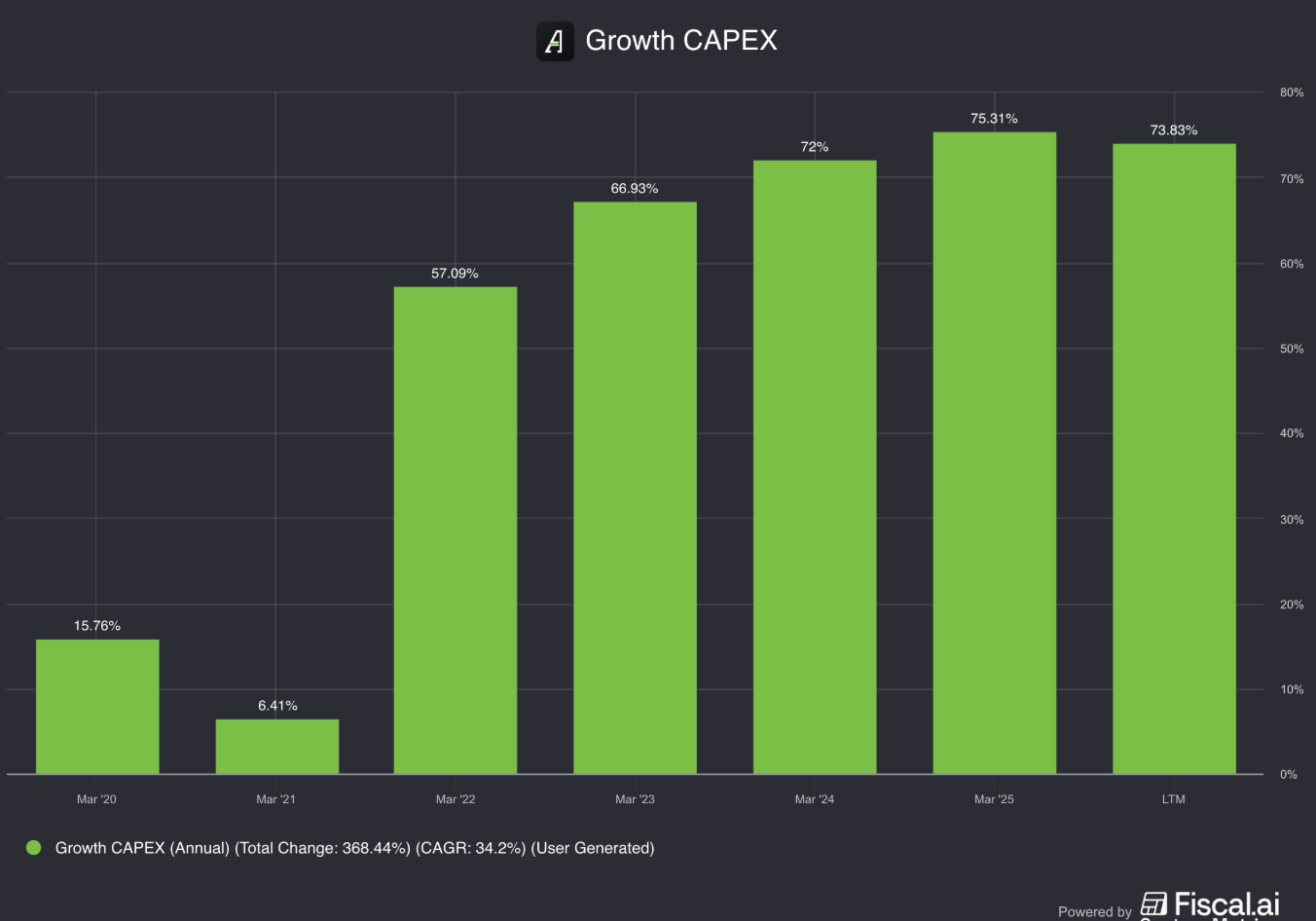

But we need to make a distinction between Growth CAPEX and Maintenance CAPEX.

You can learn more about Growth vs Maintenance Capex here.

If you do the exercise for ADS, you’ll notice that Growth CAPEX equals 73.8% of the Total CAPEX.

It also means that ADS’ Maintenance CAPEX/Sales equals only 1.9%. This is an attractive number.

Advanced Drainage Systems is investing heavily to grow in the future.

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.

We like to invest in companies that put shareholders’ money to use at attractive rates of return.

Advanced Drainage Systems:

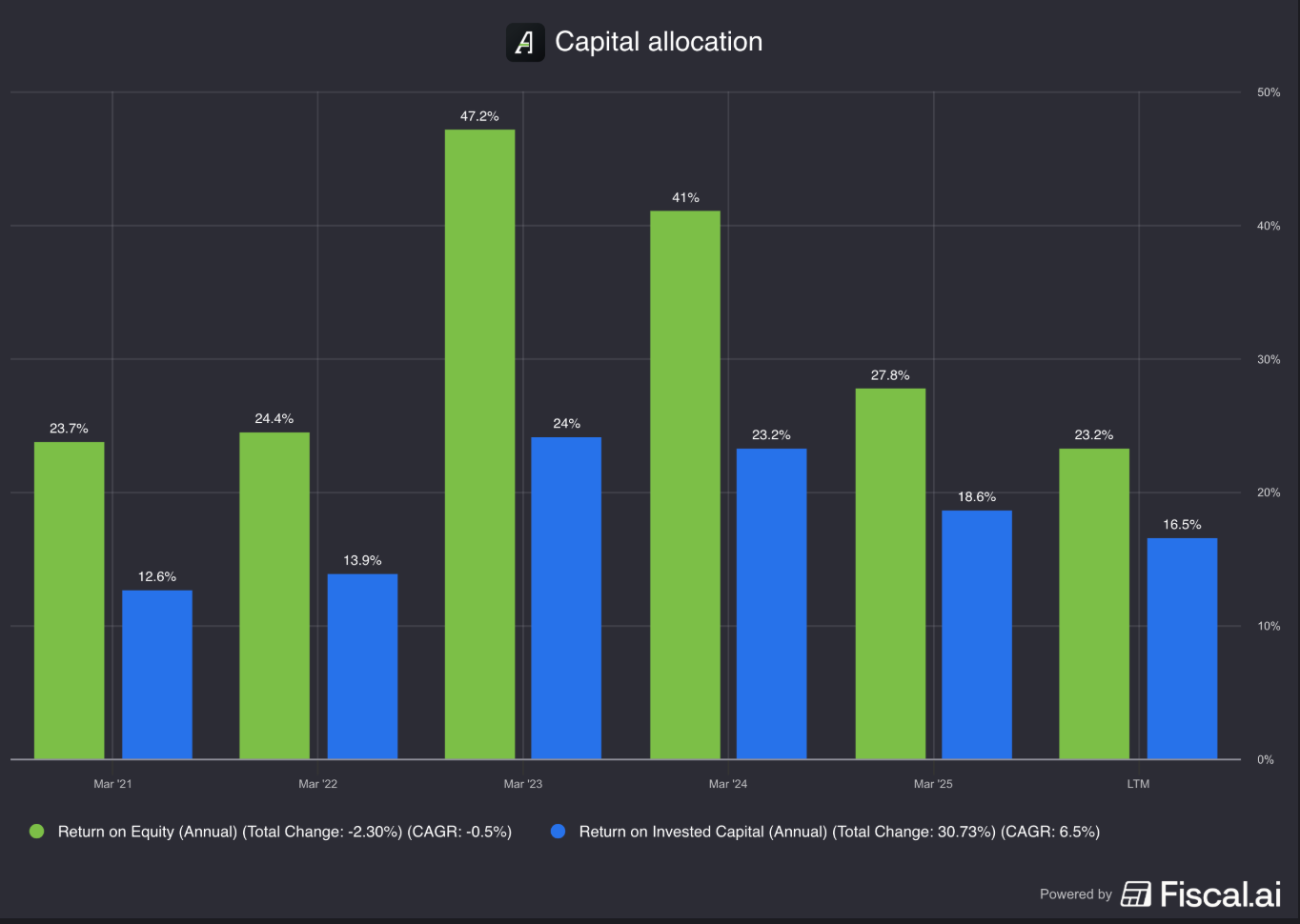

Return On Equity (ROE): 23.2% (ROE > 20%? ✅)

Return On Invested Capital (ROIC): 16.5% (ROIC > 15%? ✅)

The capital allocation metrics are slightly declining because the company has been buying new businesses.

These new companies makes its assets and equity grow fast.

The earnings, however, take longer to catch up making these numbers look temporarily low.

We don’t see this as an issue at Compounding Quality.

9. How profitable is the company?

The higher the profitability of the company, the better.

Here’s what things look like for Advanced Drainage Systems:

Gross Margin: 37.4% (Gross Margin > 40%? ❌)

Net Profit Margin: 13.3% (Net Profit Margin > 10%? ✅)

Average FCF/Net Income past 5 years: 108.8% (FCF/Net Income > 80%? ✅)

ADS is a very profitable company.

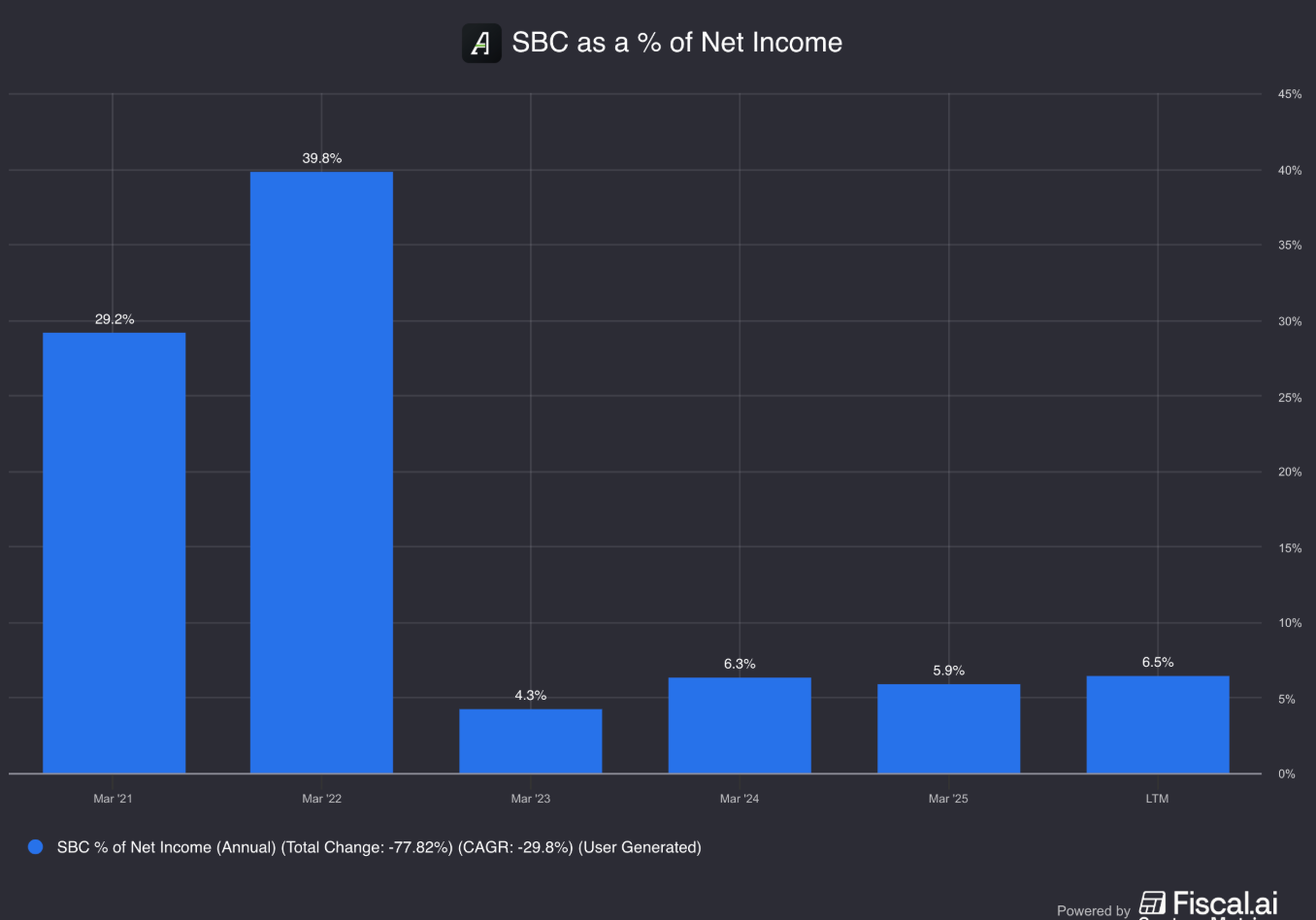

10. Does the company use a lot of Stock-Based Compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Advanced Drainage Systems:

SBCs as a % of Net Income: 6.5% (SBCs/Net Income < 10%? ✅)

Avg SBC as a % of Net Income past five years: 15.3% (SBCs/Net Income < 10%? ❌)

The reason for the high 5-year average?

Stock-based Compensation was high in 2021 and 2022.

That’s because ADS paid off its ESOP loan early.

By doing this, employees received their stock bonuses much faster, in a few years instead of many.

What is an ESOP?

An ESOP (Employee Stock Option Plan) is a program that gives employees the right to own shares of their company.SBC has declined to much more reasonable levels in recent years (a good thing).

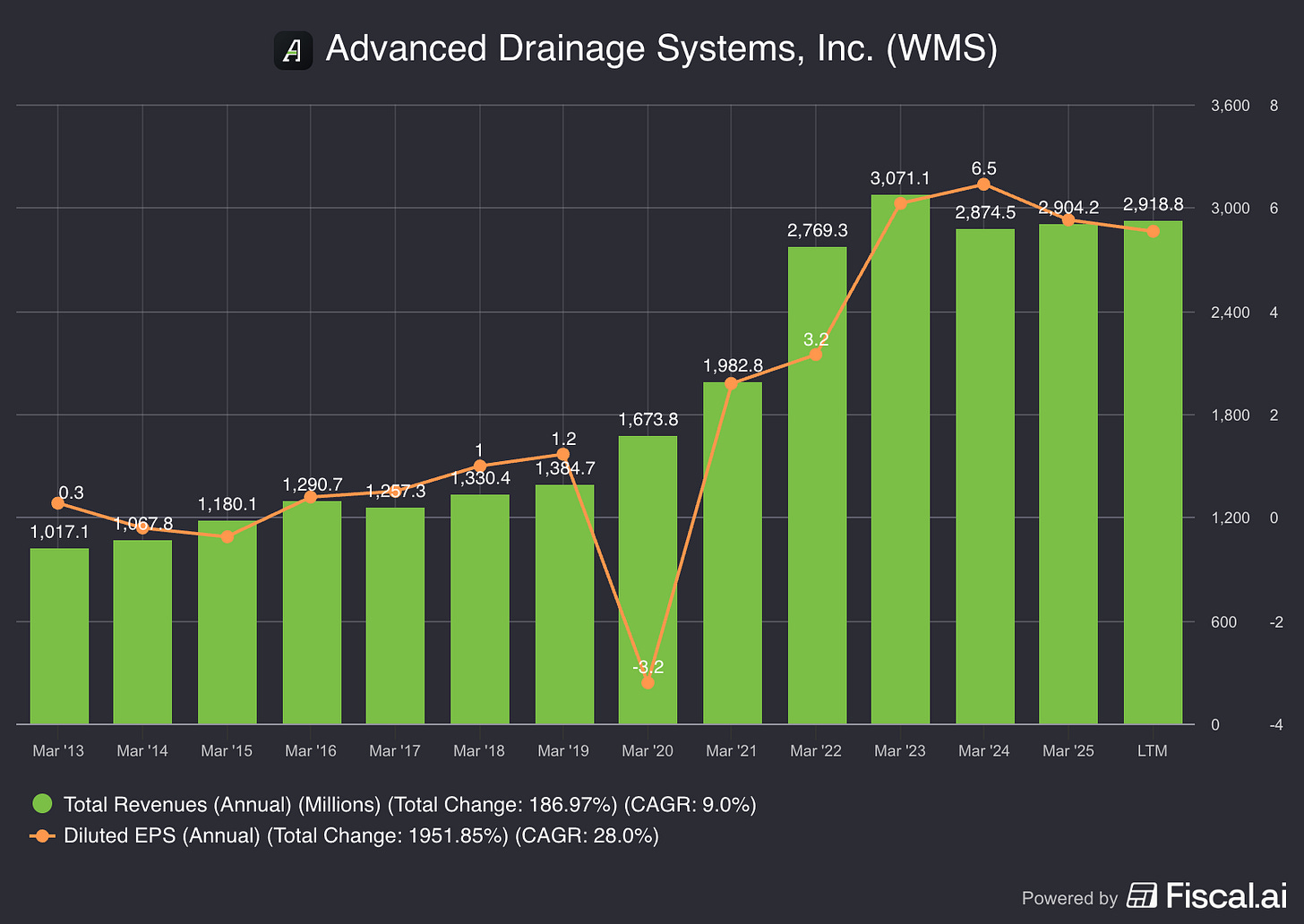

11. Did the company grow at attractive rates in the past?

We look for companies that grew their revenue and EPS by at least 5% and 7% per year in the past.

Let’s look at what recent history tells us:

Revenue growth past 5 years (CAGR): 10.5% (revenue growth > 5%? ✅)

Revenue growth past 10 years (CAGR): 9.3% (revenue growth > 5%? ✅)

EPS growth past 5 years (CAGR): 33.7% (EPS growth > 7%? ✅)

EPS growth past 10 years (CAGR): 62.7% (EPS growth > 7%? ✅)

ADS has grown at very attractive rates in the past.

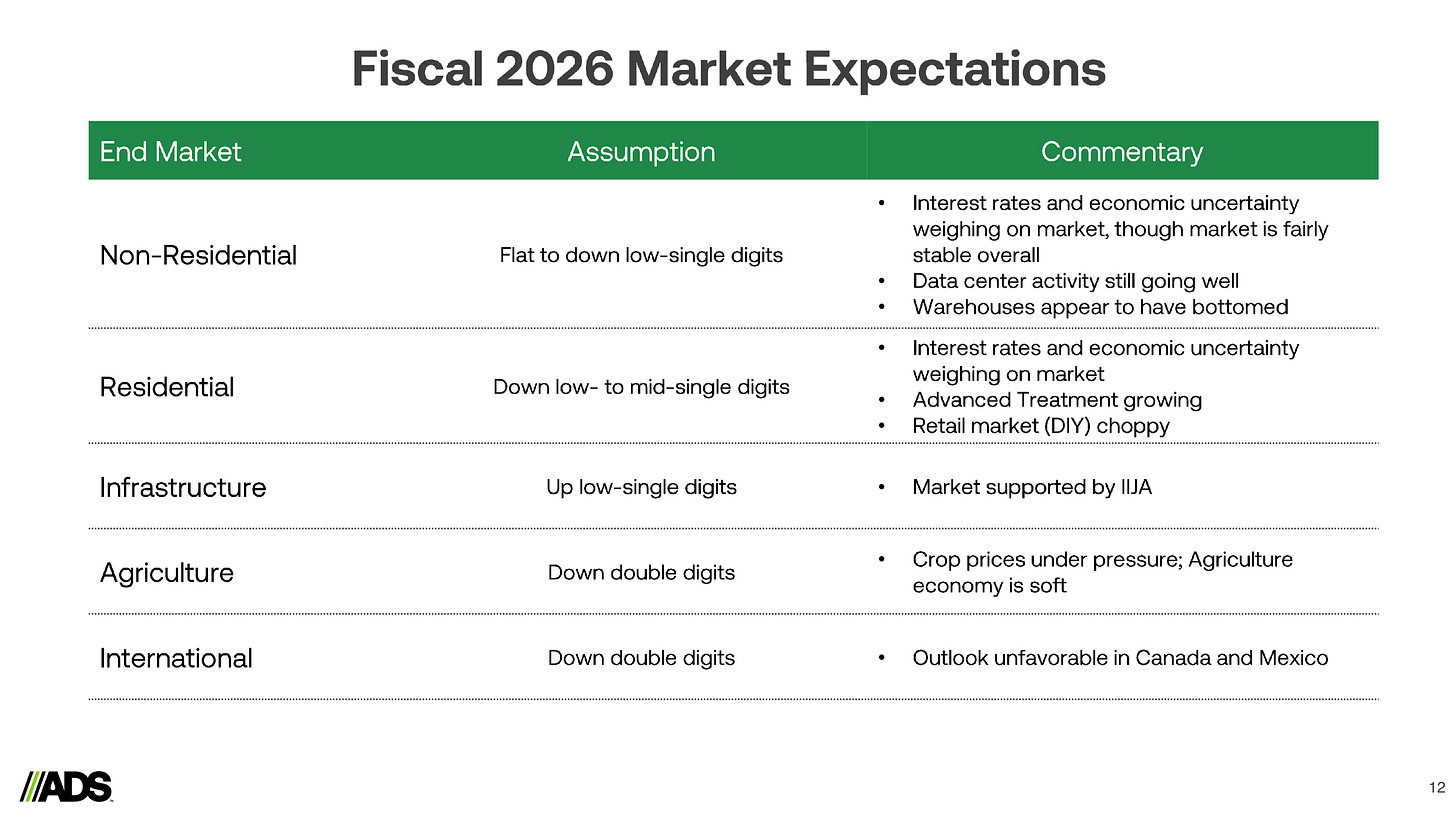

12. Does the future look bright?

We want to invest in businesses that can keep growing attractively.

Advanced Drainage Systems:

Exp. Revenue Growth next two years (CAGR): 5.3% (Revenue growth > 5%? ✅)

Exp. EPS Growth next two years (CAGR): 5.1% (EPS growth > 7%? ❌)

EPS Long-Term Growth Estimate: 12.7% (EPS growth > 7%? ✅)

For 2026, the growth rate might be a little bit lower because of higher interest rates and some economic uncertainty.

However, in the long-term, ADS is still expected to grow at attractive rates.

13. Does the company trade at a fair valuation level?

We always use three methods to look at the valuation of a company:

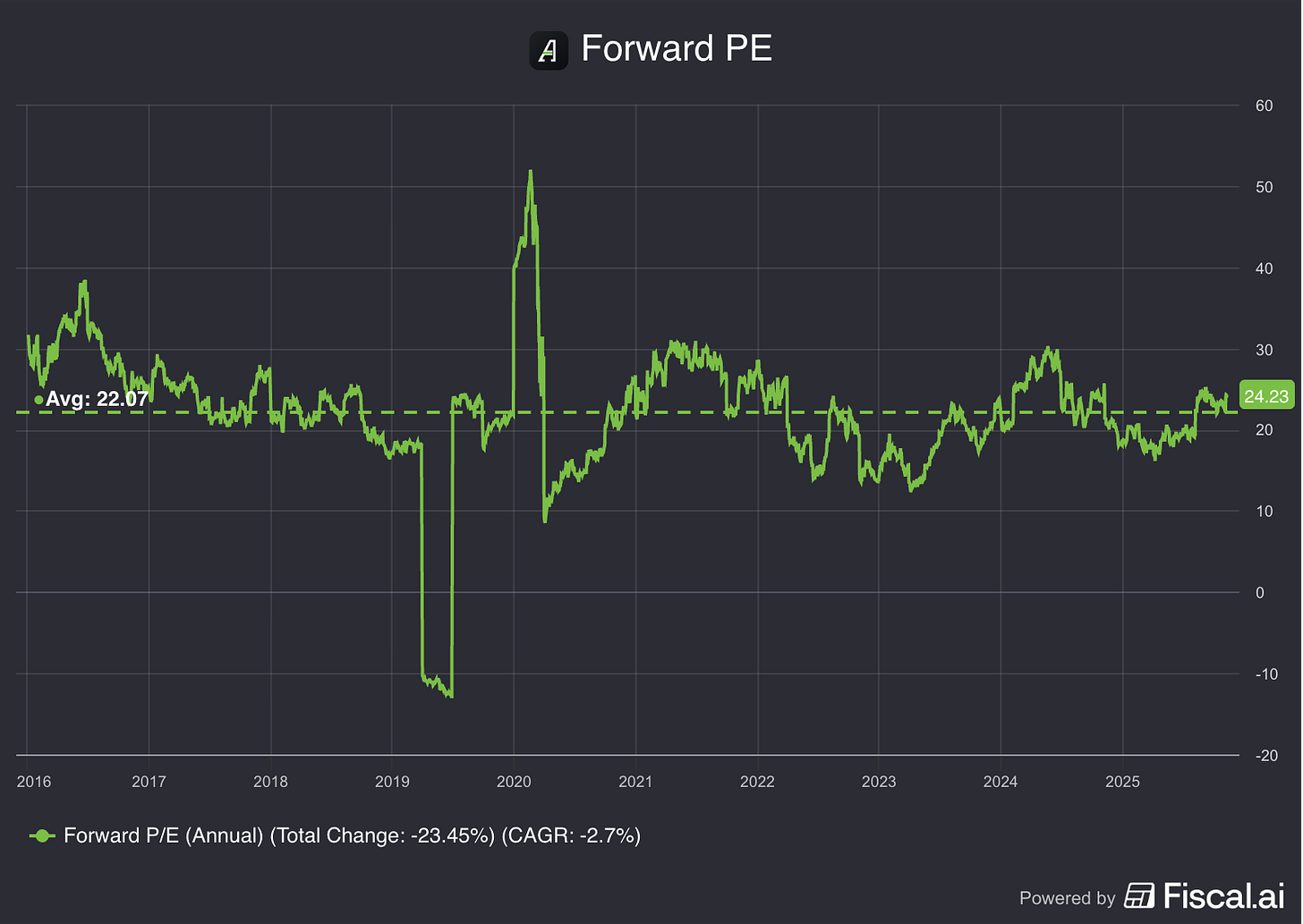

A comparison of the Forward PE multiple with its historical average

Earnings Growth Model

Reverse Discounted-Cash Flow

A comparison of the Forward PE multiple with its historical average

The first thing we do is compare the current forward PE with its historical average over the past 10 years.

This is a shortsighted method, but it already gives a quick indication.

Today, ADS trades at a forward PE of 24.2x compared to a historical average of 22.1x.

Earnings Growth Model

This model shows you the yearly return you can expect as an investor.

You can explore more about the Earnings Growth Model here.

Here are the assumptions I use:

EPS growth: 13% per year over the next 10 years

Dividend Yield: 0.5%

Forward PE to decline from 24.2x to 22.1x

Expected yearly return = 13% + 0.5% + 0.1* ((22.1x-24.2x)/24.2x)= 12.6%Reverse DCF

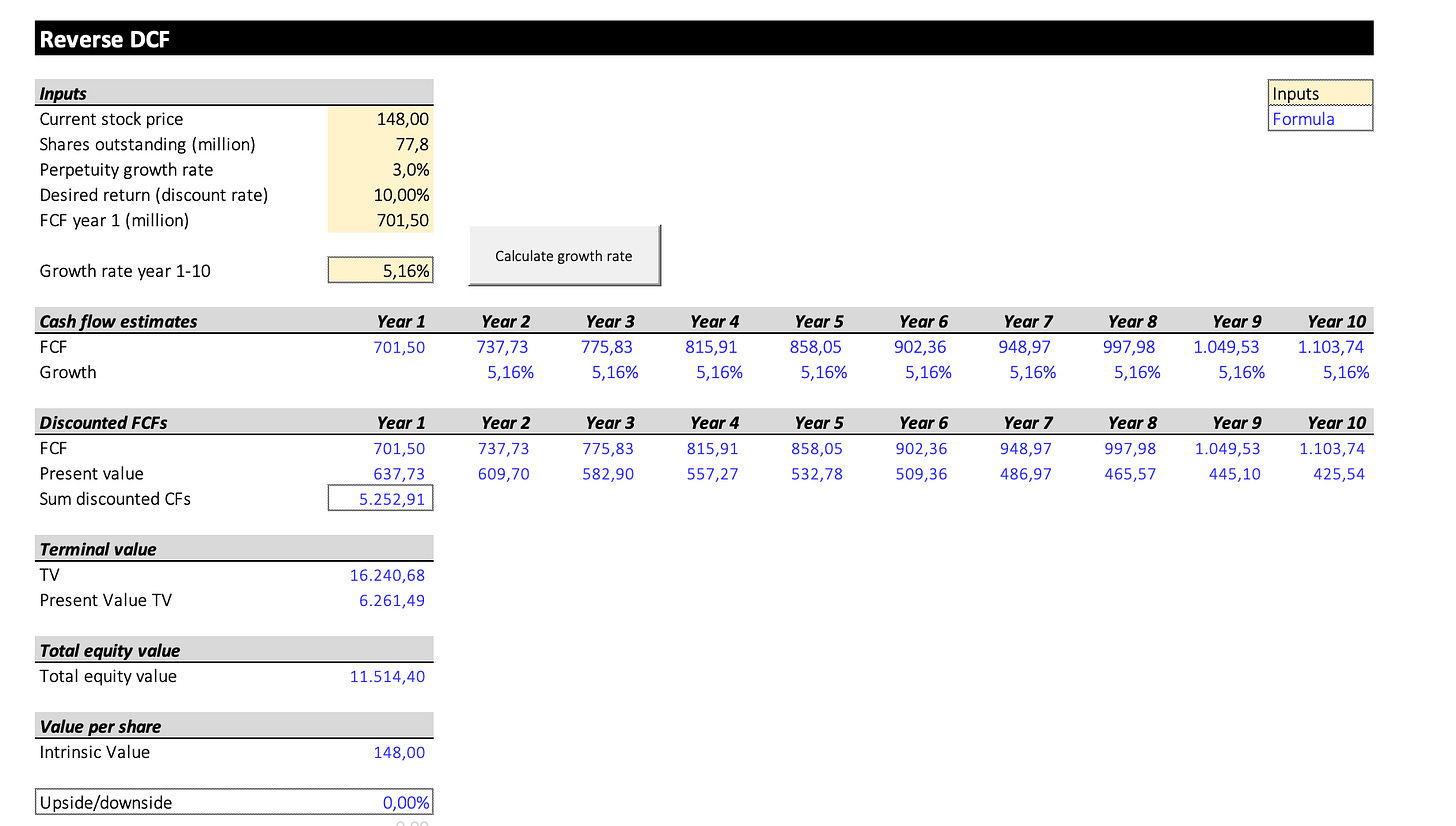

Charlie Munger once said that if you want to find a solution to a complex problem, you should invert. Always invert. Turn the problem upside down.

This is exactly what a reverse DCF does. As an investor, we don’t make assumptions.

We look at what assumptions the market has made and see whether they are reasonable.

The expected Free Cash Flow for 2026 equals $572.5 million.

We subtract the Stock-Based Compensation ($26 million) and add Growth CAPEX ($155 million) to arrive at a FCF in year 1 of $701.5 million.

The reverse DCF indicates that ADS’s FCF should grow by 5.3% each year for the next ten years.

These expectations seem reasonable. Especially if we look at the historical growth rates:

Average yearly FCF CAGR (5 years): 9.1%

Average yearly FCF CAGR (10 years): 27.7%

Advanced Drainage Systems:

Forward PE: 22.1x (lower than its 10-year average? < 24.2x? ❌)

Earnings Growth Model: 11.2% (Yearly return? > 10%? ✅)

FCF-Growth Reverse DCF: 10.3% (Realistic growth expectations? ✅)

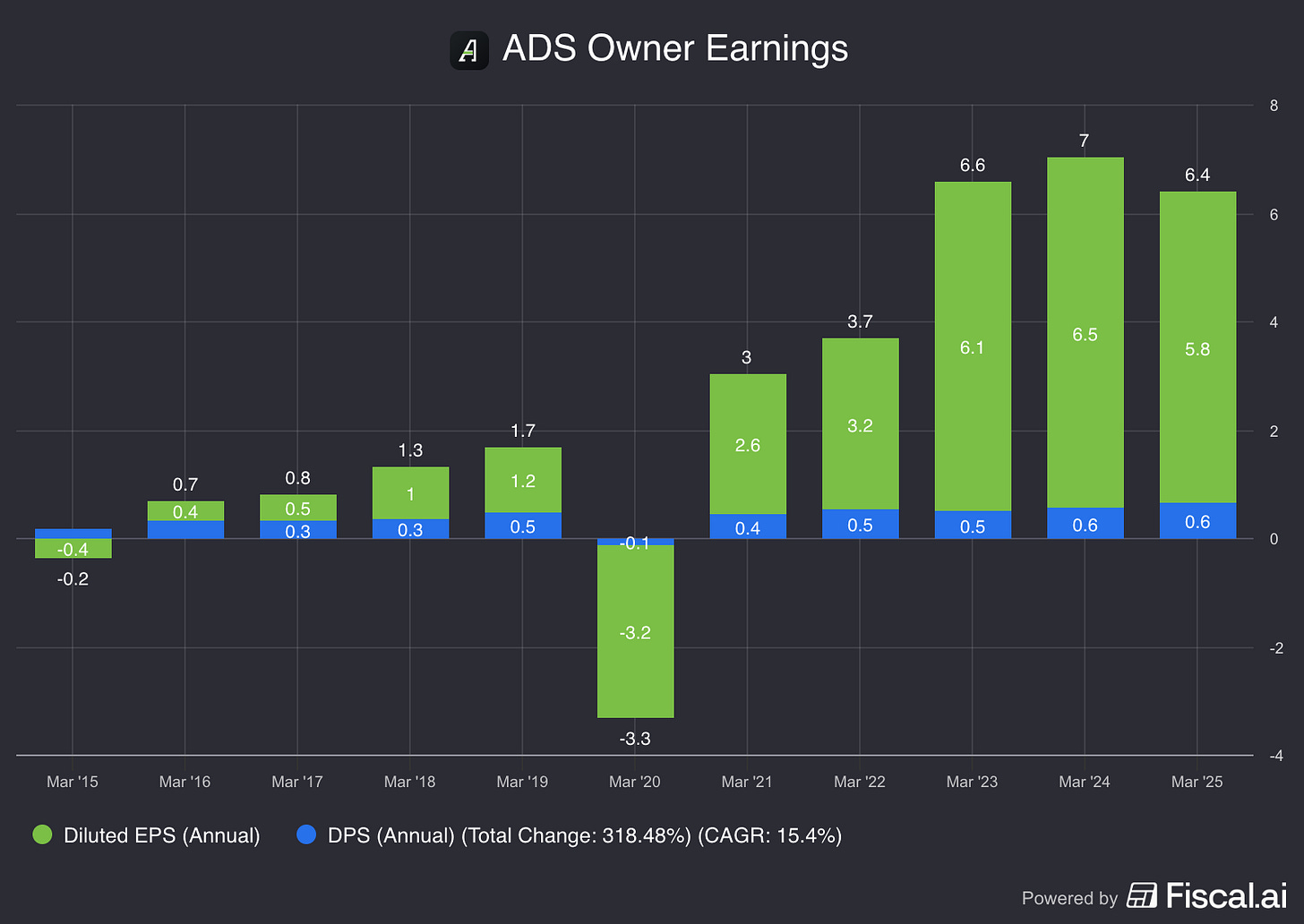

14. How did the Owner’s Earnings of the company evolve in the past?

Over time, stock prices tend to follow a company’s Owner’s Earnings (EPS Growth + Dividend Yield).

That’s why we want to invest in companies that managed to grow their Owner’s Earnings at attractive rates in the past.

Advanced Drainage Systems:

CAGR Owner’s Earnings (5 years): 34.2% (CAGR Owner’s Earnings > 12%? ✅)

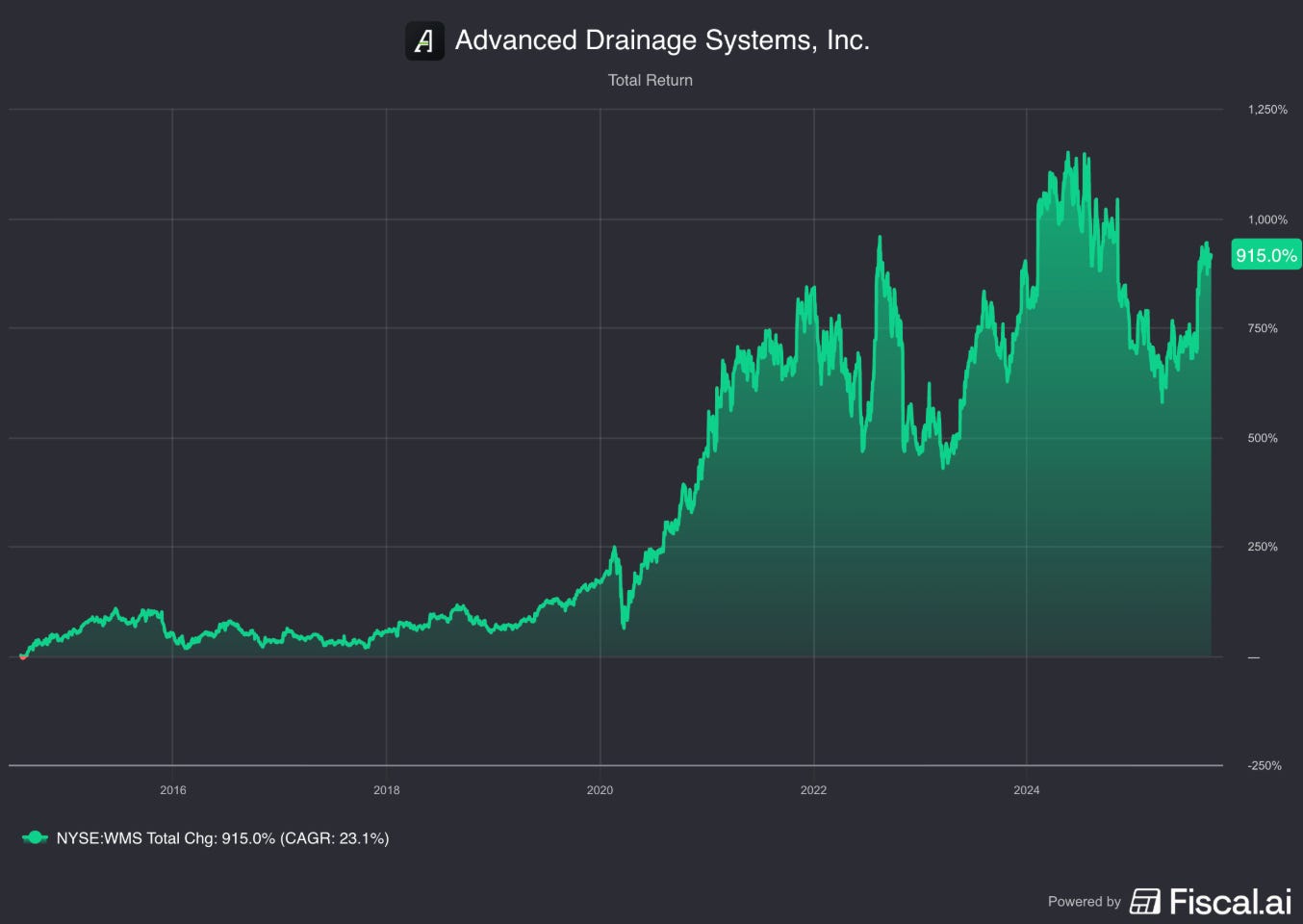

15. Did the company create a lot of shareholder value in the past?

We want to invest in companies that have managed to compound at attractive rates in the past.

Ideally, the company returned more than 12% per year to shareholders since its IPO.

Advanced Drainage Systems:

YTD: +29.3%

5-year CAGR: +20.6%

CAGR since IPO 2014: +23.1% (CAGR since IPO > 12%? ✅)

Quality Score

Finally, let’s bring everything together and give ADS a Total Quality Score.

Should you buy Advanced Drainage Systems?