Hi Partner 👋

Welcome to this week’s 🔒 paid edition 🔒 of Compounding Quality. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

A lot of people use Facebook, Instagram, and WhatsApp daily.

Almost 50% of all people use Meta Platforms every single month.

But is Meta Platforms an interesting investment? Let’s find out.

Meta Platforms - General Information

👔 Company name: Meta Platforms

✍️ ISIN: US30303M1027

🔎 Ticker: META

📚 Type: Monopoly

📈 Stock Price: $576

💵 Market cap: $1.46 trillion

📊 Average daily volume: $6.1 billion

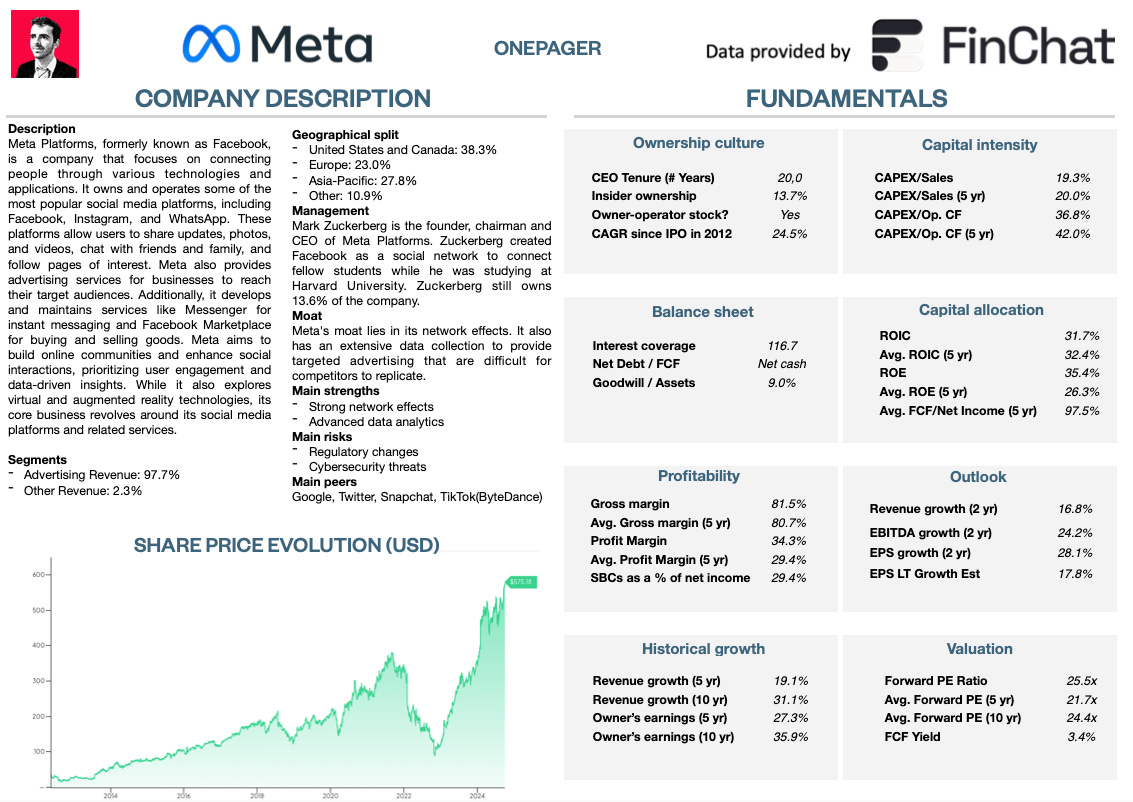

Onepager

Here’s a onepager with the essentials of Meta Platforms.

(Click on the picture to expand)

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give Meta a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

Facebook was created in 2004 in a Harvard dorm room, by a 19-year-old student.

His name? Mark Zuckerberg.

Over the years Meta has grown into a global technology company that owns big social media platforms, like Facebook, Instagram, and WhatsApp.

97.7% of Meta’s revenue is made through advertising.

Businesses pay Meta to show ads to users on their platforms.

So an advertiser pays Meta every time you click or even look at an ad.

Meta generates revenue worldwide:

2. Is management capable?

Mark Zuckerberg is the founder, chairman, and CEO of Meta Platforms.

Together with his roommates Eduardo Saverin, Andrew McCollum, Dustin Moskovitz, and Chris Hughes, they started “TheFacebook” on February 4, 2004.

It was meant as an online community where Harvard students could connect and share information.

Today, almost 50% of the entire world population uses Meta Platforms.

Mark Zuckerberg still owns 13.6% (value: $198.3 billion) of the company. At age 23, he became the world’s youngest self-made billionaire.

It’s great seeing that the founder is still leading the company.

Susan Li has been the Chief Financial Officer at Meta since 2022. Before joining the company in 2008, she was an investment banking analyst at Morgan Stanley.

3. Does the company have a sustainable competitive advantage?

Meta has a competitive advantage for sure.

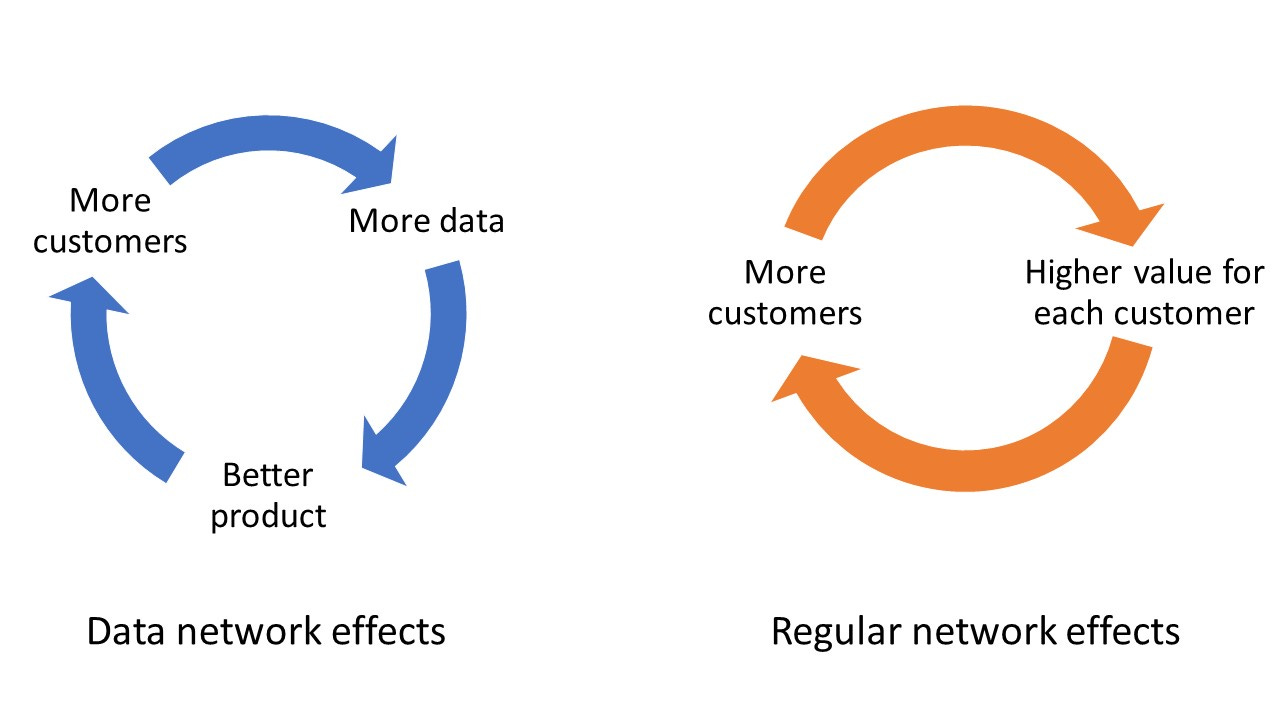

The company’s moat is based on network effects (our favorite competitive advantage).

Meta Platforms enjoys two kinds of network effects:

With this simple strategy, Meta has grown both Facebook and WhatsApp into two of the biggest social network platforms in the world.

Companies with a sustainable competitive advantage are often characterized by the following:

Gross Margin: 81.5% (Gross Margin > 40%? ✅)

Return On Invested Capital (ROIC) 31.7% (ROIC > 15%? ✅)

4. Is the company active in an attractive end market?

Social media is a very attractive end market.

The social media app market is expected to grow significantly in the years ahead.

Global adoption of 5G technology is the driving force behind this.

According to Statista, Meta owns 3 out of the 4 biggest social media platforms by monthly active users (Facebook, Instagram, and WhatsApp):

Together with Google, Meta Platforms dominates the entire market for digital advertisements.

5. What are the main risks for the company?

Some of the main risks for Meta:

Ad revenue dependence: The company relies heavily on advertising for its income.

Lawsuits: Meta faces lawsuits due to privacy concerns

Privacy Regulations: Stricter regulations limit Meta’s ability to use targeted ads.

Dependence on CEO: Mark Zuckerberg is responsible for a large part of the company’s success.

Metaverse investments: It’s uncertain whether the metaverse will generate returns.

The law of large numbers: how much room for growth does Meta still have?

6. Does the company have a healthy balance sheet?

We look at 3 ratios to determine the healthiness of Meta’s balance sheet:

Interest Coverage: 116.7x (Interest Coverage > 15x? ✅)

Net Debt/FCF: Net cash position equal to 1.4% of market cap (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 9.0% (Goodwill/assets not too large? < 20% ✅)

Meta’s balance sheet looks very healthy.

7. Does the company need a lot of capital to operate?

We prefer to invest in companies with a CAPEX/Sales lower than 5% and CAPEX/Operating Cash Flow lower than 25%.

Meta:

CAPEX/Sales: 19.3% (CAPEX/Sales < 5%? ❌)

CAPEX/Operating Cash Flow: 36.8% (CAPEX/Operating CF? < 25% ❌)

This capital intensity looks quite high, right?

But hold on!

Remember that there is a difference between Maintenance CAPEX and Growth CAPEX.

Maintenance CAPEX: Investments made in existing assets

Growth CAPEX: Investments made in new assets to grow

When a company invests a lot to grow, its growth CAPEX is very high but these investments might create a lot of value in the long term.

That’s why sometimes (like for Meta Platforms) it might make sense to only take the company’s Maintenance CAPEX into account.

As a rule of thumb, we state that the company’s maintenance CAPEX is equal to the company’s Depreciation & Amortization.

CAPEX = Maintenance CAPEX + Growth CAPEX

Wherein Maintenance CAPEX = Depreciation & Amortization

When we do the calculations for Meta Platforms:

Maintenance CAPEX/Sales: 8.6% (CAPEX/Sales < 5%? ❌)

Maintenance CAPEX/Operating Cash Flow: 16.4% (CAPEX/Operating CF? < 25% ✅)

These numbers already look a bit more reasonable.

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.

Look for companies that put the money of shareholders to work at attractive rates of return.

Meta:

Return On Equity (ROE): 35.4% (ROE > 20%? ✅)

Return On Invested Capital (ROIC): 31.7% (ROIC > 15%? ✅)

Here’s an evolution of Meta’s ROE and ROIC:

9. How profitable is the company?