Hi Partner 👋

I’m Pieter and welcome to a 🔒subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

Everyone should invest in stocks.

It’s the best way to create wealth in the long term.

And the best part? Everyone can do it.

If you just buy an index fund every month, you don’t have to worry about market timing or which stocks to pick.

In other words, you don’t have to look for the needle in the haystack, you just buy the entire haystack.

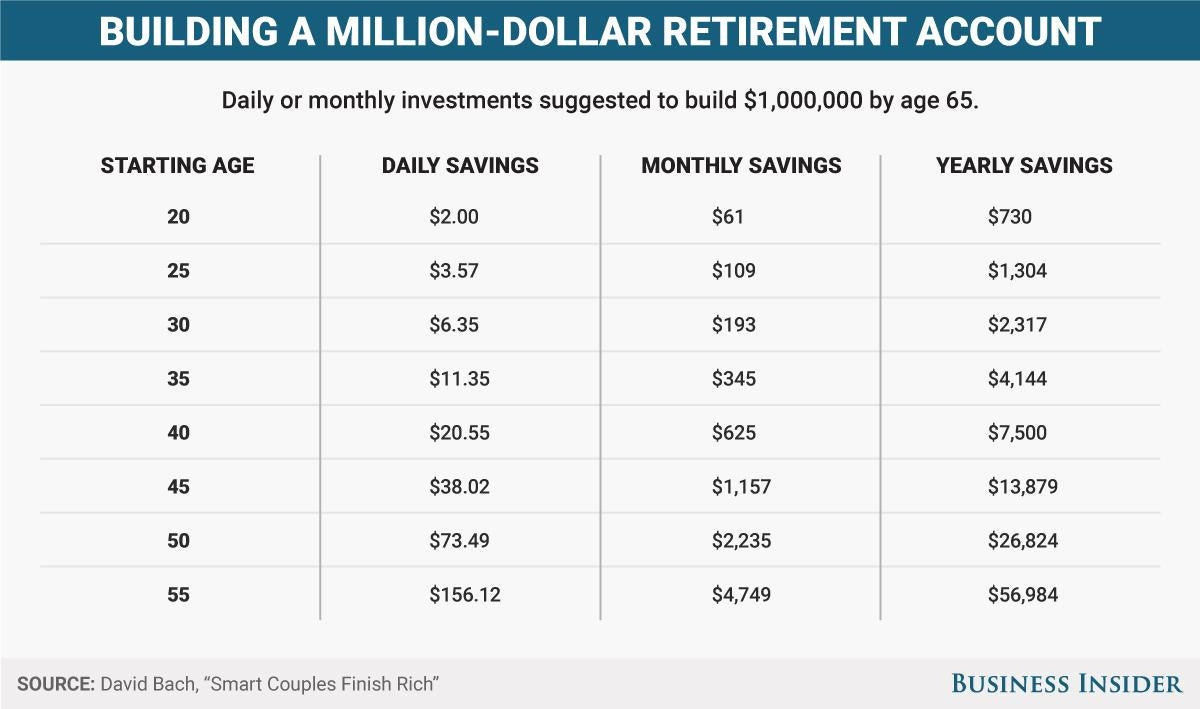

The table below shows how much money you should invest to become a millionaire by age 65.

If you start at age 20, you need to invest $2 per day

If you start at age 40, you need to invest $11 per day

Another lesson you can draw from this? The sooner you start investing, the better.

The best time to plant a tree was 10 years ago.

The second best time is now.

Source: David Bach - Business Insider

Quality Investing

As you probably know by now, we love to invest in the best companies in the world.

But does it work?

The short answer is YES.

Morningstar Wide Moat Index

The Morningstar Wide Moat Index solely invests in companies with a wide moat or sustainable competitive advantage.

This index outperformed the S&P500 by 4.2% (!) per year since 2000.

MSCI World Quality

The MSCI World Quality Index picks the highest-quality stocks out of the regular MSCI World Index based on 3 fundamental variables:

High Return On Equity (ROE)

Stable year-over-year earnings growth

Low financial leverage

The MSCI World Index outperformed the regular index by 3.5% per year since 1994.

Quality Outperforms

You now learned that quality outperforms in the long term.

That’s remarkable. Do you know why?

More than 90% of all (professional) investors underperform the market.

And with this simple investment strategy, you would have outperformed the market by an attractive margin!

When you would have just bought a quality ETF and kept it for 20 years, you would probably have outperformed 99% of investors.

And this while you just needed to do three things:

Buy the index fund

Sit back

Relax

Here’s what your performance would look like if you invested $10,000 in 2000:

Morningstar Wide Moat Index: $130,000

MSCI World Quality: $113,000

S&P 500: $50,000

This means your total return would be twice as high with the Quality Investing strategy.

And the best part? There are good ETFs that copy these indexes.

Investing in ETFs is very easy.

It’s the easiest way to create wealth for you and your family.

You don’t need to spend much time on your investments and you aren’t charged the high fees banks charge you.

Here are the relevant ETFs you can look at…