📈 Lululemon Athletica

Investment case

Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

One of the fastest-growing quality stocks in an attractive industry?

Lululemon Athletica.

The company returned 28.4% (!) per year to shareholders since 2007.

Let’s dive into this great yoga-inspired clothing company today.

Lululemon Athletica - General Information

👔 Company name: Lululemon Athletica

✍️ ISIN: US5500211090

🔎 Ticker: LULU

📚 Type: Oligopoly

📈 Stock Price: $374

💵 Market cap: $45.2 billion

📊 Average daily volume: $1.3 million

Alejandro from Quality Value gave some invaluable input for this investment case.

His investment cases are in Spanish. You can check out his newsletter here.

Onepager

Here’s a onepager with the essentials of Lululemon:

(Click on the picture to expand)

1. Do I understand the business model?

Lululemon Athletica Inc. is a designer, distributor, and retailer of technical athletic apparel, footwear, and accessories.

The American company sells pants, shorts, tops, and jackets designed for a healthy lifestyle including athletic activities such as yoga, running, training, and most other activities.

They also have a wide offering of fitness-inspired accessories.

The company generates the majority of its sales via women's clothing. 84% of their revenues are generated in the United States.

Lululemon conducts its business through two channels:

Their own stores

Direct-to-consumer (e-commerce)

Here’s what their revenue split looks like:

2. Is management capable?

Chip Wilson founded Lululemon in 1998. He was the CEO until 2005 when he sold a 48% stake to the Private Equity firms Advent International and Highland Capital Partners.

In January 2012, Wilson stepped down as chief innovation and branding officer but remained chairman of the Board. He stepped down as non-executive chairman in December 2013. Today, he still owns 8.4% of the company.

Calvin McDonald is Lululemon’s current CEO. He has been working for the company since 2018. Before joining Lululemon, McDonald served as head of the Americas region at Sephora, owned by LVMH Group.

3. Does the company have a sustainable competitive advantage?

The core of Lululemon’s competitive advantage is based on its strong brand name.

The athletic apparel industry is very competitive and relies primarily on brand image and recognition of the quality and innovation of its products. Lululemon holds a market-leading position in yoga and active clothing for women in the United States and Canada.

Lululemon has managed to build a recognized brand and quality products that have attracted millions of customers to its stores.

Its strong brand also gives Lululemon pricing power. This has allowed the company to have one of the highest margins in the industry, outperforming big brands like Nike.

Companies with a sustainable competitive advantage are often characterized by a high and robust Gross Margin and ROIC:

Gross Margin: 58.3% (Gross Margin > 40%? ✅)

ROIC: 40.9% (ROIC > 15%? ✅)

4. Is the company active in an attractive end market?

The end market for yoga and active clothes is growing at attractive rates.

The market size for global activewear is expected to grow by 5.8% until 2030 according to a study of Skyquest Technology.

Lululemon Athletica has 3 main rivals:

Nike: A global sportswear giant offering a wide range of athletic apparel and footwear, known for its innovative designs and extensive marketing campaigns.

Adidas: Another major player in the athletic apparel industry, Adidas is recognized for its diverse product line, including sportswear, shoes, and accessories, and its collaborations with popular athletes and celebrities.

Under Armour: Known for its performance-oriented apparel and footwear, Under Armour competes with Lululemon through its focus on technological advancements in sportswear and its presence in both athletic and casual markets.

5. What are the main risks for the company?

Some of the main risks for Lululemon:

Lululemon needs to maintain its strong brand recognition

The market for activewear is very competitive

Loss of pricing power

Poor execution of international expansion

Everyone starts to offer leggings at a low price - Will leggings become a ‘commoditized product’?

If Lululemon starts competing in categories like running and footwear, it will directly compete with companies like Nike

6. Does the company have a healthy balance sheet?

We look at 3 ratios to determine the healthiness of Lululemon’s balance sheet:

Interest Coverage: 252.6x (Interest Coverage > 15x? ✅)

Net Debt/FCF: 0.1x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 0.4% (Goodwill/assets not too large? < 20% ✅)

Lululemon’s balance sheet looks very healthy. The company has a net cash position and almost no goodwill on its balance sheet.

7. Does the company need a lot of capital to operate?

We prefer to invest in companies with CAPEX/Sales lower than 5% and CAPEX/Operating Cash Flow lower than 25%.

Lululemon Athletica:

CAPEX/Sales: 7.1% (CAPEX/Sales < 5%? ❌)

CAPEX/Operating Cash Flow: 33.3% (CAPEX/Operating CF? < 25% ❌)

This capital intensity looks quite high at first sight.

But please note that Lululemon’s CAPEX equals $652.3 million and that $349 million of this is growth CAPEX (investments in future growth).

When we only take the company’s maintenance CAPEX into account, the capital intensity looks as follows:

CAPEX/Sales: 3.8% (CAPEX/Sales < 5%? ✅)

CAPEX/Operating Cash Flow: 17.8% (CAPEX/Operating CF? < 25% ✅)

This capital intensity already looks way more attractive.

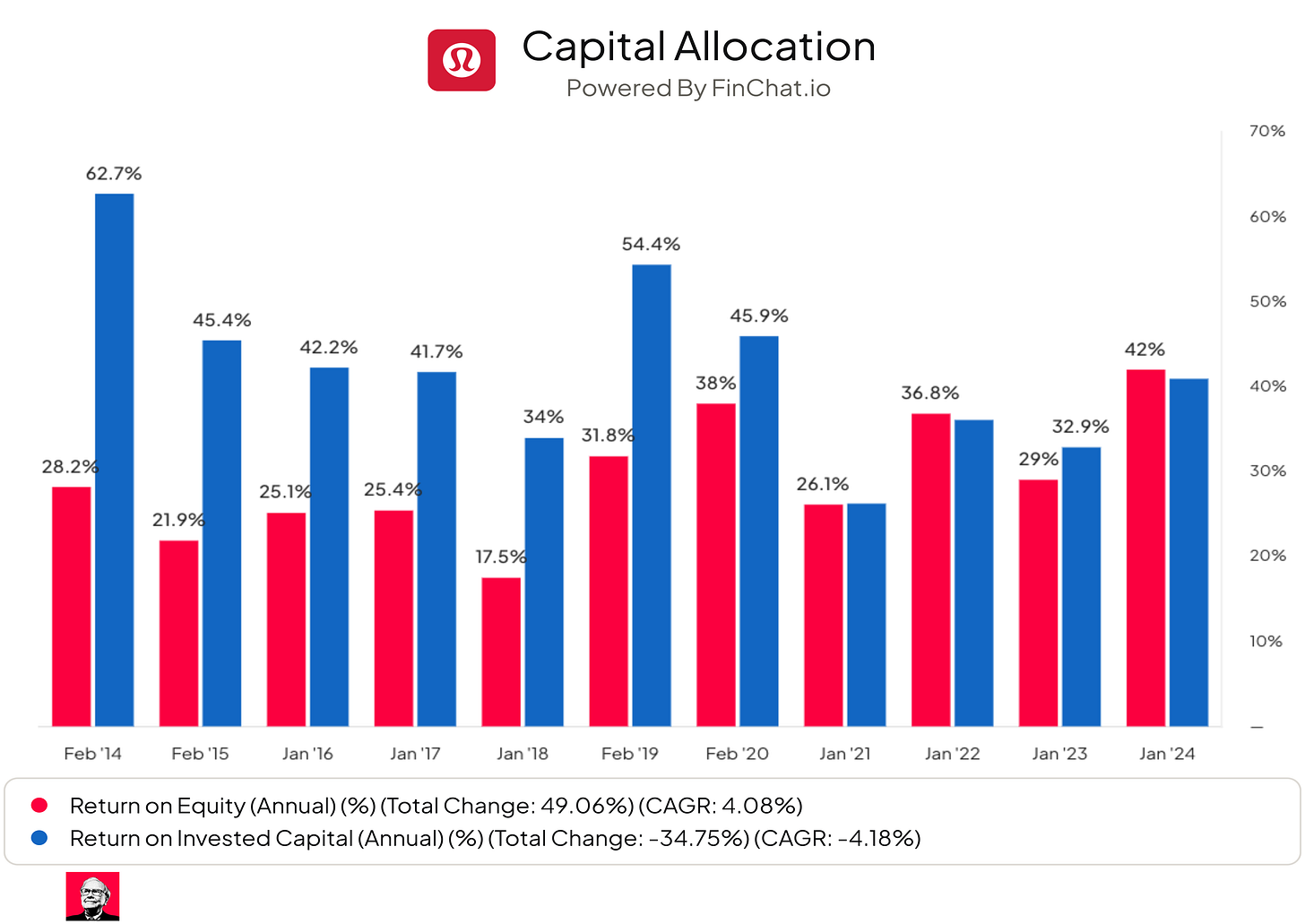

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.

Look for companies that put the money of shareholders to work at an attractive rate of return.

Lululemon:

Return On Equity: 30.5% (ROE > 20%? ✅)

Return On Invested Capital: 40.9% (ROIC > 15%? ✅)

These numbers look attractive.

9. How profitable is the company?

The higher the profitability of the company, the better.

Here’s what things look like for Lululemon:

Gross Margin: 58.3% (Gross Margin > 40%? ✅)

Net Profit Margin: 16.1% (Net Profit Margin > 10%? ✅)

FCF/Net Income: 130% (FCF/Net Income > 80%? ✅)

10. Does the company use a lot of Stock-Based Compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Lululemon:

SBCs as a % of Net Income: 8.9% (SBCs/Net Income < 10%? ✅)

Avg. SBC as a % of Net Income past 5 years: 8.2% (SBCs/Net Income < 10%? ✅)

The company pays quite some stock-based compensation but this level is still (somewhat) acceptable.

11. Did the company grow at attractive rates in the past?

We seek companies that managed to grow their revenue and FCF by at least 5% and 7% per year respectively.

Lululemon:

Revenue Growth past 5 years (CAGR): 24.7% (Revenue growth > 5%? ✅)

Revenue Growth past 10 years (CAGR): 19.7% (Revenue growth > 5%? ✅)

FCF Growth past 5 years (CAGR): 22.5% (FCF growth > 7%? ✅)

FCF Growth past 10 years (CAGR): 15.3% (FCF growth > 7%? ✅)

12. Does the future look bright?

You want to invest in companies that manage to grow at attractive rates as stock prices tend to follow FCF per share growth over time.

The company invested heavily in future growth over the past few years and Lululemon will continue to benefit from this in the years to come.

Lululemon:

Exp. Revenue Growth next 2 years (CAGR): 11.7% (Revenue growth > 5%? ✅)

Exp. EPS Growth next 2 years (CAGR): 11.9% (EPS growth > 7%? ✅)

EPS Long-Term Growth Estimate: 14.7% (EPS growth > 7%? ✅)

13. Does the company trade at a fair valuation level?

We always use 3 methods to look at the valuation of a company:

A comparison of the forward PE multiple with its historical average

Earnings Growth Model

Reverse Discounted-Cash Flow

A comparison of the multiple with the historical average

The first thing we do is compare the current forward PE with its historical average over the past 5.

Today, Lululemon trades at a forward PE of 26.0x versus a historical average of 38.8x over the past 5 years.

Earnings Growth Model

This model shows you the yearly return you can expect as an investor.

In theory, it’s really easy to calculate your expected return:

Expected return = Earnings growth + Shareholder Yield +/- Multiple Expansion (Contraction)

Wherein Shareholder Yield = Dividend Yield + Buyback Yield

Here are the assumptions I use:

Earnings Growth = 12.5% per year over the next 10 years

Shareholder yield = 0.7% (buyback yield)

Forward PE to decline from 27.1x to 25.0x over the next 10 years

Expected yearly return = 12.5% + 0.7% - 0.1* ((25.0-27.1)/27.1))= 12.4%.

An expected yearly return of 12.4% looks quite good.

14. How did the Owner’s Earnings of the company evolve in the past?

Over time, stock prices tend to follow the Owner’s Earnings of a company (EPS Growth + Dividend Yield).

That’s why we want to invest in companies that managed to grow their Owner’s Earnings at attractive rates in the past. This is the case for Lululemon.

Lululemon:

CAGR Owner’s Earnings (5 years): 23.7% (CAGR Owner’s Earnings > 12%? ✅)

CAGR Owner’s Earnings (10 years):: 16.5% (CAGR Owner’s Earnings > 12%? ✅)

15. Did the company create a lot of shareholder value in the past?

We want to invest in companies that managed to compound at attractive rates in the past.

Ideally, the company returned more than 12% per year to shareholders since its IPO.

Here’s what the performance of Lululemon looks like:

YTD: -23.8%

5-year CAGR: +21.9%

CAGR since IPO (2007): +23.5% (CAGR since IPO > 12%? ✅)

Bringing everything together

That’s it for today.

In the full article, I bring everything together.

This means I give Lululemon Athletica a Quality Score on all of the 15 metrics and I determine whether we’ll buy the company.

Premium Subscribers get the following:

✍️ Three articles per week (Tuesdays, Thursdays & Sundays)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of quality stocks

🔎 Full investment cases about interesting companies

📊 Access to the Community

Happy Compounding!

Pieter (Compounding Quality)

PS Currently you get a $100 discount on a yearly subscription ($399 instead of $499)

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Special thanks to Alejandro

The Community of Compounding Quality is amazing.

Did you like this case? You should thank Alejandro from Quality Value.

He gave some invaluable input for this investment case. His website is in Spanish but I highly appreciate Alejandro.