Medicines Biggest Moment Since Antibiotics

Hi Friend👋

You would never know it from the outside of this building…

But right now, this highly secure, nondescript lab in the Midwest is quietly reshaping the $1.7 trillion pharma market.

We’re looking at faster cures for deadly diseases, an end to crippling medical bills, and the fall of Big Pharma’s dominance.

What’s happening in this lab could even save your life one day.

For investors, this could be one of the most lucrative opportunities of the decade.

According to my research, the stock is positioned to outrun the market for years to come.

In other words, it’s a true Compounding Machine.

I can practically guarantee you’ve never heard of this company.

Because there’s a twist…

The Midwestern Firm Coming for Big Pharma

This company does NOT invent drugs. It owns NO blockbuster patents, and it does NOT produce billion-dollar treatments.

Instead, this firm is at the center of a huge medical breakthrough. One that’s still flying under the radar.

The Wall Street Journal says it’s “Medicine’s Biggest Moment Since Antibiotics…”

McKinsey calls it a “game changer…”

And according to the renowned International Journal of Surgery, it’s paving “a revolutionary path forward.”

I’ll tell you all about this disruptive innovation in a moment.

First, you need to understand that the stakes couldn’t be higher.

This is life or death.

The Biggest Health Breakthrough of the Decade

Take the story of Taryn M. from North Carolina.

Seven relatives had breast cancer. Both parents developed dementia. All of it linked to obesity.

And at 53-year-old, Taryn was obese too.

When she was diagnosed with diabetes, she saw where this was heading.

She tried everything: diets, exercise, therapy, even surgery. Nothing worked long-term.

Then Taryn found GLP-1.

In just months, she lost 85 pounds, reversed her diabetes, and changed her future. In other words, GLP-1 saved her life.

GLP-1 is better known as Ozempic.

You’ve probably seen Ozempic in the headlines in recent months.

Some call it a “miracle drug. It’s expected to save a million lives every year.

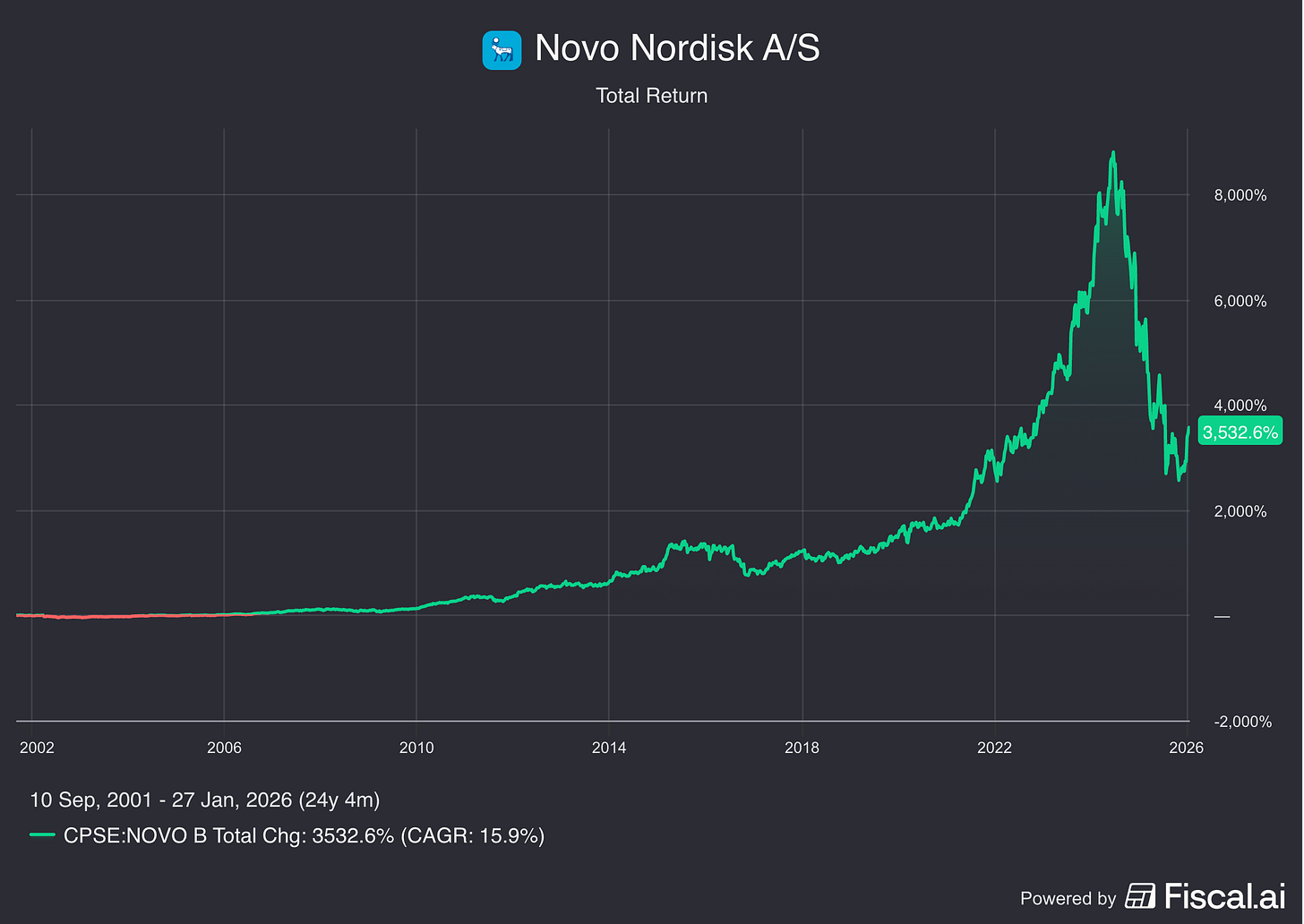

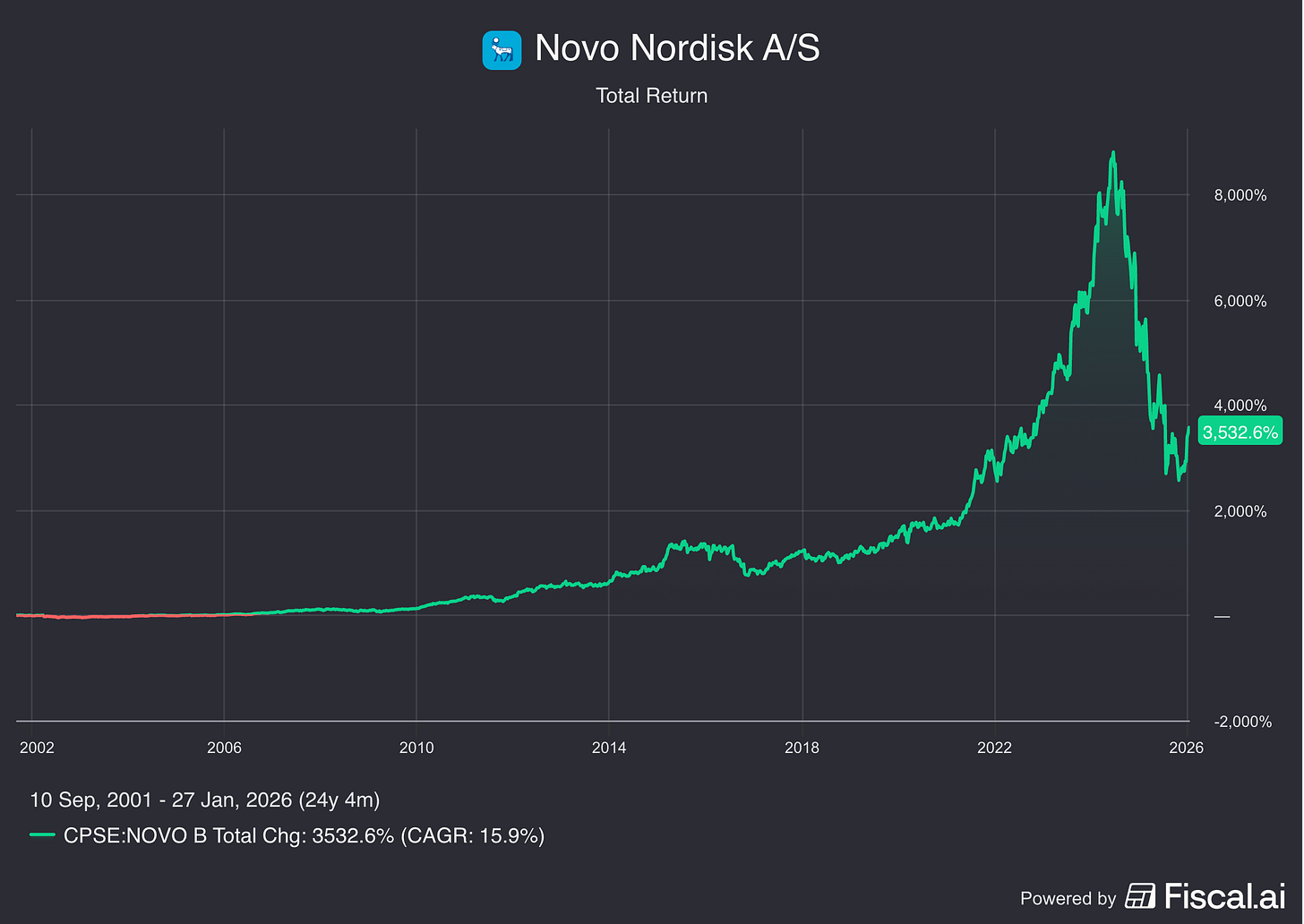

It’s no surprise Ozempic’s manufacturer Novo Nordisk made a fortune on it. The company raked in a stunning $42 billion in revenue last year.

Novo Nordisk’s market value has surpassed the entire Danish economy, the country it calls home.

And investors like you could’ve made a lot of money.

Since Ozempic’s approval in December 2017, the stock has skyrocketed 491% to its peak.

But this story isn’t just about Novo Nordisk, Ozempic, or weight loss.

It’s much bigger.

I’m talking about a breakthrough that almost certainly will extend your life, cut your medical bills, and shake Big Pharma to its core.

The company behind it could be one of the most powerful investment opportunities I’ve ever uncovered for Compounding Quality.

As you may know, our focus here is simple: elite Compounders with the potential to build lasting, generational wealth.

And based on my research, this little-known Midwestern firm could be the next market-beating giant… with the potential to deliver years of outsized returns.

Because here’s the thing…

New substances like GLP-1 emerge far more often than you’d expect.

But a lot of them never reach the patients who need them. And when they do, it takes at least a decade.

The Reason We Don’t Have More Miracle Drugs

GLP-1, for example, was discovered more than 40 years ago. But only now is it transforming lives.

Think about it…

Millions could have lived longer, healthier lives if this breakthrough had arrived sooner.

Countless heart attacks, strokes, and other obesity-related diseases could have been prevented.

This begs the question: Why did it take this long for GLP-1 to reach patients like Taryn?

The answer is simple…

The path from a petri dish to human trials to the market is brutally slow.

On average, it’s taking 10 years. Or in extreme cases, like Ozempic, even 40 years.

That’s because even the most promising medical discoveries face a grueling journey.

Healthcare in The U.S. is Broken

The critical step between the lab and real-world use are clinical trials.

And clinical trials are notoriously expensive and inefficient.

Finding the right patients can take years, and trials are often derailed by low enrollment, data bottlenecks, and compliance issues.

Many life-saving drugs fail not because they don’t work but because of roadblocks and crushing expenses.

And guess who profits from this broken system?

Big Pharma.

They’ve dominated drug development for decades. And it’s not because they innovate better.

It’s because they’re the only ones with the money and infrastructure to navigate the clinical trial process.

As a result, smaller, more agile biotech startups are often shut out before they get a chance.

Even if they are the ones developing better targeted treatments with fewer side effects and lower costs.

Meanwhile, Big Pharma holds the pricing power, dictating which drugs make it to market and how much patients pay.

But this Midwestern company I discovered is rewriting the rules as we speak…

Ending Big Pharma’s Stranglehold

Instead of billion-dollar budgets and years of red tape, it’s using cutting-edge technology to help biotech startups bring breakthrough drugs to market.

Faster, cheaper, and without Big Pharma gatekeeping.

For investors, this is a unique opportunity.

History proves it again and again:

Disruptors like this are money-printing machines.

Because they spot a lucrative market, shake it up with a bold new approach, and send the industry giants tumbling.

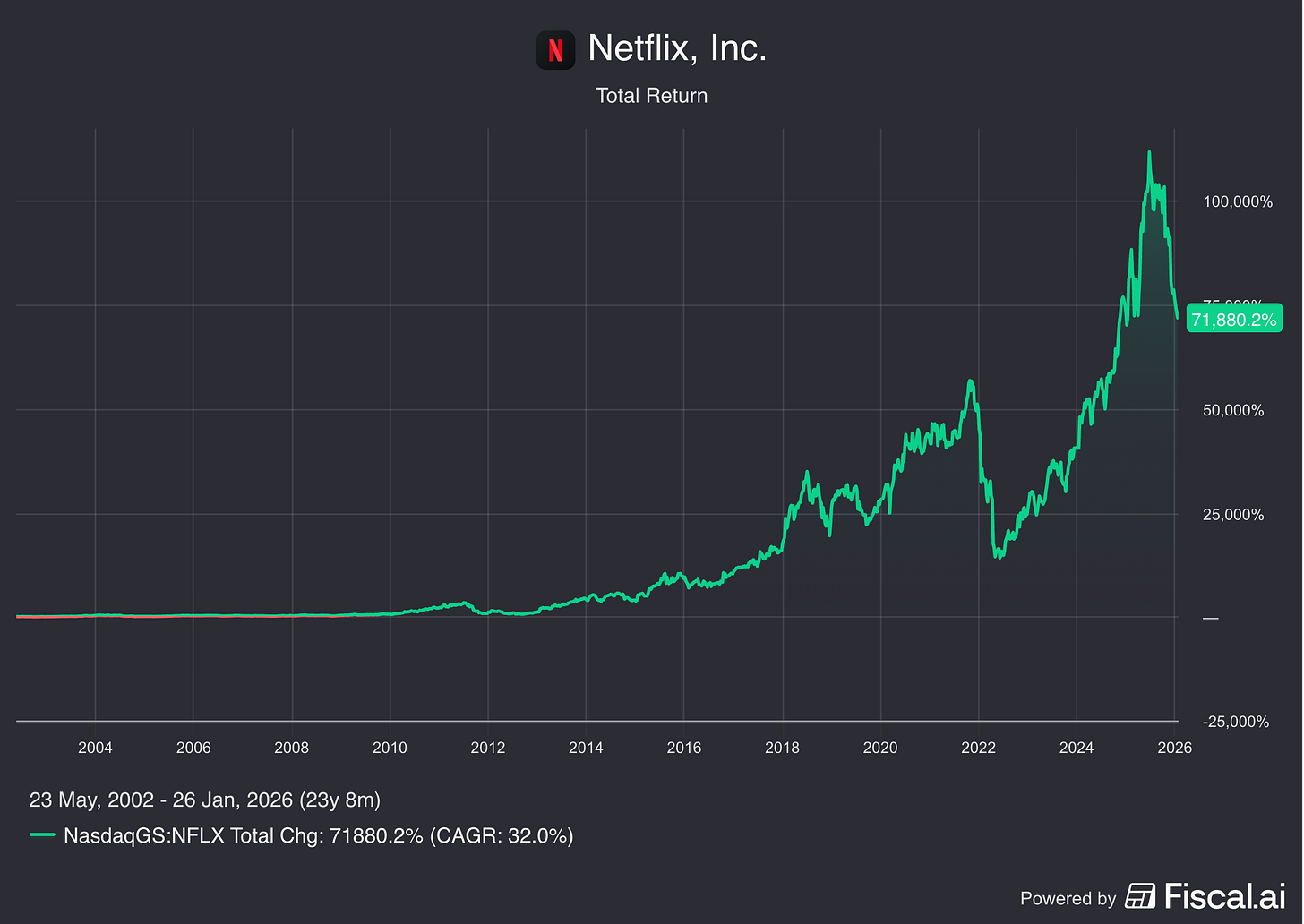

Take Netflix.

For decades, video rentals were a cash machine, with Blockbuster sitting at the top.

It had thousands of locations, millions of loyal customers, and practically total control of the market.

Then Netflix showed up with a radical new approach: video streaming.

The result?

Netflix became a $400+ billion giant, while Blockbuster was erased from existence.

Investors could’ve made a killing. Netflix shares soared more than 700% during the last 10 years.

Then there’s Salesforce.

Before Salesforce, businesses relied on Siebel Systems for customer relationship management (CRM) software.

IT workers had to manually install Siebel software from DVDs on corporate computers and constantly maintain and update it.

Then Salesforce introduced a radical new approach: software that runs entirely in the cloud.

No more installations. No more costly maintenance. It was a game-changer.

While Siebel stuck to its old ways, Salesforce skyrocketed. It went public at $11 per share in 2004.

Today, it trades at $230. That’s a 20x return for early investors.

Or take Amazon.

Sears, Borders, Toys “R” Us—all giants, all gone.

Amazon’s online-first model crushed them with lower prices, faster delivery, and unlimited selection.

You could’ve gotten in as late as 2015 and still had the chance to pocket 1,400%+ gains.

And just like Netflix, Salesforce, and Amazon, this Midwestern company is rewriting the rules.

It’s using a radical new approach to bring drugs to market… faster, cheaper, and without Big Pharma’s grip.

And just like those past disruptors, early investors could be in for outsized gains.

The amount of money at stake is huge. Remember, this industry is as big as $1.7 trillion.

And this firm is positioned to siphon off a massive share of that cash from Big Pharma.

Let me show you exactly how this company does it.

“Medicines Biggest Moment Since Antibiotics”

Like I said, this firm isn’t a drugmaker.

Instead, it controls the most critical part of the drug development process: the clinical trial.

In other words, it’s rewriting the rules for how trials are run.

This company’s secret?

Artificial Intelligence…

This company is turning AI’s power into an unstoppable advantage.

Because AI outperforms every human on Earth in one critical area: pattern recognition.

AI can analyze mountains of data in seconds, spotting trends and anomalies that even the sharpest experts would miss.

Take a radiologist, for example.

A human being examining one slide per second, every second, for a hundred lifetimes wouldn’t come close to the experience AI can gain in mere moments.

It’s the reason the Wall Street Journal calls AI “Medicine’s Biggest Moment Since Antibiotics…”

McKinsey says it’s a “game changer…”

And the International Journal of Surgery, predicts AI will pave “a revolutionary path forward.”

This company’s AI system is slashing drug testing time to a fraction of the usual process:

✅ Faster Patient Recruitment – AI scans millions of records in real-time, finding the right patients in days, not months, so trials start faster.

✅ Real-Time Trial Monitoring – AI tracks patient data live, flagging risks before they derail the trial, thereby cutting delays.

✅ Instant Data Analysis – AI processes massive datasets… from lab results to medical imaging… in seconds, not weeks. It’s speeding up evaluations and boosting accuracy.

All this is happening right now:

This company is actively running clinical trials as we speak.

Potential billion-dollar treatments targeting cancer, kidney disease, and heart conditions are just a few examples.

It’s hard to overstate this company’s significance…

Big Pharma has always had an edge because it could afford the slow, expensive trial process.

But not anymore…

Instead of waiting 10+ years and spending billions on a single blockbuster drug…

… Agile biotechs can now get better, cheaper, and more targeted treatments to patients in a fraction of the time.

Take GLP-1 again.

It took 40 years from discovery to giving investors the chance to make 491% on Novo Nordisk.

This company supercharges this cycle.

Expect a wave of highly targeted breakthrough drugs, each unlocking massive profits for the companies behind them.

But let’s be real…

Not every new drug will be a winner. It’s impossible. And that’s one of the big pitfalls of biotech.

Where The Real Money is Made

In every gold rush, the real money isn’t made by the miners. It’s made by the companies selling them picks and shovels.

These kinds of companies have a huge advantage. They profit from the entire industry’s success instead of betting on individual winners.

Some of the biggest companies in the world are built on this business model:

Take Nvidia.

Every AI company needs massive computing power and Nvidia’s chips are the industry standard.

No matter who wins AI, they all run on Nvidia. That’s why shares jumped 1,200%+ in five years.

Or consider Shopify.

Millions of businesses needed a way to sell online. Shopify gave them the tools. Now, it powers billions in transactions and takes a cut from every sale.

Investors who got in early could make massive gains. Shopify’s stock has soared over 5,000% since its IPO.

And then there’s TMSC.

Tech firms like Apple, AMD, and Qualcomm don’t manufacture their own chips. They all rely on TSMC. The company profits no matter who wins in the smartphone, AI, or computing wars.

The stock has climbed up more than 8,000% since the early 2000s.

That’s the power of a picks and shovels business.

And this company is on track to become the hottest picks and shovel player in the pharma sector.

Of course, I don’t have a crystal ball, and I can’t promise gains. However, this $1.7 trillion industry is projected to only grow bigger from here.

In other words, there’s a lot of money up for grabs. And this off-the-radar company is at the core of it all.

This firm has already 10x’ed since its 2016 IPO. And its trajectory suggests there’s plenty more upside ahead.

Because the more trials it runs, the deeper its competitive moat grows.

Here’s what I mean…

The Ultimate Moat

The more biotech firms use their technology, the more real-world trial data they collect.

And with AI, more data means smarter, faster, and more efficient trials.

Each new study refines its algorithms, making patient recruitment sharper, risk detection faster, and trial execution smoother.

This compounding advantage creates a moat Big Pharma can’t easily cross.

That’s why this stock could be THE bedrock of your journey to financial freedom.

But it’s vital you act fast…

This could be your final shot to secure shares at such a low price.

At current prices, my rating system is flashing a “STRONG BUY” signal on this company.

I just wrote up a special report on this Compounding Machine.

Inside you'll get this company’s name and ticker symbol and my extensive research on the stock.

It’s called “Fast-Tracking the Future: The Company Disrupting The $1.7 Trillion Biotech Industry.”

This report gives you everything you need to seize this massive opportunity. You can buy the stock easily with any brokerage account.

I’ll show you how to get your hands on this report in a moment. First, please let me properly introduce myself…

My name is Pieter Slegers. 🤝

I started investing when I was 13 years old.

Yes, I bought my first stock when I was still a kid… and my parents tried to talk me out of it!

But my obsession with the stock market was too powerful.

Later, I got a degree in Financial Management and worked as a Professional Investor for a Belgian Asset Management Company.

I learned a lot in the institutional world, for example:

How to speed-read balance sheets…

How to spot if management is being transparent when you talk to them…

Or how to identify a company’s key risks.

But the most important thing I learned was this…

Individual investors have a big edge over investment professionals

Institutional investors are heavily invested in major indexes like the S&P 500.

Holding it ensures they don’t underperform the market. There’s just one problem with this approach…

When the S&P 500 tanks, so does their portfolio. And the pain is real.

That’s why I chose a very different approach for my personal money.

I ignore the S&P 500. Instead, I focus on just one thing: The most powerful Compounders.

It’s how I sidestep the worst drops and maximize gains. The results speak for themselves:

Since leaving the institutional world, I’ve made it my mission to uncover the secrets of smart, long-term investing for a wider audience. 🎓

My social media following quickly grew to over 1 million…

… Including giants like Jeff Bezos, Bill Ackman, or Lebron James.

But my passion isn’t mingling with hedge fund managers and celebrities…

It’s helping everyday investors build real, lasting wealth—the kind that changes generations. 👑

Which is why I started Compounding Quality.

My Quality Investment Philosophy

Compounding Quality is all about stocks you can buy and hold forever.

This research service is designed to build intergenerational wealth by investing in the world’s most powerful businesses.

These are the stocks that compound quietly in the background, while you do nothing.

Just like the Big Pharma disrupter I just told you about.

Again, you can find all the details on this game-changing company in my brand-new research report “Fast-Tracking the Future: The Company Disrupting The $1.7 Trillion Biotech Industry.”

You can get your hands on this report for FREE within minutes.

All I ask in return is that you give Compounding Quality a risk-free trial.

You may have tried other financial research services. But this is different.

Why? Because I’m all in.

100% of my investable assets are in the Compounding Quality Portfolio.

We’re in this together. My success is your success.

Every stock in the Compounding Quality Portfolio is handpicked using my proven 7-factor system to uncover the most powerful, high-growth companies:

✅ Wide Moat – A lasting competitive edge makes companies nearly untouchable. Instead of chasing trends, smart investors look for market leaders with strong pricing power.

✅ Skin in the Game – Leaders who own meaningful stakes often outperform, ensuring their interests align with investors.

✅ Low Capital, High Growth – The best businesses grow without heavy spending. Companies with low capital intensity and high profitability become compounding machines, reinvesting in growth while maximizing returns.

✅ Smart Capital Allocation – Maximum growth requires companies to reinvest their cash wisely, prioritizing high-return growth opportunities over wasteful spending.

✅ High Profitability – The best companies turn sales into cash effortlessly, with free cash flow margins of 15%+.

✅ Secular Trends – Unstoppable megatrends like obesity treatments, AI, and semiconductors are tailwinds for growth, ensuring steady, long-term expansion.

✅ Quality Comes First – A great company at a fair price beats a mediocre company at a bargain. Quality businesses at reasonable valuations are the key to long-term wealth.

When you join Compounding Quality, you’re not just a subscriber. You’re a Partner.

Because Compounding Quality isn’t only about research. It’s about community.

You’re becoming part of an exclusive network of like-minded investors committed to learning, growing, and sharing insights.

It doesn’t matter if the market is up or down…

Inside this community, we cut through the hype and fear. We focus on the only thing that matters: building real, lasting wealth.

Here’s how Partners love their membership:

I can guarantee you’ll benefit greatly from becoming part of this exclusive community.

But that’s not everything you’ll get.

If you join today, you’ll be automatically upgraded to Founding Partner Status.

As a Founding Partner, you’ll get unrestricted access to my fully allocated 📈 personal Compounding Quality Portfolio.

I have ALL my investable assets in this portfolio

By now, you’re probably wondering how much it all costs.

The normal price to become a Founding Partner is $1,200.

But you won’t have to pay anything near that.

Today, you can get in for a huge discount.

If you act now, you can become a Compounding Quality Founding Partner for just $399/annually.

In other words, you’ll save $800.

The best part?

You’ll lock in this discount for as long as you stay subscribed.

That’s $800 you save every year.

This comes at a cost to me.

If just 0.1% of my readers take this offer, I stand to lose as much as $344,000.

It might seem crazy to pass up on this kind of money, but I’d hate to see my readers miss out on the power of compounding.

Again, my success is your success.

Of course, I’m still running a business. But I’m not doing this to make a quick buck.

I’m in it for the long haul.

Warren Buffett is 94 years old, I’m 28—hopefully this gives me another 70 years of doing this.

And I’m convinced that once you see how much Compounding Quality has to offer, you’ll stay with me for years to come.

Here’s everything you’ll get as a new Partner:

📈 My Personal Compounding Quality Portfolio full of quality stocks

✍️ Three articles per week (Tuesdays, Thursdays & Sundays)

📚 Full access to our entire library of data-driven articles

🔎 Full investment cases about exciting companies

📊 Access to the Private Community

🎥 Private Zoom meetings with the CEOs of the companies we own

And of course, my brand-new research report: “Fast-Tracking the Future: The Company Disrupting The $1.7 Trillion Biotech Industry.”

Subscription price: $399/Year

And to be clear, I’m not asking you to make a long-term commitment today.

I’m simply asking you to take a look and decide if Compounding Quality is right for you.

If you aren’t happy with the information you receive, you’re backed by my…

100% Money-Back Guarantee

You have a full 90 days to check out Compounding Quality.

If you aren’t completely happy, for any reason at all, let me know. I'll refund every penny you've spent on the subscription — no questions asked.

All the research you receive is yours to keep, of course.

Right now, you’re standing at a critical moment.

Do you walk away from what could be the biggest Big Pharma disruption of our lifetime?

A shake-up as powerful as Netflix crushing Blockbuster, Salesforce reinventing software, and Amazon dominating retail.

Remember, $1.7 trillion Big Pharma cash is up for grabs.

And this Midwestern powerhouse is perfectly positioned to redirect a massive share of that wealth into the hands of early investors.

Or do you seize this moment and take a decisive step on your path to lasting wealth?

The choice is yours.

If you want to be ahead of the curve… before the rest of the market catches on… join Compounding Quality now and get all the details.

I look forward to welcoming you as a Compounding Quality Partner!

P.S. Don’t forget—your annual membership automatically upgrades you to Founding Partner status, locking in an $800 discount. Just click here, subscribe to the annual plan, and secure your savings today.

Everything in life compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data