🤝 Meeting the CEO of Kinsale Capital

Kinsale Capital is an amazing business.

We hosted a 1-on-1 meeting with Michael Kehoe (CEO) and Bryan Petrucelli (CFO).

Let’s discuss what we learned.

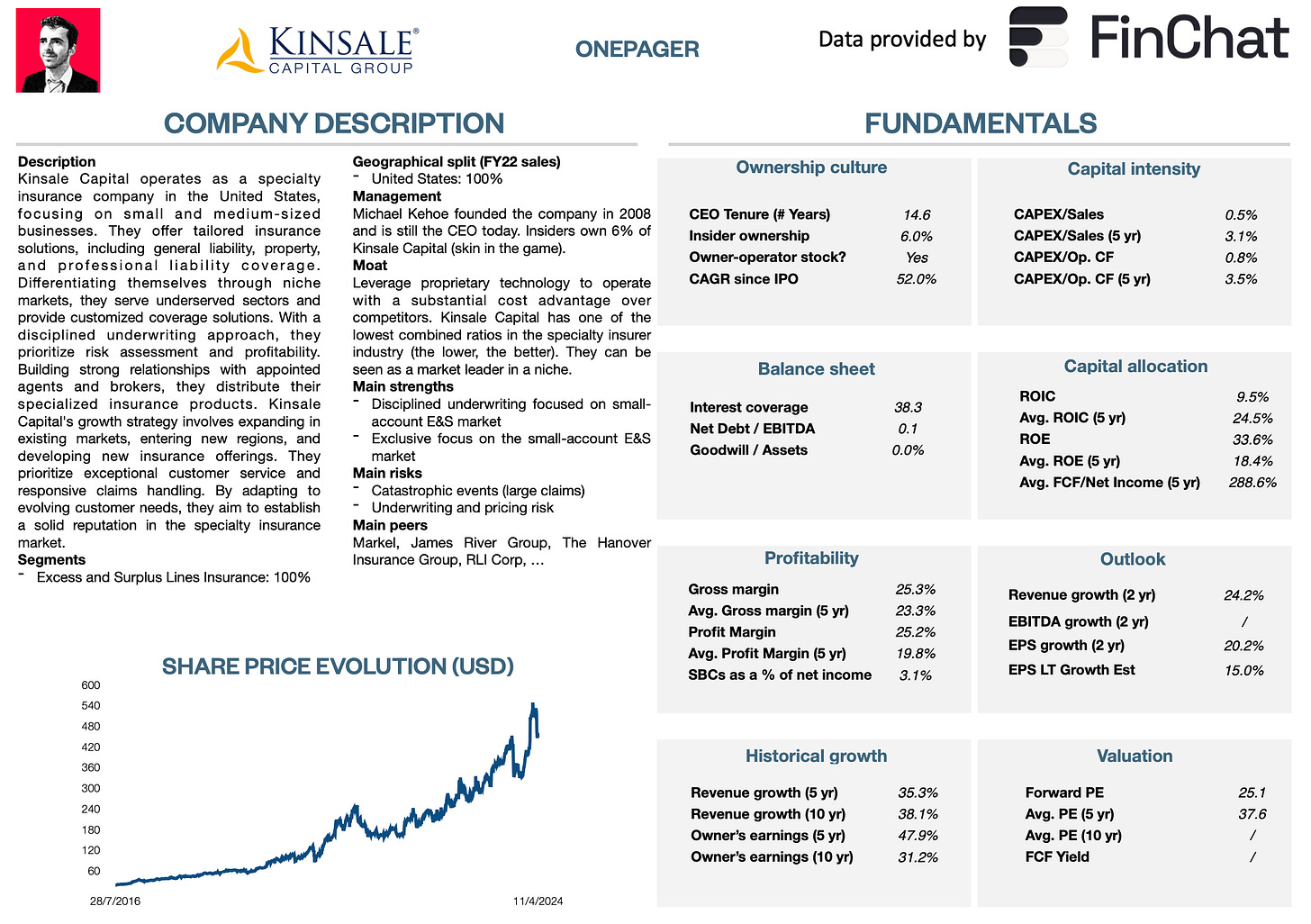

Onepager

Are you not familiar with Kinsale Capital yet?

Here are the essentials:

Here is what we already wrote about Kinsale Capital in the past:

9 May 2024: Kinsale Capital Deep Dive Part 3

9 May 2024: Kinsale Capital Deep Dive Part 2

12 May 2024: Portfolio Update May 2024

9 May 2024: Kinsale Capital Deep Dive Part 1

28 April 2024: Buying Kinsale Capital

14 April 2024: Not So Deep Dive Kinsale Capital

3 December 2023: Best Buys December 2023

27 July 2023: 15 Quality stocks you've never heard of

🧠 What we learned

What is Kinsale Capital’s allocation strategy?

Disciplined underwriting and low costs will allow them to take market share in the foreseeable future

Keeping a low loss ratio is one of the most important things for insurance companies

Management targets a ROE of at least 15%

Kinsale Capital has no interest in inorganic growth (M&A)

In the long term, they might generate more cash flow than they need for the business. This will give room for share buybacks and dividends

How do you look at finding the right balance between growth and profitability?

Over the past few years, Kinsale didn’t need to balance them. They have grown at heroic rates while being very profitable. Kinsale has grown its revenue by around 40% per year in the past

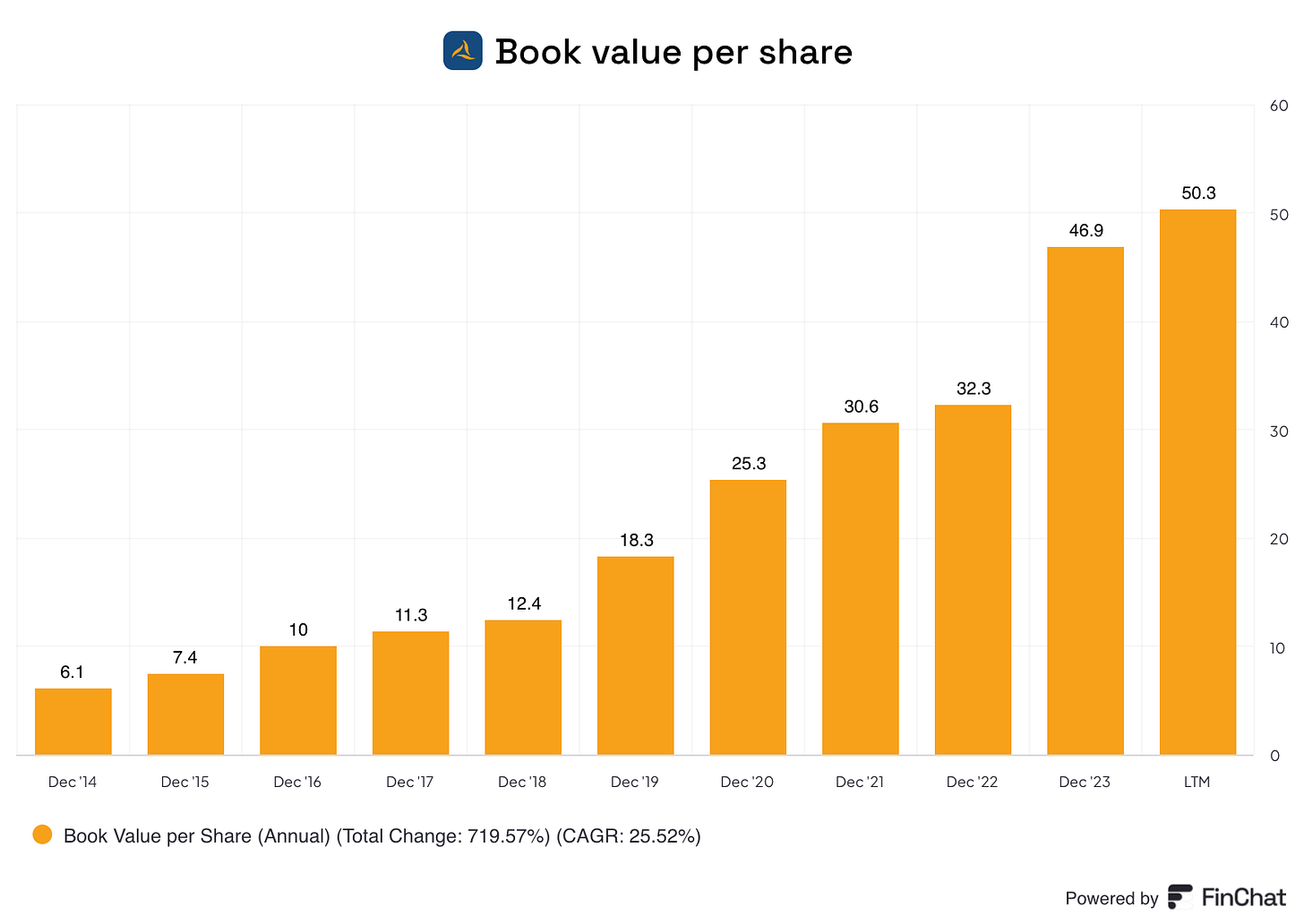

Generally speaking, management will balance growth and profitability with the end goal of maximizing the growth of the book value per share

Michael Kehoe would rather have a 15% ROE and a 15% growth rate than a 20% ROE and a 10% growth rate

Kinsale Capital has 8x’ed its book value since 2014:

Source: Finchat

Which long-term growth rate will Kinsale Capital target?

The goal for Kinsale Capital is to get rich slowly as Charlie Munger said

Kinsale wants to grow by 10-20% per year in the very long term

Michael Kehoe said they will keep executing its strategy: disciplined underwriting while keeping costs low

If the overall P&C industry will grow by 4-5% per year nominally, the E&S market will grow at slightly higher rates

Two-thirds to 75% of the E&S market would fit into Kinsale’s business. This means there is still plenty of growth potential

Kinsale Capital expects to take market share in the years ahead

“Last year Kinsale had a market share of 1.7% in the E&S market. It won’t take 15 years to reach a market share of 3.4%.”

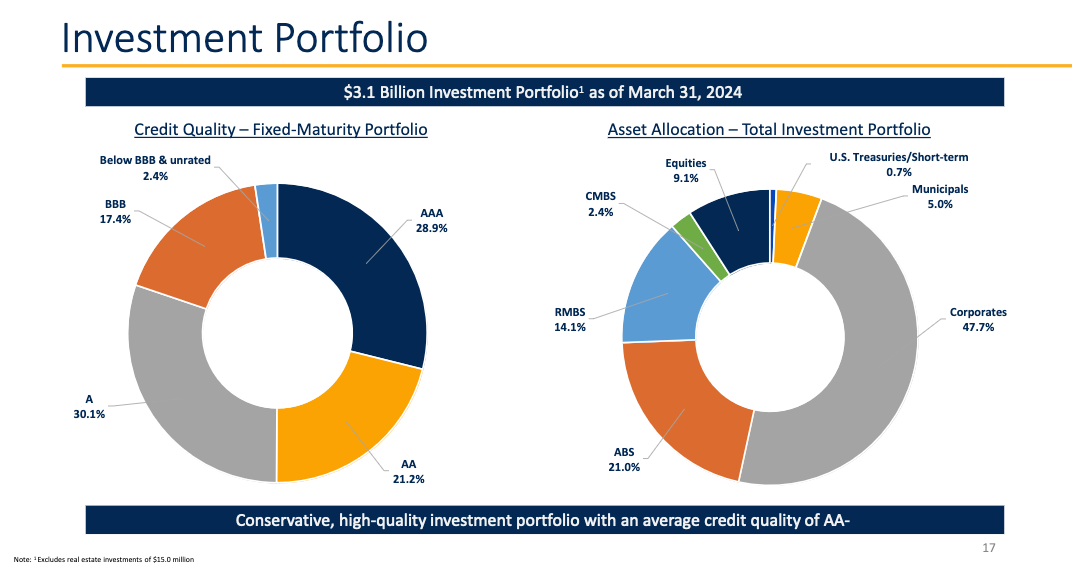

What is Kinsale Capital’s investment strategy?

Kinsale has taken a cautious approach to its investment strategy

Fixed income investments are made in-house. Equity investments are outsourced to Blackrock

“If we triple the amount of assets 5 years from now, it would make sense to keep developing in-house investment capabilities”

As the growth rate has moderated recently, Kinsale allocates a slightly higher percentage of its portfolio to equities versus fixed income. This trend could continue over time