Currently I'm in Omaha to attend the Berkshire Hathaway meeting. I'm looking forward to updating you all about the key learnings!One of the best compounders of today? MercadoLibre.

Its Intrinsic Value (Owner’s Earnings) has doubled every two years!

Is MercadoLibre the next Amazon? Let’s have a look.

MercadoLibre - General Information

👔 Company name: MercadoLibre

✍️ ISIN: US58733R1023

🔎 Ticker: MELI

📚 Type: Owner-Operator Stock

📈 Stock Price: $2,280.9

💵 Market cap: $115.6 billion

📊 Average daily volume: $863.6 million

Onepager

Here’s a onepager with the essentials of MercadoLibre:

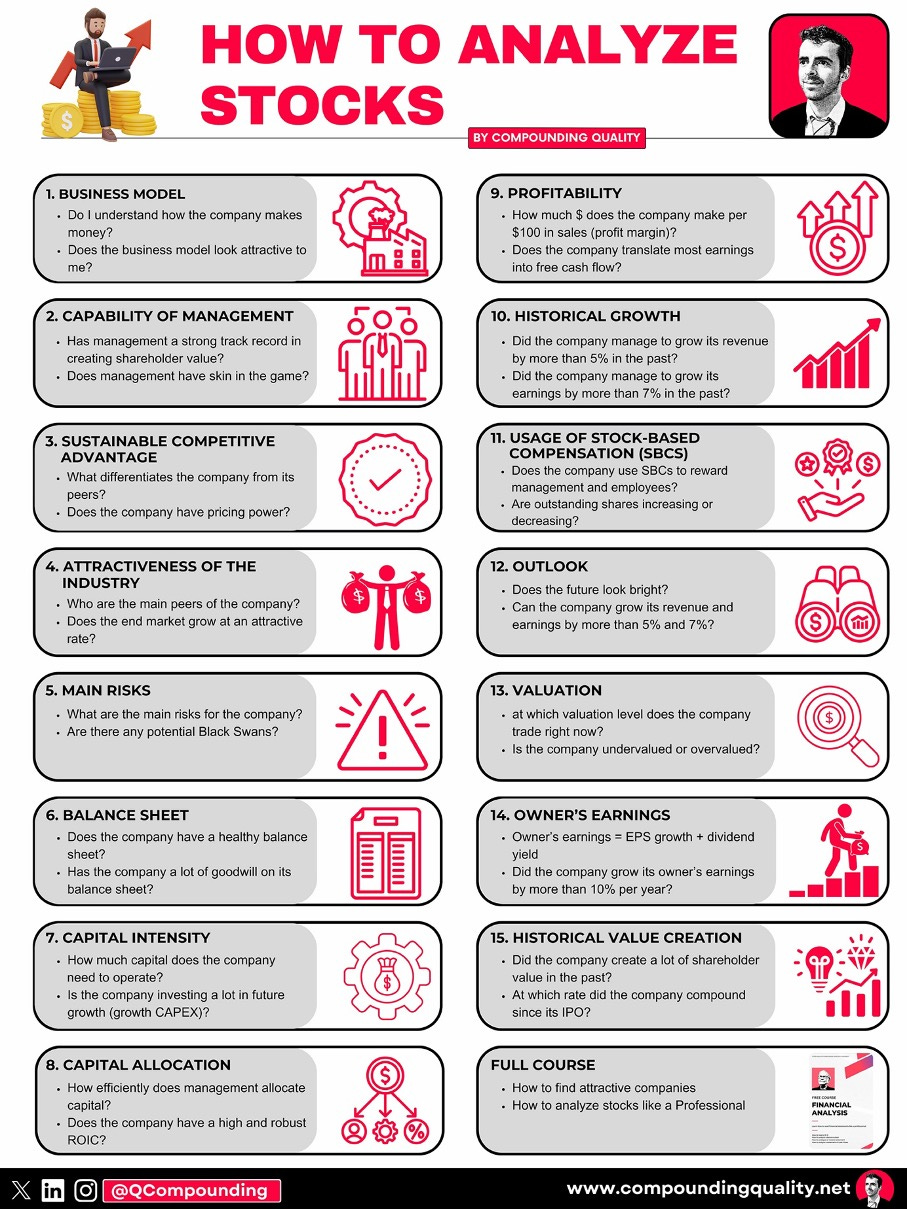

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give MercadoLibre a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

Most people have never heard of MercadoLibre.

But if you buy or sell anything online in Latin America, you’re probably using their services, whether you know it or not.

Think of MercadoLibre as the Amazon of Latin America. Except, in some ways, it’s even better.

The company was founded in 1999 with a simple goal: to make online commerce easy.

Today, it dominates the entire system. Here’s how:

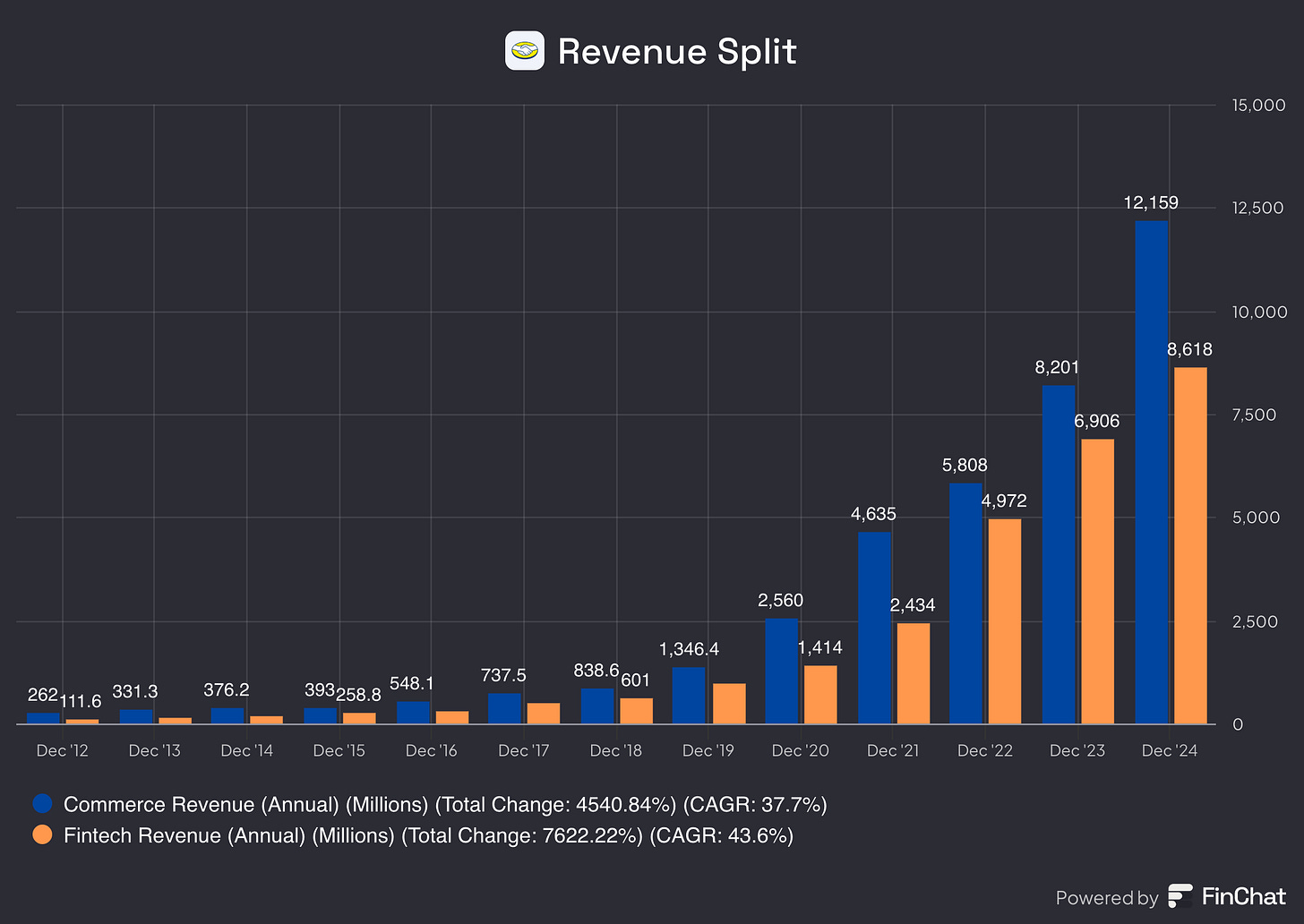

Commerce (58.5% of Total Revenue): MercadoLibre takes a cut every time someone buys or sells on its platform. They also handle shipping through Mercado Envíos, making it even harder for competitors to break in.

Fintech (41.5% of Total Revenue): MercadoLibre owns Mercado Pago, a digital wallet that processes transactions. If you pay through Mercado Pago, the company earns yet another fee.

Both revenue streams grew at a CAGR of around 40% (!) in the past:

2. Is management capable?

Marcos Galperin is the CEO and co-founder of MercadoLibre.

He had a remarkable life before he founded the company:

Studied economics and finance at the University of Pennsylvania and earned an MBA from Stanford

Helped organize Argentina's first presidential debate in 2015

His grandfather founded Sadesa, one of Argentina's biggest leather companies

Today, Galperin still owns 7% of the company (value: $7.6 billion).

Another fun fact? eBay used to own 18% of MercadoLibre, and sold its stake in 2016 for $1 billion. If they held on, it would be worth $20.8 billion today. That’s more than 50% of eBay’s current market cap!

3. Does the company have a sustainable competitive advantage?

MercadoLibre has a moat based on network effects.

Let’s say you want to sell your old PlayStation 4. You want to list it where the most buyers are, right? And if you’re buying the PlayStation 5, you go where the most sellers are.

That’s the beauty of network effects. The more people use it, the more valuable it becomes.

Sellers stay because that’s where the customers are

Buyers stay because that’s where the best selection is

This cycle keeps repeating, making it nearly impossible for competitors to break in

Furthermore, MercadoLibre also benefits from great logistics infrastructure, Fintech dominance through MercadoPago, and a strong brand across Latin America.

Companies with a sustainable competitive advantage are often characterized by the following:

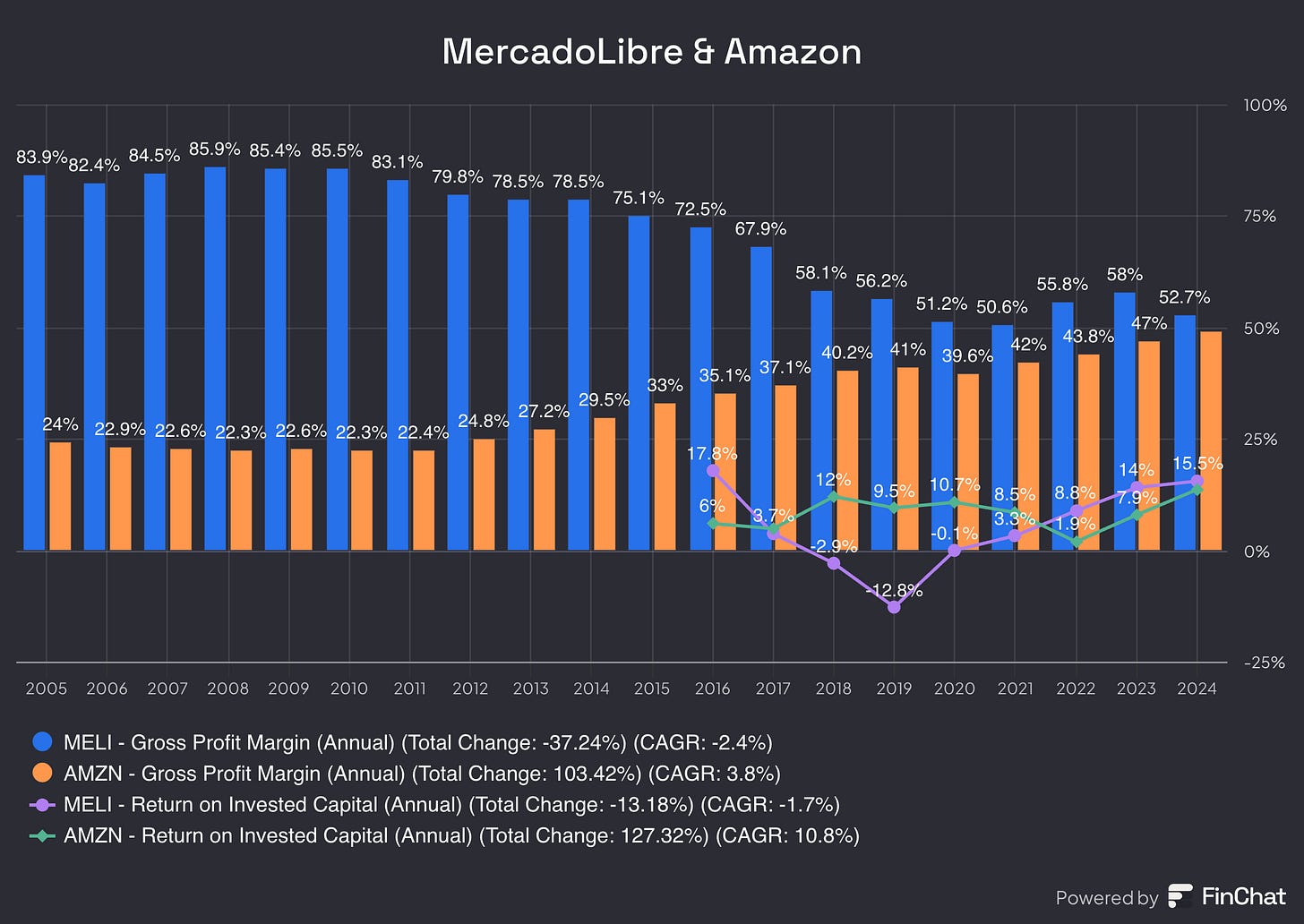

Gross Margin: 52.7% (Gross Margin > 40%? ✅)

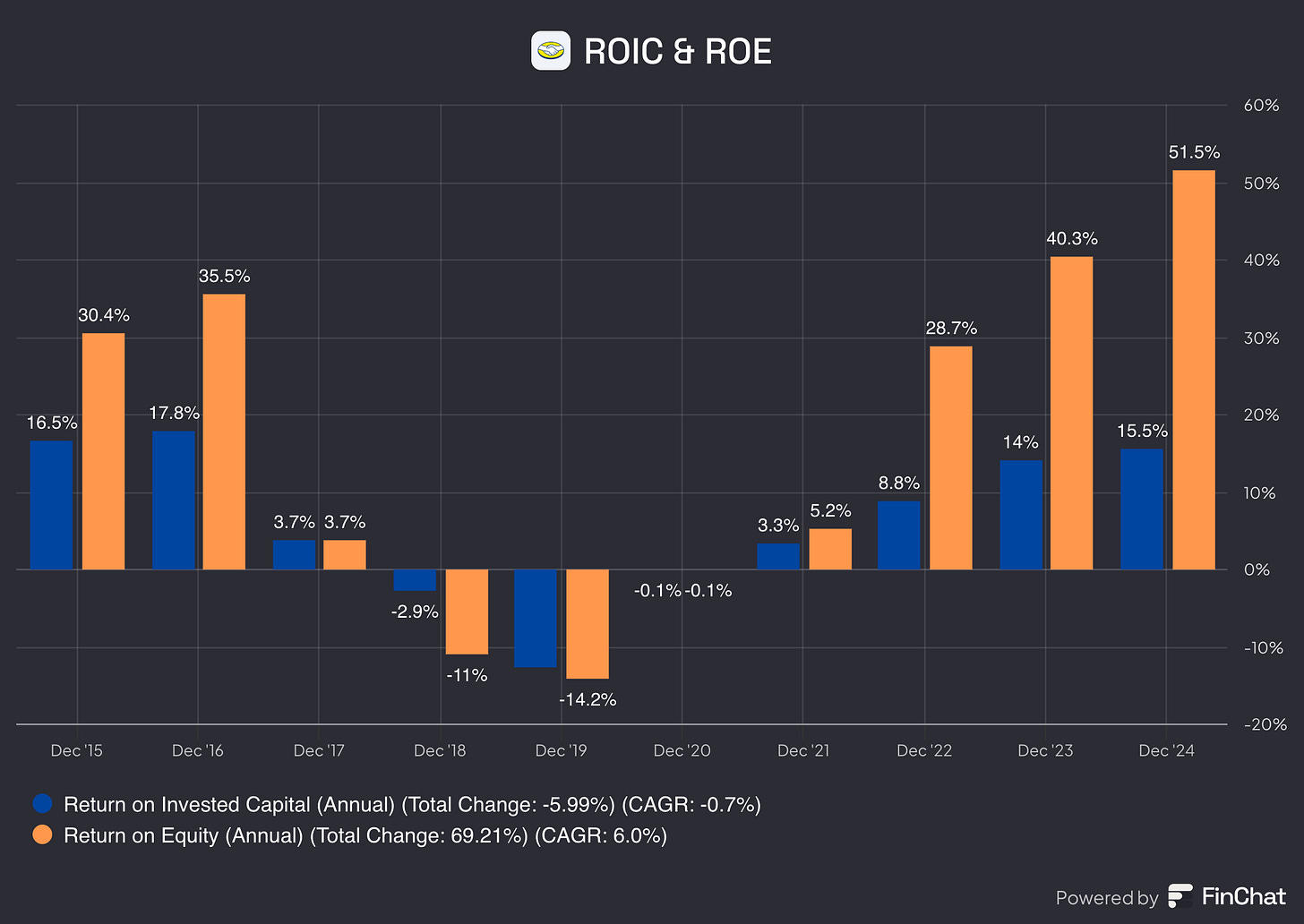

Return On Invested Capital (ROIC:) 15.5% (ROIC > 15%? ✅)

The Gross Margin and ROIC look better than their main peer, Amazon:

4. Is the company active in an interesting end market?

MercadoLibre is active in two interesting end markets:

E-commerce: According to Statista, the number of e-commerce shoppers in Latin America will soar over 50% by 2029

Payment processing: According to McKinsey, Fintech companies could grow by 15% per year until 2029

Here are the main peers of MercadoLibre:

Amazon: The Largest e-commerce player in the world

Shopee & AliExpress: Selling low-cost goods from Asia

Americanas SA: Big retailer in Brazil

As you can see, MercadoLibre is the main online marketplace in Latin America:

5. What are the main risks for the company?

Here are the main risks for MercadoLibre:

Economic instability: Latin America faces inflation, currency swings, and political risks

Dependence on CEO and co-founder Marcos Galperin

Intense competition: mainly from Amazon

Regulation: governments could tighten rules on e-commerce, payments, or Fintech

Logistics challenges: Delivering across Latin America is tough due to infrastructure gaps

Fraud and security risks: Online payments and marketplaces attract scammers

Dependence on Brazil and Argentina: These two countries drive much of its business

6. Does the company have a healthy balance sheet?

We look at three ratios to determine the healthiness of the balance sheet:

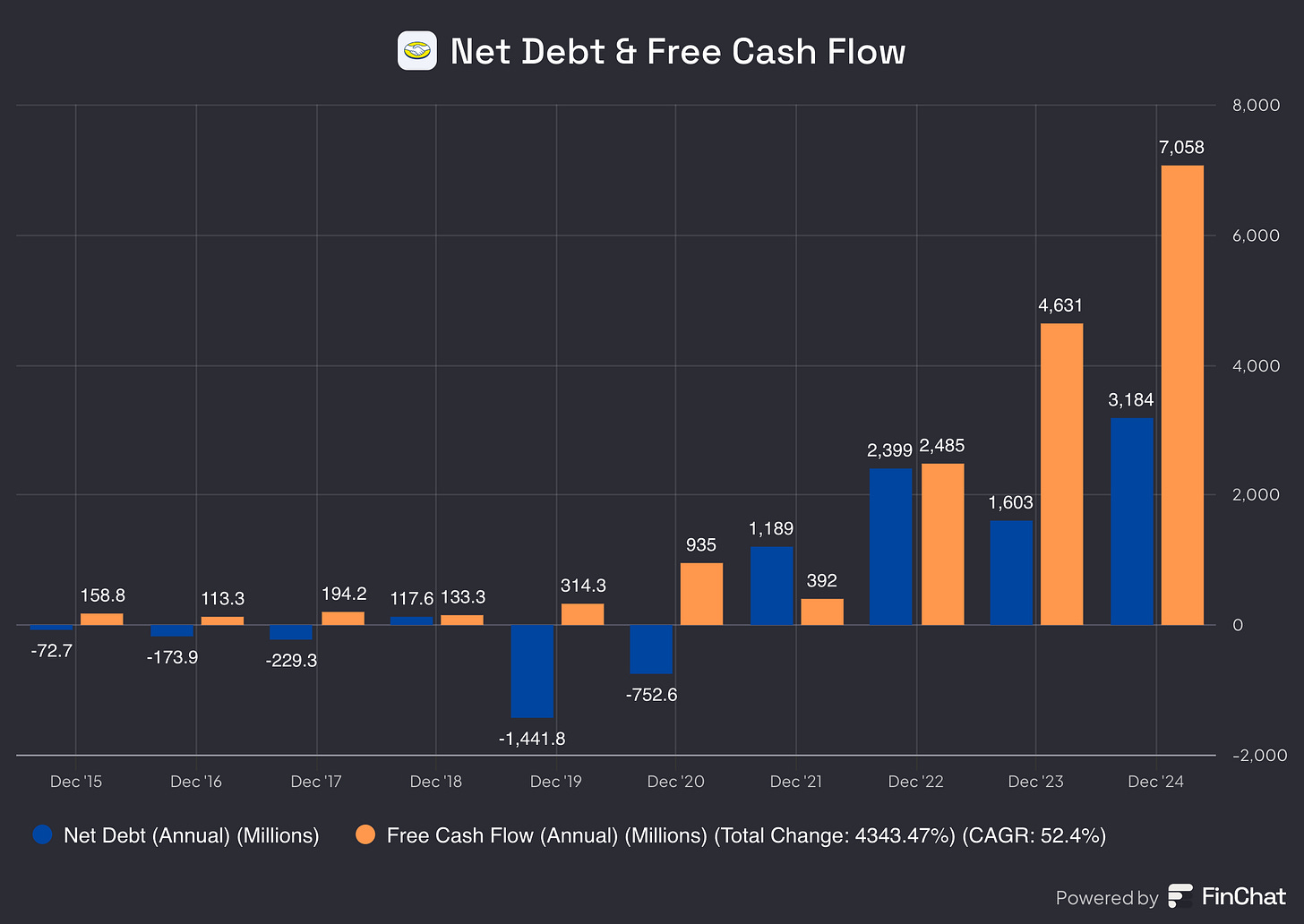

Interest coverage: 15.9x (Interest Coverage > 15x? ✅)

Net Debt/FCF: 0.5x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 0.6% (Goodwill/Assets < 20%? ✅)

MercadoLibre has a healthy balance sheet.

7. Does the company need a lot of capital to operate?

The less capital a business needs to operate, the better.

Here’s what things look like for the company:

CAPEX/Sales: 4.1% (CAPEX/Sales? < 5%? ✅)

CAPEX/Operating Cash Flow: 10.9% (CAPEX/Operating CF? < 25%? ✅)

These numbers look good.

8. Capital allocation

Capital allocation is the most important task of management.

How does MercadoLibre score on this metric?

MercadoLibre:

Return on Equity (ROE): 51.5% (ROE > 20%? ✅)

Return on Invested Capital (ROIC): 15.5% (ROIC > 15%? ✅)

The company can be seen as a good capital allocator.

9. How profitable is the company?

The higher the profitability of the business, the better.

Here’s what things look like for MercadoLibre:

Gross margin: 52.7% (Gross margin > 40%? ✅)

Net Profit Margin: 9.2% (Net Profit Margin > 10%? ❌)

FCF/Net income: 369.3% (FCF/Net income > 80%? ✅)

A lower Net Profit Margin is typical for an e-commerce platform.

But look at Free Cash Flow (FCF). It’s much higher than Net Income.

Why? MercadoLibre uses its working capital very efficiently.

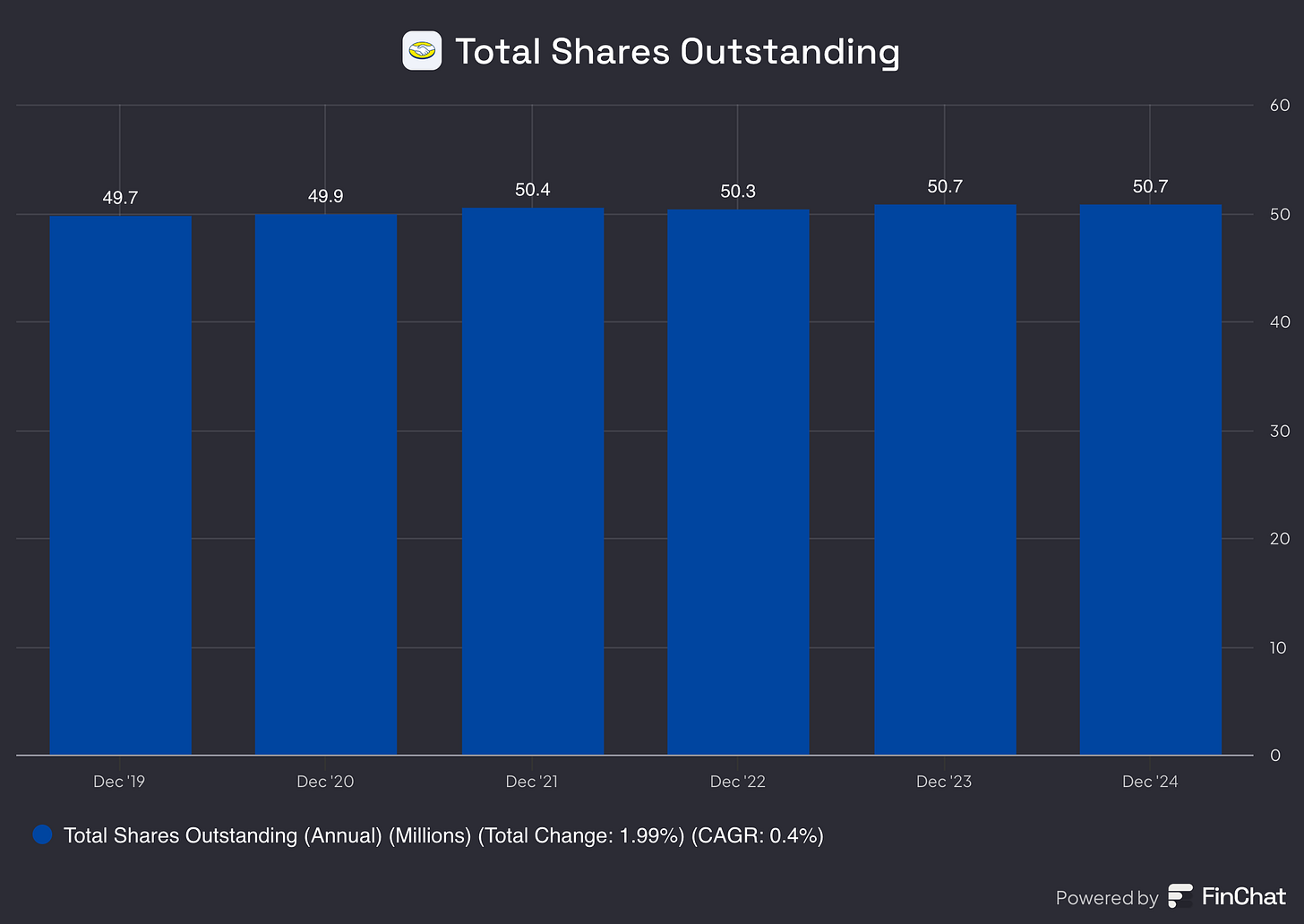

10. Does the company use a lot of Stock-Based compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Preferably, we want SBCs as a % of Net Income to be lower than 10%.

MercadoLibre:

SBCs of a % of Net Income: 14.1% (SBSs/Net income < 10%? ❌)

It’s important to know that Net Income is also quite low.

As you can see in the chart, the number of total shares outstanding is increasing slightly:

11. Did the company grow at attractive rates in the past?

Let’s look at what recent history tells us:

Revenue growth past 5 years (CAGR): 55.3% (revenue growth > 5%? ✅)

Revenue growth past 10 years (CAGR): 43.6% (revenue growth > 5%? ✅)

EPS growth past 5 years (CAGR): 59.0% (EPS growth > 7%? ✅)

EPS growth past 10 years (CAGR): 36.9% (EPS growth > 7%? ✅)

MercadoLibre has grown phenomenally in the past.

12. Does the future look bright?

Here are the analysts’ estimates for MercadoLibre:

Exp. Revenue growth next 2 years (CAGR): 23.6% (Revenue Growth > 5%? ✅)

Exp. EPS growth next 2 years (CAGR): 30.8% (Revenue Growth > 7%? ✅)

Long-term growth estimate EPS (CAGR): 28.5% (EPS Growth > 7%? ✅)

This outlook looks very attractive. It’s important to know that analysts are usually too optimistic.

13. Does the company trade at a fair valuation level?

We always use three methods to look at the valuation of a company:

A comparison of the Forward PE multiple with its historical average

Earnings Growth Model

Reverse Discounted-Cash Flow

A comparison of the Forward PE multiple with its historical average

The first thing we do is compare the current forward PE with its historical average over the past 10 years.

This is a shortsighted method, but it already gives a quick indication.

Today, MercadoLibre trades at a forward PE of 49.1x compared to a historical average of 370.4x.

Net Income was around zero in 2020 and 2021. This gives a distorted view of the historical average.

If we look at the situation since 2022, it already gives a better picture.

The company is undervalued compared to its historical average, but a Forward PE of 49.1x still looks high.

Currently, MercadoLibre trades at 27.2x the expected earnings of 2027.

Earnings Growth Model

This model shows you the yearly return you can expect as an investor.

You can explore more about the Earnings Growth Model here.

Here are the assumptions I use:

EPS growth: 15% per year over the next 10 years

Dividend Yield: 0.0%

Forward PE to decline from 49.1x to 30.0x

Expected yearly return = 15% + 0.0% + 0.1((30.0x – 49.1x)/49.1x)) = 11.1%

Reverse DCF

Charlie Munger once said that if you want to find a solution to a complex problem, you should invert. Always invert. Turn the problem upside down.

This is exactly what a reverse DCF does. As investors, we don’t like to make assumptions. We simply look at what assumptions the market has made and see whether they are reasonable.

For MercadoLibre, we should use Net Income instead of Free Cash Flow. Net Income better reflects the company’s true earnings power.

The expected Net Income of the next 12 months equals $2,380.5 million.

We subtract the Stock-Based Compensation ($261 million) and add Growth CAPEX ($248 million) to arrive at Net Income in year 1 of $2,367.5 million.

The reverse DCF indicates that MercadoLibre's Net Income should grow by 19.2% each year for the next ten years.

MercadoLibre:

Forward PE: 49.1x (Forward PE not too high? ❌)

Earnings Growth Model: 11.1% (Yearly return? > 10%? ✅)

FCF-Growth Reverse DCF: 19.2% (Realistic growth expectations? ❌)

14. How did Owner’s Earnings evolve in the past?

Over time, stock prices tend to follow the Owner’s Earnings of the company.

Owner’s Earnings = EPS Growth + Dividend Yield

That’s why we want to invest in companies that managed to grow their Owner’s Earnings at attractive rates in the past.

This is the case for MercadoLibre:

CAGR Owner’s Earnings (5 years): 59.0% (CAGR Owner’s Earnings > 12%? ✅)

CAGR Owner’s Earnings (10 years): 36.9% (CAGR Owner’s Earnings > 12%? ✅)

15. Did the company create a lot of shareholder value in the past?

We want to invest in companies that have compounded at attractive rates in the past.

Ideally, the company has returned more than 12% per year to shareholders since its IPO.

Here’s what the performance of MercadoLibre looks like:

YTD: +29.2%

5-year CAGR: +31.3%

CAGR since IPO in 2007: +28.3% (CAGR since IPO > 12%? ✅)

Quality Score

Finally, let’s bring everything together and give the company a Total Quality Score.

As you can see in the table below, MercadoLibre gets a Total Quality Score of 7.9/10:

Conclusion

MercadoLibre is an amazing business.

I don’t own it for my Portfolio and have no intention to buy it in the near future. The key reason for this? I see more attractive opportunities elsewhere.

Here’s what the performance of Our Portfolio looks like since inception in October 2023:

Subscribe to Compounding Quality to get immediate access to the entire portfolio:

Everything in life compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data