Our 10 Picks For 2026

2026 is just around the corner.

Good things happen to the prepared ones.

Let’s dive into our 10 favorite stocks of the year.

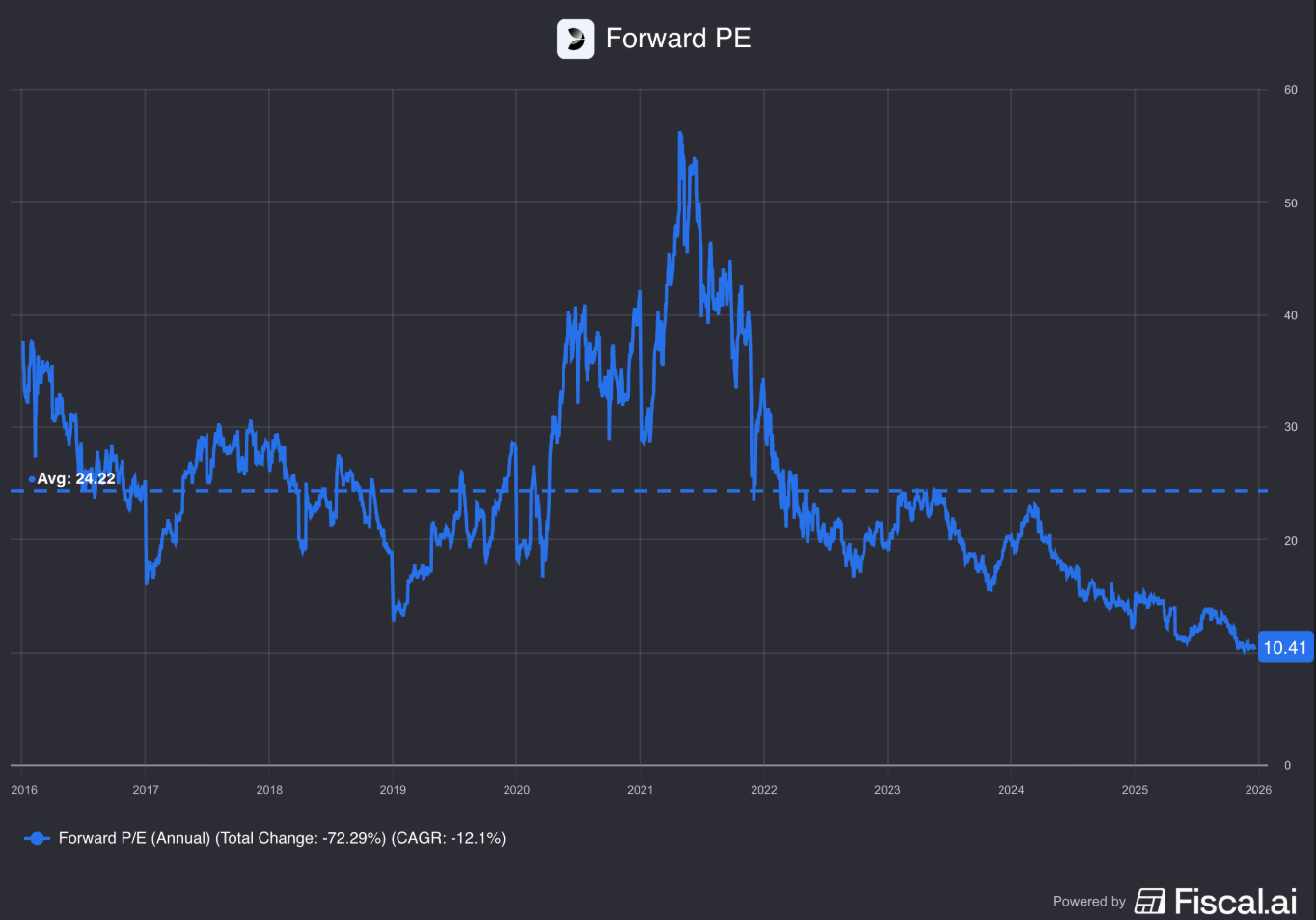

10. Evolution AB ($EVO)

Company Profile

Evolution AB is the world’s leading provider of live casino games for online betting companies.

They supply live-streamed games like Blackjack and Roulette to operators globally.

Every time someone plays a game of Evolution AB, the Swedish company gets paid a commission from the casino.

Investment Rationale

The market for online gambling is growing by more than 11% per year

Evolution AB is a market leader

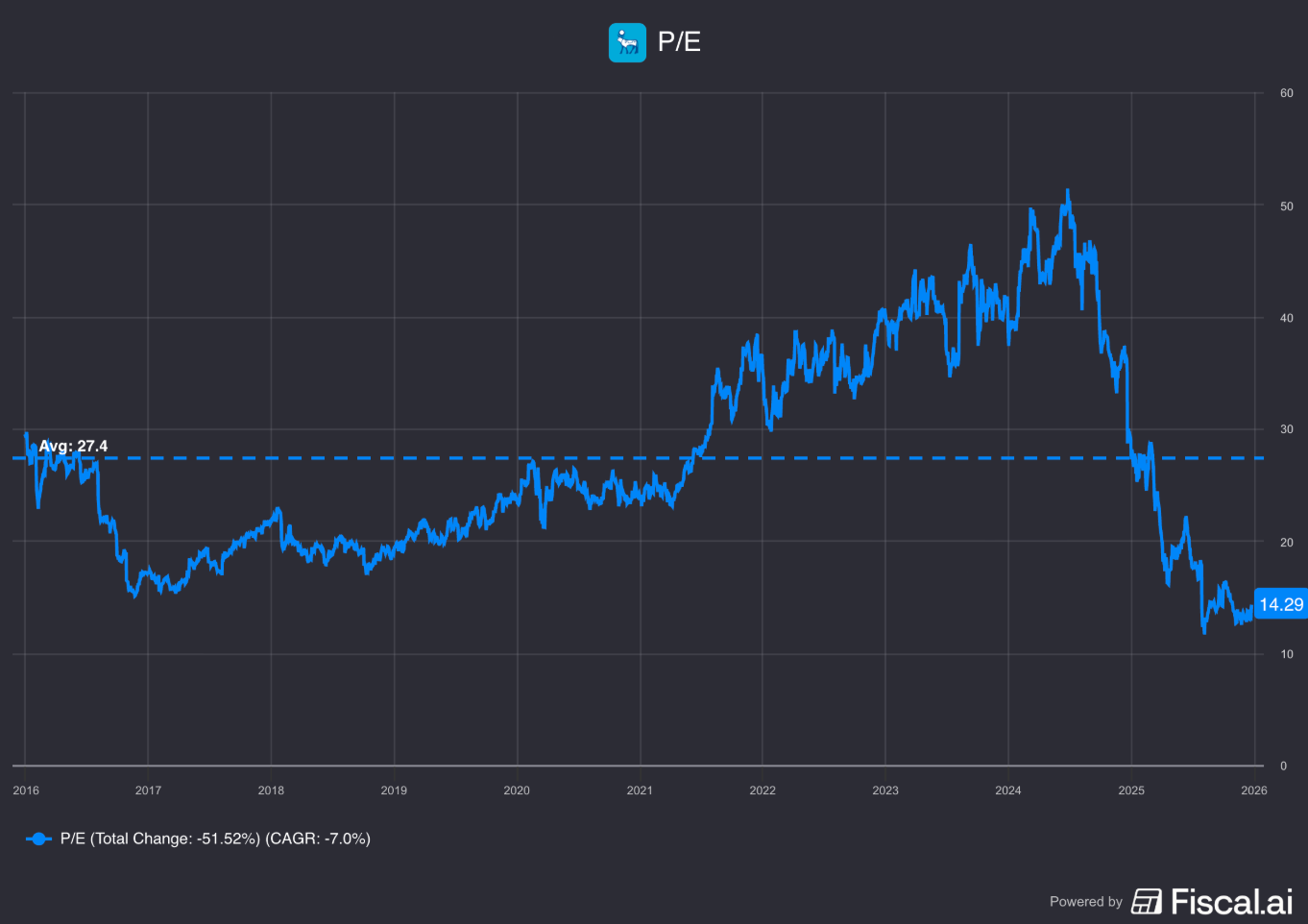

The company is very cheap and they are heavily buying back shares

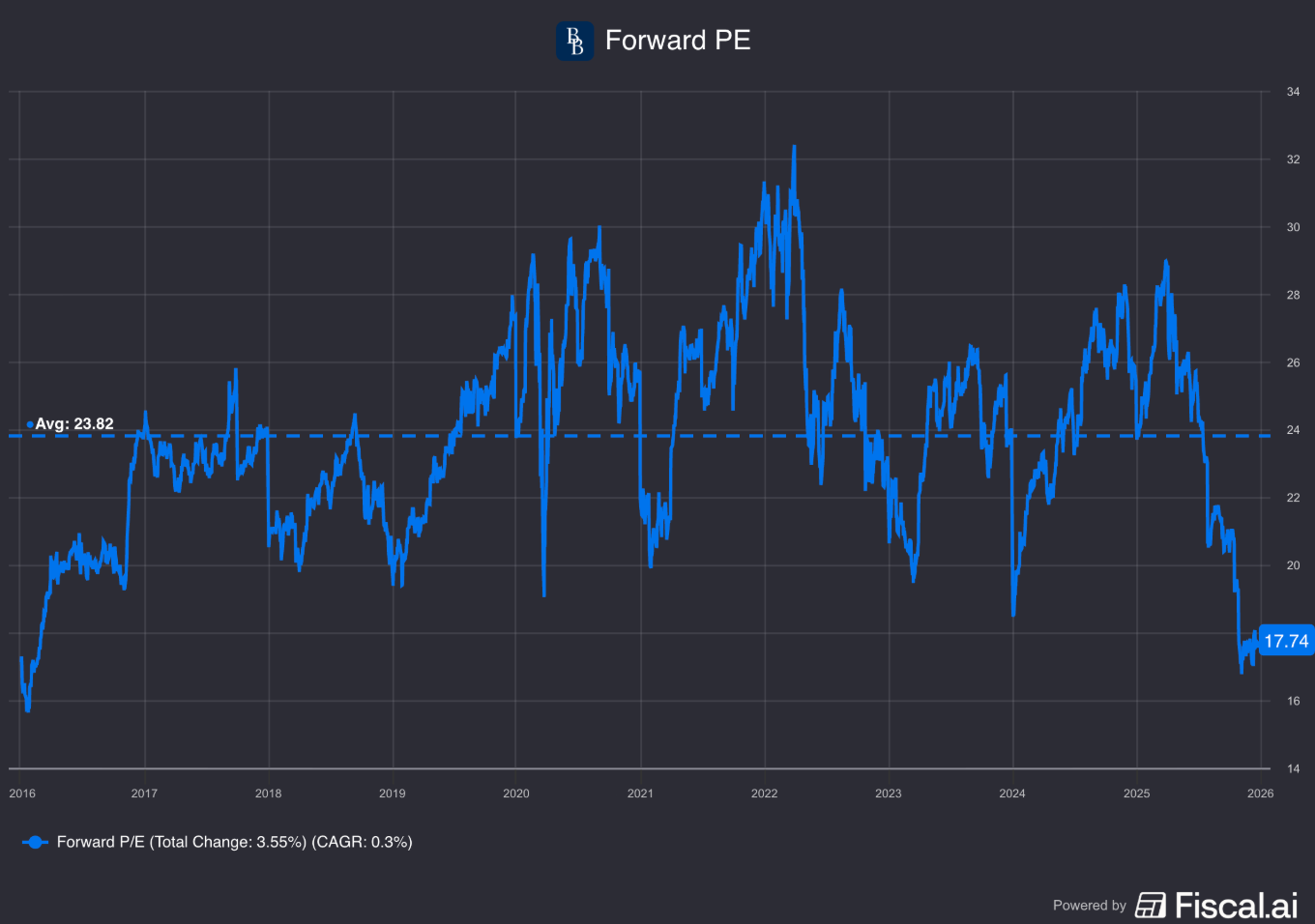

9. Brown & Brown ($BRO)

Company Profile

Brown & Brown is a leading insurance broker. They help their clients find the right insurance coverage.

The company does not carry insurance risk themselves. Brown & Brown is a broker. They get paid when they sell insurance policies to customers.

The company is led by the Brown family. It can be seen as a serial acquirer as they structurally acquire other insurance brokers.

Investment Rationale

Every business needs insurance no matter the economic conditions

Low valuation levels: BRO trades at one of the lowest valuation levels of the past 10 years

Strong compounder: the CAGR since the IPO in 2001 equals 13.1%

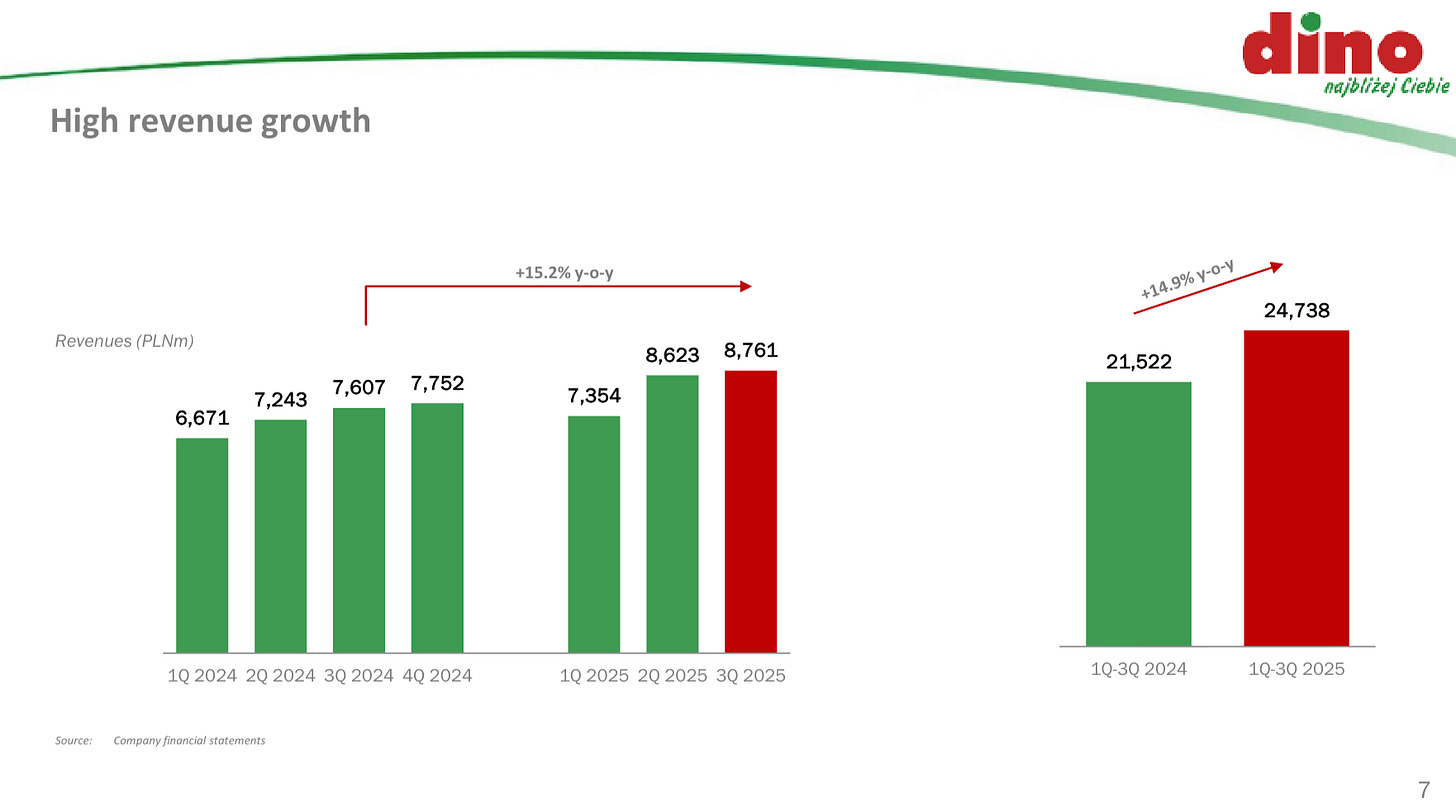

8. Dino Polska ($DNP)

Company Profile

Dino Polska is a leading supermarket chain in Poland.

They sell groceries and everyday items through small, convenient local stores.

The company aims to double its store count over the next few years.

Investment Rationale

Owner-Operator (> 50% insider ownership)

One of the fastest-growing grocery chains in the world

The company reinvests almost all its free cash flow in organic growth

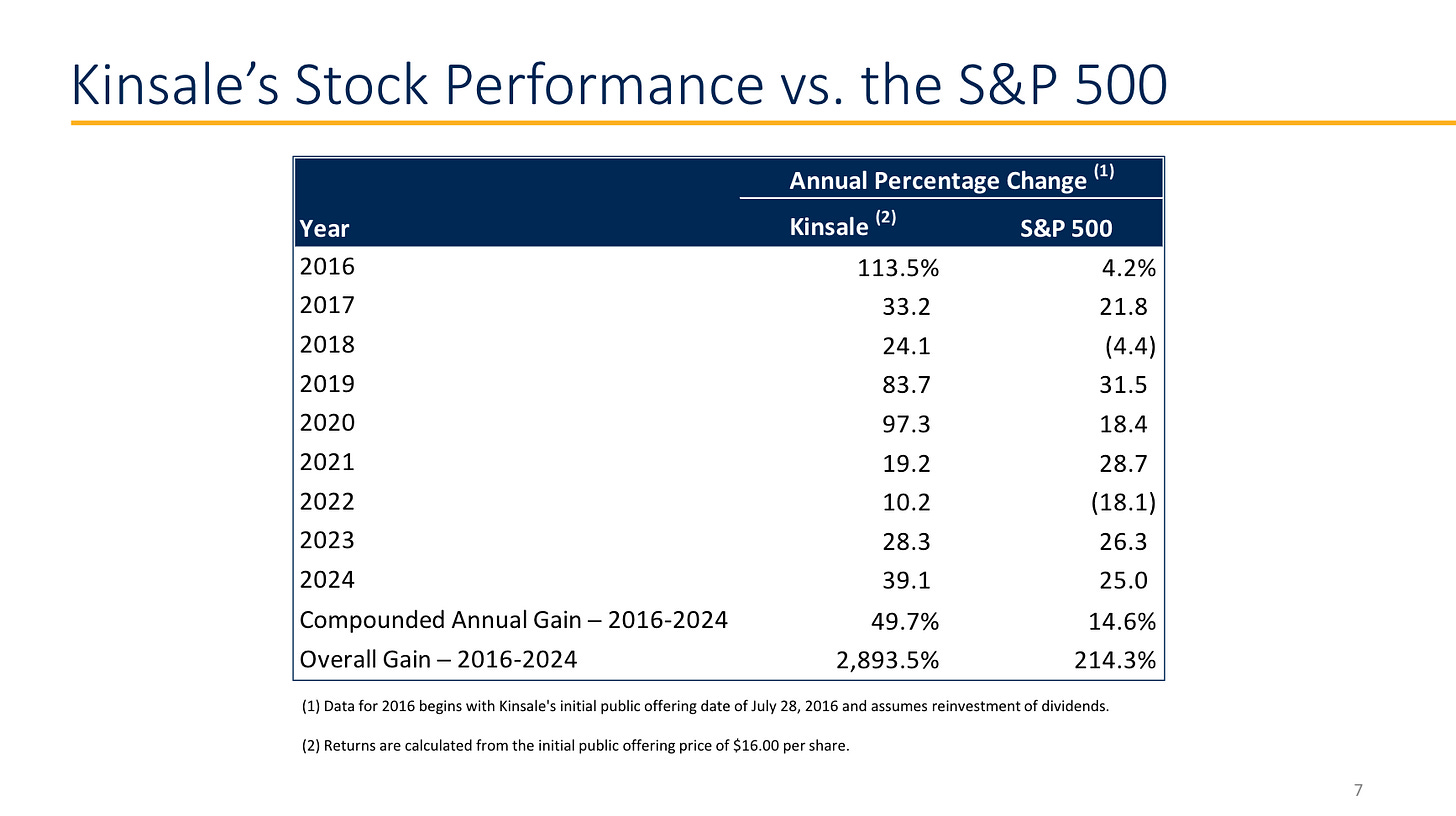

7. Kinsale Capital ($KNSL)

Company Profile

Kinsale Capital is an established and expanding specialty insurance company.

They focus exclusively on the excess and surplus lines (“E&S”) market in the United States.

Kinsale Capital is led by Michael Kehoe. He still owns 3.8% of the company.

You can read our interview with the CEO here.

Investment Rationale

Founder Michael Kehoe is an excellent CEO

Kinsale Capital should be able to double its market share

Strong growth figures (10-year Owner’s Earnings CAGR: 35.6%)

6. Visa ($V)

Company Profile

Does this company still need an introduction? Visa and Mastercard dominate the global digital payment industry.

Both companies operate networks that facilitate electronic transactions between consumers and businesses worldwide.

Instead of issuing cards, they partner with banks, earning fees for every transaction processed through their systems.

Investment Rationale

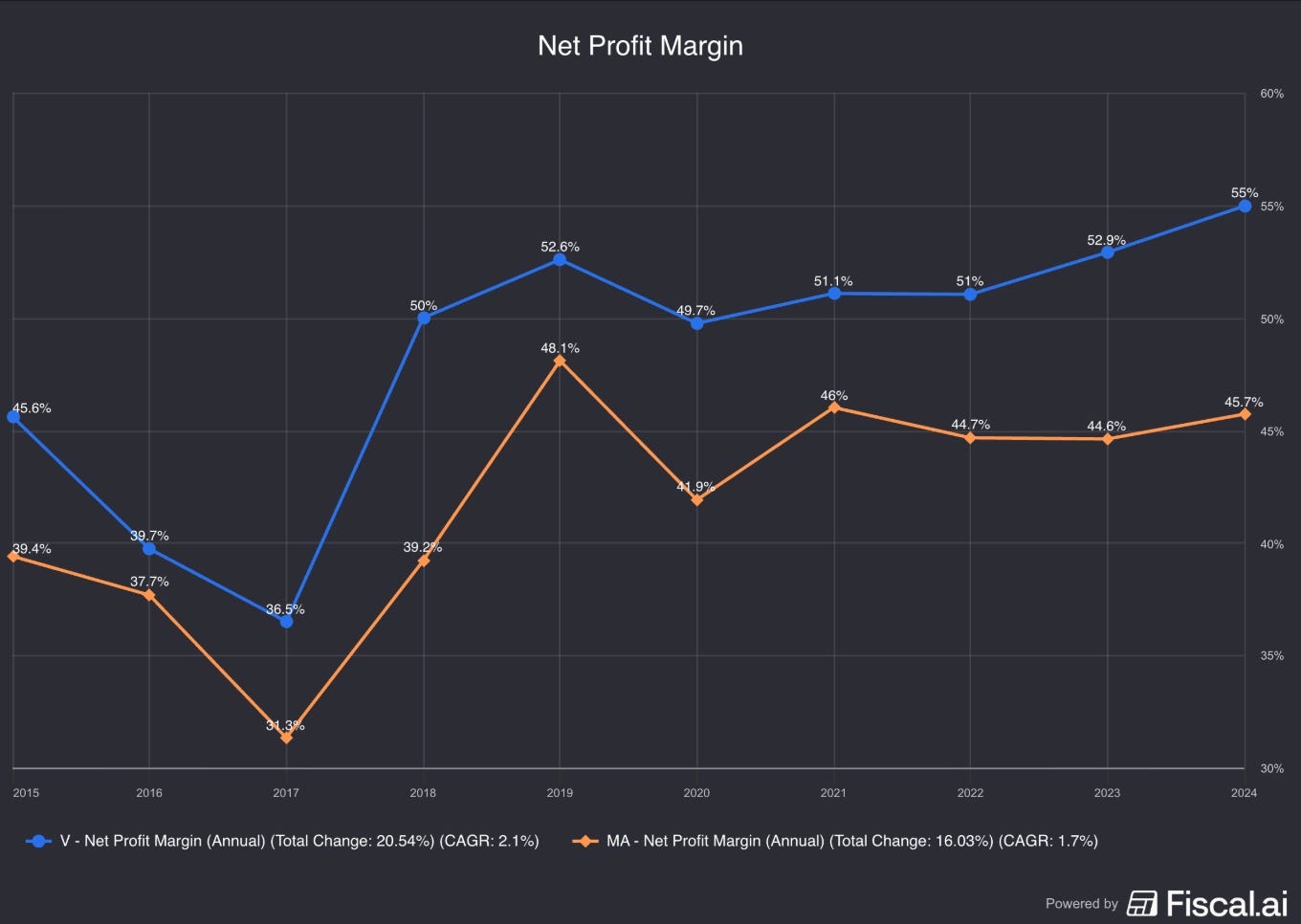

A very profitable duopoly dominating the industry

One of the strongest network effects in the world

The US Digital Payment Market is expected to grow by 17.7% (!) per year until 2034

5. Novo Nordisk ($NVO)

Company Profile

Novo Nordisk is a global market leader in diabetic and obesity care.

They make popular drugs like Ozempic and Wegovy, which are in very high demand.

The company has a strong pipeline of new treatments, supporting long-term growth beyond its current blockbuster drugs.

Investment Rationale

Rising global obesity rates are expected to drive demand for their products

High profitability (Net profit margin: 32.9% )

Novo Nordisk trades at one of its cheapest valuation levels ever

4. Topicus ($TOI)

Company Profile

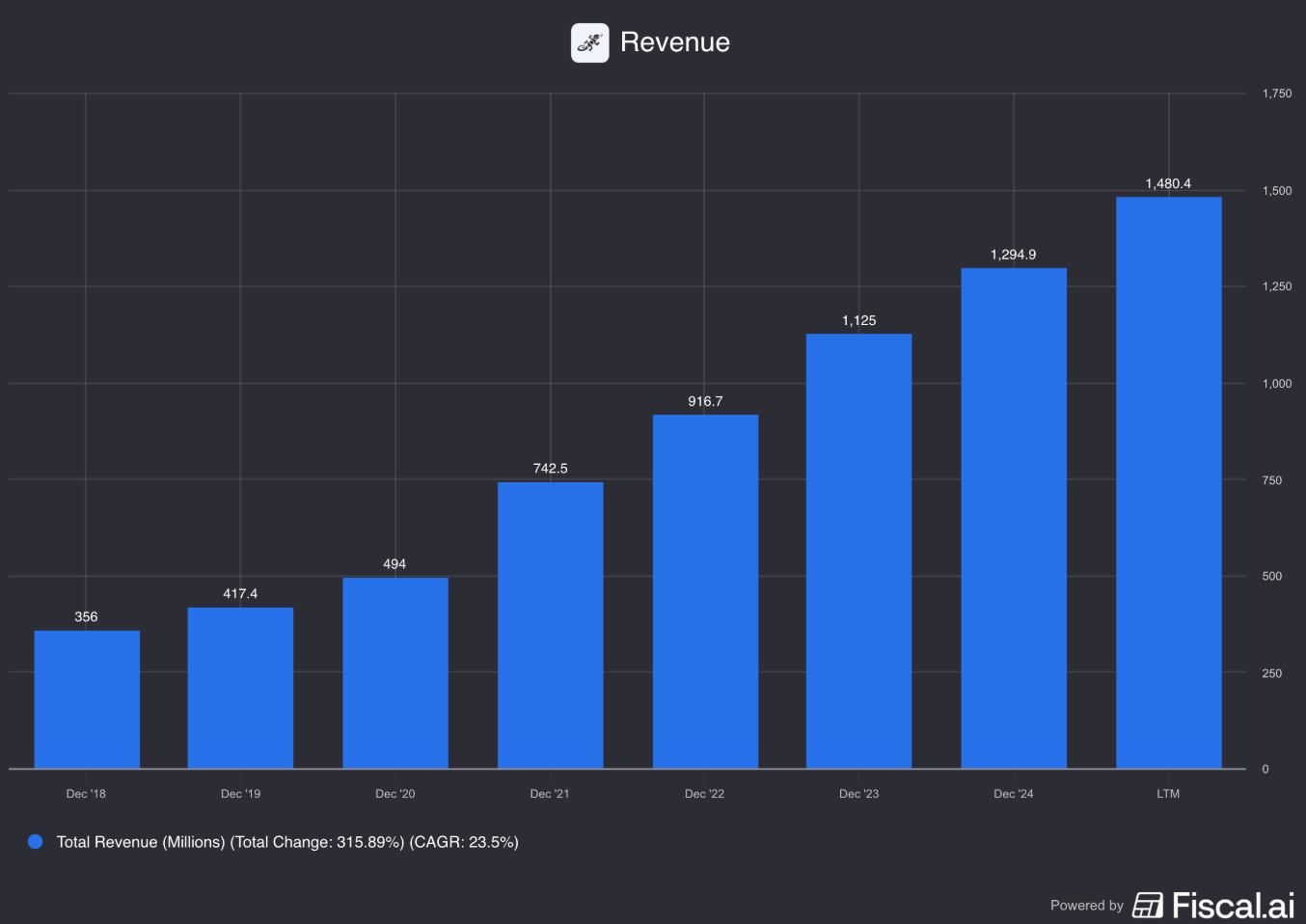

Topicus is a serial acquirer that spun off from Constellation Software.

The company focuses on Vertical Market Software (VMS) in Europe. 70% (!) of their revenue is recurring in nature.

As Topicus is still considerably smaller than Constellation Software, they have way more growth potential.

Investment Rationale

High switching costs create a durable moat

Proven track record of acquiring and integrating vertical market software (VMS) companies

Attractive growth (5-year Revenue CAGR: 25.6%)

Now let’s dive into the top 3.