Our Forever Portfolio

Those who keep learning keep rising in life.

Investing is a beautiful intellectual game.

In general, Compounding Quality invests in 3 buckets:

Owner-Operator Stocks

Monopolies and Oligopolies

Cannibal Stocks

But does this strategy work? Let’s dive in a bit more.

Our forever Portfolio

Here’s the core strategy of our Portfolio:

✅ The portfolio will invest worldwide (developed countries only)

✅ We’ll own 15-20 stocks

✅ The portfolio is aiming to invest in the best companies in the world

✅ We won’t trade a lot. Activity and costs harm our results

✅ We won’t try to time the market (I’m way too dumb for that)

✅ The characteristics of companies in the portfolio:

Sustainable competitive advantage

Integer management with skin in the game

Healthy balance sheet

Low capital intensity

Good capital allocation

High profitability

Plenty of reinvestment opportunities

Trading at fair valuation levels

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett.

Read our Owner's Manual to learn more about the core philosophy.

Portfolio Statistics

Via Finchat, I love to look at the fundamentals of the companies we own.

The great thing is that when you enter your Portfolio into the platform, you can also look at your Portfolio Statistics.

Here’s what they look like for us:

What makes me very optimistic is that the Fundamentals of our Portfolio look way healthier than those of the S&P 500.

And this while our companies are not trading at higher valuation multiples.

In that case, it makes sense that we should perform better than the S&P 500. Doesn’t it?

A small backtest

I have a question for you …

… What would your yearly return be if you owned an equal-weighted Portfolio since 2018 of the companies we own right now?

The correct answer?

The average stock within the Portfolio compounded at more than 30% per year!

Over the same period, the S&P 500 returned 12.2% per year.

Total return:

Performance Portfolio: +430.4%

Performance S&P 500: +101.1%

Can we expect returns like this in the future? NO!

As a quality investor, we are not investing in The Next Big Thing but in companies that have already won.

As a result, it makes complete sense that the companies we own performed well in the past.

Furthermore, this backtest consists of many biases (like survivorship biases).

That’s exactly why our goal is to perform slightly better than the S&P 500 over very long periods.

“The goal is not to have the longest train, but to arrive at the station first using the least fuel.” - Tom Murphy

Owner’s Earnings

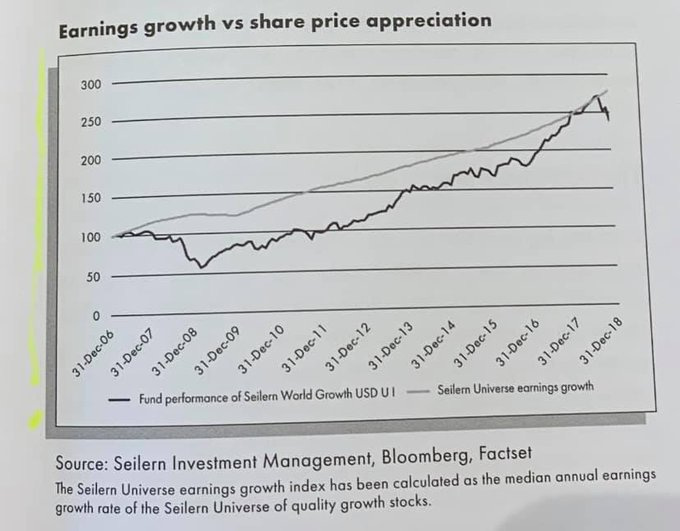

What we do know, is that stock prices will always follow the evolution of the intrinsic value over time.

Source: Only the Best Will Do (Peter Seilern)

We can easily calculate the Owner’s Earnings via this formula:

Owner’s Earnings = EPS Growth + Dividend Yield

Since 2014, the average company within our Portfolio has grown its Owner’s Earnings very attractively.

Here’s what the evolution looks like:

No company has grown its Owner’s Earning by less than 15% per year over the past 5 years: