🥂 Portfolio Update 2026 (Part II)

Hi Partner 👋

Welcome to Part II of Our Portfolio Update.

You missed Part I? You can read it here.

Investing Masterclass: Quality investing in 2026

Join us for an insightful discussion on the most important trends shaping Quality Investing today.

📅 January 29, 2026 | 2 PM ET / 8 PM CET

🌐 Online Event

Portfolio Update

Here are the essentials of Our Portfolio today:

Our companies are fundamentally way healthier than the average company.

On top of that, our companies are now also cheaper than the S&P 500.

That’s exactly what we want to see.

We own fundamentally better companies and the market doesn’t seem to recognize it (yet).

Here’s how the Owner’s Earnings of Our Portfolio evolved over the past few years:

Our companies have grown their value on average by +19.7% per year since 2015.

In Thursday’s article, you got an update about the first 9 positions of Our Portfolio.

Today it’s time to dive in the other 9 positions (those with the highest weight).

Dino Polska ($DNP)

How does the company make money?

Dino Polska, founded in 1999, is a Polish grocery company comprising medium-sized grocery supermarkets close to clients’ places of residence in rural areas.Weight in Portfolio: 5.6%

Performance (%): +7.2%

Update investment case

The stock price of Dino Polska continued to be volatile in 2025.

Like for like sales growth was low at 0.5% in Q1 of 2025, but has rebounded in the quarters since then.

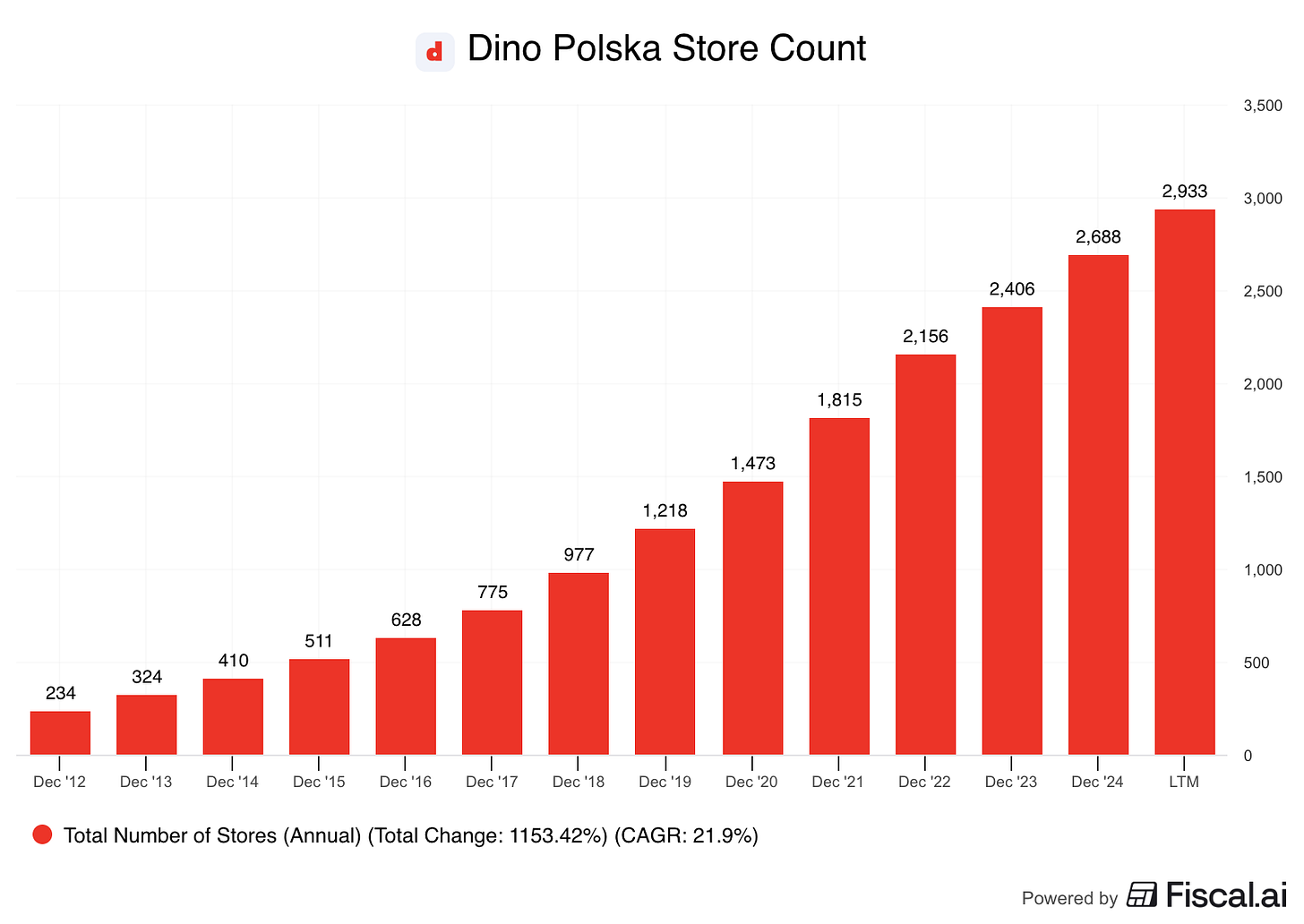

But the most important metric for Dino Polska is the number of new stores opened.

In 2025, they set a record, opening 345 new stores, almost 1 every day!

It proves what a great business Dino Polska is.

We believe the company will continue to do well in the future.

Current valuation level

Forward PE: 19.4x (lower than its 5-year average? < 24.8x? ✅)

Expected Return from Our Earnings Growth Model: 12.9% ✅

Reverse DCF - Required FCF Growth for a 10% yearly return: 13,5% (Realistic growth expectations? ✅)

Long-term estimated EPS-Growth: 24.4%

10-year CAGR FCF: 75.8%

General advice

Dino Polska = Buy

Dino Polska can be seen as 'the Costco of Poland'. The stock doesn't look expensive today while it still has a lot of growth potential.