Hi Partner 👋

Welcome to this week’s 🔒 paid edition 🔒 of Compounding Quality. Each week I talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get a 20% discount:

You know what’s beautiful?

Investing is a way to make money while you sleep.

And as a local investor from Omaha who you might know once said, if you aren’t making money while you sleep, you’ll have to work until you die.

How much money are we making?

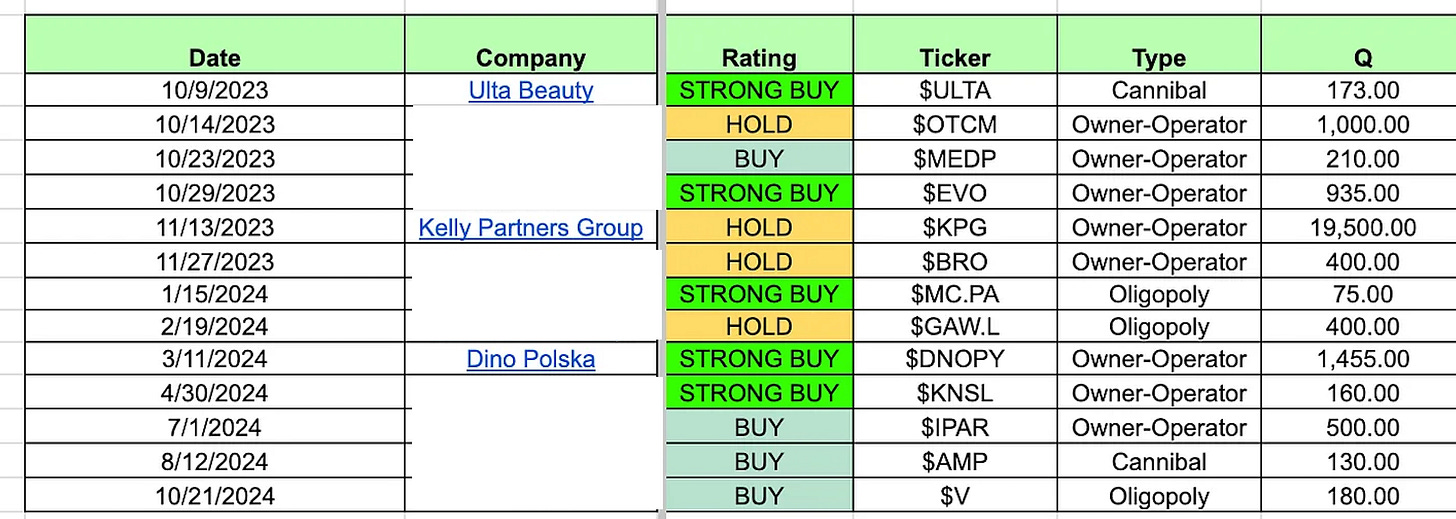

Currently, we are invested in 13 companies for a total amount of roughly $850,000.

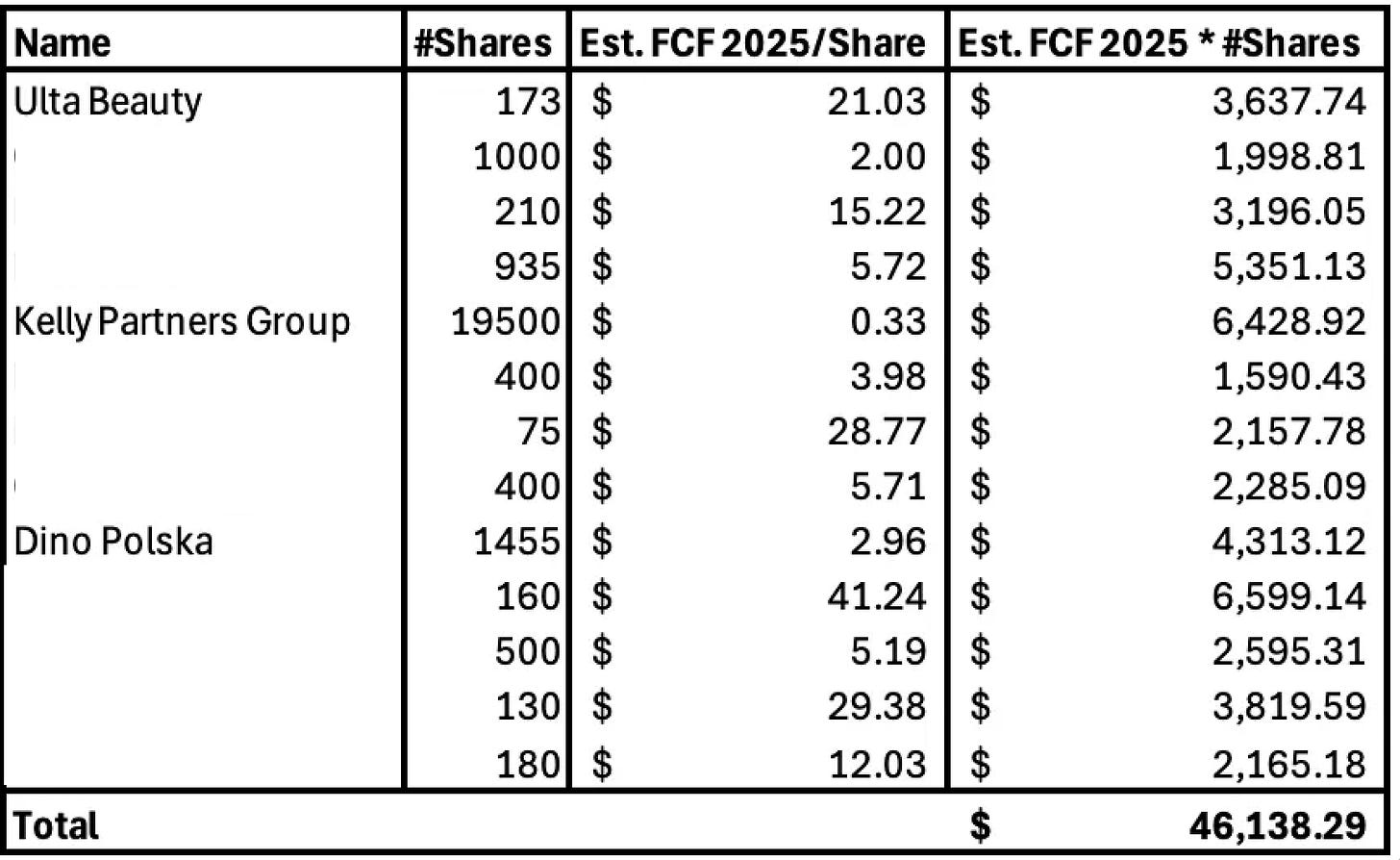

An easy way to calculate how much money each company is making for us?

What each company makes for us per year = Number of shares we own * FCF per share

To give an example, we own 180 shares of Visa. Visa is expected to generate a Free Cash Flow Per Share of $12.03 in 2025.

What each company makes for us per year = Number of shares we own * FCF per share

What Visa earns us = 180 * $12.03 = $2,165

This means Visa generates $2,165 in pure cash for us every single year!

When we do these calculations for the entire Portfolio, we get the following:

As you can see, Our Portfolio is making $46,138.2 in Free Cash Flow per year.

This is equal to:

$3,844.9 per month

$887.2 per week

$126.4 per day

$5.3 per hour

$0.09 per minute

As I sleep roughly 7 hours per day, this means I wake up with another $37.1.

While I make love with my girlfriend, which lasts typically 30 minutes if you ask me and 3 minutes if you ask her, I make another $0.27-$2.7 depending on who you ask. KA-CHING!

Performance

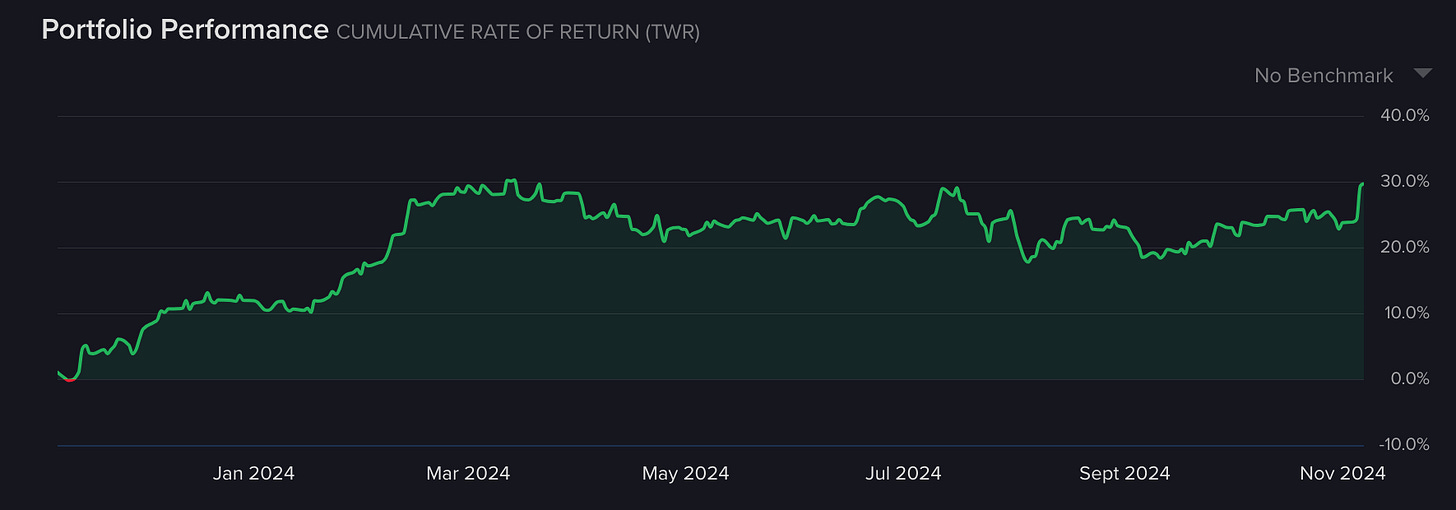

Since Compounding Quality launched on the 1st of October 2023, the Portfolio compounded at a CAGR of 28.4%.

We don’t expect this high return to continue in the years ahead.

We aim to do slightly better than the market over very long periods.

The screenshot above is the official track record from Interactive Brokers.

I use Interactive Brokers for every transaction. You can explore Interactive Brokers here.

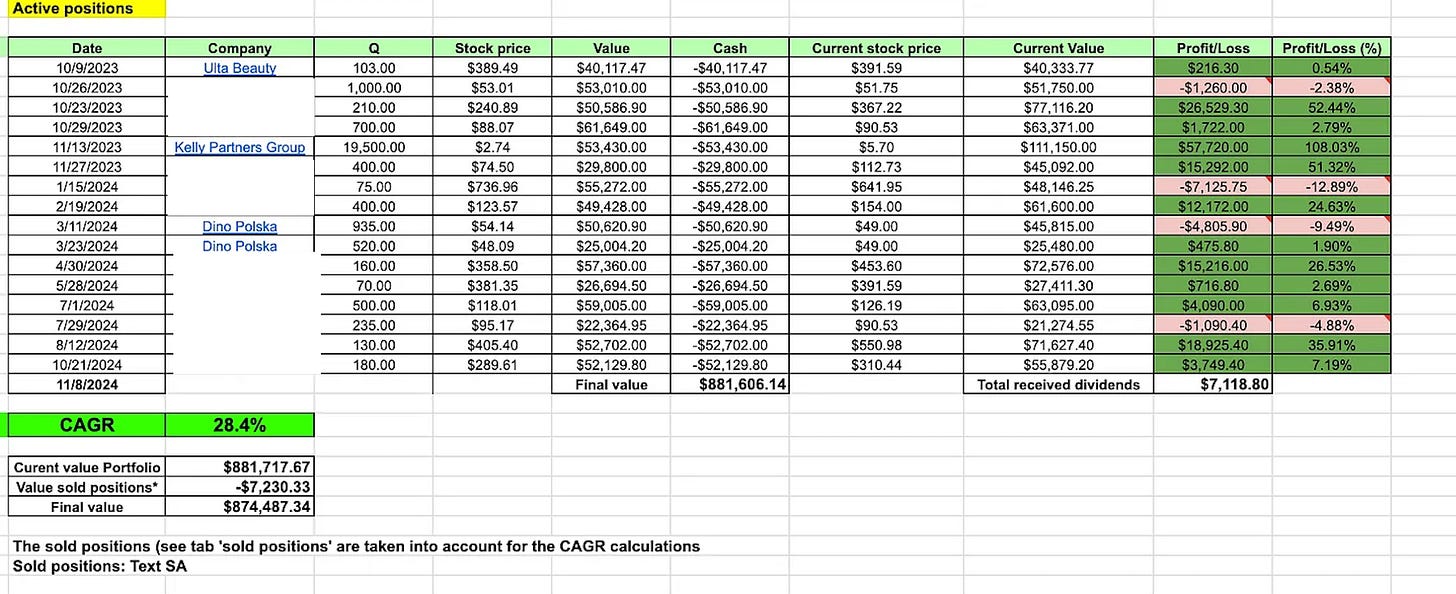

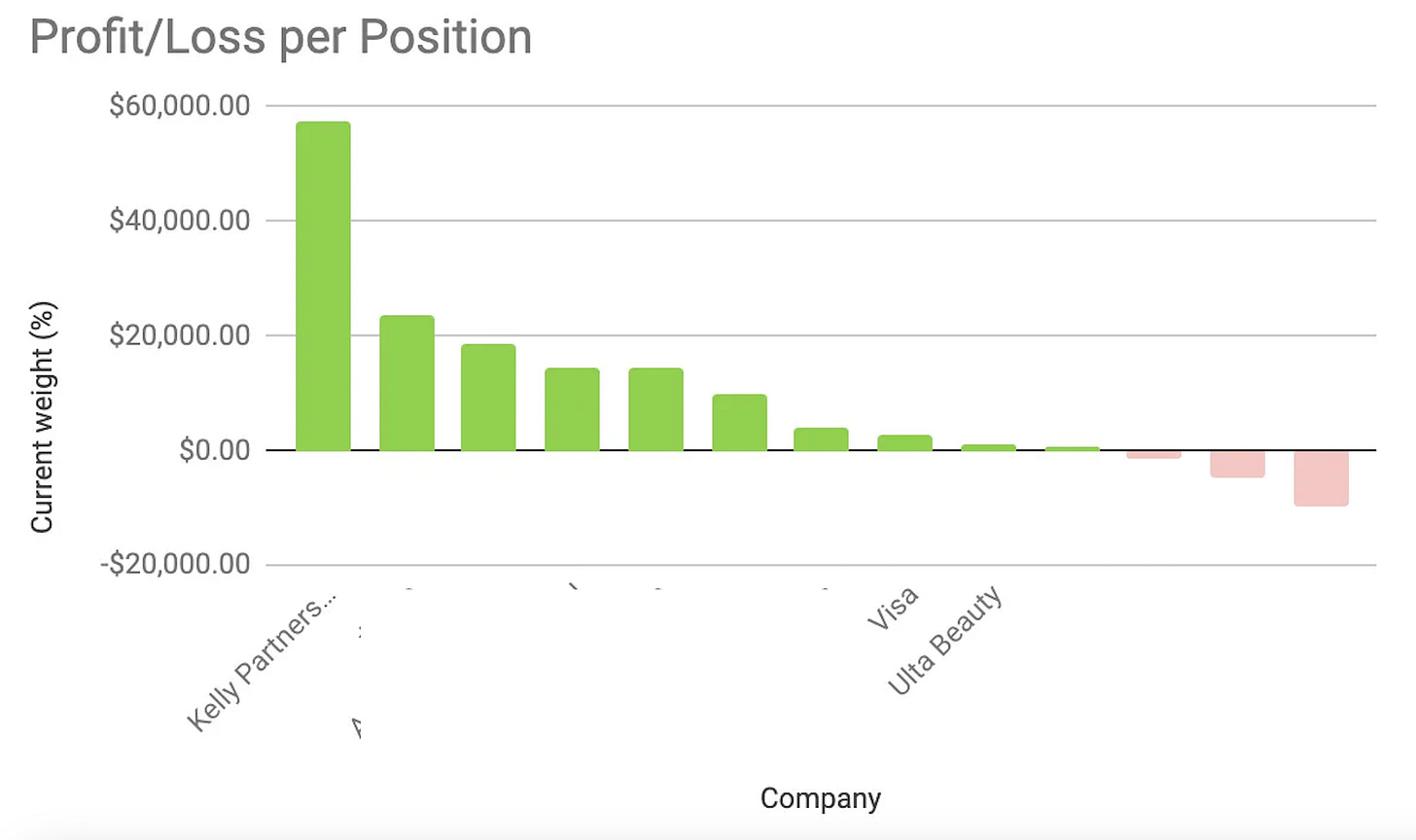

The performance per position looks like this:

Company fundamentals

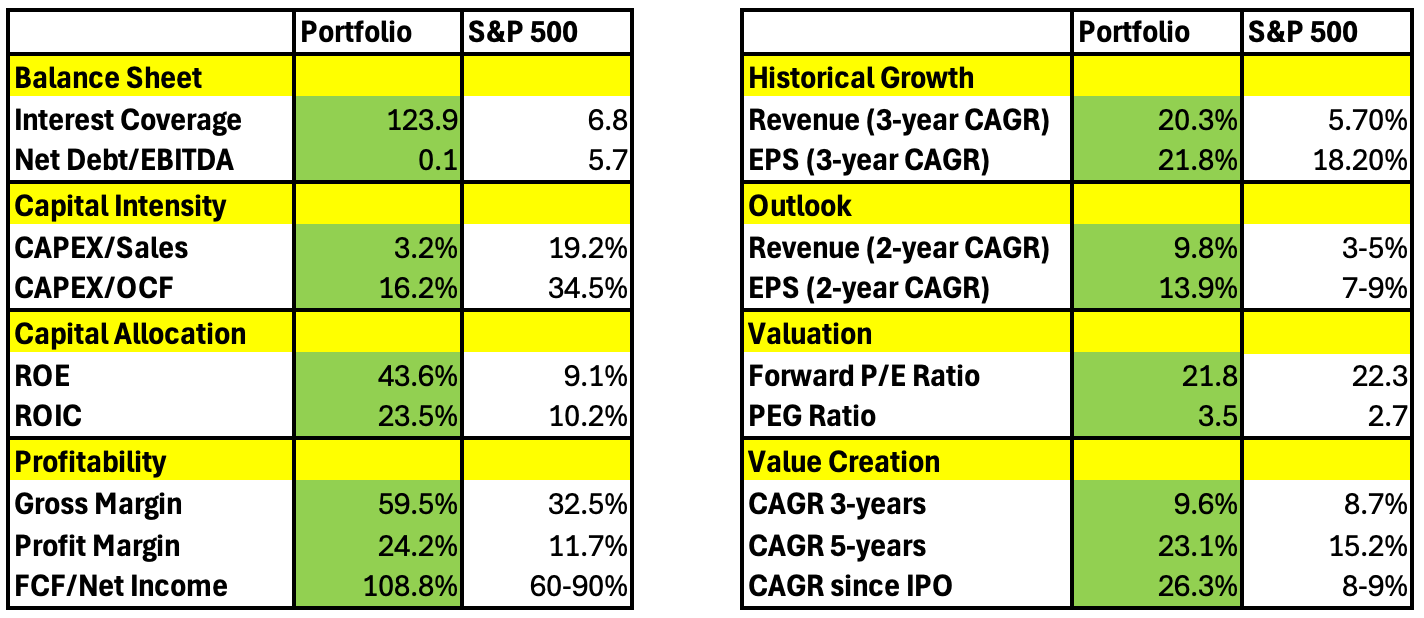

Via Finchat, you can screen for the Fundamentals of the companies we own.

When I compare them with the S&P 500, I get the following:

The Portfolio has stronger fundamentals than the S&P 500 and comes at a lower valuation level.

This makes me comfortable with Our Positions and makes me think Our Portfolio will do well compared to the S&P 500. But please do your own due diligence.

Our Portfolio

Today, I own 13 wonderful companies in which I truly believe.

Our Portfolio looks like this:

Currently, there are 5 strong buys:

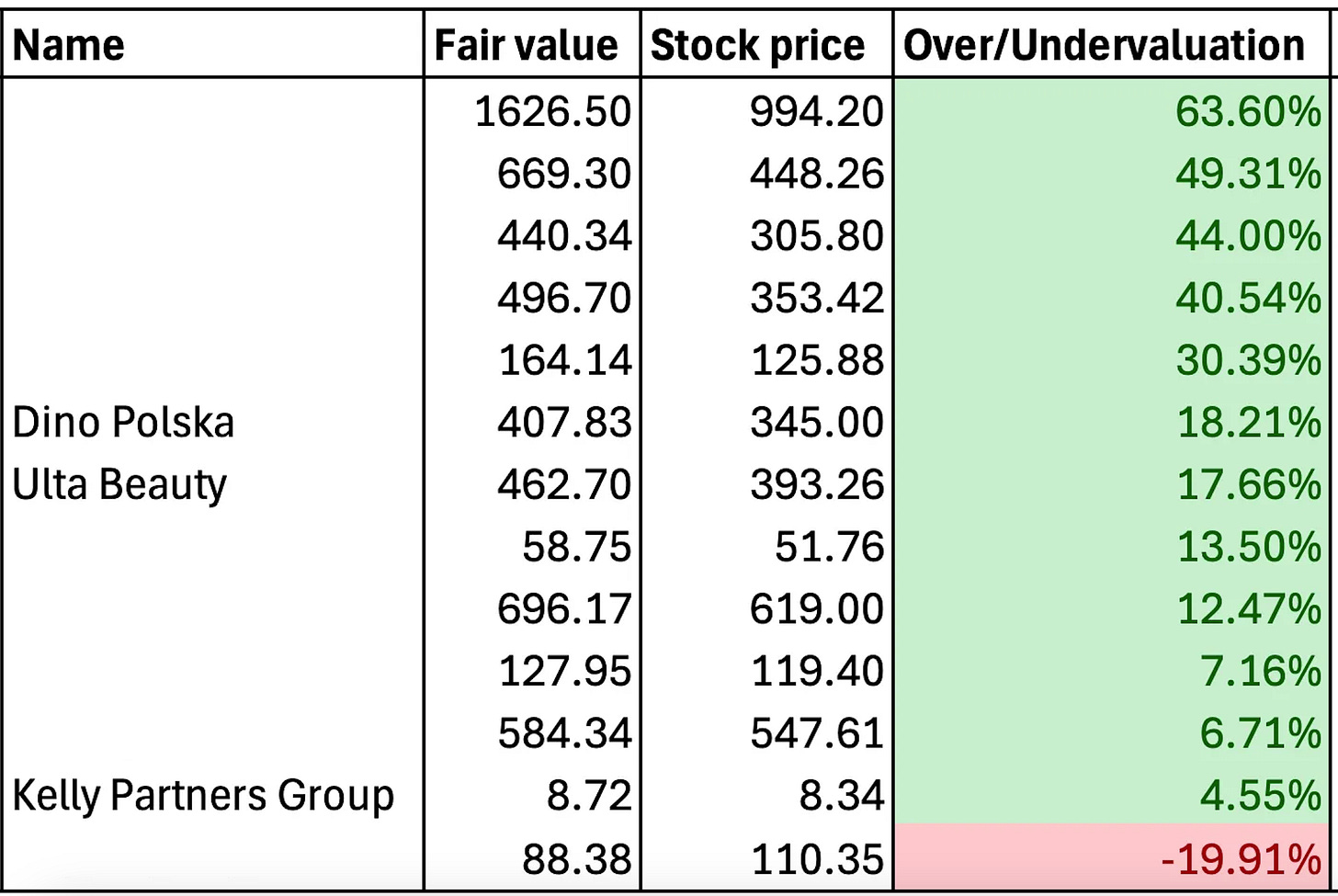

Fair Value

For every company, I calculate the Fair Value (Buy-Below Price).

The Fair Value is the price at which the expected yearly return equals 10% in our Earnings Growth Model.

I consider the company undervalued when the stock price is lower than the Fair Value.

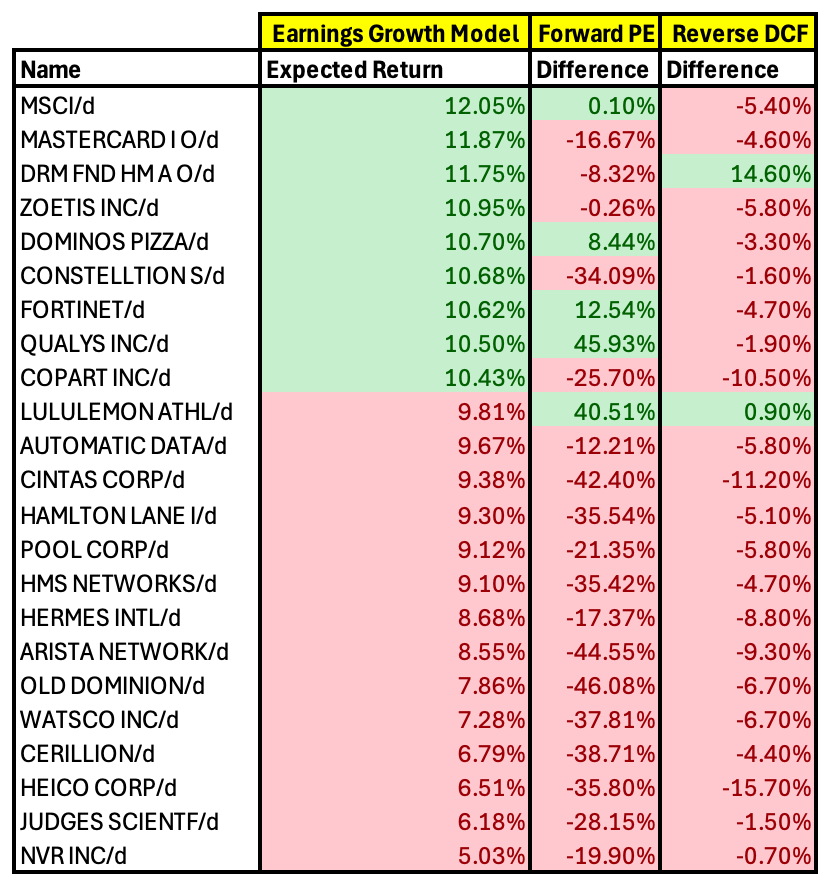

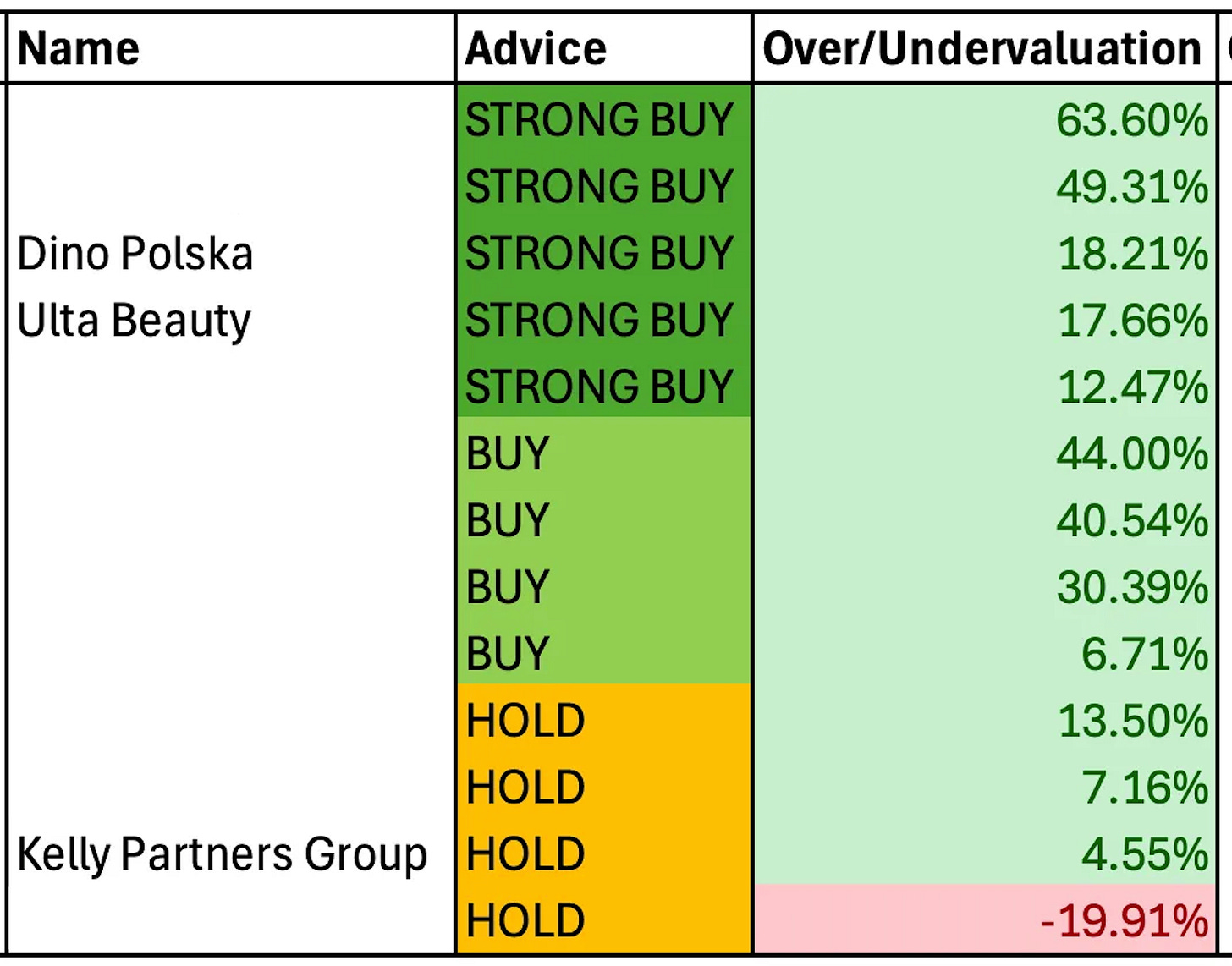

Candidates to Add to the Portfolio

In this section, you’ll get to know which companies we’re seriously looking into today.

These are all companies I would love to own at the right price:

How to Build Your Portfolio

I’m a big fan of gradually entering the market.

You are looking for investment ideas from Compounding Quality but you don’t know where to start?

It might be a good idea to gradually enter into the positions I already own (if that’s what you prefer after doing your homework).

You can use these two simple steps:

Start with the stocks with a ‘Strong Buy’ Advice

Select the companies that are the most undervalued versus their Fair Value

When you do this exercise, you get the following:

That’s it for today

Do you want immediate access to My Portfolio?

Upgrade to paid and get access right away.

Here’s everything you get:

Everything In Life Compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data