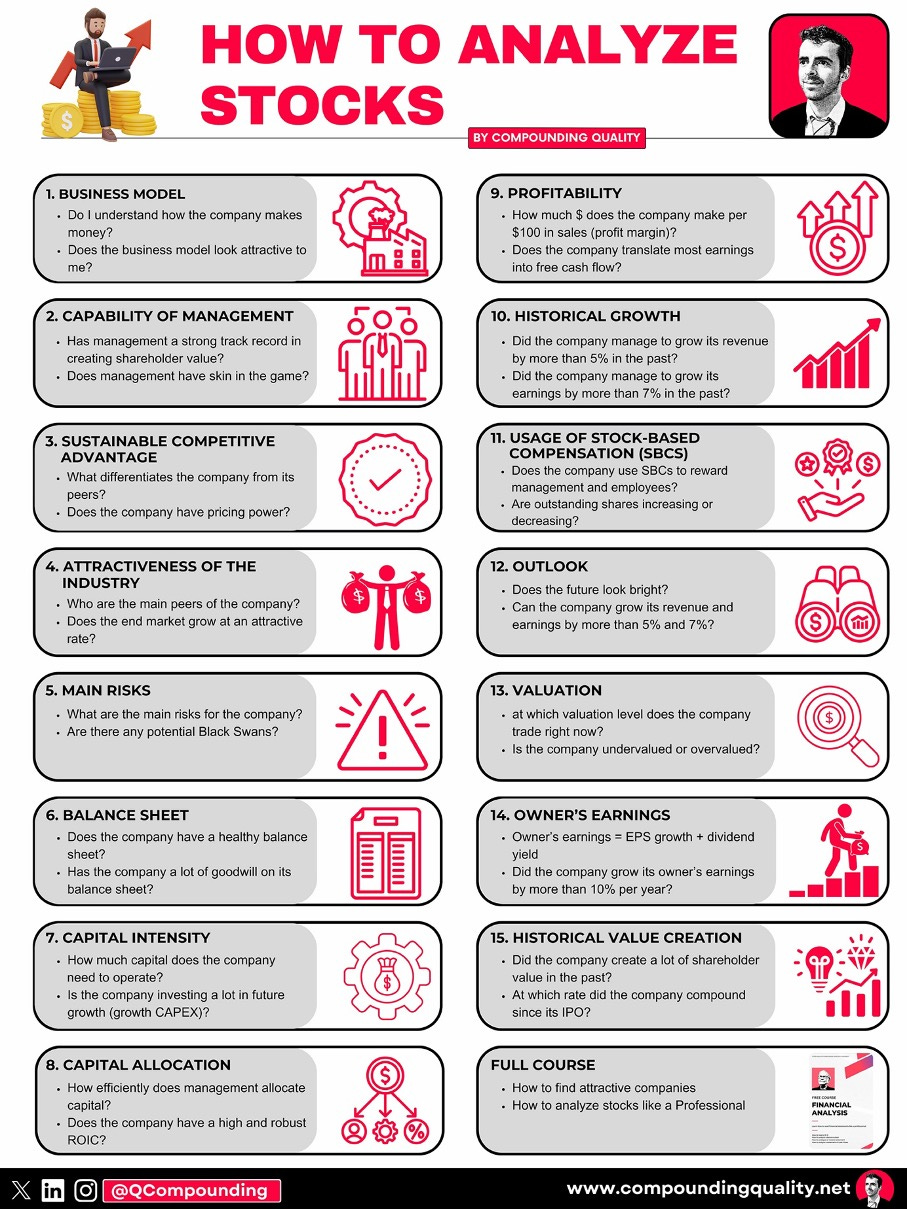

📈 Should you buy Lemaitre Vascular?

Investment case

One of the best compounders you’ve never heard of? LeMaitre Vascular ($LMAT).

Here’s what a $10,000 investment would have given you since 2006:

📈 S&P 500: $98,690

🫀 LeMaitre Vascular: $161,460

While others looked elsewhere, LeMaitre compounded quietly and massively outperformed the S&P 500.

Let’s dive into this company today.

Tiny Titan

Lemaitre Vascular is the perfect example of a Tiny Titan.

You are not part of Tiny Titans yet? The doors are closed right now.

You can put yourself on the waiting list.

If you do, you immediately receive a list of 94 companies with 10x potential:

LeMaitre Vascular – General Information

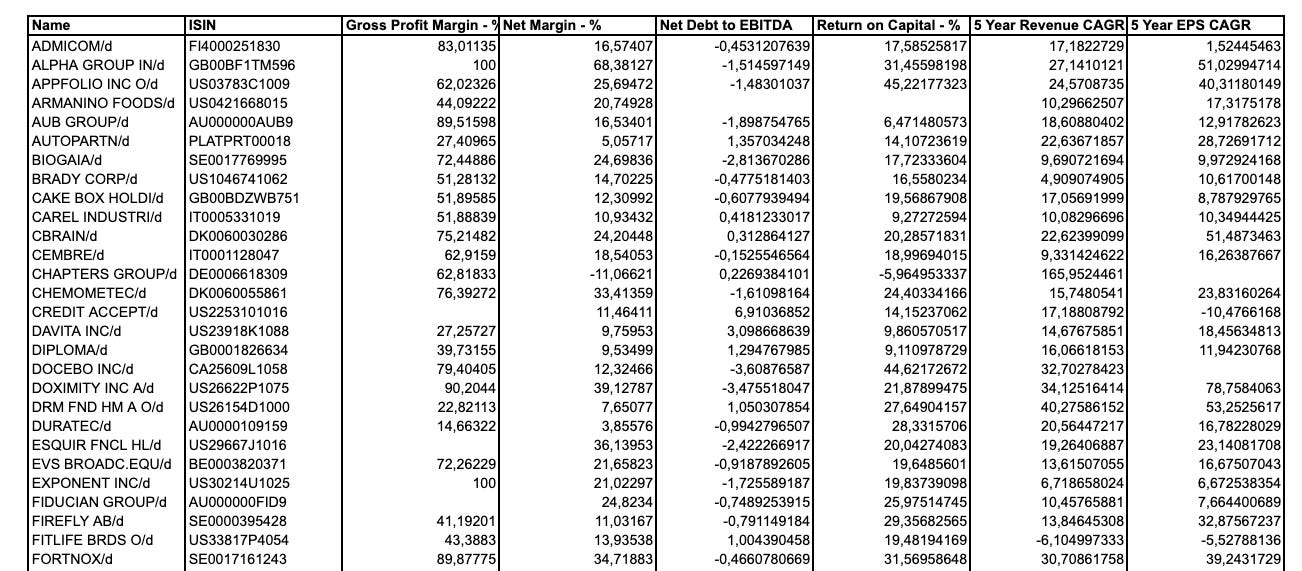

👔 Company Name: LeMaitre Vascular Inc.

✍️ ISIN: US5255582018

🔎 Ticker: LMAT

📚 Type: Owner-Operator

📈 Stock Price: $83.9

💵 Market Cap: $1.9 Billion

📊 Average Daily Volume: $14.2 Million

Onepager

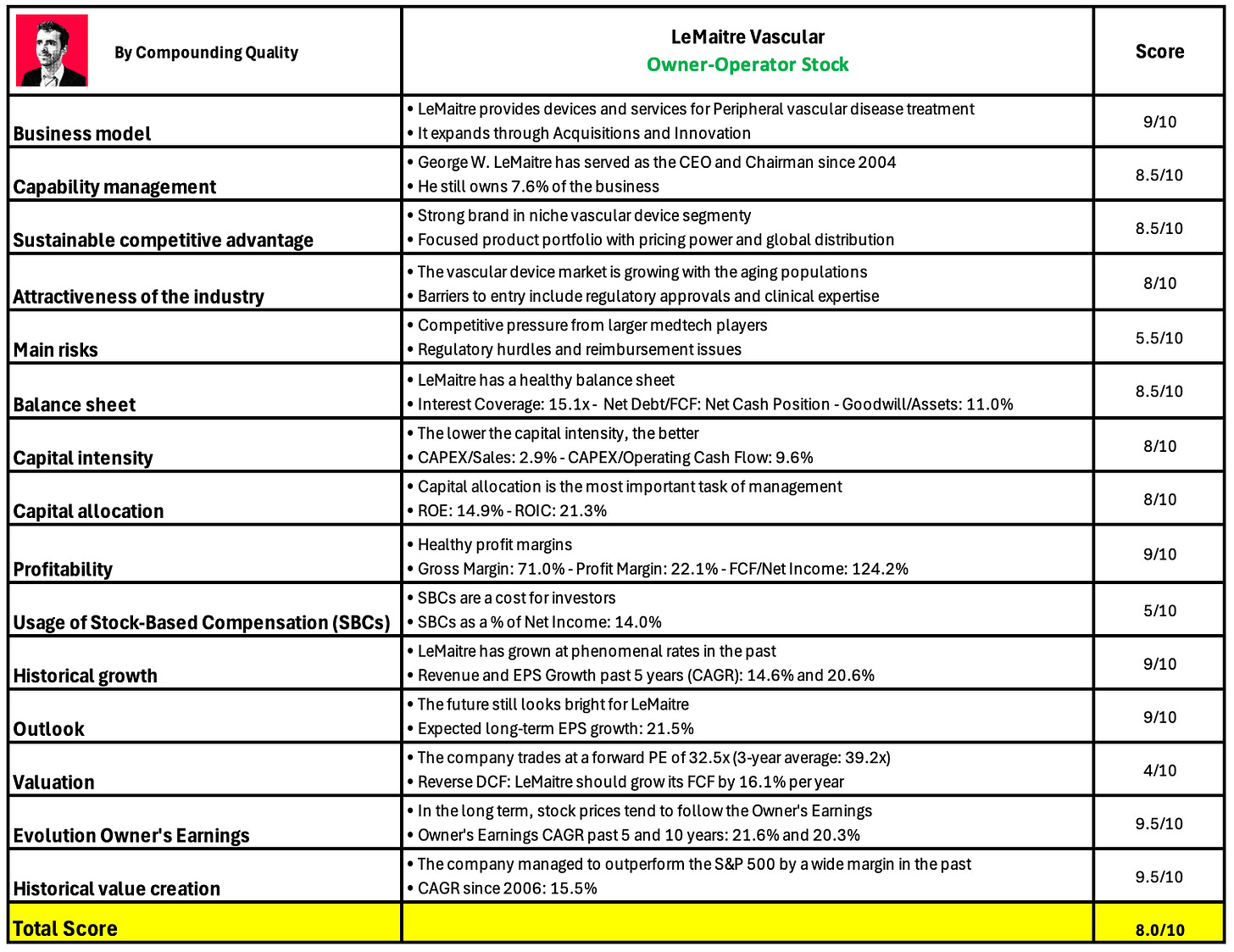

Here’s a onepager with the essentials of LeMaitre Vascular.

You can click on the picture to expand:

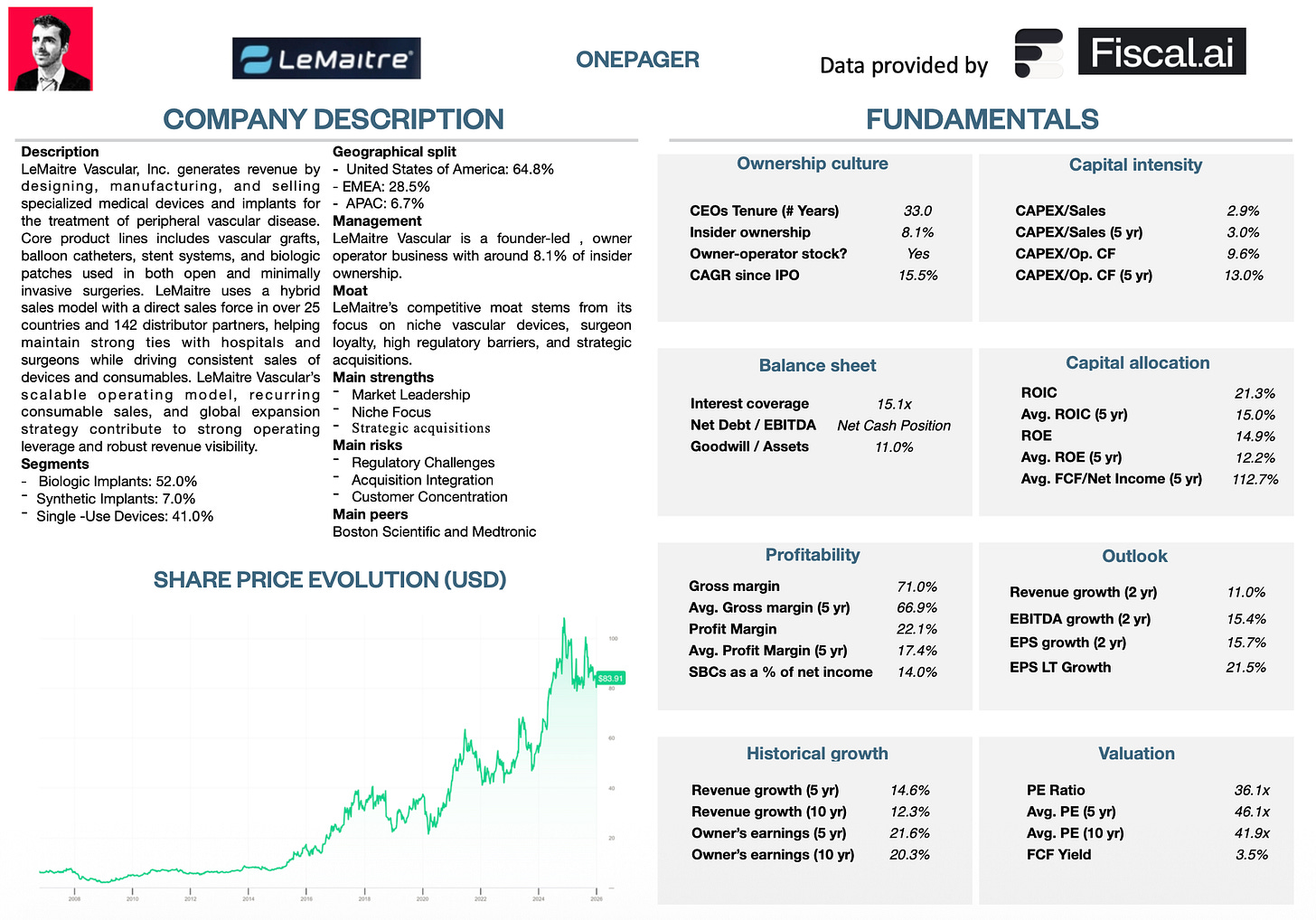

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give LeMaitre Vascular a score on each of these 15 metrics.

This results in a Total Quality Score.

Before diving into this case, you should know the following:

What are vascular procedures?

Vascular procedures are special doctor treatments to fix or help the blood vessels that carry blood through your body.

What are blood vessels?

Blood vessels are like tiny tubes in your body. Blood moves through them to go everywhere it needs to. They bring oxygen and food to your body parts.1. Do I understand the business model?

At any given moment, thousands of surgeons worldwide are performing vascular procedures to save limbs and lives.

If you’ve had any family member undergo vascular surgery, there’s a fair chance LeMaitre Vascular played a role.

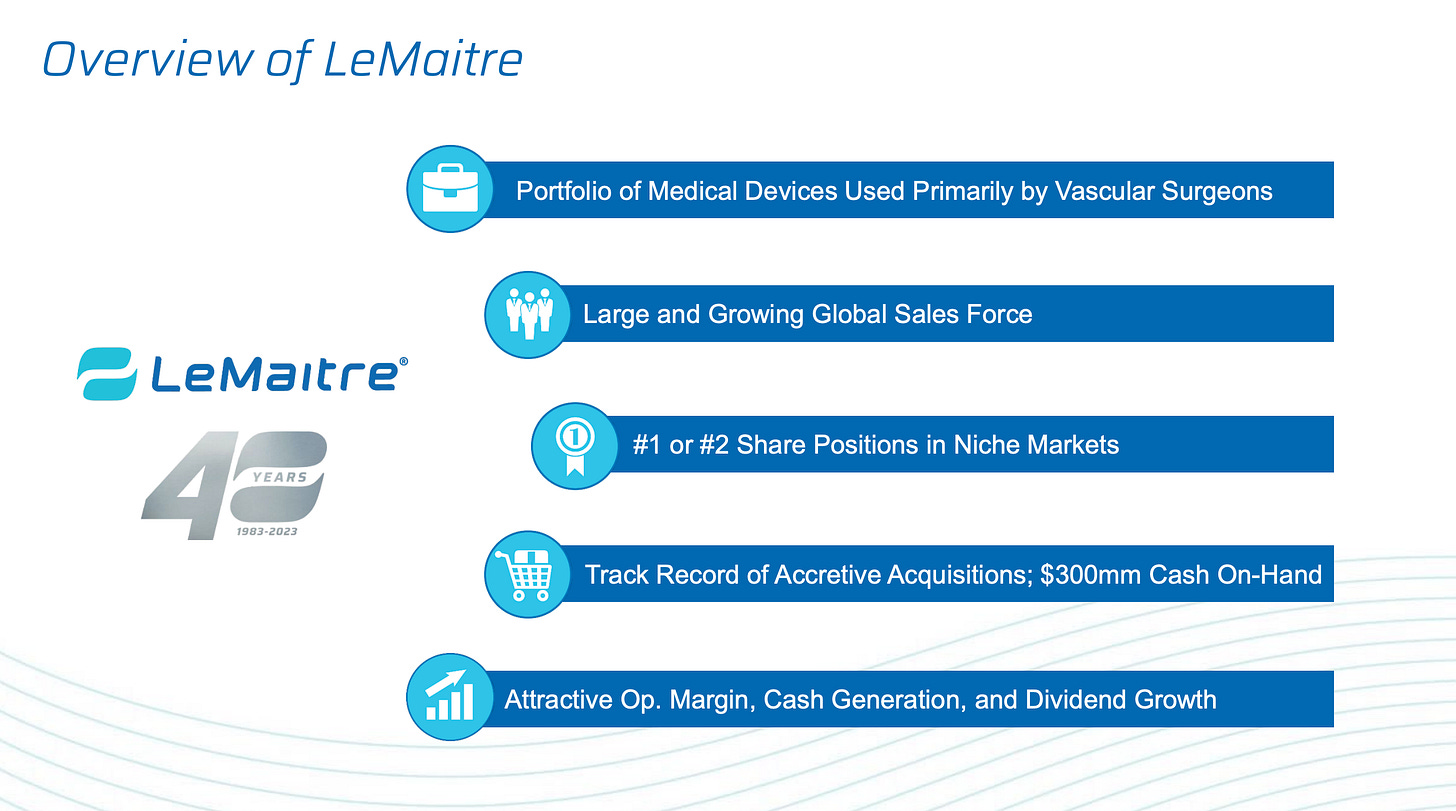

LeMaitre Vascular makes tools that help doctors fix blood vessels. These are the tubes that carry blood in your body.

Their tools are used to treat problems in blood vessels outside the heart and brain. They sell these tools to hospitals around the world.

Their product portfolio includes over 100 devices, spanning vascular grafts, stents, angioplasty balloons, patches, and surgical instruments.

But that’s just the surface.

LeMaitre currently owns 30+ subsidiaries and continues to grow via a disciplined roll-up acquisition strategy, targeting small, profitable vascular device companies globally.

That makes the company a serial acquirer in this niche. They are essential for vascular surgery.

You can learn more about serial acquirers here.

Serial acquirers like LeMaitre often enjoy structural advantages:

A fragmented market ripe for consolidation

Long sales cycles that favor existing relationships

Ingrained brand loyalty among vascular surgeons

Synergies through global distribution and margin expansion

LeMaitre also maintains a lean structure: they often acquire entire companies outright and integrate operations quickly to achieve cost and revenue synergies.

Currently, Lemaitre is active in one segment:

Peripheral Vascular Devices: designing, manufacturing, and marketing proprietary devices for open vascular surgeries, mostly for diseases like aneurysms, blockages, and varicose veins.

2. Is management capable?

George D. LeMaitre, a vascular surgeon, founded the company in 1983 after inventing a new valvulotome (a valvulotome is a tiny tool doctors use to cut open stuck valves inside veins) to treat his patients.

His son George W. LeMaitre has served as the CEO and Chairman since 2004.

Since the IPO in 2006, Lemaitre has returned over 1,500% to shareholders (CAGR: 15.5%).

This is a true Owner-Operator business as insiders still own 8.1% of the company.

It’s great knowing the incentives of management and yours as a shareholder are aligned.

Why does this matter?

Founder- and family-led businesses are often more patient. They think in decades, not quarters. And they treat shareholder capital as their own because it is.

“We aim to become the world’s most admired vascular device company —measured not just by profits, but by surgeon loyalty and patient outcomes.” – George D. LeMaitre3. Does the company have a sustainable competitive advantage?

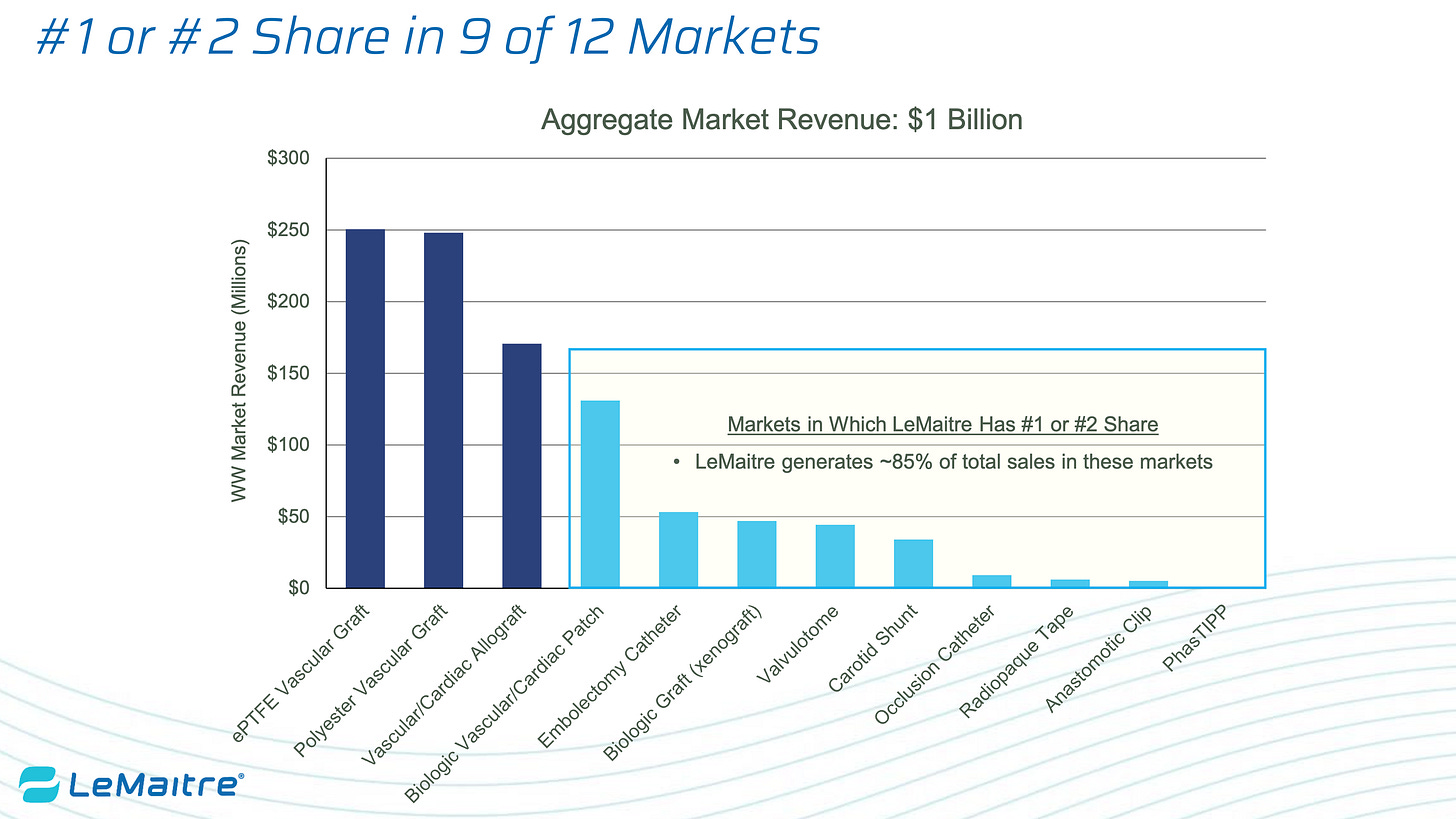

LeMaitre has a durable moat in the medical device world.

Surgeons love them because LeMaitre’s devices are highly specialized, consistently reliable, and easier to use than many alternatives.

Sounds too good to be true?

It isn’t. Rather than competing head-on with medtech giants like Medtronic or Boston Scientific, they focus solely on an interesting niche market: peripheral vascular surgery.

It’s a niche that’s too small for the giants, but too complex for generic manufacturers.

What is peripheral vascular surgery?

Peripheral vascular surgery is an operation to fix blood vessels (like veins and arteries) outside the heart and brain. It helps blood flow better to the legs, arms, or other parts of the body.On top of that, Lemaitre is an excellent capital allocator.

The company often acquires small, profitable competitors, integrates their products into its own portfolio, and leverages its 100+ strong salesforce to increase reach across hospitals and surgical centers.

Lastly, Lemaitre also benefits from regulatory barriers. Medical devices must pass through FDA and CE approvals, which can take years and can cost millions of dollars.

Switching suppliers means retesting, retraining, and risking patient safety. That’s why surgeons stick with what they trust.

In other words, once LeMaitre’s devices are in the Operator Room, they tend to stay there.

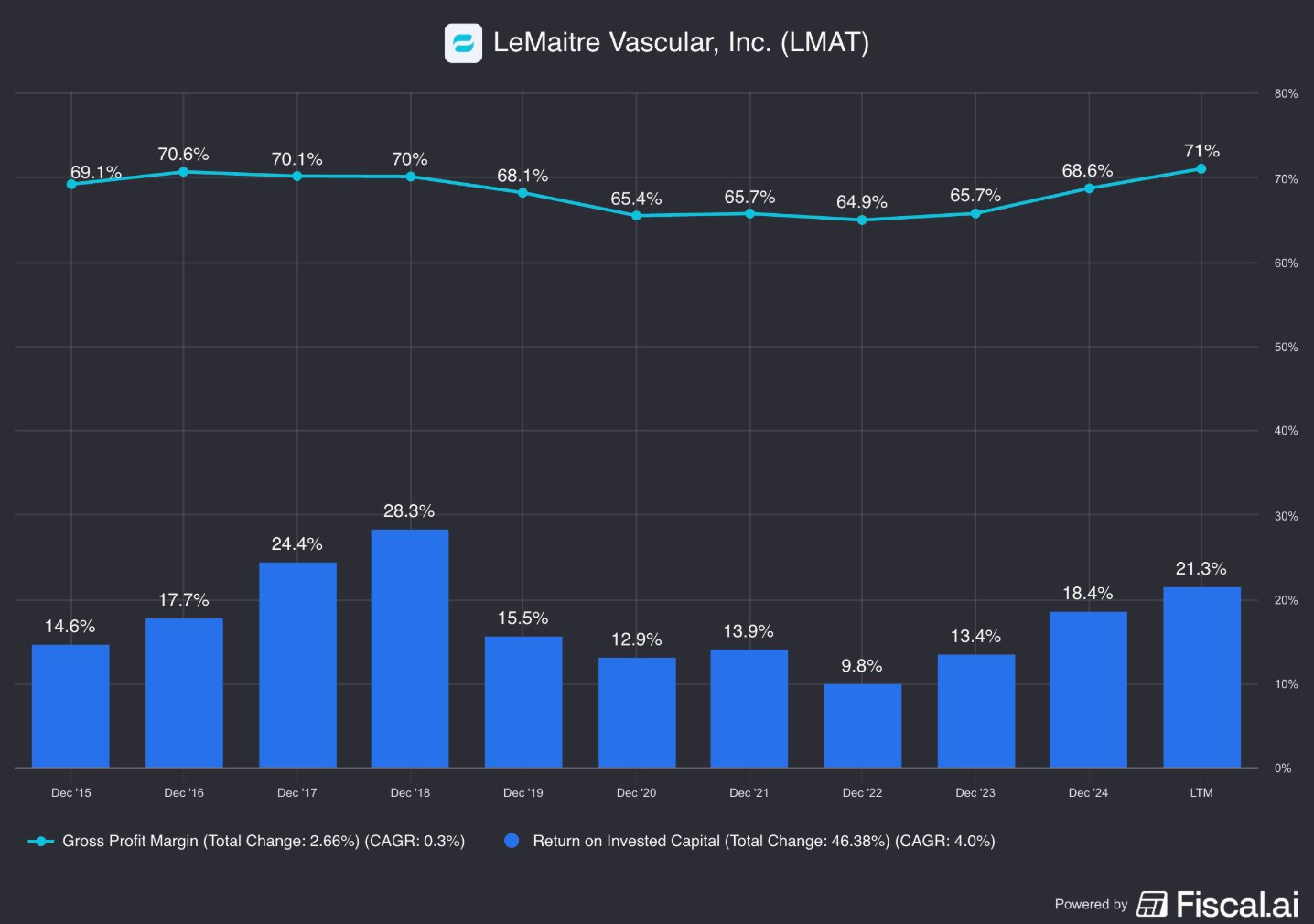

Let’s now quantify the moat:

Gross Margin: 71.0% (Gross Margin > 40%? ✅)

Return On Invested Capital: 21.3% (ROIC > 15%? ✅)

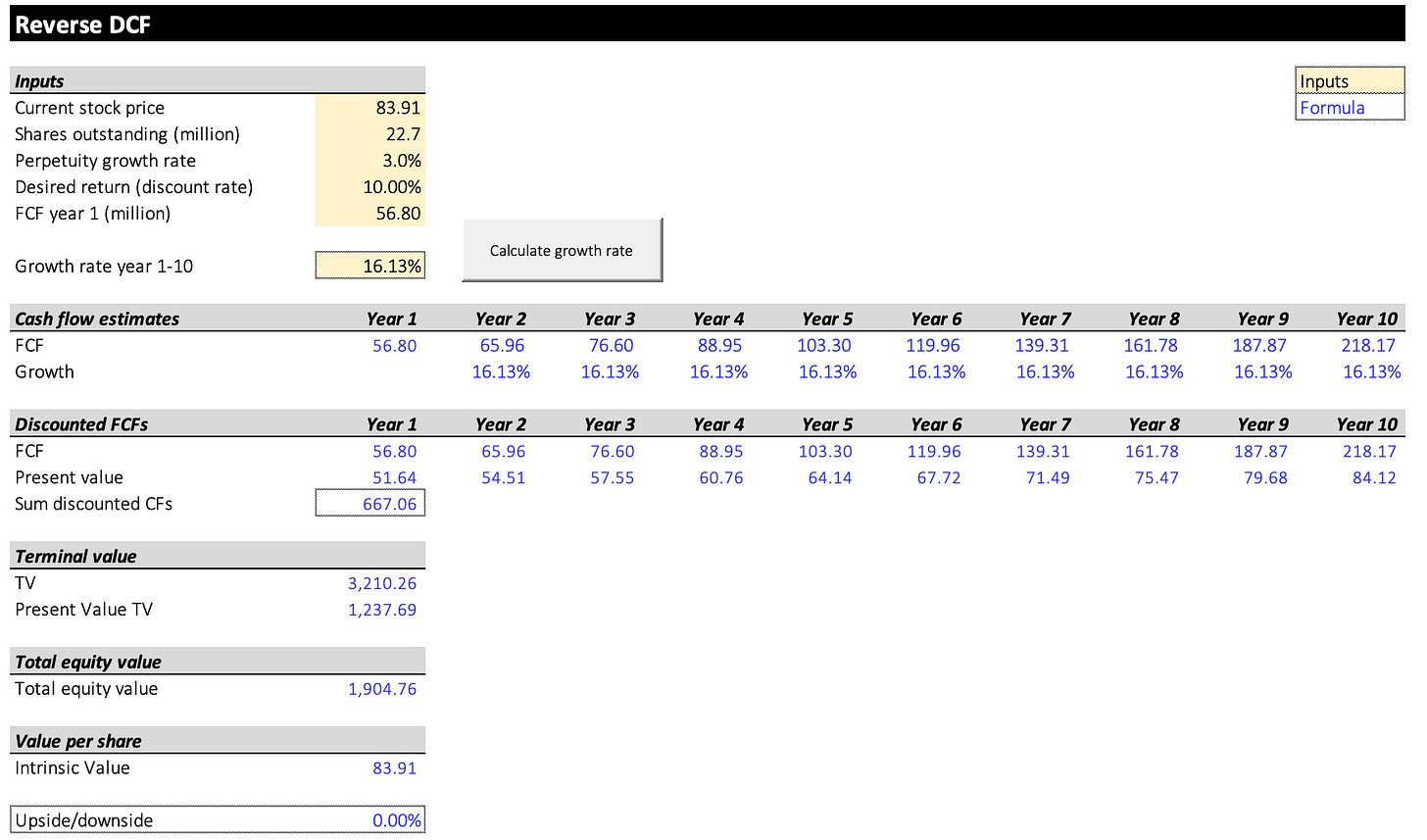

4. Is the company attractive in an interesting end market?

Serial acquirers are exceptional at one thing: turning capital into more capital.

Why? Three powerful reasons:

They constantly uncover new acquisition targets

They have sharp leadership that knows how to deploy cash wisely

They benefit from dual growth engines (strong organic growth + M&A)

But LeMaitre enjoys extra benefits.

Their business sits right in the middle of several long-term secular tailwinds:

1. Aging Global Population

As people get older, problems with blood vessels happen more often.

More patients = more surgeries = more demand for LeMaitre devices.2. Need for precise tools

More and more surgeons are using small, gentle surgeries that don’t cut the body open too much.

These need precise tools, and that’s exactly what LeMaitre makes very well.

3. Increased demand from Emerging Markets

More people in developing countries are getting access to hospitals and surgeries.

These places will need special tools for blood vessel problems. This is something LeMaitre is good at. The company is also selling more in other countries.

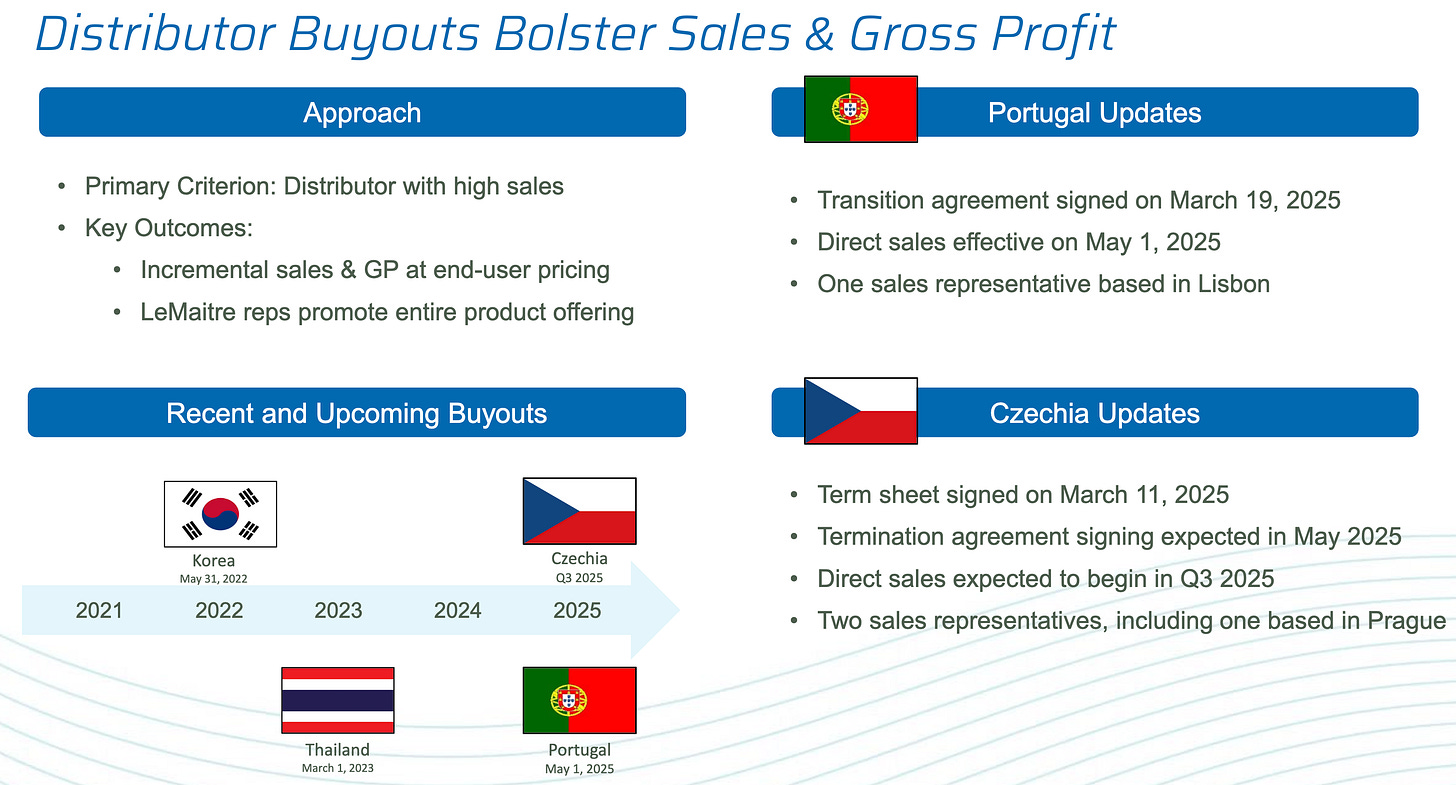

Here’s how fast the market is growing:

Tools for blood vessel surgery: 6–7% growth per year

Small, gentle surgeries: 8–9% growth per year in important areas

As you might have already noticed, Lemaitre is operating in a very attractive segment.

They enjoy a dual growth engine with both organic and inorganic growth opportunities.

5. What are the main risks for the company?

Here are the main risks for Lemaitre:

LeMaitre is still a relatively small company (~$1.9 billion market cap). That means one failed acquisition or product recall could have a large impact

If acquired products don’t integrate well or underperform, LeMaitre could end up destroying value rather than creating it

Medical device companies depend heavily on FDA approvals and insurance reimbursement rates. A single change in the regulatory environment could hurt their margins or delay product rollouts

LeMaitre has a strong brand with vascular surgeons, but a shift in surgical practices or preference toward other techniques could lead to decreased demand

LeMaitre is still concentrated in one specific domain: vascular surgery. This focus is a strength, but also a risk

George W. LeMaitre has been at the helm for two decades. What happens when it’s time for a leadership transition? Succession planning will be key

Rich valuation levels

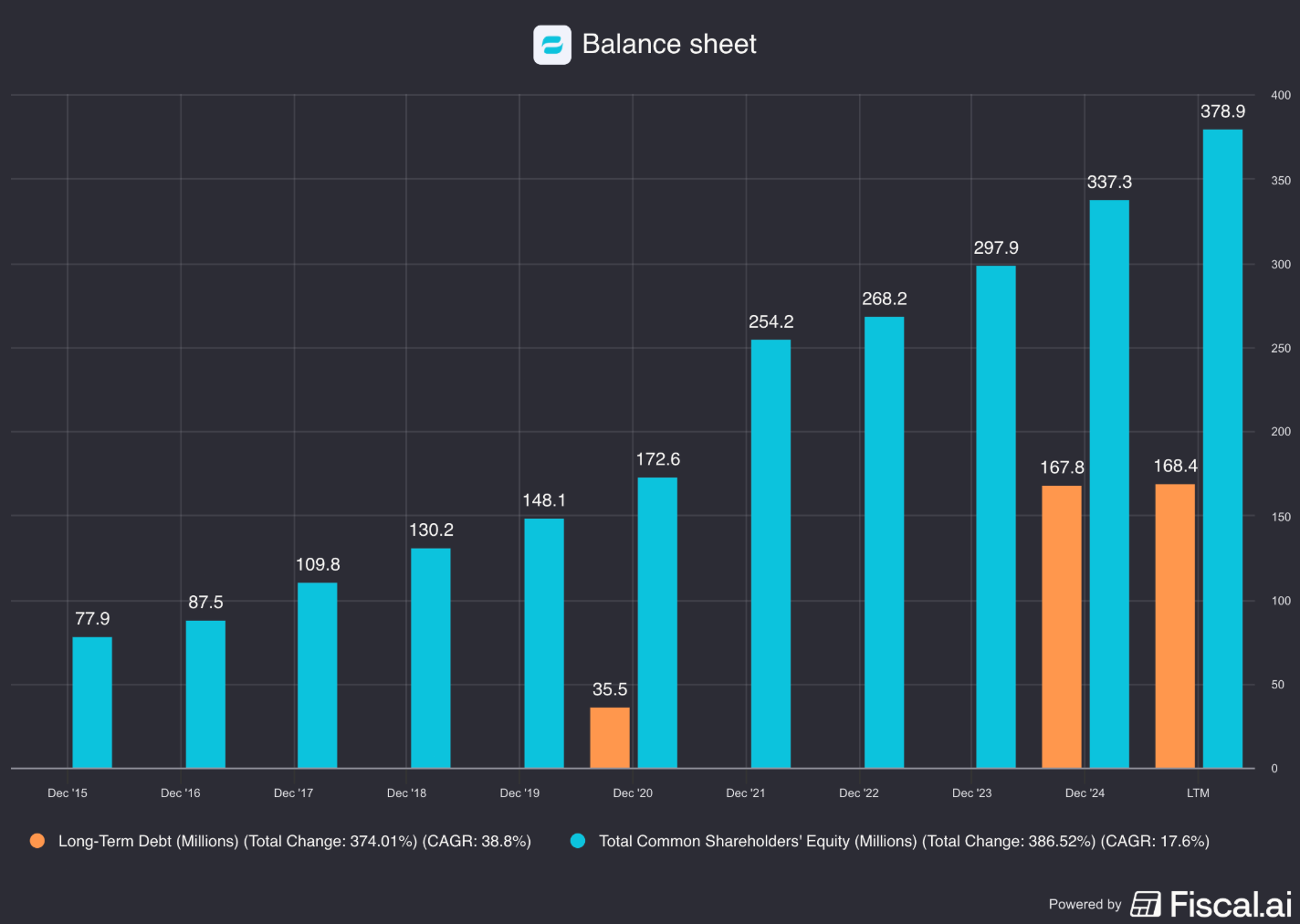

6. Does the company have a healthy balance sheet?

We look at three ratios to determine the healthiness of the balance sheet:

Interest coverage: 15.1x (Interest Coverage > 15x? ✅))

Net Debt/FCF: Net Cash Position (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 11.0% (Goodwill to assets < 20%? ✅))

The balance sheet of LeMaitre Vascular looks great.

7. Does the company need a lot of capital to operate?

The less capital a business needs to operate, the better

Here’s what things look like for LeMaitre Vascular:

CAPEX/Sales: 2.9% (CAPEX/Sales? < 5%? ✅)

CAPEX/Operating cash flow: 9.6% (CAPEX/Operating CF? < 25%? ✅)

It’s great seeing LeMaitre Vascular is so capital-light.

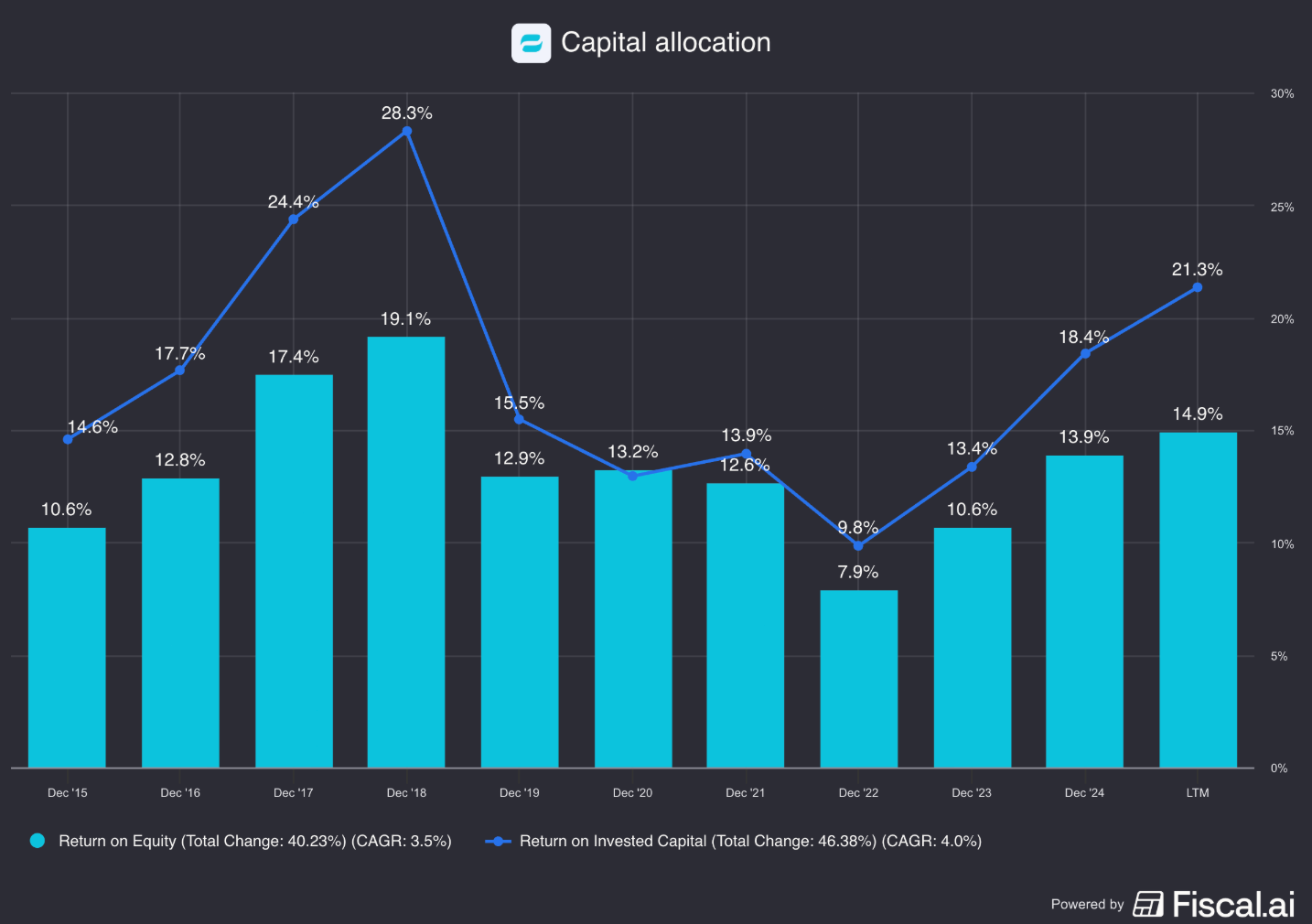

8. Capital allocation

Capital allocation is the most important task of management.

We are looking for businesses capable of allocating shareholders’ resources effectively.

LeMaitre Vascular:

Return on Equity (ROE): 14.9% (ROE > 20%? ❌)

Return on Capital (ROIC): 21.3% (ROIC > 15%? ✅)

Some other capital allocation metrics:

Return on Capital Employed: 11.0%

Return on Tangible Assets: 10.7%

These numbers look great.

Here’s an evolution of LeMaitre Vascular’s ROE and ROIC.

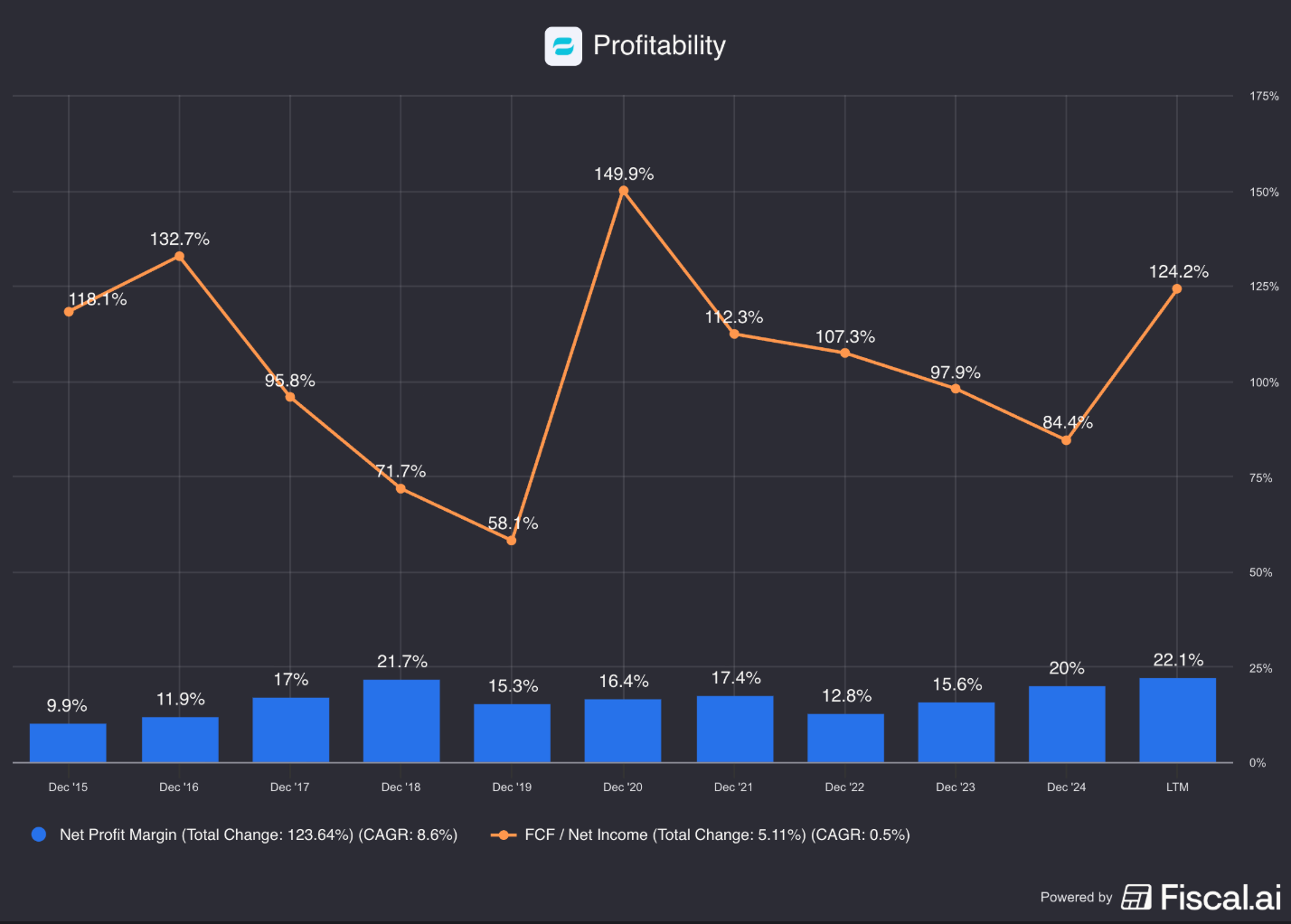

9. How profitable is the company?

The higher the profitability of the business, the better.

Here’s what thing looks like for LeMaitre Vascular:

Gross margin: 71.0% (Gross margin > 40%? ✅)

Net Profit Margin: 22.1% (Net Profit Margin > 10%? ✅)

FCF/Net income: 124.2% (FCF/Net income > 80%? ✅)

LeMaitre Vascular has great cash conversion.

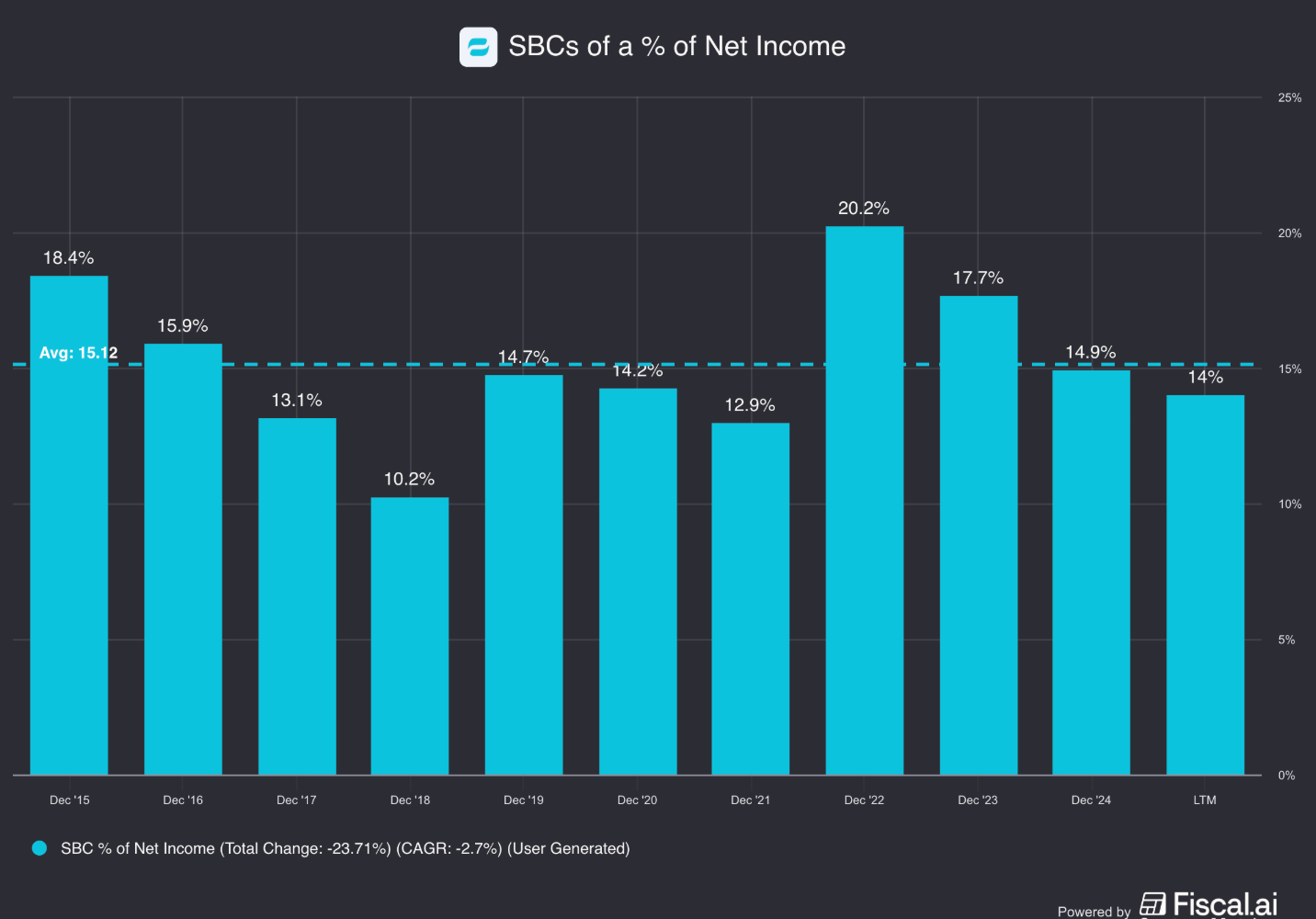

10. Does the company use a lot of Stock-Based compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Preferably, we want SBCs as a % of Net Income to be lower than 10%.

LeMaitre Vascular:

SBCs of a % of Net Income: 14.0% (SBCs/Net income < 10%?❌)

Avg. SBC as a % of Net Income past 5 years: 15.6% (SBCs/Net income < 10%? ❌)

LeMaitre Vascular uses a lot of Stock-Based Compensation, which is negative to see as an investor.

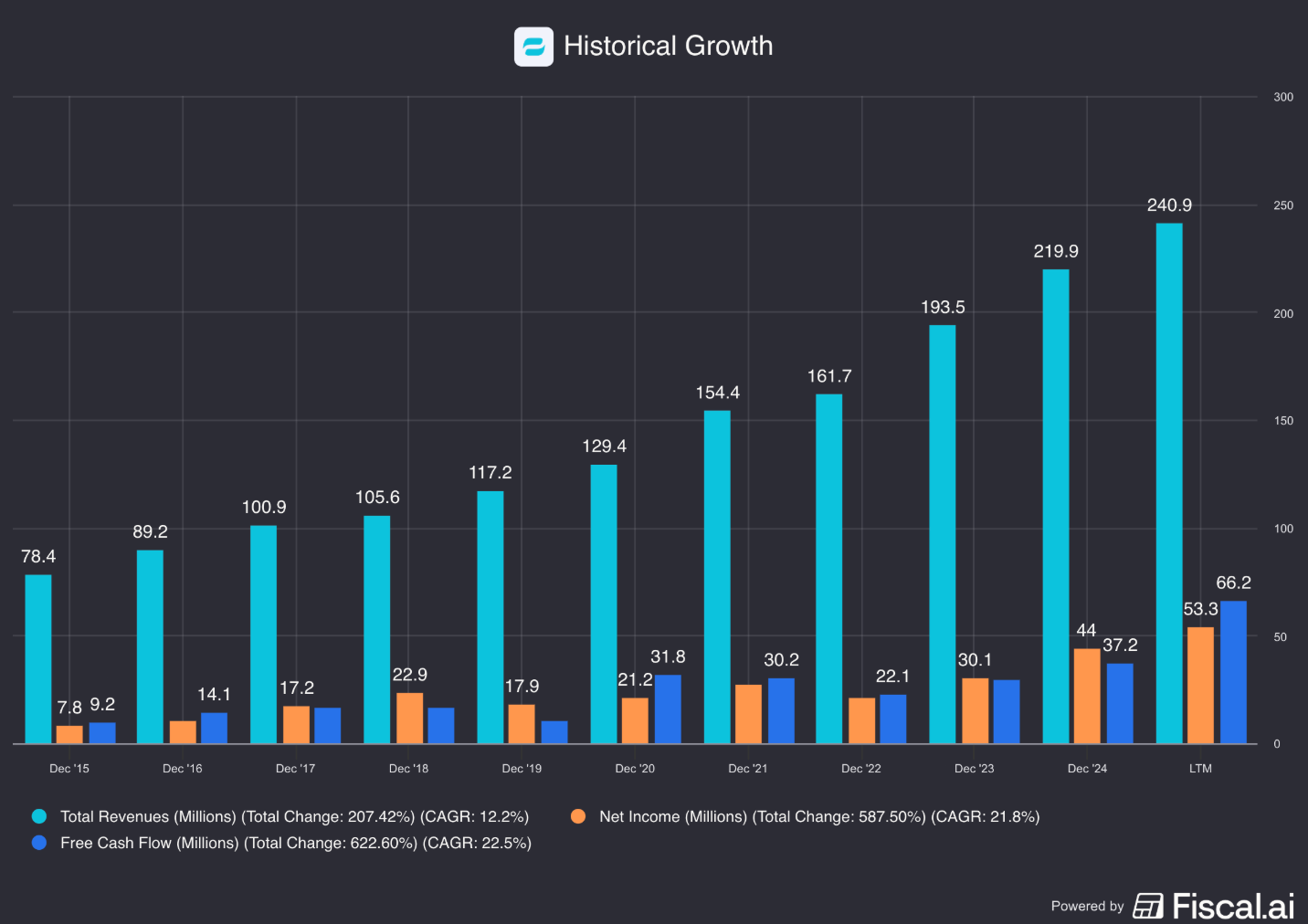

11. Did the company grow at attractive rates in the past?

Let’s look at what recent history tells us:

Revenue growth past 5 years (CAGR): 14.6% (revenue growth > 5%? ✅)

Revenue growth past 10 years (CAGR): 12.3% (revenue growth > 5%? ✅)

EPS growth past 5 years (CAGR): 20.6% (EPS growth > 7%? ✅)

EPS growth past 10 years (CAGR): 19.3% (EPS growth > 7%? ✅)

12. Does the future look bright?

Let’s look at what the estimates are:

Exp. Revenue growth next 2 years (CAGR): 11.0% (revenue growth > 5%? ✅)

Exp. EPS growth next 2 years (CAGR): 15.7% (revenue growth > 7%? ✅)

Long-term growth estimate EPS (CAGR): 21.5% (EPS growth > 7%? ✅)

This outlook looks very attractive. It’s important to know that analysts are usually too optimistic

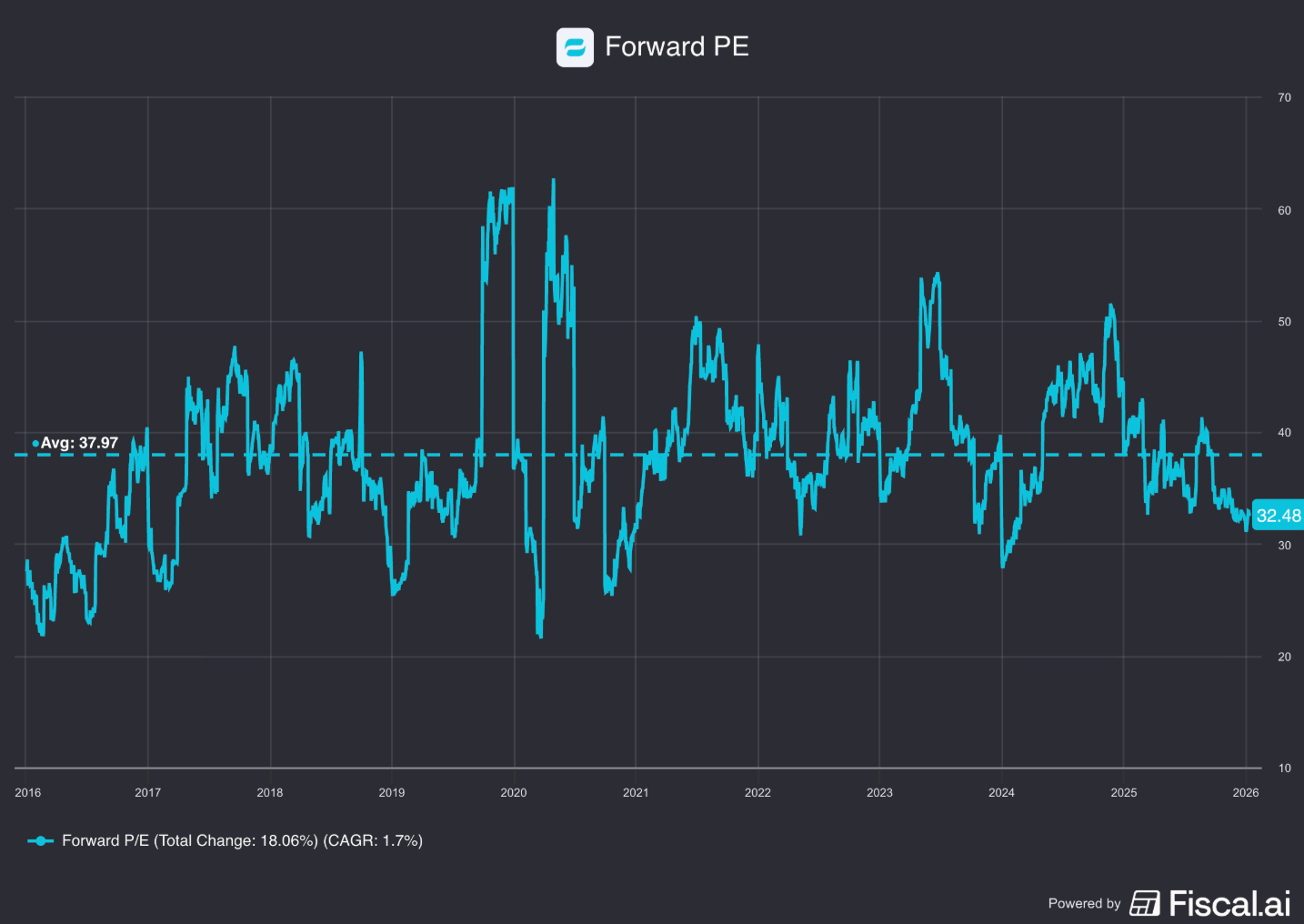

13. Does the company trade at a fair valuation level?

We always use three methods to look at the valuation of a company:

A comparison of the Forward PE multiple with its historical average

Earnings Growth Model

Reverse Discounted-Cash Flow

A comparison of the Forward PE multiple with its historical average

The first thing we do is compare the current forward PE with its historical average over the past 10 years.

This is a shortsighted method, but it already gives a quick indication.

Today, LeMaitre Vascular trades at a forward PE of 32.5x compared to a historical average of 38.0x.

Earnings Growth Model

This model shows you the yearly return you can expect as an investor.

You can explore more about the Earnings Growth Model here.

Here are the assumptions I use:

EPS growth: 13% per year over the next 10 years

Dividend Yield: 1%

Forward PE to decline from 32.5x to 25.0x

Expected yearly return = 13% + 1% + 0.1((25.0x – 32.5x)/32.5x)) = 11.7%

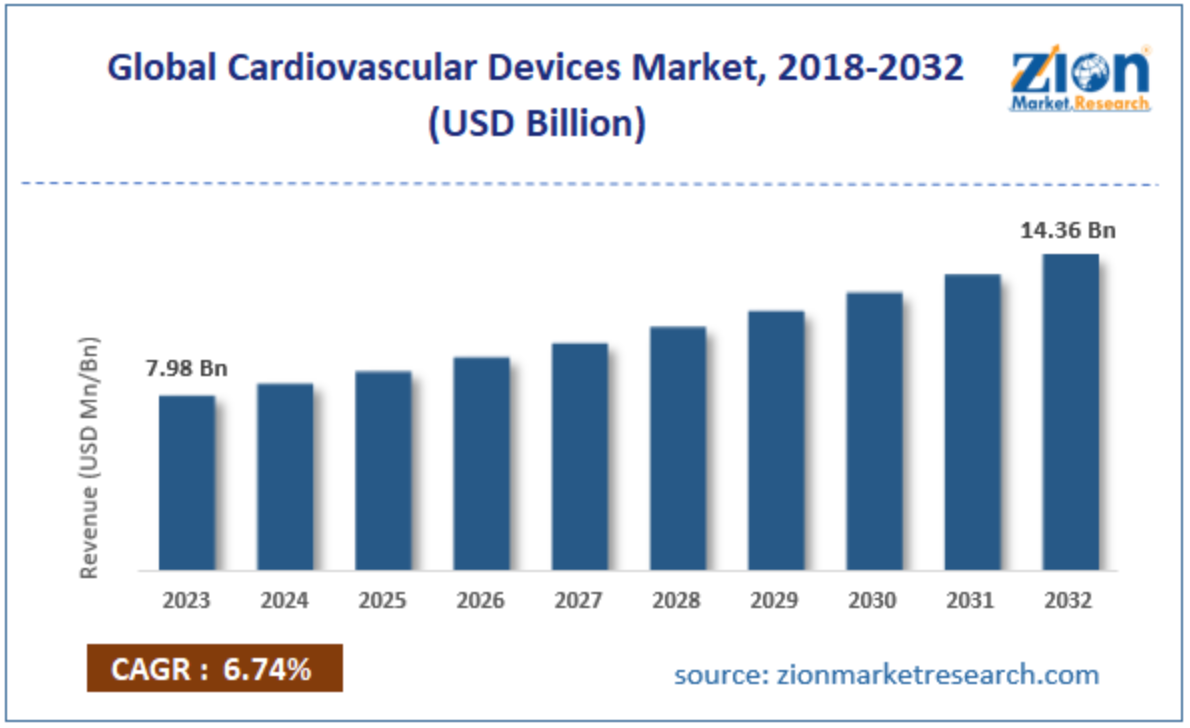

Reverse DCF

Charlie Munger once said that if you want to find a solution to a complex problem, you should invert. Turn the problem upside down.

This is exactly what a reverse DCF does. As an investor, we don’t make assumptions. We simply look at what assumptions the market has made and see whether they are reasonable.

The expected Free Cash Flow of the next 12 months equals $63.4 million.

We subtract the Stock-Based Compensation ($6.6 million) to arrive at FCF in year 1 of $56.8 million.

The reverse DCF indicates that LeMaitre Vascular‘s FCF should grow by 16.1% each year for the next ten years.

LeMaitre Vascular:

Forward PE: 32.5x (lower than its 10-year average? < 38.0x? ✅)

Earnings Growth Model: 11.7% (Yearly return? > 10%? ✅)

FCF-Growth Reverse DCF: 16.1% (Realistic growth expectations? ❌)

14. How did Owner’s Earnings evolve in the past?

Over time, stock prices tend to follow the Owner’s Earnings of the company.

Owner’s Earnings = EPS Growth + Dividend YieldThat’s why we want to invest in companies that managed to grow their Owner’s Earnings at attractive rates in the past.

LeMaitre Vascular:

CAGR Owner’s Earnings (5 years): 21.6% (CAGR Owner’s Earnings > 12%? ✅)

CAGR Owner’s Earnings (10 years): 20.3% (CAGR Owner’s Earnings > 12%? ✅)

15. Did the company create a lot of shareholder value in the past?

We want to invest in companies that managed to compound at attractive rates in the past.

Ideally, the company has returned more than 12% per year to shareholders since its IPO.

Here’s what the performance of LeMaitre Vascular looks like:

YTD: +4.7%

5-year CAGR: +16.1%

CAGR since IPO in 2006: +15.5% (CAGR since IPO > 12%? ✅)

LeMaitre Vascular has been an extraordinary compounder.

Quality Score

Finally, let’s bring everything together and give the company a Total Quality Score.

As you can see in the table below, LeMaitre Vascular gets a Total Quality Score of 8.0/10

Conclusion

That’s it for today.

Lemaitre Vascular ($LMAT) is an amazing company.

It’s the perfect example of a Tiny Titan.

You are not part of Tiny Titans yet? The doors are closed right now.

You can put yourself on the waiting list and you’ll immediately receive a list of 94 companies with 10x potential:

Everything In Life Compounds

Pieter

Book

Order your copy of The Art of Quality Investing here

Compounding Dividends

Do you like dividends? Test out Compounding Dividends here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data