One of the best investors ever? Chuck Akre

What he looks for?

High returns on capital

Plenty of reinvestment opportunities

Great management

That’s exactly what serial acquirers offer.

Let’s explore Lifco, a high-performing serial acquirer from the Nordics.

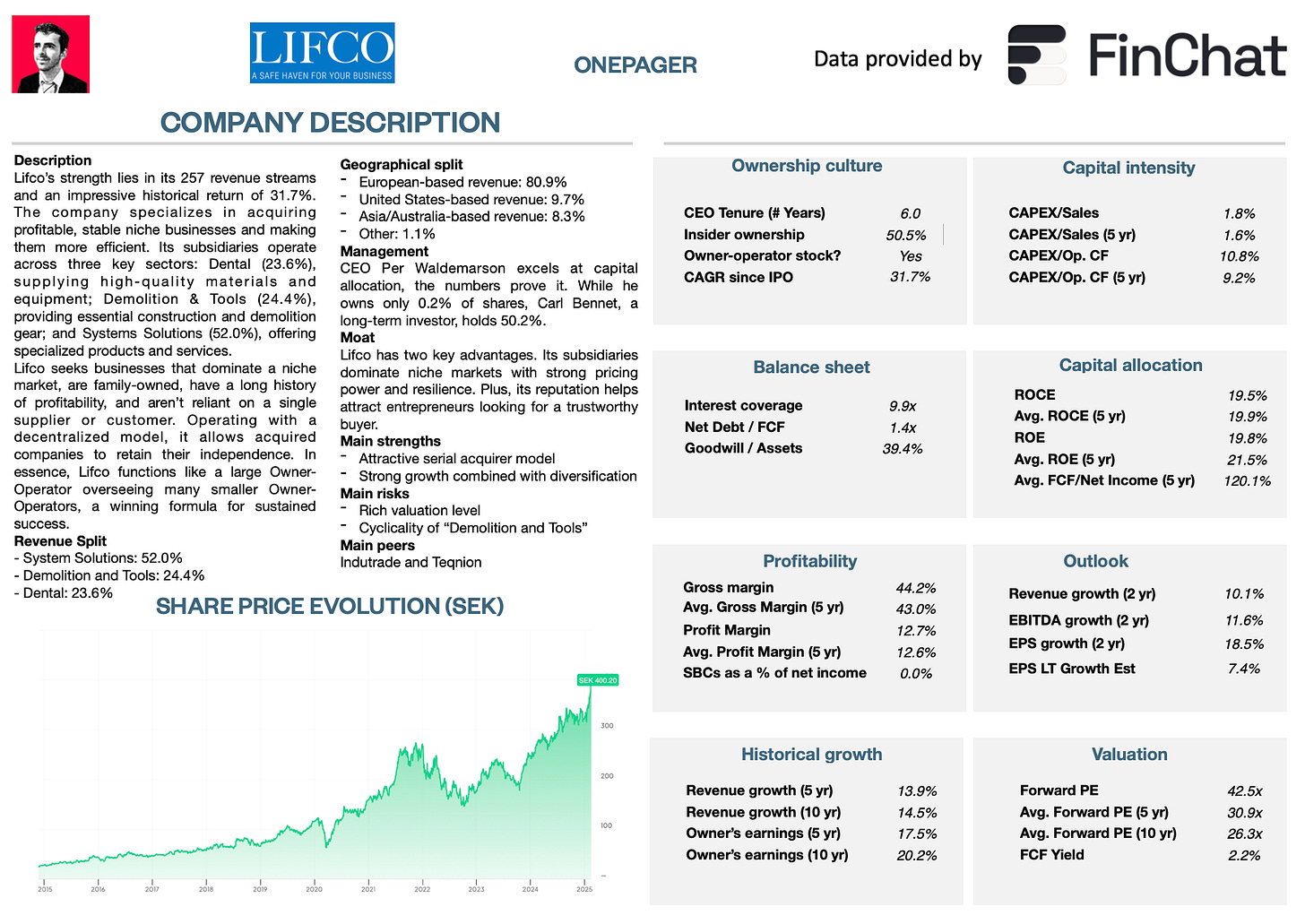

Lifco - General Information

👔 Company name: Lifco

✍️ ISIN: SE0015949201

🔎 Ticker: LIFCO-B

📚 Type: Owner-Operator Stock/Serial Acquirer

📈 Stock Price: SEK 400.2 ($41.8)

💵 Market cap: SEK 169.6 billion ($17.7 billion)

📊 Average daily volume: SEK 1.2 million

Onepager

Here’s a onepager with the essentials of Lifco:

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give Lifco a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

Lifco in one sentence?

Over 257 different revenue streams that have grown by 31.7% per year.

Lifco is a serial acquirer specializing in buying profitable, stable niche companies. Today, they have 257 (!) subsidiaries.

The Swedish company operates in the following industries:

Systems Solutions (52.0% of Revenue): Provides specialized products and services for various industries. Amayse is a subsidiary in this segment. They provide 3D advertisements.

Demolition & Tools (24.4% of Revenue): This division delivers essential equipment and accessories for construction and demolition, like the demolition robot from Lifco’s biggest subsidiary, Brokk.

Dental (23.6% of Revenue): Supplies top-quality materials, equipment, and solutions for dental professionals worldwide. An example is the production of dental implants.

Lifco’s ideal subsidiaries?

Market leaders in a niche market

Family-owned businesses

A long, stable history and proven profitability

Not relying on one supplier or customer

Lifco thinks as a quality investor.

And it gets even better.

The company runs on a decentralized model. Acquired businesses keep their independence.

It’s like one big Owner-Operator owning many small Owner-Operators.

"The best acquirers don’t buy companies to fix them, they buy great companies and let them keep doing what made them great."2. Is management capable?

The Power of Serial Acquirers?

Unlike traditional managers, serial acquirers don’t need to master daily operations. Instead, they focus on one thing: buying great businesses and letting them run independently.

Here’s why that matters:

Regular managers should be great operators and capital allocators

Management of serial acquirers only need to be great capital allocators

The great news is that capital allocation is easy to measure.

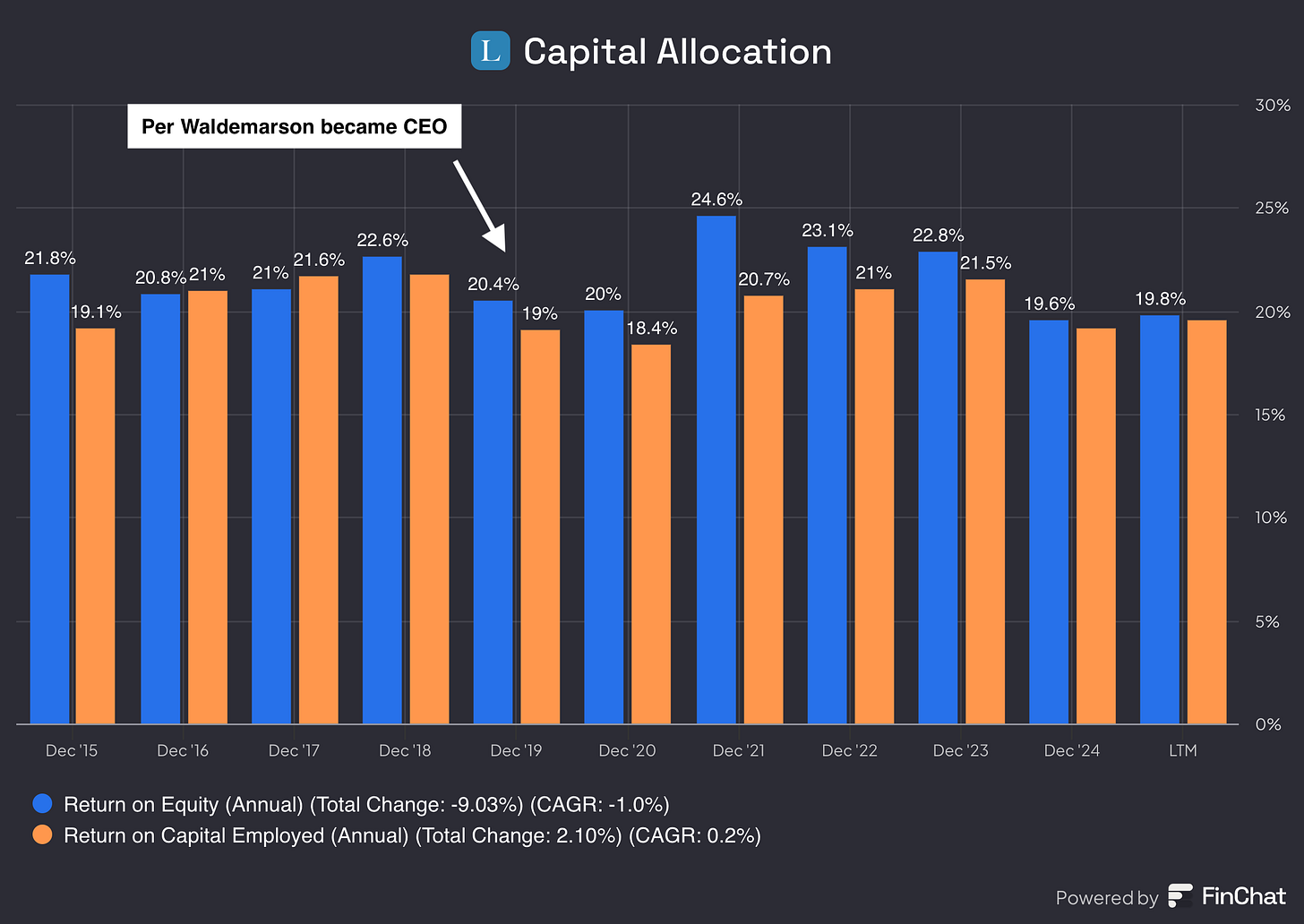

Per Waldemarson became CEO in 2019.

Let’s see how well he is doing:

The numbers speak for themselves. They are great.

Keep reading, you’ll see it’s even better than it looks!

One downside? Per Waldemarson only holds 0.2% of the shares.

But here’s the good news: Carl Bennet owns 50.2%.

He earned this stake through Getinge, which spun off Lifco in 1995. At that time, Carl was the CEO and majority shareholder of Getinge.

He is a committed long-term shareholder.

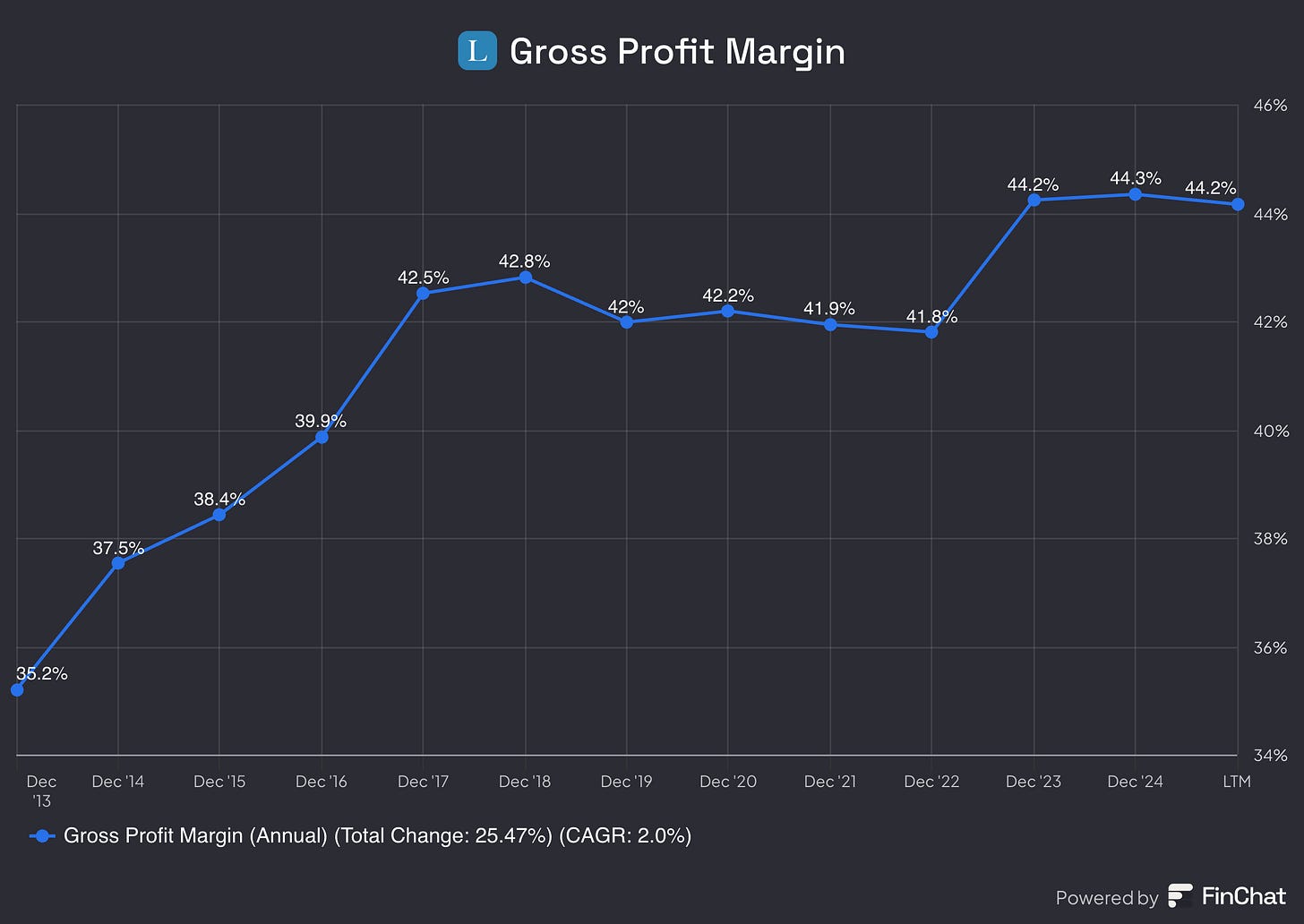

3. Does the company have a sustainable competitive advantage?

Lifco has a competitive advantage on two levels.

First, its subsidiaries operate in niche markets with little to no competition. This gives them strong pricing power. The long track record of its subsidiaries also proves resiliency.

Second, Lifco itself has a powerful edge: its reputation. Entrepreneurs are careful when selling their businesses. Lifco’s proven track record makes it easier to win their trust.

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.” - Warren BuffettCompanies with a sustainable competitive advantage are often characterized by the following:

Gross Profit Margin: 44.2% (Gross Profit Margin > 40%? ✅)

Return On Invested Capital Without Goodwill (ROIC) 17.8% (ROIC > 15%? ✅)

4. Is the company active in an attractive end market?

The interesting thing about serial acquirers is that they don’t operate in just one market. They diversify their revenue streams.

But doesn’t diversifying lower your return?

Not at all.

This reduced risk doesn’t translate to lower returns, quite the opposite.

A regular business is like a snowball rolling downhill, growing steadily as it picks up snow. A serial acquirer, however, is like an avalanche, where multiple snowballs combine.

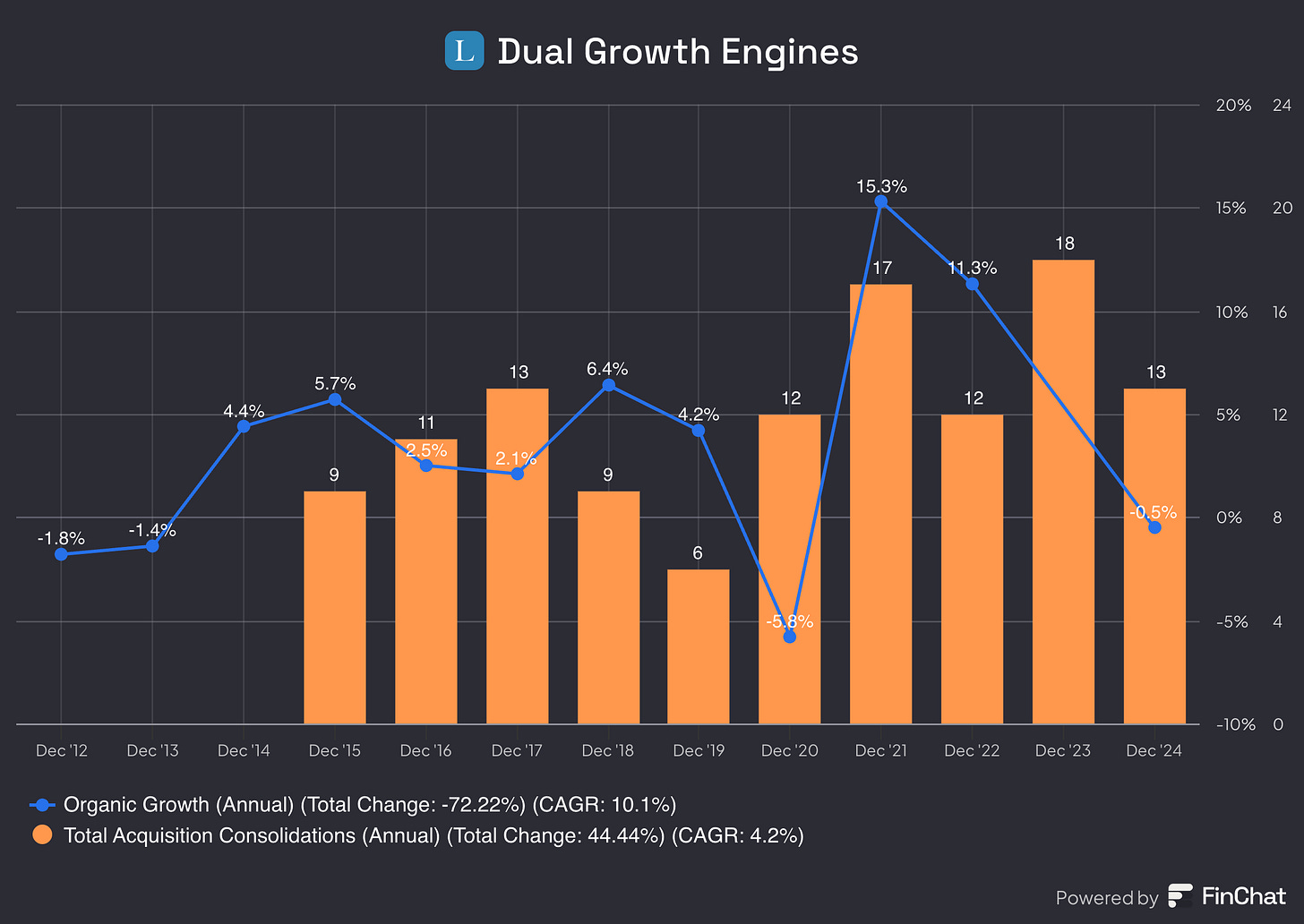

Lifco benefits from a dual growth engine:

Organic Growth means expanding through sales and margin improvement

Acquired Growth is growth that comes from doing more acquisitions

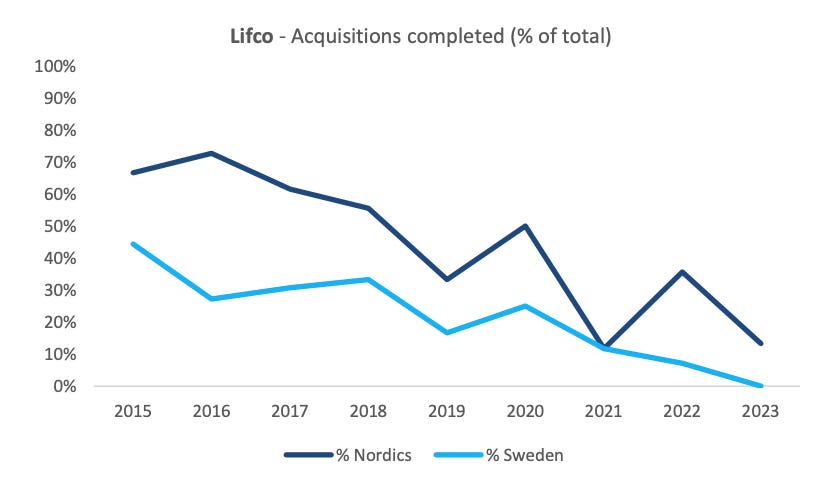

The runway is still huge for Lifco.

Europe alone has 23.5 million small businesses. Lifco has built a strong base in the Nordics, which has helped it expand into new markets gradually.

5. What are the main risks for the company?

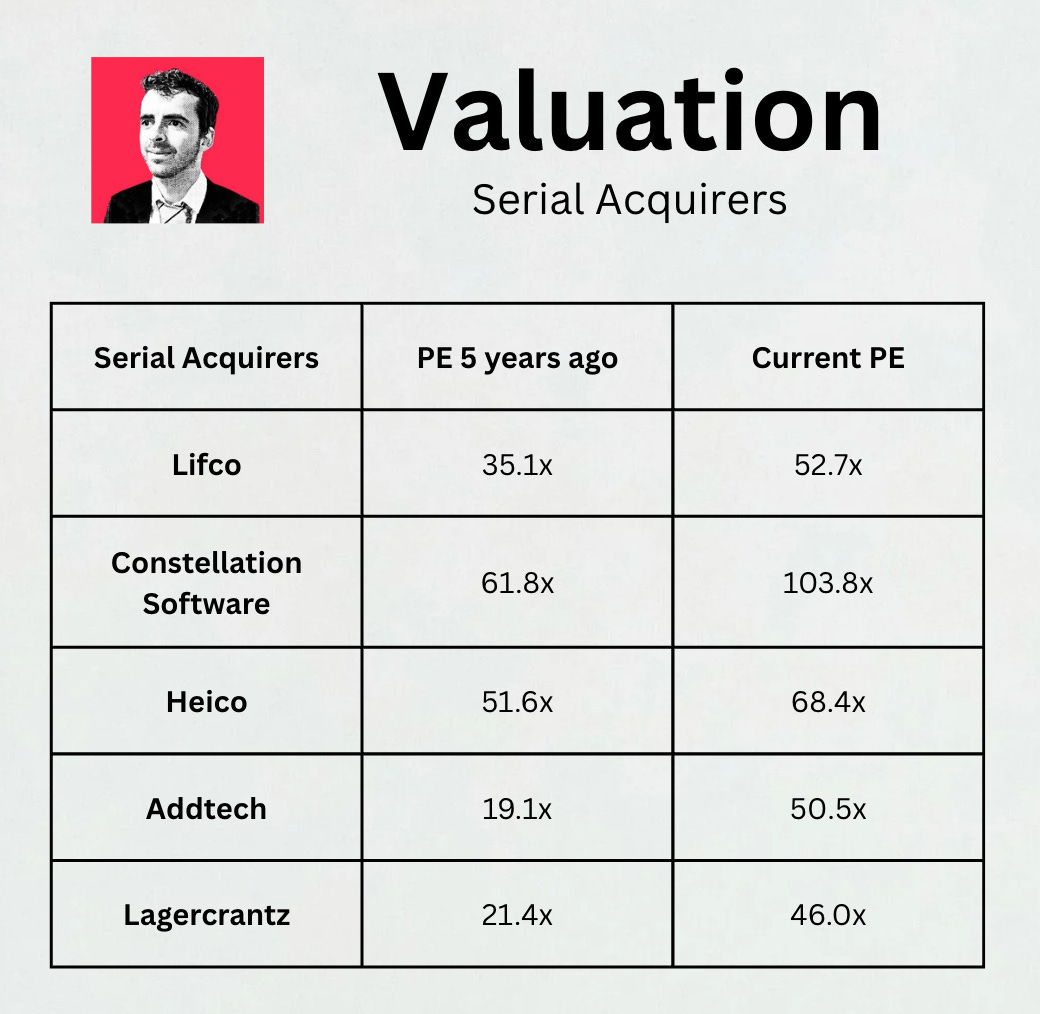

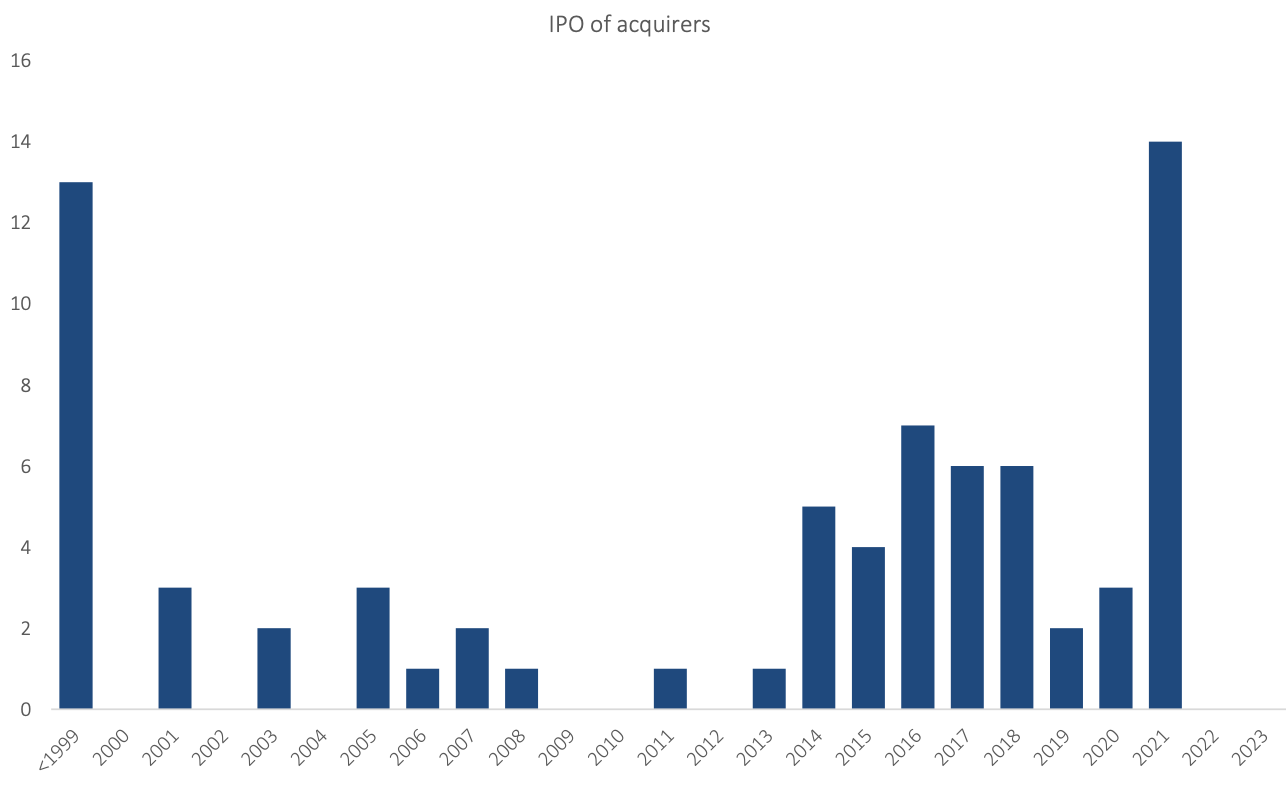

Serial acquirers have become very popular, and for good reasons. They have been excellent investments in the past.

However, this popularity has led to rich valuation levels. As a result, there may be a risk of overvaluation.

Valuation isn’t the only risk.

As Lifco grows, small acquisitions have less impact, meaning they must make more or larger deals to maintain the same growth. This can lead to lower-quality acquisitions.

The Demolition & Tools segment is also highly cyclical. Last year, it recorded negative organic growth for the first time.

Competition is another challenge. With more companies looking to acquire niche businesses, prices could rise, making acquisitions more expensive and reducing Lifco’s returns.

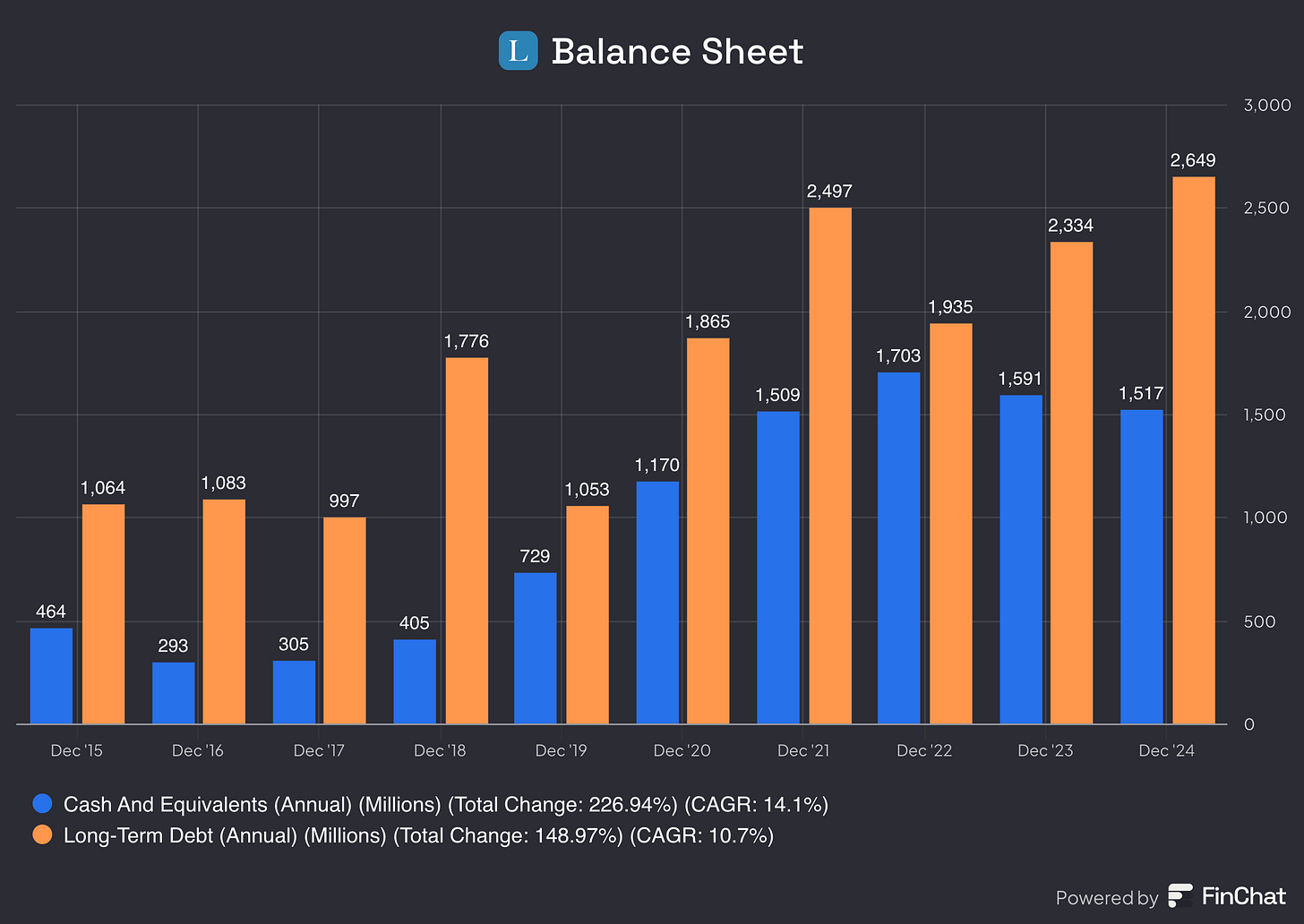

6. Does the company have a healthy balance sheet?

I look at 3 ratios to determine the healthiness of Lifco’s balance sheet:

Interest Coverage: 9.9x (interest coverage > 15x? ❌)

Net Debt/FCF: 1.4x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 39.4% (Goodwill to assets < 20%? ❌)

Despite two red crosses, Lifco has a very healthy balance sheet. Here’s why:

Lifco's predictable revenue eases interest coverage concerns

Frequent acquisitions explain the higher Goodwill

7. Does the company need a lot of capital to operate?

I prefer to invest in companies with a CAPEX/Sales ratio lower than 5% and a CAPEX/Operating Cash Flow ratio lower than 25%.

Here’s what things look like for Lifco:

CAPEX/Sales: 1.8% (CAPEX/Sales? < 5%? ✅)

CAPEX/Operating Cash Flow: 10.8% (CAPEX/Operating CF? < 25%? ✅)

Lifco doesn’t need a lot of capital to operate.

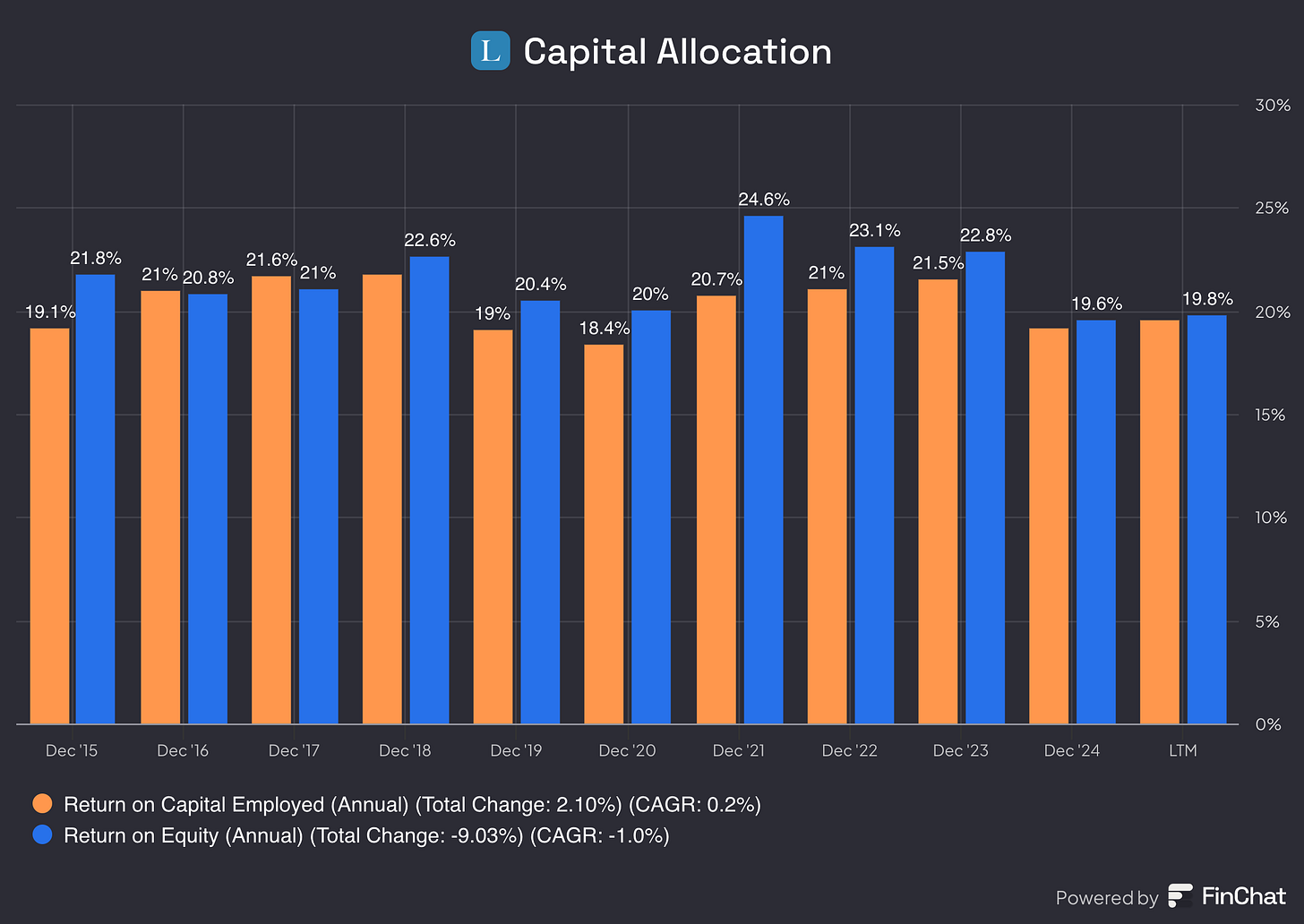

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.

We are looking for businesses capable of allocating shareholders' resources effectively.

Lifco:

Return on equity (ROE): 19.8% (ROE > 20%? ❌)

Return on Capital (ROIC): 10.8% (ROIC > 15%? ❌)

Remember that Per Waldermarson (CEO) was an even better capital allocator than we first thought?

Here is the catch.

39.4% of Lifco’s assets are intangibles.

That’s exactly why it makes more sense to look at Return on Capital Employed, and ROIC without Goodwill

Return on Capital Employed: 19.5% (ROCE > 15%? ✅)

ROIC without Goodwill: 17.8% (ROIC without Goodwill > 15%? ✅)

These numbers look great.

Here’s an evolution of Lifco’s ROCE and ROE:

The one thing I don’t like is the fact that Lifco pays a dividend (current dividend yield: 0.7%).

I'd prefer it if they kept compounding capital internally.

"We can retain and reinvest earnings at higher rates of return than our shareholders could achieve on their own." - Warren Buffett9. How profitable is the company?

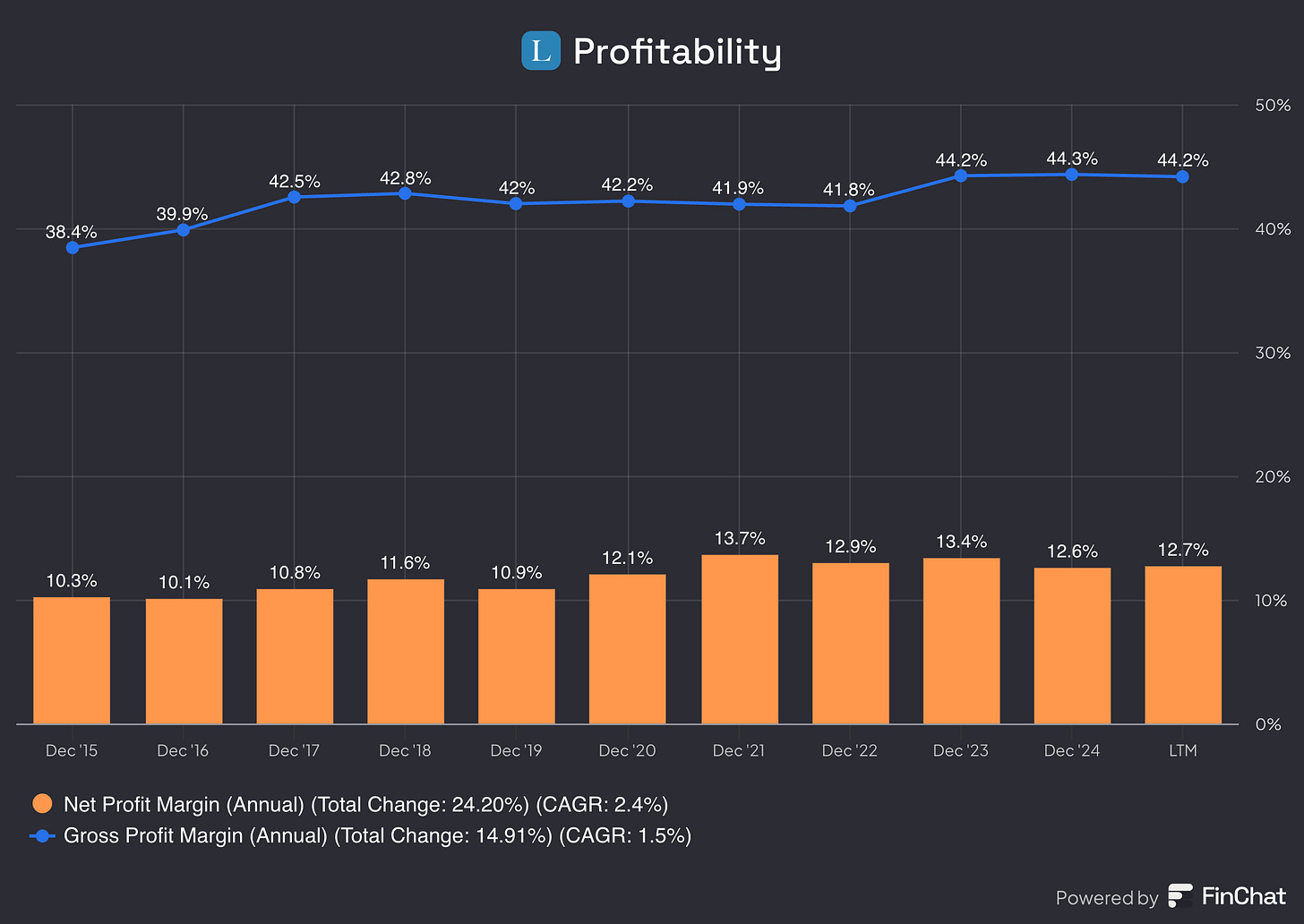

The higher the profitability of the company, the better.

Here’s what things looks like for Lifco:

Gross Profit Margin: 44.2% (Gross Profit Margin > 40%? ✅)

Net Profit Margin: 12.7% (Net Profit Margin > 10%? ✅)

FCF/Net income: 116.5% (FCF/Net income > 80%? ✅)

Lifco is a very profitable company. We love to see this. More cash means more acquisitions, which drives their growth engine.

"If your business has a high margin, you are doing something well because your customers accept paying a high price." - Fredrik Karlsson, former CEO of Lifco10. Does the company use a lot of Stock-Based Compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Preferably, we want SBCs as a % of Net Income to be lower than 10%.

Lifco:

SBCs of a % of Net Income: 0.0% (SBSs/Net income < 10%? ✅)

Avg. SBC as a % of Net Income past 5 years: 0.0% (SBCs/Net income < 10%? ✅)

It’s good seeing Lifco doesn’t fool its investors with Stock-Based Compensation.

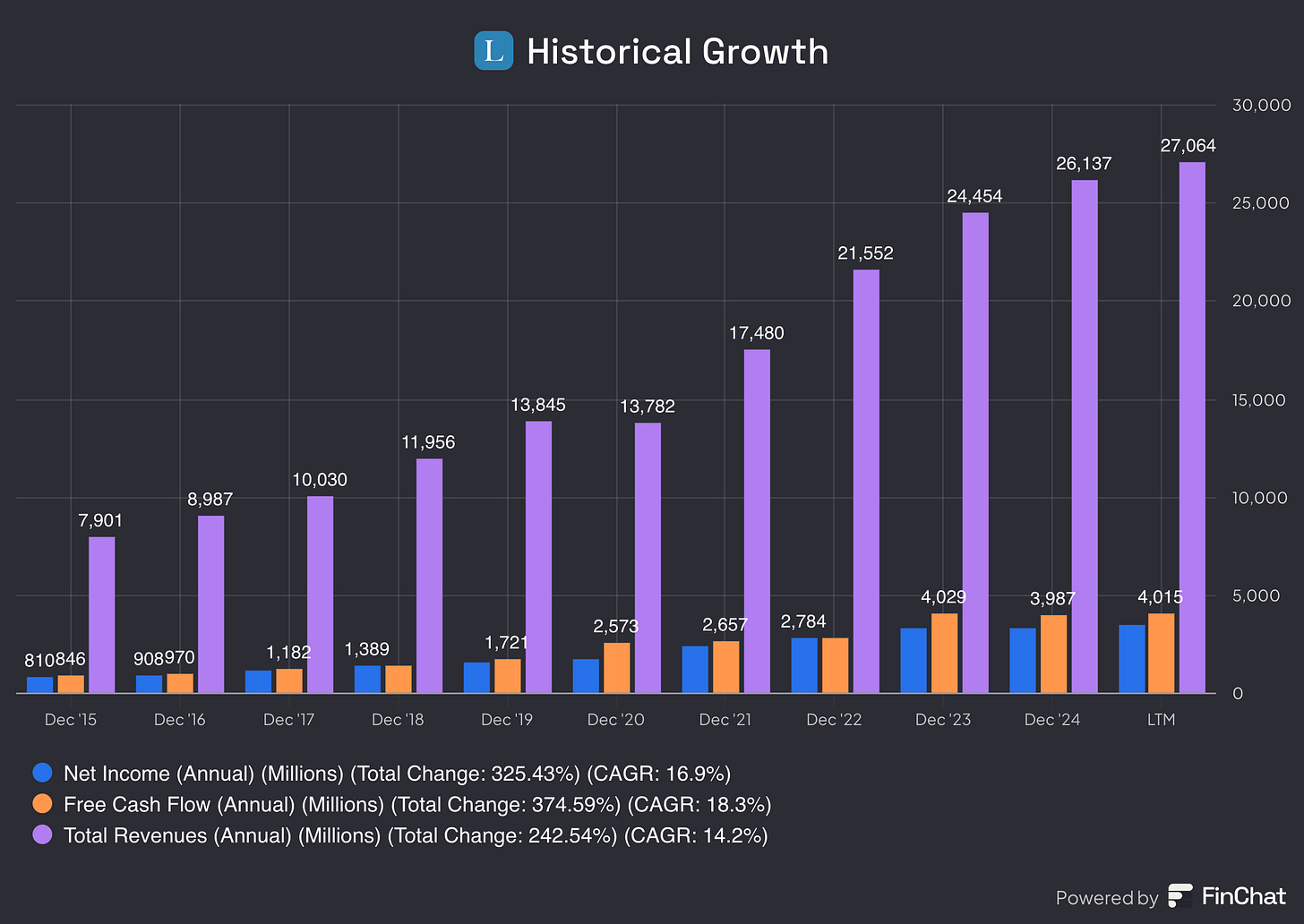

11. Did the company grow at attractive rates in the past?

I look for companies that grew their revenue and EPS by at least 5% and 7% per year in the past.

Let’s look at what recent history tells us:

Revenue growth past 5 years (CAGR): 13.9% (revenue growth > 5%? ✅)

Revenue growth past 10 years (CAGR): 14.5% (revenue growth > 5%? ✅)

EPS growth past 5 years (CAGR): 16.8% (EPS growth > 7%? ✅)

EPS growth past 10 years (CAGR): 19.5% (EPS growth > 7%? ✅)

The Swedish investment powerhouse has grown at attractive rates.

12. Does the future look bright?

You want to invest in companies that can grow at attractive rates, as stock prices tend to follow EPS growth over time.

Lifco:

Exp. Revenue growth next 2 years (CAGR): 10.1% (revenue growth > 5%? ✅)

Exp. EPS growth next 2 years (CAGR): 18.5% (revenue growth > 7%? ✅)

Long-term growth estimate EPS (CAGR): 7.4% (EPS growth > 7%? ✅)

This outlook looks attractive. I think Lifco can grow its earnings by more than 7.4% in the long term.

13. Does the company trade at a fair valuation level?

I always use 3 methods to look at the valuation of a company:

A comparison of the forward PE multiple with its historical average

Earnings Growth Model

Reverse Discounted-Cash Flow

A comparison of the multiple with the historical average

I first compare the current Forward PE with its historical average over the past 10 years.

Today, Lifco trades at a Forward PE of 42.5x compared to a historical average of 26.3x.

Lifco looks richly valued today based on this metric.

Earnings Growth Model

This model shows you the yearly return you can expect as an investor.

In theory, it’s easy to calculate your expected return:

Expected return = EPS Growth + Dividend Yield +/- Multiple Expansion (Contraction)

Here are the assumptions I use:

EPS Growth: 14.0% per year over the next 10 years

Dividend Yield: 0.7%

Forward PE to decline from 42.5x to 25.0x

Expected yearly return = 14.0% + 0.7% + 0.1*((25.0x – 42.5x)/42.5x)) = 10.6%

Please note that my 14.0% EPS growth assumption is higher than analysts expectations (7.4%).

Here’s the reasoning:

Lifco’s runway is still huge

Per Waldemarson (CEO) is a great capital allocator

The EPS growth of the past 5 years equals 16.8%

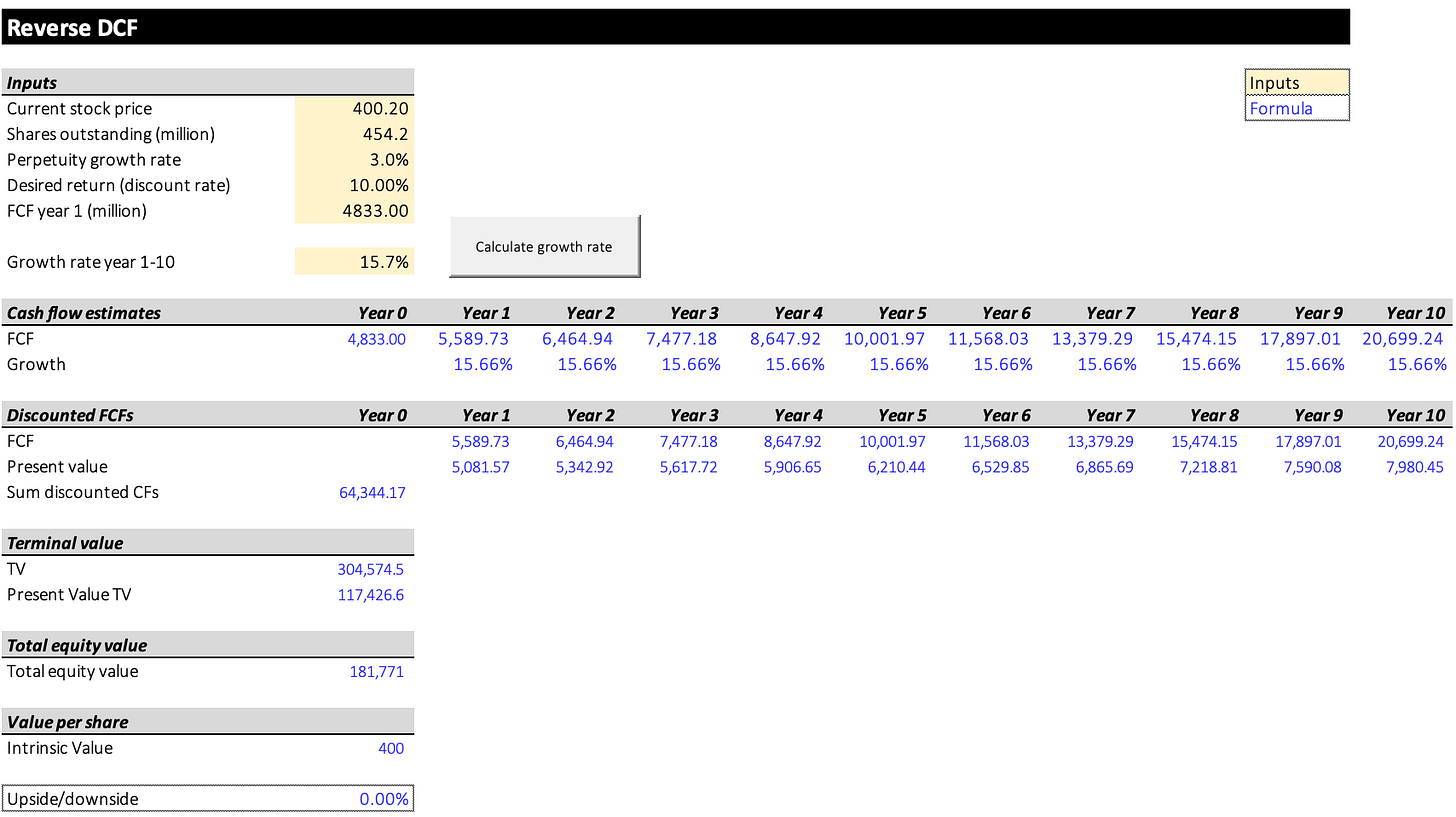

Reverse DCF

Charlie Munger once said that you should invert if you want to solve a complex problem. Always invert. Turn the problem upside down.

A reverse DCF shows you the expectations implied in the current stock price.

You try to determine for yourself whether these expectations are realistic or not.

You can learn more about a reverse DCF here: Reverse DCF

The consensus states that Lifco’s Free Cash Flow over the next 12 months will be equal to SEK 4,833.0 billion.

We subtract the Stock-Based Compensation (SEK 0) to arrive at FCF in year 1 of SEK 4,833.0 billion.

Under these assumptions, our Reverse DCF indicates that Lifco should grow its Free Cash Flow by 15.7% per year to return 10% per year to shareholders.

Lifco seems to be priced to perfection. There is no margin of safety.

Lifco:

Forward PE: 42.5x (lower than its 10-year average? < 26.3x? ❌)

Earnings Growth Model: 10.6% (Yearly return? < 10%? ✅)

FCF-Growth Reverse DCF: 15.7% (Realistic growth expectations? ❌)

14. How did the Owner’s Earnings of the company evolve in the past?

Over time, stock prices tend to follow the Owner’s Earnings of a company.

Owner's Earnings = EPS Growth + Dividend YieldThat’s why I want to invest in companies that have grown their Owner’s Earnings at attractive rates in the past.

Lifco:

CAGR Owner’s Earnings (5 years): 17.5% (CAGR Owner’s Earnings > 12%? ✅)

CAGR Owner’s Earnings (10 years): 20.2% (CAGR Owner’s Earnings > 12%? ✅)

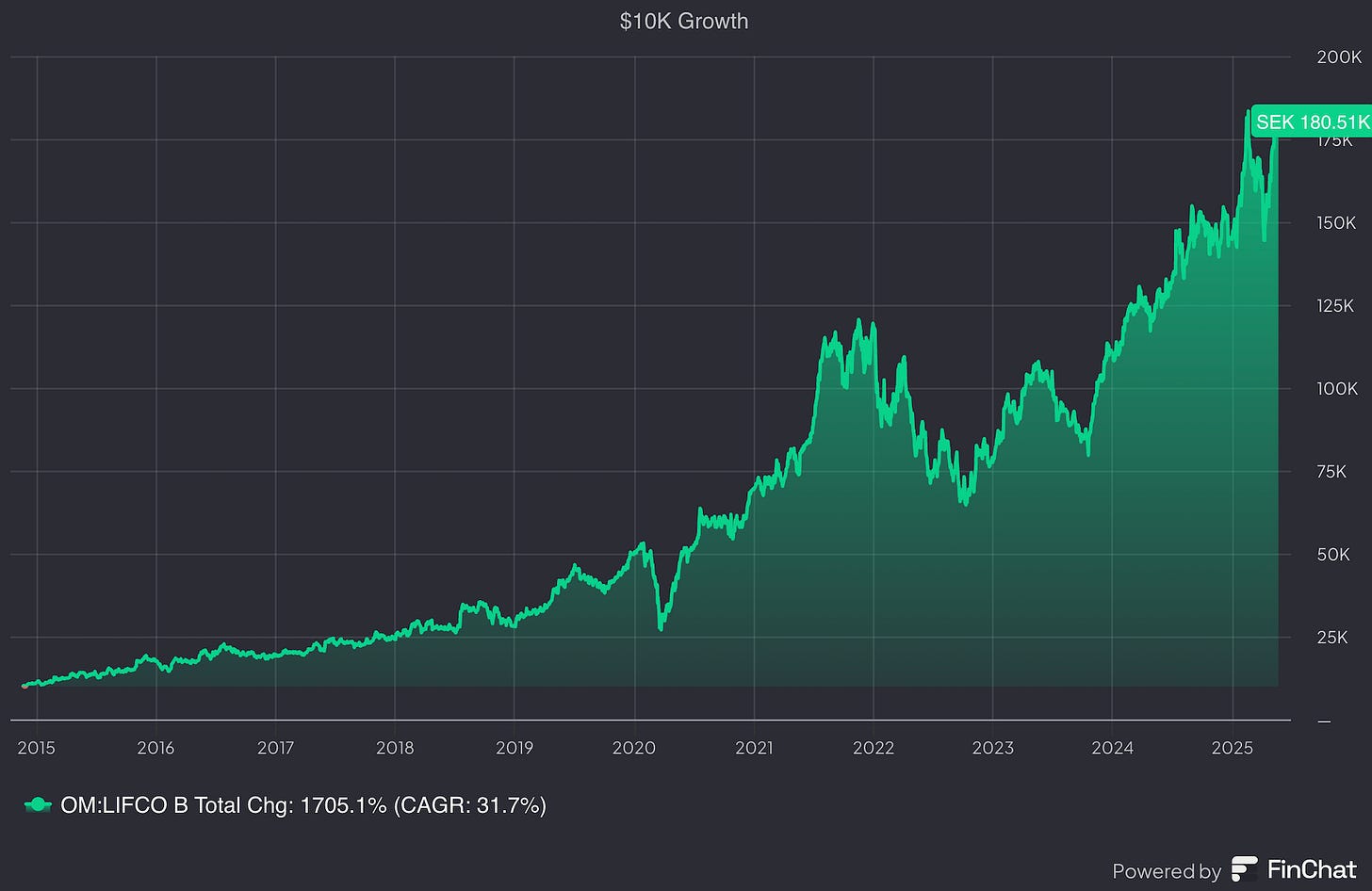

15. Did the company create a lot of shareholder value in the past?

I want to invest in companies that have compounded at attractive rates in the past.

Ideally, the company has returned more than 12% per year to shareholders since its IPO.

Here’s what the performance of Lifco looks like:

YTD: +21.3%

5-year CAGR: 30.0%

CAGR since IPO in 2014: 31.7% (CAGR since IPO > 12%? ✅)

$10,000 invested in Lifco at its IPO in 2014 would now be worth $180,510.

Quality Score

Finally, let’s bring everything together and give the company a Total Quality Score.