Stock-Based Compensation: A Silent Killer?

A hidden cost

A hidden cost most investors overlook? Stock-Based Compensation

It’s a Trojan Horse that quietly lowers your investment returns.

In this article, I’ll teach you how to avoid becoming a victim.

Cannibal stocks

A Cannibal is a business that ‘eats’ or buys back its shares. They can be very attractive investments.

The reasoning? In the long run, stocks always follow Earnings Per Share (EPS).

EPS = Earnings / Total Shares OutstandingThe only ways to improve EPS are to grow Earnings or reduce the Total Shares Outstanding.

A great cannibal does both.

Let’s take a look at O’Reilly Automotive as an example.

This is the kind of chart I dream about at night.

O’Reilly is buying back its shares while increasing Net Income at the same time.

The result? An average return of 20.2% over the past 10 years.

This means $10,000 invested in O’Reilly would now be worth $62,900.

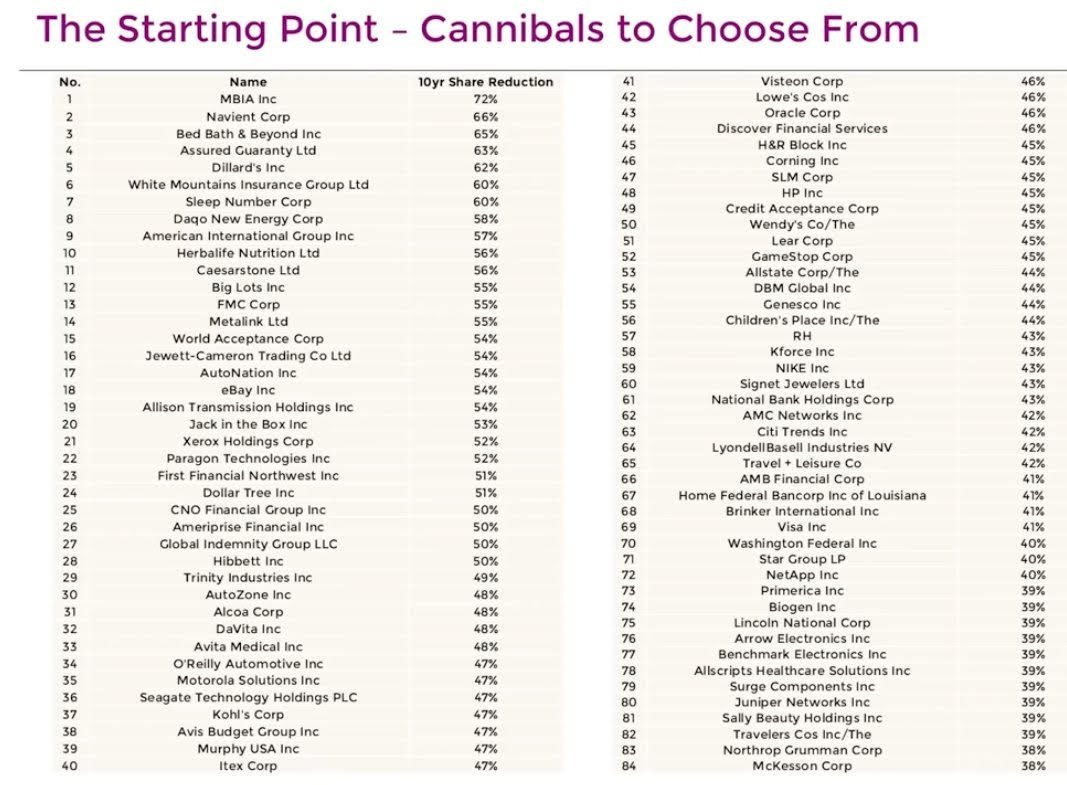

Here’s a list of interesting Cannibal Stocks according to Mohnish Pabrai:

Companies that stand out to me? AutoZone, DaVita, O’Reilly Automotive, Lowe’s, Wendy’s, RH, Nike, Visa, and Northrop Gruman.

Your worst enemy

But what if the Total Shares Outstanding would increase?

That’s exactly what Stock-Based Compensation (SBC) does.

As the name suggests, SBC is compensation based on stocks.

It allows companies to pay employees with stock instead of cash.

The problem with this is dilution. When more shares are issued, your ownership stake shrinks.

"Stock-based compensation' is the best example. The very name says it all: 'compensation'. If compensation isn't an expense, what is it?" - Warren BuffettTo avoid too much dilution, we always use these two rules:

Stock-Based Compensation as a % of Net Income should be lower than 10%

Avg. SBC as a % of Net Income past 5 years should be lower than 10% too

Let’s take a look at an example.

Snap Inc. ($SNAP)

As you can see, Snap is repurchasing shares frequently:

But would it also be a great cannibal? Let’s verify our two criteria.

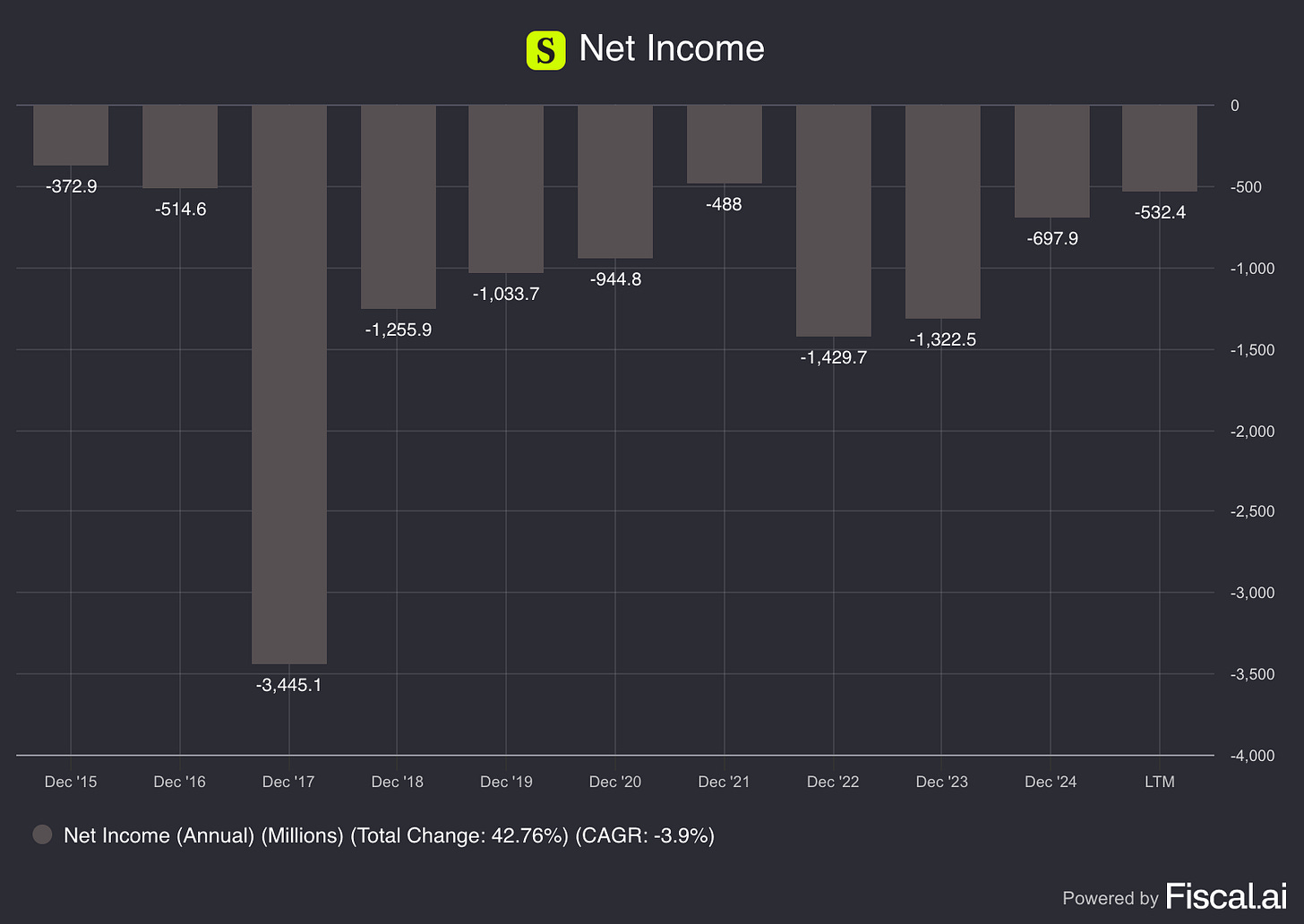

We start with the evolution of Net Income:

Over the past 10 years, Snap has not made a profit. This is not a great start.

But the story gets even worse.

Despite the Repurchase of Common Stock, Snap’s Total Shares Outstanding are rising quickly.

This immediately tells you one thing: Snap is using Stock-Based Compensation.

The result speaks for itself:

The difference between O’Reilly Automotive and Snap Inc. is night and day.

The lesson? The negative effects of Stock-Based Compensation can cancel out the positive effects of buybacks.

It’s like swimming against the flow.

No matter how hard you try, you stay in the same place.

For Snap, it’s even worse: they’re moving backward.

SBC: A Trap for Investors?

The biggest problem with Stock-Based Compensation (SBC) is the accounting.

It doesn’t just increase the number of shares.

There’s another issue…

How SBC is recorded in accounting. Or rather, how it isn’t.

Let me break it down.

A great way to check a company’s performance is by looking at its Free Cash Flow (FCF).

FCF is the money a company can take out without hurting its daily work.

Simply put, it’s what the business makes for its shareholders after paying all costs.

Here’s where things get tricky.

With SBC, no actual money moves. It’s a non-cash expense.

This means Free Cash Flow doesn’t include the negative effects of Stock-Based Compensation.

And this while it is an expense for shareholders.

That’s why you should always adjust Free Cash Flow:

Adjusted Free Cash Flow = Free Cash Flow - Stock-Based CompensationStock-Based Compensation is a real cost and should be treated that way.

It might seem tricky at first, so let’s make it simple with an example.

Snowflake ($SNOW)

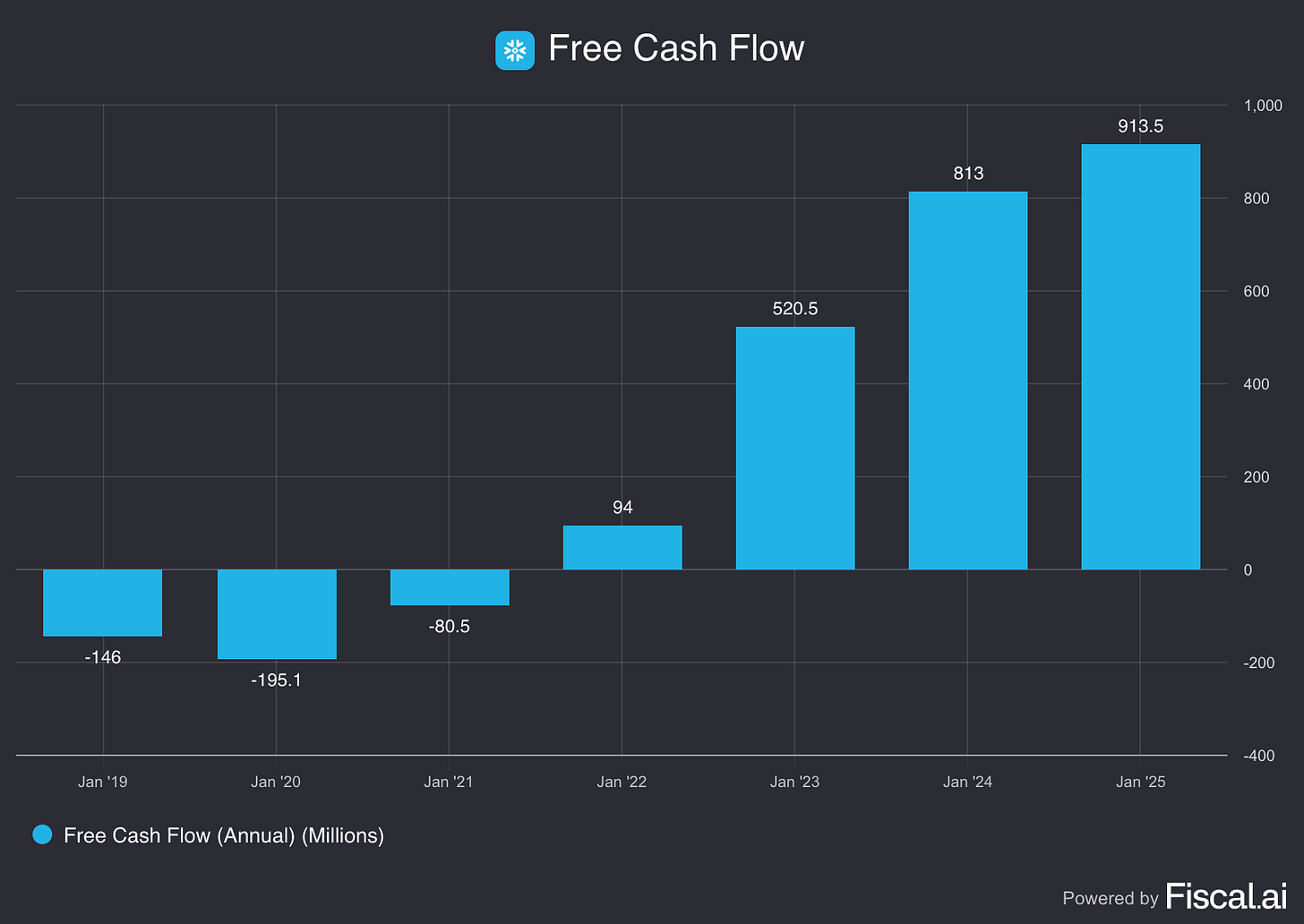

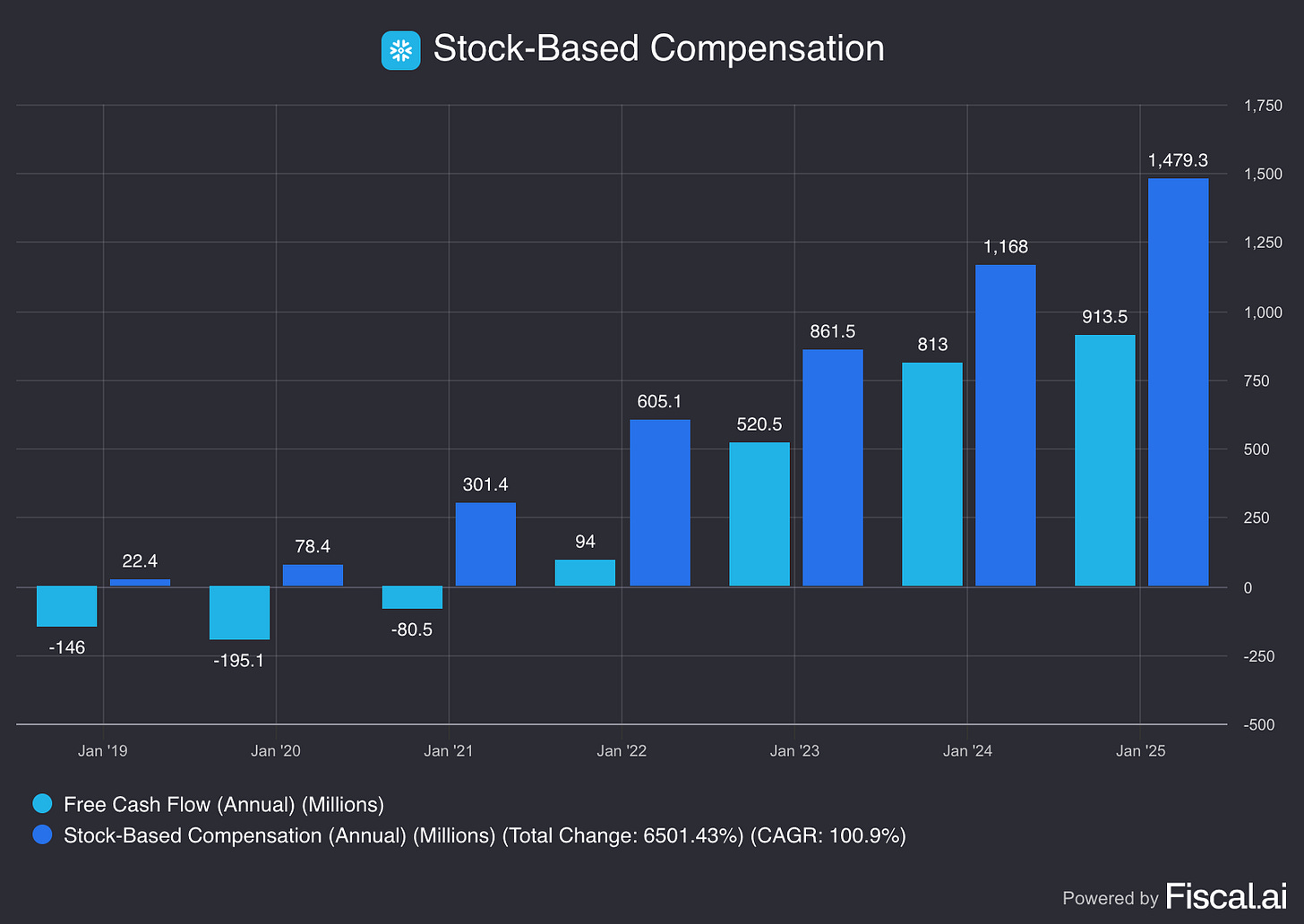

Last year, Snowflake made $913.5 million in Free Cash Flow. This is the money they make for their shareholders.

They can use it to pay a dividend, buy back shares, or reinvest in the business to create more future value.

This sounds great until you realize what’s going on.

In the same year, Snowflake rewarded its employees with a total of $1,479.3 million in Stock-Based Compensation.

Let’s now use our formula:

Adjusted Free Cash Flow = Free Cash Flow - Stock-Based Compensation

Adjusted Free Cash Flow = $913.5 million - $1,479.3 million = - $565.8 millionThis means that, in reality, Snowflake doesn’t make any money for its shareholders yet!

Why do businesses use SBC?

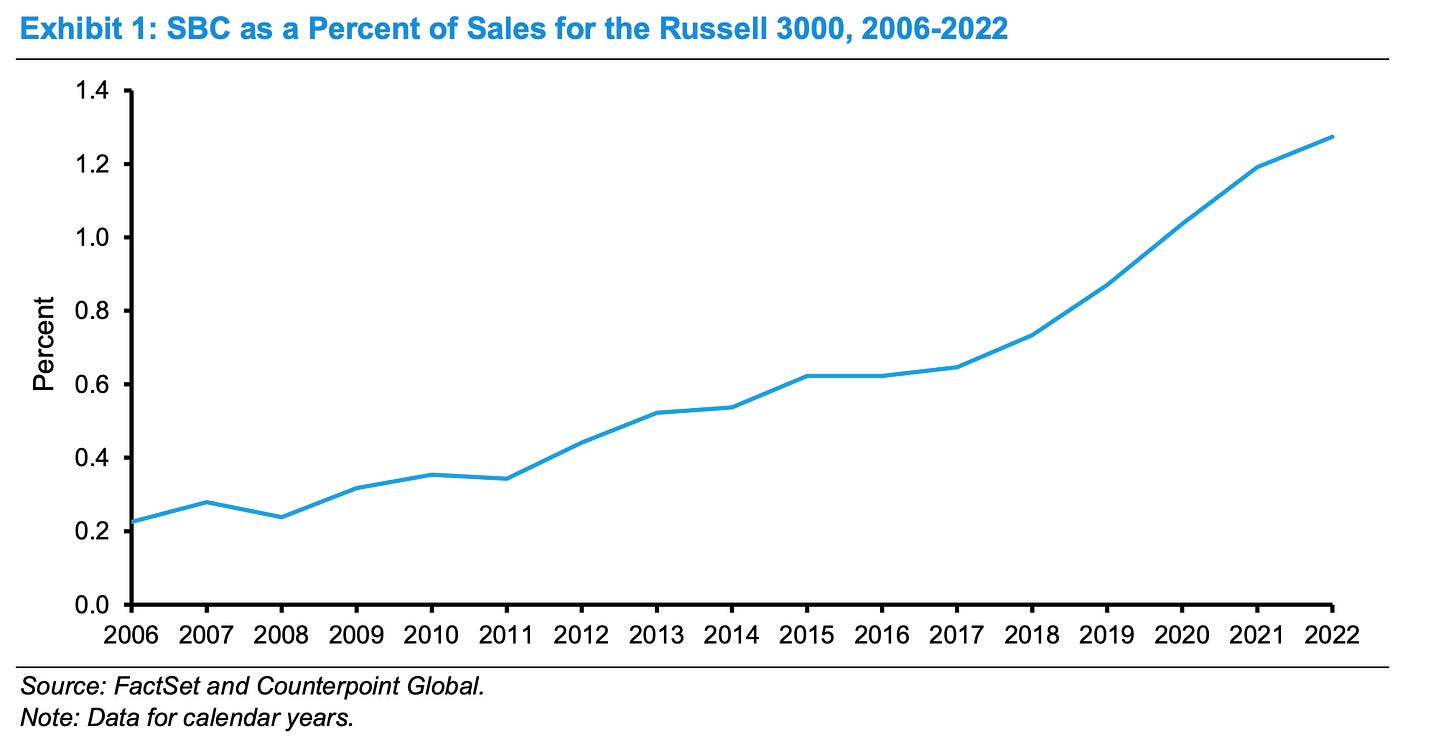

Stock-based compensation is becoming more and more popular every year.

But why would businesses use this way of compensating employees?

Small Businesses

Let’s say that today, you are the CEO of a very small business with a lot of potential.

Because you’re small, the cash flow is still limited.

But you still want to reward your employees for their hard work.

That’s where Stock-Based Compensation helps. It lets you reward them without using cash right away.

Incentives are also aligned better, as employees can reap the rewards for the upside potential.

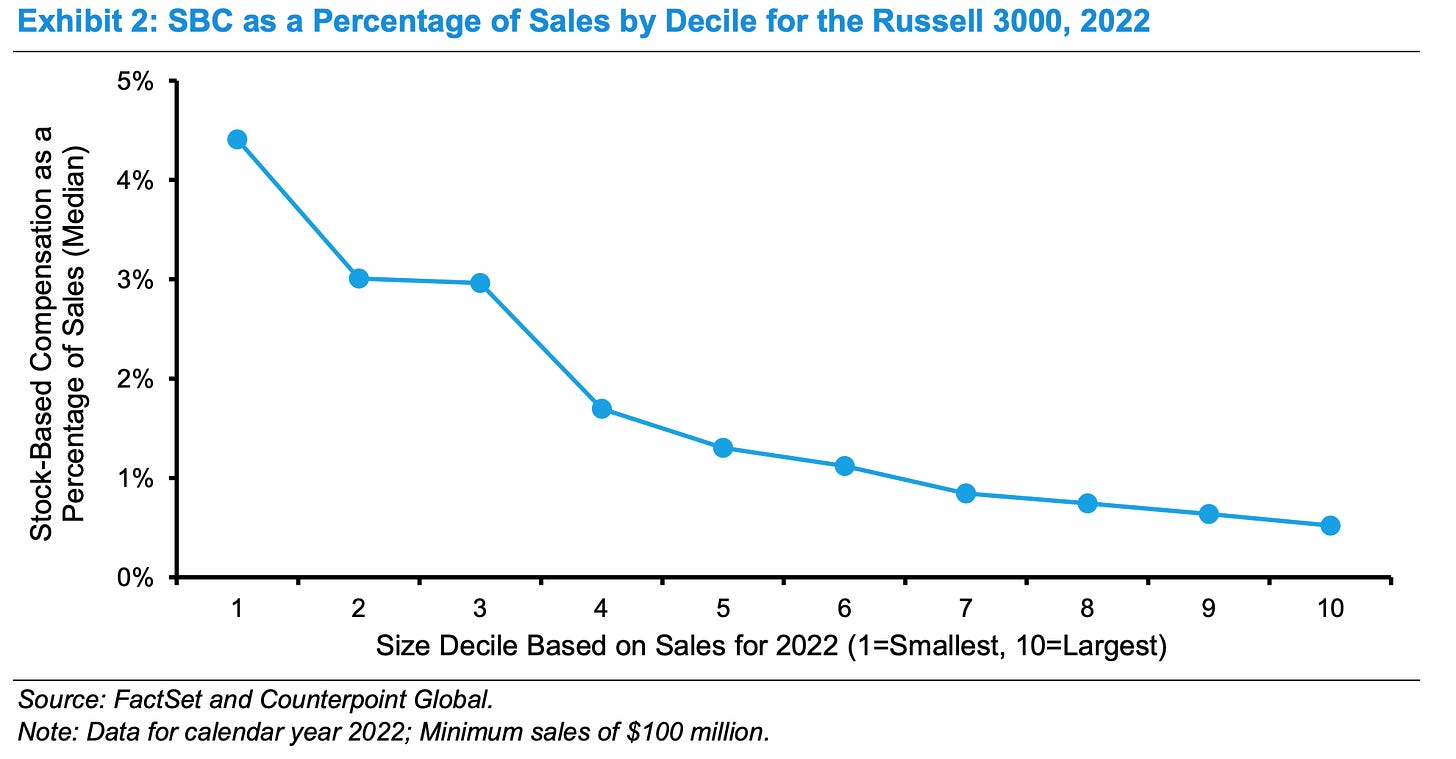

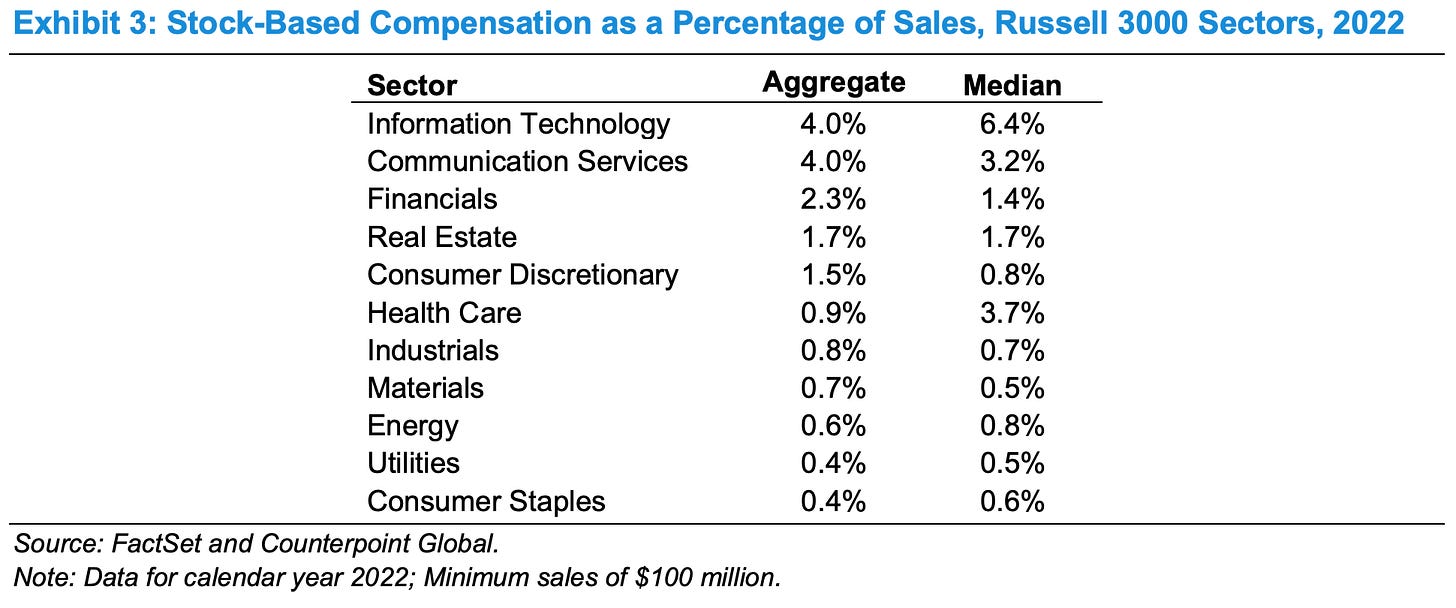

As you can see in the chart above, smaller businesses use more Stock-Based Compensation.

Big Tech

But it's not just for small businesses.

The Big Tech companies use it to win the War on Talent.

Businesses like Meta Platforms, Amazon, Google, and Uber all rely on Stock-Based Compensation.

Their success depends on the people who work for them.

To attract and keep the best employees, they offer generous stock-based bonuses.

As you can see, it’s very popular in the technology industry.

The Big Problem

Stock-Based Compensation is a real expense. It also reduces your stake in the business.

But it has benefits too:

It aligns the interests of shareholders and insiders

It motivates insiders to meet targets

It helps attract and keep top talent

Great employees deserve great compensation.

In the end, it all comes down to one question:

Who should be rewarded for great business performance: the employees or the shareholders?

It’s a big problem with a simple solution.

Let’s see how three of the smartest people I’ve studied solved it.

Warren Buffett and Charlie Munger

Charlie Munger understood the power of incentives better than anyone else.

If you have a dumb incentive system, you get dumb outcomes.

Their approach is simple.

Everyone at Berkshire Hathaway should think like a shareholder.

But interestingly, they don’t use Stock-Based Compensation to achieve this. Instead, they pay insiders in cash and require them to buy shares.

This way, insiders become real shareholders and pay the same price as other investors.

Mark Leonard’s Approach

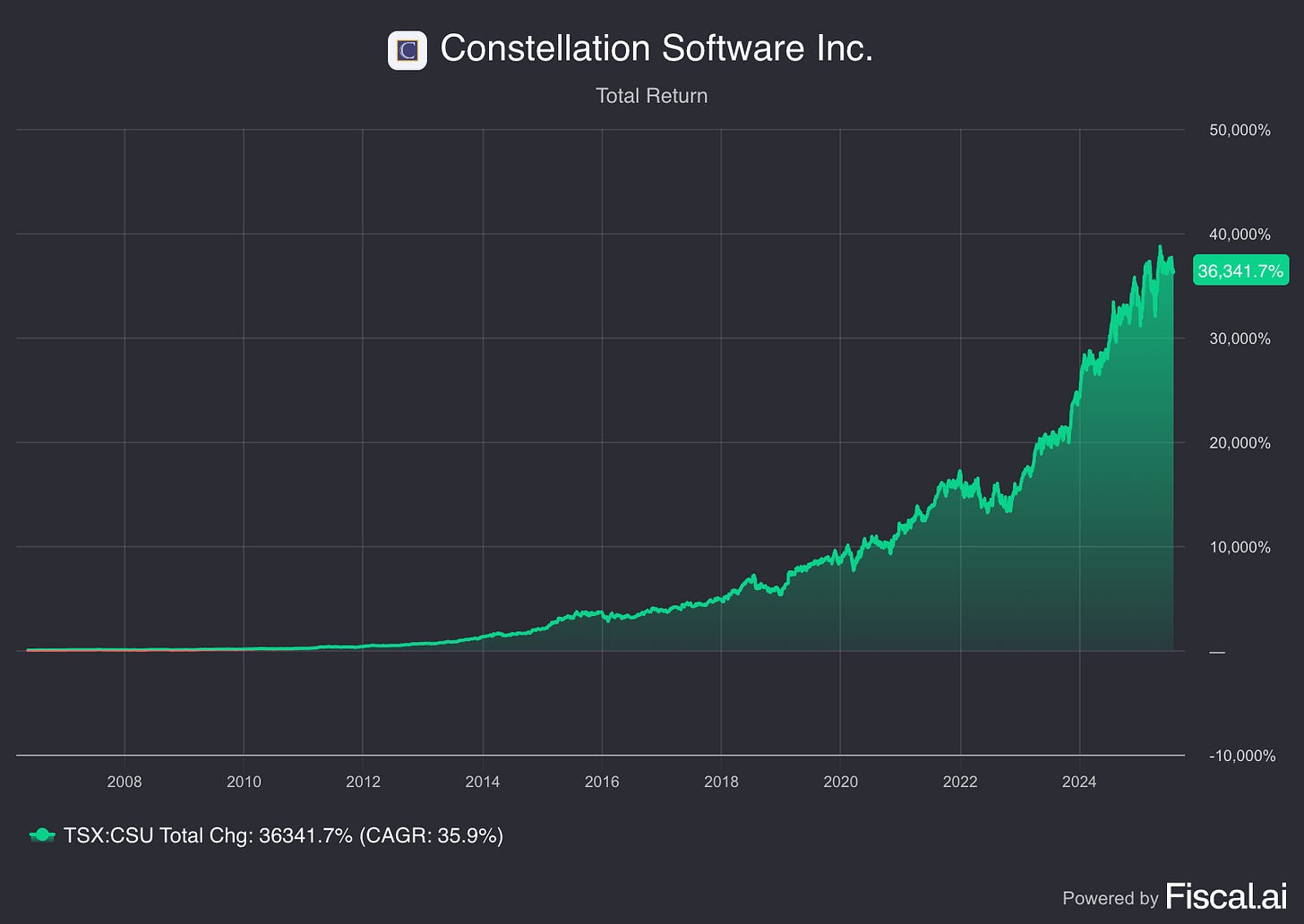

Mark Leonard is the CEO and founder of Constellation Software.

Since its IPO in 2006, Constellation Software has had an average return of 34.6%.

A big part of its success? Mark Leonard’s compensation approach.

Constellation Software pays its executives a base salary and an additional cash bonus if the businesses and executives perform well.

Here’s where things get interesting.

Executives must invest 75% of their cash bonus in Constellation Software shares. They need to keep their shares for at least four years before they can sell them.

Another interesting fact? During the last years, Mark Leonard himself received no salary.

He believes owning Constellation Software stock compensates him enough.

(You want to learn more about Mark Leonard? Read this article.)

The lesson from Buffett, Munger, and Leonard is clear.

Pay insiders in cash and cash bonuses for good performance. Then, make them buy shares with it like any other investor.

This approach works great for everyone:

Insiders get fair rewards

Insider ownership increases

Existing shareholders don’t get diluted

Everybody wins.

Conclusion

That’s it for today.

Stock-Based Compensation can be complex.

But it doesn’t have to be complicated.

Just follow these simple rules:

Always check the evolution of Total Shares Outstanding

Subtract Stock-Based Compensation from Free Cash Flow

SBCs as a % of Net Income should be lower than 10%

Another interesting lesson? Two of the best compounders ever, led by the smartest people on the planet, use a similar compensation approach.

They pay in cash and force the insiders to buy stock with it.

Would it be a coincidence? I don’t think so.

Everything in life compounds

Pieter (Compounding Quality)

PS You are not a Partner of Compounding Quality yet? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Great breakdown on SBC and its hidden cost. One thing I’d add, not all stock-related compensation is the same. I really like Employee Stock Purchase Programs (ESPPs) because they make employees put skin in the game. They buy shares (often at a modest discount), so the company gets cash and employees still have upside. It’s a gentler form of alignment than “free” stock grants, and it keeps dilution much more contained.

Great article!