Let’s try something new today.

The Community is an amazing place where all Partners share investment ideas daily.

Just look at this example of Craig Edwards about Infratil ($IFT):

Infratil is up 4,000% since its IPO in 2000.

It gave me an interesting idea…

… What if we launch a stock market competition between Partners?

Every month, Partners can pitch their favorite investment idea. Other Partners can vote for their favorite stock idea.

The winner of the month receives a free subscription to Compounding Quality for 3 months (value: $124).

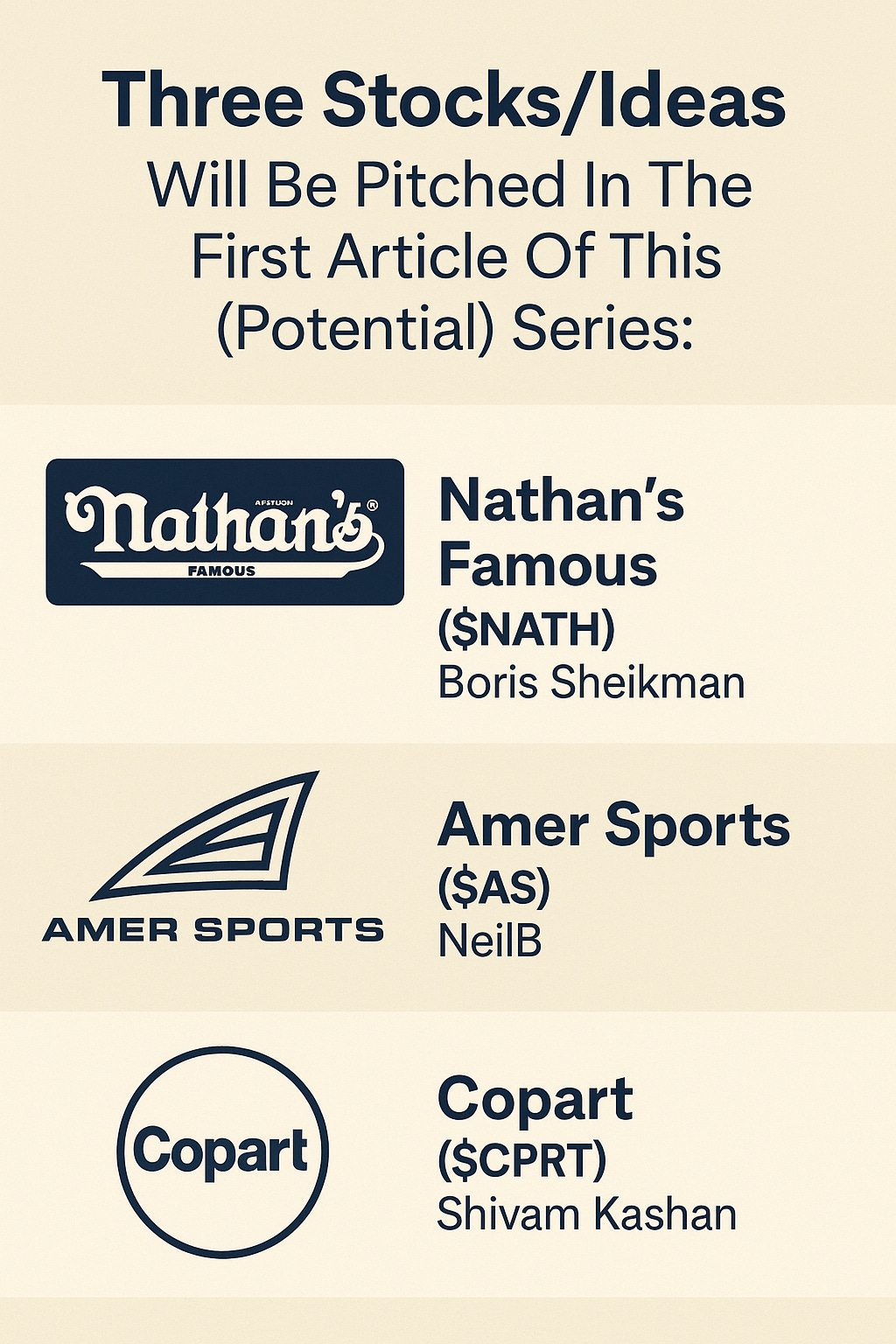

In this article, these three stocks will be pitched:

1. Nathan’s Famous ($NATH)

How does the company make money?

Nathan’s Famous ($NATH) makes money by selling branded hot dogs through retail, food service, and franchise restaurants.Boris Sheikman wrote an amazing case about Nathan’s Famous.

Here are the key takeaways in 10 bullet points:

Business model: Nathan’s Famous isn’t just a hot dog stand on Coney Island. It’s a 100+ year-old brand with a surprisingly smart and scalable business model.

They don’t make their own food: Nathan’s doesn’t own factories or cook the hot dogs themselves. Instead, they license their secret recipes to big food processors like Smithfield. It’s low-cost, high-margin, and scalable.

Big sales behind the scenes: They sell Nathan’s-branded products in bulk to big foodservice companies like Sysco. You’ll find them in stadiums, restaurants, and amusement parks (not just at the grocery store).

A small but growing franchise empire: Nathan’s has 230 franchise locations (most in the US, some abroad). There’s real growth outside the East Coast.

Marketing that pays instead of costs: Nathan’s generates revenue through events and sponsorships, turning marketing into a profit center. Like their famous Hot Dog Eating Contest.

They own just 4 restaurants: Nathan’s runs four company-owned stores, including the original Coney Island flagship. These serve more as brand beacons than core revenue drivers.

Lean and light: They don’t need heavy equipment or big inventory. Production is outsourced. The result: a lean, asset-light business with high returns and low operating risk.

The moat is in the meat: The real power lies in the brand and the original recipe. Like Coca-Cola or KFC, Nathan’s has a “secret formula” that gives it staying power and pricing strength.

Quiet compounding: Revenue and gross margins are stable and growing. The company pays a solid dividend, buys back shares, and steadily reduces its debt.

Skin in the game: Insiders are well-aligned. The CEO owns nearly 2% of the company, and compensation is tied to performance.

Under the radar: No earnings calls. No media hype. Just a 100-year-old hot dog brand compounding quietly in the background.

You can read the full 11-page investment case of Boris Sheikman here:

2. Amer Sports ($AS)

How does the company make money?

Amer Sports ($AS) earns revenue by selling premium sports equipment, apparel, and footwear under brands like Salomon, Arc'teryx, and Wilson.NeilB did some amazing work on Amer Sports. He is a loyal shareholder of the company.

Here’s a summary of his investment case:

Multi-Brand Powerhouse: Amer owns premium sports and outdoor brands like Arc’teryx, Wilson, and Salomon.

Three Segments with global reach: Operates across Technical Apparel, Outdoor Performance, and Ball & Racquet Sports. Sales are split globally across the Americas, EMEA, China, and Asia Pacific.

Premium Direct-To-Consumer (DTC) Focus: Over 40% of sales come from selling directly to customers.

High growth with low market share: Amer Sports operates in large, fast-growing markets with a relatively small market share (a lot of potential for expansion).

Moat based on strong brand name: Arc’teryx has pricing power and premium appeal. Salomon and Wilson have strong tech and design reputations, especially in footwear and tennis gear.

Skin in the game: Insiders own over 20% of the company. They are backed by Lululemon founder Dennis Wilson and Chinese parent Anta Sports (42.4% stake).

Improving financials: The company is growing while margins are increasing.

Heavy reinvestments: Amer Sports reinvests all earnings into future growth. They don’t buy a dividend or execute share buybacks.

Intense competition: Competition from companies like Lululemon, Canada Goose, Nike, …

High valuation: The company trades at a Forward PE of 45.9x. Management aims for 13-15% revenue growth in 2025.

You can read the full investment case from NeilB here:

3. Copart ($CPRT)

How does the company make money?

Copart ($CPRT) makes money by auctioning and storing used, damaged, or salvaged vehicles for insurance companies and other sellers.Shivam Kashan is a rising star within the Community. He recently created a write-up about Copart.

Here’s what you should know:

Online auto auction giant: Copart runs a global digital auction platform where insurance companies and other sellers auction used and salvage vehicles to over 1 million buyers in 190+ countries.

Powerful network effect: The more vehicles on the platform, the more buyers it attracts and vice versa. This flywheel boosts recovery rates for sellers and deepens platform loyalty.

Capital-light model driven by fees: Copart doesn’t own the cars. It earns fees for listing, title processing, storage, and logistics. This results in high margins, low capital risk, and robust cash flows.

Wide moat based on real estate: Copart owns over 8,500 acres of land across 250+ yards. Zoning restrictions make it nearly impossible for competitors to replicate this footprint, creating a durable barrier to entry.

Technological advantage: AI-driven pricing tools, remote imaging (Copart 360), and integrated title services make the system sticky and efficient. This results in switching costs for partners like insurers.

Strong Financials: No debt and very high margins. Copart has a high ROIC and still reinvests a lot in future growth.

Founder-led: The founder is still a member of the board. Executives earn stock-based compensation that only vests if the stock exceeds 25% above the strike price. This causes aligned incentives.

Strong outlook: Potential to expand internationally (Europe, the Middle East, and South America). Over 30% of U.S. cars sold go to foreign buyers, especially in Africa and Eastern Europe, where demand is rising.

Risk Factors: long-term risk from autonomous vehicles and early-stage international margin pressure.

Valuation: Copart currently trades at a Forward PE of 29.1x earnings

Here is the full investment case from Shivam:

Conclusion

Now let’s dive into the conclusion. I will also share my personal thoughts about the 3 companies pitched.