🏆 The 10 Best Companies in the World

The Ultimate Quality List

Hi Friend 👋

Welcome to this week’s free edition of Compounding Quality. Each week we talk about the financial markets and give an update on our Portfolio.

Partners get access to My Personal Portfolio, ETF Portfolio, and much more.

In case you missed it:

Subscribe to get access to these posts, and every post.

Another month, another Best Buy list.

The best investors in the world invest in great companies.

It’s the easiest way to create wealth in the long term.

Why? Time is on your side when you own wonderful businesses.

Warren Buffett said you should think about your investment decisions like a punch card.

Imagine that you online had twenty punches in a lifetime, and every financial decision used up one punch.

What would you do? That’s right, you’d only invest in the best of the best.

In today’s article, we discuss the 15 best companies in the world, regardless of. valuation.

10. Visa

Company Profile

Every time you use your Visa card to make a payment, the company makes money.

Visa is a global payment company. They enable transactions between people, banks, and businesses.

The company is used by millions of people worldwide to make purchases, both in-person and online. They make money by charging a small fee for each transaction.

Fundamentals

Net Profit Margin: 55.0%

ROIC: 25.7%

Forward PE: 25.9x

Long-Term EPS Growth: +12.3%

9. Microsoft

Company Profile

Microsoft is a technology company that makes software and devices. They are best known for their Windows operating system and Office software.

The company has shifted to focusing on cloud services, which is now a major part of its revenue.

They continue to grow by expanding into new areas like Artificial Intelligence.

Fundamentals

Net Profit Margin: 35.6%

ROIC: 23.3%

Forward PE: 31.2x

Long-Term EPS Growth: +13.1%

8. Mastercard

Company Profile

Together with Visa, Mastercard is one of the largest payment companies in the world. They provide the technology for payments between banks, merchants, and consumers.

Mastercard isn’t a bank, they just make sure payments go through.

They focus on making digital payments faster and safer.

Fundamentals

Net Profit Margin: 45.3%

ROIC: 42.6%

Forward PE: 32.3x

Long-Term EPS Growth: +14.9%

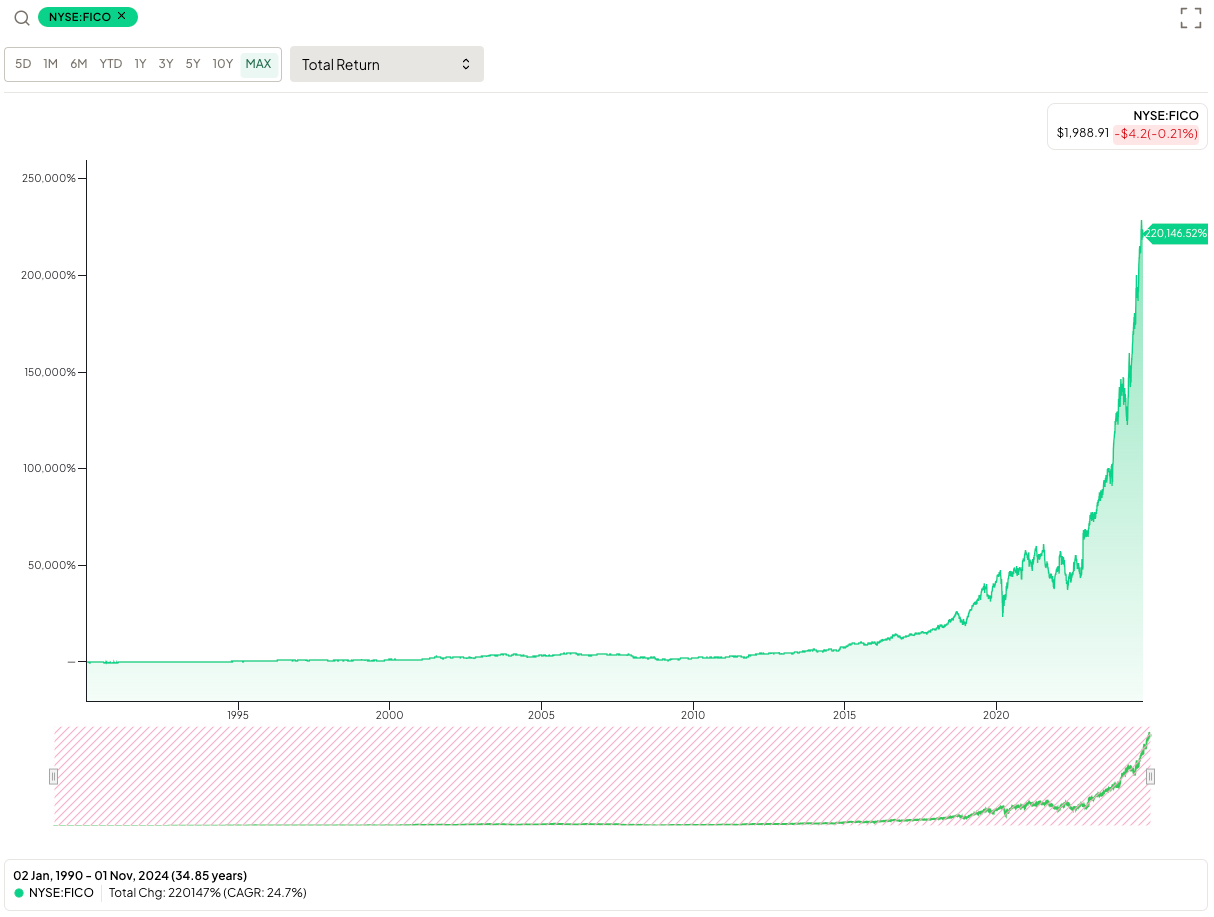

7. Fair Isaac (FICO)

Company Profile

Ever checked your credit score? If so, you’ve interacted with Fair Isaac, the company behind the famous FICO score.

The company also makes software that helps businesses manage risk. Fair Isaac focuses on data and analytics to provide insights to banks and other financial institutions.

Their software is used by companies all over the world. FICO's credit scores are very important in the lending industry.

Fundamentals

Net Profit Margin: 28.9%

ROIC: 41.0%

Forward PE: 71.6x

Long-Term EPS Growth: +27.7%

6. Cintas

Company Profile

Cintas provides uniforms and cleaning services to companies. They help businesses look professional by supplying workwear, mats, and cleaning supplies.

The company is also known for delivering first-aid kits and safety products. Their customers come from many industries, including hotels, hospitals, and restaurants.

They focus on excellent customer service. They have a steady stream of business because companies need these services regularly.

Fundamentals

Net Profit Margin: 16.8%

ROIC: 22.4%

Forward PE: 47.5x

Long-Term EPS Growth: +11.8%

5. IDEXX Laboratories

Company Profile

If you’ve ever taken your dog or cat to the vet, your pet might have been helped via products of IDEXX.

IDEXX makes products for vets and farmers. Their main product is machines that test animal blood and other samples.

They operate all over the world, but most of their business is in the U.S.

Fundamentals

Net Profit Margin: 22.5%

ROIC: 38.6%

Forward PE: 35.8x

Long-Term EPS Growth: +13.9%

4. Constellation Software

Company Profile

Constellation Software buys smaller software companies. They focus on companies that serve niche markets like schools or city governments.

They don't usually change the businesses they buy. Instead, they let them continue as before. The company has grown by buying many of these smaller businesses.

Constellation looks for software companies with strong recurring revenues. This gives them a steady cash flow. They aim to be patient, long-term investors.

Fundamentals

Net Profit Margin: 7.0%

ROIC: 7.9%

Forward PE: 36.8x

Long-Term EPS Growth: +25.6%

3. Copart

Company Profile

Ever wonder what happens to cars after an accident? That’s exactly where Copart steps in.

Copart runs an online marketplace for used and wrecked cars. They help insurance companies sell cars that have been in accidents.

Copart is known for making car auctions easier and more accessible. They have a big focus on keeping their operations efficient. This has helped them stay profitable.

Fundamentals

Net Profit Margin: 32.2%

ROIC: 28.7%

Forward PE: 33.1x

Long-Term EPS Growth: +15.0%

2. Hermès

Company Profile

Think of Hermès as the ultimate luxury brand. If you’ve ever seen a Birkin bag, you know how exclusive and expensive their products are.

They are famous for their leather goods, scarves, and perfumes. Their products are very expensive and made in small quantities.

They control their stores and production tightly to keep standards high. The company has been around for over 180 (!) years.

Fundamentals

Net Profit Margin: 31.3%

ROIC: 46.7%

Forward PE: 46.2x

Long-Term EPS Growth: +9.5%

1. Heico

Company Profile

Heico makes sure planes and spacecraft stay in the air by providing important replacement parts.

Airlines love them because the company’s parts are cheaper than the original manufacturers’ but work just as well. If you’ve ever flown, there's a good chance some Heico parts were on that plane.

The company grows by buying smaller companies and expanding what they offer.

Fundamentals

Net Profit Margin: 12.6%

ROIC: 11.9%

Forward PE: 60.0x

Long-Term EPS Growth: +17.9%

Deal of the week

I genuinely believe that everyone should invest in stocks.

And that the best investment is always one in yourself.

When you invested $1 in 1800, you would have $50 million (!) today.

Today you can benefit from a ⏰ Special Discount ⏰ I prepared for you as a loyal reader.

📈 Subscribe today and get the privilege to receive the ⭐ Founding Subscription ⭐ for the price of the regular subscription 📈

This means you pay $499 per year instead of $1,200 per year.

The best part? It’s not only for the first year.

It’s for as long as you stay subscribed to Compounding Quality.

Everything In Life Compounds

Pieter