The Art of Luxury

LVMH's Luxury Empire

Next week, it's 🔔 Black Friday 🔔. I prepapered something special for you. Make sure you don't miss out and check your mailbox on Tuesday.

Make sure you subscribe and don't miss out.LVMH is an amazing business.

Over the years, Bernard Arnault has built a Luxury Empire:

Owner-Operator: Bernard Arnault still owns almost 50% of the company

Return since IPO in 1987: 14.4% per year

Acquisitions executed since IPO in 1987: 70

The Story of LVMH

Loyal readers know that we like LVMH.

The stock is struggling today as it’s down 20% YTD.

But guess what?

We don’t care about the evolution of stock prices in the short term.

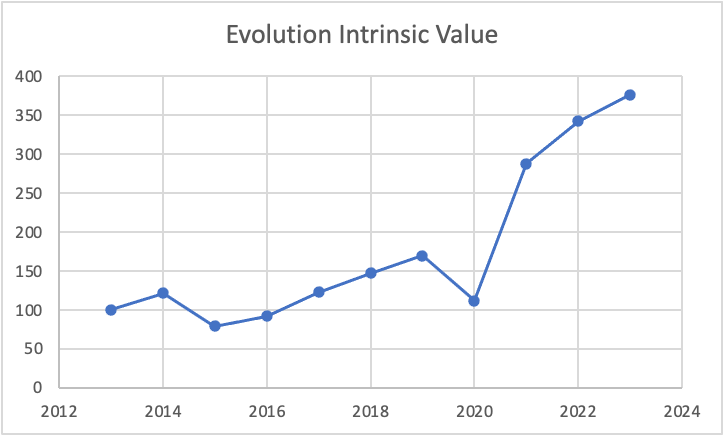

What we DO care about is the evolution of the intrinsic value per share.

We calculate the growth of the intrinsic value per share as follows:

Growth Intrinsic Value = EPS Growth + Dividend Yield

Here’s what the evolution looks like for LVMH:

The evolution over the past 10 years looks as follows:

Since 2013, the intrinsic value of LVMH compounded by 14.2% per year.

This is a great growth rate and I expect this trend to continue in the future.

During one of the latest earnings calls, Bernard Arnault mentioned he expects LVMH to grow organically by 9% per year.

This is in line with their historical average.

As a result, EPS and FCF should be able to grow by roughly 12% per year if you ask me.

Bernard Arnault keeps buying

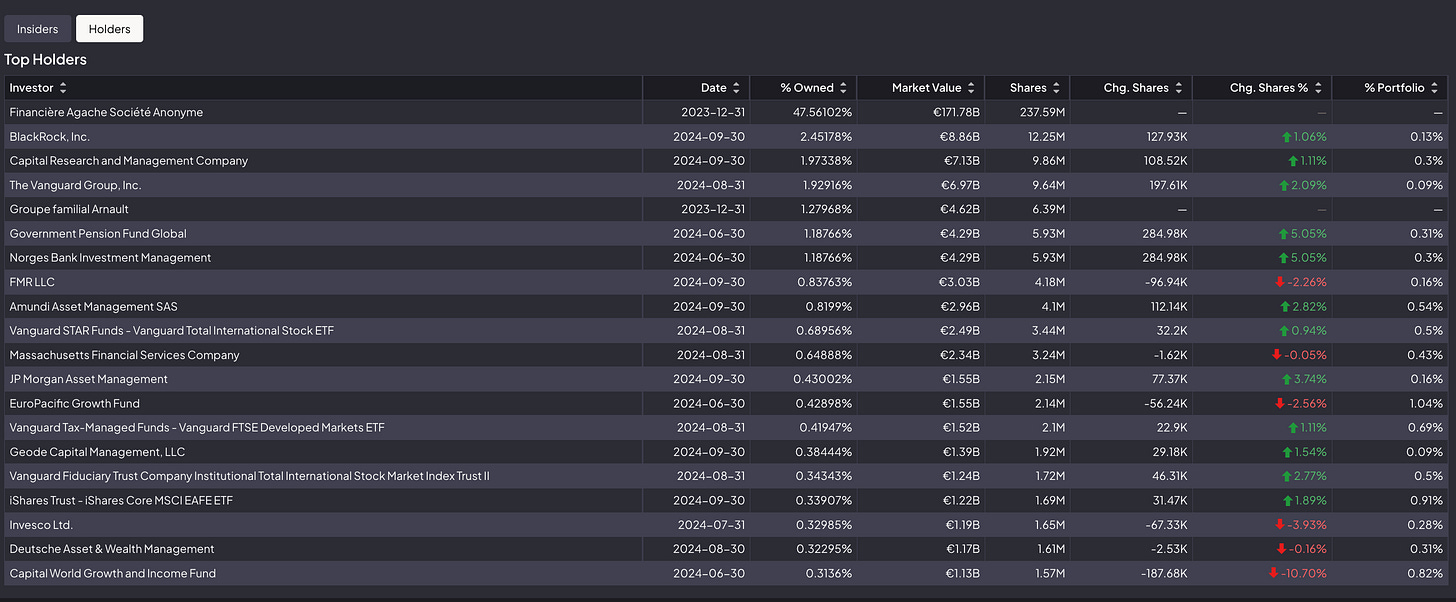

Via Finchat, you can use the tab ‘Ownership’ to look at the Insider Ownership of a company:

As you can see, LVMH is owned for 47.6% by Financière Agache.

This is a French holding company controlled by the Arnault family.

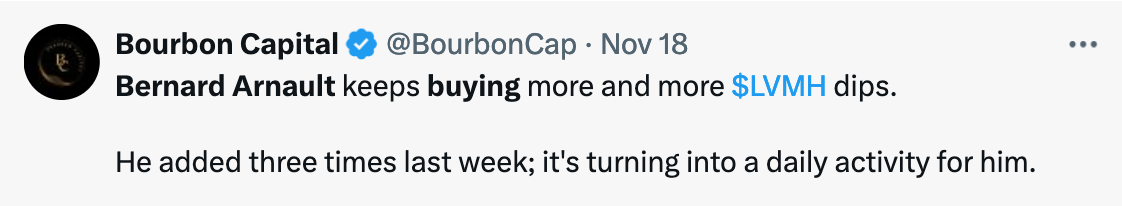

It’s lovely to see that Bernard Arnault keeps buying shares of LVMH. This indicates his long-term confidence in the company.

Results

Last month, LVMH published its Q3 results.

Results were less than expected, causing the stock price to decline.

Key takeaways Q3 results

Revenue: €60.8 billion (a slight decline)

Slight growth for Europe and the US

Revenue declined mainly because of the lower growth seen in Japan

Revenue per segment (first 9 months 2024):

Wines & Spirits: 8% organic revenue decline

Champagne was down due to the ongoing normalization of post-Covid demand

Weak demand for Hennessy cognac in the Chinese market

Fashion & Leather Goods: broadly stable on an organic basis

Perfumes & Cosmetics: organic revenue growth of +5%

Great performance for Christian Dior

Watches & Jewelry: a slight decline on an organic basis.

LVMH entered a 10-year global partnership with Formula 1

Selective retailing: organic revenue growth of +6%.

Sephora performed well and continued to gain market share in North America, the Middle East, and Europe

Outlook: LVMH expects to keep gaining market share.

Key takeaways earnings call

Overall, demand has been characterized by two opposing trends

On the one hand, demand from China clientele remained fairly dynamic in the first half of the year

On the other hand, demand from Western clientele shows a sequential improvement, this being very gradual, given that inflation and interest rates remained high

Extra taxes in France

LVMH will need to pay additional corporate taxes in France which should range between € 700 million and € 800 million.

This year, LVMH's FCF is expected to be equal to roughly $14 billion. This tax would have a negative effect of around 5%.

Sephora

Sephora continues to do very well, gaining market share and growing in all of its markets.

After rain comes sunshine. It’s currently raining for LVMH.

“Yes. Things will never be the same again. I mean, it would be the first time that I don't hear that when things are going down. No, I don't believe that a minute. We are still very, very strong believers in the future of luxury, in the future of the emergence of the upper middle class in China and elsewhere. And we see absolutely no reason why after a cyclical downturn as we are experiencing today, we shall not be in a position to recover.” - Bernard Ernault

Conclusion earnings LVMH

LVMH’s results were less than expected.

However, after rain comes sunshine. It’s great seeing Bernard Arnault is still very optimistic about the outlook for LVMH (and so am I).

LVMH declined almost 35% from its high in March earlier this year and this might offer opportunities for rational investors.

In the Community, Manuele Valsecchi shared a great comparison between LVMH and Hermès.

Over the past 20 years, there have been periods when LVMH outperformed Hermès, and the other way around.

Hermès has been outperforming LVMH over the past few quarters, but I expect this trend to revert one day.

Valuation

LVMH is available at a Black Friday discount if you ask me.

The company is trading at a Forward PE under 20x:

Earnings Growth Model

This model shows you the yearly return you can expect as an investor.

In theory, it’s easy to calculate your expected return:

Expected return = EPS Growth + Dividend Yield +/- Multiple Expansion (Contraction)

Here are the assumptions we use:

Earnings per Share Growth = 10.0% per year over the next 10 years

Dividend Yield = 2.3%

Forward PE to remain constant for LVMH

Expected yearly return = 10% + 2.3% + 0% = 12.3% per year

An expected yearly return of 12.3% looks attractive.

Reverse DCF

Charlie Munger once said that if you want to find the solution to a complex problem, you should invert. Always invert. Turn the problem upside down.

A reverse DCF shows you the expectations implied in the current stock price.

You try to determine for yourself whether these expectations are realistic or not.

You can learn more about a reverse DCF here: Reverse DCF 101.

We assume LVMH’s FCF over the next 12 months will equal €14,702.2 million. We add growth CAPEX (€408 million) to become an adjusted FCF of €15,110.2 million

Today, LVMH has 499.5 million shares outstanding.

Under these assumptions, our Reverse DCF indicates that LVMH should grow its Free Cash Flow by 7.4% per year to return 10% per year to shareholders.

Could LVMH achieve this?

LVMH grew its FCF at a CAGR of 17.3% over the past decade

Expected LT Growth: 9.6% per year

Yes, we think it’s likely that LVMH can grow its FCF by more than 7.4% per year in the years ahead.

Conclusion

Should we buy LVMH? Partners of Compounding Quality receive the full investment case.

Since October 2023, Our Portfolio returned +42.0% versus +36.1% for the S&P 500.

The S&P 500 was a very hard index to beat as Big Tech performed exceptionally well.

I’m very proud of this performance given the fact that we don’t own Nvidia, Amazon, Netflix, Meta Platforms, …

The goal is to slightly outperform the S&P 500 in the very long term.

Partners of Compounding Quality get access to my personal stock portfolio with 100% transparency.

ALL my investable assets are invested in this Portfolio.

“We have an attitude of partnership. Charlie Munger and I think of our shareholders as owner-operators.” – Warren BuffettGet immediate access here:

Everything In Life Compounds

Pieter