🏰 The investment secret of Peter Lynch

#QualityTuesday

Quality Tuesday

It’s #QualityTuesday! In this series, we will teach you 5 things about the stock market in less than 5 minutes.

If you are reading this and are not subscribed yet, feel free to join the Compounding Quality family here:

1️⃣ 6 Categories of companies by Peter Lynch

Peter Lynch is one of the best investors in the world. His book One Up On Wall Street is a must read.

According to Lynch, there are 6 different kind of companies, which you can see in the picture below.

The secret of the success of Peter Lynch? Focus on the fast growers. These are often small companies that can grow their earnings at a very high rate.

If you choose wisely, this is the land of the 10- to 40-baggers.

You only need a few big winners during your investment career to become very successful.

2️⃣ Don’t fool yourself

Revenue is NOT equal to net income.

You want to invest in companies which translate most revenue into earnings (at least 10%).

3️⃣ One simple investment quote

Cash is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.

Always have some cash on the sidelines. This allows you to invest heavily during a crisis.

“Cash combined with courage in a crisis is priceless.” – Warren Buffett

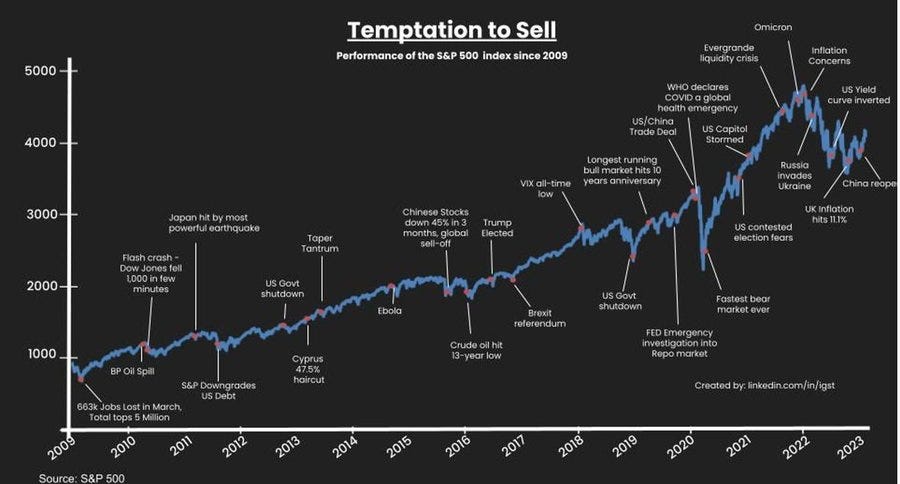

4️⃣ Resist the temptation to sell

Compound interest is the eighth wonder of the world.

Never interrupt it unnecessarily.

5️⃣ Example of a Quality Company

O’Reilly Automotive is one of the largest sellers of aftermarket automotive parts, tools, and accessories, serving professional and DIY customers. The company sells branded as well as own-label products

FCF Margin: 20.7%

ROIC: 40.3%

FCF yield: 3.6%

Expected FCF Growth next 3 years: 7.6%

CAGR since IPO: 21.6%

Every single article we write right now is completely for free. If you liked this, can you please give this article a like and/or let us know in the comments? In 2023, we would love to engage more with our audience.

Contact details

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis.

If you have any suggestions to further improve our posts, or do you want certain topics to be covered? Send us an email:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Excellent selection! The rules of all times. The crisis is the time of opportunity, now this is even more relevant.

Interesting read!!!