👑 What you need to know about free cash flow

Free cash flow is all what matters

In the end, free cash flow is all what matters.

But what is free cash flow and how can you calculate it?

In this article we’ll teach you everything you need to know about one of the most important metrics in the world of finance.

Disclaimer: please note that this article will be a bit more advanced than our previous writings. Do not worry if you don’t understand everything and feel free to send us an email if you have any questions.

What is free cash flow?

In child language, the free cash flow of a company is equal to all the cash that enters a company minus all the cash that leaves a company over a certain period.

The official formula of free cash flow goes as follows:

Free cash flow = operating cash flow - CAPEX

Operating cash flow = operating income + non-cash changes - changes in working capital - taxes

CAPEX = changes in Property, Plant & Equipment (PPE) + depreciation

The operating cash flow measures the amount of cash that is generated by a company’s normal business operations.

In other words, the operating cash flow measures all the cash a company generates by selling its products / services.

The capital expenditures (CAPEX) shows how much money a company has used to maintain or buy physical assets.

A distinction can be made between maintenance CAPEX and growth CAPEX:

Maintenance CAPEX = investments made in existing assets

Growth CAPEX = investments made in new assets in order to grow

When a company is investing heavily in future growth, the free cash flow will decline due to the fact that the growth CAPEX is high.

Growth investments can be very valuable if they create added value for the company.

That’s why some people prefer to only take the maintenance CAPEX into account to calculate the free cash flow.

In that case the formula for free cash flow goes as follows:

Free cash flow = operating cash flow - maintenance CAPEX

It goes without saying that the higher the free cash flow of a company is, the better.

As in investor you want to buy companies that generate a lot of cash.

What can a company do with its free cash flow?

The free cash flow of a company is the cash a company has generated over a certain period.

The company can do different things with its free cash flow:

Reinvesting in itself for organic growth

Pay down debt

Acquisitions and takeovers (M&A)

Paying out dividends

Buying back shares

Capital allocation (choosing what to do with its free cash flow) is the most important task of management.

You want to invest in companies that manage to allocate capital very efficiently.

In general, reinvesting in itself for organic growth is the most preferred capital allocation strategy.

Obviously, the company needs to have enough growth opportunities in order to do this. It is also important to underline that it only makes sense to invest in organic growth when these organic investments create value.

Free cash flow margin

The best way to look at the profitability of a company, is by taking a look at the FCF margin.

This metric indicates how much cash a company is generating per dollar in sales.

FCF margin = (free cash flow / sales)

Visa for example has a free cash flow margin of 60.2%. This means that for every $100 in sales, Visa generates $60.2 in pure cash.

This in stark contrast with General Electric, which has a FCF margin of only 2.9%.

It goes without saying that it is justified to pay a higher valuation multiple for Visa compared to General Electric.

A study of James O’Shaugnessey (What Works on Wall Street) found that companies who translated most earnings into FCF outperformed companies that translated the least earnings into FCF by 18% (!) per year.

That’s why focusing on the FCF margin of a company can help you a lot to make better investment decisions.

Source: What Works on Wall Street (James O’Shaugnessey)

Free cash flow is NOT the same as net income

Earnings are an opinion, cash is a fact.

That’s why you should always look at the free cash flow of a company and not at its earnings.

While earnings are an accounting metric, free cash flow looks at the money that actually entered and left the firm over a certain period.

In other words: the net income of a company contains a lot of non-cash items whereas free cash flow looks at the cash that effectively entered and exited the business.

Net income = total revenue - total expenses

Free cash flow = operating cash flow - CAPEX

To go from the net income of a company to its free cash flow, you should make the following adaptions:

Free cash flow = Net income + depreciation / amortization - change in working capital - capital expenditures

In general, free cash flow can be seen as a better metric compared to the earnings of a company because this metric is more reliable and is harder to manipulate.

FCF conversion

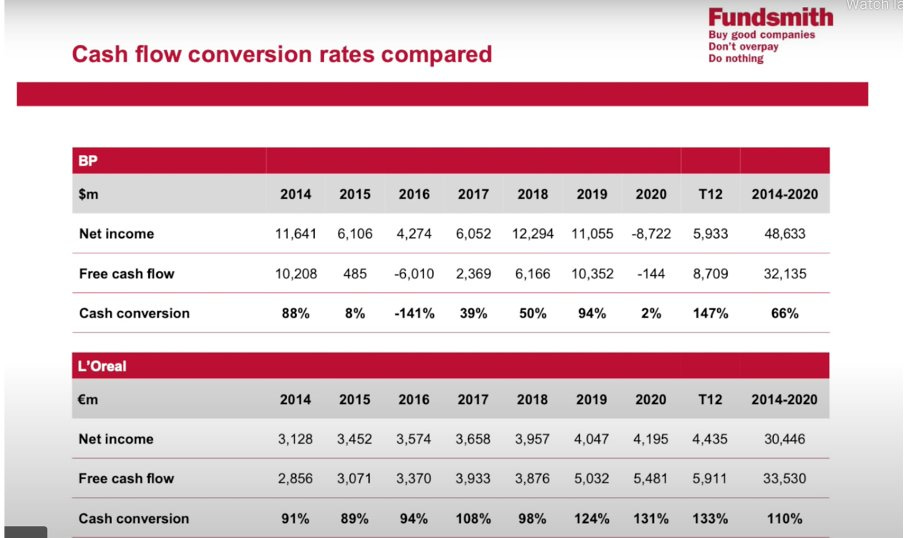

Quality companies convert most earnings into free cash flow.

FCF Conversion = (free cash flow / net earnings)

When there is a huge difference between the free cash flow and the earnings of a company, you should be suspicious as an investor.

It gives an indication that the earnings quality of the company is low.

In the example below, L’Oréal is the robust, quality company whereas the cash flow conversion of BP is more unreliable.

Source: Fundsmith

Free cash flow yield

The free cash flow yield (FCF Yield) of a company is a great way to look at the valuation of a company.

Free cash flow yield = (Free cash flow per share/ stock price)

The higher this ratio, the cheaper the stock.

You can compare the FCF Yield of a company to its historical average FCF Yield to get a grasp about how expensive the company is an historic perspective.

Watch out for stock-based compensation

A lot of technology companies are giving a lot of stock-based compensation benefits to their employees to attract and retain talent.

For investors, stock-based compensations are a cost as it dilutes existing shareholders.

As a result, you should always look at the FCF per share excluding stock-based compensations to get a more reliable and conservative view of the company.

Free cash flow = operating cash flow - CAPEX - stock-based compensation

For example, for Amazon the price to free cash flow based on the estimated free cash flow of 2023 is equal to 36.1.

However, when you would treat stock-based compensation as an expense, the price to free cash flow would increase to 159.2!

This is a huge difference and underlines why you should exclude stock-based compensation.

Source: Morgan Stanley

Expected return

Last but not least, you can use the following rule of thumb to calculate your expected return as an investor:

Expected return per year = FCF per share growth + buyback yield +/- multiple expansion (multiple contraction)

Shareholder yield= dividend yield + buyback yield

Let’s use Visa as an example again.

We estimate that Visa will be able to grow its free cash flow per share with 13% per year over the next 5 years. The dividend yield is equal to 0.9% and we estimate that the outstanding shares of Visa will remain constant over the next years. Furthermore, we think the current FCF Yield of Visa (4.2%) is fair, as a result no multiple expansion nor contraction will take place.

Under these assumptions the expected yearly return for Visa is equal to:

Expected return per year Visa = 13% + 0.9% + 0% = 13.9%

Would you be happy with an annual return of 13.9% per year? If so, Visa might be an interesting investment.

Your feedback is highly appreciated

It has been 6 months since we have been writing 2 articles per week entirely for free to teach investors.

We will keep doing this without doubt. But can we ask you for 1 little favor in return?

We would love to hear from you which kind of articles you want to read from us in the future:

Feel free to tell us in the comments which topic(s) you want to see covered in the future.

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

If you have any suggestions to further improve our posts, or do you want certain topics to be covered? Send us an email:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Thanks for putting together such a comprehensive summary!

great content, thank you!