👑 What you need to know about moats

How to think about moats

In investing, it all starts with the moat or competitive advantage of a company.

Determining the existence and durability of a competitive advantage is key to become a great investor.

In this article, you’ll learn everything you need to know about Moats.

What is a moat?

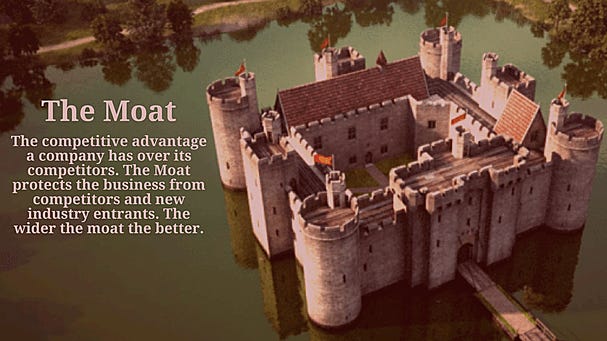

A moat or durable competitive advantage is a condition that puts a company in a superior business position. This will allow the business to maintain and increase its profit margin and market share.

“It’s incredibly arrogant for a company to believe that it can deliver the same sort of product that its rivals do and actually do better for very long.” - Warren Buffett

Warren Buffett once stated that the company itself can be seen as the equivalent of a castle and the value of the castle will be determined by the strength of the moat. In other words: the moat protects those inside the castle and prevents outsiders from entering the fortress.

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors.” - Warren Buffett

How do you know the company has a moat?

A moat is a structural business characteristic that allows a firm to generate excess economic returns for a long period of time.

There are two critical factors to determine whether a company has a moat:

The company has a Return On Invested Capital (ROIC) greater than its Weighted Average Cost of Capital (WACC)

The ROIC has maintained high and constant for a reasonable period of time in the past.

Looking at the evolution of the gross margin and ROIC over the past decade can already give you a great indication. When both metrics are robust and (very) high, this is already a great sign that the company has a moat.

Morningstar states that a company has a sustainable competitive advantage when they will be able to generate a ROIC > WACC for at least the next 20 years.

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much more than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result." - Charlie Munger

If you want to learn more about the ROIC, take a look at this article from Compounding Quality:

Companies with a moat often have a lot of pricing power too. Munger stated once that a few times in your lifetime, you’ll find a company which could raise its return enormously by just raising their prices, and yet they haven’t done it. This gives them a lot of untapped picing power. These companies are the ultimate no-brainer.

Coca-Cola, S&P Global and See’s Candies are great examples of companies with pricing power.

“The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business.” - Warren Buffett

Different kinds of moats

In general, there are 5 different kinds of moats:

Switching costs

Intangible assets

Network effects

Cost advantages

Efficient scale

Switching costs

The costs a consumer pays as a result of switching brands or products. These costs can be monetary, but also psychological, effort-based, and time-based.

A good example of a company with switching costs is Salesforce, a Customer Relationship Management (CRM) company which tries to expand the relationship with its customers by cross-selling other services that provide additional value (e.g. data collection and cross-selling other services). This makes it even harder for their customers to change to another CRM system.

Switching from Windows to Apple and vice versa can also be seen as a switching cost as it takes some time to master the software.

Other examples: Automatic Data Processing and Intuitive Surgical.

Intangible assets

A moat based on intangible assets includes a competitive advantage because of the strong brand, patents, or regulatory licenses. This may prevent competitors from duplicating products or allow a company to charge a premium price.

Buffett once stated that he didn’t know the value of a brand until Berkshire Hathaway bought See’s Candies.

“We didn’t know the power of a good brand. Over time we just discovered that we could raise prices 10% and no one cared. When you were a 16-year-old, you took a box of candy on your first date with a girl and gave it either to her parents or to her. In California the girls slap you when you bring Russell Stover, and kiss you when you bring See’s.” - Warren Buffett

Munger and Buffett try to determine the strength of a moat based on the brand by measuring whether a competitor can replicate or weaken the moat with massive investments. Their test on Coca-Cola is a good example:

“If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done.” - Warren Buffett

Network effects

A moat based on network effects is one of the strongest moats companies can create because this moat source is very scalable.

A network effect exists when the value of a product or service grows as its user base expands. Each additional customer increases the value of the product or service exponentially.

Think about companies like American Express, Amazon, Mastercard & Visa, and Alphabet.

'“Google has a huge new moat. In fact I’ve probably never seen such a wide moat.” - Charlie Munger

Cost advantage

Companies that are able to produce products or services at lower costs than its rivals benefit from cost advantages.

Firms with a structural cost advantage can either undercut competitors on price while earning similar margins, or can charge market-level prices while earning relatively high margins. Ikea and Walmart are two companies with strong cost advantages.

For us personally, cost advantages are the least preferred moat source. The reason for this is that these companies often have no pricing power. Pricing power is a very important characteristic of quality companies.

Efficient scale

Last but not least, efficient scale is the fifth moat source.

In some markets, there is only room for a few players. These kinds of markets are called monopolistic (only 1 company) or oligopolistic (only a few companies) markets.

Scale economies are very important in business. It is the dynamic in which a market of limited size is effectively served by few companies. Incumbents generate economic profits, but new entrants would cause returns for all players to fall to a level in line with or below the cost of capital. For that reason, it is not interesting for new players to enter the market.

Great examples are S&P Global and Moody’s and US railroad stocks like Union Pacific.

Durability of the moat

For quality investors, the margin of safety does not lay in a cheap valuation but in the strength of the competitive advantage.

That’s why for moats, durability matters.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett

You want to invest in companies which will still have a huge competitive advantage in 5, 10, and 20 years from now.

Disruption is the greatest enemy of quality investors.

No reversion to the mean

Mean reversion is a theory used in finance that states that historical returns will revert to the long-term average.

For stocks, this means that when a certain industry is very attractive, new competitors will start to get interested and enter the market which will result in a lower profitability for all companies active within that market.

Michael Mauboussin summarized it as follows:

“Companies generating high economic returns will attract competitors willing to take a lesser, albeit still attractive return which will drive down aggregate industry returns to the opportunity cost of capital.”

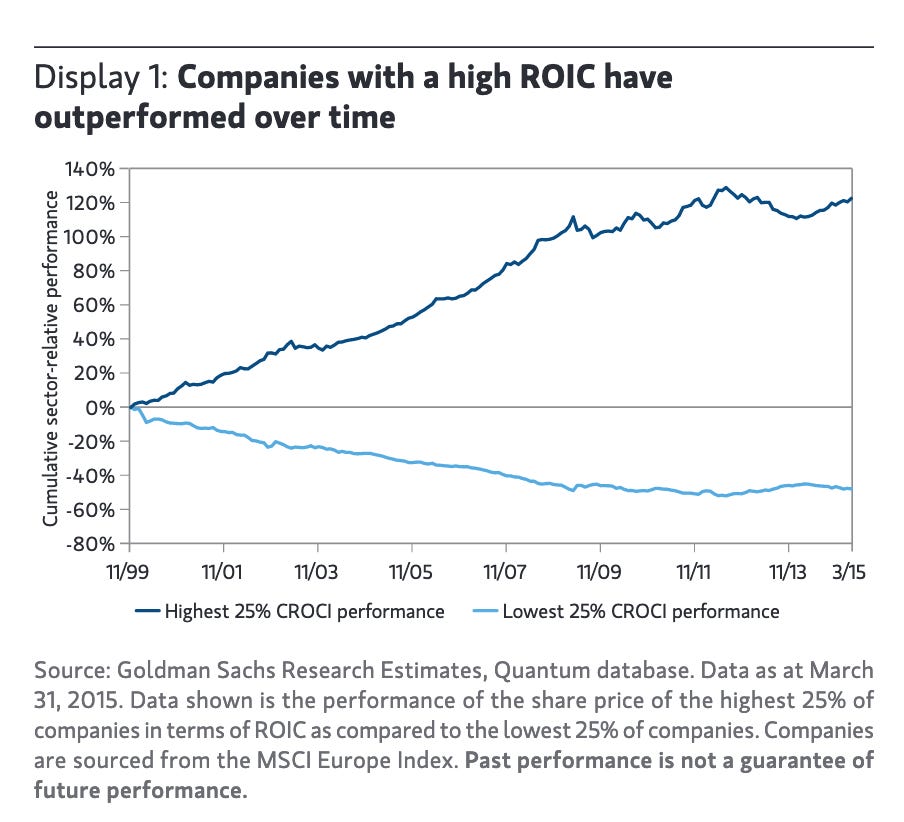

In general, reversion to the mean indeed takes place in the economy. However, mean reversion does not take place for companies with a wide and durable moat.

Why? Because no matter how many enterprises would like to enter a certain very attractive market, when the companies which are already active in that market have a huge economic moat, new entrants won’t be able to take market share from these existing companies.

Just look at this chart which states that companies with a high ROIC (a first indication that a company has a wide moat) tend to outperform over time:

Does investing in wide moat stocks work?

The question of $1 million is whether it helps to focus on companies with a wide moat.

The answer is YES!

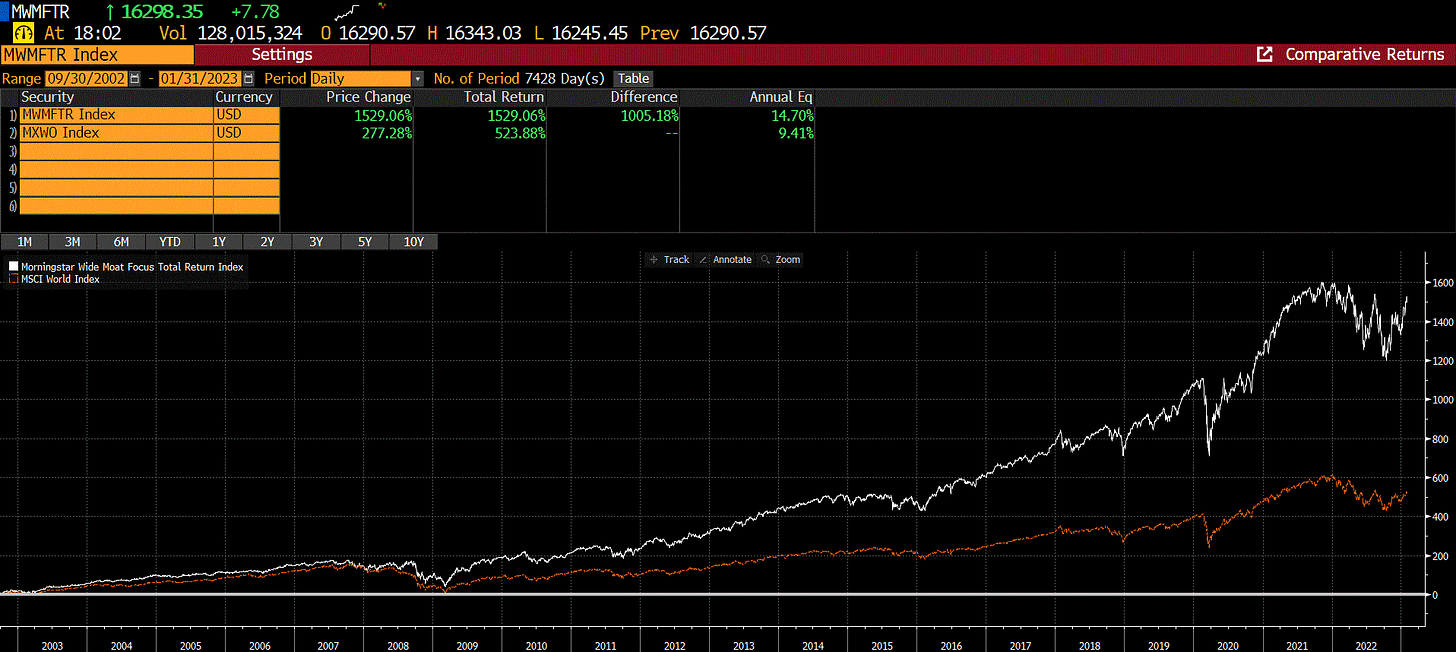

Between 2002 and today, the Morningstar Wide Moat index, an index with only wide moat companies, returned 14.7% per year to shareholders compared to 9.4% for for the MSCI World.

This means that wide moat stocks outperform the market with more than 5% per year over the past 2 decades.

Conclusion

For quality investors, it all starts with the moat of a company

A company has a moat when its ROIC is greater than its WACC for a very long period of time

There are 5 different kinds of moats: switching costs, intangible assets, network effects, cost advantages and efficient scale

You want to invest in companies which still have a moat in 10 and 20 years from now

Reversion to the mean doesn’t take place for companies with a wide moat

Stocks with a durable competitive advantage outperform the market

“If you can buy the best companies, over time the pricing takes care of itself.” - Warren Buffett

“Sometimes you have both a moat and a great manager and as Mae West once said: “Too much of a good thing can be wonderful.” - Trey Griffin

Used sources to write this article: 25IQ.com, Morningstar and Bloomberg.

Paper Michael Mauboussin

Do you want to learn more about moats? This paper from Michael Mauboussin is a must read:

Every single article we write right now is completely for free. If you liked this, can you please give this article a like and/or let us know in the comments? In 2023, we would love to engage more with our audience.

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

If you have any suggestions to further improve our posts, or do you want certain topics to be covered? Send us an email:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Great Content , Thank You .

Great content as usual! You mention on a couple of your articles the Weighted Average Cost of Capital (WACC). How do you get that value?