Who is Peter Lynch?

Peter Lynch is one of the best investors in the world.

In 13 years, he turned $18 million into over $14 billion. A return of 29.3% (!) per year.

Let’s teach you some key lessons from this amazing investor.

Who is Peter Lynch?

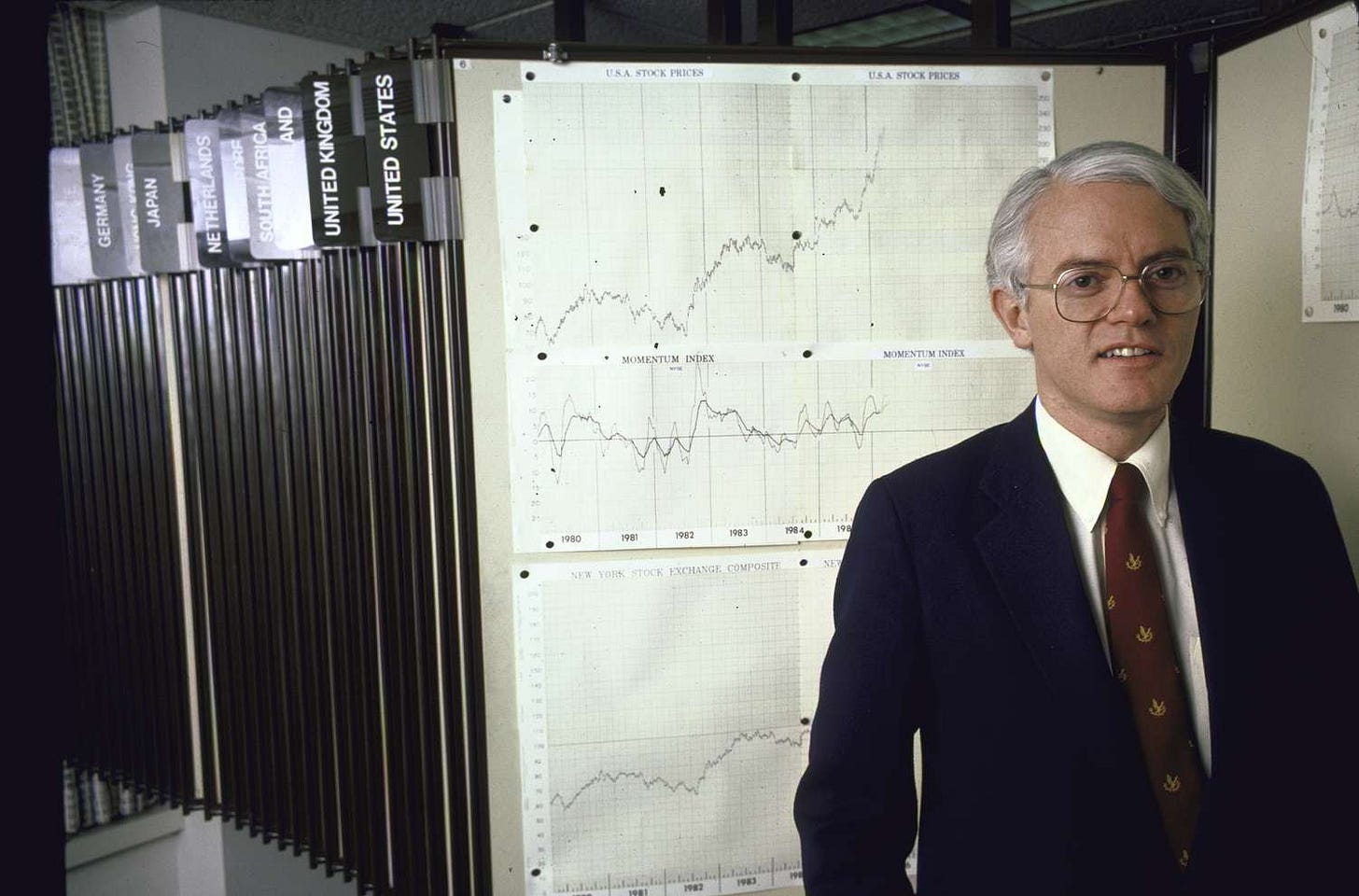

Peter Lynch is one of the greatest investors ever.

People call him “the chameleon of investing”.

Why? Because he never followed just one strategy.

Instead, he matched different strategies to different markets.

Born in 1944 in Massachusetts, Lynch got interested in stocks early.

As a teenager, he worked as a caddie at a golf club and heard investors talk about investing all day. That’s where it all started for him.

Peter Lynch studied at Boston College and earned his MBA from Wharton.

He is famous for popularizing the PEG ratio.

What is the PEG ratio?

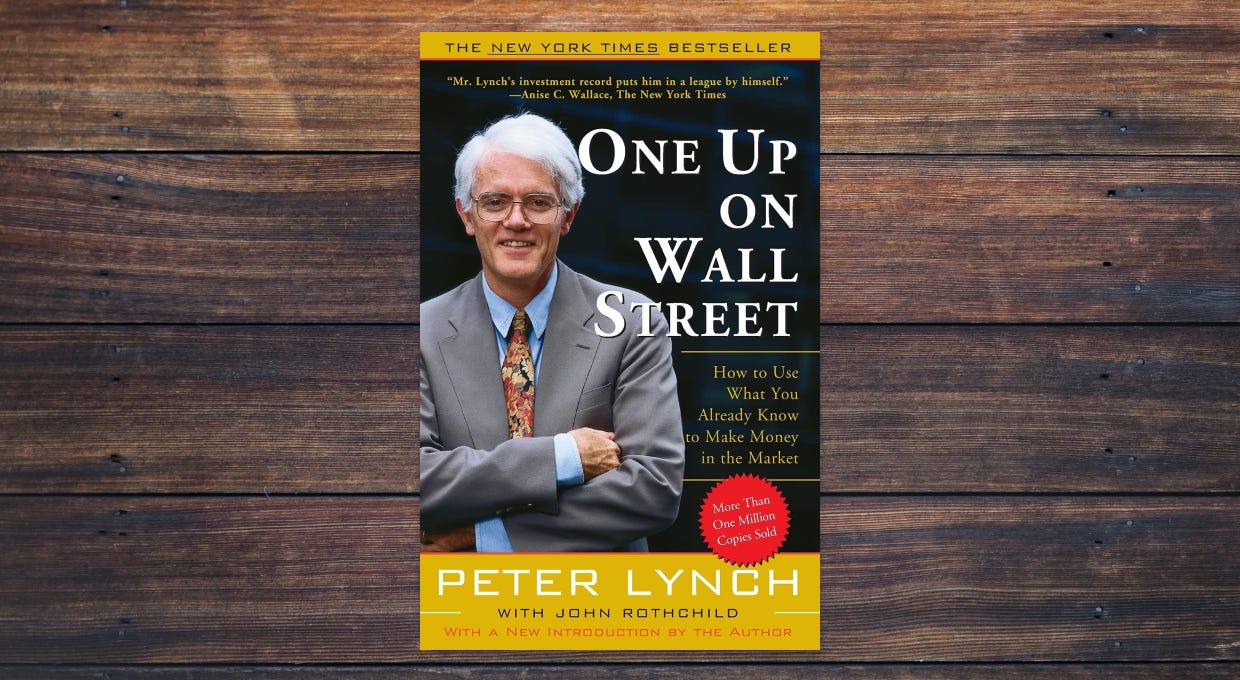

The PEG ratio compares a stock’s price-to-earnings (P/E) ratio to its expected earnings growth rate to show whether the stock may be over- or undervalued relative to its growth.He also wrote “One Up on Wall Street,” one of the best investing books ever.

Lynch joined Fidelity in 1969. By 1977, he was running the Magellan Fund.

Over the next 13 years, he turned it into the biggest mutual fund in the world.

His style was different from most legendary investors.

Instead of owning just a few stocks, he held hundreds at the same time.

Lynch retired in 1990, but his ideas still strongly influence investors today.

In this 23-page PDF document, you can learn more about his investment strategy.

It’s pure gold:

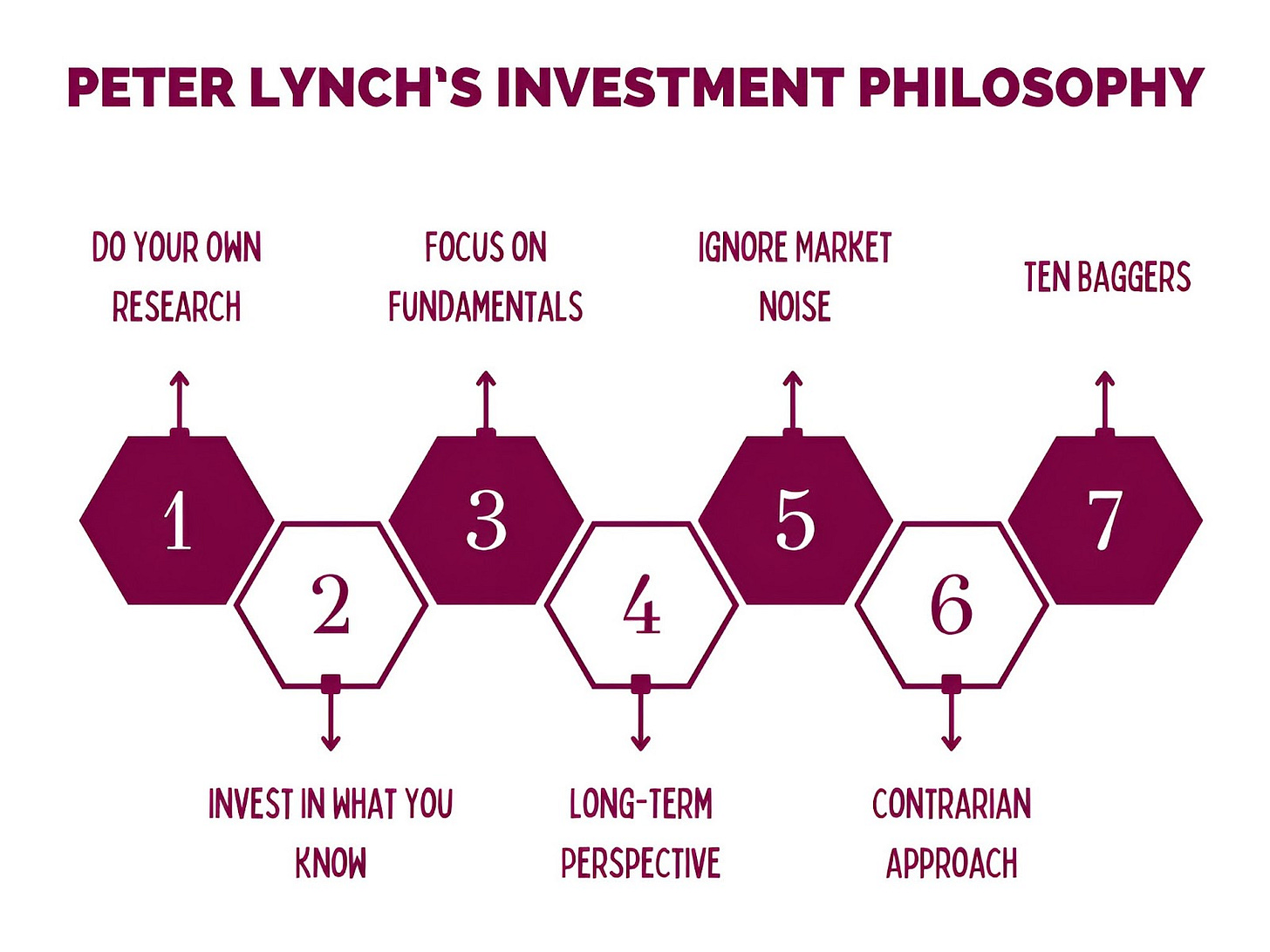

Investment Philosophy

The Peter Lynch approach can be summarized as follows:

To achieve this, he always used three core principle:

Always stay within your circle of competence

Do your homework

Be patient and think long-term

1. Always stay within your circle of competence

The best investment opportunities are often found by looking around in your daily life.

For example:

Do your kids or all their friends want a certain product?

Does your wife only want clothes from a certain brand?

It’s information you can use to your advantage as an investor.

It allows you to spot trends way earlier than Wall Street can.

2. Do Your Homework

Lynch also emphasizes the importance of “doing your own research.”

He advises investors to study a company’s financials, management, and competitive position before buying shares.

At Compounding Quality we do the same.

We focus on strong businesses with fundamentals that are better than the market.

And we don’t overpay for them.

That’s why I think we can outperform in the years ahead.

3. Be Patient and Think Long-Term

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” — Peter LynchPeter Lynch was a long-term investor.

He believed your returns improve when you hold great stocks for years and don’t panic over short-term swings.

Most of the time, he held his winning positions for 3-5 years.

And that patience paid off.

Performance

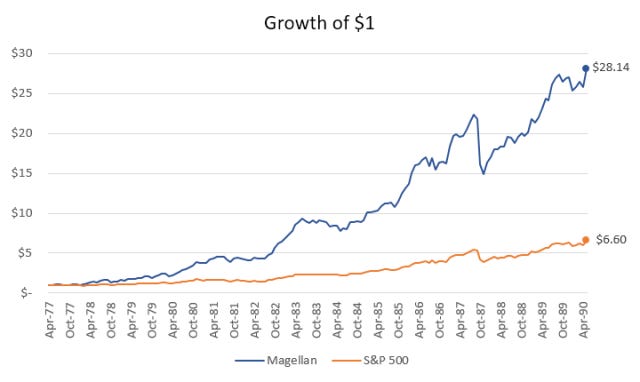

Peter Lynch’s performance at the Magellan Fund is legendary:

From 1977 to 1990, the Magellan Fund returned an average of 29.3% per year, nearly twice as good as the S&P 500

An investment of $10,000 in Magellan at the start of Lynch’s tenure would have grown to over $280,000 by the time he retired 13 years later

The fund grew from $18 million in Assets Under Management to over $14 billion

Peter Lynch’s Portfolio

Now let’s take a look at some of Peter Lynch’s most famous investments from the Magellan Fund.

5. Taco Bell (now part of Yum! Brands)

How does the company make money?

Taco Bell earns revenue from fast-food sales, franchising, and licensing.Why Lynch liked Taco Bell

Lynch noticed something simple: Taco Bell was expanding very rapidly.

The restaurants were packed, the brand was getting more popular, and the business was growing fast.

To him, that was the perfect setup: strong growth at a reasonable price.

While he held the stock for only 2 years he made a return of over 600%.

4. Ford ($F)

How does the company make money?

Ford makes money by manufacturing and selling automobiles and trucks.Why Lynch liked Ford

Ford was struggling at that time Peter Lynch discovered it.

But Lynch saw Ford as a company that could make a comeback.

With better management and better cars, he believed the growth potential was significant.

And he was right. In three years, the stock rose by over 500%.

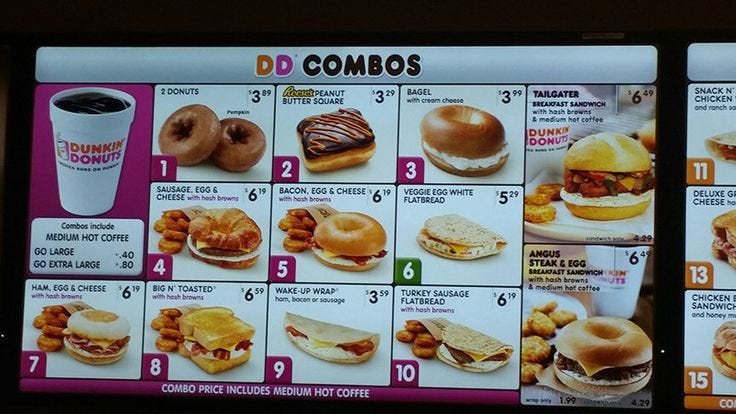

3. Dunkin’ Donuts (now part of Inspire Brands)

How does the company make money?

Dunkin’ Donuts earns revenue from coffee, baked goods, and franchising.Why Lynch liked Dunkin’ Donuts

Have you ever had a donut or coffee at Dunkin’ Donuts?

Lots of people stop there every day.

You could see people standing for hours to get their Donuts at the time Peter Lynch was looking into the company.

Lynch observed the brand’s strong customer loyalty and widespread presence in his own community.

Guess what? The company made him over 900% returns in 10 years.

2. Fannie Mae (now FNMA)

How does the company make money?

Fannie Mae buys home loans from banks and guarantees them so that banks have more money to lend to new homebuyers.Why Lynch liked Fannie Mae

Fannie Mae was necessary to the U.S. mortgage market and consistently generated profits.

Lynch called it the Perfect stock.

Over six years, the stock delivered a return of more than 2,900%.

A little sidenote

Peter Lynch was 'lucky' not to own the company during the financial crisis. The stock is still down over 80% since then.1. Home Depot ($HD)

How does the company make money?

Home Depot is the largest home improvement retailer in the U.S. selling products and services to homeowners and construction professionals.Why Lynch liked Home Depot

Lynch spotted Home Depot early in his career.

The company had strong management and was quickly adding stores.

These were clear signs of long-term growth potential.

Peter Lynch made a return of over 600% by investing in Home Depot.

Since his retirement, the stock kept doing well.

Conclusion

Peter Lynch was a master in spotting high-quality businesses early.

Think about companies like Dunkin’ Donuts, Taco Bell and Home Depot.

At Compounding Quality, we try to do the same thing.

We look at companies that can grow their Owner’s Earnings for years and even decades.

Everything in life compounds

Pieter (Compounding Quality)

PS You are not a Partner of Compounding Quality yet? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal: Financial data