Hi Partner 👋

I’m Pieter and welcome to an 🔒exclusive edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

Curious about the best stocks to buy right now?

There are 18 companies on my watchlist trading at attractive valuation levels today.

Let's dive into the top picks from the Compounding Quality Universe!

Our Universe

Our Watchlist has 147 top-quality stocks.

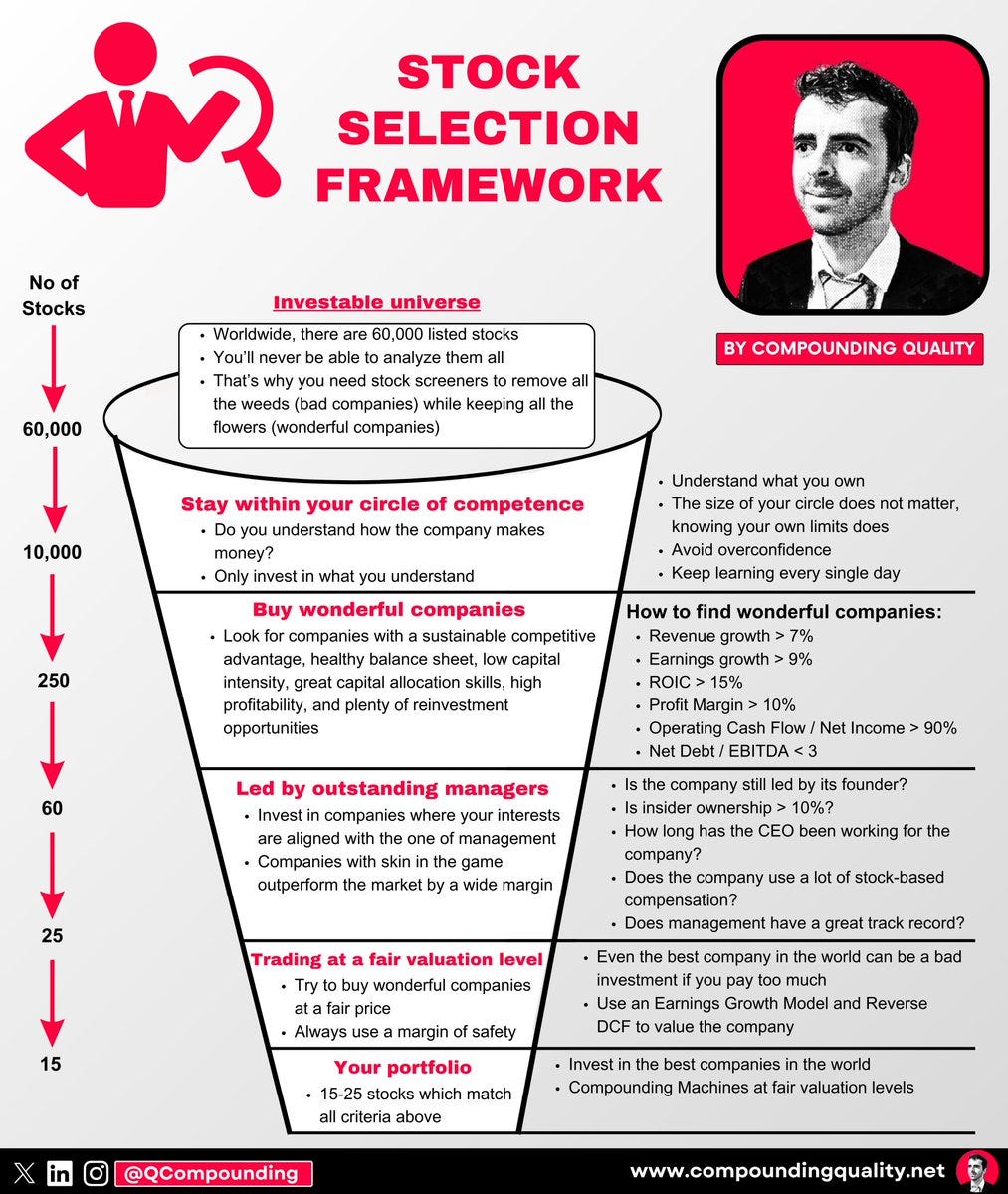

We use this framework to select the best companies in the world:

Since the last update, we added a few companies to our Universe:

Costco: The best retailer in the world

Topicus: Excellent spin-off from Constellation Software

MSCI: A cash flow machine with a lot of recurring revenue

Adyen: A great payment provider that is gaining market share

Outperformance

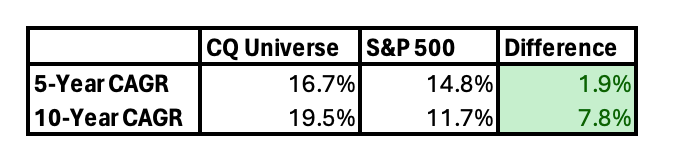

When we look at the historical performance of our Investable Universe, it looks like this:

It’s great to see the list outperformed the S&P 500.

Within our universe, we try to select the most attractive stocks.

Buy-Hold-Sell List

A few weeks ago, we introduced a Buy-Hold-Sell List based on the valuation of each Quality Stock in Our Universe.

Every month, we’ll update the list.

We use three methods to value each company:

Comparing the forward PE multiple to its historical average

Earnings Growth Model

Reverse Discounted-Cash Flow

Based on these methods, we give each company a recommendation:

Buy: Quality stocks to consider buying right now

Hold: Quality stocks that are a bit expensive

Sell: Quality stocks you might want to sell if you already own them

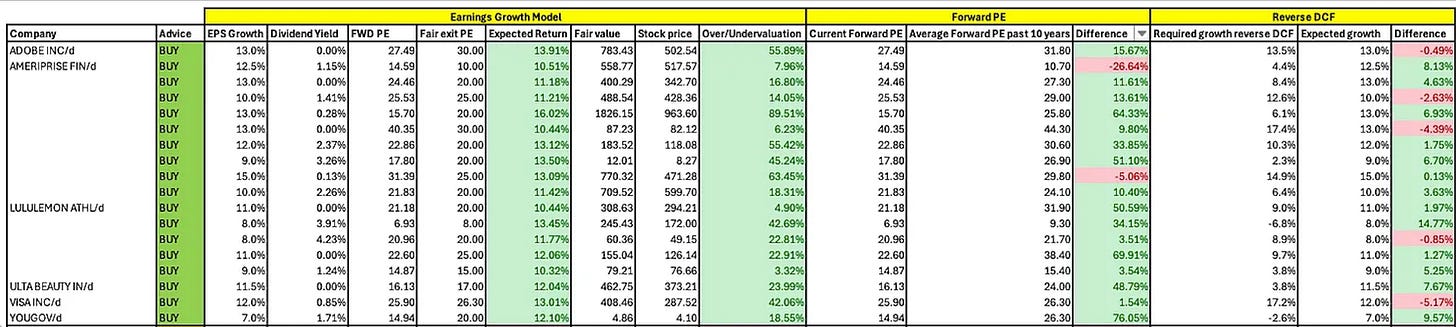

18 Stocks to Buy

Currently, there are 18 Buys on our Buy-Hold-Sell list.

To be a Buy:

The company must be undervalued based on the Earnings Growth Model (Output EGM > 10%)

Furthermore, the company must be undervalued on at least 1 out of these 2 parameters

Forward PE lower than its 5-year average?

FCF-Growth Reverse DCF: Realistic growth expectations?

The outlook of the company should look attractive

Today, we give 18 companies in the Compounding Quality Universe a Buy Rating.

You can see them here:

Last month, 22 companies received a ‘Buy’ recommendation versus 18 today.

The reason? The stock market increased and some companies became more expensive.

Eight Companies went from Buy to Hold:

CTS Eventim

El.EN

Equasens

Games Workshop

Interpump Group

Moncler

Thermador Group

One company went from Hold to Buy: Visa.

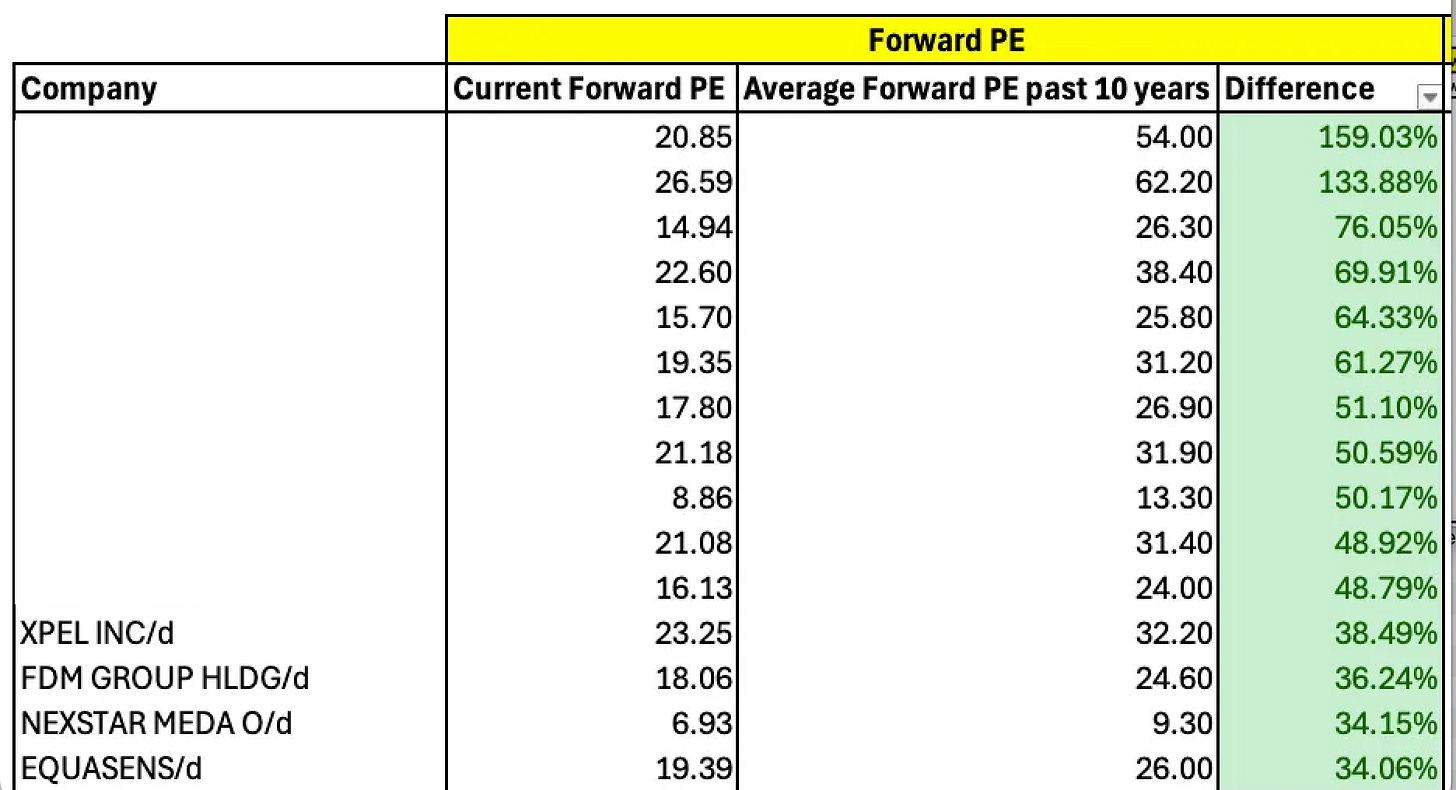

1️⃣ Forward PE versus historical average

The forward PE shows how much investors are willing to pay for a company.

The lower the forward PE, the cheaper the stock.

The Forward PE indicates a company is undervalued if:

Current Forward PE < 10-Year Average Forward PE

An interesting stock based on this valuation metric? Evolution AB.

Evolution AB has a forward PE of 15.6x, compared to its historical average of 25.8x over the past 10 years.

This indicates the company is undervalued compared to its historical average.

Source: Finchat

Here are the companies on my watchlist that are the most undervalued based on the Forward PE:

Of the 147 companies on our watchlist, 42 (28.6%) are undervalued compared to their historical average.

2️⃣ Earnings Growth Model

This model shows you the yearly return you can expect as an investor.

In theory, it’s easy to calculate your expected return:

Expected return = EPS Growth + Dividend Yield +/- Multiple Expansion (Contraction)

EPS Growth: The expected EPS growth over the next 10 years

Dividend Yield: Dividend Per Share / Stock Price

Multiple Expansion (Contraction): The yearly change in valuation over the next 10 years. We assume the company will evolve to its fair exit PE

Exit PE: the multiple we consider fair for the company in the long term

A company is undervalued based on this valuation method if the expected yearly return in the Earnings Growth Model is larger than 10%.

Fair Value

Based on the Earnings Growth Model (EGM), we calculate a Fair Value for every company.

The fair value is calculated by turning the EGM upside down:

Fair Value = The multiple you could pay to receive a 10% return as a shareholder

You calculate the Fair Value by multiplying the multiple you could pay by the expected EPS for the next 12 months.

Sounds strange?

Let’s use Kainos Group as an example to clarify.

Here are the assumptions used for Kainos:

EPS Growth = 9.0% per year over the next 10 years

Dividend Yield = 3.3%

I consider an exit PE of 20x as fair in the long term

Now you need to calculate the multiple you could pay for Kainos to receive a return of 10%.

Expected return = EPS Growth + Dividend Yield +/- Multiple Expansion (Contraction)

10% = 9.0% (EPS Growth) + 3.3% (Dividend Yield) - 0.1* (20.0x - Multiple you could pay)/ Multiple you could pay

When you do the math, the multiple you could pay equals 25.9x times earnings.

Now we know this, we can calculate the Fair Value of Kainos:

Fair value = Multiple you could pay * expected EPS next 12 months

Fair value = 25.9x * £0.5 = £12.01

As the current stock price is £8.27, Kainos is undervalued by 45.25%.

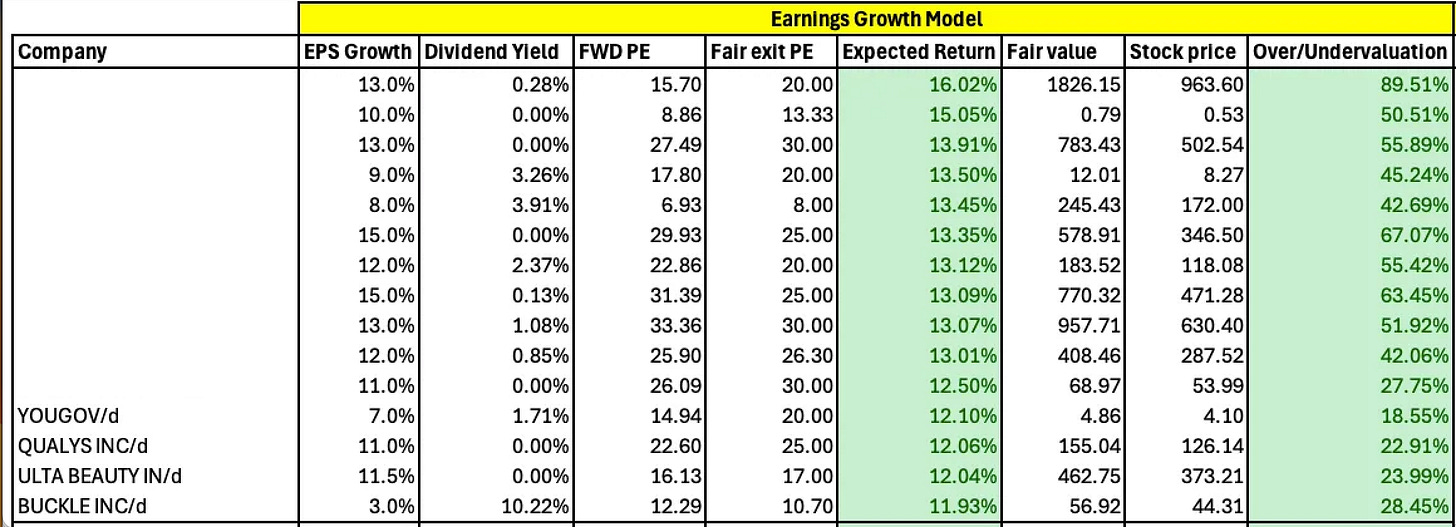

Here are the companies within the watchlist that are the most undervalued based on the Earnings Growth Model:

It’s great to see that 6 out of the 15 most undervalued companies are in Our Portfolio.

3️⃣ Reverse DCF

A reverse DCF shows you how much growth the stock price has priced in.

The lower the expected growth of the stock, the better.

You need to determine for yourself if this growth number is realistic.

For a reverse DCF, you need the following data:

The current stock price

Total shares outstanding

Perpetuity growth rate: This is the growth rate of the free cash flow after year 10.

This number should be in line with GDP growth. We use 3.0%

Desired return (discount rate): We use 10.0% as a desired return

Free cash flow in year 1: This is the Free cash flow you expect the company to generate in year 1

We always adjust the free cash flow in year 1 with Stock-based compensation.

SBC is a cost for shareholders so we should subtract it from Free Cash Flow.

The adjusted free cash flow in year 1 is:

Adjusted FCF year 1 = Expected FCF year 1 – Stock-Based Compensation

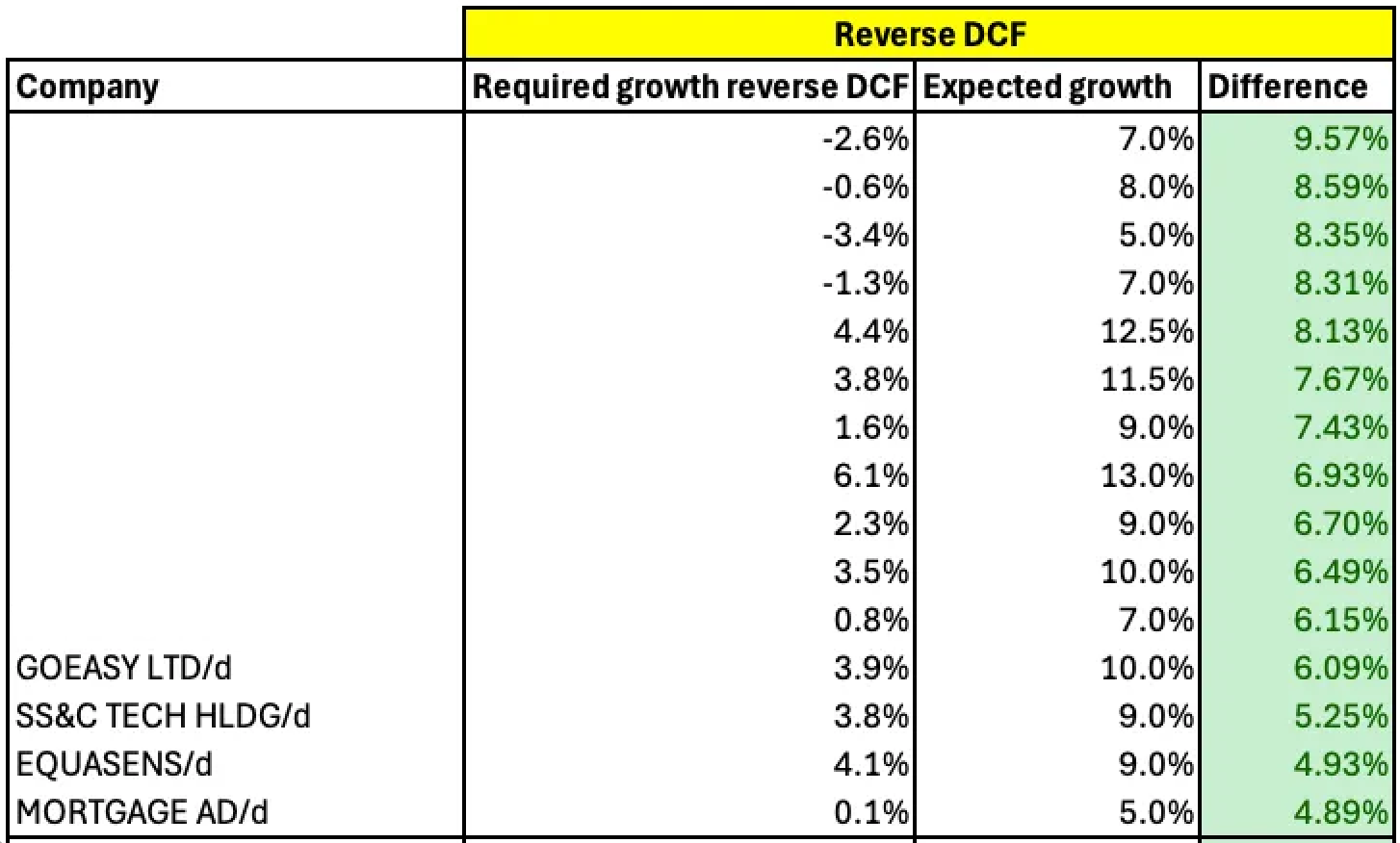

The most undervalued companies based on the Reverse DCF are the following:

Approximately one-third of the companies on our Watchlist are undervalued based on the Reverse DCF.

Undervalued companies

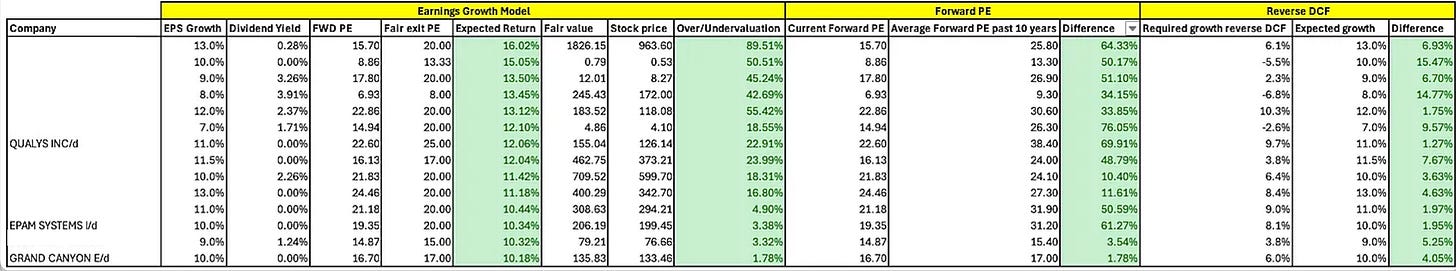

In total, 14 companies are undervalued on each valuation method.

Click on the picture to expand it:

There is one company that is clearly the most undervalued on this list.

Conclusion

That’s it for today.

Here’s what you should remember:

Our Universe only consists of High-Quality Stocks

14 Companies are undervalued on every valuation method

Our Buy-Hold-Sell List currently has 18 Buys

The entire list is only available for Partners of Compounding Quality.

The current price for a subscription, including the Portfolio costs $1,200 per year.

Take an annual plan for $499 today and get upgraded to the Founding Subscription without extra charge:

Everything In Life Compounds

Pieter