Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

The launch of The Art of Quality Investing has been a huge success.

Thousands of people are learning more about quality investing via the book.

You can still order it here:

Favorite stocks Luc Kroeze

The man who taught me the most about quality investing? Luc Kroeze.

What Benjamin Graham is to Warren Buffett, Luc Kroeze is to me.

The result of our friendship? The Art of Quality Investing. A book that teaches you everything we know about quality investing from A to Z.

In today’s article, Luc shares his 3 favorite quality stocks.

Please note that Luc has a position in all the companies mentioned. We love to be surrounded by people who put their money where their mouth is.

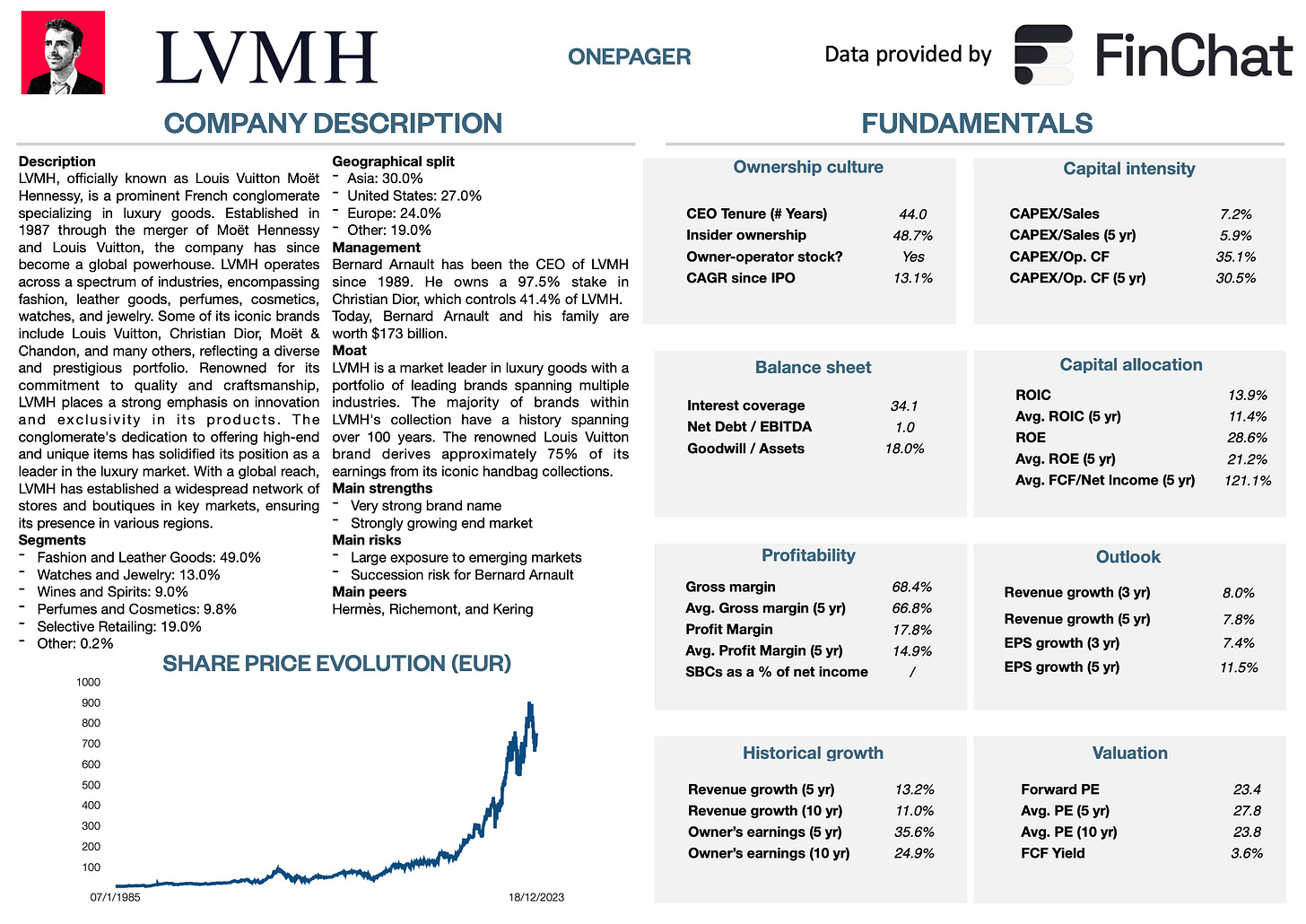

3. LVMH

I'll kick off today's selection with the French conglomerate LVMH, which has previously been tipped by Compounding Quality himself.

The company develops and sells a wide range of luxury goods and has an impressive track record of strong growth and high capital returns. Even including goodwill, which is significant for this serial acquirer, the ROIC is well above the cost of capital.

The high margins add an extra layer of quality to the ROIC ratio and have been on an upward trend for years. Additionally, LVMH has a strong balance sheet with a healthy level of debt.

I believe LVMH is the kind of company that, driven by several long-term trends, can continue to perform well for years. Such trends include the growth of e-commerce, the increasing number of ultra-rich individuals in emerging markets, and the growing focus on personalization and premiumization.

During a potential recession, certain segments of LVMH may struggle, but the segments targeting the ultra-rich will continue to perform well, making the company resilient to economically challenging conditions. The family-owned nature and a focus on long-term value creation is an additional asset.

LVMH is the type of stock that can form a cornerstone for a quality portfolio. As you can read in The Art of Quality Investing, quality investors have a special interest in companies with pricing power. Pricing power is both an attractive and exceptional characteristic.

There are sectors without pricing power, sectors with pricing power, and finally, there is the luxury sector. The luxury sector operates under different rules you won't find anywhere else, resulting in a lot of pricing power. In other sectors, price increases are tolerated at best. But in the special world of luxury goods, customers are thrilled by a price increase because a higher price makes the products even more exclusive. Exclusivity is what the luxury sector is all about. Customers happily accept price increases and pay with a smile. This is unique and, in my opinion, the sector's most important asset. A rare phenomenon, but you won't hear me complaining as an investor.

The sector has several attractive competitors. I think of Hermes, but despite its high quality, the stock seems uninvestable given the current valuation. In my opinion, several years of earnings beats are already priced into the stock price.

On the other end of the spectrum, we have Kering, a potential value play with some quality characteristics and a strong history. An investment in Kering is largely a bet on a potential recovery of the fading Gucci brand. If you believe the turnaround will be successful, I think you can do well, but an investment in Kering is currently more concentrated and probably riskier than LVMH.

I think that LVMH is a well-diversified high-quality choice in this sector. By investing in LVMH, you immediately gain exposure to a large portion of the luxury sector. It is active in leather goods and fashion, wine and spirits, jewelry, cosmetics, and perfumes, among other areas.

The stock has already had a good run this year and is no longer cheap, but I still recommend it to the pure quality investor as a foundation for a quality portfolio, provided that he or she keeps the long term in mind.

2. Visa/Mastercard

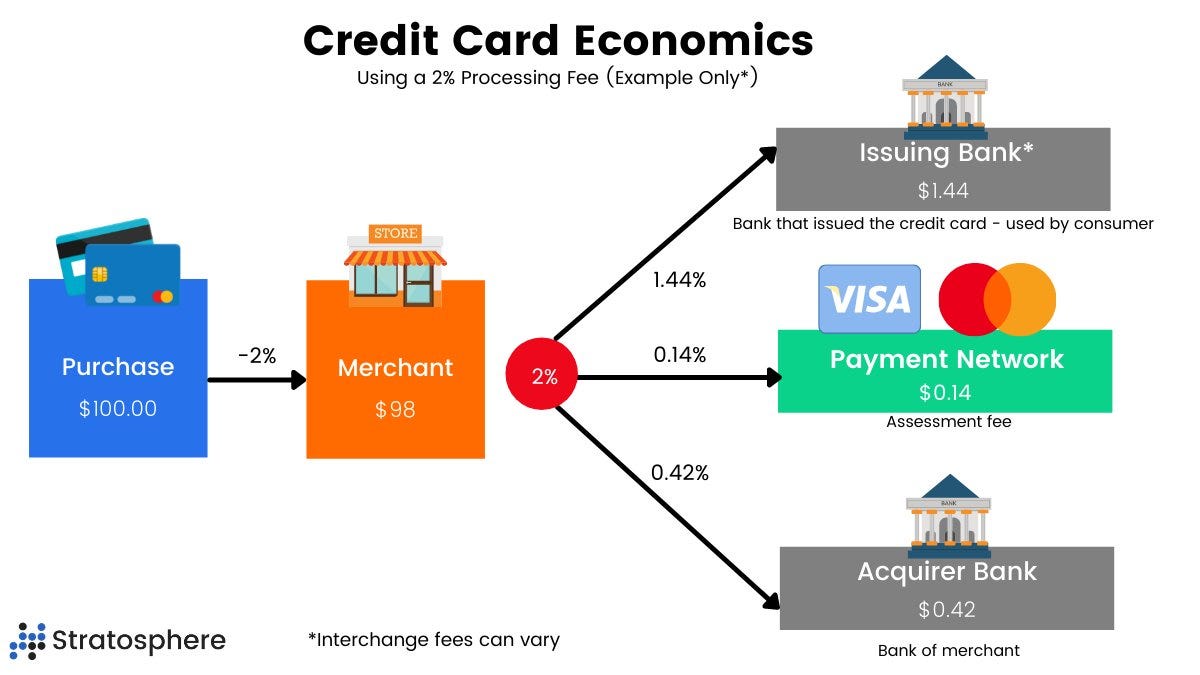

For the second spot in this selection, I am going to cheat a bit because I haven't reserved it for one company, but for two companies that can be mentioned in the same breath: Visa and Mastercard.

Visa and Mastercard are often mistakenly considered as financials. They are not. They are companies that process digital payments. Together, they own the infrastructure that can be seen as digital railways on which payments take place worldwide, and they are richly compensated for every transaction that passes through their network.

I am not exaggerating, as more than half of the revenue remains as operating profit. Both Visa and Mastercard have had an impressive growth trajectory, but the possibilities are far from over.

According to various studies, more than half of the world's population still pays with cash today. Sooner or later, that will change. They enjoy a strong position and network effects that are promising for dominating the attractive growth market in the coming years as well. Organic growth costs Visa and Mastercard hardly anything. Given the highly scalable nature of their business, they spit out cash while growing at double-digit rates.

However, we must not overlook the potential risks. There are two main risks for both companies: regulatory risk and the fact that their excellent fundamentals attract competition. The sector seems prone to disruption, which is a factor that needs to be considered. While Visa and Mastercard enjoy network effects and superior technology that will make it challenging for competitors, innovative rivals are constantly devising ways to simplify digital payments and compete for a coveted position in the lucrative growth market.

It must be said, however, that regularly a new technology emerges that is expected to disrupt Visa and Mastercard, but to date, no competitor has succeeded in doing so. Every time a true disruptor seems to emerge, it ends up becoming yet another partner of Visa and Mastercard, bringing additional volume to their networks. Startups thus benefit from the scale and reach of Visa and Mastercard, while the latter gain access to innovative technologies. These collaborations can also help accelerate the adoption of new payment solutions in the broader market. Visa and Mastercard are quick to act and offer startups their services, network expertise, and know-how, benefiting both parties. Instead of viewing newcomers as competitors, they partner with them.

Of course, you can choose which stock you find most attractive. Visa is the global market leader and has the highest margins, but Mastercard may have slightly more growth potential and room for margin expansion. Therefore, Mastercard can be considered the somewhat more aggressive play of the two. If you'd like to invest in these companies but find it difficult to choose, you may consider a shared position.

Over the years, these companies have rarely disappointed investors. I believe they can continue to excel in what they do best: dominate a secularly growing sector without the need for capital to fund their growth (which explains the relatively high multiples at which they trade).

Now let’s dive into Luc’s favorite stock…