A Guide To Finding 100-Baggers

How to find stocks that grow 100x

Investing in a 100-bagger is the ultimate dream of every investor.

Finding one is rare, but not impossible if you know what to look for.

In today’s article, I’ll teach you how to become a 100-bagger hunter.

The Power of 100-Baggers

The beautiful thing about investing is that you don’t have to be right often.

Don’t believe me? Let’s build a portfolio together and see how it works.

Imagine we start with $10,000 in 10 different stocks.

That means the total value of our portfolio is $100,000.

Now, fast forward 20 years.

Looking back, it seems we didn’t do our homework properly… 9 of the 10 companies we bought went bankrupt.

But here’s the twist: the one remaining stock became a 100-bagger.

That single investment turned our entire portfolio into $1,000,000.

This means we went from $100,000 to $1,000,000 in just 20 years.

And this while 9 of our stocks went bankrupt.

This is a CAGR of 12.2%.

In other words, this ‘terrible’ portfolio would have outperformed the S&P 500.

That’s the power of 100-baggers.

Let’s dive into how we can find them.

100-Bagger Characteristics

1. High Returns on Invested Capital

A high Return on Invested Capital (ROIC) is the secret to finding 100-bagger stocks.

A company with a high ROIC makes more profit from every dollar it invests.

In other words, it can create a true compounding machine by investing money back into the business.

In an ideal world, this becomes a flywheel:

The business generates cash

It reinvests this cash at attractive rates

As a result, it generates more cash

Which means they have even more cash to reinvest

True compounding machines can follow this loop over and over again.

That’s why you should always look for businesses with a Return on Invested Capital (ROIC) above 15%.

This rule alone can have a great impact.

What’s also interesting? The longer you hold a stock, the more your returns align with the returns of the underlying business.

2. Cash in over cash out

Capital allocation doesn't need to be complicated.

It's simply how a business spends its money.

There’s a clear distinction between Cash In and Cash Out.

Cash In: The company reinvests money - through acquisitions, R&D, or other growth initiatives

Cash Out: Money goes out of the company - refers to when a business takes money out by paying dividends, repaying debt, or buying back shares

The ideal capital allocation strategy for 100-baggers? Cash In.

If you discover businesses with strong returns on capital, plenty of reinvestment opportunities, and little to no cash taken out, you're entering great hunting ground for 100-baggers.

100-baggers = High Returns On Invested Capital + Reinvestment Opportunities + Cash In3. Owner-Operators

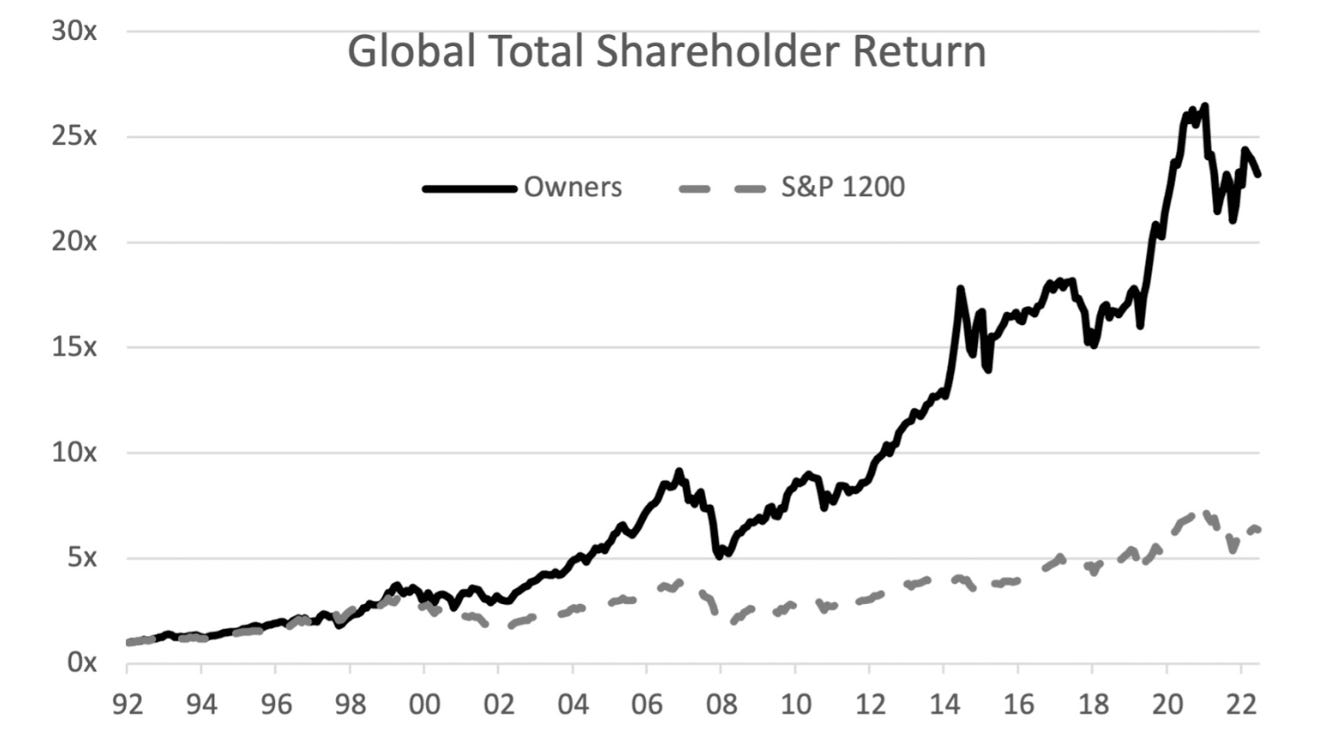

Owner-Operators are businesses still run by their founders.

In other words, these are people who treat their business like their child.

This often leads to a long-term focus and better capital allocation.

Owner-Operators usually prefer Cash In over Cash Out because they understand it’s the best strategy for long-term success.

Let’s put this theory to the test.

Copart, a 300-bagger, is a prime example of an Owner-Operator.

Founder Willis Johnson still owns 5.6%, and former CEO Jayden Air holds a 2.6% stake.

Both Willis and Jayden think in decades, not quarters. Instead of paying dividends for short-term satisfaction, they reinvest everything back into the business.

Copart’s biggest competitor, Insurance Auto Auction (IAA), takes a different approach: It distributes dividends.

The result? Year after year, Copart gains market share while IAA loses it.

4. A sustainable competitive advantage

High returns on capital are always attractive.

Not just to quality investors, but also to competitors.

More competition usually means profits will shrink over time. That’s how the market works, right?

No…

Not if a company has a wide moat.

A moat protects the castle, making it hard for others to enter.

Think of a strong brand, high switching costs, patents, or network effects.

These advantages act like deep waters and high walls, keeping profits safe inside.

That’s why the best businesses stay great for decades.

(Click here if you want to learn more about moats)

5. Buy small

The bigger a business gets, the harder it is to grow.

This is called the ‘Law of Large Numbers’.

Small companies have way more room to grow than giant ones.

If Apple wanted to grow 100 times from here, its value would need to hit $350 trillion.

But all the big winners? They started small.

When Amazon went public in 1997, it was worth less than $500 million.

Most people think you have to invest in companies at their IPO to make huge gains.

But here’s the best part…

With Amazon, you could have waited 10 years after its IPO and still made 100 times your money.

6. The twin engines of growth

A cheap stock can rise simply if the multiple expands.

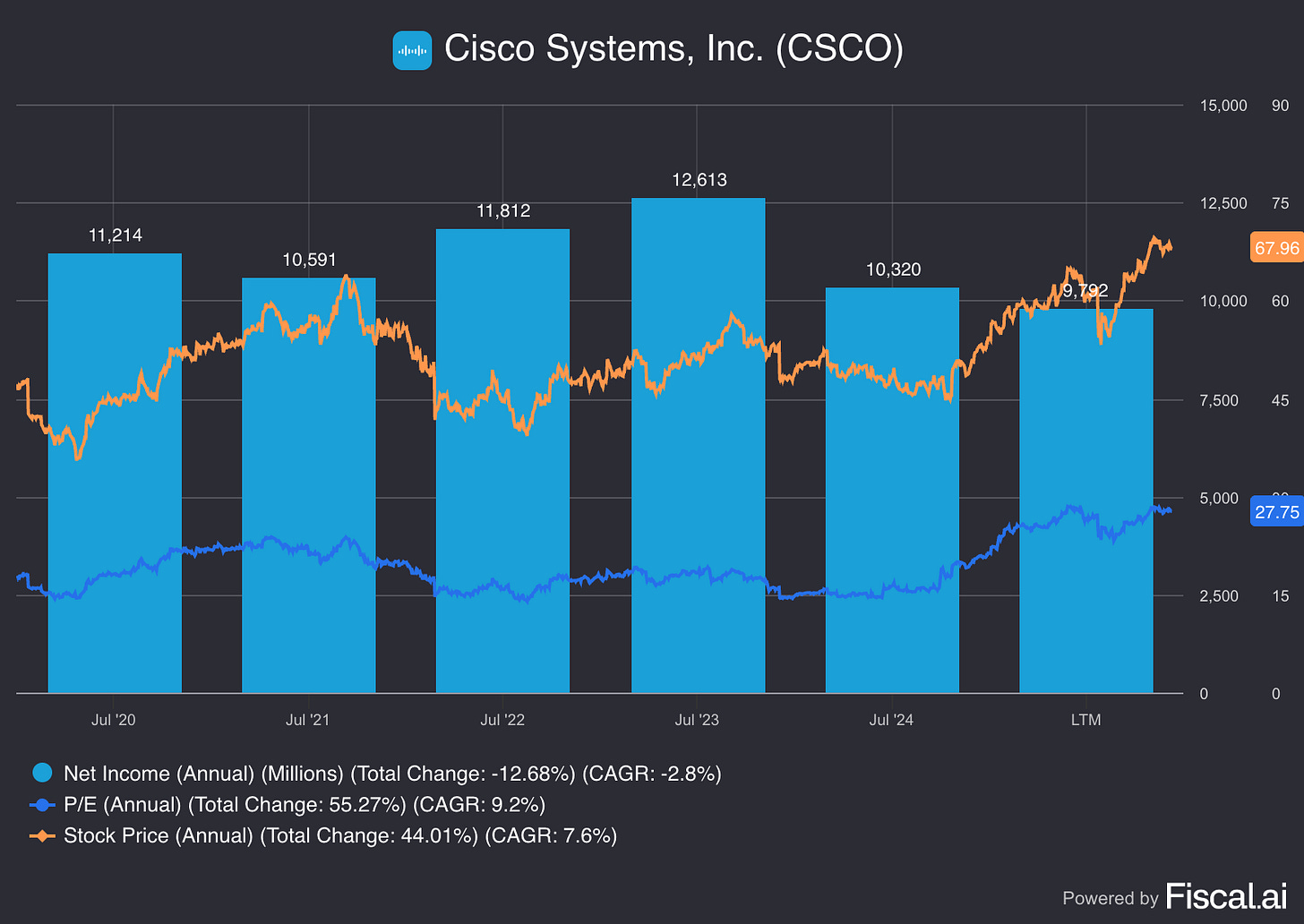

Cisco ($CSCO) fits this idea.

As you can see, over the last 5 years, Cisco shares were up almost 30% without dividends, while Net Income declined.

The reason? Multiple expansion.

On the other hand, an expensive stock can rise if the business grows a lot.

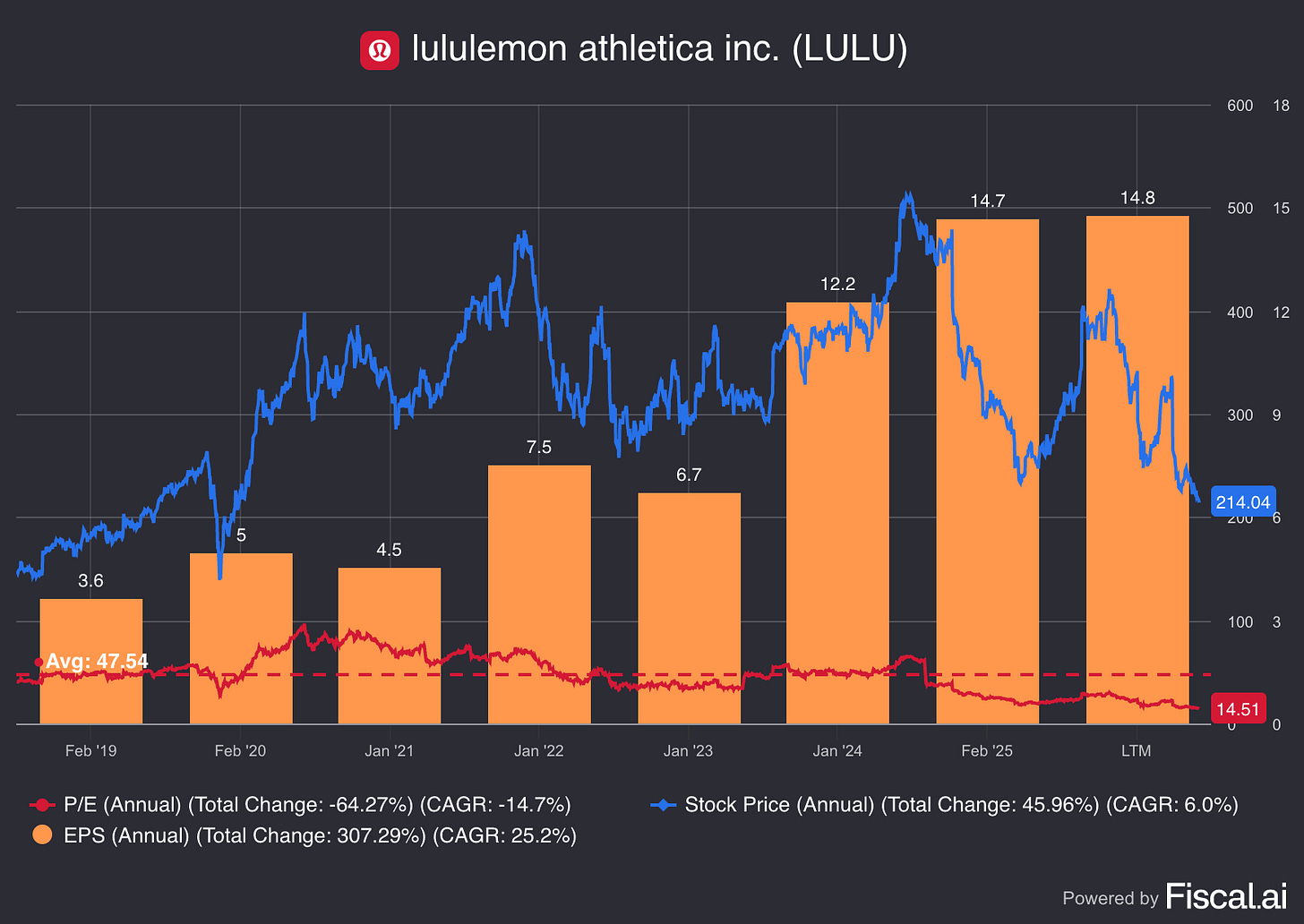

Let’s take a look at Lululemon ($LULU).

Lululemon currently trades at a Price-to-Earnings (PE) of 14.7x compared to a 6-year average of 47.5x.

Despite this multiple contraction, the stock increased by +50%.

That’s the power of growth at play.

But what if both engines fire together? That’s where the magic happens.

Chris Mayer calls this the ‘twin-engines’ of 100-baggers.

One engine is high earnings per share (EPS) growth, like Lululemon, and the other is multiple expansion, like Cisco.

7. The element of surprise

Amazon transformed from a loss-making online bookstore to the biggest company on the planet in terms of revenue.

Apple, on the brink of collapse in the late 1990s, saw Steve Jobs return in 1997. Today, Apple is the third biggest company in terms of market cap.

Netflix, which started as a DVD rental service in 1997, made a risky and uncertain pivot to streaming in 2007. The stock is up +100,000% since 2002.

Elon Musk said the following about Tesla:

“The Model 3 was the difference between Tesla going bankrupt or not. It was touch and go.” - Elon MuskI can keep giving examples all day long.

The truth is, there’s usually an element of surprise, luck, and unpredictability that transforms these businesses into big winners.

A great 100-bagger hunter knows his limitations: it’s not just skill, but luck too.

Investor characteristics

Knowing the characteristics of a 100-bagger is important, but what’s even more important is knowing yourself.

In other words, how you, as an investor, behave is what truly matters.

A great 100-bagger hunter has two key characteristics.

1. Patience

In 1966, Warren Buffett met Walt Disney.

Warren seemed to like Walt and the business and decided to buy 5.0% of the company for $4.0 million.

As usual, Warren was right. A year later, he had already made a 50% return.

But this time he was wrong. Warren decided to take profits.

Today, that 5% would be worth more than $10.0 billion, not to mention the dividends he missed.

This expensive mistake taught a young Warren a valuable lesson:

"Our favorite holding period is forever" - Warren Buffett.Investing in a 100-bagger like Disney takes a lot of time and patience.

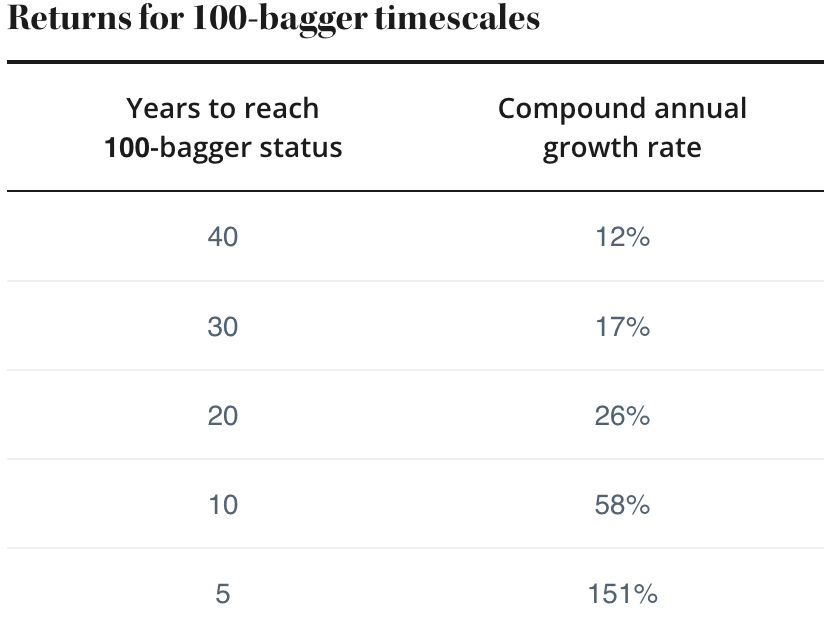

As you can see, 100 to 1 doesn’t happen overnight.

The key lesson? Be patient and let your winners run.

Thomas Phelps, author of the book ‘100 to 1 in the Stock Market’ wrote:

"Fortunes are made by buying right and holding on." - Thomas PhelpsThe only way to get to a 100-bagger is not to sell when it’s a 5-, 10-, or even a 50-bagger.

2. A great stomach

Just because a stock goes up doesn’t mean it’s a great investment.

And just because a stock goes down doesn’t mean it’s a bad one.

In the short term, the stock market is all about sentiment.

“In the short term, the stock market is a voting machine. In the long run, it's a weighting machine” - Benjamin GrahamFear. Greed. Hype. Panic.

These mood swings can cause price drops in your future 100-baggers.

This could trigger fear.

And fear is an expensive feeling in the stock market.

Don’t become part of the voting machine because of fear.

As long as there is a lot of weight in the business, don’t sell.

As Peter Lynch said:

"The real key to making money out of stocks is to not get scared out of them." - Peter LynchThe art of not selling is just as important as the art of buying.

94 Potential 100-Baggers

For Tiny Titans, I identified 94 companies that have the potential to become a 100-bagger.

You can download the list, including all fundamental data, here: