🏰 Bullsh*t Earnings

Hi Partner 👋

Welcome to this week’s 📈 free edition 📈 of Compounding Quality. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

It’s #QualityTuesday!

In this series, you’ll learn 5 things about the stock market in less than 5 minutes.

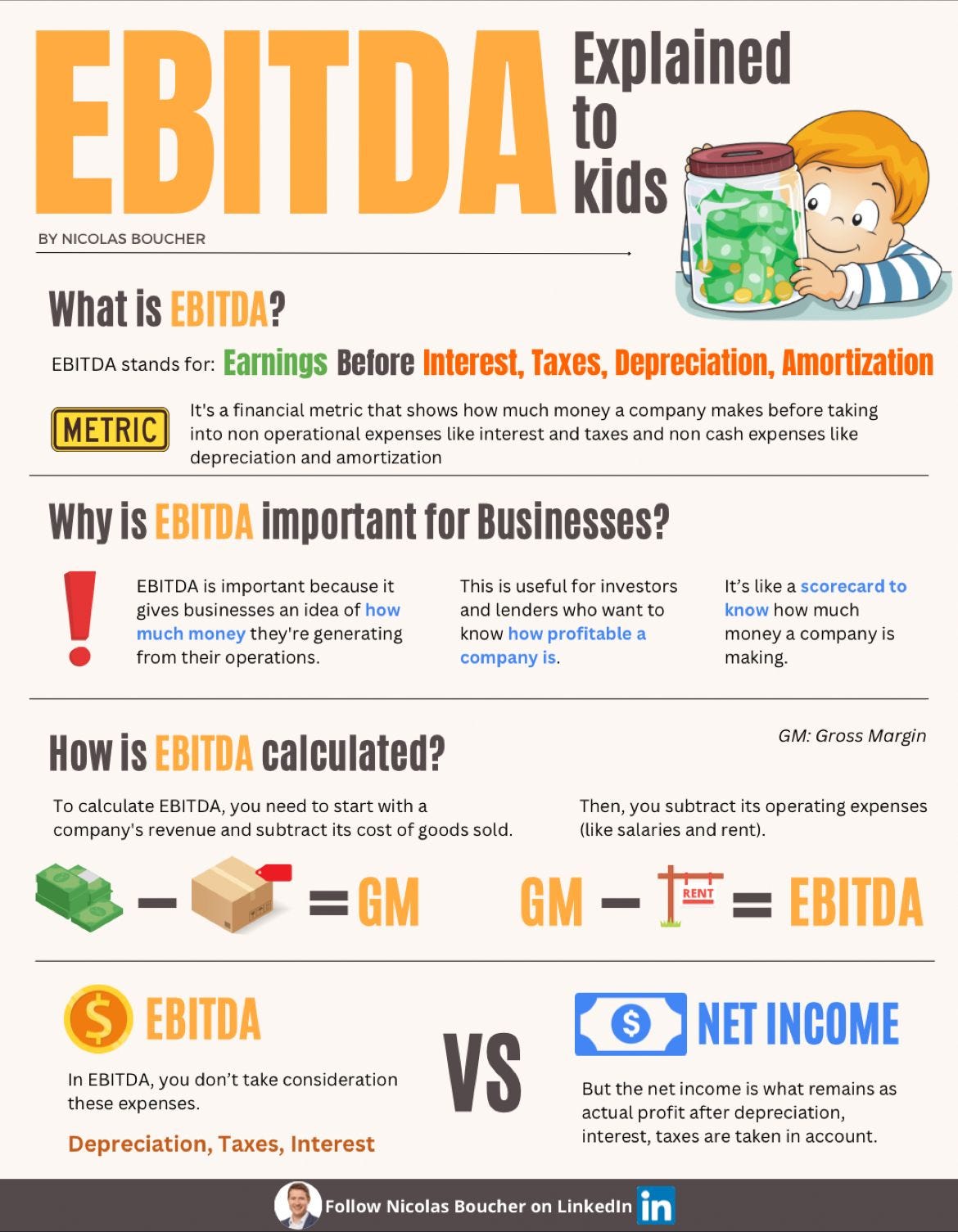

1️⃣ EBITDA explained to kids

EBITDA is one of the most used and misused metrics ever.

But is EBITDA equal to bullsh*t earnings as Charlie Munger said?

Nicolas Boucher did a great job explaining the essentials.

On top, he produces awesome cheat sheets and I recommend his Finance Cheat Sheet, his 100 KPIs, or his Top 100 Excel Tips.

2️⃣ The Investor’s Playbook

The Investor’s Playbook is a free e-book.

It teaches you about quality investing, how to read Financial Statements, and much more.

You can grab it here:

3️⃣ SWOT Analysis

Knowing the Strengths and Weaknesses of the companies you own is crucial.

A SWOT Analysis can help you a lot.

Here’s an interesting breakdown:

Source: Unknown

4️⃣ Learn like Charlie Munger

Those who keep reading keep rising in life.

The best investors read a LOT.

But how do they learn from what they read? And why do they read so much history?

This free series of essays explains how you can learn like Charlie Munger:

5️⃣ Example of a Quality Company

Here are a few examples of Quality Stocks:

Microsoft

Lululemon Athletica

Kinsale Capital

Fortinet

Copart

Constellation Software

Arista Networks

Apple

Amazon

Adobe

I compiled a PDF with 10 onepagers of these companies:

👉 If you enjoy reading this post, share it with friends! Or feel free to click the ❤️ button on this post so more people can discover it on Substack 🙏

New features

Compounding Quality 2.0 is almost there.

These new features were added:

A FAQ helping you to get the most out of Compounding Quality

A recommendation for every company we own: Strong Buy - Buy - Hold - Sell

A dedicated page for Our Portfolio

In the tab ‘Our Portfolio’, you can find the following:

An overview of all our Positions

A dedicated page for every company we own. On this page you’ll find:

The full investment case of 30-40 pages

A brief investment case (onepager)

A chronocial overview of all articles we’ve written about the company in the past

The investable universe

More than 10 ‘Not So Deep Dives’ and 50 onepagers

And much more!

Whenever you’re ready

That’s it for today.

Do you want to walk our investment journeys together?

Consider becoming a Partner of Compounding Quality.

Compounding Quality is all about securing your financial future.

Whenever you’re ready, here’s how I can help you:

📈 Access to my Portfolio with 100% transparency

📚 Access to my ETF Portfolio

🔎 Full investment cases about interesting companies

📊 Access to the Community

✍️ And much more!

Subscribe now to get access to everything:

Everything in life compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

EBIDTA is a great way to make a non-profitable company look profitable to people who aren’t paying attention or are fools.