Constellation Software Deep Dive Part 3

CSI week part III

Constellation Software could be the best quality business I’ve ever seen.

Does it still make sense to buy the company after it increased +19.000%?!

Let’s take a look at this wonderful business.

Constellation Software Week

This is part III of Constellation Software week. Did you skip parts 1 and 2?

Constellation Software

👔 Company name: Constellation Software

✍️ ISIN: CA21037X1006

🔎 Ticker: $CSU

📚 Type: Owner-Operator/Serial Acquirer

📈 Stock Price: CAD 3,385

💵 Market cap: CAD 71.8 billion

📊 Average daily volume: CAD 183 million

During this investment thesis, we will often use CSI. To avoid confusion, this refers to Constellation Software Inc. (CSI).

8. Is the company a great capital allocator?

Let’s split this segment up into two: capital allocation and reinvestment rate.

Capital allocation

Mark Leonard understands the importance of capital allocation like no other CEO:

“Over the long term, stock returns will be determined largely by which capital allocation decisions the CEO makes. Two companies with identical operating results and different approaches to allocating capital will derive two very different long-term outcomes for shareholders.” - Mark Leonard

This is the essential piece of this investment thesis: What are the returns that Constellation makes on its investments?

We cannot just look at ROIC.

The typical ROIC formula (NOPAT/Invested Capital) is based on profits.

Under the “profitability section” of the investment case, you’ll read why NOPAT and other profit metrics don’t reflect the true value creation for CSI.

To better reflect reality, we use EBITA instead of NOPAT in the nominator of the formula.

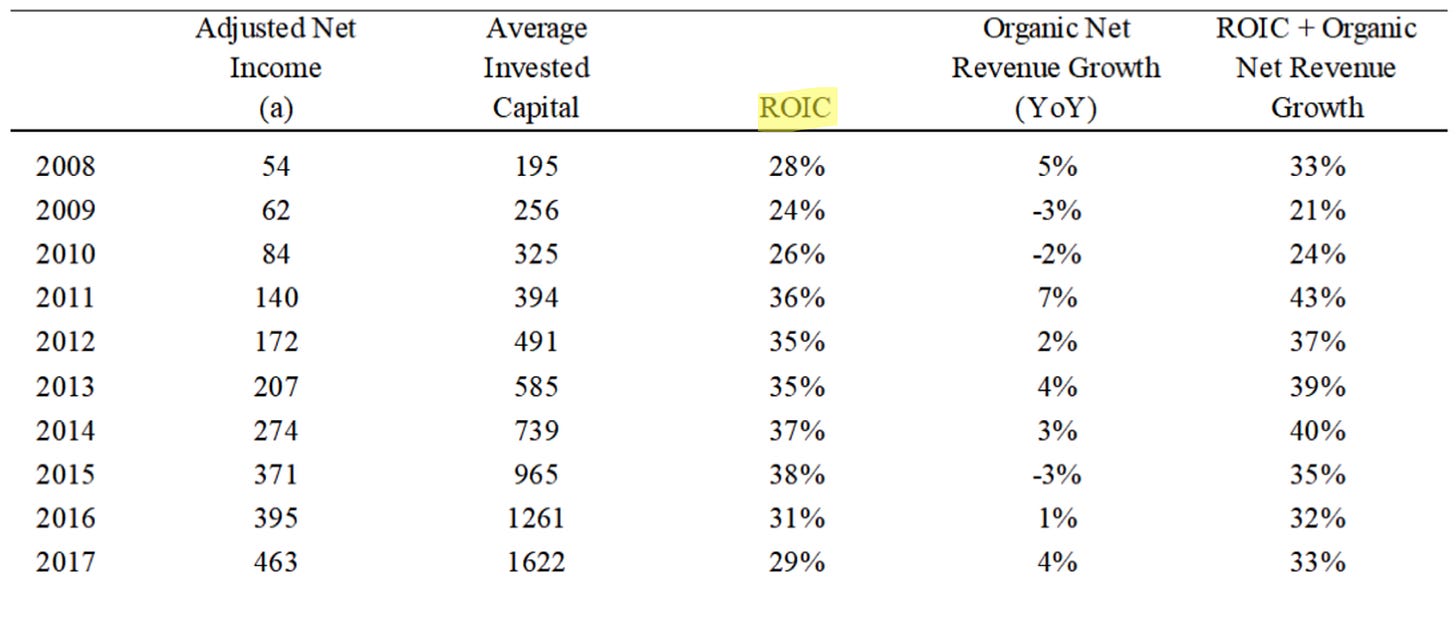

When using the adjusted ROIC, we arrive at the following number:

Adjusted ROIC: 32.5% (Adjusted ROIC 15%? ✅)

This is a very attractive number. It’s similar to the Adjusted ROIC that Leonard shared in his earlier shareholder letters.

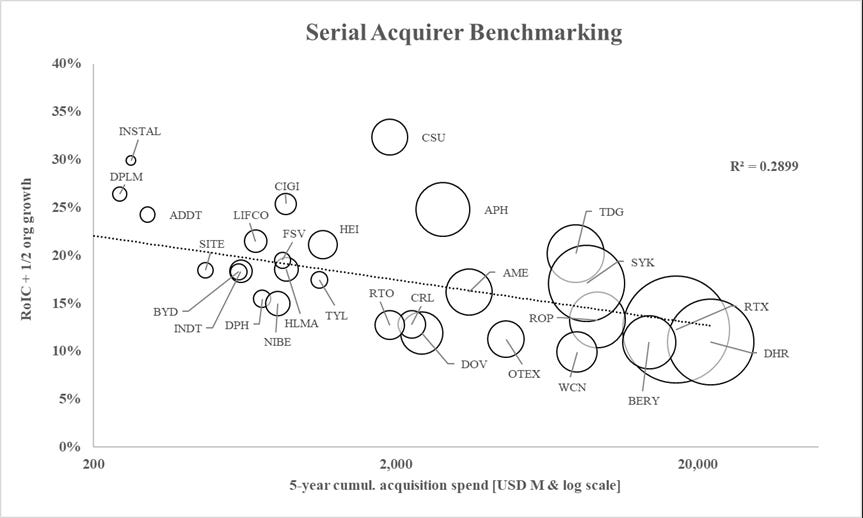

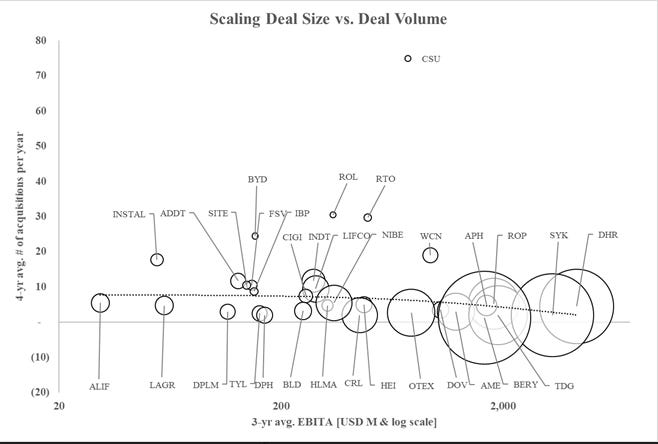

The visual below summarizes the entire investment case. It shows once again that CSI is the golden standard of serial acquirers.

The larger a serial acquirer becomes, the lower the ROIC tends to go.

When doing the research for this investment case, I found something else that was extremely interesting. In 2002, Constellation’s ROIC was still negative. This is 7 years after the company was founded.

The lesson I took away from this is that you should never be too fixated on the absolute ROIC. Instead, focus more on the direction and evolution of ROIC.

Reinvestment Rate

The million-dollar question for Constellation Software is this: How long can they maintain their high reinvestment rate?

Personally, I think a lot longer than most investors believe. Berkshire is roughly 15x times as big as Constellation and still finds creative ways to keep deploying capital instead of paying dividends.

Constellation Software has a massive database of VMS companies that it tracks. Although it’s not publicly known how many companies are in the database, some people argue it’s close to 200,000. This tells you a lot about the runway.

Mark Leonard’s 2021 shareholder letter (unfortunately, the last one he wrote) is devoted entirely to this question: how can we keep the investment rate high?

CSI has found two (potential) solutions to keep the reinvestment rate high:

Do larger VMS acquisitions. I do see a world in which Constellation will run a portfolio of public software companies in which they are minority shareholders. Buffett has mentioned several times that his best deals are private companies where he can buy 100%. Nevertheless, he also made great investments in public companies. In the past, Mark Leonard spoke very highly of Veeva ($VEEV) and AppFolio ($APPF). I think it’s a realistic scenario that Constellation will buy smaller stakes in companies like this. Topicus, an operating platform, is already doing this as we speak, with investments in Sygnity ($SGN) and Asseco Poland ($ACP).

Develop a circle of competence outside VMS. Constellation 2.0 could be a serial acquirer that is diversifying away from VMS. Mark Leonard has mentioned this point several times. But so far, they haven’t deployed capital here.

Mark Leonard has been brutally honest and mentioned that these two steps (buying large VMS companies and acquiring outside VMS) will lower ROIC.

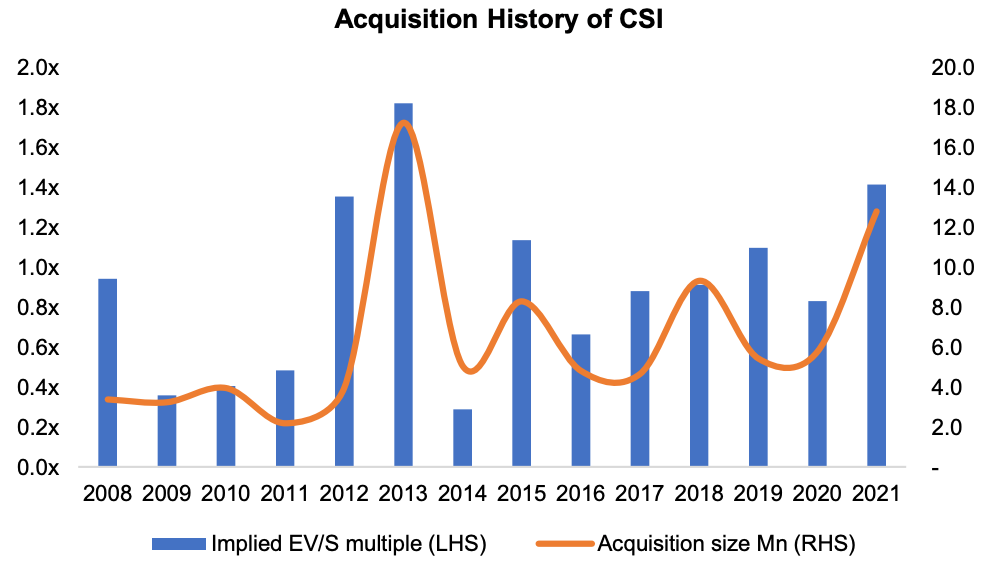

“If we are successful in acquiring one or two large VMS businesses per annum, then I anticipate that CSI’s return on investors’ capital will decrease, but we will not have to return any of our free cash flow to shareholders”- Mark LeonardAs you can see, there is a strong historical correlation between valuation multiples and average deal size:

Mark Leonard gave us a third reason why Constellation can keep M&A activity high in his 2015 shareholder letter. Most large holding companies or serial acquirers follow this model: operations are highly decentralized, but capital allocation is centralized.

Constellation started out in this way, but over time, it has shifted to a different structure: both operations and capital allocation are decentralized.

In the early years, CSI’s head office made all the acquisitions. Later, Operating Groups began sourcing deals, but they still needed head office approval. Today, almost all acquisitions are made directly by the Operating Groups. Now, these Operating Groups have grown so large that they are starting to delegate capital allocation even further down to the individual Business Units.

CSI is actively training its operators (the people running the businesses) on how to evaluate and execute acquisitions. This is important. Because vertical market software (VMS) businesses operate in small markets, operators already know their competitors. Once they learn how to make acquisitions, they can unlock many more opportunities. Every operator that learns to make acquisitions can be a new snowball that starts rolling.

This decentralization also works because incentives are tied to ROIC (Return on Invested Capital). If an operator makes a poor acquisition, it reduces their ROIC, and they are penalized. For Constellation, ROIC is the single most important metric.

This ethos of pushing capital allocation down to the operators is likely the main reason CSI avoids the “reversion to the mean” problem that most serial acquirers face.

Serial acquirers typically rely on one or two brilliant capital allocators at the top. As the company grows, it cannot scale its human capital fast enough and keeps relying on a few bright minds. To maintain reinvestment rates, they shift toward larger acquisitions, which usually generate lower returns. CSI is the only acquirer that seems to avoid the laws of gravity.

As you can see, ROIC comes down once acquirers need to deploy more capital. CSI is the outlier.

By decentralizing capital allocation, they have found a way to keep doing small, higher return acquisitions.

Constellation is often called the Berkshire of software, but this is a critical difference between them. Buffett wants the subsidiaries to return excess cash to Omaha; Leonard does not want all the cash to be returned to Toronto. He wants the businesses to reinvest it themselves. Leonard: “Keep your capital!”

I think that these three steps (acquiring larger VMS companies + moving outside VMS + decentralizing capital allocation), can keep Constellation reinvesting at high rates for a long time.

Overall score – Capital allocation: 9/10

Constellation is a true compounding machine. It has a high reinvestment rate and will probably maintain this in the coming decades, and the adjusted ROIC looks great.How profitable is the company?

When assessing profitability, we don’t focus on Net Profit Margins. That’s because Constellation applies heavy amortization to its intangible assets. Typically, acquired companies are amortized at 10–13% per year, which implies a lifetime of only 8–10 years (1/13% to 1/10%) for a VMS company.

Instead, we prefer metrics that exclude amortization for two key reasons:

Amortization is a non-cash expense: it reduces reported profit without affecting cash flow.

The assumed lifetime is too short: the average customer stays with a VMS company for about 25 years. That means the company’s economic life is also far longer than the 8–10 years implied by accounting rules.

In short, amortization understates both profitability and the durability of VMS businesses.

Profit margins that exclude amortization are the EBITA-margin and the FCF-margin.

EBITA-margin: 26.0% (EBITA-margin > 15%? ✅)

FCF-margin: 22.1% (FCF-margin > 10%? ✅)

Keep in mind that this is a “clean” FCF-margin. Constellation doesn’t use Stock-Based Compensation, so we don’t have to adjust here.

Overall score – Profitability: 9/10

CSI is a very profitable business. Both the EBITA-margin and FCF-margin are well above 20%.Does the company use a lot of Stock-Based Compensation?

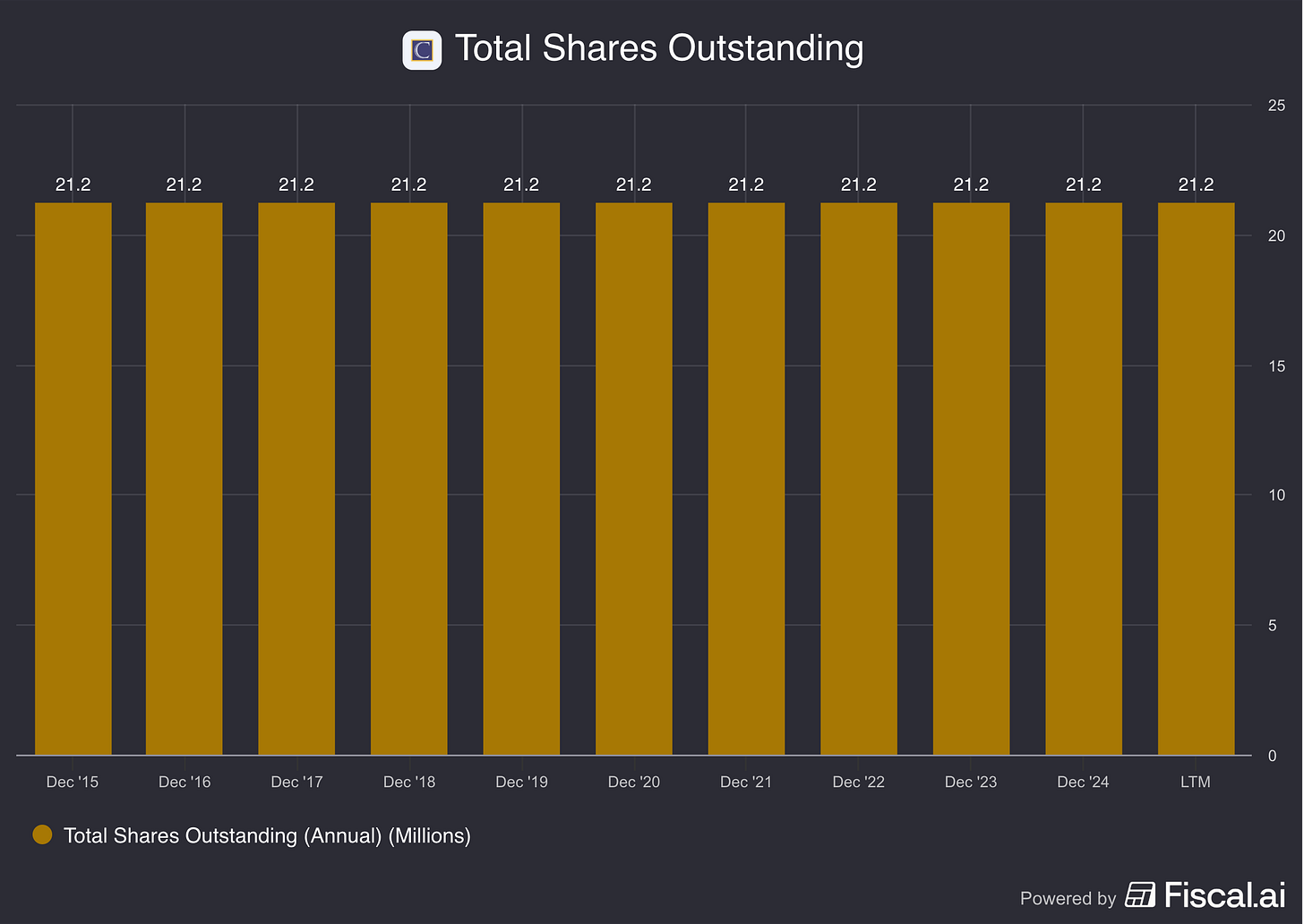

There is a running joke among Constellation Software shareholders that goes like this:

“There will always be 21 million”.

With that joke in mind, now look at the evolution of Total Shares Outstanding:

The punchline? It’s a reference to the maximum supply of Bitcoin, which also happens to be 21 million.

Constellation has only raised equity twice. They raised $25 million when they were founded in 1995 and another $60 million in 1999. They didn’t even issue new shares on the IPO in 2006. The only reason Mark Leonard took the company public was to provide liquidity to his early shareholders. Poor early investors… the Market Cap at the IPO was CAD 70 million. Those who sold missed a 250x.

We’re not getting diluted by equity raises, but more importantly, SBC is zero. Why? Constellation has a very unique way of compensating insiders. It’s very similar to what Berkshire is doing.

Constellation offers cash bonuses, but with a twist: a large portion must be used to purchase common shares on the open market. Once bought, these shares are locked in for four years. Executives are required to reinvest 75% of their bonuses this way, while board members must allocate 100% of their fees into shares.

Mark Leonard has been known to talk the stock down, something few CEOs ever do. One reason is likely his concern that employees could be forced to buy overvalued shares.

This compensation system checks every box investors should care about. Shareholders aren’t diluted, expenses are clearer since there’s no need to adjust free cash flow for stock-based compensation, insider ownership steadily increases, and management is fairly rewarded for performance. In my opinion, it should be the standard compensation model.

Leonard has mentioned that many CSI employees are now millionaires thanks to their shareholdings, with most of their wealth tied directly to the company’s stock.

Constellation Software:

SBCs as a % of Net Income: 0.0% (SBCs/Net Income < 10%? ✅)

Avg. SBC as a % of Net Income past 5 years: 0.0% (SBCs/Net Income < 10%? ✅)

Constellation doesn’t pay stock-based compensation to employees. This is a great sign.

Overall Score – Stock-Based Compensation: 10/10

Constellation Software pays no stock-based compensation to its employees. The average SBC as a % of Net Income over the past 5 years is equal to 0.0%.Did the company manage to grow attractively in the past?

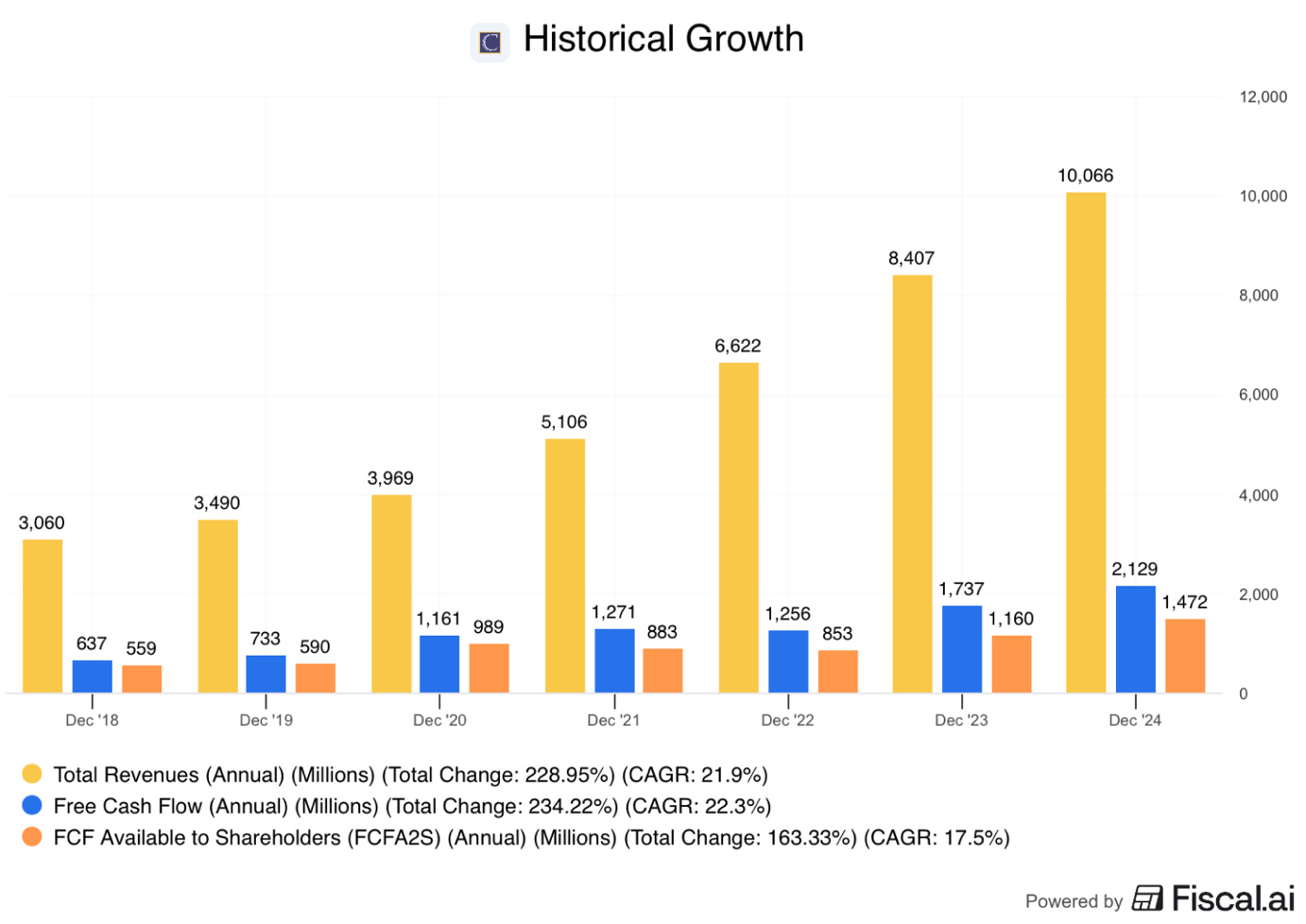

If a company is not growing, it’s dying. We look for companies that have been growing attractively in the past.

Here’s what this looks like for Constellation Software:

Revenue CAGR past 10 years: 20.1% (Revenue CAGR > 7%? ✅)

FCF per Share CAGR past 10 years: 21.2% (FCF CAGR > 9%? ✅)

Overall score – Historical growth: 10/10

CSI managed to grow very attractively in the past. Over the past 10 years, CSI has grown its revenue and FCF per Share at a CAGR of 20.1% and 21.2% respectively.Does the future look bright?

Unfortunately, we don’t have a crystal ball, but I think Constellation will continue to deliver.

Three things have made the company a mega-winner:

An excellent culture

A big emphasis on capital allocation with strict discipline

A high reinvestment rate

I think that as long as Constellation maintains these three, it will continue to perform well.

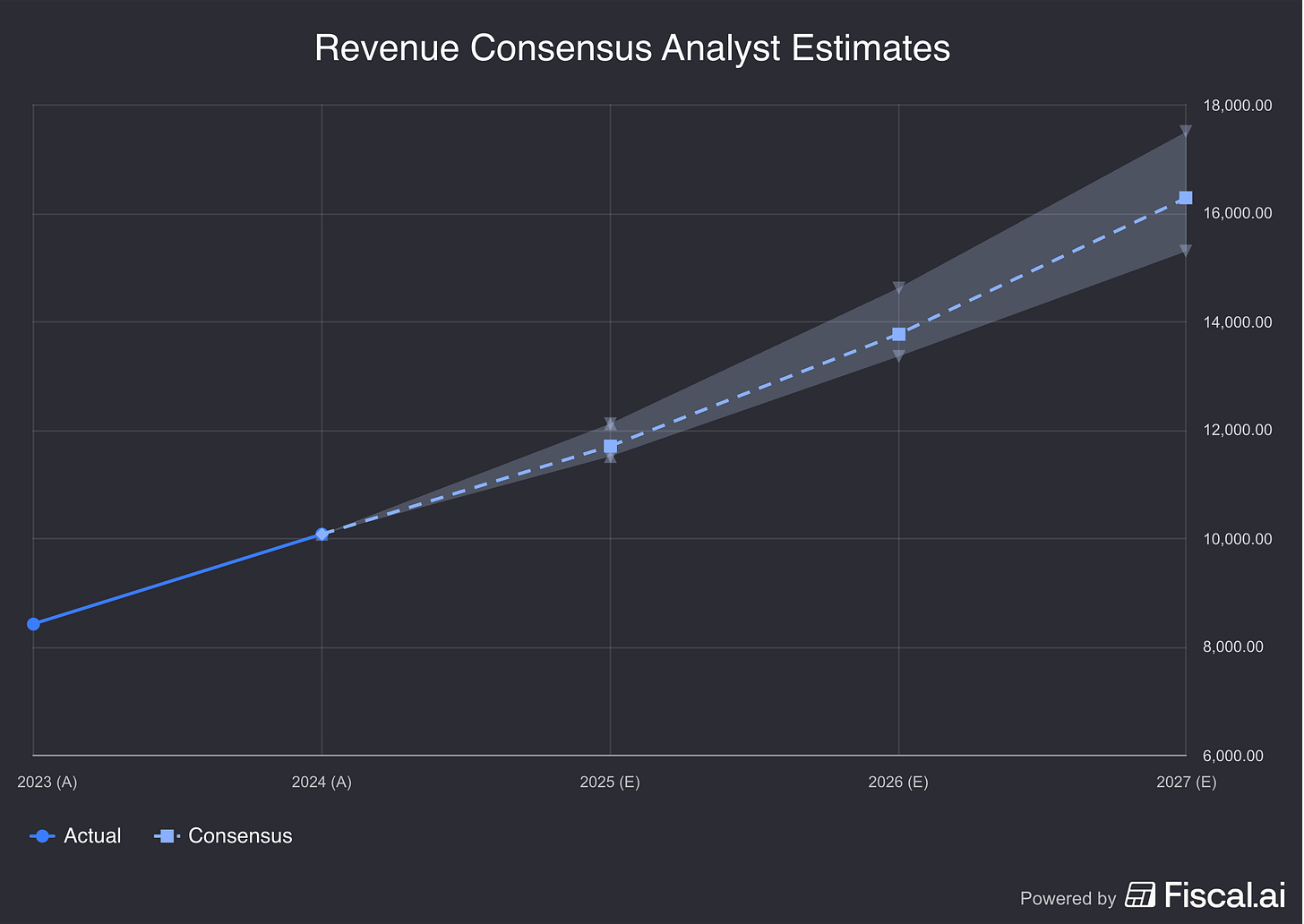

Analysts are also optimistic about the company:

I personally believe that a growth rate in the mid-teens range is a conservative and realistic outlook for this compounding machine.

Overall Score – Outlook: 7/10

The future still looks bright for the company. I believe there are three key aspects for future performance here: an excellent culture, a focus on capital allocation, and a high reinvestment rate.Is the valuation of the company fair?

We always use 3 methods to look at the valuation of a company:

A comparison of the forward FCF-Yield with its historical average

Earnings Growth Model

Reverse Discounted-Cash Flow

Let’s dive into the valuation to determine whether Constellation Software is a potential buy.