Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

In the coastal town of Kinsale (Virginia), something happened that would shape the future of specialty insurance forever.

Michael Kehoe grew up in Kinsale and he knew the harbor inside out. He saw the untapped potential of the maritime history of the small town.

As a young professional, Michael had spent years in the insurance industry. He realized that traditional insurance companies often overlooked niche markets with unique risks.

On a stormy night in Kinsale in 2009, while the waves crashed against the harbor, Michael got the idea to set up his own specialty insurance company. A company that could face storms like the ships that sailed through the waters of Kinsale.

Today, the company is worth more than $10 billion and the stock compounded at more than 50% (!) per year since its IPO.

And the most remarkable thing? Kinsale Capital’s headquarters still overlooks the harbor of Kinsale. A symbol of the company’s resilience and its ability to adapt to changing tides.

Kinsale Capital

👔 Company name: Kinsale Capital

✍️ ISIN: US49714P1084

🔎 Ticker: KNSL

📚 Type: Owner-Operator Stock

📈 Stock Price: $450

💵 Market cap: $10.5 billion

📊 Average daily volume: $63.3 million

Onepager

Here’s a onepager with the essentials of Kinsale Capital.

You can click on the picture to expand it:

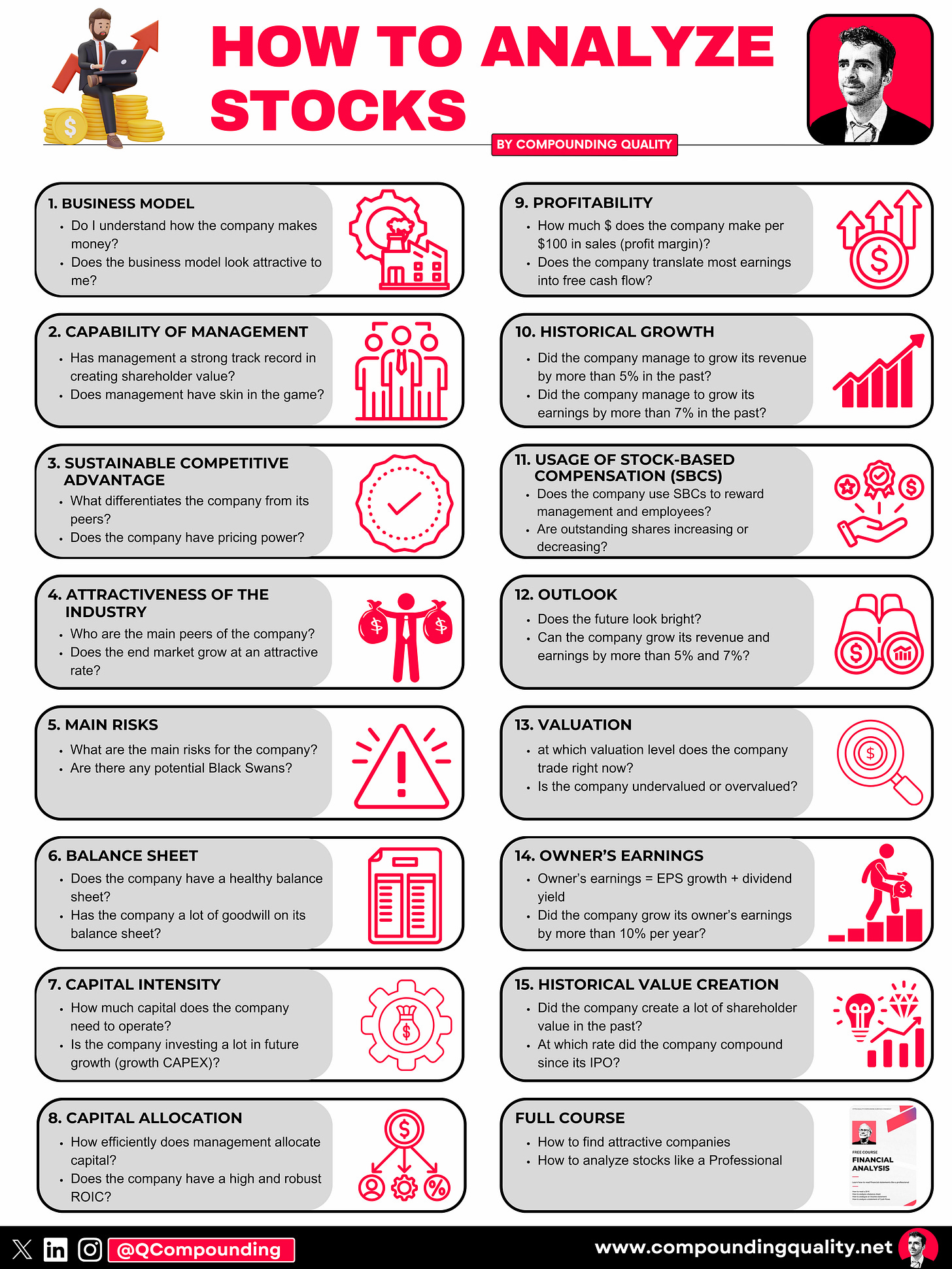

15-Step Approach

Now let’s use our framework to analyze the company.

1. Do I understand the business model?

Kinsale Capital was founded in 2009 and focuses solely on the excess and surplus lines (“E&S”) market in the United States.

Excess and Surplus Lines are designed for businesses with uniquely high risks that the traditional insurance market will not cover.

This means Kinsale Capital focuses on covering rare and/or expensive specialty items or events.

Kinsale Capital uses its underwriting expertise to write coverage for hard-to-place small and mid-sized business risks.

The American company makes money in 2 ways:

Premiums: In exchange for providing insurance coverage, Kinsale charges its customers a fee called a premium

Investments: The money collected from premiums is not just sitting there. Insurance companies often invest these funds to generate additional income. They invest in stocks, bonds, and other financial instruments.

2. Is management capable?

Kinsale Capital is an Owner-Operator stock.

Michael Kehoe founded the company in 2009 and he’s still the CEO and President. Today, Kehoe owns 4.1% of Kinsale Capital. In total, all executive officers and directors own 6% of the business.

Kinsale Capital also benefits from an experienced and cohesive management team with over 30 years of relevant experience on average. Many employees of Kinsale worked together for decades at other E&S insurance companies:

3. Does the company have a sustainable competitive advantage?

Kinsale Capital has a moat based on 4 main factors:

1️⃣Leveraging its technology to generate superior data, insights, and services

2️⃣Exclusive focus on the E&S market (a more profitable segment within insurance)

3️⃣Vigilantly controlling expenses (resulting in a lower expense ratio versus competitors)

4️⃣Focus on small accounts (Kinsale is a market leader in this underserved niche)

The best way to look at whether an insurance company has a moat is by looking at its combined ratio:

A combined ratio under 100% indicates an underwriting profit

A combined ratio over 100% indicates an underwriting loss.

It’s great seeing that Kinsale Capital’s combined ratio is one of the lowest amongst their specialty insurer peers.

Over the past 10 years, Kinsale Capital’s combined ratio averaged 78% and the combined ratio has never been higher than 86% over the past decade.

This is truly great for an insurance company.

4. Is the company active in an attractive end market?

Kinsale Capital has a market share of 1.3% in the total E&S market.

The company believes its exclusive focus on the E&S market and its high level of service allows the company to better service brokers and position Kinsale to profitably increase its market share.

Primary competitors in the E&S sector include Arch Capital Group., Argo Group, James River Group, Lloyds of London, Markel Corporation, RLI Corp., and W. R. Berkley Corporation.

In the E&S market, Kinsale Capital is the only publicly traded pure-play.

5. What are the main risks for the company?

Here are some of the main risks for Kinsale Capital:

Dependence on general economic conditions (recessions, inflation, periods of high unemployment, lower economic activity, …)

Insurance is a cyclical business (year-on-year results are unpredictable)

E&S insurance covers risks that are typically more complex and unusual than standard risks. They require a high degree of specialized underwriting

Historically, the financial performance of the P&C insurance industry has tended to fluctuate in cyclical periods of price competition and excess capacity (known as a soft market) followed by periods of high premium rates and shortages of underwriting capacity (known as a hard market).

Severe weather conditions, catastrophes, pandemics, and similar events

Kinsale Capital relies on a select group of brokers. Kinsale Capital is somewhat reliant on these distribution channels

Last year, 58.5% of gross written premiums were distributed through 5 of their 179 brokers.

Kinsale Capital invests its float. This means they are exposed to investment risks

Regulation risks

6. Does the company have a healthy balance sheet?

We look at 3 ratios to determine the healthiness of Kinsale Capital’s balance sheet:

Interest Coverage: 38.3x (Interest Coverage > 15x? ✅)

Net Debt/FCF: 0.1x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 0.0% (Goodwill/assets not too large? < 20% ✅)

As you can see, Kinsale Capital’s balance sheet looks healthy.

Source: Finchat

7. Does the company need a lot of capital to operate?

The less capital a company needs to operate, the better.

Here’s what things look like for Kinsale Capital:

CAPEX/Sales: 0.5% (CAPEX/Sales < 5%? ✅)

CAPEX/Operating Cash Flow: 0.8% (CAPEX/Operating CF? < 25% ✅)

As you can see, Kinsale Capital’s capital intensity is very low.

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.

We like to invest in companies that put the money of shareholders to use at attractive rates of return.

Remember the formula for ROIC:

ROIC = NOPAT / Total Invested Capital

Wherein Invested Capital = Total Debt + Total Equity + Non-Operating Cash

When you look at Kinsale’s ROIC, you get the following:

Source: Finchat

These numbers don’t look fantastic at first sight. Do they?

But you should know that 70% of Kinsale Capital's total assets are Investments as the company invests the Premiums it receives from its clients (this is called float).

When we exclude these investments, the company’s ROIC would increase from 9.5% to 22.1%.

This is already a different story!

The best way to look at Kinsale’s capital allocation is probably its ROE:

Source: Finchat

The company’s ROE does look attractive!

9. How profitable is the company?

The more profitable the company, the better.

Here’s what things look like for Kinsale Capital:

Gross Margin: 25.3% (Gross Margin > 40%? ❌)

Net Profit Margin: 25.2% (Net Profit Margin > 10%? ✅)

FCF/Net Income: 276.6% (FCF/Net Income > 80%? ✅)

Ideally, we would want the Gross Margin to be a bit higher but the bottom line is very profitable.

10. Does the company use a lot of Stock-Based Compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Kinsale Capital:

SBCs as a % of Net Income: 3.1% (SBCs/Net Income < 10%? ✅)

Avg. SBC as a % of Net Income past 5 years: 3.5% (SBCs/Net Income < 10%? ✅)

These numbers look very reasonable.

11. Did the company grow at attractive rates in the past?

We seek companies that managed to grow their revenue and EPS at attractive rates in the past.

Kinsale Capital:

Revenue Growth past 3 years (CAGR): 40.8% (Revenue growth > 5%? ✅)

Revenue Growth past 5 years (CAGR): 35.3% (Revenue growth > 5%? ✅)

EPS Growth past 3 years (CAGR): 47.9% (EPS growth > 7%? ✅)

EPS Growth past 5 years (CAGR): 44.4% (EPS growth > 7%? ✅)

Those growth figures look very attractive.

Source: Finchat

12. Does the future look bright?

You want to invest in companies that manage to grow at attractive rates.

Why? Stock prices tend to follow earnings growth over time.

Kinsale Capital:

Exp. Revenue Growth next 2 years (CAGR): 24.2% (Revenue growth > 5%? ✅)

Exp. EPS Growth next 2 years (CAGR): 20.2% (EPS growth > 7%? ✅)

EPS Long-Term Growth Estimate: 15.0% (EPS growth > 7%? ✅)

Bringing everything together

In the last part of the investment case (exclusively for Partners), we look into the valuation of the company and determine when we would be interested in buying Kinsale Capital.

Currently, we don’t own the company as we think the companies we own offer more attractive opportunities.

Become a Partner to get immediate access to our Portfolio and the full investment case:

Partners get the following:

Happy Compounding!

Pieter (Compounding Quality)

PS Currently you get a $100 discount on a yearly subscription ($399 instead of $499)

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data