🧑🏫 Is management capable?

Analyzing Mastercard's management

This is the sixth article in the series How to Analyze a Stock.

In this course you’ll learn:

How to find attractive stocks

Where to find information about these companies

How to determine whether a company is an attractive investment

In case you missed it:

Today you’ll learn how to look at management using Mastercard as an example.

Is management capable?

You want to invest in companies that are led by great managers.

Preferably, you want these managers to have skin in the game.

This is the case when the founder or his family are still active within the business.

Great capital allocators

Capital allocation is the most important task of management.

Capital allocation is all about putting the capital of the company to work at attractive rates of return.

Management should focus relentlessly on creating shareholder value.

The best book that has been written about this topic? The Outsiders by William Thorndike.

The essence of the book?

Great capital allocators put a lot of emphasis on the following elements:

They see capital allocation as their most important task

Great capital allocators focus on the increase in the intrinsic value per share and not on overall growth or size

A relentless focus on cash flows

They use a decentralized business model

They think independently and aren’t afraid to go against conventional wisdom

Sometimes the best investment opportunity is your own stock (share repurchases)

With acquisitions, patience is a virtue … as is occasional boldness

You want to learn more about the characteristics of great capital allocators?

I wrote a 19-page summary of the book for everyone who’s interested. You can grab it here:

Insider ownership

The main reason why companies with skin in the game outperform is quite obvious: they tend to think and act like owners.

They’re not just doing it for the money. They genuinely love what they do and they put the creation of shareholder value first.

Companies with skin in the game don’t want to maximize quarterly results.

They want to make sure that the company gets bigger, stronger, and more robust so their (grand)children can continue to reap the benefits from what they’ve built over the years.

These companies dare to make decisions that might hurt results in the short term but are very good for long-term value creation.

In other words: they think in decades instead of quarters.

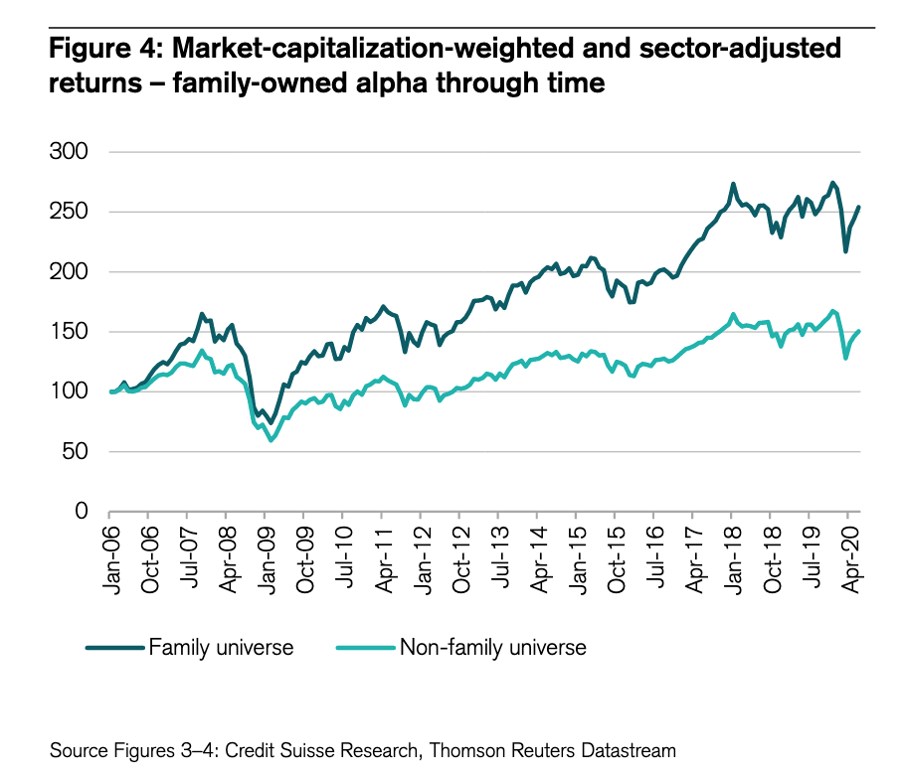

A study of Credit Suisse has shown that family-owned companies outperformed non-family-owned companies by 3.6% per year since 2006: