Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

Visa and Mastercard are two beautiful businesses.

They operate in a duopoly and dominate the entire electronic payment industry.

Is Mastercard an interesting investment? Let’s find out today.

Mastercard - General Information

👔 Company name: Mastercard

✍️ ISIN: US57636Q1040

🔎 Ticker: MA

📚 Type: Oligopoly

📈 Stock Price: $469

💵 Market cap: $437 billion

📊 Average daily volume: $1.1 billion

Onepager

Here’s a onepager with the essentials of Mastercard

You can click on the picture to expand:

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give Mastercard a score on each of these 15 metrics, resulting in a Total Quality Score.

1. Do I understand the business model?

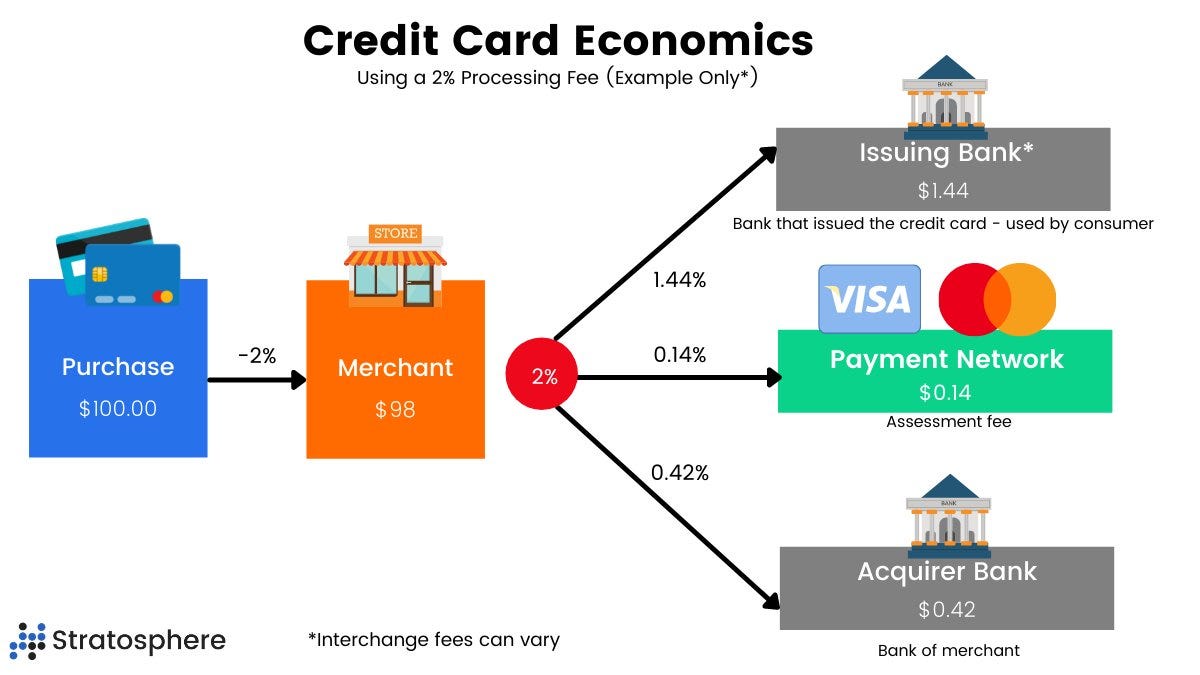

Mastercard operates as a global financial services company with a straightforward business model in transaction fees and providing payment services.

They do not issue credit or debit cards. Instead, they partner with banks and financial institutions that issue these cards to consumers.

Mastercard's core function is to operate a payment network that connects merchants, banks, and cardholders.

Every time you purchase something using Mastercard, the merchant pays a fee to Mastercard for processing this transaction.

Banks and financial institutions pay fees to Mastercard for access to its payment network, enabling them to issue Mastercard-branded cards and process payments.

Additionally, Mastercard generates revenue from cross-border transactions, such as currency conversion fees, which apply when a transaction involves different currencies.

Mastercard offers various services to banks and merchants, including fraud prevention tools, data analytics, and payment security solutions. These services add an extra source of revenue to the company's bottom line.

The company’s revenue primarily comes from transaction fees, fees paid by banks, and income from ancillary services, making it a profitable player in the financial services industry.

2. Is management capable?

Michael Miebach has been the CEO of Mastercard since January 2021. Miebach has been working for Mastercard since 2010 when he joined the company to lead its Middle East and Africa.

He directly owns 23,419 shares of the company, resulting in a stake of $9 million in Mastercard. In total, insiders own 383,000 shares (value: $147.8 million).

Sachin Mehra, the CFO of Mastercard, has been working for the company since 2007 and owns 9,904 shares of Mastercard.

While there isn’t a lot of insider ownership, the track record of management has been excellent.

3. Does the company have a sustainable competitive advantage?

Mastercard has a sustainable competitive advantage. Their substantial presence in the financial services industry spans numerous countries, involving millions of businesses, and they enjoy significant pricing power.

The electronic payment networks of both Visa and Mastercard developed over decades, are unique and incredibly challenging for new entrants to replicate. This provides them with barriers to entry.

Lastly, Mastercard benefits from its strong brand name and established client relationships.

Credit cards of Visa and Mastercard can be used worldwide. This is very hard for newcomers to attain as it takes time to build customer relationships.

This is a beautiful example of network effects at play.

4. Is the company active in an attractive end market?

Grand View Research estimates that the global digital payment market size will grow at a CAGR of 21.1% (!) until 2030.

This indicates Mastercard is active in an attractively growing end market.

Mastercard operates in an oligopoly together with Visa.

Here’s a brief comparison between Visa and Mastercard:

As you can see, Visa is more profitable and valued cheaper while Mastercard can grow at more attractive rates.

5. What are the main risks for the company?

Here are some of the main risks for Mastercard:

Dependence on global economic conditions

Legal and regulatory risks

Data security risks

Rapid advancements in technology and changes in payment methods

Cybersecurity and data privacy risks

Dependence on partners (banks, merchants, and other partners)

6. Does the company have a healthy balance sheet?

We look at 3 ratios to determine the healthiness of Mastercard’s balance sheet:

Interest Coverage: 25.3x (Interest Coverage > 15x? ✅)

Net Debt/FCF: 0.6x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 18.0% (Goodwill/assets not too large? < 20% ✅)

Mastercard’s balance sheet looks healthy.

Source: Finchat

7. Does the company need a lot of capital to operate?

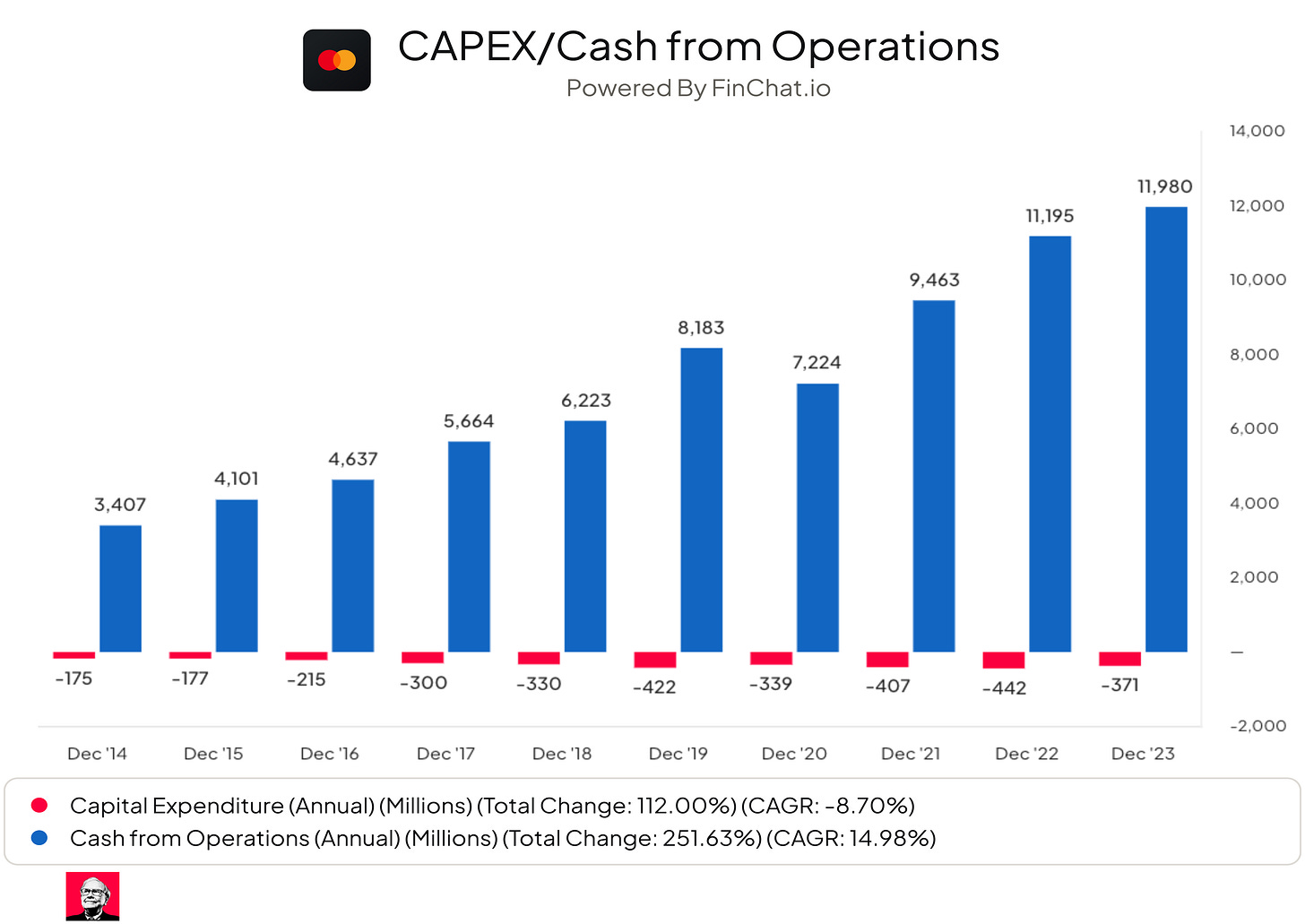

We prefer to invest in companies with CAPEX/Sales lower than 5% and CAPEX/Operating Cash Flow lower than 25%.

Mastercard:

CAPEX/Sales: 1.5% (CAPEX/Sales < 5%? ✅)

CAPEX/Operating Cash Flow: 3.1% (CAPEX/Operating CF? < 25% ✅)

As you can see, Mastercard has a very low capital intensity.

Source: Finchat

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.

Look for companies that put the money of shareholders to work at attractive rates of return.

Mastercard:

Return On Equity: 167.4% (ROE > 20%? ✅)

Return On Invested Capital: 40.7% (ROIC > 15%? ✅)

These numbers look attractive.

Source: Finchat

9. How profitable is the company?

The higher the profitability of the company, the better.

Here’s what things look like for Mastercard:

Gross Margin: 76.7% (Gross Margin > 40%? ✅)

Net Profit Margin: 44.6% (Net Profit Margin > 10%? ✅)

FCF/Net Income: 103.8% (FCF/Net Income > 80%? ✅)

Mastercard’s profitability looks phenomenal.

"Mastercard and Visa's profit margins are 4x as high as the average company within the S&P 500. This means that you could halve their profit margin, and do it gain to get to the average profit margin of other companies." - Chuck Akre

Source: Finchat

10. Does the company use a lot of Stock-Based Compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Preferably we want SBCs as a % of Net Income to be lower than 4% and certainly below 10%.

Mastercard:

SBCs as a % of Net Income: 4.1% (SBCs/Net Income < 10%? 🤷♂️)

Avg. SBC as a % of Net Income past 5 years: 3.5% (SBCs/Net Income < 10%? ✅)

11. Did the company grow at attractive rates in the past?

We seek companies that managed to grow their revenue and FCF by at least 5% and 7% per year respectively.

Mastercard:

Revenue Growth past 5 years (CAGR): 10.9% (Revenue growth > 5%? ✅)

Revenue Growth past 10 years (CAGR): 11.7% (Revenue growth > 5%? ✅)

FCF Growth past 5 years (CAGR): 10.6% (FCF growth > 7%? ✅)

FCF Growth past 10 years (CAGR): 15.3% (FCF growth > 7%? ✅)

These growth figures look attractive.

Source: Finchat

12. Does the future look bright?

You want to invest in companies that manage to grow at attractive rates as stock prices tend to follow FCF per share growth over time.

Mastercard:

Exp. Revenue Growth next 2 years (CAGR): 12.3% (Revenue growth > 5%? ✅)

Exp. EPS Growth next 2 years (CAGR): 17.0% (EPS growth > 7%? ✅)

EPS Long-Term Growth Estimate: 17.0% (EPS growth > 7%? ✅)

Now let’s look into the valuation of Mastercard and give the company a Quality Score to determine whether it’s worth buying this excellent company.

![100+] Credit Card Wallpapers | Wallpapers.com 100+] Credit Card Wallpapers | Wallpapers.com](https://substackcdn.com/image/fetch/$s_!8BL6!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9f1b4c90-3104-4efc-9589-44119a8adaf0_1920x1200.jpeg)