Kelly Partners Group is an amazing business.

We hosted a 1-on-1 meeting with the CEO Brett Kelly.

Let’s discuss what we learned.

Onepager

Are you not familiar with Kelly Partners Group yet?

Here are the essentials:

I would also highly encourage you to look at the Owner’s Manual of the company.

The strategy of Kelly Partners Group is based on three core principles:

Keep Promises: Be as transparent as you can

Margin of Safety: Minimize risks as much as possible

Stay a Hedgehog: Stay within your circle of competence and remain flexible

Here’s what we already wrote about the company in the past:

29 September 2024: Portfolio Update September 2024

29 August 2024: 10 Getting Rich Stocks

25 August 2024: 🥂 Portfolio Update (1st anniversary)

14 July 2024: Portfolio Update July 2024

31 March 2024: Portfolio Update March 2024

3 February 2024: Update investment case

15 December 2023: Update after Annual General Meeting

3 December 2023: Best Buys December 2023

12 November 2023: Building an empire

2 November 2023: Results Season

22 September 2022: 20 Undervalued small-cap quality stocks

🧠 What we learned

Can you expand on the business model of Kelly Partners Group? What makes the company unique?

Brett Kelly: We have a deep understanding of our small circle of competence.

Our Partner-Owner-Driver Model is part of what we think makes the business very different.

It’s important to highlight we don’t use a roll-up strategy.

In a roll-up, there is no skin in the game at a subsidiary level.

At KPG, the Partners still have a stake in the company. We consider every acquisition as a Partnership.

There is no business I’m aware of that uses a similar structure as we do.

Our goal is to expand our competitive advantage every single day.

If you can encourage your people to strive for this daily, it makes a huge difference.

Our business model is shown below.

We’ve operated successfully for 18 years and our business has grown at a CAGR of 30%.

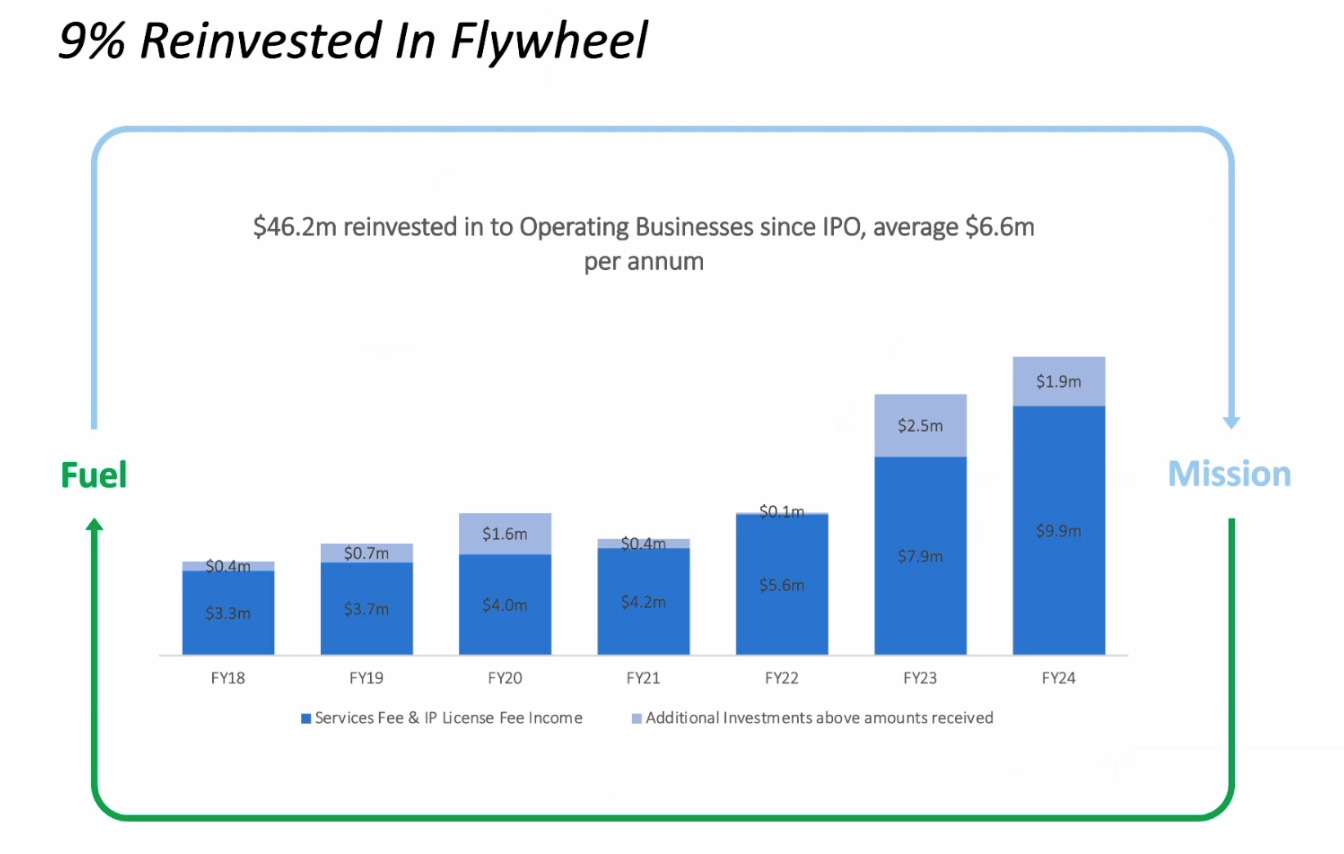

On average, we invest 9% for organic growth:

Kelly Partners Group revenue split looks like this:

Can you walk us through KPG’s capital allocation strategy?

Brett Kelly: Capital allocation is very important.

Our capital allocation strategy has always been rational and aggressive around lowering risk and maximizing return.

The main priority is to lower the risk. We believe a very strong defense is the ultimate offense.

The book ‘The Outsiders’ by William Thorndike is used as a framework to make capital allocation decisions.

We have three main goals:

Keep growing via M&A

Grow our business organically by at least 5%

Repurchase shares

It is a mistake to think that we can’t do these three things simultaneously.

We are very hesitant to use KPG shares to acquire companies. We would only do it when it makes a lot of sense. As a result, we usually use debt instead as we don’t want to dilute existing shareholders.

Share buybacks will also be used. Nobody can understand the value of the business better than we do and we have a lot of financial capacity. We will buy back shares when they trade at a discount compared to intrinsic value.

So far, we haven’t been wrong yet on our buybacks. the key goal is to maximize value for our shareholders.

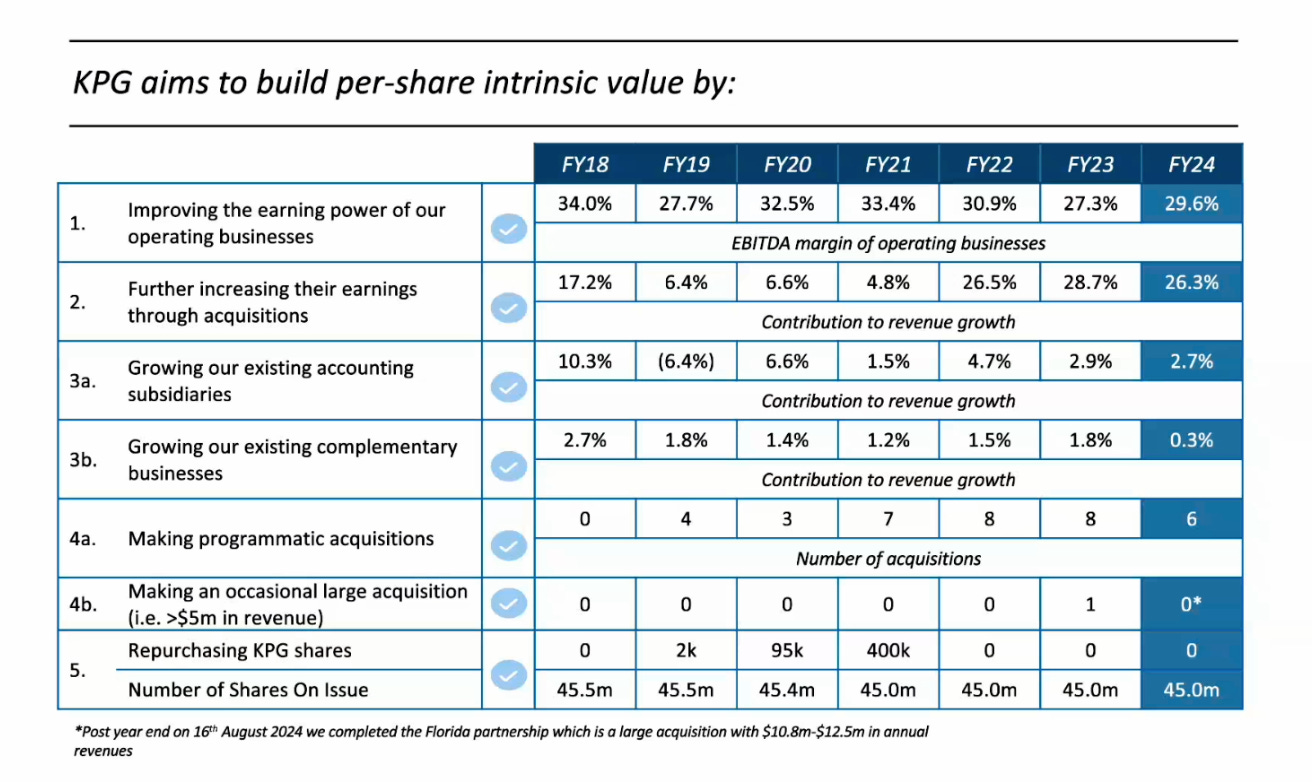

As you can see here, we are executing on our strategy:

Where should KPG be in 5 and 10 years from now?

Brett Kelly: We want to become a top 10 accounting firm in Australia while growing internationally (mainly in the United States).

The book ‘Double Double’ by Cameron Harold is excellent. It’s about how you can double your business in 3 years.

Could KPG achieve this?