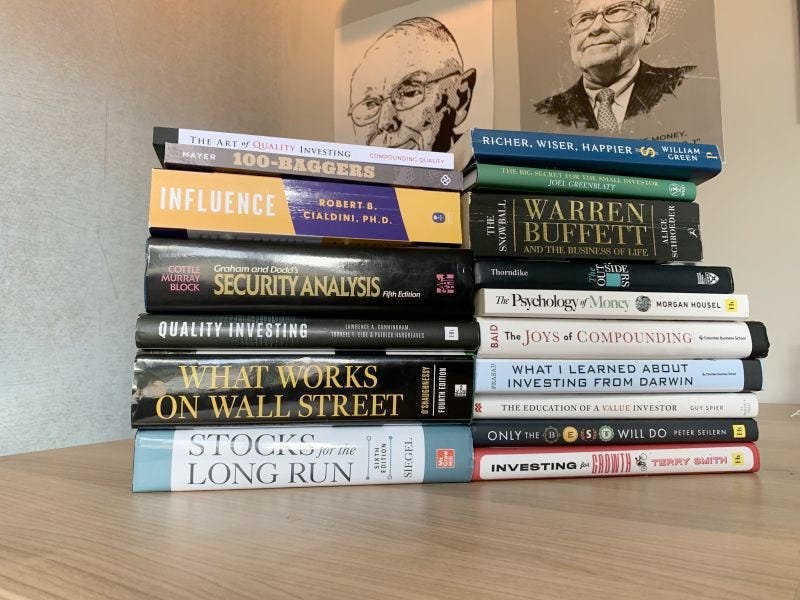

🏰 My favorite books

17 Investing books you should read

Hi Partner 👋

Welcome to this week’s 📈 free edition 📈 of Compounding Quality. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

It’s #QualityTuesday!

In this series, you’ll learn 5 things about the stock market in less than 5 minutes.

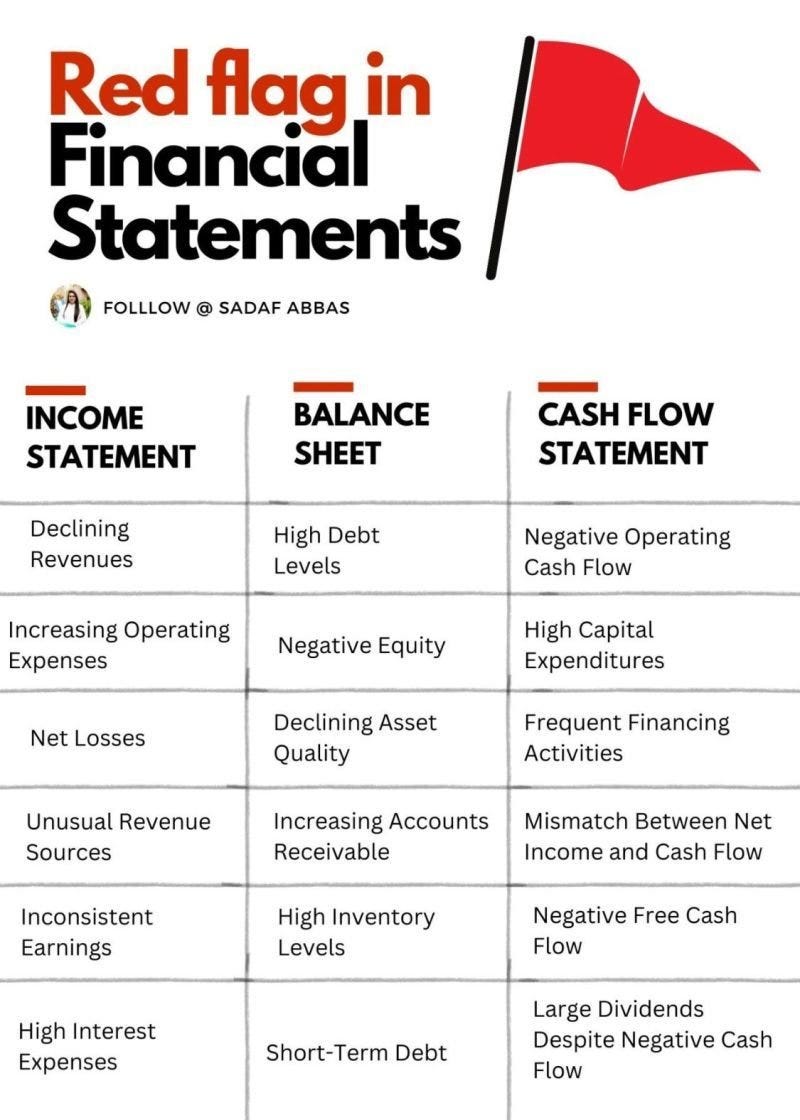

1️⃣ Red Flags in Financial Statements

Investing is all about preventing mistakes.

Here are 18 red flags in Financial Statements you should avoid:

2️⃣ My favorite books

Those who keep learning keep rising in life.

Here are 17 books that will teach you more than an MBA ever will:

3️⃣ One simple investment quote

Being an optimist is a great way to live.

It can also help you get better returns as an investor.

4️⃣ The Investing for Beginners Podcast

Recently we were a guest in ‘The Investing for Beginners Podcast’.

Dave and I talked about Quality Investing and How to Find Quality Stocks.

You can listen to the episode on Spotify and Apple Podcasts.

5️⃣ Example of a Quality Company

Hermès is a company that makes and sells luxury items. They create high-quality bags, clothes, and accessories like scarves, belts, and shoes.

The company is famous for its handmade products, using the best materials.

Net Profit Margin: 31.3%

ROIC: 46.7%

Forward PE: 41.3x

Expected LT EPS Growth: 10.3%

CAGR since IPO in 1990: 22.1%

👉 If you enjoy reading this post, share it with friends! Or feel free to click the ❤️ button on this post so more people can discover it on Substack 🙏

Everything In Life Compounds

Pieter (Compounding Quality)

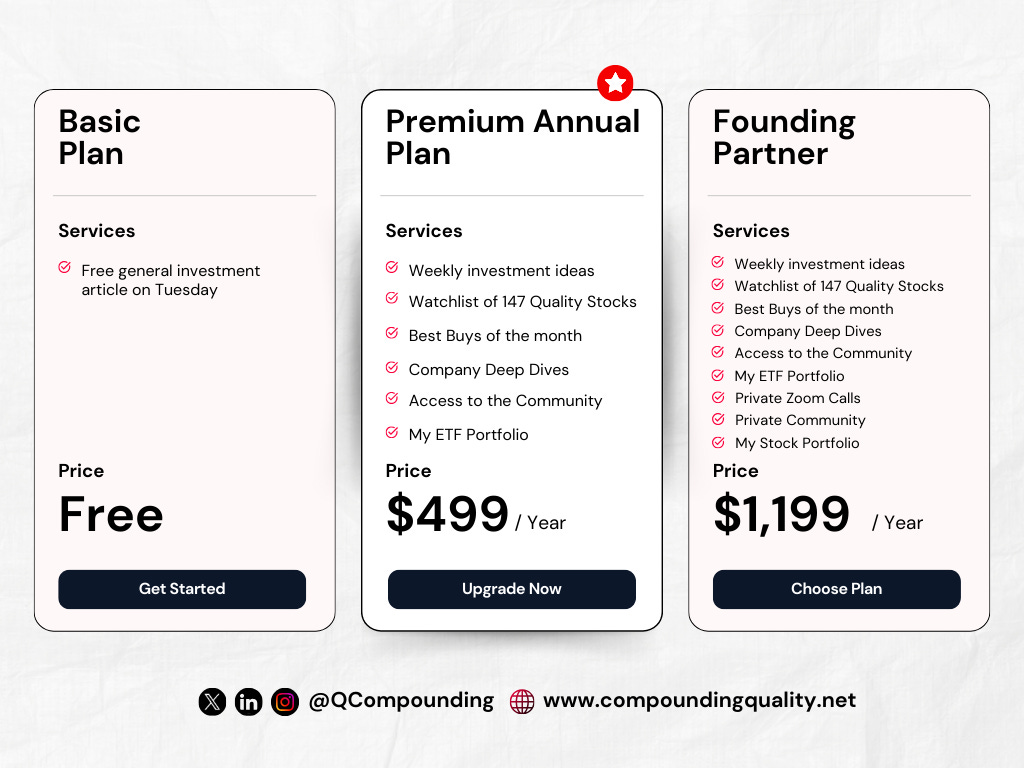

Whenever you’re ready

That’s it for today.

Do you want to walk our investment journeys together?

Consider becoming a Partner of Compounding Quality.

Compounding Quality is all about securing your financial future.

Whenever you’re ready, here’s how I can help you:

📈 Access to my Portfolio with 100% transparency

📚 Access to my ETF Portfolio

🔎 Full investment cases about interesting companies

📊 Access to the Community

✍️ And much more!

Subscribe now to get access to everything:

Everything In Life Compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

So excellent books.

I would add two more books to your list of 17. They are not investing books but they can add lots of color in someone's view of money ... which investors deal with every day.

"The Richest Man in Babylon" by George Clason

"The Richest Man In Babylon" offers very financial and investing advice through very simple tales, such as spending less that you what you earn, avoiding debt, investing what you can instead of hoarding it, etc. A seasoned investor won't learn anything new but may learn how to say old ideas in a new light. I would recommend this book to the younger generation for sure.

"Happy Money" by Ken Honda

"Happy Money" examines our relationship with money. A lot of people struggle here because they feel like they are constantly battling themselves and their cash flow. Income comes in and there's always a bill to pay. Kids need to be fed, clothed, and educated. None of that is free. The book challenges you to look at money as something that happily came into your life for your labor and effort and you should be happy to spend it on the good things in life, like on your children and loved ones for the good right things. It made me think of money as being a magician. This magician can make things appear and disappear. If you have a problem you can often ask money to make it disappear. If you want to have something or see something done then money can make it appear. I think this book will be more relevant to investors when they transition from accumulating to de-cumulating in their later years. Imagine spending 40+ years saving, Now it's time to draw down but spending may be such an unfamiliar act that it will feel bad. It shouldn't feel bad.