Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

Nvidia is one of the best-performing companies in the world.

An investment of $10,000 turned into $33.5 million (!) since 1999.

But is it an interesting stock? Let’s find out.

Nvidia - General Information

👔 Company name: Nvidia Corporation

✍️ ISIN: US67066G1040

🔎 Ticker: NVDA

📚 Type: Monopoly

📈 Stock Price: $117

💵 Market cap: $2.88 trillion

📊 Average daily volume: $411 million

Onepager

Here’s a onepager with the essentials of Nvidia:

(Click on the picture to expand)

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give Nvidia a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

Nvidia is an American tech company founded in 1993.

Today, it’s a dominant supplier of Artificial Intelligence (AI) hardware and software.

Nvidia makes money by creating and selling powerful computer chips (GPUs) and software. This helps computers and other devices to show amazing graphics and work really fast.

The company makes money from two main sources:

Data Centers (83.3% of revenue): Nvidia's GPUs are used in data centers for tasks like processing big data and running artificial intelligence programs. Companies pay Nvidia to use their powerful GPUs for these tasks.

Gaming (13.7% of revenue): Nvidia's GPUs are also popular among gamers. Nvidia makes money when gamers buy computers, consoles, or devices that use their GPUs.

Whenever you ask your computer to do something demanding, like using ChatGPT, playing a video game, or running a complex program, chances are Nvidia is speeding up the process.

Here’s what the geographical split looks like:

Source: Finchat

2. Is management capable?

Jen-Hsun Huang is the CEO, co-founder, and president of Nvidia.

Today, Huang still owns 3.8% (value: $109 billion) of Nvidia, making him one of the richest persons in the world.

It’s great seeing that one of the founders is still leading the company.

Colette Kress has been Nvidia’s CFO since 2013. She previously served for three years as senior vice president and Chief Financial Officer at Cisco.

In total, all directors and executive officers own 104 million shares of the company (value: $121 billion). Total insider ownership at Nvidia is 4.2%.

3. Does the company have a sustainable competitive advantage?

Nvidia has a competitive advantage for sure.

Their chips currently outperform all other chips. That’s why their GPUs have become the go-to choice for powering complex AI workloads. At the end of last year, Nvidia owned 80% (!) of the GPU market share.

There is no good alternative for Nvidia’s GPUs. This allows them to charge higher prices.

The company also enjoys a strong brand name. It has a strong reputation within the gaming industry and AI.

Companies with a sustainable competitive advantage are often characterized by the following:

Gross Margin: 75.3% (Gross Margin > 40%? ✅)

ROIC: 118.9% (ROIC > 15%? ✅)

Source: Finchat

4. Is the company active in an attractive end market?

Nvidia is active in an attractive end market.

According to Statista, the GPU market is expected to grow from $65.3 billion (2024) to $274.2 billion (2029). This is a CAGR of 33.2% (!).

This means the company is active in a clear secular trend.

When you look at Nvidia’s rivals, you see some competitors like AMD, Intel, IBM, …

However, no one has been able to make GPU chips that are nearly as good as the ones of Nvidia.

5. What are the main risks for the company?

Some of the main risks for Nvidia:

Competition: A lot of companies are trying to compete with Nvidia.

Dependence: Jen-Hsun Huang (Nvidia’s CEO) is responsible for a large part of the company’s success.

Technological disruption: NVDA operates in a changing environment

Regulatory risks: Upcoming regulations might affect Nvidia’s revenue

Rich valuation level (see later)

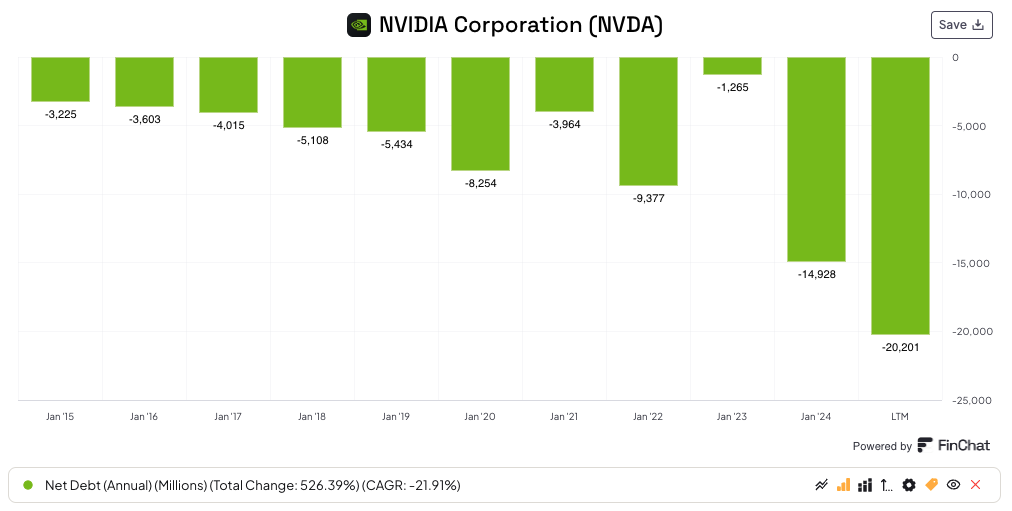

6. Does the company have a healthy balance sheet?

We look at 3 ratios to determine the healthiness of Nvidia’s balance sheet:

Interest Coverage: 187.2x (Interest Coverage > 15x? ✅)

Net Debt/FCF: Net cash position (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 5.8% (Goodwill/assets not too large? < 20% ✅)

Nvidia’s balance sheet looks very healthy.

Source: Finchat

7. Does the company need a lot of capital to operate?

We prefer to invest in companies with a CAPEX/Sales lower than 5% and CAPEX/Operating Cash Flow lower than 25%.

Nvidia:

CAPEX/Sales: 1.5% (CAPEX/Sales < 5%? ✅)

CAPEX/Operating Cash Flow: 2.9% (CAPEX/Operating CF? < 25% ✅)

The capital intensity of Nvidia is very low. This is something we love to see.

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.

Look for companies that put the money of shareholders to work at attractive rates of return.

Nvidia:

Return On Equity: 115.7% (ROE > 20%? ✅)

Return On Invested Capital: 118.9% (ROIC > 15%? ✅)

Here’s an evolution of Nvidia’s ROE and ROIC:

Source: Finchat

The company’s capital allocation metrics have been a bit volatile in the past.

Now let’s dive into the most important fundamentals. Is Nvidia an interesting buy?