Hi Partner 👋

I’m Pieter and welcome to a 🔒subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

The Forgotten Fortune

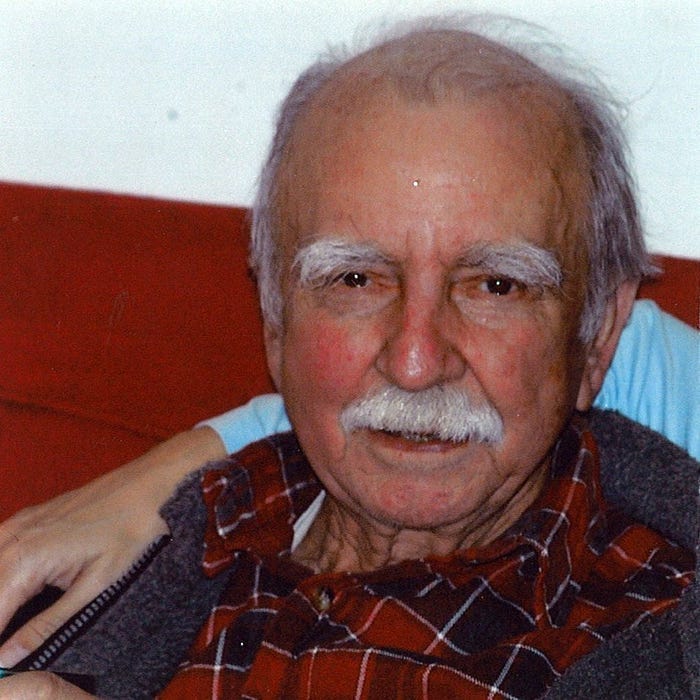

Do you know Ronald Read?

Ronald was an ordinary man who worked as a janitor and gas station attendant, earning a below-average salary.

For most of his life, he lived in a very modest way. He drove a second-hand car and chopped his own firewood to save money.

But you know what’s remarkable about Ronald?

When he passed away at age 92, he was one of the richest men in Vermont.

And nobody knew it!

By investing periodically and living below his means, Ronald left behind $8 million (!).

The key lesson?

Everyone can become wealthy by investing in stocks.

It might be easier than you think.

Ronald Read used a ‘Set it and forget it’ approach.

He focused relentlessly on the long term and stayed invested in the market for decades.

The easiest way to do this is by investing in index funds:

Periodically buy an index fund

Sit back

Relax and let the magic of compounding do the work for you

Did you know that in 1792 the first company was listed on the New York Stock Exchange?

Since then, an investment of $1 turned into more than $20 million!

I will hand out a signed copy of my book The Art of Quality Investing to someone who answers this question correctly:

Source: Stocks for the Long Run - Jeremy Sigel

ETF Portfolio

Our ETF Portfolio consists of 5 ETFs.

It uses small tweaks that should perform slightly better than the market as a whole.

Over the past 20 years, our ETF Portfolio performed 2.2% per year better than the S&P 500.

This means an investment of $10,000 turned into:

Our ETF Portfolio: $87,300

S&P 500: $59,000

Today we are adding to our ETF Portfolio.