Novo Nordisk is down 40% compared to last year.

There are a few reasons for this:

Disappointing trial results

Increased competition

Pricing pressures & regulatory challenges

Is the decline justified? Or is this the opportunity of a century?

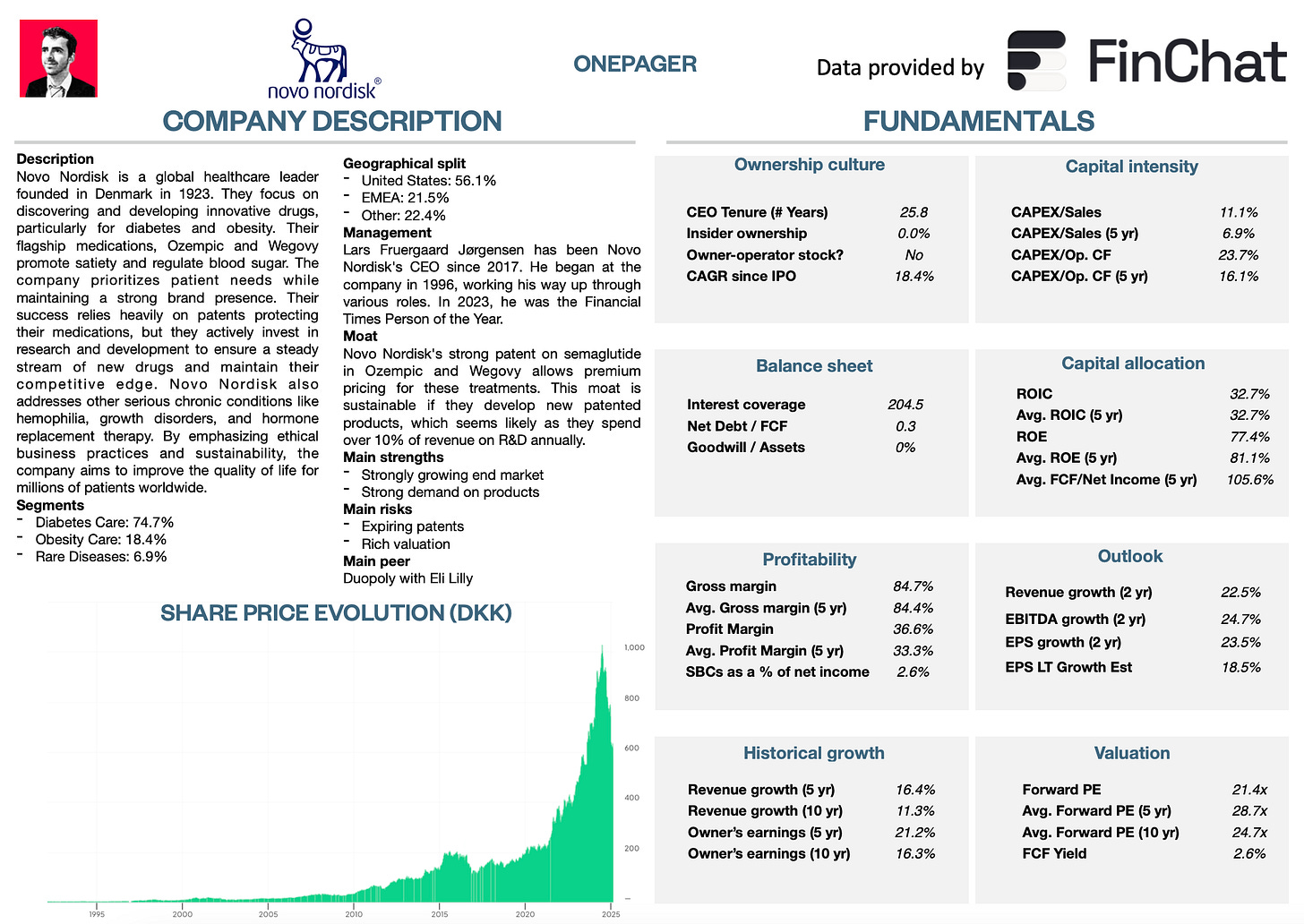

Onepager

Here’s a onepager with the essentials of Novo Nordisk:

(Click on the picture to expand)

How does Novo Nordisk make money?

Novo Nordisk is a global pharmaceutical company engaged in diabetes and obesity care. Furthermore, they are also active in other rare diseases and cardiovascular medicine.

The company focuses on discovering, developing, and manufacturing innovative drugs globally.

Over the years, the Danish company has built a strong track record. In 2023, Novo Noridsk celebrated its 100th (!) birthday.

Currently, Novo Nordisk’s main source of income comes from products that help with obesity and diabetes.

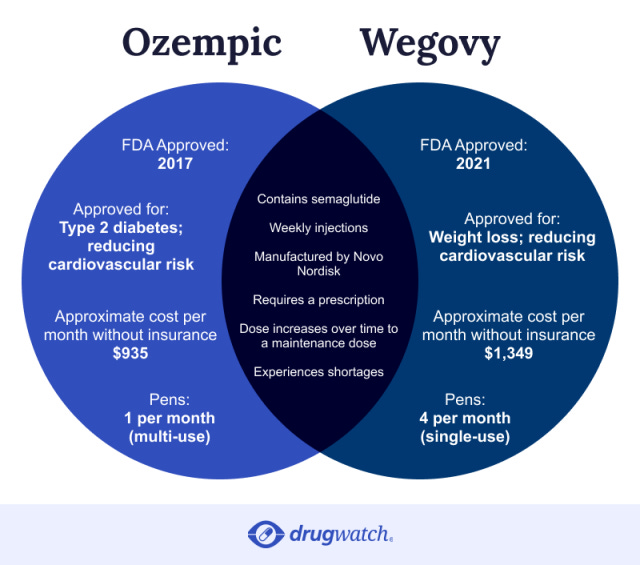

They offer two unique products:

Ozempic for diabetes care

Wegovy for obesity care

Both Ozempic and Wegovy are protected by a patent based on semaglutide.

Semaglutide is a medicine that helps people with type 2 diabetes and those trying to lose weight.

It works by copying a natural hormone in your body that controls blood sugar and reduces hunger.

Do you want to learn more about the business model of Novo Nordisk? You can find a Not So Deep Dive here.

Successful Track Record

Novo Nordisk has been very successful in the past.

Since 2001, the stock increased 50x.

This means $10,000 turned into $500,000:

Together with Eli Lilly, they dominate the entire market.

Both companies are mainly active in the obesity and diabetes treatment market.

The World Health Organization indicates that 1 out of 8 people in the world suffer from obesity.

This means Novo Nordisk has 1 billion (!) potential customers.

The diabetes care market should grow by almost 8% annually until 2030. This results in plenty of growth opportunities.

Analysts expect Novo Nordisk to grow its EPS by over 15% per year over the next few years.

And yet… The stock declined by almost 40% recently.

What’s going on?

There are three main reasons why Novo Nordisk is down:

Disappointing trial results CagriSema

Increased competition

Pricing pressures & regulatory challenges

1. Disappointing trial results CagriSema

In December 2024, Novo Nordisk published trial results for its obesity drug CagriSema.

The trial demonstrated an average weight loss of 22.7% over 68 weeks for participants on CagriSema.

This number is statistically significant, but it fell short of Novo's anticipated 25% target.

The results of the trial raised concerns about whether Eli Lilly’s obesity drug (Zepbound) might be better than the one of Novo Nordisk.

On this news, the stock dropped by 27%, erasing $125 billion in market value.

It was the largest one-day decline for Novo Nordisk ever.

2. Increased competition

Rival companies such as Hims & Hers ($HIMS) have intensified their marketing efforts.

You might have seen their advertisements during the recent Super Bowl.

The increased competition in the GLP-1 weight-loss drug market impacted Novo Nordisk’s market share and investor confidence.

3. Pricing pressures & regulatory challenges

The Inflation Reduction Act (IRA) in the US aims to reduce the costs of Medicare*. The measures needed would become effective from 2027.

This may impact the profitability of Novo Nordisk’s main products Ozempic and Wegovy.

*Medicare is a U.S. government health insurance program primarily for people aged 65 and older, as well as some younger individuals with disabilities.

Next to pricing pressures, the Danish company faces regulatory challenges regarding the safety and manufacturing of its products.

The U.S. Food and Drug Administration (FDA) found problems at the company after an inspection in March 2024.

At the same time, the European Medicines Agency is looking into studies that suggest Ozempic might be linked to a rare eye disease called NAION.

Novo Nordisk says its products are safe. But these investigations could change how people see the drug and how rules are made.

Drawdown

As a result of these things, Novo Nordisk is down 39% from it’s 52-week high:

This is one of the largest drawdowns Novo Nordisk has ever experienced.

Now let’s dive into the valuation to find out whether this offers buying opportunities.

Valuation

We always use three methods to look at the valuation of a company:

A comparison of the Forward PE multiple with its historical average

Earnings Growth Model

Reverse Discounted-Cash Flow

A comparison of the Forward PE multiple with its historical average

The first thing we do is compare the current forward PE with its historical average over the past 5 years.

This is a shortsighted method but it already gives a quick indication.

Today, Novo Nordisk trades at a forward PE of 21.4x compared to a historical average of 28.7x.

In other words: Novo Nordisk looks cheap.

Earnings Growth Model

This model shows you the yearly return you can expect as an investor.

You can explore more about the Earnings Growth Model here.

Here are the assumptions I use:

EPS growth: 12.0% per year over the next 10 years

Dividend Yield: 2.0%

Forward PE to decline from 21.4x to 20.0x

Expected yearly return = 12% + 2.0% + 0.1((20.0x – 21.4x)/21.4x)) = 13.3%

An expected yearly return of 13.3% per year sounds attractive.

Reverse DCF

Charlie Munger once said that if you want to find a solution to a complex problem, you should invert. Turn the problem upside down.

This is exactly what a reverse DCF does. As an investor, we don’t make assumptions. We simply look at what assumptions the market has made and see whether they are reasonable.

Learn how to do a Reverse DCF yourself here.

The expected Free Cash Flow of the next 12 months equals DKK 90.1 billion.

We subtract the Stock-Based Compensation (DKK 2.3 billion) and add Growth CAPEX (DKK 39.8 billion) to arrive at FCF in year 1 of DKK 127.6 billion.

The reverse DCF indicates that Novo's FCF should grow by 9.5% each year for the next ten years.

These growth estimations sound more than reasonable.

Novo Nordisk:

Forward PE: 21.4x (lower than its 5-year average? < 28.7x? ✅)

Earnings Growth Model: 13.3% (Yearly return? < 10%? ✅)

FCF-Growth Reverse DCF: 9.5% (Realistic growth expectations? ✅)

My Take

Novo Nordisk experienced one of its largest stock price declines ever.

But is this a golden opportunity to buy the stock? Here’s my take…