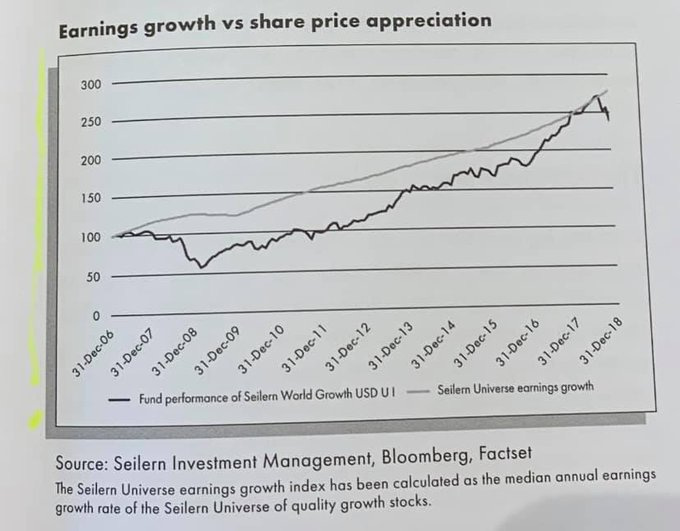

In the long term, stock prices always follow the evolution of the intrinsic value.

That’s why earnings growth is so important for investors.

I’ll teach you everything you need to know in today’s article.

The value of a company

The value of every company is the same:

Value of a company = All future cash flows discounted to today

The more (earnings) growth a company can report, the more the value of the company increases.

That’s why in the long term stock prices tend to follow earnings growth:

Stable Inc. versus Growth Inc.

Let’s say that we have 2 companies: Stable Inc. and Growth Inc.

You know the following:

Earnings growth over the next 20 years:

Stable Inc.: 3% per year

Growth Inc.: 10% per year

When all other information is equal, I hope it’s very straightforward that Growth Inc. looks more attractive.

However, let’s say that you now get some extra information:

Both companies keep the same growth rate for the next 20 years. But…

You sell Stable Inc. for 1.5x the valuation level you bought it for

You sell Growth Inc. for only two thirds the valuation level you bought it for

This means that, based on valuation alone, your return in Stable Inc. would be +50% after 20 years while your return in Growth Inc. would be -33.3%.

Which company would you choose now?

Here’s the evolution of the earnings growth for the next 20 years for both companies:

You sell Stable Inc. for 15 times earnings in year 20, meaning that the stock price at that point in time is equal to $27.1 ($1.81*15).

You bought the stock for $10 so your return after 20 years would be equal to 171% or 5.1% per year.

On the other hand, you sell Growth Inc. for 20 times earnings or $134.6 per share ($6.73*20).

You bought the stock for $30 so your return after 20 years would be equal to 348.6% or 7.8% per year.

It turns out that in this example Growth Inc. is the better investment.

A key lesson that can be drawn for this?

The longer you hold a stock, the less important valuation and the more important earnings growth.

"If you bought the S&P 500 at a P/E of 5.3x in 1917, and sold it in 1999 at a P/E of 34x, your annual return would have been 11.6%. Only 2.3% p.a. came from the massive increase in P/E. The rest of your return came from the companies’ earnings and reinvestments." - Terry Smith

How a company can grow its earnings

A company can grow its earnings in different ways:

Sell more of its products/services

Increase prices (pricing power)

Lowering costs

Geographical expansion

Increasing market share

M&A

…

It’s very important to know that not all growth is created equal.

First and foremost, it’s important to understand that growth only creates value when the Return On Invested Capital (ROIC) of the company is higher than the Weighted Average Cost of Capital (WACC).

Take a look here if you want to learn more: Everything you need to know about ROIC.

In general, organic growth is the most preferred source of growth.

Why? Because it’s the most sustainable growth source.

It’s good that a company increases its earnings as a result of cutting costs or because it reduces its investments in R&D, but this growth source is not sustainable in the long term. A company can only cut its costs to a certain level for example.

Companies can only keep growing its earnings at attractive rates when they are able to grow its revenue organically at attractive rates.

That’s why I personally seek for companies which can grow their revenue with at least 6% per year.

Don’t buy growth at any price

While in the long term earnings growth is more important than valuation, it’s important to understand that you can’t buy growth at any price.

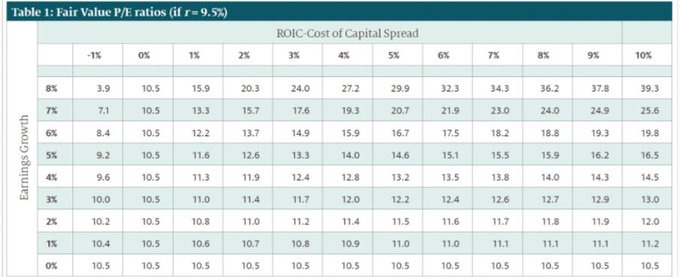

Take a look at this table for example:

While the table above dates from the end of 2022, the main message is still clear.

When you massively overpay for a company that can grow its earnings at attractive rates, you can still end up with horrible investment results.

As an investor you want to buy great companies at fair valuation levels.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett

Just take Nvidia for example. The stock currently trades at 232x earnings! That’s the valuation level at which many stocks traded during the Nifty Fifty bubble.

When you execute a reverse DCF (take a look here if you want to learn how to do it yourself), you’ll find that Nvidia needs to grow its free cash flow with 39% (!) per year for the next 10 years to return 10% per year to shareholders.

This means that Nvidia should grow its free cash flow to well over $100 billion. In the history of the stock market, there is (almost) no company which managed to grow at these rates for so long. Especially not when you take into account Nvidia’s size.

Here’s an interesting table which shows you which valuation levels are reasonable at a given Return On Invested Capital and Earnings Growth Rate:

Disclaimer: while I think Nvidia is massively overvalued, I wouldn’t short the stock. As John Maynard Keynes said: “Markets can stay irrational longer than you can stay solvent.”

Your expected return as an investor

As an investor, it’s very easy to calculate your expected return (at least in theory):

Expected return = Earnings growth + shareholder yield +/- multiple expansion (contraction)

Shareholder yield = dividend yield + buyback yield

Let’s use an example to make everything more clear.

Suppose we are considering investing in Evolution Gaming.

We expect the company can grow its earnings with 13% per year. The shareholder yield (dividend yield + buyback yield) is equal to 2% and the stock trades at 25x earnings.

As Benjamin Graham taught us, we always want to use a margin of safety so we state that the stock will trade at 20x earnings in 10 years from now. This valuation level seems reasonable to us.

In that case, our expected return is equal to:

Expected return = Earnings growth + shareholder yield + multiple expansion/contraction

Expected return = 13.0% + 2.0% - 2% = 13%

Multiple contraction over 10 years = (PE in 10 years from now - PE today)/ PE today

Multiple contraction over 10 years = (20-25)/25 = -20%

Average multiple contraction per yearc = -2% (-20%/10 years)

In this example, the expected return for an investment in Evolution Gaming would be equal to 13% per year for 10 years.

Would you be happy with this return? In that case you should consider investing in Evolution Gaming.

Aren’t you happy with 13% per year? Then you should look for other, more attractive investment opportunities.

The end

That’s it for today.

Do you want to read more from Compounding Quality? Please subscribe to my newsletter where I provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. I’ve read over 500 investment books and spend more than 50 hours per week researching stocks.

CQ, greetings from London. Thank you SO much for all of your work and generosity in sharing this excellent knowledge. It is an outstanding resource and the first port I go to when I see something new. Would love one day to have a Compounding Quality get together in person. Flying over to attend the Berkshire AGM in Omaha in May 2024, given that Warren will be 93 and Charlie will be 100. Might not have too many more chances to see them both in action.

Dear friend CQ,

Thank you once again for delivering yet another superb gem of an article. Your consistent ability to provide insightful analysis and deliver it with eloquence positions this latest piece as a prime candidate for inclusion in economics curricula, be it at the school or university level.

The incorporation of a quote from Mr. Terry Smith, a figure I deeply admire, truly stood out to me. As you are aware, my admiration for Maestro Terry Smith runs deep, and I am proud to be an investor in his fund. Moreover, I want to acknowledge your skill in seamlessly integrating valuable commentary alongside your articles. This often-overlooked aspect serves as a valuable extension of the already illuminating content you provide.

Without fail, every Tuesday and Thursday, I find myself filled with gratitude for the way you elucidate the intricacies of the investing craft. Your commitment to education reverberates clearly through your work, benefiting readers like me who are constantly striving to enhance our understanding of the field. Once again, your work proves to be an invaluable resource.

I wish you a week filled with productivity and positivity.

Best Regards,