The Top Picks of Our Partners

Results 2025

The wisdom of crowds is amazing.

When I first launched Compounding Quality, I asked all Partners for their favorite stocks.

Let’s see which 10 companies made the list and how they’ve performed so far.

Amazing results

Flabbergasted.

That’s the only thing I can say.

Since the start of the year, the Top 10 Partner picks have returned +47.6% on average.

And this while the S&P 500 ‘only’ returned 8.0%.

It shows what an amazing Community we have.

From hedge fund managers to people who are managing tens of millions of dollars of their own wealth.

The 10 picks of Our Partners

Now let’s dive into the 10 picks of Our Partners and their performance so far.

You can read the previous article we wrote about this topic here.

I ranked the 10 picks from worst to best so far.

10. Harrow Inc. ($HROW)

YTD performance: -9.2%

Company Profile

Harrow Inc. is a company focusing on eye health.

They create and sell special medicines to treat eye problems.

Their main business, ImprimisRx, makes these medicines and provides them to doctors and patients.

These medicines treat eye conditions such as dryness, infections, or inflammation and support healing after surgeries.

Investment Rationale

Amazing growth (10-year Revenue CAGR: 52.1%)

Harrow is an Owner-Operator stock with skin in the game

Still a long runway ahead

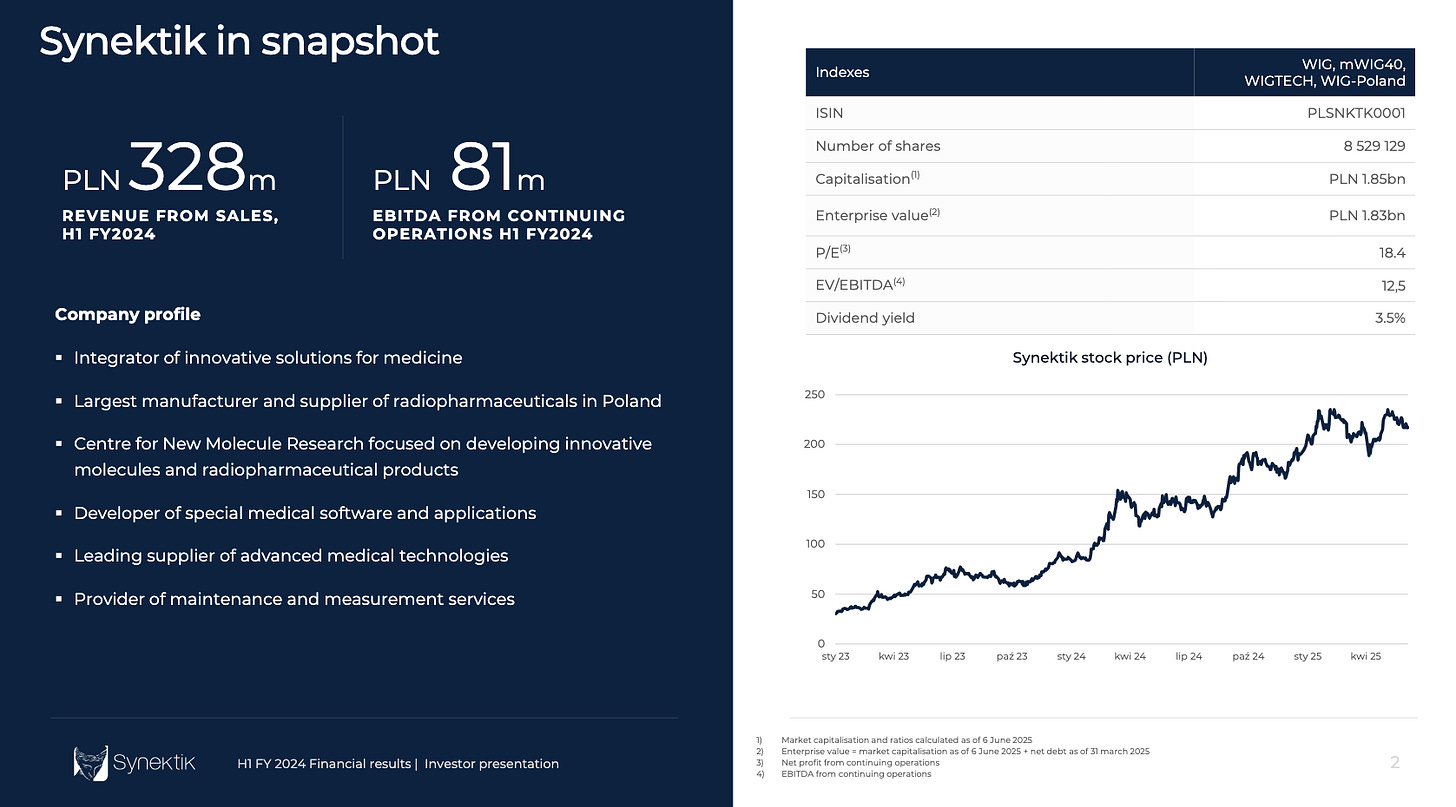

9. Synektik ($SYN)

YTD performance: -1.0%

Company Profile

Synektik makes special medicines called radiopharmaceuticals. Doctors use them to find diseases like cancer inside the body.

They also build and sell high-tech medical gear. Even robots that help doctors during surgery.

One of their most important products? Da Vinci robots (Intuitive Surgical). These machines assist doctors in performing precise and minimally invasive surgeries.

Synektik has exclusive rights to distribute da Vinci robots in Poland, the Czech Republic, and Slovakia until 2030.

Investment Rationale

Excellent capital allocation (ROIC: 26.4%)

Insider ownership: 51.6% of total shares outstanding

Long-term estimated EPS-Growth: 25.0%

8. Pro Medicus ($PME)

YTD performance: +22.3%

Company Profile

Pro Medicus makes smart software for doctors and hospitals. It shows medical images like X-rays, MRIs, and CT scans on a computer.

The software uses artificial intelligence (AI) to spot problems that might be hard for doctors to notice.

Pro Medicus also makes it easy for doctors to share these images with other specialists around the world.

This saves time and helps patients get the right treatment faster.

Investment Rationale

Excellent capital allocation (ROIC: 102.9%)

The two co-founders still own 46.2% of the business

The intrinsic value (Owner’s Earnings) doubled every 2 years for the last 10 years

7. Lemonade ($LMND)

YTD performance: +29.9%

Company Profile

Lemonade is an insurance company that offers home, apartment, pet, and life insurance coverage.

Instead of filling out lots of paperwork, you can sign up for insurance using their app or website in just a few minutes.

They use Artificial Intelligence (AI) to help process claims quickly, sometimes in just a few seconds.

Lemonade gives leftover money (that’s not used for claims) to charities you choose.

Investment Rationale

Disruptive approach to the traditional insurance industry

Amazing growth (Historical 5-year Revenue CAGR: 46.6%)

Expected revenue growth 2025: +37.0%

6. Nvidia ($NVDA)

YTD performance: +30.7%

Company Profile

Nvidia makes super-powerful computer chips called GPUs (graphics processing units).

These help computers create amazing visuals and run complicated programs.

Besides AI, GPUs are mostly used for gaming. Nvidia makes video games look realistic and run smoothly.

When you use ChatGPT, play video games, or run complex programs, chances are Nvidia is speeding up the process.

PS We wrote a Not So Deep Dive about Nvidia already. You can read it here.

Investment Rationale

Founder Jen-Hsun Huang is an excellent CEO

There is no good alternative to Nvidia’s GPU

Exceptional profitability (Gross Margin: 70.1%)

5. TerraVest Industries ($TVK)

YTD performance: +41.7%

Company Profile

Terravest Industries is a serial acquirer in niche manufacturing markets.

They own companies in fields like energy, transportation, and industrial equipment.

Terravest helps these companies improve by providing them with resources and guidance. They look for opportunities to make these businesses more efficient and profitable.

PS You can read a Not So Deep Dive about the company here.

Investment Rationale

Still a long runway ahead

Serial acquirers outperform the market in the long run on average

CAGR of the stock since IPO in 2012: 43.7%

4. Sea Ltd ($SE)

YTD performance: +42.0%

Company Profile

Sea Ltd is a technology company from Singapore.

They operate in 3 segments:

Garena - A gaming platform: They make popular games like Free Fire and also let people play and connect online.

Shopee - An online shopping app: Allows you to buy everything from clothes to electronics and have it delivered to your door.

SeaMoney - Payment Service: Helps people pay for things online or send money to others, like a digital wallet.

Investment Rationale

Sea Ltd is likely to profit from the growing middle class in Asia

Strong diversification across business lines

Amazing growth (5-year Revenue CAGR: 47.8%)

Now let’s dive into the top 3.