Best 5 ETFs Now

Great ETFs you should consider buying

Hi Partner 👋

I’m Pieter and welcome to a 📈 free edition 📈 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

Did you ever hear about Exchange-Traded Funds (ETFs)?

It’s one of the easiest ways to create wealth.

In today’s article, you’ll learn about 5 interesting ETFs.

What is an ETF?

An ETF (Exchange-Traded Fund) is like a basket of different stocks or bonds you can buy all at once.

It's an easy way to invest in many companies without picking each one individually.

You can for example buy an ETF on the S&P 500, Nasdaq, and much more.

Want to learn more? Grab our free ETF course here.

Now let’s give you five interesting ideas.

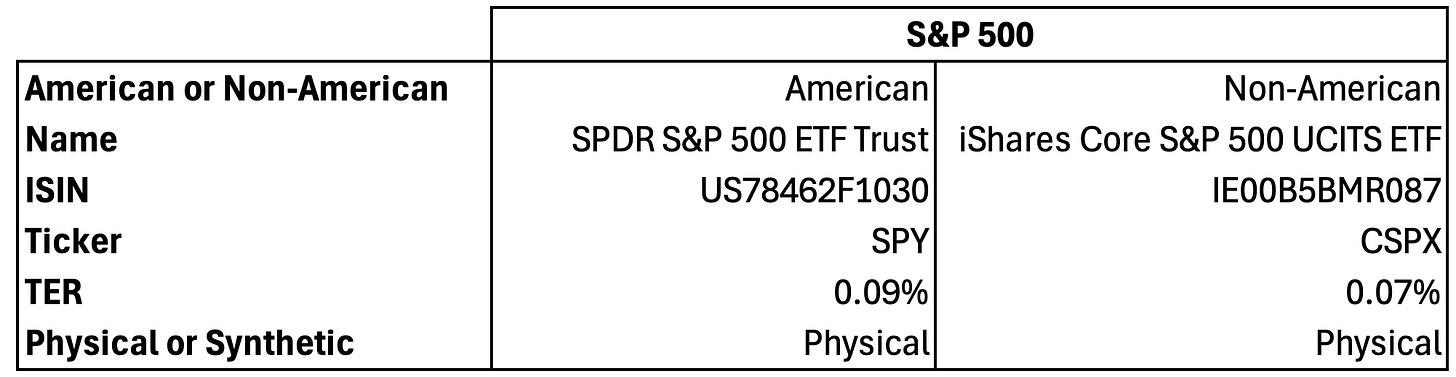

For every index, we recommend two ETFs that copy this specific index.

One for people living in the United States

One for people living outside the United States

Why? Because people in the US can’t buy an ETF located outside the US and the other way around.

5️⃣ S&P 500

The S&P 500 is an index that contains the 500 largest U.S. companies.

It's an easy way to invest in a mix of big American companies.

Since 1992, the S&P 500 has returned 11.0% per year on average.

4️⃣ MSCI Emerging Markets

The MSCI Emerging Markets is an index of companies operating in countries that are still growing quickly, like China, Brazil, and India.

These countries are developing fast, and companies active there have plenty of potential to grow.

However, it can be riskier than investing in the U.S. or Europe.

Since 2000, the MSCI Emerging Markets Index has returned 7.7% annually. This is 1% per year better than the MSCI World.

I use Interactive Brokers to execute all my transactions.

Discover more about Interactive Brokers here.

3️⃣ Nasdaq 100

The Nasdaq index tracks US technology companies like Google, Amazon, and Facebook.

Technology is a fast-growing part of the world economy, and companies in this index are often innovation leaders.

By investing in the Nasdaq, you're investing in the future of tech.

Since 2008, the Nasdaq-100 Index has returned 16.9% annually, compared to 14.2% for the S&P 500.

2️⃣ MSCI World

The MSCI World Index tracks large companies from developed countries worldwide (mainly the United States and Western Europe).

The main difference with the S&P 500 is that the MSCI World also invests in non-US companies.

This Index includes 1,429 companies. This covers about 85% of the total market value in each country.

Since 1987, the MSCI World Index has returned 8.6% annually.

1️⃣ Russell 2000

The Russell 2000 is a list of 2,000 smaller companies in the U.S.

Smaller companies tend to grow faster than larger ones.

Investing in the Russell 2000 could bring higher returns, but the volatility will probably be higher than the S&P 500.

Since 2005, the Russell 2000 Index has delivered an average annual return of 9.3%.

Conclusion

Here are the 5 ETFs we discussed today:

S&P 500 - SPY (US citizens) & CSPX (non-US citizens)

Why? The S&P 500 is one of the best indices in the world

MSCI Emerging Markets - EEM (US citizens) & EIMI (non-US citizens)

Why? Companies in developing countries have high growth potential

NASDAQ 100 - ETFs: QQQ (US citizens) & EQQQ (non-US citizens)

Why? Technology companies have a lot of growth potential

MSCI World - URTH (US citizens) & IWDA (non-US citizens)

Why? Extra diversification as you also invest outside the US

Russell 2000- IWM (US citizens) & R2SC (non-US citizens)

Why? Small-caps tend to perform better in the very long term

Whenever you’re ready

That’s it for today.

Here’s the publication schedule for November:

Compounding Quality is all about securing your financial future.

Whenever you’re ready, here’s how I can help you:

📈 Access to my Portfolio with 100% transparency

📚 Access to my ETF Portfolio

🔎 Full investment cases about interesting companies

📊 Access to the Community

✍️ And much more!

Today we’re adding to an existing position.

Subscribe now to get access:

Everything in life compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Russell 200 is more about exposure to growth vs. value -- diversification difference between 200 and 2000 is actually surprisingly very small. Russell 200 is available only as IWY - Russell 200 Growth - vs. Russell 2000. And if big tech stops outperforming, nothing says big non-tech will perform well.

I don't know if the implication is that holding all of these in a portfolio is a good thing "now," but I would be careful about the Tech-heavy approach here. With SPY, QQQ, and URTH, you'd be looking at over a combined 30+% of the Mag 7. Lots of exposure there.