Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

Subscribe to get access to these posts, and every post.

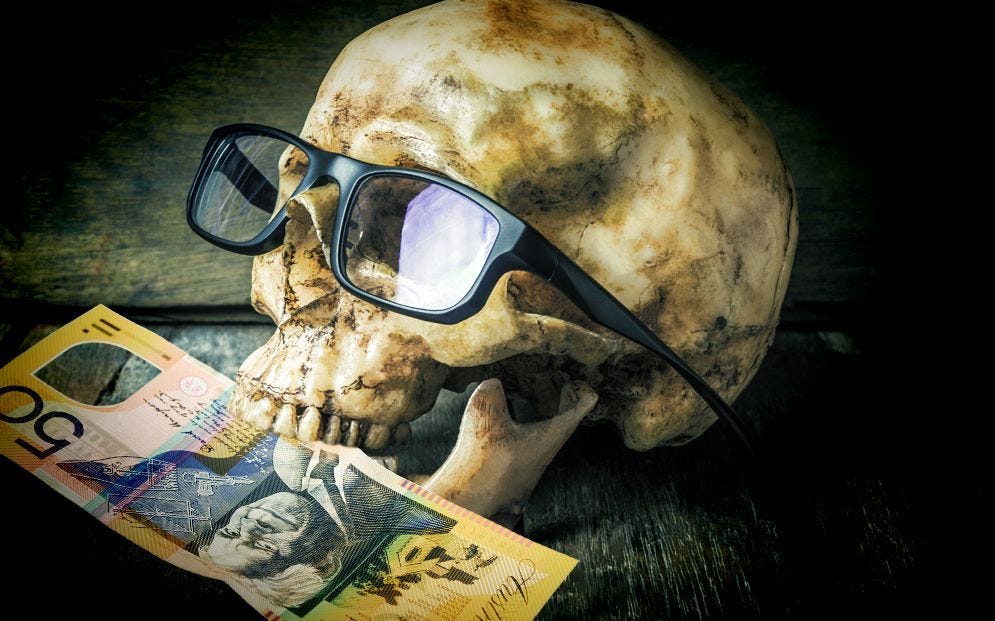

The best investor is a dead investor.

Being lazy pays off tremendously on the stock market.

Let’s teach you why.

The big advantage of large asset managers?

They have a tremendous amount of data providing them with many insights.

A few years ago, the American asset manager Fidelity wanted to know which clients reported the best investment performance.

The conclusion?

The highest returns came from accounts in which the account holder was dead.

The second-best returns?

People who had forgotten they had investments.

Trading and costs harm your investment results.

Time in the market beats timing the market every single day.

In the very long term, 90% of all investors underperform the market.

That’s exactly why investing passively might be a good investment strategy for many people.

The essence is very simple:

Buy an index fund

Sit back

Relax

Factor investing

The good news?

You can consistently outperform the market in the long term by using small tweaks.

Value investing:

The 20% cheapest stocks outperformed the S&P 500 by 3.2% per year over the past 70 years

Small cap investing:

Size matters. Over the past 100 years, the 10% smallest stocks compounded at 14.0% per year compared to 10.3% for the S&P 500

Quality investing:

Morningstar’s Wide Moat Index outperformed the S&P 500 by 4.2% per year since 2000

ETF Portfolio

Our ETF Portfolio consists of 5 ETFs.

It uses these small tweaks to perform slightly better than the market.

Over the past 20 years, our ETF Portfolio performed 2.2% per year better than the S&P 500.

This means an investment of $10,000 with monthly additions of $200 turned into:

Our ETF Portfolio: $232,000

S&P 500: $167,000

A difference of $65,000!

Today we are adding to our ETF Portfolio.