It’s #QualityTuesday!

In this series, I’ll teach you 5 things about the stock market in less than 5 minutes.

Understanding Financial Statements is crucial to make good investment decisions.

Here’s how to analyze and interpret the:

- Balance Sheet

- Income Statement

- Cash Flow Statement

in a few minutes.

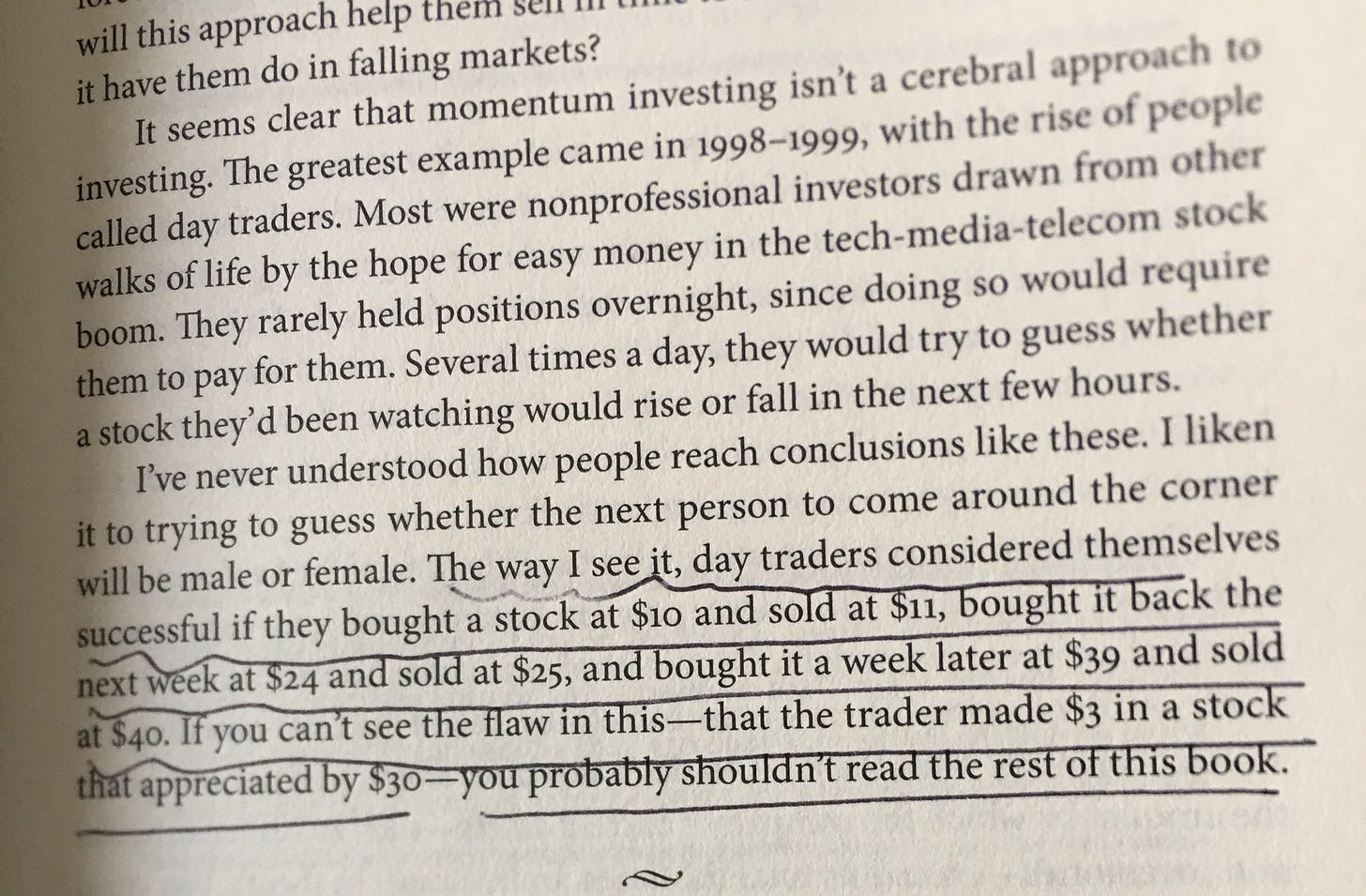

Investors make money for themselves.

Day traders make money for their brokers.

Here’s what Howard Marks has to say about this topic in his excellent book The Most Important Thing:

Napoleon once said that a military genius is someone who can do the average when everyone else around him is losing his mind.

The same goes for investing.

If even 99-year-old Charlie Munger thinks on the long term, shouldn’t you?

Watch this 40-minute Charlie Munger masterclass to improve your knowledge.

Adobe is a great example of a Quality Company.

Click on the picture hereunder to open it in high resolution.

Starting from the 1st of October, Compounding Quality will transform into a full investment platform.

Everyone who subscribes before Sunday gets 3-month access to Koyfin Pro for free (value: $300).

Become a Premium Partner

Do you want to read more? Here are our 5 latest articles:

That’s it for today.

Do you want to read more from Compounding Quality? Please subscribe to my newsletter where I provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

Send us an email

Compounding Quality has a true passion for investing and helping other investors. He aims to invest in the best companies in the world as it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Compounding Quality used to work as a Professional Investor but left his job to help investors like you. The main reason for this? He was sick of the short-term mindset of Wall Street and wanted to genuinely do the right thing.

All readers of Compounding Quality are treated as PARTNERS. We ride our investment journeys together.

“We have an attitude of partnership. Charlie Munger and I think of our shareholders as owner-operators.” – Warren Buffett

Disclaimer: The Accuracy of Information and Investment Opinion

The content provided on this page by the publisher is not guaranteed to be accurate or comprehensive. All opinions and statements expressed herein are solely those of the author.

Publisher's Role and Limitations

Compounding Quality serves as a publisher of financial information and does not function as an investment advisor. Personalized or tailored investment advice is not offered. The information presented on this website does not cater to individual recipient needs.

Not Investment Advice

The information found on this website should not be interpreted as investment advice, nor does it express any viewpoint on the future trading prices of any company's securities. The opinions and information shared here should not be taken as specific guidance for making investment decisions. Investors are encouraged to conduct their own research and evaluations based on publicly available information, rather than relying on the content herein.

No Offer or Solicitation

The content, including opinions and expressions, present on this website, is not a direct or indirect offer or solicitation to buy or sell securities or financial instruments mentioned.

Forward-Looking Statements and Uncertainties

Any forward-looking statements, projections, or market forecasts contained in this content are inherently uncertain and speculative. They are based on certain assumptions and may not accurately reflect actual future events. Unforeseen events might impact the performance of discussed securities significantly. The provided information is current as of the preparation date and might not apply to future circumstances. The publisher is not obligated to correct, update, or revise the content beyond its initial publication date.

Position Disclosures

The publisher, its affiliates, and clients may hold long or short positions in the securities of companies mentioned. Such positions are subject to change without guarantee.

Liability Disclaimer

Neither the publisher nor its affiliates assume liability for any direct or consequential losses arising directly or indirectly from the use of the information provided in this content.

Consent and Agreement

By accessing the site or affiliated social media accounts, you signify your agreement to this disclaimer and the terms of use. Unauthorized reproduction of the content, whether through photocopying or other means, is unlawful and subject to legal consequences.

Website Ownership and Terms

Compounding Quality (www.compoundingquality.net) is operated by Substack. By accessing the site, you agree to adhere to the current Terms of Use and Privacy Policy. These terms are subject to potential amendments. The content on this site does not constitute an offer to buy, sell, or subscribe to securities where prohibited by law.

Regulation and Investment Guidance

Compounding Quality is not an underwriter, broker-dealer, Title III crowdfunding portal, or valuation service. The site does not provide investment advice or transaction structuring.

Compounding Quality does not validate the adequacy, accuracy, or completeness of information provided. Neither the publisher nor any associated parties make any warranties, explicit or implied, regarding the information's accuracy or the use of the site.

Investing in securities carries substantial risk, and investors should be prepared for potential loss. Each individual should independently assess whether to invest based on their own analysis.

Hi Compound Quality, I hope you're doing well. Massive fan of your Substack/Twitter.

I am a founder of Zeed (https://zeed.ai/). We're helping creators transform their written content (like this Substack) into dynamic video pieces using AI to capture new audiences.

Would love to show you an example and jump on a call if you're interested in hearing more! Best, Rohan.

My friend and partner CQ,

I greatly appreciate your consistent ability to share high-quality content in an easily comprehensible manner. The world of investing may seem straightforward at first glance, but it is far from easy. Establishing a robust philosophical foundation is paramount. Subsequently, it's crucial for an investor to continually revisit and deeply internalize the key principles, akin to a boxer tirelessly honing their jab or a guitarist perfecting an etude by varying its speed, tempo, or emphasis.

Therefore, I implore you to persist in emphasizing these profound principles. The rewards from doing so will undoubtedly compound over time!

Thank you!