🧑🏫 Start with the moat

The most important thing for quality investors?

A company’s moat or competitive advantage.

In today’s article, you’ll learn everything you need to know.

“The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors.” - Warren Buffett

🧑🏫 Course: How to Analyze a Stock

This is the seventh article in the course How to Analyze a Stock.

In this course you’ll learn:

How to find attractive stocks

Where to find information about these companies

How to determine whether a company is an attractive investment

In case you missed it:

Today you’ll learn how to look at a company’s competitive advantage.

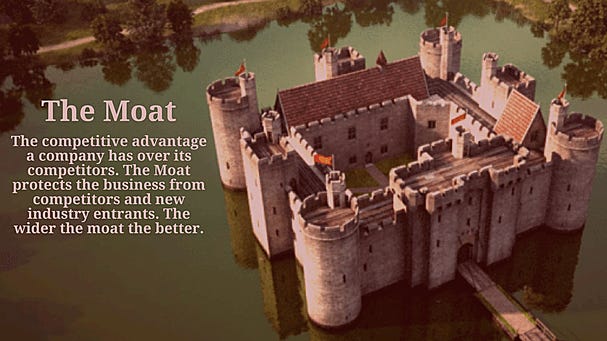

What is a moat?

A moat or durable competitive advantage is a condition that puts a company in a superior business position.

In other words: the company is doing something unique that separates them from its main rivals.

This will allow the business to maintain and increase its profit margin and market share.

“It’s incredibly arrogant for a company to believe that it can deliver the same sort of product that its rivals do and actually do better for very long.” - Warren Buffett

Warren Buffett once stated that the company itself can be seen as the equivalent of a castle and the value of the castle will be determined by the strength of the moat.

In other words: the moat protects those inside the castle and prevents outsiders from entering the fortress.

How do you know the company has a moat?

In general, a company has a sustainable competitive advantage when 2 criteria are met:

The company has a high and stable Gross Margin (> 40%)

The company has a high and stable Return On Invested Capital (> 15%)

When both criteria are met, you know the company has a moat as well as pricing power.

Moat sources

In general, there are 5 different kinds of moats:

Intangible assets

Switching costs

Network effects

Cost advantages

Efficient scale

Intangible assets

A moat based on intangible assets includes a competitive advantage because of the strong brand, patents, or regulatory licenses a company as.

This may prevent competitors from duplicating products or allow a company to charge a premium price.

A great example? Coca-Cola:

“If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done.” - Warren Buffett

Switching costs

Switching costs are costs a consumer pays as a result of switching brands or products.

These costs can be monetary, but also psychological, effort-based, and time-based.

A good example of this? Switching from Windows to Apple and vice versa can be painful for customers as it takes some time to master the software.

Other examples? Automatic Data Processing and Intuitive Surgical.

Network effects

A moat based on network effects is one of the strongest moats a company can have.

Why? It’s very scalable.

A network effect exists when the value of a product or service grows as its user base expands.

Each additional customer increases the value of the product or service exponentially.

Think about companies like American Express, Amazon, Mastercard & Visa, and Alphabet.

“Google has a huge new moat. I’ve probably never seen such a wide moat.” - Charlie Munger

Cost advantage

Companies that can produce products or services at lower costs than its rivals benefit from cost advantages.

Think about companies like Ikea and Walmart for example.

To me personally, cost advantages are the least preferred moat source. The reason for this is that these companies often have no pricing power. Pricing power is a very important characteristic of quality companies.

Efficient scale

Last but not least, efficient scale is the fifth moat source.

In some markets, there is only room for a few players. These kinds of markets are called monopolistic (only 1 company) or oligopolistic (only a few companies) markets.

Scale economies are very important in business. It is the dynamic in which a market of limited size is effectively served by a few companies.

Companies active in these kinds of industries are often very profitable and benefit from a lot of pricing power.

Great examples are S&P Global and Moody’s and US railroad stocks like Union Pacific.

Mastercard’s moat

Now let’s put the theory into practice and analyze the moat of Mastercard.